XPeng Inc. (ticker: XPEV)

2024-01-25

XPeng Inc., designated by the ticker symbol XPEV on the New York Stock Exchange, is an emerging player in the electric vehicle (EV) industry, primarily operating in China, one of the world's largest automotive markets. The company specializes in the design, development, production, and sale of smart EVs that cater to the mid-to-high-end consumer segment. Known for its commitment to innovation and intelligent features, XPeng focuses on leveraging cutting-edge technologies such as autonomous driving and artificial intelligence to differentiate itself from competitors in the rapidly evolving EV landscape. Despite the competitive and regulatory challenges within the Chinese EV market, XPeng has demonstrated significant growth potential, as evidenced by its growing vehicle sales, expanding product lineup, and investment in research and development. Its financial performance and market capitalization are subject to fluctuations based on investor sentiment, regulatory policies, and the company's ability to scale operations while maintaining quality and customer satisfaction.

XPeng Inc., designated by the ticker symbol XPEV on the New York Stock Exchange, is an emerging player in the electric vehicle (EV) industry, primarily operating in China, one of the world's largest automotive markets. The company specializes in the design, development, production, and sale of smart EVs that cater to the mid-to-high-end consumer segment. Known for its commitment to innovation and intelligent features, XPeng focuses on leveraging cutting-edge technologies such as autonomous driving and artificial intelligence to differentiate itself from competitors in the rapidly evolving EV landscape. Despite the competitive and regulatory challenges within the Chinese EV market, XPeng has demonstrated significant growth potential, as evidenced by its growing vehicle sales, expanding product lineup, and investment in research and development. Its financial performance and market capitalization are subject to fluctuations based on investor sentiment, regulatory policies, and the company's ability to scale operations while maintaining quality and customer satisfaction.

| City | Guangzhou | ZIP Code | 510640 | Country | China |

| Industry | Auto Manufacturers | Sector | Consumer Cyclical | Full Time Employees | 15,829 |

| Previous Close | 9.20 | Day Low | 8.925 | Day High | 9.24 |

| Beta | 3.019 | Forward P/E | -8.61 | Volume | 7,224,446 |

| Market Cap | 8,734,276,608 | 52 Week Low | 7.505 | 52 Week High | 23.62 |

| Price to Sales Trailing 12 Months | 0.384 | Fifty Day Average | 14.4982 | Two Hundred Day Average | 14.12265 |

| Enterprise Value | 3,155,020,288 | Profit Margins | -50.028% | Float Shares | 1,049,354,180 |

| Shares Outstanding | 943,409,024 | Shares Short | 51,857,120 | Held Percent Insiders | 1.151% |

| Held Percent Institutions | 12.081% | Short Ratio | 4.62 | Book Value | 33.288 |

| Price to Book | 0.269 | Last Fiscal Year End | 2022 | Net Income to Common | -11,389,334,528 |

| Trailing EPS | -1.62 | Forward EPS | -1.04 | PEG Ratio | 6.99 |

| Enterprise To Revenue | 0.139 | Enterprise To EBITDA | -0.313 | 52 Week Change | -10.156% |

| Current Price | 8.955 | Target High Price | 28.01 | Target Low Price | 8.0 |

| Target Mean Price | 18.23 | Recommendation Mean | 2.6 | Total Cash | 29,017,968,640 |

| Total Cash Per Share | 16.774 | Total Debt | 16,257,170,432 | Debt to Equity | 56.46 |

| Total Revenue | 22,765,985,792 | Revenue Growth | 25% | Gross Margins | 0.517% |

| EBITDA Margins | -44.318% | Operating Margins | -37.058% | Return on Assets | -9.944% |

| Return on Equity | -33.383% | Revenue Per Share | 26.41 | EBITDA | -10,089,422,848 |

