Vanguard Consumer Staples ETF (ticker: VDC)

2023-12-28

The Vanguard Consumer Staples ETF (ticker: VDC) is an exchange-traded fund that offers investors exposure to the U.S. consumer staples sector, which consists of companies that provide goods and services considered essential for daily life, such as food, beverages, household and personal products, and tobacco. This sector is generally viewed as non-cyclical and may exhibit less sensitivity to economic cycles, potentially providing a level of stability to an investment portfolio. The ETF follows a passively managed, full-replication approach and seeks to track the performance of the MSCI US Investable Market Index (IMI)/Consumer Staples 25/50, which represents the consumer staples segment of the U.S. equity market. VDC is known for its diversified portfolio of established companies, low expense ratio, and the distribution yield it offers, making it well-suited for investors looking for a steady income stream along with long-term capital growth. Its holdings typically include well-recognized multinational corporations with a significant presence in the consumer market, thereby offering a balance between quality and value for long-term investors.

The Vanguard Consumer Staples ETF (ticker: VDC) is an exchange-traded fund that offers investors exposure to the U.S. consumer staples sector, which consists of companies that provide goods and services considered essential for daily life, such as food, beverages, household and personal products, and tobacco. This sector is generally viewed as non-cyclical and may exhibit less sensitivity to economic cycles, potentially providing a level of stability to an investment portfolio. The ETF follows a passively managed, full-replication approach and seeks to track the performance of the MSCI US Investable Market Index (IMI)/Consumer Staples 25/50, which represents the consumer staples segment of the U.S. equity market. VDC is known for its diversified portfolio of established companies, low expense ratio, and the distribution yield it offers, making it well-suited for investors looking for a steady income stream along with long-term capital growth. Its holdings typically include well-recognized multinational corporations with a significant presence in the consumer market, thereby offering a balance between quality and value for long-term investors.

| Previous Close | 189.96 | Open | 189.9 | Day Low | 189.66 |

| Day High | 190.75 | Trailing P/E | 24.215435 | Volume | 96,576 |

| Average Volume | 164,124 | Average Volume 10 days | 129,550 | Bid | 187.26 |

| Ask | 194.15 | Bid Size | 900 | Ask Size | 800 |

| Yield | 2.52% | Total Assets | 7,519,627,264 | 52 Week Low | 172.75 |

| 52 Week High | 201.65 | 50 Day Average | 184.1052 | 200 Day Average | 190.43355 |

| Trailing Annual Dividend Rate | 0.0 | Trailing Annual Dividend Yield | 0.0 | NAV Price | 189.89 |

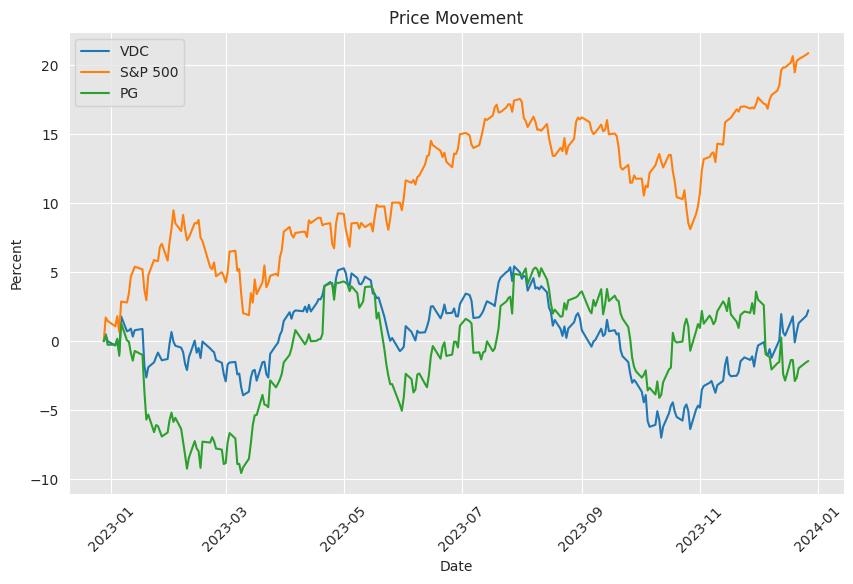

| YTD Return | 1.83619% | Beta 3 Year | 0.62 | Three Year Average Return | 5.90736% |

