American Electric Power Company, Inc. (ticker: AEP)

2024-01-07

American Electric Power Company, Inc. (ticker: AEP) stands as one of the largest electric utilities in the United States, serving over five million customers across 11 states. With its headquarters in Columbus, Ohio, AEP boasts a vast infrastructure that includes approximately 224,000 miles of distribution lines. The company's revenue streams are predominantly derived from its regulated utility operations, which include the generation, transmission, and distribution of electricity. A historic player in the energy sector, AEP has been transitioning towards cleaner energy sources, investing in wind and solar projects while gradually reducing its reliance on coal. The publicly-traded company is listed on the NYSE and is a component of the S&P 500 index, reflecting its prominence in the market and the economy. AEP's strategy focuses on modernizing the power grid, enhancing reliability, and promoting energy efficiency, which aligns with broader environmental goals while seeking to deliver value to its shareholders.

American Electric Power Company, Inc. (ticker: AEP) stands as one of the largest electric utilities in the United States, serving over five million customers across 11 states. With its headquarters in Columbus, Ohio, AEP boasts a vast infrastructure that includes approximately 224,000 miles of distribution lines. The company's revenue streams are predominantly derived from its regulated utility operations, which include the generation, transmission, and distribution of electricity. A historic player in the energy sector, AEP has been transitioning towards cleaner energy sources, investing in wind and solar projects while gradually reducing its reliance on coal. The publicly-traded company is listed on the NYSE and is a component of the S&P 500 index, reflecting its prominence in the market and the economy. AEP's strategy focuses on modernizing the power grid, enhancing reliability, and promoting energy efficiency, which aligns with broader environmental goals while seeking to deliver value to its shareholders.

| Full Time Employees | 16,974 | Day Low | 82.98 | Day High | 84.54 |

| Dividend Rate | 3.52 | Dividend Yield | 4.19% | Payout Ratio | 76.15% |

| Five Year Avg Dividend Yield | 3.38 | Beta | 0.505 | Trailing PE | 19.28211 |

| Forward PE | 15.0125 | Volume | 2,464,013 | Average Volume | 3,486,729 |

| Average Volume 10 Days | 2,783,220 | Market Cap | 44,210,397,184 | 52 Week Low | 69.38 |

| 52 Week High | 98.32 | Price to Sales Trailing 12 Months | 2.2923331 | Fifty Day Average | 79.3778 |

| Two Hundred Day Average | 82.68515 | Trailing Annual Dividend Rate | 3.32 | Trailing Annual Dividend Yield | 3.9812926% |

| Enterprise Value | 86,537,764,864 | Profit Margins | 11.699% | Float Shares | 525,228,806 |

| Shares Outstanding | 525,876,000 | Shares Short | 7,539,935 | Shares Percent Shares Out | 1.43% |

| Held Percent Insiders | 0.023% | Held Percent Institutions | 77.667% | Short Ratio | 2.04 |

| Short Percent Of Float | 1.43% | Book Value | 48.151 | Price To Book | 1.7459657 |

| Earnings Quarterly Growth | 39.5% | Net Income To Common | 2,256,199,936 | Trailing Eps | 4.36 |

| Forward Eps | 5.6 | Peg Ratio | 4.27 | Total Debt | 42,851,799,040 |

| Total Revenue | 19,286,200,320 | Debt To Equity | 169.043 | Revenue Per Share | 37.386 |

| Return On Assets | 2.644% | Return On Equity | 9.0579994% | Gross Profits | 8,414,100,000 |

| Free Cashflow | -2,949,087,488 | Operating Cashflow | 4,230,500,096 | Earnings Growth | 37.6% |

| Revenue Growth | -3.3% | Gross Margins | 43.164003% | Ebitda Margins | 36.244% |

| Operating Margins | 26.368% | Current Price | 84.07 | Price To Sales Trailing 12 Months | 2.2923331 |

Based on the detailed datasets provided for technical analysis, fundamental analysis, and balance sheet assessments, we can generate an informed outlook on the possible stock price movement for American Electric Power (AEP) in the upcoming months.

Based on the detailed datasets provided for technical analysis, fundamental analysis, and balance sheet assessments, we can generate an informed outlook on the possible stock price movement for American Electric Power (AEP) in the upcoming months.