| Sharpe Ratio | -5.064783591155675 | Sortino Ratio | -90.28076813071176 |

| Treynor Ratio | 0.08917453891984216 | Calmar Ratio | -0.13133613775569564 |

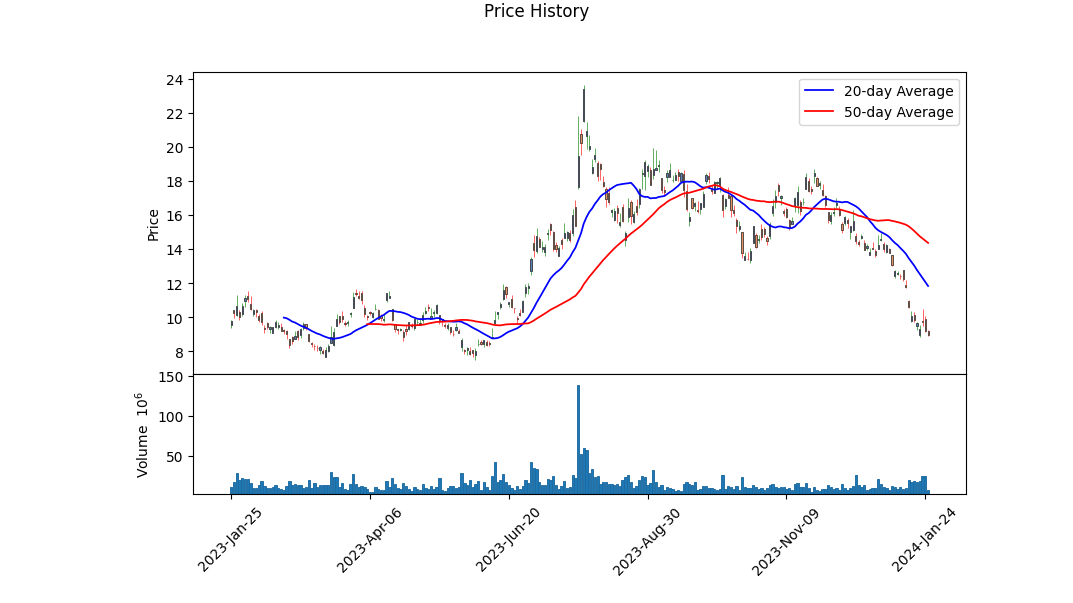

Xiaopeng Motors (XPEV) presents a unique case for technical and fundamental analysis. Over the observed period, the stock showed an overall decline. The Open price was witnessed to decrease significantly from around $16 down to approximately $9. Technical indicators like the On-Balance Volume (OBV) suggest selling pressure, culminating into a negative OBV in millions, implying a severe outflow of volume from the stock.

The MACD histogram has remained negative throughout the observed period, indicating bearish momentum. While the lack of MACD values for the starting period precludes a clear trend analysis, the persistent negative values towards the latest data points suggest a decreasing bullish sentiment and possible continuation of the downtrend.

Fundamentally, the balance sheet reflects a company with substantial total debt, which by the end of 2022, stood at over $12 billion. The high debt level should be a point of concern for prospective investors, despite the sizable tangible book value suggesting solid asset backing.

The cash flow situation reveals significant challenges, with a sizable negative free cash flow and net income from continuing operations. These figures are indicative of a company that's spending more than it's earning - a worrisome sign for long-term sustainability.

The negative Sharpe, Sortino, and Calmar ratios underscore the lackluster performance, with high volatility and significant downside risk not compensated by adequate returns. However, the positive Treynor Ratio suggests that the market risk associated with XPEV is minimal.

