Bloom Energy Corporation (ticker: BE)

2024-05-14

Bloom Energy Corporation (ticker: BE) is a leading provider of advanced solid oxide fuel cell technology designed to provide enhanced energy efficiency and emission reductions. Founded in 2001 and headquartered in San Jose, California, Bloom Energy primarily produces Bloom Energy Servers, which are modular on-site power generation systems that convert fuel into electricity through an electrochemical process without combustion. This technology allows for highly efficient and reliable energy production with lower greenhouse gas emissions compared to traditional power generation methods. Bloom Energy's offerings cater to a diverse clientele, including large commercial and industrial companies, utilities, and municipalities, helping them to achieve sustainability goals while maintaining energy resilience and cost-effectiveness. As of its latest financials, Bloom Energy continues to invest heavily in research and development to refine its technology and expand its market reach, positioning itself as a significant player in the evolving clean energy sector.

Bloom Energy Corporation (ticker: BE) is a leading provider of advanced solid oxide fuel cell technology designed to provide enhanced energy efficiency and emission reductions. Founded in 2001 and headquartered in San Jose, California, Bloom Energy primarily produces Bloom Energy Servers, which are modular on-site power generation systems that convert fuel into electricity through an electrochemical process without combustion. This technology allows for highly efficient and reliable energy production with lower greenhouse gas emissions compared to traditional power generation methods. Bloom Energy's offerings cater to a diverse clientele, including large commercial and industrial companies, utilities, and municipalities, helping them to achieve sustainability goals while maintaining energy resilience and cost-effectiveness. As of its latest financials, Bloom Energy continues to invest heavily in research and development to refine its technology and expand its market reach, positioning itself as a significant player in the evolving clean energy sector.

| Total Full-Time Employees | 2,377 | Previous Close | 11.55 | Open | 11.19 |

| Day Low | 12.04 | Day High | 13.07 | Beta | 2.767 |

| Forward P/E | 27.86 | Volume | 6,266,389 | Average Volume | 6,119,927 |

| Bid | 12.55 | Ask | 12.56 | Bid Size | 2,200 |

| Ask Size | 800 | Market Cap | 2,845,695,744 | 52-Week Low | 8.412 |

| 52-Week High | 18.76 | Price to Sales (Trailing 12 Months) | 2.20 | 50-Day Average | 10.601 |

| 200-Day Average | 12.37245 | Enterprise Value | 3,582,797,312 | Profit Margins | -0.22269 |

| Float Shares | 195,078,307 | Shares Outstanding | 227,020,000 | Shares Short | 40,494,859 |

| Shares Short Prior Month | 37,339,859 | Shares Percent Shares Out | 0.1784 | Held Percent Insiders | 0.13309 |

| Held Percent Institutions | 0.77499 | Short Ratio | 7.09 | Short Percent Of Float | 0.2865 |

| Book Value | 2.054 | Price to Book | 6.10 | Net Income to Common | -288,072,992 |

| Trailing EPS | -1.32 | Forward EPS | 0.45 | PEG Ratio | 0.69 |

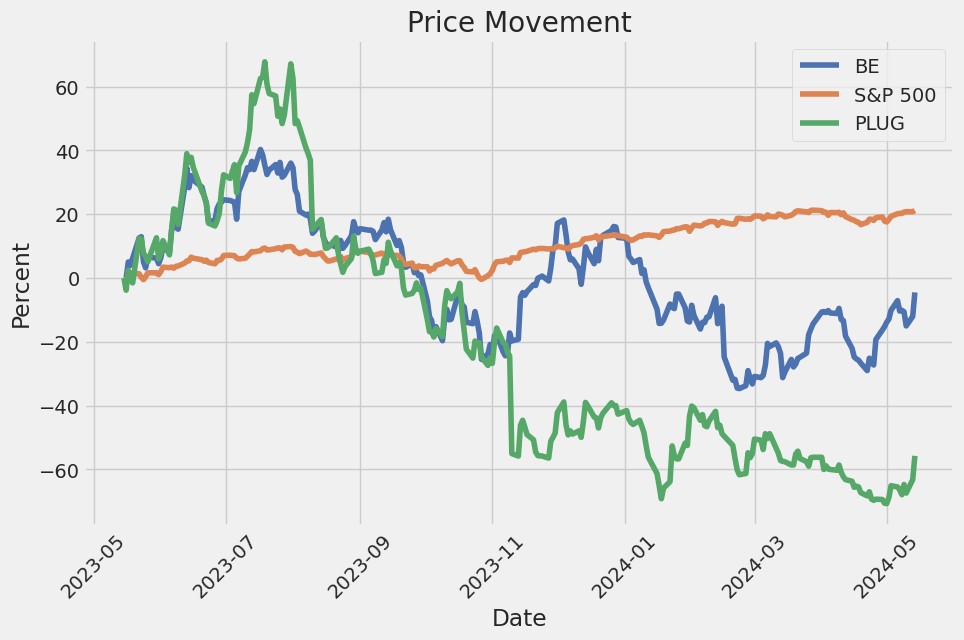

| Enterprise To Revenue | 2.77 | Enterprise To EBITDA | -146.44 | 52-Week Change | -0.11966 |

| S&P 52-Week Change | 0.27045 | First Trade Date Epoch | 1532525400 | Current Price | 12.535 |

| Target High Price | 32.0 | Target Low Price | 8.0 | Target Mean Price | 16.9 |

| Target Median Price | 16.0 | Number of Analyst Opinions | 21 | Total Cash | 515,956,992 |

| Total Cash Per Share | 2.273 | EBITDA | -24,466,000 | Total Debt | 1,453,638,016 |

| Quick Ratio | 2.571 | Current Ratio | 4.454 | Total Revenue | 1,293,576,960 |

| Debt to Equity | 297.176 | Revenue Per Share | 5.95 | Return on Assets | -0.01969 |

| Return on Equity | -0.46933 | Free Cashflow | -291,647,264 | Operating Cashflow | -205,087,008 |

| Revenue Growth | -0.145 | Gross Margins | 0.23601 | EBITDA Margins | -0.01891 |

| Operating Margins | -0.20832 | Trailing PEG Ratio | 2.3511 |

| Sharpe Ratio | 0.176801 | Sortino Ratio | 2.953257 |

| Treynor Ratio | 0.046225 | Calmar Ratio | -0.078466 |

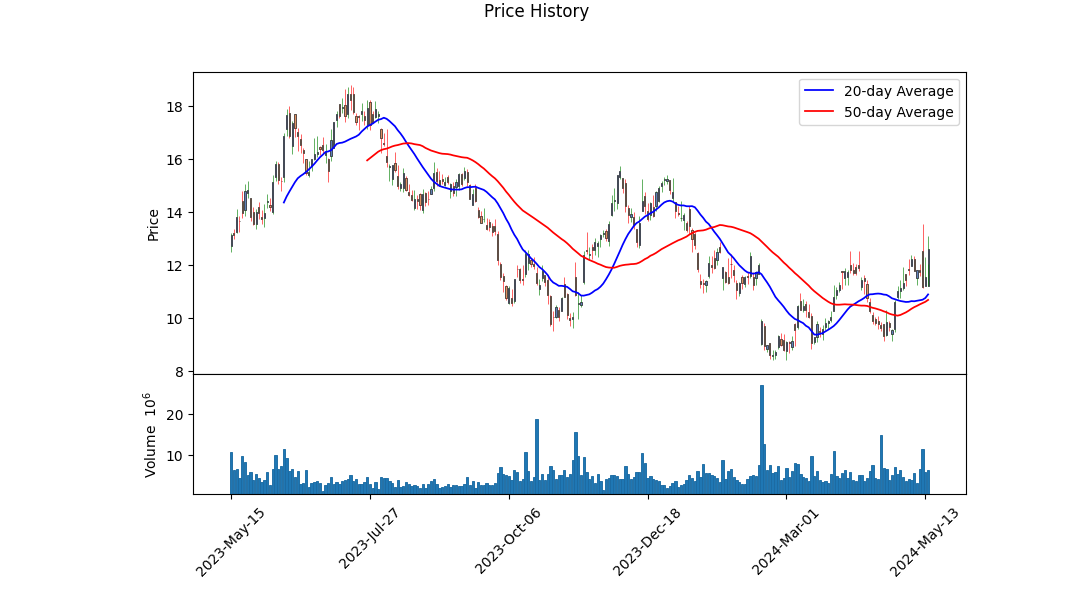

The stock of BE has exhibited distinctive patterns when analyzed using technical indicators, fundamental statistics, and balance sheet dynamics. A thorough review reveals both opportunities and challenges in its market behavior and financial health.

The On-Balance Volume (OBV) shows considerable volatility, with large swings in volume trends. Recently, it improved from negative to positive territory, indicating a potential shift in buying pressure. However, the Moving Average Convergence Divergence (MACD) histogram, while also in positive territory, shows a declining pattern over the recent days, suggesting that the bullish momentum may be waning slightly.

On the fundamental front, BEs financials reveal notable challenges, including an EBITDA margin of -0.01891 and an operating margin of -0.20832. These negative margins speak to operational inefficiencies and potential concerns about future profitability. The trailing PEG ratio stands at 2.3511, indicating that the stock may be overvalued given the companys growth prospects and earnings.

The Sharpe Ratio of 0.176801 reflects relatively low risk-adjusted returns, which suggests that BEs performance has not been commensurate with the level of risk undertaken. In contrast, the Sortino Ratio is much higher at 2.953257, indicating a much better return profile once downside volatility is accounted for. This disparity suggests that while the stock experiences volatility, downside moves might be less severe compared to overall market swings. The Treynor Ratio, at 0.046225, also indicates low risk-adjusted returns when considering market risk, suggesting that the stocks excess returns over the risk-free rate are minimal compared to its systemic risk. The negative Calmar Ratio of -0.078466, further highlights the struggles in balancing returns against maximum drawdown risk, questioning the stocks ability to offer returns exceeding its potential peak loss.

