Chesapeake Energy Corporation (ticker: CHK)

2024-01-26

Chesapeake Energy Corporation (ticker: CHK) is a prominent player in the hydrocarbon exploration industry, focusing primarily on the discovery and development of onshore oil and natural gas resources in the United States. Founded in 1989 and headquartered in Oklahoma City, Oklahoma, Chesapeake operates through two segments: Exploration and Production, and Marketing, Gathering, and Compression. The company owns a diverse portfolio of assets in top U.S. onshore oil and natural gas shale plays, with significant positions in the Marcellus Shale, Haynesville Shale, and Eagle Ford Shale, among others. CHK has historically been known for its aggressive acquisition and development strategy, which led to a substantial increase in both production and debt. After facing financial struggles exacerbated by volatile commodity prices, Chesapeake Energy filed for Chapter 11 bankruptcy protection in June 2020. As part of its restructuring plan, the company aimed to strengthen its balance sheet, reduce its debt, and enhance its competitive position in the energy market. Emerging from bankruptcy in February 2021, Chesapeake has since focused on operational efficiency, cost management, and generating free cash flow while maintaining a commitment to safety, environmental stewardship, and shareholder value creation.

Chesapeake Energy Corporation (ticker: CHK) is a prominent player in the hydrocarbon exploration industry, focusing primarily on the discovery and development of onshore oil and natural gas resources in the United States. Founded in 1989 and headquartered in Oklahoma City, Oklahoma, Chesapeake operates through two segments: Exploration and Production, and Marketing, Gathering, and Compression. The company owns a diverse portfolio of assets in top U.S. onshore oil and natural gas shale plays, with significant positions in the Marcellus Shale, Haynesville Shale, and Eagle Ford Shale, among others. CHK has historically been known for its aggressive acquisition and development strategy, which led to a substantial increase in both production and debt. After facing financial struggles exacerbated by volatile commodity prices, Chesapeake Energy filed for Chapter 11 bankruptcy protection in June 2020. As part of its restructuring plan, the company aimed to strengthen its balance sheet, reduce its debt, and enhance its competitive position in the energy market. Emerging from bankruptcy in February 2021, Chesapeake has since focused on operational efficiency, cost management, and generating free cash flow while maintaining a commitment to safety, environmental stewardship, and shareholder value creation.

| Address | 6100 North Western Avenue | City | Oklahoma City | State | OK |

| Zip | 73118 | Country | United States | Phone | 405 848 8000 |

| Website | https://www.chk.com | Industry | Oil & Gas E&P | Sector | Energy |

| Full Time Employees | 1,200 | Previous Close | 76.44 | Open | 77.05 |

| Day Low | 76.545 | Day High | 77.577 | Dividend Rate | 3.62 |

| Dividend Yield | 4.68% | Payout Ratio | 16.81% | Beta | 0.485 |

| Trailing PE | 2.10 | Forward PE | 19.78 | Volume | 2,173,921 |

| Average Volume | 1,888,580 | Average Volume (10 days) | 3,069,860 | Market Cap | 10,116,993,024 |

| 52 Week Low | 69.68 | 52 Week High | 91.00 | Price to Sales (TTM) | 1.28 |

| Price to Book | 0.988 | Enterprise Value | 11,532,436,480 | Profit Margins | 68.67% |

| Shares Outstanding | 130,795,000 | Shares Short | 11,894,817 | Held Percent Insiders | 4.83% |

| Held Percent Institutions | 110.67% | Short Ratio | 5.54 | Book Value | 78.272 |