| Five Year Average Return | 10.75953% |

Based on the most recent technical analysis (TA) data presented, we can derive a number of insights that hint at the potential future price movements of the VDC stock over the next few months. The given data presents a snapshot of different technical indicators that are widely relied upon by market analysts to forecast the direction of stock prices. Here we will focus primarily on the Open, High, Low, Close (OHLC) data, along with the On-Balance Volume (OBV) in millions and the Moving Average Convergence Divergence (MACD) histogram with the configuration 12, 26, 9.

Firstly, considering the OBV, which measures buying and selling pressure as a cumulative indicator, we can observe a downward trend over the given period. This is indicated by the descending OBV values, transitioning from a positive 0.01044 million to a negative -0.07276 million before a slight improvement at the end of the period to -0.02054 million. Generally, OBV is used to predict price movements based on volume flow, suggesting that there has been significant selling pressure. However, the slight increase at the end of the period may indicate a reduction in selling momentum or an increase in buying activity.

The MACD histogram is another key indicator of market sentiment and momentum. It provides a visual representation of the difference between the MACD line and its signal line. A negative MACD histogram indicates bearish momentum, and throughout the given data, there is a consistent negative histogram. However, it's crucial to point out the histogram values are increasing towards zero, moving from -0.200221 to -0.044226 in the last two recorded days. This trend represents a possible bullish convergence, describing a slowing of the downward momentum and potentially signaling an imminent positive reversal in the trend.

Without fundamental data and financials to complement the technical indicators, our analysis must rely heavily on the TA data provided. It is worth noting that fundamentals are critical to understanding the underlying value and potential of a company, which can support or contradict the signals from technical indicators. However, in their absence, we must proceed cautiously with the available information.

Combining these observations, it is reasonable to forecast that while the near-term outlook appears bearish due to the overall declining OBV, the decrease in negative momentum observed in the MACD histogram could suggest that the stock may find support in the coming weeks. If the MACD histogram continues to rise towards the zero line and eventually turns positive, this could indicate a potential bullish trend emerging. Therefore, we could expect a stabilization or a modest rebound in VDC's stock price. However, caution is warranted, as a continuation of the previous decline in the OBV indicates that the market has not yet fully shifted to a buying stance.

Provided these observations, investors should pay close attention to upcoming trading sessions to confirm whether these potential signals manifest into a change in trend. Specifically, a continual improvement in the OBV would support a bullish sentiment, while further increase towards the positive territory in the MACD histogram could be viewed as confirmation of an impending upward momentum. As always, these predictions are based on past data and TA indicators, and they attempt to forecast potential future price movements, not guarantees. It is essential to continuously monitor the market for changes and adjust any trading strategy accordingly.

As we shift our focus from a robust earnings season to the emerging consumer trends, it's imperative to consider the interim sales performances of key market players and their potential implications on the Vanguard Consumer Staples ETF (VDC). This ETF, which is a favored vehicle for investors aiming to invest in the consumer staples sector, is typically associated with lower risk and stable dividends, offering a buffer against volatile economic conditions.

Efforts to scrutinize near-term consumer behavior are fortified by reports from retailers such as Costco and The Buckle, alongside global automakers. These reports serve as early indicators of the sector's health. Costco, now the second-largest component in the Consumer Staples sector by ETF weight, stands out for its remarkable retention rate above 90% and reliable revenue from membership fees. Notably, the Washington-based retailer has experienced strong sales growth and there are speculations about a potential rise in the annual fee, which could impact the revenue stream and hence, the ETF's performance.

The more diminutive retailer The Buckle provides additional perspectives, particularly within the apparel segment. Its recent figures indicated a dip in net sales year over year at October's end, particularly in women's clothing which may raise concerns over discretionary spending trends during the crucial holiday shopping period.

Turning to the automobile sector, the aftermath of October's labor strikes brought anticipation for the release of monthly production and sales figures from automakers such as Toyota, Honda, and Ford. These figures are particularly telling of consumer confidence and the health of a sector closely connected to economic cycles. Announcements at industry conferences by major firms could also hold substantial information for investors eyeing VDC's performance.