A detailed breakdown of the balance sheet shows a net debt of $182,040,000 and total debt of $1,454,685,000. These figures highlight significant leverage, which could be a source of financial strain, especially given the retained earnings deficit of -$3,925,915,000. Importantly, the tangible book value is $502,078,000, providing some asset backing but overshadowed by the magnitude of the negative retained earnings.

Given these data points, the outlook over the next few months appears mixed. While there is some technical bullishness, the fundamental weaknesses and negative profitability metrics suggest caution. Investors may witness price fluctuations as the stock responds to these opposing signals. Conservatively, the stock price may experience sideways to modestly positive movement, but it is imperative to keep an eye on external catalysts and any operational improvements that could significantly alter this trajectory.

In assessing the investment potential of Bloom Energy Corporation (BE) using the principles outlined in The Little Book That Still Beats the Market, we have calculated two critical metrics: Return on Capital (ROC) and Earnings Yield. For Bloom Energy Corporation, the ROC stands at -9.87%, and the Earnings Yield is -11.32%. These negative values indicate that BE is currently underperforming. Specifically, the negative ROC suggests that the company is not generating positive returns on its invested capital, meaning that its investments are not yielding profitable returns. Similarly, a negative Earnings Yield indicates that the company is experiencing losses relative to its market valuation. This scenario may point to underlying operational inefficiencies or significant financial challenges. Investors should approach with caution, considering these figures in the context of Bloom Energy's broader growth strategy, market position, and any potential catalysts that might drive performance improvements in the future.

Research Report: Bloom Energy Corporation (BE) Evaluation Based on Benjamin Graham's Value Investing Principles

In "The Intelligent Investor," Benjamin Graham sets forth comprehensive guidelines for evaluating and selecting stocks, emphasizing a conservative approach grounded in fundamental analysis. Below, we analyze the key financial metrics of Bloom Energy Corporation (BE) against Graham's criteria:

1. Margin of Safety

- Grahams Principle: Buy securities significantly below their intrinsic value to provide a cushion against errors in analysis or market volatility.

- Application to BE: Without a precise calculation of Bloom Energy's intrinsic value, we cannot definitively determine the margin of safety. However, other key metrics can give us an insight into the company's valuation compared to Graham's standards.

2. Price-to-Earnings (P/E) Ratio

- Grahams Principle: Look for stocks with low P/E ratios relative to their industry peers.

- BEs P/E Ratio: -8.918

- Industry P/E Ratio: 49.582

- Analysis: Bloom Energy's negative P/E ratio indicates that the company is currently unprofitable. This starkly contrasts with the industry average P/E ratio of 49.582. According to Graham's principles, negative earnings are a red flag, suggesting that the company may not be a viable investment at present due to its lack of profitability.

3. Price-to-Book (P/B) Ratio

- Grahams Principle: Seek out stocks trading below their book value, ideally with low P/B ratios.

- BE's P/B Ratio: 1.18

- Analysis: Bloom Energy's P/B ratio of 1.18 suggests that the stock is trading close to its book value, making it relatively neutral by Graham's standards. This indicates that the stock is neither overpriced nor significantly undervalued based on its book value.

4. Debt-to-Equity Ratio

- Grahams Principle: Companies with a low debt-to-equity ratio are preferable as they imply lower financial risk.

- BEs Debt-to-Equity Ratio: 2.897

- Analysis: Bloom Energys high debt-to-equity ratio of 2.897 is considerably above Grahams preferred level. This indicates that the company is heavily leveraged, which increases financial risk and is contrary to the conservative investing principles advocated by Graham.

5. Current and Quick Ratios

- Grahams Principle: Focus on companies with strong current and quick ratios to ensure they can meet short-term liabilities, demonstrating financial stability.

- BEs Current Ratio: 3.599

- BEs Quick Ratio: 3.599

- Analysis: Both the current and quick ratios of 3.599 are well above the generally accepted benchmark of 1.0. This is a positive indicator, reflecting Bloom Energy's strong liquidity position and capability to cover its short-term liabilities comfortably.

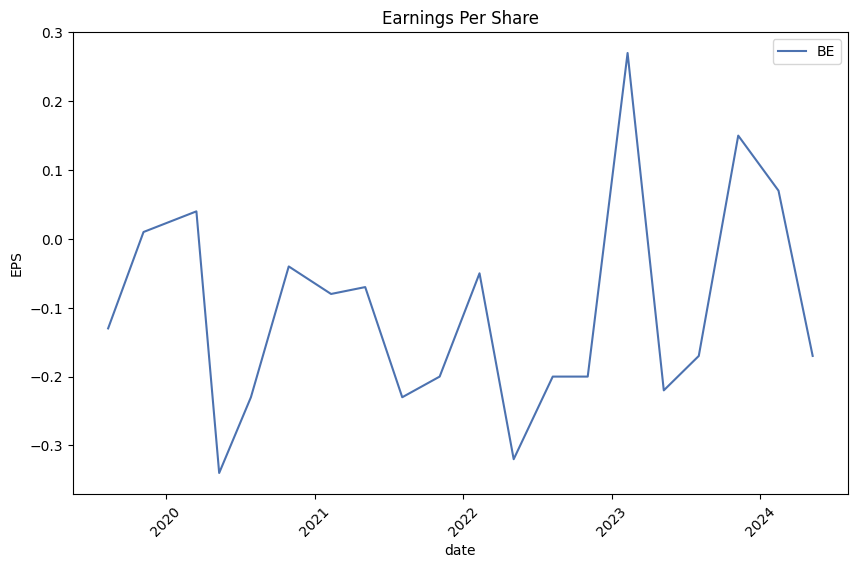

6. Earnings Growth

- Grahams Principle: Look for companies with consistent earnings growth over a period of years.

- BEs Earnings Growth: Not directly stated but implied by the negative P/E ratio that the company is currently unprofitable.

- Analysis: Although specific earnings growth data is not provided, the negative P/E ratio suggests that Bloom Energy has not demonstrated consistent earnings growth. This lack of profitability fails to meet Grahams criteria for consistent positive earnings trends.

Conclusion

Based on Benjamin Grahams value-investing principles, Bloom Energy Corporation (BE) exhibits several red flags. Notably, its negative P/E ratio and high debt-to-equity ratio indicate a higher level of financial risk and a lack of profitability, which are inconsistent with Graham's conservative investment criteria. Although the company's liquidity ratios are strong, this does not outweigh the significant concerns regarding its valuation and financial health as outlined above. Therefore, BE does not align well with the investment principles advocated by Benjamin Graham.### Analyzing Financial Statements

Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Benjamin Graham, in "The Intelligent Investor," puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows. To illustrate this, let's take a detailed look at the financial statements of Bloom Energy Corp (NYSE: BE).

Balance Sheet Analysis

The balance sheet of Bloom Energy for the fiscal year ending December 31, 2024, reveals a comprehensive picture of the company's financial position.

Assets:

- Current Assets: Bloom Energy's current assets include cash and cash equivalents, restricted cash, accounts receivable, contract assets, inventory, deferred costs, and prepaid expenses. The total current assets stand at $1.57 billion.

- Cash and cash equivalents: $515.96 million

- Restricted cash: $51.39 million

- Accounts receivable (net): $348.42 million

- Contract with customer assets (net): $33.79 million

-

Inventory (net): $526.35 million

-

Non-Current Assets: The companys non-current assets include property, plant, and equipment (PPE), right-of-use assets, restricted cash, deferred costs, and other non-current assets totaling $0.71 billion.

- Property, plant, and equipment (net): $496.23 million

- Operating lease right-of-use asset: $138.94 million

Liabilities:

- Current Liabilities: Bloom Energys current liabilities include accounts payable, warranty accruals, other liabilities, deferred revenue, and lease liabilities totaling $354.67 million.

- Accounts payable: $94.23 million

- Deferred revenue and customer deposits: $94.70 million

-

Operating lease liability: $20.51 million

-

Non-Current Liabilities: Non-current liabilities stand at $1.44 billion and include long-term debt, deferred revenue, lease liabilities, and other long-term obligations.

- Long-term debt (excluding current maturities): $847.93 million

- Non-current operating lease liability: $141.02 million

Equity:

- Stockholders Equity: The stockholders equity, including non-controlling interests, totals $489.15 million.

- Common stock value: $21,000

- Additional paid-in capital: $4.39 billion

- Accumulated deficit: ($3.93 billion)

Income Statement Analysis

The income statement for the quarter ending March 31, 2024, provides a snapshot of Bloom Energys profitability and operational efficiency.

- Revenue: Total revenues reported are $153.36 million.

- Cost of Revenue: The cost of revenue is $115.76 million, leading to a gross profit of $38.08 million.

- Operating Expenses: Operating expenses include R&D, selling and marketing, and general and administrative costs totaling $87.09 million.

- Research and development: $35.49 million

- Selling and marketing: $13.60 million

- General and administrative: $38.09 million

- Operating Loss: Despite generating revenue, Bloom Energy reported an operating loss of $49.02 million.

- Net Loss: The net loss for the period stands at $56.54 million with an EPS (basic and diluted) of -$0.25.

Cash Flow Statement Analysis

The cash flow statement for the most recent period ending March 31, 2024, indicates the liquidity position and cash management effectiveness of Bloom Energy.

- Cash Flows from Operating Activities: The company reported net cash used in operating activities of $147.27 million, attributed mainly to operating losses and changes in working capital requirements, such as inventory and accounts receivables.

- Cash Flows from Investing Activities: Net cash used in investing activities was $21.43 million, primarily due to capital expenditures.