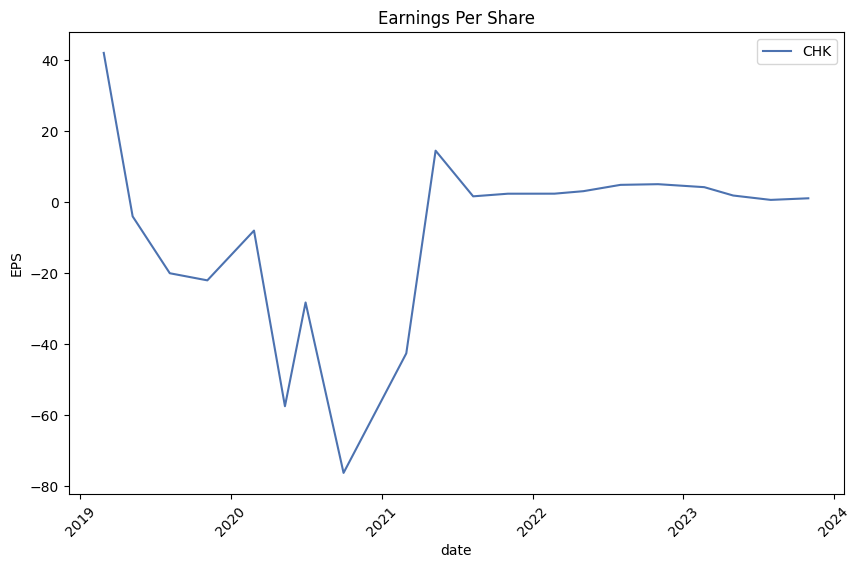

| Net Income (TTM) | 5,362,999,808 | Trailing EPS | 36.91 | Forward EPS | 3.91 |

| Total Cash | 713,000,000 | Total Debt | 2,107,000,064 | Total Revenue (TTM) | 7,906,999,808 |

| Debt to Equity | 20.52 | Revenue Per Share (TTM) | 59.146 | Return on Assets (TTM) | 17.13% |

| Return on Equity (TTM) | 65.36% | Operating Cash Flow (TTM) | 2,960,000,000 | Gross Margins (TTM) | 43.71% |

| Sharpe Ratio | -14.711807896924542 | Sortino Ratio | -238.13763274953098 |

| Treynor Ratio | -0.0670351674519427 | Calmar Ratio | -0.45176370105439767 |

Technical analysis (TA) and fundamental analysis are two primary methods used for evaluating investment opportunities. TA involves examining historical market data such as price and volume, while fundamental analysis looks at economic and financial factors of securities. Incorporation of balance sheet data provides additional insights into a company's financial health.