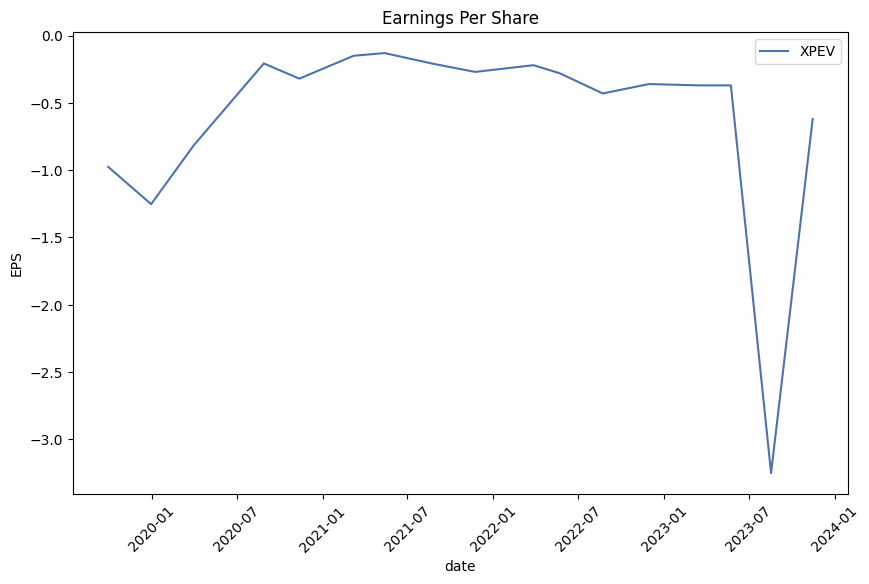

The earnings and revenue estimates indicate a brighter prospect for the next year, with analysts expecting a reduction in loss per share and a substantial increase in sales growth. Although this might seem encouraging, the earnings history reflects a pattern of earnings underperforming estimates, which raises questions about the reliability of future earnings expectations.

In conclusion, despite the analysts' expectations of improved future performance, the technical indicators and risk-adjusted returns signal extreme caution. The market appears to have a subdued outlook on XPEV, as evidenced by the negative price movement and deteriorating technicals. Unless there is a fundamental shift in the company's financial health or market sentiment, the stock may continue to experience downward pressure in the coming months. It's essential for potential investors to closely monitor any changes in XPEV's financial metrics and market trends that could signal a reversal or reinforcement of the current trend.

| Alpha | -0.0344 |

| Beta | 1.9398 |

| R-squared | 0.134 |

| Adj. R-squared | 0.133 |

| F-statistic | 132.6 |

| Prob (F-statistic) | 1.28e-28 |

| Log-Likelihood | -2,668.0 |

| AIC | 5,340 |

| BIC | 5,350 |

| No. Observations | 857 |

| Df Residuals | 855 |

| Df Model | 1 |

| Std. Err. | 0.168 |

| t | 11.514 |

| P>|t| | 0.000 |

| [0.025 | 1.609 |

| 0.975] | 2.270 |

| Omnibus | 347.478 |

| Prob(Omnibus) | 0.000 |

| Skew | 1.584 |

| Kurtosis | 11.932 |

| Durbin-Watson | 1.964 |

| Cond. No. | 1.12 |

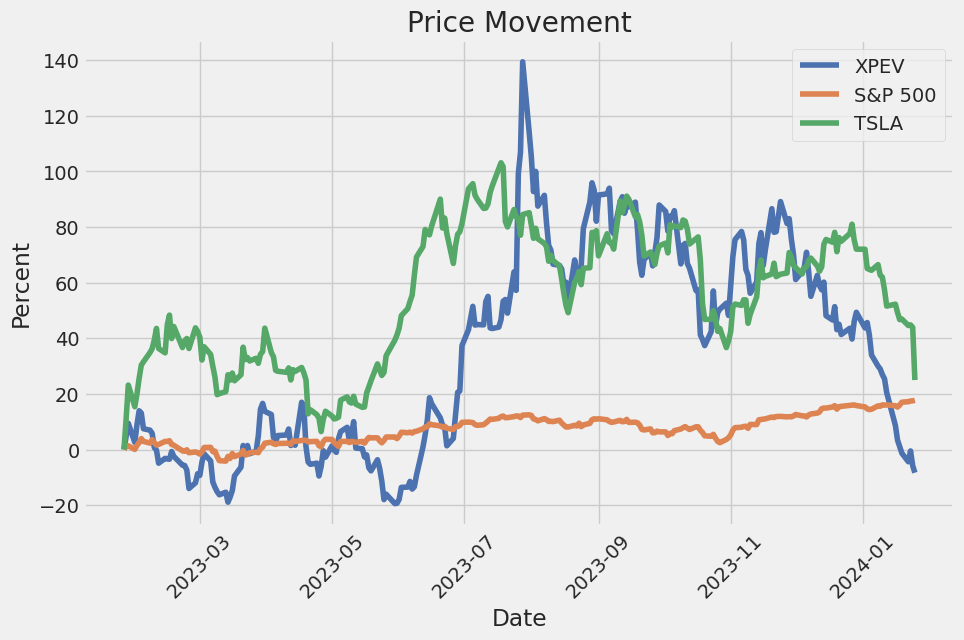

The linear regression model indicates a beta coefficient of 1.9398, suggesting that for every 1% movement in SPY, which represents the broader market, XPeng Inc. (XPEV) is expected to move by approximately 1.94%. The relationship is statistically significant, as indicated by the t-statistic and the associated P-value being virtually zero. The alpha value of -0.0344, although negative, is not considerably different from zero given its statistical insignificance, as evidenced by a high p-value of 0.854. This implies that XPEV does not have a statistically significant abnormal return over the period that is unexplained by the movements in SPY.