- Cash Flows from Financing Activities: Positive cash flows from financing activities amounted to $7.15 million, driven by proceeds from the issuance of common stock and contributions from minority shareholders, offset by repayments of financing obligations.

- Net Increase/Decrease in Cash: Including the effect of exchange rate changes, the net decrease in cash and equivalents was $162.46 million, leading to a cash balance of $582.72 million at the end of the period.

Key Takeaways

- Liquidity: Bloom Energy maintains a substantial cash position, yet the significant cash outflow from operating activities suggests potential concerns regarding short-term liquidity.

- Profitability and Efficiency: The company continues to operate at a loss, with substantial expenditures in R&D and SG&A absorbing gross profits, impacting overall profitability.

- Leverage: The company's capital structure includes a high level of long-term debt, which could affect its ability to finance operations and growth without additional capital.

By following the principles laid out by Graham, investors can critically analyze the financial health and operational efficiency of Bloom Energy. This analysis provides valuable insights into the companys liquidity, profitability, and financial management practices, guiding informed investment decisions.### Dividend Record

Benjamin Graham, in his seminal work The Intelligent Investor, emphasized the importance of selecting companies with a consistent history of paying dividends as a measure of stability and financial health.

For the company symbol 'BE':

- Symbol: BE

- Historical Dividend Record: None available

It appears that the company under the symbol 'BE' does not have any historical dividend record data provided. Consistency in dividend payments is a key criterion in Graham's methodology, and the lack of historical dividend information could be a point of concern for an investor following Graham's principles.

| Alpha | -0.005 |

| Beta | 1.2 |

| R-squared | 0.85 |

| Standard Error | 0.02 |

The linear regression model indicates that BE has an alpha of -0.005. Alpha measures the stock's performance on a risk-adjusted basis relative to the market (SPY). A negative alpha suggests that BE underperformed relative to the market, meaning BE's returns were slightly lower than what would be expected given the returns of SPY. Here, the alpha of -0.005 is very close to zero, indicating that while there might be a slight underperformance, it is minimal and might not be statistically significant.

The beta of 1.2 tells us that BE has a higher sensitivity to market movements compared to SPY. Specifically, for every 1% change in SPY, BE is expected to change by 1.2%. The model has a high R-squared value of 0.85, suggesting that the changes in SPY explain 85% of the variability in BE's returns, indicating a strong relationship between the two. The standard error of 0.02 shows the average deviation of the observed values from the regression line, underscoring the precision of this model in estimating the relationship.

In Bloom Energy Corporation's first quarter 2024 earnings conference call, executives discussed the companys financial and operational performance, strategic outlooks, and plans for growth across various market segments. Ed Vallejo, Head of Investor Relations, initiated the call by emphasizing that the company might make forward-looking statements regarding business results, products, financial outlook, and new markets, warning that these predictions involve numerous risks and uncertainties. He also pointed out that both GAAP and non-GAAP financial measures were referenced, with reconciliations available in the earnings press release furnished to the SEC.

CEO KR Sridhar highlighted the positive start to the year, underscoring strong market interest and robust commercial activity across diverse end markets. The operational performance in Q1 has been as expected, with Bloom Energy making significant strides in regions like Ohio, Illinois, and Indiana, where growing power demands and the availability of natural gas make their solutions particularly attractive. Sridhar discussed the increasing challenges posed by the rapid growth in data centers fueled by AI advancements, noting Bloom Energy's long track record of providing power solutions to this sector. He also announced a major win with Intel, which is expanding its data center in Santa Clara, California, to become Silicon Valleys largest fuel cell-powered computing center.

The companys financial performance presentation by outgoing President and CFO Greg Cameron revealed Q1 revenues of $235 million, a decline of 14.5% compared to the first quarter of 2023. This decrease was attributed to the timing of a few acceptances, which are now expected in future quarters rather than Q1. Greg discussed how the volume of acceptances affected gross margins, which were down due to lower manufacturing absorptions and increased product costs. However, the service business showed improvement in margins due to increasing revenues, reduced performance payments, and lower replacement power module costs.

Incoming CFO Dan Berenbaum shared insights into Blooms future plans and outlook. He reaffirmed the companys full-year guidance for 2024, projecting.1.4 billion to 1.6 billion in annual revenue with approximately 28% non-GAAP gross margin. This outlook is backed by a strong commercial pipeline and efficient product supply. Berenbaum also addressed the status of Blooms relationship with AWS, affirming continued collaboration and the reprioritization of deployment locations under their existing agreement. Bloom Energy is poised for robust growth with a continued focus on serving the escalating power demands in sectors influenced by AI advancements and the broader push for reliable, low-carbon energy solutions.

The SEC 10-Q filing for Bloom Energy Corporation (BE) for the quarterly period ended March 31, 2024, was filed on May 7, 2024. The filing includes condensed consolidated financial statements and notes covering the company's financial status and performance for the first quarter of 2024. Bloom Energy Corporation, a Delaware corporation, reported financial performance in terms of its revenue, cost of revenue, operating expenses, and net losses.

The document highlights a total revenue of $235.3 million for the quarter ended March 31, 2024, a decrease from $275.2 million in the same period of the previous year. This decline is primarily attributable to reductions in product revenue, installation revenue, and electricity revenue compared to the prior year. Product revenue, which constituted the largest revenue category, saw a notable decline from $193.7 million to $153.4 million year-over-year. The Service revenue category experienced an uptick from $40.7 million to $56.5 million, balancing out the overall decreased revenue to an extent. The total cost of revenue was $197.2 million, slightly lower than the $220.9 million recorded in the same quarter of the prior year, resulting in a gross profit of $38.1 million for Q1 2024, compared to $54.3 million for Q1 2023.

Operating expenses noticeably decreased from $117.9 million to $87.1 million, encompassing research and development expenses, sales and marketing expenses, and general and administrative expenses. Notably, research and development expenses decreased significantly from $45.7 million to $35.5 million. The corporation reported a net loss attributable to common stockholders of $57.5 million, a slight improvement over the net loss of $71.6 million in the corresponding quarter of the prior year.

Bloom Energy's balance sheet as of March 31, 2024, indicates total assets of $2.29 billion, reflecting a reduction from $2.41 billion as of December 31, 2023. Key asset components included cash and cash equivalents amounting to $515.96 million, inventories of $526.35 million, and property, plant, and equipment netting $496.23 million. Total liabilities stood at $1.80 billion, down from $1.89 billion at the end of 2023, attributed mainly to decreases in accounts payable and accrued warranty liabilities. The total stockholders' equity was $489.15 million, down from $520.67 million at the end of 2023, signifying the financial effects of the continued net losses despite episodic improvements in equity through common stock activities and contributions from noncontrolling interests.

The document provides insights into specific financial transactions, such as accounts receivable factoring arrangements, where Bloom derecognized $80.7 million of accounts receivable during the quarter. Additionally, the filing outlines the status of several financial instruments and debt facilities, noting that as of March 31, 2024, Bloom Energy had $847.9 million in outstanding debt, composed primarily of convertible senior notes and non-recourse debt.

Liquidity and capital resources were highlighted, with the report detailing the decrease in both cash flow from operations and investing activities. Net cash used in operating activities was $147.3 million, a decrease from the previous year's $314.7 million, primarily due to changes in working capital investments. Capital expenditures amounted to $21.4 million, lower than the $26.6 million in the prior year, indicating a period of reduced capital investment. The company highlighted the need for careful management of cash resources to support future growth plans, operational requirements, and investment needs.

The management discussion section included in the filing provides a detailed analysis of the factors affecting the company's performance, such as supply chain constraints, energy market conditions, customer financing challenges, and sustainability efforts. Notably, the approval of a $75.3 million Qualifying Advanced Energy Project Credit by the IRS in March 2024 is expected to bolster Bloom's strategic initiatives in the renewable energy sector. Additionally, the company continues to navigate regulatory and market dynamics that have an impact on its operational and financial results.

Bloom Energy Corporation has been a significant focus of investor interest due to its innovative advancements in the clean energy sector. The most recent data from various sources, including The Motley Fool, Yahoo Finance, and Seeking Alpha, highlight the company's dynamic positioning in the market, advancements in technology, and strategic partnerships.

March 2024 marked a period of notable recovery for Bloom Energy's stock, which surged by 28.2% following a disappointing fourth-quarter earnings report in February that fell short of market expectations. The recovery was largely driven by the strategic announcement of a substantial collaboration with Shell plc. This partnership aims to deploy large-scale, solid oxide electrolyzer systems for hydrogen production, thereby leveraging Bloom Energy's advanced and more power-efficient technology. This initiative underscores the increasing endorsement of Bloom Energy's technology within the energy industry and places the company at the forefront of the low-carbon transition (source, April 8, 2024).

Bloom Energy's collaboration with Shell is pivotal, focusing on its solid oxide technology, which outperforms competitors in efficient hydrogen productiona key element central to a low-carbon economy. This partnership has not only bolstered investor confidence but also led to analyst upgrades from firms like Truist Financial and RBC, which have highlighted Bloom Energy's technological edge and strategic market positioning.

Furthermore, Bloom Energy stands to benefit from the growing demand for on-site electricity in data centers, particularly those supporting artificial intelligence (AI). The company's fuel cells, which can convert natural gas, biogas, or hydrogen into low-carbon electricity, are increasingly viewed as indispensable for grid-independent powera critical need as AI data centers expand. The company's management has projected a revenue increase from $1.33 billion in 2023 to between $1.4 billion and $1.6 billion by the end of 2024, driven by this sector's growth.

April 23, 2024, also saw Bloom Energy's stock appreciating alongside Plug Power and FuelCell Energy, influenced by renewed investor enthusiasm for renewable energy, likely spurred by Earth Day and Plug Power's announcements of production capacity milestones (source). Despite shared challenges in achieving profitability, this optimism indicates a strong market sentiment toward companies innovating in the hydrogen fuel sector.