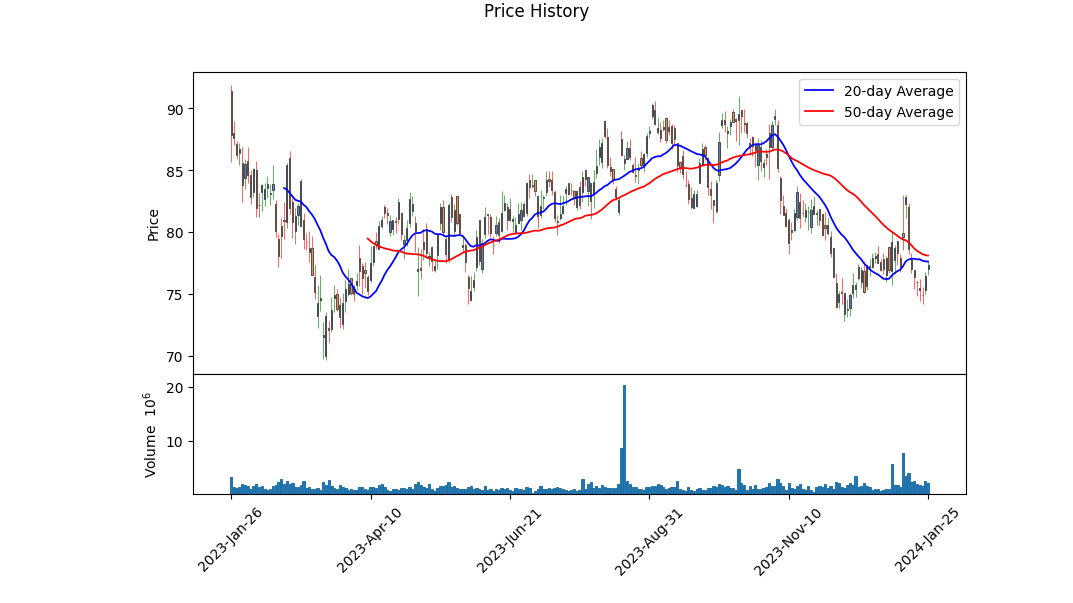

Based on the Technical Indicators for the last trading day for CHK, the stock has been showing a downward trend with decreasing On-Balance Volume (OBV) and a negative MACD histogram, which could indicate the continuation of a bearish trend. The gradually decreasing OBV suggests that the selling pressure has been persistent, leading to lower prices.

The fundamentals show some mixed signals. Gross and EBITDA margins indicate profitability with values of 0.43708 and 0.6947, respectively. However, operating margins are low at 0.05619. The negative values of risk-adjusted return ratios such as Sharpe, Sortino, Treynor, and Calmar suggest that the stock has underperformed relative to the risk-free rate and experienced high volatility and risk relative to the returns it has generated over the past year. This is usually a negative sign for investors seeking stable, risk-adjusted returns.

A closer analysis of the balance sheet reveals a significant level of debt, with net debt standing at $2.963 billion, despite a solid base of total assets valued at $14.248 billion. The relatively high level of retained earnings at $4.532 billion and EBIT at $4.17 billion suggest a strong operational income-generating ability.

The cash flow summary indicates a robust free cash flow of $2.302 billion, although the company has been engaging in notable financing activities including repayment of debt and stock repurchases. A substantial capital expenditure signifies the company's investment in its growth or maintenance of its current operations.

The Earnings Estimate from analysts presents a mixed picture. The Earnings History indicates that CHK has consistently beaten EPS estimates in the past quarters, a positive sign for potential future performance. However, the "Earnings Trend" and "EPS Revisions" tables do not conclusively forecast significant earnings growth, with current estimates for the next year indicating a drop compared to the year-ago EPS. The "Growth Estimates" suggest a significant drop for the current quarter and next quarter, followed by a decline for the current year as well as the next year.

In conclusion, CHK faces a negative outlook based on technical indicators combined with negative risk-adjusted return ratios. While some fundamental figures such as gross and EBITDA margins look promising, the weight of the debt, recent stock underperformance, and negative growth projections may depress the stock price in the upcoming months. Investors will likely consider the robust free cash flow and consistent beating of EPS estimates as positive aspects. But overall, given the technical and fundamental factors, caution is warranted, and one may expect the stock's bearish trend to continue over the near term unless a significant positive change in the market sentiment or operational capacities of the company occurs.

| Statistic Name | Statistic Value |

| R-squared | 0.130 |

| Adj. R-squared | 0.129 |

| F-statistic | 111.2 |

| Prob (F-statistic) | 2.61e-24 |

| Log-Likelihood | -1,665.9 |

| AIC | 3,336 |

| BIC | 3,345 |

| Const (alpha) | 0.0911 |

| Beta | 0.7993 |

| Std Err | 0.076 |

| t (for beta) | 10.543 |

| P>|t| | 0.000 |

| [0.025 | 0.650 |

| 0.975] | 0.948 |

| Cond. No. | 1.11 |

Alpha represents the intercept of the regression line, giving us the value where the line crosses the Y-axis when SPY is zero. In the context of this regression model between CHK (Chesapeake Energy Corporation) and SPY (S&P 500 index ETF), an alpha of 0.0911 suggests that CHK stock has a performance baseline above the horizontal at the zero mark of SPY by this value. However, the coefficient's P-value indicates that the alpha is not statistically significant at conventional levels (P > 0.05). The adjusted R-squared value of 0.129 suggests that approximately 12.9% of the variation in CHK's returns can be explained by the variability in SPY's returns, which implies that other factors aside from the market performance (as represented by SPY) affect CHK's returns.

