American Tower Corporation (ticker: AMT)

2023-12-24

American Tower Corporation (NYSE: AMT) is a leading independent owner, operator, and developer of multitenant communications real estate. The company provides a critical and strategic layer of infrastructure to support the wireless ecosystem, including wireless service providers, broadcasters, and businesses across various industries. With a portfolio of approximately 214,000 communication sites, as of 2023, American Tower operates on a global scale, encompassing the United States and international markets in Asia, Latin America, Europe, the Middle East, and Africa. The company's business model centers around leasing antenna space on its towers to various tenants, which typically provides stable and recurring revenue streams. Given the proliferation of mobile devices, the advent of 5G technology, and the increasing demand for wireless data consumption, American Tower is positioned to potentially benefit from the continued expansion and upgrade of telecommunications networks worldwide. The stock symbol AMT represents American Tower on the New York Stock Exchange, where investors can buy shares in the company.

American Tower Corporation (NYSE: AMT) is a leading independent owner, operator, and developer of multitenant communications real estate. The company provides a critical and strategic layer of infrastructure to support the wireless ecosystem, including wireless service providers, broadcasters, and businesses across various industries. With a portfolio of approximately 214,000 communication sites, as of 2023, American Tower operates on a global scale, encompassing the United States and international markets in Asia, Latin America, Europe, the Middle East, and Africa. The company's business model centers around leasing antenna space on its towers to various tenants, which typically provides stable and recurring revenue streams. Given the proliferation of mobile devices, the advent of 5G technology, and the increasing demand for wireless data consumption, American Tower is positioned to potentially benefit from the continued expansion and upgrade of telecommunications networks worldwide. The stock symbol AMT represents American Tower on the New York Stock Exchange, where investors can buy shares in the company.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 100.31B | 76.66B | 90.40B | 95.23B | 98.64B | 99.96B |

| Enterprise Value | 145.01B | 121.82B | 135.51B | 140.25B | 143.18B | 147.37B |

| Trailing P/E | 143.46 | 80.22 | 65.08 | 53.49 | 33.68 | 35.37 |

| Forward P/E | 44.05 | 32.68 | 43.10 | 46.51 | 47.17 | 42.19 |

| PEG Ratio (5 yr expected) | 2.64 | 1.93 | 1.76 | 1.83 | 3.44 | 2.76 |

| Price/Sales (ttm) | 9.08 | 7.03 | 8.34 | 8.83 | 9.33 | 9.61 |

| Price/Book (mrq) | 22.13 | 14.84 | 16.72 | 17.09 | 15.70 | 14.37 |

| Enterprise Value/Revenue | 13.11 | 43.22 | 48.89 | 50.68 | 52.93 | 55.16 |

| Enterprise Value/EBITDA | 27.81 | 69.02 | 85.36 | 93.33 | 398.17 | 71.96 |

| Full Time Employees | 6,391 | Previous Close | 214.28 | Market Cap | 100,314,046,464 |

| Open | 214.96 | Day Low | 213.66 | Day High | 217.11 |

| Dividend Rate | 6.8 | Dividend Yield | 0.0316 | Payout Ratio | 3.1267 |

| Five Year Avg Dividend Yield | 2.12 | Beta | 0.683 | Trailing PE | 142.50993 |

| Forward PE | 43.826885 | Volume | 1,106,416 | Average Volume | 2,314,626 |

| Average Volume 10 Days | 2,248,830 | Bid | 215.0 | Ask | 220.0 |

| Fifty Two Week Low | 154.58 | Fifty Two Week High | 235.57 | Price to Sales Trailing 12 Months | 9.067936 |

| Fifty Day Average | 191.8806 | Two Hundred Day Average | 189.19255 | Trailing Annual Dividend Rate | 6.31 |

| Trailing Annual Dividend Yield | 0.029447451 | Enterprise Value | 151,712,579,584 | Profit Margins | 0.0646 |

| Shares Outstanding | 466,164,992 | Float Shares | 465,246,773 | Shares Short | 6,209,078 |

| Shares Percent Shares Out | 0.0133 | Held Percent Insiders | 0.00157 | Held Percent Institutions | 0.93548 |

| Short Ratio | 2.71 | Short Percent of Float | 0.0154 | Book Value | 9.725 |

| Price to Book | 22.127506 | Net Income to Common | 714,600,000 | Trailing EPS | 1.51 |