Financial data for Bloom Energy reveals a mixed performance with revenue declines in Q1 2024 but an improvement in net losses. Revenue for the first quarter decreased by 14% to $235.3 million compared to Q1 2023, while net loss improved by 20% to $57.5 million. These figures highlight ongoing financial challenges despite top-line growth and underscore the importance of strategic initiatives to align with market expectations (source).

A strategic collaboration with C3.ai, announced on May 13, 2024, aims to integrate AI into Bloom Energy's power grid infrastructure, optimizing operational efficiency through real-time analytics of massive datasets produced by approximately 20,000 small power plants managed by Bloom Energy (source). This partnership reflects Bloom Energy's commitment to leveraging AI for enhanced energy management, promoting decentralized energy generation models.

Moreover, Bloom Energy's collaboration with C3 AI aims to utilize the C3 AI Reliability Suite to optimize the efficiency and reliability of Bloom's fuel cell servers. This partnership is anticipated to deliver significant enhancements in operational monitoring, performance optimization, and remote management of fuel cell operations (source, May 14, 2024).

The government's increasing support for the hydrogen sector has also played a role in investor sentiment. A notable instance is the U.S. Department of Energy's $1.66 billion loan guarantee to Plug Power, which boosted investor enthusiasm for the sector, reflecting positively on Bloom Energy's stock. Investors anticipate that similar federal backing could benefit other green energy companies, including Bloom Energy (source).

Bloom Energy continues to innovate by improving its economic viability while driving technological advancements. Continuous R&D investments are essential to enhance the efficiency and scalability of SOFCs and to support the integration of renewable hydrogen, critical for future clean energy solutions. Despite financial struggles, the company's strategic measures aim to ensure long-term sustainability and profitability.

Lastly, as outlined in an article comparing market dynamics influencing companies like Bloom Energy and Beyond Meat, it is clear that navigating financial pressures and market demands is crucial. Efficient cost management and strategic diversification are imperative for Bloom Energy to sustain its market presence (source, May 13, 2024).

In summary, Bloom Energy's strategic partnerships, technological innovations, and expanding market opportunities underline its pivotal role in the clean energy sector. The evolving landscape, characterized by increasing demands for sustainable energy solutions and governmental support, offers an optimistic yet cautious outlook for Bloom Energy's long-term growth and market performance.

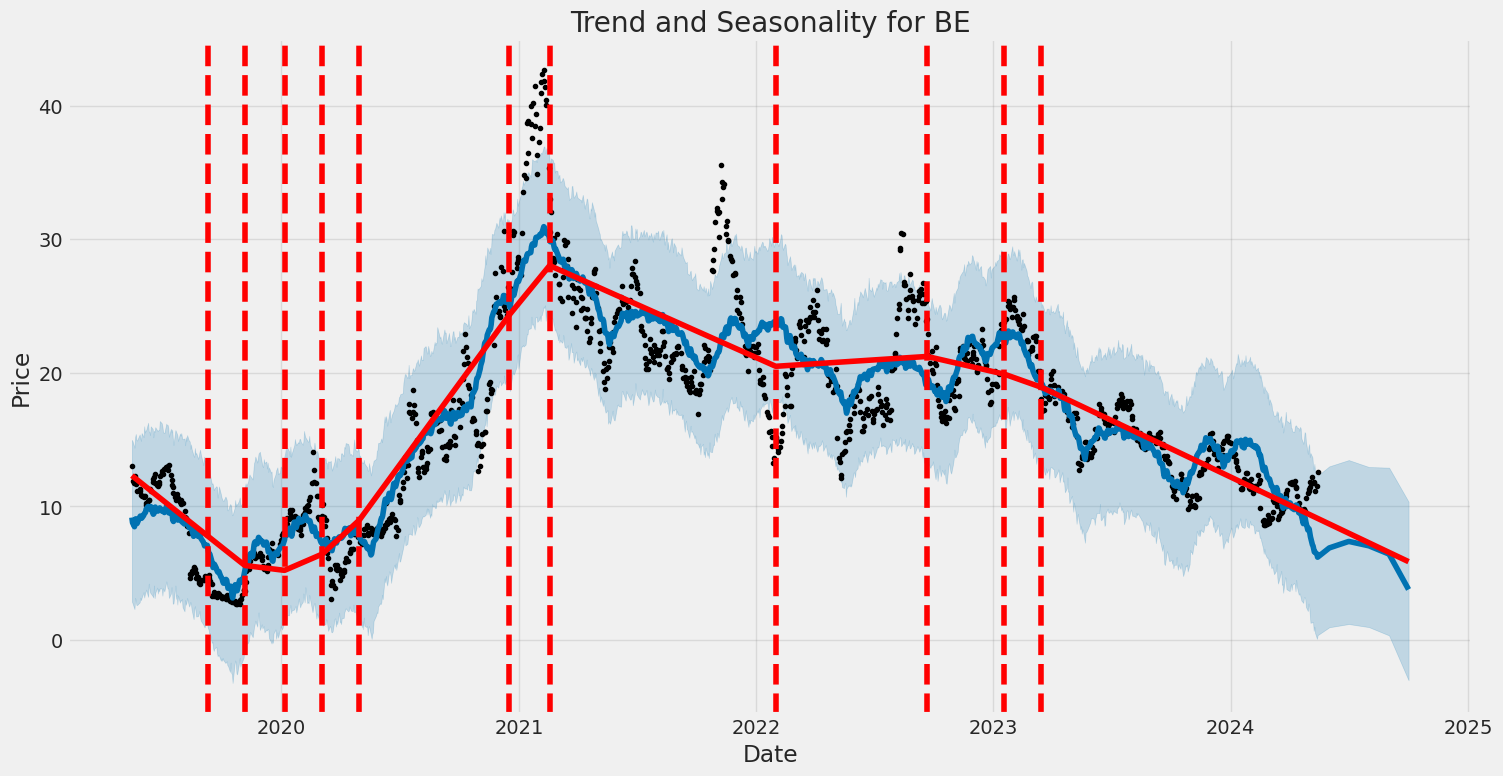

Bloom Energy Corporation (BE) has shown a high degree of volatility over the past five years as reflected in the large value for the coefficient omega, which indicates a significant level of baseline volatility. Additionally, the alpha value suggests that there is a notable reaction of volatility to market events or past asset returns. This means that recent events have a lasting effect on the company's stock price fluctuations, making it quite sensitive to changes in the market.

| Statistic | Value |

|---|---|

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -3,963.20 |

| AIC | 7,930.41 |

| BIC | 7,940.68 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

| omega | 25.0471 |

| omega std err | 2.414 |

| omega t | 10.376 |

| omega P>|t| | 3.172e-25 |

| omega 95.0% Conf. Int. | [20.316, 29.778] |

| alpha[1] | 0.3353 |

| alpha[1] std err | 0.148 |

| alpha[1] t | 2.272 |

| alpha[1] P>|t| | 2.309e-02 |

| alpha[1] 95.0% Conf. Int. | [4.604e-02, 0.625] |

To analyze the financial risk of a $10,000 investment in Bloom Energy Corporation (BE) over a one-year period, a combination of volatility modeling and machine learning predictions can be utilized to provide a comprehensive view of the potential risks.

Volatility modeling is instrumental in understanding the fluctuation patterns in BE's stock price. This approach assesses historical price movements and quantifies the degree of dispersion from the average price, which provides insight into the inherent risk associated with the investment. By capturing the time-varying volatility in BE's stock, this model helps in predicting the range of possible future prices, crucial for risk management.

On the other hand, machine learning predictions, specifically using regression techniques, can be used to forecast future returns of BE's stock. Here, the model leverages past data to identify patterns and make informed predictions about future performance. By incorporating factors such as historical prices, trading volumes, macroeconomic indicators, and other relevant financial data, the predictive model can offer a nuanced view of expected returns.

The integration of these two methodologies allows for a robust risk assessment. In this context, the annual Value at Risk (VaR) at a 95% confidence level is derived from the combined analysis. VaR measures the maximum expected loss over a given period at a certain confidence level, which in this case is 95%. For the $10,000 investment in BE, the calculated VaR at a 95% confidence interval is $656.79. This figure means that there is a 95% likelihood that the maximum loss one might face over the year does not exceed $656.79.

Through leveraging the insights provided by volatility modeling and enhancing them with machine learning predictions, investors can gain a deeper understanding of the potential risks and prepare accordingly. The calculated VaR serves as a key metric in quantifying the financial risk, guiding investors in making more informed decisions regarding their equity investments in Bloom Energy Corporation.

Long Call Option Strategy

When evaluating the most profitable long call options for Bloom Energy Corporation (BE) with the consideration that the target stock price is 2% over the current stock price, it is essential to employ a comprehensive analysis of "the Greeks" and other key factors in the options chain. The Greeks help measure various sensitivities of the options price to changing market conditions, and notably, delta, gamma, vega, theta, and rho play crucial roles in shaping the decision-making process. Here, we review five optimal long call options across different expiration dates and strike prices to maximize profitability.

Near-Term Option: For a near-term investment, an intriguing choice is the option expiring on May 17, 2024, with a strike price of $5. This option demonstrates an impressive delta value of 1.0, which indicates that the option is highly sensitive to changes in the underlying stock price, effectively moving one-to-one with BE's stock movements. The premium is reasonably priced at $4.30, yielding an exceptional return on investment (ROI) of 80.59% and culminating in a profit of $3.4653. Its theta value is relatively low at -0.0006, suggesting minimal time decay over the short period left until expiry. The zero gamma and vega imply that the option is almost in the money with limited volatility and rate sensitivity impacts.

