Apple Inc. (ticker: AAPL)

2024-01-06

Apple Inc. (AAPL) stands as one of the world's most valuable and recognizable brands, with its headquarters in Cupertino, California. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, the company has centered its business model around the design, manufacture, and marketing of consumer electronics, computer software, and online services. Its portfolio of products includes the iconic iPhone, iPad, Mac computers, Apple Watch, and Apple TV, among others. Alongside hardware, Apple's software offerings encompass the iOS and macOS operating systems, the iTunes media player, and the Safari web browser. The company has also expanded into digital services through the Apple Store, iCloud, Apple Music, Apple Pay, and more recently, subscription-based ventures such as Apple TV+ and Apple Fitness+. Apple's commitment to innovation, a strong customer base, brand loyalty, and a robust ecosystem of products and services sustain its leading position in the technology sector. With an emphasis on privacy and the environment, the company is focused on addressing contemporary challenges while driving forward technology as a means of enriching people's lives. As of my knowledge cutoff date in early 2023, Apple's financial position remains strong, with a history of consistent growth in revenues and profitability, making AAPL a staple in many investment portfolios and a bellwether for the tech industry at large.

Apple Inc. (AAPL) stands as one of the world's most valuable and recognizable brands, with its headquarters in Cupertino, California. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, the company has centered its business model around the design, manufacture, and marketing of consumer electronics, computer software, and online services. Its portfolio of products includes the iconic iPhone, iPad, Mac computers, Apple Watch, and Apple TV, among others. Alongside hardware, Apple's software offerings encompass the iOS and macOS operating systems, the iTunes media player, and the Safari web browser. The company has also expanded into digital services through the Apple Store, iCloud, Apple Music, Apple Pay, and more recently, subscription-based ventures such as Apple TV+ and Apple Fitness+. Apple's commitment to innovation, a strong customer base, brand loyalty, and a robust ecosystem of products and services sustain its leading position in the technology sector. With an emphasis on privacy and the environment, the company is focused on addressing contemporary challenges while driving forward technology as a means of enriching people's lives. As of my knowledge cutoff date in early 2023, Apple's financial position remains strong, with a history of consistent growth in revenues and profitability, making AAPL a staple in many investment portfolios and a bellwether for the tech industry at large.

| Full Time Employees | 161,000 | Previous Close | 181.91 | Day Low | 180.17 |

| Day High | 182.76 | Dividend Rate | 0.96 | Dividend Yield | 0.53% |

| Payout Ratio | 15.33% | Five Year Avg Dividend Yield | 0.8% | Beta | 1.29 |

| Trailing PE | 29.60 | Forward PE | 25.34 | Volume | 61,666,311 |

| Average Volume | 54,028,051 | Average Volume 10days | 51,248,110 | Market Cap | 2,817,856,110,592 |

| 52 Week Low | 128.12 | 52 Week High | 199.62 | Price to Sales Trailing 12 Months | 7.35 |

| 50 Day Average | 187.40 | 200 Day Average | 180.02 | Trailing Annual Dividend Rate | 0.94 |

| Trailing Annual Dividend Yield | 0.52% | Enterprise Value | 2,880,222,527,488 | Profit Margins | 25.31% |

| Float Shares | 15,535,488,445 | Shares Outstanding | 15,552,799,744 | Shares Short | 120,233,720 |

| Held Percent Insiders | 0.07% | Held Percent Institutions | 61.50% | Short Ratio | 2.29 |

| Book Value | 3.997 | Price to Book | 45.33 | Last Fiscal Year End | 1696032000 |

| Most Recent Quarter | 1696032000 | Earnings Quarterly Growth | 10.8% | Net Income to Common | 96,995,000,320 |

| Trailing Eps | 6.12 | Forward Eps | 7.15 | Peg Ratio | 4.5 |

| Total Cash | 61,554,999,296 | Total Cash Per Share | 3.958 | Ebitda | 125,820,002,304 |

| Total Debt | 123,930,001,408 | Revenue Per Share | 24.344 | Return On Assets | 20.26% |

| Return On Equity | 171.95% | Gross Profits | 170,782,000,000 | Free Cashflow | 82,179,997,696 |

| Operating Cashflow | 110,543,003,648 | Earnings Growth | 13.5% | Revenue Growth | -0.7% |

| Gross Margins | 44.13% | Ebitda Margins | 32.83% | Operating Margins | 30.13% |

Based on the provided technical, fundamental, and financial data for Apple Inc. (AAPL), the following analysis gives insight into potential stock price movements over the next few months.