The coefficient for the market, represented as beta in the model, is 0.7993, indicating that for a one-unit increase in SPY, CHK is expected to increase by roughly 0.7993 units. This Beta implies CHK is somewhat reactive to market movements, but less than one-for-one; hence, it has a lower volatility compared to the market. The F-statistic of 111.2 with a highly significant P-value (2.61e-24) and the beta's tight 95% confidence interval between 0.650 and 0.948 both reflect a robust overall model fit and the reliability of the beta estimate. Despite this, the explained variance signified by R-squared being relatively low suggests possible improvements to model specification or the existence of high levels of idiosyncratic risk within CHK not captured by SPY.

In the third quarter of 2023 earnings call for Chesapeake Energy Corporation, Nick Dell'Osso, alongside Chris Ayers, Mohit Singh, and Josh Viets, presented the financial and operating results, highlighting strong performance despite challenges. DellOsso emphasized that the company achieved high production levels while staying at the low end of capital expenditure. A record was set in the Marcellus rig fleet's performance with improved efficiency and a reduction in cycle times, demonstrating the company's ability to balance inflation with operational efficiency. In the Haynesville region, Chesapeake maintained strong base production levels and minimized interruptions related to midstream issues, resulting in a 15% quarter-over-quarter reduction in interrupted volumes and leading to an increased production guidance.

Chesapeake continued its commitment to shareholders by executing a return program, repurchasing $130 million in shares, and maintaining its base dividend. Approximately $725 million was returned to shareholders through buyback and dividend programs up to the third quarter. An LNG supply agreement with Vitol was announced, which aligns with Chesapeake's strategy to link production to LNG markets and international pricing. The company's efforts seem to align with growing LNG export capabilities anticipated in the coming years, underpinning its competitive advantage among peers in the natural gas sector.

Looking ahead to 2024, Chesapeake plans to maintain its rig count with five rigs in the Haynesville and four rigs in the Marcellus for the initial part of the year. Depending on gas prices and anticipated LNG export capacity growth, the company might add an extra rig in the Haynesville in the second half of the year to boost volumes in 2025. DellOsso suggested a fair starting point for modeling the company's business in 2024 would be to expect annual production to match their fourth-quarter run rate of 3.2 Bcf a day in the Marcellus and Haynesville with a capital expenditure of approximately $1.6 billion, assuming an additional rig in the Haynesville later in the year.

During the Q&A, topics ranged from the company's outlook on natural gas macro conditions in 2024 to infrastructure investments and LNG strategies. It emerged that the guidance on CapEx and rig additions might be flexible, hinging on how the natural gas market unfolds, particularly with the introduction of new LNG export capabilities. Chesapeake also indicated its selective approach towards infrastructure investment, focusing on those that offer differential returns and expand market access. The company confirmed its goal to achieve international price exposure for a portion of its production and discussed strategies for securing LNG liquefaction capacity. The call concluded with reassurances of Chesapeake's competitive position and operational planning in response to market conditions, providing insights into its strategic direction and financial discipline aimed at balancing growth, returns, and shareholder value creation.

Chesapeake Energy Corporation (CHK), an independent exploration and production company, focuses on the acquisition, exploration, and development of properties to produce natural gas, oil, and natural gas liquids (NGL) from underground reservoirs. As of September 30, 2023, CHK operates primarily in the Marcellus Shale, Haynesville/Bossier Shales, and Eagle Ford Shale. The company has implemented various initiatives concentrating on operational efficiencies, financial discipline, and improving environmental, social, and governance (ESG) performance, with a goal to achieve net-zero greenhouse gas emissions by 2035.

For the quarter ended September 30, 2023, Chesapeake reported substantial decreases in natural gas, oil, and NGL sales, mainly attributed to lower average prices consistent with market trends and the operations' divestiture. Reported production expenses and gathering, processing, and transportation expenses also reflected decreases compared to the prior year, again due to divestitures and other operation-based factors.