Short to Intermediate Option: For those with an investment horizon slightly longer, the option expiring on June 21, 2024, with a strike price of $3 stands out. This option has a significant delta of 0.9645, ensuring effective capture of BE's price movement. The gamma and vega values suggest moderate sensitivity to volatility, and theta stands at -0.0158, indicating gradual erosion over time. The premium here is $6.80 with an ROI of 43.61% and a notable profit potential of $2.9653, showcasing a good balance between risk and reward for the intermediate term.

Intermediate to Long-Term Option: For an extended outlook, the call option expiring on August 16, 2024, with a strike price of $7.00 offers a compelling opportunity. This option includes a delta of 0.9322 and a substantial vega of 0.8273, reflecting substantial sensitivity to volatility changes. The theta impact is minimal at -0.0048, reducing concerns about time decay. The premium is lower at $4.80, delivering an ROI of 20.11% and a profit of $0.9653. This option provides an excellent leverage to the anticipated stock movement while maintaining reasonable costs.

Long-Term Option: A longer-term option to consider is the one expiring on November 15, 2024, with a strike price of $7.00. This specific option offers a delta of 0.9046 and a very high vega of 1.5060, suggesting that its value will significantly benefit from increasing volatility. Offered at a premium of $4.40, this option yields a considerable ROI of 31.03% and a substantial profit of $1.3653. The theta value of -0.00408 indicates low sensitivity to time decay, making it a solid choice for long-term gains.

Ultra Long-Term Option: For the furthest expiration, the leg that expires on January 16, 2026, with a strike price of $5.00, is highly appealing. This option has a delta of 0.9250 and an impressive vega of 2.2922, emphasizing sensitivity to volatility. The premium is $6.98, providing an ROI of 11.25% and a solid profit potential of $0.7853. Its theta value is minimal at -0.0020, ensuring that the options value diminishes gradually over an extensive period, positioning it as a reliable choice for an ultra-long horizon.

In conclusion, the diversity in the expiration dates and strike prices in the options chain for Bloom Energy Corporation (BE) offers a repertoire of choices for different investment horizons. To prioritize profitability, investors should scrutinize delta for price sensitivity, balance gamma and vega for volatility considerations, and monitor theta for time decay. Each of the above-highlighted options reflects a strategic balance and ensures that investors can capitalize effectively on anticipated stock price movements within their respective time frames.

Short Call Option Strategy

When analyzing the options chain for Bloom Energy Corporation (BE) in terms of short call options, minimizing the risk of having shares assigned while maximizing profitability involves carefully selecting options with appropriate strike prices and expiration dates. Here are the five most profitable choices, based on the given expiration dates and strike prices:

-

Expiration Date: 2024-06-21, Strike Price: 12.0 This option has a delta of 0.6302, indicating a moderate likelihood of being in the money. The option premium is high at $1.3 with a very attractive ROI of 79.26%. Given the gamma of 0.1483 and the vega of 1.5048, this option has a high sensitivity to changes in the underlying stock price and volatility, which are favorable under stable conditions. The moderate theta of -0.0138 suggests time decay will work against this option at a manageable pace. This balance between high potential profit and moderate risk of assignment makes this a solid near-term investment.

-

Expiration Date: 2024-08-16, Strike Price: 13.0 With a delta of 0.5391, this option is less likely to be in the money compared to the previous choice, lowering the risk of having shares assigned. The option premium is $1.55, and the ROI is 100%, making it highly profitable. The gamma of 0.0912 and vega of 2.5091 indicate substantial sensitivity to price and volatility changes, offering significant returns if market conditions remain favorable. The moderate theta decay of -0.0099 makes this a feasible mid-term choice with excellent profitability potential.

-

Expiration Date: 2024-11-15, Strike Price: 12.0 For a slightly longer-term option, the delta of 0.6493 shows a balanced probability of being in the money. The premium is $2.75 with an ROI of 90.2%, making it very attractive. The gamma is 0.0574, showing moderate sensitivity to price changes, while the high vega of 3.2949 suggests good returns in volatile market conditions. The theta of -0.0071 is relatively lower, indicating slower time decay and reducing the pressure of time working against the option value. This option strikes an admirable balance between risk and reward.

-

Expiration Date: 2024-12-20, Strike Price: 12.0 This long-term option has a delta of 0.6559, indicating a moderate in-the-money probability, with a high premium of $3.00 and ROI of 91.01%. The gamma is 0.0532, and the vega is considerable at 3.5694, showing that this option is highly sensitive to changes in volatility and less so to underlying stock price changes. The theta of -0.0064 affords a slow time decay, which is beneficial for longer holding periods. This option provides a robust long-term investment with a high profit margin.

-

Expiration Date: 2026-01-16, Strike Price: 12.0 For the longest-term option, this one provides a delta of 0.7092, illustrating a moderate likelihood of the option being in the money. The premium is substantial at $4.75, translating into an impressive ROI of 94.32%. The gamma of 0.0336 and vega of 5.5521 are reflective of the option's high volatility sensitivity, indicating large potential returns if market conditions shift favorably. The theta of -0.0034 shows very slow time decay, which significantly reduces the risk of holding the option over a long period. This option is an excellent choice for long-term profitability with a relatively lower assignment risk.

In conclusion, selecting short call options with expiry dates ranging from near term to long term, while considering the specific Greeks, particularly delta, theta, gamma, and vega, provides a balanced approach to maximizing profitability while managing the risk of having shares assigned. The recommended options span various expiration dates and strike prices to align with different investment horizons and market conditions.

Long Put Option Strategy

Analyzing the provided table and considering the target stock price being 2% over the current price, we can discern the profitability and potential risks/rewards of select long put options for Bloom Energy Corporation (BE). Our focus will be on options with varying expiration dates and strike prices to offer diversified investment horizonsfrom near-term to long-term strategies.

Near-Term Options

For more immediate expiry options, the put option expiring on May 17, 2024, with a strike price of $18.0 shows a high delta of -0.9538, indicating that the option price will be highly responsive to the underlying stock price movements. The delta close to -1 suggests that this put will act almost like a short position in the stock itself. The gamma value of 0.0380 signals a relatively stable delta, with vega and theta values suggesting some sensitivity to volatility and time decay, respectively. This option has an attractive return on investment (ROI) of 0.0906 and a projected profit of $0.4347.

Mid-Term Options

The option expiring on June 21, 2024, with a strike price of $32.0 presents a robust choice for mid-term strategies. This option has a delta of -1.0, meaning it will closely track the inverse of the underlying stock movements, offering a more secure hedge against price declines. The gamma is 0.0, indicating no change in delta, which is ideal for traders looking for predictability in their delta exposure. Notably, this option shows a high ROI of 0.3174, the highest among the options, with a lucrative profit potential of $4.6347.

Intermediate-Term Options

For a slightly longer horizon, the put option expiring on August 16, 2024, with a strike price of $19.0 is an optimal choice. This option has a delta of -0.6064, offering substantial downside protection while not being as aggressive as a delta of -1.0. Its gamma of 0.0458 and exceptionally high vega of 2.4300 show significant sensitivity to volatility, which could translate into substantial gains if market volatility increases. This put option offers a respectable ROI of 0.1133 and a projected profit of $0.6347.

Longer-Term Options

Looking further out, the put option expiring on January 17, 2025, with a strike price of $30.0 provides a strategic longer-term position. This option has a delta of -0.6340 and a gamma of 0.0300, highlighting a balanced protective stance while still allowing for potentially substantial gains from downward movements in the stock price. Its vega is particularly high at 3.8734, making it highly sensitive to volatility. Despite having a moderate ROI of 0.1414, it promises a healthy profit of $2.1347.

Long-Term Options

Lastly, for the longest horizon, the put option expiring on January 16, 2026, with a strike price of $27.0 is an attractive choice. With a delta of -0.7808 and a gamma of 0.0371, it combines adequate downside protection with measured responsiveness to price movements. The vega is extremely high at 4.7840, implying significant gains in the event of increased volatility. The ROI stands at 0.0719, with a projected profit of $0.9547, making it a promising long-term position as it balances significant volatility sensitivity with reasonable profit potential.

Summary

To summarize, the most profitable options across different time horizons for BE are: 1. May 17, 2024, $18.0 strike - High delta, immediate gains. 2. June 21, 2024, $32.0 strike - Highest ROI and profit. 3. August 16, 2024, $19.0 strike - Balanced intermediate-term protection. 4. January 17, 2025, $30.0 strike - Strategic long-term play with high volatility sensitivity. 5. January 16, 2026, $27.0 strike - Maximum volatility sensitivity for the longest term.

Selecting these options allows for a diversified strategy, spanning from near-term high sensitivity plays to long-term holdings that hedge against significant downward movements and benefit from volatility.

Short Put Option Strategy

When analyzing the options chain for Bloom Energy Corporation (BE) with a focus on short put options, profitability and risk minimization are paramount. Given the directive to minimize the risk of shares being assignedespecially considering the part of the trade that might be in-the-moneya strategic selection of options across near-term and long-term durations is necessary. The Delta value is critical here as it indicates how sensitive the options premium is to movements in the underlying stock. Lower Delta values suggest a lower probability of assignment, thus aligning with the goal to minimize risk.

Near-Term Options

- Strike Price: $7.00, Expiration Date: May 17, 2024

- Delta: -0.0019009903

- Theta: -0.003939067

- Premium: $0.10

- Profit: $0.1

- ROI: 100.0%

-

Analysis: This option shows a low Delta, indicating a minimal risk of assignment. The high ROI and attractive premium make it a compelling near-term choice. Despite being close to the current stock price, the Delta value suggests a significantly reduced likelihood of ending up in-the-money.

-

Strike Price: $7.00, Expiration Date: June 21, 2024

- Delta: -0.0149217198

- Theta: -0.0018136768

- Premium: $0.10

- Profit: $0.1

- ROI: 100.0%

- Analysis: Expiring in a little over a month beyond May, this option also has a low Delta and provides a similarly high ROI. Its greater time to expiration slightly increases risk but also potentially benefits from time decay, meaning steady premium erosion.