These insights, however, are juxtaposed against Walmart's CEO's warning about a slowdown in retail demand, suggesting a softening in the sector which could have downstream effects on ETFs such as VDC. The cooling off observed in the October Retail Sales report could prelude adjustments in consumer spending that often serve as economic bellwethers.

The presence of retail giants and their performance in VDC's portfolio means that such trends could sway the ETF's outcomes substantially. Given the importance of retail sales figures during the holiday season, a vigilant eye on these indicators is warranted.

In juxtaposition to the consumer sectors, one must consider investment strategies that have historically thrived despite economic headwinds. Warren Buffetts investments in non-cyclical entities like Visa and Coca-Cola are instructive. Visa, although part of the financial sector, has shown resilience during inflationary times, capturing gains from elevated consumer spending a relevant lesson for the consumer staples sector. Coca-Cola's longevity in Buffett's portfolio underscores the defensiveness of strong, well-entrenched brands, even when they slightly underperform against benchmarks like the S&P 500.

These cases bolster the raison d'etre of an ETF like VDC, which homes in on companies resilient in the face of economic downturns, rewarding investors with stability and continuous dividends. It stresses the importance of including companies within the ETF that have durable competitive advantages and that cater to essential consumer needs.

In contrast to the stability of consumer staples, the wider economic context introduces the concept of "Peak Everything," a term that reminds us of the finite nature of resources and the resultant vulnerability of global supply chains. The scarcity paradigm, compounded by geopolitical tensions and the decline in conventional energy investments, hints at uncertainties and potential upheavals that could influence the sector's dynamics. While scarcity can foster investment opportunities, particularly in commodities and sectors where prices surge due to limited supply, it also underscores the importance of diversification and prudent resource management within investment portfolios.

In the shadow of market volatility, the wisdom of allocating investments in sectors less susceptible to economic cycles becomes particularly salient. The Vanguard Consumer Staples ETF embodies this strategy by concentrating on essentials such as food, beverages, household goods, and personal care items. These basics tend to maintain demand even as economic conditions fluctuate.

Adding to the blend is the concept that certain sectors, like healthcare and consumer staples, traditionally exhibit defensive characteristics during economic downturns. With looming recessionary signals identified by market experts, a shift toward ETFs like VDC could provide a more steadfast investment path. The broader economic indicators prompting discussions about recession preparedness make the case for an ETF like VDC stronger.

Ultimately, while the broader equity markets possess the capacity to recover from recessions delivering substantial returns over time, ETFs such as VDC offer an attractive blend of stability, managerial acumen, and lower volatility. As investors traverse a more complex economic landscape marked by retail market fluctuations and global scarcity concerns, reliance on consumer staples and the strategic selection of ETF investments becomes more relevant.

This analysis of the Vanguard Consumer Staples ETF (VDC) amidst current market trends reaffirms its essence as an investment geared toward capital protection and long-term growth. Tracking companies that inhabit the more resilient crevices of the marketplace, the ETF assumes a formidable position for those seeking a hedge against economic uncertainty while still planning for eventual prosperity.

Similar Companies in Household & Personal Products:

Procter & Gamble Co (PG), Coca-Cola Co (KO), PepsiCo Inc (PEP), Walmart Inc (WMT), Report: Costco Wholesale Corp (COST), Costco Wholesale Corp (COST), Mondelez International Inc (MDLZ), Colgate-Palmolive Company (CL), General Mills Inc (GIS), Kellogg Company (K), Kimberly-Clark Corporation (KMB)

News Links:

https://www.fool.com/investing/2023/10/01/downturn-coming-2-defensive-index-funds-to-buy-now/

https://seekingalpha.com/article/4655074-retail-and-autos-in-focus-november-interim-sales-trends

https://www.fool.com/investing/2023/04/13/2-warren-buffett-investments-to-lead-you-through-a/

https://seekingalpha.com/article/4606908-a-decade-of-scarcity-understanding-peak-everything

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 4YOtlL

https://reports.tinycomputers.io/VDC/VDC-2023-12-28.html Home