| Forward EPS | 4.91 | PEG Ratio | 9.45 | Enterprise to Revenue | 13.714 |

| Enterprise to EBITDA | 22.681 | 52 Week Change | 0.020341396 | Current Price | 215.19 |

| Total Cash | 2,118,899,968 | Total Cash Per Share | 4.545 | EBITDA | 6,688,999,936 |

| Total Debt | 46,816,198,656 | Quick Ratio | 0.461 | Current Ratio | 0.56 |

| Total Revenue | 11,062,500,352 | Debt to Equity | 416.718 | Revenue Per Share | 23.744 |

| Return on Assets | 0.0336 | Return on Equity | 0.05411 | Gross Profits | 7,447,300,000 |

| Free Cashflow | 4,745,762,304 | Operating Cashflow | 4,765,499,904 | Earnings Growth | -0.301 |

| Revenue Growth | 0.055 | Gross Margins | 0.70584 | EBITDA Margins | 0.60466 |

| Operating Margins | 0.34939 | High Price Target | 259.0 | Low Price Target | 183.0 |

| Mean Price Target | 225.71 | Median Price Target | 234.0 | Number of Analyst Opinions | 17 |

Based on the provided technical analysis data and fundamentals for AMT (assumed to be American Tower Corporation), the stock appears to be at an important juncture. Here are some insights from the technical indicators on the last trading day:

- The MACD is above the signal line, indicating bullish momentum, although the negative histogram suggests that the bullish strength is waning.

- A RSI value of 72.26 leans toward overbought territory, indicating that the stock may be due for a pullback or consolidation in the near term.

- Bollinger Bands show the price closer to the upper band, which could signal that the stock is overextended to the upside in the short term.

- The stock price is above both the SMA_20 and EMA_50, suggesting a long-term uptrend.

- The OBV indicates positive volume flow, which can support a continued rise in price.

- Stochastics are moderately positive, with the %K above the %D, signaling upward momentum.

- A strong ADX of 43.51 indicates a very strong trend, and the current direction has been strong, but it's important to note trends can't persist forever without corrections or reversals.

- The Williams %R also suggests overbought conditions, reinforcing the RSI's indication.

- Chaikin Money Flow (CMF) is slightly positive, suggesting some buying pressure.

- Parabolic SAR is currently below the price, confirming the uptrend, although this indicator typically works better in trending markets.

The fundamentals provide a broader view of the companys financial health and valuation:

- Market Cap has seen fluctuations over the quarters but remains relatively high, which implies investor confidence.

- The Trailing P/E is high which can either suggest optimism about future growth or that the stock is overvalued compared to earnings.

- Forward P/E is lower than the trailing P/E, indicating that earnings are expected to grow.

- The PEG Ratio and Price/Sales ratios are relatively high, which can suggest that the stock is richly valued at current levels.

- EV/EBITDA is elevated, another sign that the stock is not cheap.

- Financial statements show solid EBITDA and Operating Income growth over the past years.

- Net Income has varied, with a notable decline in the most recent year.

- Interest Expenses have been significant, hinting at the high burden of debt.

In the immediate term, the overbought conditions indicated by RSI and Williams %R, combined with the negative MACD histogram, caution against excessive bullish expectations and prepare investors for potential short-term pullbacks or sideways price action. This could have the stock experiencing some consolidation, as traders and algorithms could take profits and reassess positions.

However, the longer-term uptrend is supported by the price residing above both the SMA and EMA (20 and 50-days), a positive OBV, and strong ADX. This implies any short-term consolidation may be a precursor to continued upward movement, especially if corporate fundamentals, such as revenue and EBITDA growth, remain robust and justify the high valuation ratios.

The overall sentiment, reinforced by solid operating results and moderate CMF, could see the stock maintaining its bullish trend over the next few months, barring any severe market turmoil or adverse company-specific news. However, the high valuation metrics suggest investors will be closely monitoring future earnings reports to ensure the growth trajectory can sustain these valuations. Any signals of slowing growth or reduced profitability could lead to price adjustments.

In conclusion, while strong fundamentals suggest confidence in the company's overall performance, technical indicators hint at overbought conditions that may result in near-term consolidation. Investors will need to weigh these technical signals against the company's growth narrative. It's also critical to monitor incoming fundamental information, such as quarterly reports and market conditions, to evaluate whether the stock can continue its upward trajectory or if a revaluation is on the horizon.