The R-squared value of 0.134 suggests that approximately 13.4% of the variability in XPEV's stock returns can be explained by the movements in SPY. However, this also indicates that a large portion of XPEV's price movements are due to factors not captured by the market index SPY. The adjusted R-squared, which accounts for the number of predictors in the model, is closely aligned at 0.133. These metrics together suggest that while there is some relationship between XPEV's returns and the market, many other specific or idiosyncratic factors are at play in determining the stock's performance.

XPeng Inc., a leading player in the smart electric vehicle (EV) market, conducted its third quarter 2023 earnings conference call, revealing significant strides in company performance and outlining ambitious strategies for the coming years.

He Xiaopeng, Co-founder, Chairman, and CEO, expressed gratitude for the support received during a transformational period for XPeng. Key achievements for Q3 included an impressive 72% quarter-over-quarter growth in vehicle deliveries, surpassing 40,000 vehicles, and generating positive free cash flow exceeding RMB 1 billion. XPeng's G6 SUV emerged as a top seller in its price segment, reflecting the company's ability to set new benchmarks in the smart EV industry. A new record in vehicle deliveries is projected for Q4, with expectations of exceeding 60,000 units.

The company launched the 2024 edition XPENG G9 with a higher gross margin than its predecessor, showcasing cost reductions through technological advancements. The announcement of the flagship seven-seater XPeng X9 at the Guangzhou Auto Show marked the introduction of an MPV model with exceptional space, design, and advanced ADAS capabilities. With its sights set on the large electric MPV market, XPeng is optimistic about the X9's sales prospects upon delivery in January 2024.

XPeng is also preparing to introduce a new EV brand in the RMB 150,000 price segment, leveraging a strategic partnership with DiDi to boost sales and expand market share. This initiative, coupled with a significant restructuring of sales networks and new store launches, positions XPeng for extensive growth in 2024 and beyond. Strategic cooperation with Volkswagen Group, aligning with global market opportunities and cost control best practices, is directed towards achieving gross margin improvements and profitability at scale in the long term.

James Wu, VP of Finance, detailed the financial performance for Q3 2023. Total revenues hit RMB 8.53 billion, marking a significant year-over-year and quarter-over-quarter increase. Vehicle sales revenues stood at RMB 7.84 billion, also reflecting substantial growth. Despite gross and vehicle margins being negative in Q3 due to inventory write-downs and the phasing out of NEV subsidies, they are expected to turn positive in Q4. R&D and SG&A expenses exhibited notable changes, aligning with the companys strategic R&D investments and sales network expansion. XPeng closed the quarter with RMB 36.5 billion in cash, reinforcing a strong financial position that encompasses cash equivalents, restricted cash, short term investments, and time deposits.

Overall, XPeng Inc. demonstrated resilience and innovation in a competitive market landscape. By focusing on smart EV technology, cost efficiency, strategic partnerships, and a customer-centric approach, XPeng is firmly on the path to establishing itself as a top smart EV company by 2030.

XPeng Inc., the vibrant Chinese electric vehicle (EV) manufacturer, entered 2024 on the heels of a solid performance in the previous year. The company reported significant growth, delivering 141,601 units through the yearan increase of 17% from the year prior. Its momentum was particularly remarkable in the fourth quarter when it set a record by delivering 60,158 units, a 171% increase from the same period the previous year. By December 2023, the company had reached a cumulative total of over 400,311 vehicle deliveries, underscoring its fast-paced growth and the market's appetite for its brand of electric vehicles.