Based on the provided technical, fundamental, and financial data for Apple Inc. (AAPL), the following analysis gives insight into potential stock price movements over the next few months.

Technical Indicators: - The Parabolic SAR (PSAR) indicator, with acceleration factors from 0.02 to a maximum of 0.2, has shown a bearish trend since the dots are above the price for several months. - On Balance Volume (OBV) initially indicates buying pressure from September to October but then a decline, suggesting a potential slowdown in momentum or distribution. - The Moving Average Convergence Divergence (MACD) histogram has been on a downward trend, suggesting bearish momentum entering January.

Fundamentals: - The gross margin (44.131%), EBITDA margin (32.827%), and operating margin (30.134%) confirm a strong profitability level. - The trailing PEG ratio of 2.1717 suggests that the stock might be overvalued based on its growth rates, a potential concern for price sustainability. - A stable increase in revenues and a high level of net income emphasize successful operations and profitability.

Balance Sheets: - There's a notable level of debt with a net debt of USD 81.123 billion but compared to the total capitalization, Apple boasts a strong balance sheet. - The tangible book value of USD 62.146 billion provides a fundamental footing for the company's valuation, though it does not reflect a significant market premium based on the company's valuation.

Cash Flows: - Apple has a strong free cash flow of USD 99.584 billion, indicating its operational efficiency and capacity to fund its operations, investments, and shareholder return programs. - Capital stock repurchases and dividend payments signal a return of value to shareholders and a confident outlook by management on the company's financial health.

Future Stock Price Movement: Considering the technical indicators alongside Apple's robust fundamentals and financial health, the forecast for the stock price shows a nuanced outlook. The bearish technical signals may limit the upside in the short term as the market digests the latest financials and adjusts for the potential overvaluation suggested by the trailing PEG ratio.

However, given the company's strong balance sheet and continued ability to generate significant free cash flow, there is underlying support for the stock price. This fiscal strength may cushion any significant downside and potentially attract long-term investors if the price were to soften.

Investors should carefully monitor upcoming quarterly reports for signs of continued strong operational performance, which, combined with technical indicator reversals, could offer opportunities for price appreciation. Conversely, if bearish technicals persist and are coupled with any signs of weakening fundamentals, the stock could experience further consolidation or downward pressure in the months ahead.

In conclusion, Apple's stock price behavior in the next few months will likely be influenced by both technical patterns indicating short-term bearish sentiment and solid fundamentals providing longer-term price support. Given the mixed signals, investors should adopt a cautious approach, seeking confirmation of either a return of bullish momentum or the support of strong financials before making significant investment decisions.

Over the five-year period ending today, the probabilistic linear regression between AAPL (Apple Inc.) and SPY (an ETF that tracks the S&P 500, representing the market) indicates a moderate positive correlation, signaling that AAPL's returns have had a tendency to move in the same direction as SPY's, but not perfectly so. The prior, training, and test R-squared (R2) values, which measure the proportion of variation in the dependent variable that can be explained by the independent variable, are 0.540603, 0.523408, and 0.458112 respectively. These figures indicate that the model can explain between approximately 46% to 54% of the variance in AAPLs returns based on SPYs returns over this time frame. The standard deviation of the R-squared values in each phase prior (0.005219), training (0.011761), and test (0.030994) reveals the stability of the models performance throughout different stages of analysis, with a higher standard deviation in the test phase suggesting less certainty in the model's predictive power out-of-sample.

The role of alpha (often represented as the intercept in a linear regression model) is to capture the average return that AAPL would yield over the market return as estimated by SPY, which is independent of the market's performance. The 'posterior_alpha' data array reflects various draws from the posterior distribution of the alpha parameter after model training. The variation between these draws represents the uncertainty inherent in estimating alpha. These values, which hover around -0.3 to -0.5, suggest that when SPY's return is at its mean value, AAPL's returns would tend to be less than SPYs returns by this alpha magnitude. However, it's important to interpret this in the context of the broader model, the covariates, and only as an average over the observed five-year period.