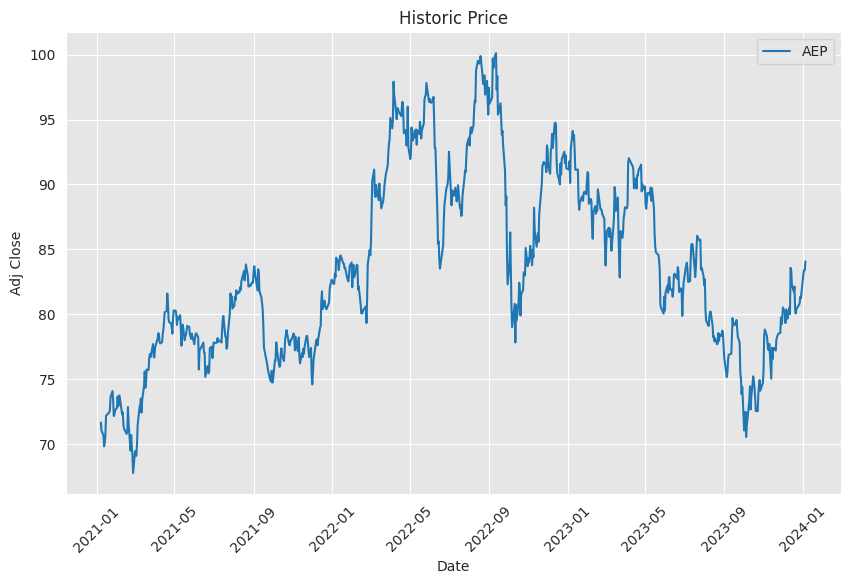

Technical Analysis Overview: - Recent closing prices show a steady uptrend, indicative of bullish sentiment. - The Positive Volume Index (PVI) suggests a strong correlation between rising volume and increasing stock prices. - The Moving Average Convergence Divergence (MACD) histogram has moved from negative to positive territory, highlighting a potential momentum shift favoring the bulls. - There are no apparent resistance signals from the Parabolic SAR (Stop and Reverse) indicator, as the focus remains on the long positions.

Fundamental Analysis Insights: - AEP exhibits solid fundamentals, marked by consistent gross, EBITDA, and operating margins over the years, suggesting stable financial operations. - The company's net income has shown resilience, although with slight variations due to non-operational factors like tax provisions and unusual items. - Earnings Per Share (EPS) are robust, a positive indicator for investors emphasizing profitability. - The balance sheet speaks to a sizeable debt position that has increased year on year, signaling a heavy capital structure that might concern debt-focused analysts.

Balance Sheet and Financials Reflection: - The growth in total revenue over the past years demonstrates AEP's ability to grow its operational scale. - Investment activities, such as the issuance of debt and repayment of debts, are significant, pointing to active capital management. - Free cash flow has been negative, which may raise questions about liquidity and cash management efficiency. - Capital expenditures have been substantial, indicating ongoing investment in infrastructure which is typical for utility companies.

Forecast and Price Movement Expectation: Considering the prevailing market conditions, bullish technical indicators, and stable financial fundamentals:

- In the short term, one might expect a continuation of the bullish trend, thanks to the positive momentum identified via MACD and the high volume of shares traded.

- The positive narrative might continue in the medium term as well, supported by the company's good performance in generating revenue and maintaining profitability.

- The heavy debt load is a cause for caution, and sustained monitoring will be essential. Should interest rates rise or if there is any adverse news on the regulatory front for utilities, this could negatively impact the price.

- Over a longer horizon, unless there is a significant change in the market environment or company fundamentals, the stock may plateau as investors digest the growth prospects against the backdrop of the high debt levels.

Investors should weigh these factors against their investment objectives and risk tolerance. As always, it's essential to consider current market sentiment, sector-specific news, analyst reports, and broader economic indicators alongside technical and fundamental analysis to make informed investment decisions. The bullish indicators and strong fundamentals suggest an optimistic outlook for AEP's stock in the coming months, assuming no negative macroeconomic or company-specific developments occur.