Among the notable highlights was the expansion of XPeng's XNGP Advanced Driver Assistance System, which reached 52 cities in China through an Over-the-Air update. The company then planned to further push the envelope by expanding to 200 cities nationwide, reaffirming its commitment to evolving technology and customer satisfaction. Another significant move was the unveiling of the X9 7-seater multi-purpose vehicle, built on the new SEPA 2.0 technology architecture and competitively priced to capture a share of its segment.

In the international domain, XPeng made clear its ambitions. It was leveraging a strategic approach to exports, targeting markets in Europe and Southeast Asia, while navigating the complex trade scenarios with the United States, where an existing 27.5% tariff posed challenges. Yet, the company succeeded in exporting electric buses, revealing its flexibility and strategic thinking.

Amidst the companys upward trajectory, Brian Gu, vice chairman and co-president of Xpeng Inc., expressed optimism. In an interview with CNBC, he revealed expectations for the X9 to potentially lead its segment and underlined plans to surpass industry growth in 2024 by capitalizing on market share and expanding driver-assist technology. Innovation remained at the core of Xpeng's strategy, as evidenced by its alliance with Guangdong Huitian to explore the burgeoning field of flying vehiclesa venture that highlighted the company's forward-thinking approach.

However, XPeng also faced challenges, notably failing to meet its delivery target of 200,000 vehicles for 2023. The company's stock experienced a volatile phase; after an 80% downturn, market analysts were assessing its rebound potential, especially given the heightened interest in the EV sector's growth potential. Stock prices also saw repercussions when Tesla cut prices, prompting a dip in automaker shares across the board and reflecting the highly competitive nature of the EV industry.

Financially, XPeng grappled with indicators that pointed to challenges ahead. Its net losses had grown to their largest since its public listing, and vehicle gross margins turned negative, shifting from 11.6% the previous year to -6.1% in Q3. Despite these hurdles, XPeng's emphasis on technology and partnerships, such as with Volkswagen on EVs, suggested a strategic resolve to overcome market pressures.

Moreover, the company's nuanced shareholder structure, with substantial retail ownership, instilled a level of democratic influence on governance, even as major shareholders and insiders, including its CEO Xiaopeng He, held substantive stakes. This ownership mix indicated varied interests and potential for influence over company decisions, which would play a role in shaping XPeng's future.

Facing headwinds in early 2024, XPeng demonstrated its adaptability. It initiated a round of organizational restructuring to enhance competitiveness and align with market demands, indicating responsiveness to industry challenges. Quentin Webb reported a selloff in U.S.-listed Chinese technology stocks, which included XPeng. The broader market sentiment affected the company's American depositary receipts, prompting a more cautious outlook among investors and stakeholders.

Despite these trials, the company's leading role in the transition toward electric and autonomous vehicles within Chinas burgeoning automotive market placed it at the forefront of innovation and growth. Maintaining focus on technological evolution and adherence to strategic expansion plans would be crucial for XPeng in outpacing competitors and satisfying the evolving consumer demands.

The exploration of novel markets such as flying cars through its subsidiary XPeng Aeroht showcased the company's zeal for innovation. The entity aimed to disrupt traditional mobility with preorders expected to open by late 2024 for its eVTOLs. This thrust into uncharted territory further illustrated XPengs ambition to spearhead not just the terrestrial EV market but also the nascent aerial mobility sector, pointing to a future where XPeng isn't just an automotive manufacturer but a broader mobility provider.

As market dynamics shifted, with advancements and competitive standoffs becoming regular occurrences, XPeng's strategies and resilience would be the determining factors for its continued ascendance. The course ahead was marked by optimism drawn from robust technological foundations, strategic alignments, and adaptive maneuvers aimed at ensuring sustainable growth and maintaining market relevance.

(Access to the full articles mentioned and used in the research for this report is available through the links provided in the text.)