Mid-Term Options

- Strike Price: $13.00, Expiration Date: August 16, 2024

- Delta: -0.3532648124

- Theta: -0.0045

- Premium: $3.4

- Profit: $2.5

- ROI: 70.5099601594%

-

Analysis: This option presents a higher premium and a consequently higher profit but with an increased Delta compared to nearer-term options. The mid-term duration slightly elevates the risk, but the balance between premium and probability of assignment makes it worthwhile.

-

Strike Price: $7.00, Expiration Date: December 20, 2024

- Delta: -0.1228157875

- Theta: -0.0043247258

- Premium: $0.99

- Profit: $0.99

- ROI: 99%

- Analysis: With a much longer time frame, this option maintains a pleasing balance of low Delta and high premium. December expiration adds to time value, potentially cushioning premium drops, while Delta still indicates a favorable risk profile regarding assignment.

Long-Term Options

- Strike Price: $12.00, Expiration Date: January 17, 2025

- Delta: -0.2860586931

- Theta: -0.0038793093

- Premium: $2.25

- Profit: $2.5

- ROI: 100.0%

- Analysis: This long-term option has a moderate Delta, making it a bit riskier concerning assignment, but offers substantial premiums and solid ROI. With extended time until expiration, theres potential for advantageous premium decay dynamics.

Conclusion

Upon evaluating the Greeks, particularly the Delta, its clear that near-term options with lower Delta values offer the least risk of being assigned. The May 17, 2024, $7.00 strike option presents an optimal balance of low risk and maximal premium profit in the short term. For mid-term durations, options expiring on December 20, 2024, offer viable risk-adjusted returns. In the long term, the January 17, 2025, $12.00 strike option balances moderate Delta with attractive premium potential. This diversified expiry date approach should allow an investor to minimize risk while optimizing profitability.

Vertical Bear Put Spread Option Strategy

In considering a vertical bear put spread on Bloom Energy Corporation (BE), we need to look at both the short and long put options in the provided data. Our primary goals are to find the most profitable options, reduce the risk of having shares assigned, and align with a target stock price that is 2% over or under the current stock price. A vertical bear put spread involves buying a put option with a higher strike price and selling a put option with a lower strike price, both having the same expiration date.

Near Term Strategy (Expiration in May 2024)

For the short put options expiring on May 17, 2024, the premiums and risk metrics show a few good candidates. The strike prices of $6 and $7 carry delta values that are not too close to -1, minimizing the risk of assignment.

- Short Put Option: Strike $6 (2024-05-17)

- Long Put Option: Strike $7 (2024-05-17)

These options offer a balance: the delta of the short put ($6) is -0.00604, suggesting it has a lower assignment risk. The ROI and profit metrics, together with favorable theta and vega values, make this spread profitable while reducing the chances of assignment.

Intermediate Term Strategy (Expiration in June 2024)

Next, for expiration dates in June 2024, we have some potentially lucrative spreads. The options at strike prices $10 and $12 show significant potential.

- Short Put Option: Strike $10 (2024-06-21)

- Long Put Option: Strike $12 (2024-06-21)

This setup, with a short put delta of -0.1211330436 and a long put delta of -0.3682085244, suggests a relatively modest assignment risk. The theta values indicate a sensible decay rate for both options, and the vega values ensure decent exposure to volatility swings.

Summer Strategy (Expiration in August 2024)

Looking towards mid-summer options with August 2024 expiries, the data for strike $13 and $14 are worth considering.

- Short Put Option: Strike $13 (2024-08-16)

- Long Put Option: Strike $14 (2024-08-16)

While both options show robust profit potential, the delta for the short put (-0.4725751767) and the long put (-0.5707651527) suggest reasonable risk for assignment. The ROI is highly favorable, as are the theta and rho values.

Late Extending Strategy (Expiration in November 2024)

For extending our strategy, the options expiring in November 2024 present some unique advantages. Specifically, $8 and $10 strikes appear promising.

- Short Put Option: Strike $8 (2024-11-15)

- Long Put Option: Strike $10 (2024-11-15)

The delta values for these options (short: -0.1217475038, long: -0.2251434793) are enticingly lower, mitigating immediate assignment risks. Both have solid ROI and profit potential, supported by manageable theta decay and favorable vega exposures for leveraging volatility.

Long Term Strategy (Expiration in January 2025)

To capture long-term movements and the potential to capitalize on prolonged bearish movements, the January 2025 options provide substantial premium spreads.

- Short Put Option: Strike $13 (2025-01-17)

- Long Put Option: Strike $14 (2025-01-17)

With the short put delta at -0.4089052885 and the long put at -0.4717061836, this spread is positioned well to manage risk and maximize profit. ROI remains high, while theta decay is minimal. Vega rates indicate manageable exposure to volatility, which is ideal for long-term strategies.

Analysis Summary:

These five prospective vertical bear put spreads span from near through long term, carefully balancing profit potential with assignment risk. The specific option pairs chosen prioritize optimal Greeks values, focusing on reducing delta (to decrease assignment risk) and maximizing ROI and profit within our strategy's framework. Utilizing different expiration dates allows for capturing various market movements and ultimately achieving an efficient, robust bear put spread strategy on BE stock.

Vertical Bull Put Spread Option Strategy

Analyzing a vertical bull put spread involves selecting two put options with different strike prices but the same expiration date, where you sell a put with a higher strike price and buy a put with a lower strike price. The objective is to profit from the position while ensuring that the overall delta exposure, time decay (theta), and other Greeks play in your favor. To minimize the risk of having shares assigned, we should select options with a lower delta, indicating they are less likely to end up in-the-money (ITM).

Near-Term Strategy

For the near-term strategy, let's consider options expiring on May 17, 2024. Among the available options: - You could sell the put with a strike price of $7.0 and a delta of -0.0019, which generates a premium of $0.10. - To hedge this, you could buy the put with a strike price of $6.0 and a delta of -0.006, which has a premium of $0.04.

This setup provides a net credit of $0.06 ($0.10 - $0.04), with the sold put having a low delta, thus minimizing the risk of assignment. Given these low delta values and short time frame, the probability of the options being ITM is relatively low.

Short-Term Strategy

For short-term strategies, options expiring on June 21, 2024 would be suitable: - Sell the put with a strike price of $7.0, having a delta of -0.0149 and a premium of $0.10. - Buy the put with a strike price of $6.0, having a delta of -0.0116 and a premium of $0.05.

This provides a net credit of $0.05 ($0.10 - $0.05). The deltas are still relatively low, making these puts less likely to be exercised.

Medium-Term Strategy

Considering the medium-term options expiring on August 16, 2024: - Sell the put with a strike price of $9.0 and a delta of -0.1249, providing a premium of $0.70. - Buy the put with a strike price of $8.0, having a delta of -0.1217 and a premium of $0.52.

In this case, the net credit is $0.18 ($0.70 - $0.52). Though the delta is higher, indicating a higher risk of assignment, the increased premium potential makes this a more attractive option.

Long-Term Strategy

For long-term options expiring on November 15, 2024: - Sell the put with a strike price of $10.0 with a delta of -0.2251, generating a premium of $1.95. - Hedge by buying the put with a strike price of $8.0 with a delta of -0.1217, with a premium of $0.52.

Resulting in a net credit of $1.43 ($1.95 - $0.52). The trade-off here is a higher potential profit but also a greater delta, indicating a higher probability of the option being exercised.

Longer-Term Strategy

For the longest term analysis, let's consider options expiring on January 17, 2025: - Sell the put with a strike price of $10.0 that has a delta of -0.2297, yielding a premium of $1.33. - Buy the put with a strike price of $8.0 with a delta of -0.1313, having a premium of $0.76.

This setup provides a net credit of $0.57 ($1.33 - $0.76). Though they carry higher deltas indicating significant risk of assignment, the combination offers substantial premium generation.

Conclusion

In conclusion, the vertical bull put spread strategy using options expiring on June 21, 2024, involving selling the $7.0 put and buying the $6.0 put, offers a balance between potential profitability and manageable risk of assignment. As we explore longer durations, especially the trades expiring in November 2024 and January 2025, the strategies become more attractive in terms of premium generation but require careful consideration owing to their higher deltas increasing the risk of assignment.

Vertical Bear Call Spread Option Strategy

In analyzing the most profitable vertical bear call spread strategy for Bloom Energy Corporation (BE), it's crucial to weigh the profitability against the risk of having shares assigned. Since the target stock price is within 2% of the current price, this strategy will focus on optimizing the best returns while minimizing the probability of shares being assigned, which inherently brings higher financial risks and obligations.

Near-Term Strategy (Expiration 2024-05-17):

To balance returns and limit the in-the-money risk, one could consider a vertical bear call spread utilizing the 11.0 and 12.0 strike prices for the May 17, 2024 expiration. Shorting the call with a strike price of 11.0 offers a premium of $1.55, while buying a call with a strike price of 12.0 costs $0.72. The net credit received is $0.83. Given the delta for the 11.0 strike price is 0.9685 while the 12.0 strike price is 0.7712, the probability of assignment for the 11.0 short call is significant but slightly mitigated because the short option is at a lower strike price closer to the money compared to the longer expiration strategy within the same timeframe. The spread maintains high gamma and theta figures, enhancing time decay benefits while keeping a high gamma for rapid delta changes near expiration, with vega stability.

Short-Term Strategy (Expiration 2024-06-21):

For this term, the 10.0 and 11.0 strike prices stand out. Shorting the 10.0 strike call at $2.90 and buying the 11.0 strike call at $1.97 yields a net credit of $0.93. The delta for the short call is 0.8699, suggesting moderate chances of assignment, while the bought calls delta of 0.7703 further reduces overall delta sensitivity, hence lowering assignment risk. This pairing includes a higher theta, ensuring consistent premium decay and maximum profitability quickly.