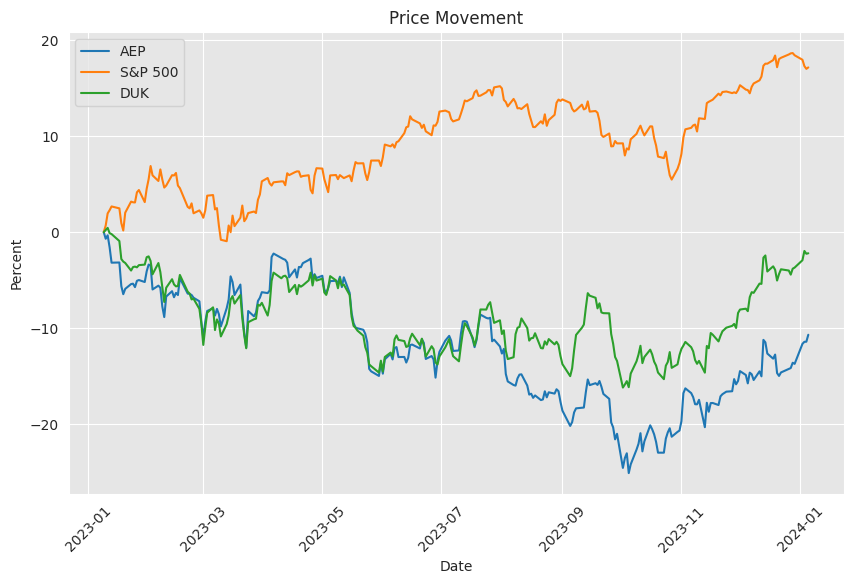

The regression analysis of AEP returns against SPY, a proxy for the market, demonstrates a positive relationship with an R-squared value of 0.267. The adjusted R-squared value is slightly lower at 0.266, indicating that approximately 26.6% of the variability in AEP returns can be explained by movements in SPY returns. The model has a statistically significant F-statistic with a value of 456.3 and a p-value of 1.34e-86, suggesting that the independent variable (SPY) provides predictive value for the dependent variable (AEP). A beta coefficient of 0.5967 implies that for every one percent change in the SPY, AEP is expected to change by approximately 0.5967%. This beta value indicates a positive but less than one-for-one relationship between AEP's returns and the market's returns.

The alpha, or the intercept of the model, represents the expected return on AEP when the SPY's return is zero. For this model, alpha is -0.0032627918500735048, essentially close to zero with a p-value of 0.929. This p-value indicates that the alpha is not statistically different from zero, suggesting that there is no significant abnormal performance in AEP returns that isn't accounted for by its relationship with the market as measured by SPY. Furthermore, the confidence interval for alpha is between -0.076 and 0.069, reinforcing the notion that alpha is not significantly different from zero. The low alpha along with the positive beta implies that AEP's returns seem to follow the market's returns without providing a sizeable consistent outperformance or underperformance on its own.

As per the 10-Q filing for the American Electric Power Company, Inc. (AEP) for the period ending September 30, 2023, the company presented its financial position, operating results, and cash flows. The financial statements reflect significant transactions and capital movements that occurred during this period in the context of their business and industry operations.

During the quarter, AEP maintained a focus on revenue generation through the sale of drones, sensors, related accessories, and software subscriptions. The company recognizes revenue primarily upon the transfer of control to customers, which is typically upon delivery of the product or completion of service obligations. There are specific sections where the company detailed its arrangements relating to its SaaS platforms, namely HempOverview and Ground Control, which operate on a subscription basis and recognize revenue over the given membership period as services are rendered.

The company also gave considerable attention to the management of its inventory, ensuring that it maintains the lower of cost or net realizable value. The management strategically assesses forecasted demand relative to inventory levels on hand to account for any provisions for excess or obsolete inventories.

The filing also showed that the company had to contend with a complex financial structure featuring a mix of equity transactions including the issuance of common stock and warrants, as well as deferred payments. For example, a significant amount of financing was raised in the form of a promissory note coupled with common stock purchase warrants to an institutional investor. The company further entered into a Securities Purchase Agreement which resulted in the issuance of shares and warrants, effectively raising additional capital. AgEagle incurred losses during the nine-month period, which triggered liquidity considerations. The company indicated that the continuing ability to raise capital is not guaranteed.