American Tower Corporation (NYSE: AMT), a global leader in wireless communications infrastructure, operates under the robust structure of a real estate investment trust (REIT), a status bestowed upon it due to its model of owning, operating, and developing properties for wireless and broadcast communications. Headquartered in Boston, this giant maintains an expansive portfolio that includes nearly 225,000 communication sites worldwide. Of these, around 43,000 are planted in the U.S. and Canada, while approximately 182,000 spread out internationally, presenting a testament to its extensive reach and strategic assets placement.

The company distinguishes itself not only by the sheer number of sites it manages but also through its financial fortitude, evident from its position among the top 25 "Dividend Giants." Indeed, it holds a sizable ETF-held stock investment estimated at $14.86 billion. Investors are drawn to AMT's appealing dividend yield of 3.14%, and the firm continues to impress with a history of consistent payouts. These figures articulate a story of both stability and confidence in its strategic growth trajectory, signifying a solid stance within the industry.

Looking at the financials from AMT's third quarter, we see an impressive performance, underscored by a sizable 5.5% growth in total revenue to $2.819 billion. This growth is mainly driven by a 7% leap in property revenue, amassing to $2.792 billion. Moreover, the company's Adjusted EBITDA soared by 10.4%, hitting $1.814 billion. However, this financial surge contrasts a 29.6% dip in net income, resting at $577 million. Despite this fluctuation, the markets faith remains unshaken, with 19 experts issuing a strong buy rating on the stock and predicting a 20% upside potential.

In the fluctuating terrain of today's housing market, AMT rises as a bastion of resilience, deftly navigating the typically choppy waters that often bewilder real estate stocks. This unique positioning is bolstered by concentrating on communication site properties, a strategic move that harnesses the relentless demand for digital connectivity and wireless infrastructure, sectors remarkably shielded from traditional real estate market gyrations. Its dividends, consistent and reflecting growth prospects, are alluring beacons for investors seeking stable harbors in volatile markets.

Digging deeper into the fabric of the real estate sector reveals its economic significance, spurring job creation and contributing to growth. Through REITs like AMT, investors find an avenue into this crucial sector, minus the complexities of direct property ownership. The current real estate climate, shadowed by soaring property prices and mortgage rates coupled with constrained inventory, posts significant hurdles. Yet, American Tower's performance stands as robust evidence that certain real estate stocks hold the potential to deliver stable income through dividends while promising substantive growth despite broader economic uncertainties.

When comparing AMT with other REIT behemoths like Prologis (PLD) and Realty Income (O), one observes a commonalitya strong endorsement of each as resilient dividend stocks with bright prospects for long-term investment. This endorsement banks upon their historical performances, robust business frameworks, and dominant market positions. American Tower, in particular, has a vital stake in the digital infrastructure arena, sheltering a diverse portfolio that navigates across 25 different nations.

A key facet of American Tower's continued triumph is relentless demand from major mobile network providerswho are the main lessees of AMT's infrastructurealongside a strong customer base that fosters a sound cash inflow. Seated within a sector projected to burgeon, American Tower's investment appeal is magnified by its penchant for dividend growth, now spanning 12 years, crowned with a yield of approximately 3.2%. These attributes label it as a prime buy-and-hold target for those whose investment strategies blend growth with income.