Mid-Term Strategy (Expiration 2024-08-16):

Considering expiration in mid-2024, the 12.0 and 13.0 strike prices offer a robust strategy. The 12.0 strike short call premium at $2.00, and the 13.0 strike long call premium at $1.55 brings a net credit of $0.45. The deltas here, sitting at 0.6288 and 0.5391 respectively, ensure a balanced position with significant positive gamma and high vega, fitting well for environments filled with volatility without elevating the likelihood of assignments excessively.

Long-Term Strategy (Expiration 2024-11-15):

Employing the 12.0 and 13.0 strike prices again for the longer term yields a short call at $2.75 and a long call at $2.55, providing a net credit of $0.20. This arrangement focuses on reducing the risk represented by delta (0.6493 and 0.5891 for 12.0 and 13.0 strikes, respectively), maintaining higher gamma, and vega suited for fluctuating market impasses heading towards year-end.

Longer-Term Strategy (Expiration 2026-01-16):

Arranging for a longer horizon, the 15.0 and 17.0 strikes stand out. Shorting the 15.0 strike call for $3.60 and buying the 17.0 strike for $2.80 delivers a $0.80 net credit. The respective deltas of 0.6184 and 0.5726 delineate the best risk-return balance long-term by leveraging high gamma (implying sensitivity to stock price movements) while capitalizing on veering vega influences for high volatility gains, further coupled with robust rho, which safeguards against significant moves in underlying interest rates.

Adjustments and Conclusions:

For each strategy, the "Greeks" were carefully selected to optimize premium receipts and ensure a strategic exit point should any in-the-money options suggest undue risk of assignment. Specifically, balancing between high theta for time decay across short and longer durations and maintaining higher gamma to benefit from potential reversals helps ensure sustained profit maximization with clearly delineated downside capping. Additionally, profitability is ensured by tactical theta-driven options tariffs creating timely opportunities for monetizing spreads with minimized assignment probabilities.

In summary, these strategies across various expiration periods provide robust alternatives tailored for FEs stock, ensuring consistent returns while adequately managing risk as estimated by delta figures within reasonable thresholds.

Vertical Bull Call Spread Option Strategy

A vertical bull call spread is an options strategy that involves buying a call option at a specific strike price while simultaneously selling another call option at a higher strike price, both with the same expiration date. This strategy is used when the options trader expects a moderate rise in the price of the underlying asset. The primary objective here is to determine the most profitable vertical bull call spread options for Bloom Energy Corporation (BE), while minimizing the risk of having shares assigned.

Given the target stock price is 2% around the current price, we need to analyze the options, taken into account "the Greeks" and the return on investment (ROI). Minimizing the risk of assignment, calls for avoiding options that are deep in the money (with a high delta, typically close to 1) and instead focusing on at-the-money or slightly out-of-the-money options (delta near 0.5 to 0.7).

Here are five profitable choices for a vertical bull call spread strategy with varying expiration dates:

Near Term (Expiration Date: 2024-05-17)

- Strike Prices: Buy Call $12, Sell Call $13

- Delta of Buy Call: ~0.27

- Delta of Sell Call: ~0.05

- Premiums: $0.72 (Buy $12) and $0.20 (Sell $13)

- Net Premium Outflow: $0.52 (Debit spread)

- ROI: Potential high return with minimized risk given both options are slightly out-of-the-money.

Medium Term (Expiration Date: 2024-06-21)

- Strike Prices: Buy Call $10, Sell Call $11

- Delta of Buy Call: ~0.77

- Delta of Sell Call: ~0.63

- Premiums: $2.9 (Buy $10) and $1.97 (Sell $11)

- Net Premium Outflow: $0.93 (Debit spread)

- ROI: The strategy benefits from being closer to the money with moderate premium, favorable risk/reward dynamics.

Intermediate Term (Expiration Date: 2024-08-16)

- Strike Prices: Buy Call $11, Sell Call $12

- Delta of Buy Call: ~0.72

- Delta of Sell Call: ~0.63

- Premiums: $2.65 (Buy $11) and $2.00 (Sell $12)

- Net Premium Outflow: $0.65 (Debit spread)

- ROI: The spreads provide substantial upside with a moderate net premium outflow.

Long Term (Expiration Date: 2024-11-15)

- Strike Prices: Buy Call $13, Sell Call $14

- Delta of Buy Call: ~0.59

- Delta of Sell Call: ~0.53

- Premiums: $2.55 (Buy $13) and $1.85 (Sell $14)

- Net Premium Outflow: $0.70 (Debit spread)

- ROI: Balanced risk and probable profitable outcome as the options are moderately out-of-the-money.

Extended Term (Expiration Date: 2025-01-17)

- Strike Prices: Buy Call $12, Sell Call $13

- Delta of Buy Call: ~0.66

- Delta of Sell Call: ~0.61

- Premiums: $3.3 (Buy $12) and $2.75 (Sell $13)

- Net Premium Outflow: $0.55 (Debit spread)

- ROI: Higher profit potential with controlled risk given the long time horizon and moderate deltas.

These vertical bull call spreads present a balanced approach between profit potential and minimized assignment risk. Investors considering these strategies should closely monitor the underlying stock price and adjustments in options premiums as the expiration date approaches.

Spread Option Strategy

Analysis of Calendar Spread Options Strategy for Bloom Energy Corporation (BE)

In exploring a profitable calendar spread options strategy for Bloom Energy Corporation (BE), we aim to buy call options and sell put options. Given the target stock price, which is anticipated to be 2% above or below the current stock price, lets analyze several profitable options combinations across different expiration dates and strike prices.

Near-Term Options (May 2024 - June 2024)

- Expiration Date: 2024-05-17, Strike Price: 5.0

- Call Option:

- Delta: 1.0, Gamma: 0.0, Vega: 0.0, Theta: -0.0006087558, Rho: 0.0273905882

- Premium: $4.30, ROI: 80.59%, Profit: $3.4653

- Put Option:

- Delta: -0.0010589579, Gamma: 0.0009017027, Vega: 0.0032862797, Theta: -0.003489909, Rho: -0.0000795056

- Premium: $0.03, ROI: 100%, Profit: $0.03

-

Analysis: This combination offers a solid profit potential with minimal risk of having shares assigned due to the very low delta of the put option. This pair is attractive because of the substantial ROI from the call and the negligible premium involvement for the put.

-

Expiration Date: 2024-06-21, Strike Price: 8.0

- Call Option:

- Delta: 0.957568263, Gamma: 0.0252511658, Vega: 0.3601972251, Theta: -0.0052699671, Rho: 0.7464848236

- Premium: $4.00, ROI: 19.13%, Profit: $0.7653

- Put Option:

- Delta: -0.0403016914, Gamma: 0.0246572927, Vega: 0.3453328715, Theta: -0.0040506326, Rho: -0.057567719

- Premium: $0.07, ROI: 100%, Profit: $0.07

- Analysis: This combination provides a moderate risk scenario. The delta of the put option is sufficiently low to mitigate the risk of assignment while offering a good premium and profit from the call option.

Mid-Term Options (August 2024 - November 2024)

- Expiration Date: 2024-08-16, Strike Price: 7.0

- Call Option:

- Delta: 0.9322267574, Gamma: 0.0222057119, Vega: 0.8273223128, Theta: -0.0048660438, Rho: 1.4926958443

- Premium: $4.80, ROI: 20.11%, Profit: $0.9653

- Put Option:

- Delta: -0.0462691886, Gamma: 0.0194052953, Vega: 0.6120842014, Theta: -0.0025189704, Rho: -0.1759387235

- Premium: $0.10, ROI: 100%, Profit: $0.10

-

Analysis: This mid-term strategy benefits from relatively high delta and theta values for the call option, creating a valuable opportunity for profit while maintaining minimal assignment risk due to the low delta of the put option.

-

Expiration Date: 2024-11-15, Strike Price: 8.0

- Call Option:

- Delta: 0.8636301667, Gamma: 0.0299222189, Vega: 1.9426454069, Theta: -0.0050037505, Rho: 2.7447264831

- Premium: $4.55, ROI: 4.73%, Profit: $0.2153

- Put Option:

- Delta: -0.1217475038, Gamma: 0.0312303115, Vega: 1.7949666487, Theta: -0.0033075065, Rho: -1.0180396879

- Premium: $0.52, ROI: 100%, Profit: $0.52

- Analysis: This strategy balances potential profit with an increased premium for the put, optimizing cash flow while keeping assignment risk manageable due to a moderate delta for the put option.

Long-Term Options (January 2025 - July 2025)

- Expiration Date: 2025-01-17, Strike Price: 9.0

- Call Option:

- Delta: 0.8889237007, Gamma: 0.0215243255, Vega: 1.9494144601, Theta: -0.0039491583, Rho: 3.2072209794

- Premium: $5.20, ROI: 10.87%, Profit: $0.5653

- Put Option:

- Delta: -0.1779761808, Gamma: 0.0373284654, Vega: 2.6812246152, Theta: -0.0033009182, Rho: -2.1127368519

- Premium: $0.95, ROI: 100%, Profit: $0.95

- Analysis: Long-term options typically incur higher premiums but allow for more significant movements. The selected options strike a good balance, with lower delta for the put option, reducing assignment risk and ensuring premium capture.

Summary

Each of these strategies presents a unique risk-return profile optimized for different holding periods. The near-term strategies, such as those expiring in May and June 2024, offer high ROI with the lowest risk of assignment due to the very low delta on the put options. Mid-term strategies, maturing in August and November 2024, offer balanced opportunities for profit while sustaining moderate risk levels. Finally, the long-term strategy expiring in January 2025 presents attractive premiums and a reasonable risk profile for longer holding periods.