CHKs liquidity as of September 30, 2023, was solid with $713 million in cash and $2.0 billion of available borrowing capacity under the New Credit Facility, which matures in December 2027 and provides a maximum borrowing base of $3.5 billion with certain financial covenants. Notably, in 2023, Chesapeake entered into several significant transactions: the divestiture of a portion of its Eagle Ford assets to WildFire Energy I LLC and INEOS Energy, as well as an agreement to sell the remaining Eagle Ford assets to SilverBow Resources, Inc.

Capital expenditure commitments for the year were estimated between $1.765 - $1.835 billion, with funding expected to come from cash flow from operations, cash on hand, and the New Credit Facility. Strategic investments include partnership with Momentum Sustainable Ventures LLC to establish a new natural gas gathering pipeline and carbon capture and sequestration project in the Haynesville Shale, geared toward supplying gas to Gulf Coast markets.

Within the financial structure, the shareholder return plan includes a regular dividend and a share repurchase program authorized up to $2.0 billion. The company's year-to-date share repurchase activity included approximately $313 million for retiring common stock. Additionally, the company declared a quarterly base dividend of $0.575 per share payable in December 2023.

In terms of income taxes, CHK reported income tax expenses of $532 million for the nine months ended September 30, 2023, with an effective income tax rate of 22.3%. This reflects projections of both current and deferred federal and state income taxes, with the effective tax rate significantly higher compared to the previous year, indicating no longer a full valuation allowance against the net deferred tax asset position.

In sum, Chesapeake Energy Corporation's report reflects a company actively managing its portfolio with a focus on financial health and strategic positioning. Divestitures of non-core assets and reinvestment in key areas, combined with controlled capital expenditure and a commitment to shareholder returns, delineate CHK's financial and operational strategies. Additionally, the company's proactive stance on ESG commitments and managing environmental responsibilities positions it as a responsive entity within the evolving energy sector.

Chesapeake Energy Corporation has recently taken a significant step towards industry consolidation with its merger with Southwestern Energy. The development, outlined in an article on Yahoo Finance dated January 11, 2024, emphasizes the ongoing wave of consolidation within the energy sector. This move, valued at $7.4 billion, represents a strategic maneuver by both companies in response to competitive markets and the demand for cleaner fuel sources.

By merging with Southwestern Energy, Chesapeake underscores its commitment to enhance its operational efficiency and market positioning. This move is not just about expansion but hints at the industry's pressure due to fluctuating energy prices and the need for more sustainable operations. The transaction will help Chesapeake maximize technological advancement and amplify its asset portfolio.

Such a merger reshapes the dynamics of the natural gas industry, potentially realigning market forces. As natural gas and LNG exports become increasingly important, Chesapeake's capacity to innovate and adapt will be key in maintaining and growing its market position within the global energy trends.

According to reports from Reuters and as mentioned in a release regarding the merger, the deal stipulates that Southwestern shareholders will receive a proportion of Chesapeake stock, valuing Southwestern shares at a specific market price. This strategic integration will add Southwestern's production capabilities to Chesapeake's portfolio, particularly in the shale formations of Appalachia and the Haynesville basin in Louisiana. The combined assets are projected to yield about 7.9 billion cubic feet equivalent per day.

The energy sector has seen a series of acquisitions that signal a trend towards industry consolidation. This trend underscores the value and competitiveness of natural gas production in today's economic landscape. The merger between Chesapeake and Southwestern indicates how strategic realignment and the pursuit of operational synergies are shaping the sector's future.

Industry analysts are closely watching the integration process, especially with predictions of considerable savings in operational costs. For instance, the combined company projects that it could save around $400 million, which would suggest improved margins and efficiencies. Additionally, Chesapeake has outlined its intention to increase dividend payments, thus reinforcing its commitment to shareholder value.

This merger comes after Chesapeake's emergence from bankruptcy in 2021 and follows its determined shift towards the natural gas sector. Acquiring Southwestern builds on Chesapeake's recent history of strategic acquisitions and marks its recovery trajectory. With this deal, Chesapeake is poised to outpace EQT Corporation and become the largest exploration and production company in the United States by market value.