Additionally, the report stipulated conditions and eventslike global economic challenges, the impact of war, pandemics, rising inflation, supply chain disruptions, and adverse labor market conditionsthat could introduce economic uncertainty and volatility affecting the company's operational and financial performance. This also includes concerns about the company's ability to secure components and parts necessary for manufacturing its proprietary drones and sensors.

Throughout the document, certain accounting and financial benchmarks and methods are detailed, including inventory management, accounts and note receivable processes, provisions for warranties, and treatments of foreign currency and comprehensive income, which are all in accordance with U.S. GAAP.

Lastly, as per the filing, a certain level of risk exists due to the company's sustained operating losses, and there exists substantial doubt concerning the company's ability to continue as a going concern without additional financing, potentially leading to significant restructuring or reduction in operations.

Its important to note that this summary is derived from a limited initial analysis. For a complete understanding of AEP's financial situation and the nuances of its operations, further detailed analysis is recommended.

American Electric Power Company, Inc. (AEP) has carved out a reputation as a top utility stock in the United States, especially appealing for investors seeking stable and consistent passive income. This is made possible by its attractive high-yield dividend, a characteristic of considerable value given the broader market context where high-yield sectors like energy and utilities have largely underperformed. Despite this general trend, AEP offers a compelling case as a haven for investors who are willing to be patient and prioritize steady dividend income over rapid growth.

Rooted in a rich historical lineage that traces back to 1906, AEP has grown into one of the largest electric utilities in the U.S. The company's commanding presence is bolstered by an extensive asset base, including a transmission network surpassing 40,000 miles and a distribution system spanning more than 225,000 miles. Focusing on providing services to roughly 5.6 million customers, the regulated markets AEP operates in ensure predictable revenue and earnings. These strengths have enabled AEP to engage in a tradition of sharing profits with shareholders in the form of dividends.

American Electric Power's solid financials reflect a firm's commitment to growth and stability. A 5.6% dividend compound annual growth rate over the past decade showcases the company's intention of continually increasing shareholder returns. The company has communicated its strategy to align future payout increases with an annual operating earnings growth forecasted between 6% and 7%. By aiming to keep a payout ratio between 60% to 70%, AEP demonstrates a balance of pursuing growth and maintaining financial well-being, with the average payout ratio of the past five years standing at 67%.

The strategic direction of AEP secures investor confidence by showcasing an investment in the company's financial health as well as a commitment to shareholder returns. As a utility operating in a regulated sector, AEP's business model is characterized by stability and a conservative approach to managing capital. This differentiates it as an attractive option for income-focused investors, especially in a market that tilts toward more aggressive, potentially speculative ventures.

Peering into the future, the predicted 4.4% forward-yielding dividend by AEP accentuates the company's allure. The expectation of a continuous rise in dividends paired with the careful orchestration of payout ratios signals a resilient income source for investors. Such steady growth, in conjunction with the consistency of shareholder returns, gives AEP a prominent place in the landscape of utility investments and positions it as a reliable constituent in diversified investment portfolios.

In terms of resilience and solidity, few companies in the utilities sector can boast the long historical dividend track record that AEP has. Over a century of consecutive payouts signifies a company that is profoundly dedicated to financial health and shareholder value. The substantial base of 5.6 million customers serves as a testament to the enduring nature of AEP's business, which proves to be a particularly critical factor amidst concerns of potential stock market instability and economic downturns.

AEP's resolute financial management and strategic planning have been evident in its consistently increasing dividends, with a remarkable upward trajectory since 2010. This progress presents a promising sign for investors in search of a stable income in an unpredictable market environment. In comparison to similar utility providers like Dominion Energy, which has recently experienced more considerable distaste and transformation, AEP's dividend story contrasts with its steadiness and predictable growth.

The consistent dedication to financial discipline from AEP has allowed it to navigate through various economic challenges. This is highlighted by its ability to not only maintain but also aim for increased dividend yields in times when other sectors might face contractions. The utility sector's de facto resilience against economic downturns, owing to inelastic demand for its services, provides a stable backdrop for AEP's dependable revenue streams.