The SEC 10-Q filing for Apple Inc. (AAPL) provides detailed insights into the company's financial and operational status for the third quarter ended July 1, 2023. Apple Inc. experienced a slight decline in total net sales of 1% year-over-year, amounting to $81.797 billion for the quarter. The sales decrease was driven primarily by lower sales in the iPhone and iPad segments, partially offset by an increase in services. The services segment saw an 8% increase in net sales, largely due to higher revenues from advertising, cloud services, and the App Store.

The filing also reports the regional sales performance, with Americas experiencing a 6% reduction, while the Europe and Greater China segments recorded increases of 5% and 8%, respectively. Japan and the Rest of Asia Pacific saw declines of 11% and 8%. These fluctuations in net sales are attributed to a combination of factors, including the impact of foreign currency exchange rates, particularly the weakening of foreign currencies against the U.S. dollar.

The company's gross margin showed improvement, with the total gross margin at 44.5%, up from 43.3% in the same quarter last year. This increase is a result of cost savings measures and a favorable product mix. Product gross margin rose due to cost savings, while services gross margin rose due to higher net sales, though that was partially offset by increasing service costs.

Operating expenses for the quarter rose to $13.415 billion, driven by higher research and development costs that reflect an increase in headcount-related expenses. The companys effective tax rate decreased to 12.5% during the third quarter of 2023 from 15.7% in the third quarter of 2022 primarily due to reduced taxes on foreign earnings, which also included favorable adjustments related to tax benefits.

Apple Inc. continued its significant capital return program to shareholders, repurchasing $18 billion of its common stock and paying dividends and dividend equivalents of $3.8 billion. Liquidity remains strong with cash, cash equivalents, and marketable securities totaling $177.778 billion.

During the third quarter, the company launched several products, including the 15-inch MacBook Air with M2 chip, Mac Studio with M2 Max and M2 Ultra chips, and the Apple Vision Pro. It also announced updates to its operating systems, which are expected to be available in the fall of 2023.

The 10-Q filing further addresses the ongoing legal proceedings, highlighting a lawsuit filed by Epic Games, Inc. against Apple Inc. regarding its App Store operations. The U.S. District Court ruled in favor of Apple on nine out of ten counts, with the U.S. Court of Appeals for the Ninth Circuit affirming the ruling. Apples motion to stay enforcement of an injunction pending an appeal to the U.S. Supreme Court was granted, with Epic having appealed the Circuit Courts stay.

This filing reiterates Apple's intent to manage its capital return program prudently and suggests confidence in its financial position and liquidity for the foreseeable future. It is evident that Apple continues to innovate with new product launches while also facing and managing various legal and operational challenges.

