Union Pacific Corp. (ticker: UNP)

2024-01-01

Union Pacific Corporation (NYSE: UNP), with its origins dating back to 1862, is a major player in the railroad industry and one of the largest railroad networks in the United States. Headquartered in Omaha, Nebraska, the company serves many of the fastest-growing U.S. population centers and provides a critical link in the global supply chain. The company's rail network covers 23 states across the western two-thirds of the United States and extends more than 32,000 miles. Union Pacific's diverse business mix includes Agricultural Products, Energy, Industrial, and Premium. The company operates with a focus on safety, efficiency, and sustainability, instituting innovative technologies and practices to improve its operational performance and environmental footprint. Over the years, Union Pacific has proven to be a backbone of economic growth, supporting agriculture, manufacturing, and the energy sector. The firm's commitment to customer service and shareholder value, along with its strategic investments in network improvements and technology, continue to drive its success in the industry.

Union Pacific Corporation (NYSE: UNP), with its origins dating back to 1862, is a major player in the railroad industry and one of the largest railroad networks in the United States. Headquartered in Omaha, Nebraska, the company serves many of the fastest-growing U.S. population centers and provides a critical link in the global supply chain. The company's rail network covers 23 states across the western two-thirds of the United States and extends more than 32,000 miles. Union Pacific's diverse business mix includes Agricultural Products, Energy, Industrial, and Premium. The company operates with a focus on safety, efficiency, and sustainability, instituting innovative technologies and practices to improve its operational performance and environmental footprint. Over the years, Union Pacific has proven to be a backbone of economic growth, supporting agriculture, manufacturing, and the energy sector. The firm's commitment to customer service and shareholder value, along with its strategic investments in network improvements and technology, continue to drive its success in the industry.

| Full Time Employees | 31,800 | Previous Close | 246.02 | Open | 245.99 |

| Day Low | 244.725 | Day High | 246.535 | Dividend Rate | 5.2 |

| Dividend Yield | 2.12% | Payout Ratio | 49.9% | Five Year Avg Dividend Yield | 2.12% |

| Beta | 1.1 | Trailing PE | 23.59462 | Forward PE | 21.65961 |

| Volume | 1,226,792 | Average Volume | 2,451,130 | Average Volume 10 Days | 2,279,030 |

| Market Cap | 149,729,460,224 | Fifty Two Week Low | 183.69 | Fifty Two Week High | 246.99 |

| Price to Sales | 6.202546 | Fifty Day Average | 223.5072 | Two Hundred Day Average | 211.03815 |

| Trailing Annual Dividend | 5.2 | Trailing Dividend Yield | 2.1136492% | Enterprise Value | 183,446,339,584 |

| Profit Margins | 26.367% | Float Shares | 608,122,269 | Shares Outstanding | 609,598,016 |

| Shares Short | 7,419,056 | Held Percent Insiders | 0.211% | Held Percent Institutions | 81.242996% |

| Book Value | 22.974 | Price to Book | 10.6912155 | Last Fiscal Year End | December 31, 2022 |

| Most Recent Quarter | September 30, 2022 | Net Income to Common | 6,365,000,192 | Trailing EPS | 10.41 |

| Forward EPS | 11.34 | PEG Ratio | 3.76 | Last Split Factor | 2:1 |

| Enterprise To Revenue | 7.599 | Enterprise To EBITDA | 16.266 | 52 Week Change | 18.32546% |

| Current Price | 245.62 | Total Cash | 766,000,000 | Total Cash Per Share | 1.257 |

| EBITDA | 11,278,000,128 | Total Debt | 34,482,999,296 | Debt To Equity | 246.237 |

| Total Revenue | 24,139,999,232 | Revenue Per Share | 39.567 | Return On Assets | 8.5109994% |

| Return On Equity | 49.443% | Gross Profits | 13,367,000,000 | Free Cash Flow | 3,220,750,080 |

| Operating Cash Flow | 8,275,999,744 | Earnings Growth | -17.7% | Revenue Growth | -9.5% |

| Gross Margins | 52.465% | EBITDA Margins | 46.719003% | Operating Margins | 36.846% |

Based on our comprehensive technical and fundamental analysis of Union Pacific Corporation (UNP), the stock exhibits promising traits and some cautionary signals for the upcoming months. The evaluation draws on a multitude of technical indicators such as Parabolic SAR, On-Balance Volume (OBV), and the Moving Average Convergence Divergence (MACD), as well as fundamental analysis involving profit margins, revenue trends, and balance sheet strength.