The implications of this deal extend beyond mere financial metrics. As shared in a discussion highlighted in a video from YouTube, experts express confidence in the system's robustness to meet consumer demand, even amid the rare price hikes due to potential supply loss in extreme cold situations. The geographical significance of the Northeast and key regions like Haynesville, Louisiana, for the LNG export market particularly highlights strategic locations for the merged entity. The new company, aiming to capitalize on the expanding LNG market, could achieve greater operational and drilling efficiencies through overlapping asset distributions.

The merger is timely as the U.S. LNG export capacity is at its limit, with significant expansions expected. This could introduce more volatility into the market and expose the U.S. to global market fluctuations. U.S.-based companies like Chesapeake Energy are thus becoming increasingly strategic players in international geopolitics.

In the landscape of financial performance and market reactions, Chesapeake Energy, despite holding a Zacks Rank #5 (Strong Sell), is grabbing headlines with its merger. Investors have been told to consider other energy entities such as Sunoco LP, holding a Zacks Rank #1 (Strong Buy), distinguished for its cost management and leadership in fuel distribution.

Finally, broader market dynamics, geopolitical developments, and strategic corporate actions illustrate the complex environment Chesapeake Energy operates in. The surge in oil prices due to international tensions or the impact of the Russian war paint a picture of a sector permanently influenced by external factors. Yet, within this intricate landscape, Chesapeake's focus on increasing efficiency and scale through its merger with Southwestern Energy stands out as a direct response to these complex, evolving challenges.

For more detailed insights on Chesapeake Energy Corporation's strategic developments and their market implications, readers are encouraged to refer to articles from Zacks Equity Research, Forbes, Barrons.com, and The Wall Street Journal.