Among the utilities sector, AEP has surfaced as a topic of interest in investment circles, particularly following comments from high-profile investors like Jeffrey Gundlach. He cautioned on the valuation of the tech giants and their potential vulnerability in an anticipated recession. In contrast, sectors like utilities, with staunch players like AEP, are considered valuable especially given their recurrent outperformance in times of economic stress and their attractive dividend yields that gain favor when bond yields are declining.

AEP's determined sale of assets in New Mexico Renewable Development to Exus North America Holdings for a ticket price of approximately $230 million demonstrates a strategic refinement. This deal clears the way for AEP to strengthen its core focus on regulated operations and redirects resources to enhance its financial flexibility and investment in energy infrastructure. This sale follows a previously completed $1.5 billion divestiture, further concentrating AEP's focus on regulated utility functions.

These focused corporate actions are framed by AEP's commitment to sustainability, as the company gradually shifts towards renewable energy sources and away from fossil fuel-based generation. By investing significantly in such areas and holding steadfast to emission-reducing targets, AEP positions itself as an innovator willing to transform in line with both market and environmental exigencies.

AEP's concentrated business strategy and investment on infrastructure modernization reflect a dedication to both customer value and investor confidence. The company's broad and future-focused capital plan underpins objectives of reliability, diversity, and emissions reduction. In doing so, AEP honors its role as a trailblazer in the utility sector and reiterates its resolve to achieve growth, accept community responsibility, and support environmental stewardship.

The most recent quarterly earnings for AEP point to a company with an adept handle on strategic investment and growth amidst various economic pressures such as inflation and fluctuating weather patterns. The recorded GAAP earnings increase compared to the year before and narrowed operating earnings guidance for the current year foreground the company's assurance in its long-term growth targets. Strategic business decisions, including asset divestitures and renewable investment advancements, underpin the company's ambition to balance customer needs with market progression and investor aspirations.

As one of the prominent dividend-payers in the Nasdaq-100, AEP balances its position as a solid dividend source in an index known for high-growth, low-dividend technology stocks. The company's dividend strength lies in its impressive track record of consistent payouts, stretching back over a century, offering investors a sense of regularity and security seldom found in the utilities domain. However, the slow pace in stock value growth compared to other Nasdaq components suggests that AEP is more suited for those prioritizing income over rapid capital appreciation.

AEP's distinct corporate endeavors extend to the talent they cultivate. The commendation of their internship program as the highest-rated in the energy industry by Vault's Internship Rankings underlines AEP's effort in developing industry leaders. The acknowledgment of their work environment, career prospects, and diversity objectives are mirrored in the company's broader values and strategies to ensure a sustainable energy future.

Finally, AEP's ability to raise its quarterly dividend, maintaining a history of continuous payouts for over 110 years, signals an entity in strong fiscal health with a forward-looking vision. AEP's focus on clean, sustainable energy, an expansive and modern service infrastructure, and a pledge to environmental and societal responsibilities reveal a company that not only promises stability but also propels a vision of progress and innovation within the energy sector.

Similar Companies in Electric Utilities:

Duke Energy Corporation (DUK), Report: Southern Company (SO), Southern Company (SO), Dominion Energy, Inc. (D), Exelon Corporation (EXC), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Xcel Energy Inc. (XEL), PG&E Corporation (PCG), Edison International (EIX), FirstEnergy Corp. (FE), PPL Corporation (PPL)

News Links:

https://www.fool.com/investing/2023/12/10/3-monster-dividend-stocks-buy-before-the-new-year/

https://finance.yahoo.com/news/aep-signs-agreement-sell-mexico-113000184.html

https://finance.yahoo.com/news/aep-streamlining-business-focusing-regulated-213000006.html

https://www.fool.com/investing/2023/09/27/stock-market-sell-off-consider-dividend-stocks/

https://finance.yahoo.com/news/aep-reports-third-quarter-2023-105700484.html

https://www.fool.com/investing/2023/12/23/this-utility-is-making-a-smart-move-to-lock-in-smo/

https://finance.yahoo.com/news/aep-selected-best-internship-energy-192800312.html

https://www.fool.com/investing/2023/12/14/should-you-buy-the-3-highest-paying-dividend-stock/

https://finance.yahoo.com/news/aep-increases-quarterly-dividend-88-163700835.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: tiyhJcW

https://reports.tinycomputers.io/AEP/AEP-2024-01-07.html Home