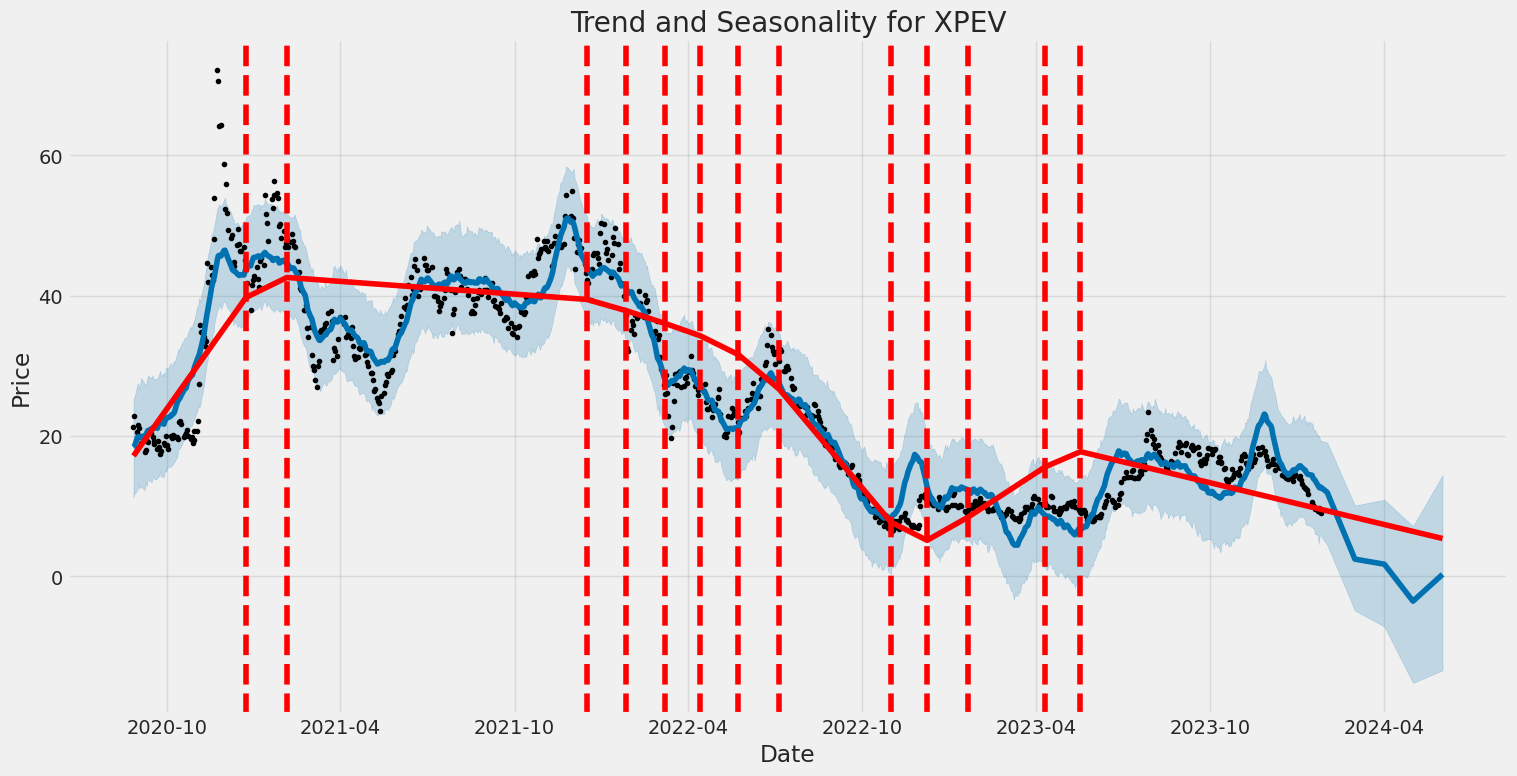

XPeng Inc. (XPEV) has experienced significant fluctuations in its stock price between August 27, 2020, and January 25, 2024. The volatility model suggests that the variations in returns did not exhibit any predictable pattern based on past returns, as indicated by the low R-squared value. Key features of the volatility include a baseline level of variation (omega) and the impact of the most recent return on future volatility (alpha[1]), although the latter was not statistically significant.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,714.97 |

| AIC | 5,433.95 |

| BIC | 5,443.45 |

| No. Observations | 857 |

| omega | 27.6218 |

| alpha[1] | 0.2271 |

To analyze the financial risk of a $10,000 investment in XPeng Inc. (XPEV) over a one-year period, the combination of a volatility modeling technique and machine learning predictions can be employed. Specifically, volatility models like the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model capture the time-variant nature of volatility, essential for understanding probable future price fluctuations in XPeng Inc.'s stock.