Based on our comprehensive technical and fundamental analysis of Union Pacific Corporation (UNP), the stock exhibits promising traits and some cautionary signals for the upcoming months. The evaluation draws on a multitude of technical indicators such as Parabolic SAR, On-Balance Volume (OBV), and the Moving Average Convergence Divergence (MACD), as well as fundamental analysis involving profit margins, revenue trends, and balance sheet strength.

Technical Indicators:

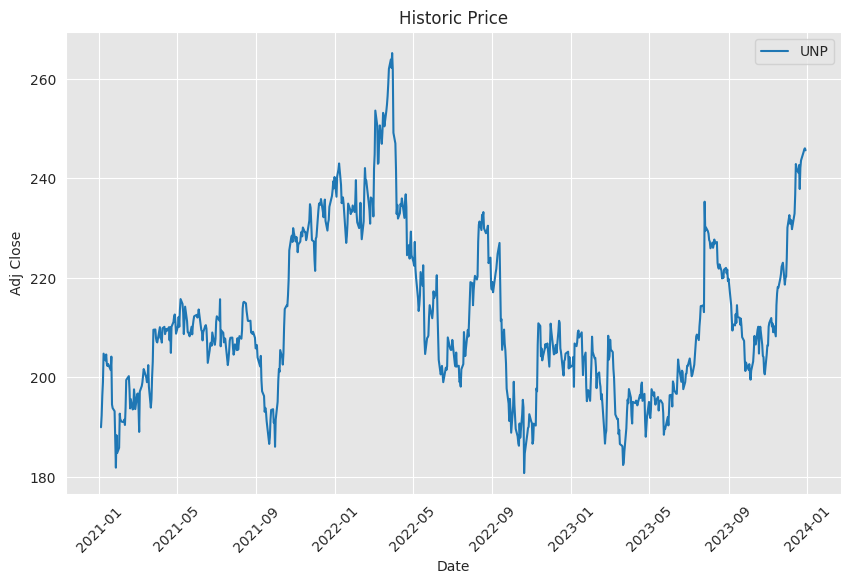

- Parabolic SAR (PSAR): The stock's behavior indicates a bullish trend, as the PSAR is currently below the price. This suggests that the upward momentum may continue in the short term.

- OBV: The On-Balance Volume has shown an overall increase, which can denote bullish sentiment as volume tends to precede price. The rising OBV is supportive of an uptrend continuation, signifying greater buying pressure.

- MACD: The Moving Average Convergence Divergence (MACD) histogram is positive but shows signs of decreasing momentum as the histogram bars are shortening. This could hint at a potential slowdown or pullback in the bullish trend.

Fundamental Analysis:

- Profit Margins: Union Pacific has strong gross (52.465%) and operating (36.846%) margins, showing efficient cost management and a strong competitive position in the industry.

- Revenue and Income Trends: The company has demonstrated a consistent growth in EBITDA and net income over the past three years, which is a positive sign for sustainability of future profits.

- Balance Sheet Strength: The balance sheet shows increasing net debt, which signals a higher leverage. However, with strong operating cash flows, the company has the capability to service its debt.