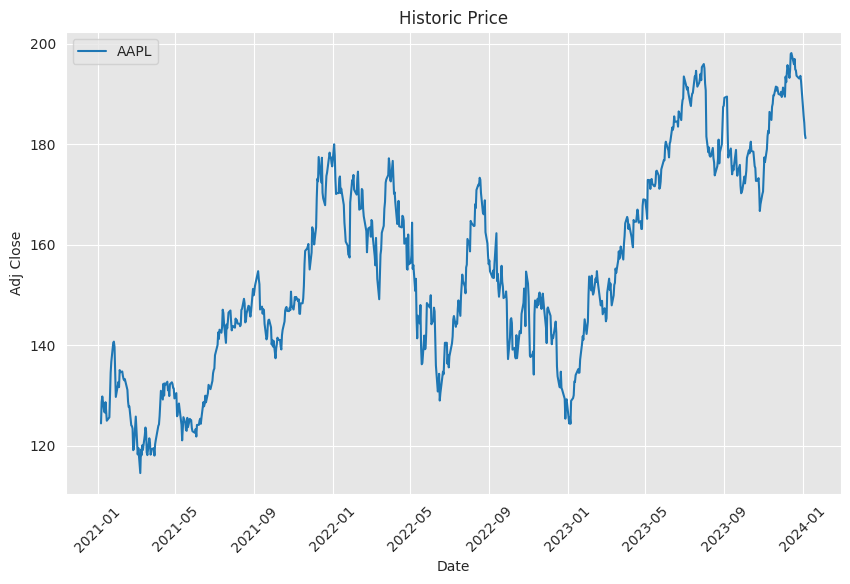

Apple Inc.'s performance in the fiscal year ending on September 30, 2023, showcased the company's resilience and adaptability in the face of global economic headwinds. Recording sales of $383.3 billion, the tech giant's revenue was driven primarily by its hallmark product, the iPhone, which contributed 52% to the overall figure. However, the modest 2.8% increase in iPhone sales in the fourth quarter to $43.8 billion, despite the release of the iPhone 15, indicates potential challenges in sustaining growth rates comparable to previous years, especially given supply constraints and competitive pressures. CEO Tim Cook credited these sales figures to a strong showing in China, a market that has become increasingly vital for Apple, despite regulatory hurdles and competition from domestic brands.

The revenue from other Apple products, including Mac, iPad, smartwatches, and accessories, did not meet expectations for the fourth quarter. Apple's struggle to introduce industry-disruptive products in recent times, coupled with the impact of inflation on consumer spending power, has contributed to a subdued performance in these segments. The anticipated launch of the new mixed reality headset, Vision Pro, generated excitement but also concerns about its affordability and widespread appeal.

On the bright side, Apple's services segment saw a buoyant increase in sales of 16% during the same quarter, reaching $22.3 billion, underscoring a strategic shift towards diversifying revenue streams. The high gross margin associated with services presents a strong potential for increased profitability. It is clear that Apple is bolstering its services offerings, which range from Apple Music and iCloud to Apple Pay, positioning this segment as a pillar of the tech giant's future growth strategy.

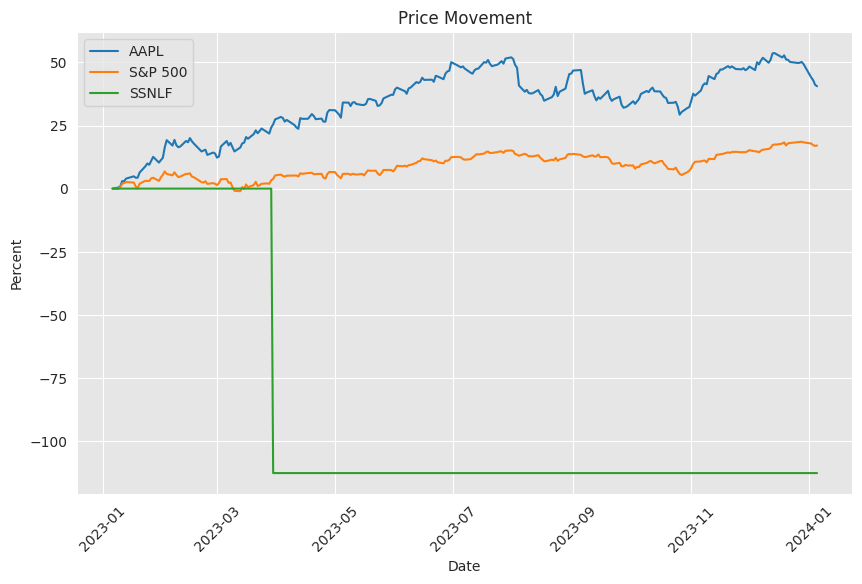

Despite mixed signals from product and service segments, Apple's stock experienced a significant uptick over the past year, rising by 48% and outperforming the S&P 500. This robust growth in Apple's share price has led to a high price-to-earnings (P/E) ratio of 30, suggesting an elevated market valuation. This peak standing challenges Apple to maintain its growth trajectory, especially within the fiercely competitive iPhone market and against the backdrop of needing to revitalize its other product lines.

Looking forward, the ongoing geopolitical and economic climate is likely to affect companies globally, and Apple is no exception. The anticipated U.S. Justice Department antitrust case against Apple could have implications on its business practices, while a shift in the Chinese economy, a key market for Apple, may influence future demand for its products. Meanwhile, competition remains fierce as industry leaders Qualcomm, Google, and Samsung form an alliance, potentially disrupting Apple's niche in the tech sector.