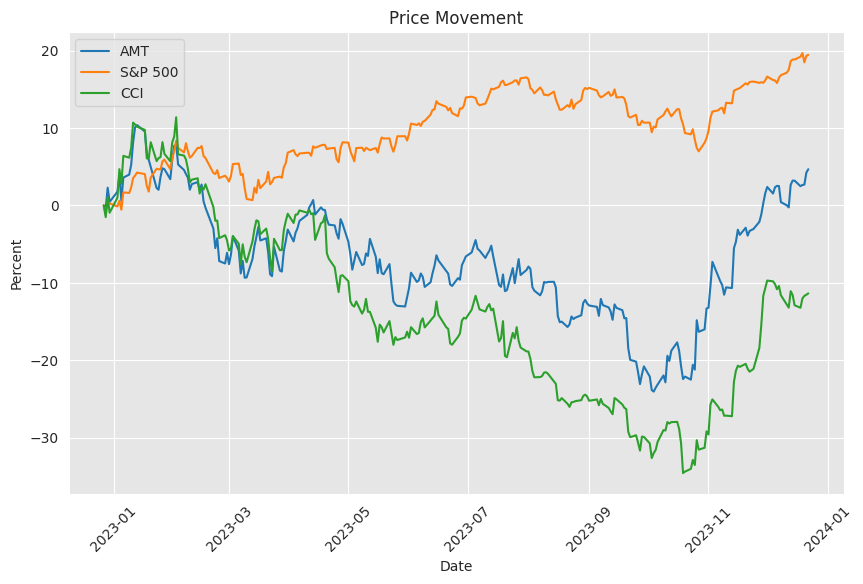

Fast forwarding to the third quarter of 2023, American Tower faced its share of challenges, affecting its stock stature. By mid-December, shares hovered at $212.15 each, boasting a 7.29% gain over a single month, but reflecting a marginal year-over-year dip of 0.61%. Standing strong with a market capitalization around $98.9 billion, American Tower continues to be an influential player in the communication real estate arena, especially with its multitenant operations model lens.

From an investment perspective, the insight from ClearBridge Global Infrastructure Value Strategy unveils the intricacies of AMT's market journey over the period. Whilst the Strategy lagged behind the S&P Global Infrastructure Index because of sector allocation detracting from its performance, ClearBridge pinpoints American Tower as a notable underperformer. Their extensive network exemplifies a substantial presence in emerging markets, which is central to their value proposition.

Challenges bringing about a subdued performance include apprehensions over a 5G infrastructure slowdown and the impact of volatile interest and exchange rates. Yet, as the investment landscape monitors market expectations, AMT's fortitude reflects in its stabilized number of held hedge fund positions, suggesting a sustained confidence among institutional investors. The delicate equilibrium between AMT's market anticipation and sector-specific dynamics, when interwoven with macroeconomic elements, will indeed shape its forthcoming performance narrative.

Dividend stocks, with their characteristic stability and yield, have historically upheld a significant stature in investment portfolios. AMT's recent announcement of a 4.9% hike in its quarterly dividend, boosting it to $1.70 per share, reaffirms its allegiance to investors. This continues a laudable chapter of dividend growth, now in its 13th year, and holds a magnetic allure for those championing reliable income sources, particularly in uncertain market climates.

At the twilight of the third quarter in 2023, AMT's gravity in the investor universe remains undeniable as reflected by 60 hedge funds standing with stakes in the firm, per Insider Monkey's database. Their collective belief, amounting to more than $3 billion in value, lays testament to the trust in American Tower's prospects. This is further illuminated by the dividend yield holding firm at 3.22%, a figure that propels AMT into a favorable orbit among dividend stocks.

Delving into the evolution of AMTs operations, one observes a strategic accentuation of growth and scalability via its subsidiary CoreSite. CoreSite's projects in New York and Denver signify pivotal enhancements in AMT's hybrid IT solutions provision. The New York campus, marked by the NY3 facility, is slated to encompass 85,000 square feet, with Denver's ambitious three-building data center development positioned to meet an escalating need for high-density computing and storageboth serving as testament to the company's strategic growth orientation.

American Tower Corporation, with its commanding presence and substantial market capitalization, holds a venerable spot amidst the largest REITs. Its extensive communication infrastructure, which spans numerous countries and continents, upholds a diversified approach that stands as a cornerstone of its growth narrative. The financial health of American Tower can be discerned from its solid adjusted funds from operations (AFFO) growth rate averaging 11% over the past decade, in conjunction with an impressive dividend growth average of 20.70%. Projections, albeit moderate, indicate a steadying increase in AFFO for the coming years, highlighting an AFFO payout ratio that well covers the dividend yield.

The current financial performance points to an AMT that offers not just a sleep-well-at-night stock but one that promises income alongside capital appreciation potential. This is particularly relevant as technological trends shape the consumption of communication services, solidifying AMT's leadership in the industry. The company's diversified portfolio, substantial property revenue from regional tenants, and future AFFO growth prospects together indicate a resilient proposition in the real estate field.

Turning the lens onto American Tower's corporate communication aspect, the company recently announced that its board of directors sanctioned a cash distribution to shareholders. The payout, set at $1.70 per share on common stock, is expected to be paid in early February 2024 to stockholders of record by late December 2023. This pronouncement illustrates AMT's durable operational output and its drive to sustain shareholder value.