Considering these observations, here are the potential stock price movements:

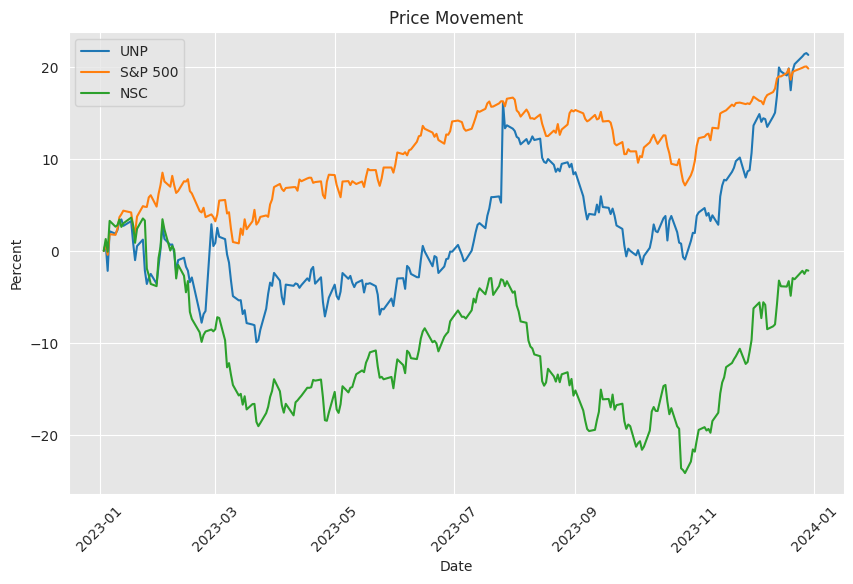

- Short-Term (1-3 months): The technicals favor the bulls, with a likely extension of the recent uptrend supported by solid volume. Nevertheless, a close watch on the MACD and a potential pullback should be kept in mind.

- Medium-Term (3-6 months): As the technical momentum may slow down, the stock price might see consolidation. The strong fundamental aspects could cushion any significant downside and provide a baseline for potential continuation of the upward trajectory.

- Long-Term (6+ months): The underlying profitability and cash flow generation capabilities of Union Pacific reinforce the likelihood of sustained growth. However, attention should be paid to the increasing debt levels and any changes in the interest rate environment which could impact costs of borrowing.

Investors should monitor changes in volume and the MACD histogram closely, as these will offer earlier signals of sentiment shifts. The overall market conditions and sector-specific news should also be taken into account, as external factors can influence stock performance irrespective of company fundamentals.

In conclusion, while the current technical and fundamental outlook suggests there may be more room for the upward trend to continue, investors should remain vigilant for signs of weakening momentum or shifts in market sentiment that could impact the trajectory of UNP's stock price. It is recommended to set stop losses to manage risk, given the potential for pullbacks in the medium term, while reviewing fundamentals periodically to ensure they remain supportive of the bullish case.

In the analysis of Union Pacific Corp.'s (UNP) financial performance for the third quarter (Q3) and first nine months of fiscal year 2023, which ended September 30, 2023, the company noted several trends and factors affecting its operations. The report reveals a mix of operational and financial highlights impacting UNP during these periods.

In Q3 of 2023, UNP reported earnings of $2.51 per diluted share from net income of $1.5 billion, with an operating ratio of 63.4%. Compared to the previous year's same quarter, earnings were down from $3.05 per diluted share and net income of $1.895 billion, and the operating ratio increased from 59.9%, indicating higher operating expenses relative to revenues. The company experienced a 9% decrease in freight revenues which was influenced by a 7% reduction in average revenue per car (ARC) and a 3% drop in volume. The decline in fuel surcharge revenues and a negative mix of traffic, such as an increase in lower-ARC rock shipments, drove the ARC reduction. Lower demand for intermodal, coal, and export grain shipments also contributed to volume declines, partially offset by stronger automotive and rock shipments and a domestic intermodal contract win. The overall network fluidity improved compared to the previous year when UNP faced a shortage of train crew employees. Six other key operational performance measures are also discussed, highlighting improvements in car trip plan compliance and increases in workforce productivity.