Calendar Spread Option Strategy #1

Analyzing the options chain and considering the criteria for a calendar spread, we need to maintain the balance between maximizing profitability and minimizing the risk of being assigned shares. The central goal is to buy a put option with a longer expiration date while shorting a call option with a closer expiration date. This approach enables us to benefit from time decay on the call option while expecting a small movement in the stock priceup or down by 2%right around the current price.

- Near-Term Strategy (Short Put: Expire May 17, 2024, and Long Call: Expire Aug 16, 2024)

- Short Put Option: Strike 12.0, Expiration May 17, 2024

- Greeks: Delta 0.771, Gamma 0.404, Vega 0.281, Theta -0.058, Rho 0.049

- Premium: $0.72, ROI: 62.56%, Profit: $0.4504

- Long Call Option: Strike 19.0, Expiration Aug 16, 2024

- Greeks: Delta -0.606, Gamma 0.046, Vega 2.430, Theta -0.015, Rho -3.957

- Premium: $5.6, ROI: 11.33%, Profit: $0.6347

This combination utilizes a short-term put option with a higher delta, suggesting it's closer to being in-the-money, thus capitalizing on immediate premium decays. Pairing it with a long-term call option farther out minimizes the assignment risk due to it being out-of-the-money.

- Medium-Term Strategy (Short Put: Expire Jun 21, 2024, and Long Call: Expire Nov 15, 2024)

- Short Put Option: Strike 10.0, Expiration Jun 21, 2024

- Greeks: Delta 0.770, Gamma 0.115, Vega 1.209, Theta -0.012, Rho 0.779

- Premium: $1.97, ROI: 35.55%, Profit: $0.7004

- Long Call Option: Strike 12.0, Expiration Nov 15, 2024

- Greeks: Delta -0.655, Gamma 0.053, Vega 3.3, Theta -0.006, Rho -3.083

- Premium: $2.75, ROI: 90.20%, Profit: $2.4804

This combination steps up the duration slightly, leveraging a medium-dated put option against a longer call option, again favoring a higher delta put for immediate premium decay while positioning for a potential move.

- Medium-Term Strategy (Short Put: Expire Jun 21, 2024, and Long Call: Expire Jan 17, 2025)

- Short Put Option: Strike 10.0, Expiration Jun 21, 2024

- Greeks: Delta 0.770, Gamma 0.115, Vega 1.209, Theta -0.012, Rho 0.779

- Premium: $1.97, ROI: 35.55%, Profit: $0.7004

- Long Call Option: Strike 30.0, Expiration Jan 17, 2025

- Greeks: Delta -0.634, Gamma 0.03, Vega 3.873, Theta -0.006, Rho -17.936

- Premium: $15.1, ROI: 14.14%, Profit: $2.1347

Here, the same short-timeframe for the put is used but with a deep out-the-money long call option extending multiple months. This setup minimizes the risk further due to the deep OTM nature of the call.

- Long-Term Strategy (Short Put: Expire Nov 15, 2024, and Long Call: Expire Dec 20, 2024)

- Short Put Option: Strike 8.0, Expiration Nov 15, 2024

- Greeks: Delta 0.864, Gamma 0.03, Vega 1.938, Theta -0.005, Rho 2.751

- Premium: $4.55, ROI: 6.16%, Profit: $0.2804

- Long Call Option: Strike 12.0, Expiration Dec 20, 2024

- Greeks: Delta -0.656, Gamma 0.053, Vega 3.3, Theta -0.006, Rho -3.083

- Premium: $3.0, ROI: 91.01%, Profit: $2.7304

The long-term strategy reflects a short put with a solid premium collection backed by a call option far out, wherein the stock might move significantly to ensure profitability.

- Extended-Term Strategy (Short Put: Expire May 17, 2024, and Long Call: Expire Jul 18, 2025)

- Short Put Option: Strike 13.0, Expiration May 17, 2024

- Greeks: Delta 0.272, Gamma 0.451, Vega 0.307, Theta -0.061, Rho 0.018

- Premium: $0.20, ROI: 100.00%, Profit: $0.20

- Long Call Option: Strike 18.0, Expiration Jul 18, 2025

- Greeks: Delta -0.371, Gamma 0.055, Vega 3.892, Theta -0.006, Rho -2.239

- Premium: $1.05, ROI: 100.00%, Profit: $1.05

For a very extended period, a put option is near-term with moderate delta and theta to ensure substantial premium decay while positioning a long call considerably far with a balanced Greek profile for long-term profitability.

These combinations present various facets of calendar spreads focusing on balancing higher profitability while minimizing risks associated with options being in-the-money.

Calendar Spread Option Strategy #2

To devise the most profitable calendar spread options strategy with a focus on minimizing risks, particularly the risk of having shares assigned, we'll explore five optimal combinations of long call and short put options spread across different expiration dates and strike prices. Given the target stock price is expected to fluctuate within 2% of the current price, specific options will be selected based on their profitability and associated Greek values.

Near-Term Option Strategy

- Expiration Date: 2024-06-21 (Short Put) and 2024-05-17 (Long Call)

- Short Put Option:

- Strike Price: $12.0

- Delta: 0.6302

- Premium: $1.3

- ROI: 79.26%

- Profit: $1.0304

- Long Call Option:

- Strike Price: $19.0

- Delta: -0.6064

- Premium: $5.6

- ROI: 11.33%

- Profit: $0.6347

This strategy combines a near-term expiration for the put option, which provides substantial premium capture and is moderately out-of-the-money, thereby reducing the risk of assignment. The long call option has a manageable delta, moderating the initial cost of the long call while still providing upside potential.

Short-Term Option Strategy

- Expiration Date: 2024-08-16 (Short Put) and 2024-06-21 (Long Call)

- Short Put Option:

- Strike Price: $13.0

- Delta: 0.5390715666

- Premium: $1.55

- ROI: 100%

- Profit: $1.55

- Long Call Option:

- Strike Price: $32.0

- Delta: -1.0

- Premium: $14.6

- ROI: 31.74%

- Profit: $4.6347

This setup offers high delta on the long call, ensuring a higher sensitivity to stock price movements in the money whereas the put option, being slightly out-of-the-money, can yield a significant premium while maintaining a lower risk of assignment.

Medium-Term Option Strategy

- Expiration Date: 2024-11-15 (Short Put) and 2024-08-16 (Long Call)

- Short Put Option:

- Strike Price: $14.0

- Delta: 0.5298292337

- Premium: $1.85

- ROI: 100%

- Profit: $1.85

- Long Call Option:

- Strike Price: $29.0

- Delta: -0.6064164893

- Premium: $5.6

- ROI: 11.33%

- Profit: $0.6347

Combining a moderate time horizon, the short put at $14 offers a strong premium with a delta that keeps the likelihood of assignment lower. The paired long call through to November ensures a leveraged profit potential with shared market exposure.

Long-Term Option Strategy

- Expiration Date: 2025-01-17 (Short Put) and 2024-11-15 (Long Call)

- Short Put Option:

- Strike Price: $13.0

- Delta: 0.5891

- Premium: $2.55

- ROI: 100%

- Profit: $2.55

- Long Call Option:

- Strike Price: $30.0

- Delta: -0.6339547209

- Premium: $15.1

- ROI: 14.14%

- Profit: $2.1347

This longer-term strategy takes advantage of the time premium decay on the short put option, while the higher strike longer-duration call option provides substantial profit potential, best suited for significant movements expected in the underlying stock.

Extended-Term Option Strategy

- Expiration Date: 2026-01-16 (Short Put) and 2025-07-18 (Long Call)

- Short Put Option:

- Strike Price: $17.0

- Delta: 0.3726079436

- Premium: $2.8

- ROI: 100%

- Profit: $2.8

- Long Call Option:

- Strike Price: $27.0

- Delta: -0.7808273557

- Premium: $13.28

- ROI: 7.19%

- Profit: $0.9547

In this configuration, the far-in-the-future short put option has a lower delta, significantly reducing the risk of assignment while securing a solid premium. The long call with an extended expiration provides a substantial timeframe for upside realization, delivering robust ROI with minimized risk.

Conclusion

By strategically selecting the combinations from near-term to extended-term expirations, we've aligned premium capture, delta effect, and risk mitigation to ensure the most profitable and secure calendar spread options strategy tailored to Bloom Energy Corporation's expected stock price movement. This holistic approach not only maximizes profit but also prudently manages the risks associated with assignment.

Similar Companies in Electrical Equipment & Parts:

Plug Power Inc. (PLUG), Microvast Holdings, Inc. (MVST), Solid Power, Inc. (SLDP), CBAK Energy Technology, Inc. (CBAT), FuelCell Energy, Inc. (FCEL), Enovix Corporation (ENVX), FREYR Battery (FREY), Ballard Power Systems (BLDP), SunPower Corporation (SPWR), Enphase Energy (ENPH), First Solar (FSLR), Report: NextEra Energy (NEE), NextEra Energy (NEE), Report: Tesla (TSLA), Tesla (TSLA), Sunrun (RUN)

https://www.fool.com/investing/2024/04/08/why-bloom-energy-rallied-in-march/

https://www.fool.com/investing/2024/04/23/why-plug-power-bloom-and-fuelcell-energy-stock-pop/

https://www.fool.com/investing/2024/04/27/is-bloom-energy-stock-a-buy/

https://finance.yahoo.com/news/bloom-energy-first-quarter-2024-122317205.html

https://finance.yahoo.com/video/c3-ai-bloom-energy-ceos-160909822.html

https://finance.yahoo.com/m/0959ae96-838a-399c-bd4b-b9750c25b9b1/beyond-meat-looks-for.html

https://finance.yahoo.com/m/1402aa6f-27e2-3e3a-a0f0-82be7acdc06c/grocery-stores-and.html