The volatility modeling process commences by examining historical stock prices of XPeng Inc. to understand its volatility dynamics. By fitting the historical data to the model, it accounts for patterns such as volatility clusteringhigh volatility events tend to follow high volatility events, and low volatility follows low volatility. The volatility model can also adjust to asymmetric effects, where negative and positive shocks to the stock price have a different impact on the volatility. Parameters derived from this model help us to forecast future volatility levels, providing insights into the potential risk profile of the investment.

Once the volatility projections are on hand, the machine learning algorithm, exemplified by the "machine learning predictions" method, can incorporate these volatility forecasts along with other inputs to project the path of stock returns for XPeng Inc. Machine learning methods like the "machine learning predictions" technique excel at finding non-linear patterns and interactions between a vast array of inputs, making it a powerful tool for forecasting. Having trained the model on historical return and volatility data, it can predict the future stock returns of XPeng Inc., considering the forecasted volatility to improve its predictions.

The integration of volatility forecasts into the machine learning method provides a comprehensive view of the investment's risk profile. It enables the investment to be assessed under a range of scenarios, thereby predicting the stock's return distribution for the forthcoming year.

To quantify the risk, the Value at Risk (VaR) metric is calculated. VaR provides a measure of the potential loss over a specified time frame and at a given confidence interval. In this context, with a 95% confidence interval, the annual VaR for the $10,000 investment in XPeng Inc. is calculated to be $806.48. This figure implies that there is a 95% probability that the investment will not lose more than $806.48 over the course of one year. It serves as a useful risk management tool indicating the extent of potential losses under normal market conditions.

In evaluating the VaR, it is crucial to recognize that this measure is subject to the model's accuracy and the assumption that past behavior and current trends will continue into the future. The machine learning model, despite its robustness, may also have limitations due to overfitting or underestimation of market anomalies. However, the use of volatility modeling to inform machine learning predictions represents a sound approach to quantifying financial risk, acknowledging that actual results may vary due to unforeseen market movements or events.

Similar Companies in Auto Manufacturers:

Report: Tesla, Inc. (TSLA), Tesla, Inc. (TSLA), Li Auto Inc. (LI), Rivian Automotive, Inc. (RIVN), Lucid Group, Inc. (LCID), NIO Inc. (NIO), BYD Company Limited (BYDDY), Ford Motor Company (F), Fisker Inc. (FSR), Mullen Automotive, Inc. (MULN), Nikola Corporation (NKLA), Lordstown Motors Corp. (RIDE), Canoo Inc. (GOEV), Faraday Future Intelligent Electric Inc. (FFIE), Workhorse Group Inc. (WKHS)

https://www.fool.com/investing/2023/12/25/down-80-is-xpeng-stock-a-buy-for-2024/

https://www.zacks.com/stock/news/2204395/nio-xpeng-xpev-li-auto-li-report-2023-deliveries

https://www.youtube.com/watch?v=l79NzvrFZGg

https://www.fool.com/investing/2024/01/17/why-did-nio-and-xpeng-stock-crash-on-tuesday/

https://www.youtube.com/watch?v=9kYNJ1YazSA

https://finance.yahoo.com/m/2cc8a26e-d46b-33ea-9638-9d8f27b48ad6/automaker-stocks-fall-after.html

https://finance.yahoo.com/news/flying-car-stocks-taking-off-132415849.html

https://finance.yahoo.com/m/8d2950c1-63ac-36ab-a5c6-0c45bc2baa4b/alibaba-stock-falls-below-ipo.html

https://finance.yahoo.com/news/retail-investors-xpeng-inc-nyse-135027242.html

https://finance.yahoo.com/video/alibaba-cybersecurity-stocks-xpeng-trending-153520814.html

https://finance.yahoo.com/m/16bcba85-566d-3547-b0ac-e2b27767e793/big-chinese-tech-stocks-in.html

https://finance.yahoo.com/m/95a64d12-ba87-3cce-b988-88457abd829a/chinese-ev-maker-stocks-fall.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: nzqFfD

Cost: $0.65192

https://reports.tinycomputers.io/XPEV/XPEV-2024-01-25.html Home