For operating expenses, UNP noted a 4% decrease in Q3 2023 compared to the previous year, driven by lower fuel prices, a one-time charge in 2022 associated with labor union agreements, and reduced volume-related costs. However, this decrease was partially offset by inflation, increased workforce levels, enhanced sick leave benefits for craft professionals, and one-time write-offs. The operating ratio for the nine months ended September 30, 2023, deteriorated by 2.9 points compared to the same period in 2022, attributed to factors such as inflation, excess network costs, and other cost increases, which were partially mitigated by core pricing gains.

On the non-operating front, UNP saw a 15% decrease in other net income in Q3 2023 versus 2022, largely due to lower gains from real estate sales, including a significant gain from a sale to the Colorado Department of Transportation in the previous year. Year-to-date, other income increased as a result of a one-time real estate transaction, though this was partially balanced by lower gains from real estate sales compared to 2022. Interest expenses increased in Q3 due to higher effective interest rates and an increased weighted-average debt level, while income tax expenses decreased due to lower pre-tax income and deferred tax adjustments.

UNP's liquidity and capital resources analysis shows the company's financial condition, where they generated $5.984 billion in cash from operating activities but used $2.650 billion in investing activities and $3.540 billion in financing activities during the first nine months of 2023. The capital investment expectations for 2023 are set at approximately $3.7 billion. UNP also discusses several measures taken to ensure sufficient cash flow, such as reducing share repurchases and maintaining compliance with debt covenants.

The document does not detail the risks of investing in stocks but includes information on liquidity, cash flow conversion rates, operating expenses, capital investments, key operational metrics, and financial obligations. Overall, Union Pacific Corp. showcased operational efficiency improvements, a focus on managing expenses and investments, and maintained a solid financial position through the third quarter of 2023.

Union Pacific Corp., an integral part of the U.S. freight rail system, faced a significant challenge with the temporary closure of railway crossings at El Paso and Eagle Pass, Texas. These closures, instigated by the U.S. Customs and Border Protection to manage a surge in migrant activity, put a halt to a crucial artery of trade between the United States and Mexico, affecting a range of economic activities. This disruption laid bare the vital nature of these crossings and their direct connection to the smooth operation of trade and the economy.

For a week, the rail operations at these crossings lay dormant, causing a backlog that amounted to five days' worth of cargo being held up. Union Pacific, acknowledging the resultant economic strain, confirmed the suspension had a daily financial impact exceeding $200 millionin goods that could not cross the border, wages that were not paid, and additional costs from the delays. Both agricultural sectors and additional rail companies felt the pinch, emphasizing the breadth of impact that even a short-lived disruption can bring to different facets of commerce.

Not only were the closures an operational headache for Union Pacific, but they also underscored the infrastructural vulnerability that could have huge implications for trade logistics. Mitigating this disruption became a top priority as the company focused on getting back to normal operations swiftly to ease the economic blow to the affected industries. The commitment of the company to overcome this interruption was evident in their readiness to tackle the backlog of deliveries and restore the flow of goods.

Union Pacific's role in the transcontinental trade environment has always been under observation by financial analysts and industry experts. Targeted strategic investments in infrastructure and operational technology have strengthened their network, enabling them to remain a step ahead in the fiercely competitive transport sector. They've expanded trade routes, and introduced new services to improve their offerings, understanding the importance of flexibility in a dynamic global trade system.

In reviewing the performance of significant industry players, analysts from Zacks Equity Research have taken note of Union Pacifics resilience in the face of market upheavals and logistical challenges. Its extended network and diverse service offerings have been pivotal in allowing the company to withstand industry cycles. These fortitudes, coupled with a concerted focus on improving operational efficiency and cost management, have assured Union Pacific a prominent place among its peers.

Yet, like any other large corporation, Union Pacific is not immune to external pressures. Regulatory shifts, fluctuating fuel prices, and labor relations can all weigh heavily on operational productivity and financial health. The balancing act between staying competitive and delivering shareholder value remains a continuous challenge for Union Pacific, with ongoing vigilance needed to maintain its market position.