The AMT investor relations website serves as a repository of financial insights offering access to an array of investor-centric tools like earnings materials and detailed presentations. This resource stands as a testament to the company's commitment to financial stewardship and transparent corporate discourse.

In addition to corporate updates, dynamically unfolding news such as stock picks for 2024 adds to AMT's story when experts like Timothy Green highlight the company's stable model and growth potential. Green acknowledges the tower REIT's importance within the mobile communications industry, where the infinite growth of data usage and technological upgrades like 5G networks propel American Tower into a promising position within the investment realm.

This alignment with industry growth trends, coupled with dividend growth and resilience, casts American Tower in favorable light. Recognized for its consistent performance and anticipated benefits from a shift toward mobile connectivity, the company presents itself as a worthwhile consideration for those looking to balance growth with income.

The story of REITs in 2022 drew to a crescendo with a downturn in performance within the U.S. real estate sector. Against this backdrop stood American Tower, an entity whose portfolio diversification and emphasis on non-cancellable customer lease revenue echoed a distinctive narrative of growth during uncertain times. American Tower's operational strategy, underpinned by strong organic tenant billings growth and disciplined financial approaches, rendered a display of strength in a volatile sector.

As anticipated growth in 5G networks unfolds, AMT finds itself in a favorable growth curve, with projections indicating that network traffic is set to scale new heights around 2025. This scenario is backed by the soaring appetite for mobile data and streaming services. Investor sentiment, while cautious, hints at a buoyant outlook for certain REIT stocks, with American Tower deemed poised to ride the upward trends fueled by technological progress and infrastructural requirements.

Not to be overlooked within the sphere of REITs is a potential dividend increase by American Tower Corporation. An announcement from AMT forecasting a boost in its quarterly dividend payment confirms its solid cash flow and value generation strategy. Such moves stand tall in an economic climate teeming with federal interest rate adjustments and significant economic data releases. For dividend-focused investors, American Tower Corporation's commitment to maintaining and raising dividends despite broader economic forces underscores the firm's dependability and strength.

In the looming horizon of 2024, REITs may step into a realm of growth opportunity amidst years marked by fiscal tightening and economic strain. Analysts like Brad Thomas prognosticate a possible uplift in the sector, with an expectation for well-positioned, well-managed REITs to leverage market inefficiencies and growth chances. Thomas's outline for the year ahead, underpinned by his "anchor and buoy" philosophy, emphasizes a mindful approach to REIT investing, advocating for a well-diversified portfolio that can weather the anticipated economic conditions and emanate continuous income through dividends.

Ultimately, American Towers calculated gestures within the investment landscape, mirrored in its dividend projections and targeted growth strategies, are marked indicators of its forward trajectory and burgeoning prospects within the dynamic REIT sector.

Similar Companies in Real Estate Investment Trusts:

Report: Crown Castle International Corp (CCI), Crown Castle International Corp (CCI), SBA Communications Corporation (SBAC), Uniti Group Inc. (UNIT), Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR)

News Links:

https://finance.yahoo.com/news/3-real-estate-stocks-still-214409391.html

https://www.fool.com/investing/2023/12/01/bull-market-buys-3-dividend-stocks-to-own-for-the/

https://finance.yahoo.com/news/why-american-tower-amt-declined-053343836.html

https://finance.yahoo.com/news/26-best-stocks-dividends-171705184.html

https://finance.yahoo.com/news/american-towers-amt-subsidiary-coresite-170500045.html

https://seekingalpha.com/article/4655619-next-generation-sleep-well-at-night-reits

https://finance.yahoo.com/news/american-tower-corporation-declares-quarterly-130000965.html

https://www.fool.com/investing/2023/12/22/2-no-brainer-stocks-to-buy-with-200-right-now/

https://finance.yahoo.com/m/1fd1d664-c2f1-329d-95b5-19ea3fba6cfb/5-top-stocks-i%27m-betting-on.html

https://seekingalpha.com/article/4654199-att-exodus-at-bottom

https://www.fool.com/investing/2023/12/07/5-unstoppable-trends-to-invest-1000-in-for-2024/

https://www.fool.com/investing/2023/12/20/5-top-stocks-im-betting-on-in-2024/

https://seekingalpha.com/article/4657310-whos-ready-for-a-santa-claus-reit-rally

https://seekingalpha.com/article/4657027-wall-street-breakfast-week-ahead

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: VEXXmi

https://reports.tinycomputers.io/AMT/AMT-2023-12-24.html Home