The broader financial markets also present a complex backdrop for Apple's journey into 2024. An unexpected boost in U.S. jobs in December has led to a rise in Treasury yields, impacting financial markets and intensifying concerns about the Federal Reserve's interest rate policies. Such macroeconomic developments are integral for Apple investors to monitor, given the company's global footprint and susceptibility to market sentiment.

Despite potential headwinds, Warren Buffetts persisting investment in Apple via Berkshire Hathaway instills confidence in the company's longevity and underlying value. The holding of substantial cash reserves, coupled with a nearly doubled number of paid subscriptions over three years, provides Apple with leeway to navigate short-term market challenges while furthering its strategic objectives.

However, given Apple's revenue downturn in each quarter of 2023, other investment opportunities are emerging as more attractive alternatives for growth-seeking investors. Amazon and Visa, for example, have showcased more resilient financials and have been recommended over Apple by experts like Jeremy Bowman and Keithen Drury from The Motley Fool. This shift in recommendations illuminates the industry's dynamic nature and the need for investors to continually reassess their portfolios in the face of changing market conditions.

Discussions on Apple's future inevitably revolve around innovationwhether the tech behemoth can disrupt the industry once more with groundbreaking technology remains a pivotal query. The much-speculated entry into autonomous vehicles could rekindle Apple's growth and redefine its market position. However, these speculations have yet to materialize into concrete business plans, leaving them in the realm of potential rather than actual drivers of growth.

Investors are thus faced with a crossroad: whether to align with analysts who suggest reallocating funds from Apple, such as The Motley Fool's Lawrence Rothman, or to consider the company's position with a long-term perspective. While challenges are evident, so are opportunities. Apple's emphasis on its growing services sector and potential new markets, like AR and VR, should be weighed against market concerns and the possibility of plateauing iPhone sales.

In sum, as we move through 2024, Apple's narrative is one of complexity, brimming with both triumphs and trials, and it is up to the investors to infer whether the tech leader's stock should continue to command a prominent place in their investment portfolio.

Similar Companies in Consumer Electronics:

Samsung Electronics Co., Ltd. (SSNLF), Alphabet Inc. (GOOGL), Microsoft Corporation (MSFT), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Sony Group Corporation (SONY), Dell Technologies Inc. (DELL), HP Inc. (HPQ), Lenovo Group Limited (LNVGY), Xiaomi Corporation (XIACF), Intel Corporation (INTC), Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Advanced Micro Devices, Inc. (AMD), Qualcomm Incorporated (QCOM), LG Electronics Inc. (LGEIY), International Business Machines Corporation (IBM)

News Links:

https://seekingalpha.com/article/4661471-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2024/01/06/what-that-famous-quote-about-bulls-bears-and-pigs/

https://www.fool.com/investing/2024/01/05/qualcomm-google-and-samsung-partner-up-to-take-on/

https://finance.yahoo.com/m/81ac8361-941a-364b-9128-fd48135e88d3/is-apple-stock-a-buy%3F.html

https://www.fool.com/investing/2024/01/05/x-fantastic-warren-buffett-stocks-for-2024/

https://finance.yahoo.com/m/07b5672c-00b5-3565-bd1b-bdc1ac363367/out-of-cloud-storage%3F-these.html

https://www.fool.com/investing/2024/01/05/forget-apple-2-stellar-warren-buffett-stocks/

https://www.fool.com/investing/2024/01/05/best-stock-to-buy-apple-vs-alibaba/

https://finance.yahoo.com/news/apples-reign-worlds-most-valuable-093000048.html

https://www.fool.com/investing/2024/01/05/is-apple-stock-a-buy/

https://www.fool.com/investing/2024/01/06/is-apple-stock-a-buy-now/

https://finance.yahoo.com/m/2e9e26a8-b3c7-3305-8028-797a92dab0aa/is-apple-stock-a-buy-now%3F.html

https://finance.yahoo.com/news/microsoft-stock-nasdaq-msft-stay-033425189.html

https://www.fool.com/investing/2024/01/05/is-it-too-late-to-buy-apple-stock/

https://www.fool.com/investing/2024/01/06/apple-buy-sell-or-hold/

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: YOEPTm

https://reports.tinycomputers.io/AAPL/AAPL-2024-01-06.html Home