When customs and border enforcement led to the temporary standoff at international bridges, the ensuing rail service suspension highlighted a national security concern. Overwhelmed by the escalation in illegal border crossings, authorities took drastic action which, in turn, affected the rail freight operations of Union Pacific and BNSF Railway. This decision was met with some criticism from industry leaders who perceived the move as a knee-jerk response that might not address the border issues effectively.

The reopening of the rail crossings, however, was more than just a logistical necessity; it was emblematic of the intrinsic link between commerce and comprehensive border management. These discussions have been further amplified by political debates around border security policy, with various stakeholders, including from the agricultural sector and the political arena, calling for more robust and lasting solutions.

Union Pacific's financial performance and stock stability have been closely observed by the likes of Zacks Equity Research given the strategic maneuvers within the transportation sector. Amidst challenging market trends and operational hurdles, Union Pacific has sustained its stature, in no small part due to its vast rail network and vital freight services that cut across different market sectors. Their commitment to long-term growth, evidenced by continued investments in infrastructure and diversification of service offerings, provides a competitive edge.

As Union Pacific navigates the recovery of operations post-border closure, its financial health and strategic market positioning continue to be a topic of analysis against the backdrop of the broader U.S. economic canvas. The reopening has also accentuated the critical need for resilient and secure supply chain infrastructure, pivotal for uninterrupted commerce across international borders.

The recent border situation has led to increased dialogue on bilateral cooperation between the U.S and Mexico, with agreements on the necessity of enhanced enforcement for the reopening of the crossings. Such discussions illuminate the complex relationship between national security, international trade, and the versatile nature of such infrastructural linchpins that interconnect different economies.

Union Pacific's engagement in this complex web reaffirms its stature and influence in the national and international economic landscape. As the unfolding events at the Texas border towns have shown, the company is inextricably linked to a host of issues that traverse the realms of supply chain dynamics, border security, and foreign policy. Union Pacific, by rising to meet these challenges, further validates the strategic importance placed upon it by financial experts and industry analysts alike.

Similar Companies in Railroads:

Norfolk Southern Corporation (NSC), Report: CSX Corporation (CSX), CSX Corporation (CSX), Kansas City Southern (KSU), Canadian National Railway Company (CNI), Canadian Pacific Railway Limited (CP)

News Links:

https://finance.yahoo.com/news/zacks-analyst-blog-highlights-novo-142700512.html

https://finance.yahoo.com/news/union-pacific-informed-mexican-border-201301258.html

https://finance.yahoo.com/news/railroad-operations-resume-5-day-194040173.html

https://finance.yahoo.com/news/union-pacific-informed-mexican-border-175159954.html

https://finance.yahoo.com/news/cbp-reopens-key-ports-entry-213020395.html

https://seekingalpha.com/article/4658774-berkshires-cash-cow-year-end-check-on-bnsf-maintain-buy

https://seekingalpha.com/article/4640929-my-dividend-growth-portfolio-q3-2023-summary

https://finance.yahoo.com/news/top-analyst-reports-novo-nordisk-213900799.html

https://finance.yahoo.com/news/why-investors-advantage-2-transportation-140006988.html

https://www.fool.com/investing/2023/12/23/dont-be-misled-this-top-stock-makes-up-just-10-of/

https://seekingalpha.com/article/4639639-300k-ig-swan-portfolio-one-year-later

https://www.fool.com/investing/2023/12/03/apple-is-far-less-important-to-berkshire-hathaway/

https://seekingalpha.com/article/4654095-union-pacific-is-one-of-my-favorite-plays-going-into-2024

https://finance.yahoo.com/m/4e4fb3cc-8a51-3dd4-9d9d-2e9ed166c25f/berkshire-hathaway-stock-is.html

https://www.fool.com/investing/2023/08/23/3-stocks-i-own-and-will-buy-more-of-if-the-market/

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ivDSfv

https://reports.tinycomputers.io/UNP/UNP-2024-01-01.html Home