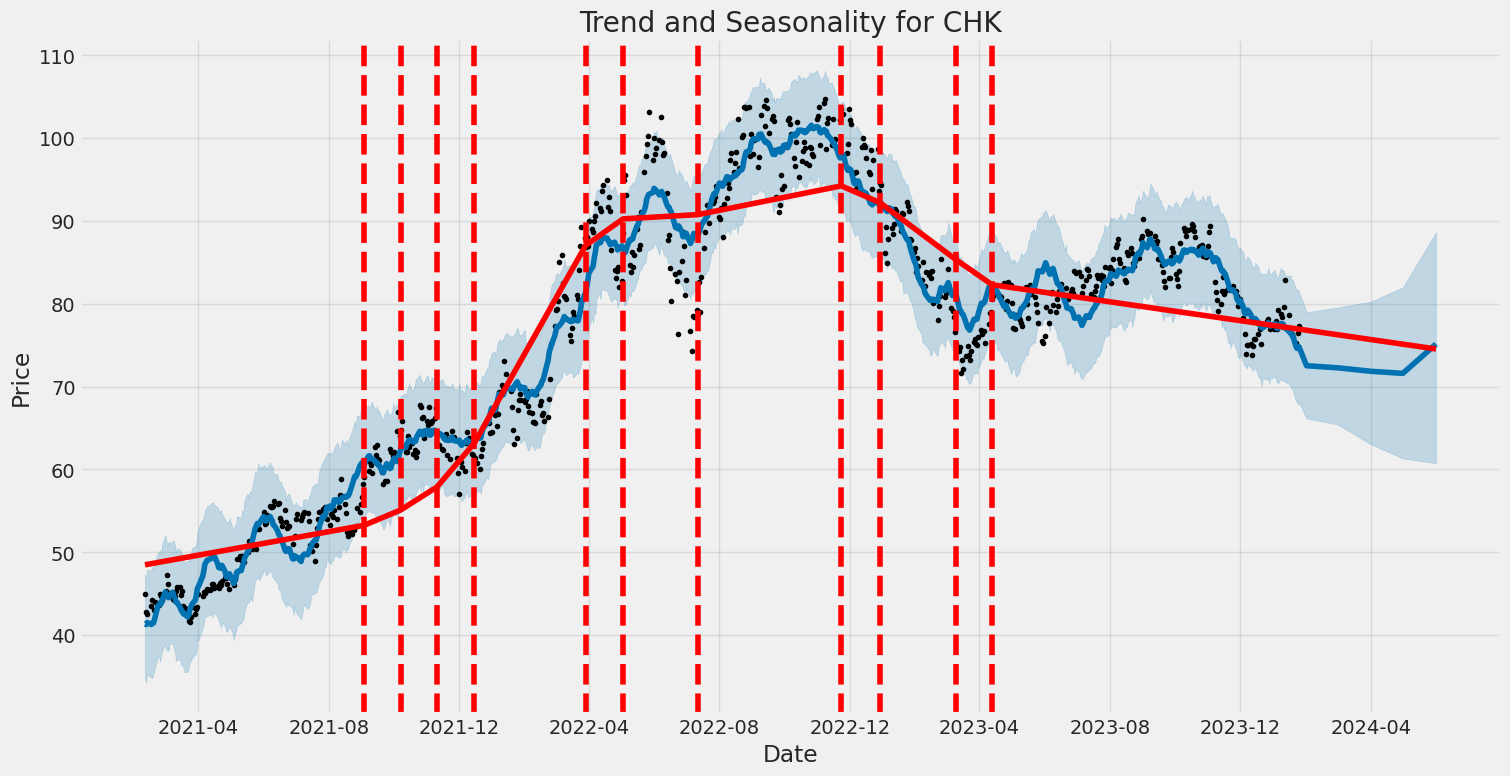

Chesapeake Energy Corporation (CHK) has experienced significant volatility from February 10, 2021, to January 25, 2024. The company's stock fluctuations could not be easily predicted by past returns as the R-squared value is 0, indicating no explanatory power of the model's past values on future volatility. The ARCH model identifies that the constant volatility (omega) was relatively high and the impact of the previous day's return shock on today's volatility (alpha[1]) was also significant, suggesting sharp movements in stock price based on new information or market events.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Log-Likelihood | -1711.68 |

| AIC | 3427.35 |

| BIC | 3436.57 |

| No. Observations | 743 |

| omega | 5.2210 |

| alpha[1] | 0.1252 |

To assess the financial risk of investing $10,000 in Chesapeake Energy Corporation (CHK) over a one-year timeframe, we leverage a two-pronged approach integrating volatility modeling and machine learning predictions.

Volatility modeling is a critical tool in financial econometrics for understanding and forecasting the ever-changing variance of asset returns. In the context of CHK, this methodology helps us parse through historical stock prices to discern patterns and predict future volatility. This information is pivotal because it allows for a meticulous estimation of the fluctuations investors might encounter.

Meanwhile, machine learning predictions complement volatility modeling by utilizing extensive historical data sets to forecast future returns. For this particular evaluation, we employ a decision tree-based approach, which is adept at capturing non-linear patterns that could escape traditional statistical models. This model tends to provide more nuanced insights into potential future performance, considering a wide array of factors.

When synthesizing the insights from both the volatility modeling and the decision tree-based machine learning approach, we garner a more nuanced perspective on expected stock behavior. Instead of looking at historical returns as a static sequence, volatility modeling accounts for potential changes in market dynamics and investor sentiment. The machine learning prediction, on the other hand, extrapolates current trends to foresee the return trajectory.

Combining these methodologies gives us the tools to determine the Value at Risk (VaR), which is a measure used to assess the potential for loss in investment and to quantify the level of financial risk. The VaR figure reflects the maximum expected loss over a set period with a certain level of confidence. For CHK, our computations suggest an annual VaR at a 95% confidence interval of $298.30 for a $10,000 investment. This implies that there's a 5% chance that the investment will lose more than $298.30 over the next year due to stock market fluctuations.

By taking into account the derived volatility and leveraging advanced predictive analytics, investors can gain a thorough understanding of the risk profile for CHK. While historical performance is no guarantee of future results, the calculated VaR provides a statistical estimate of the downside risk, which is vital in making informed investment decisions.

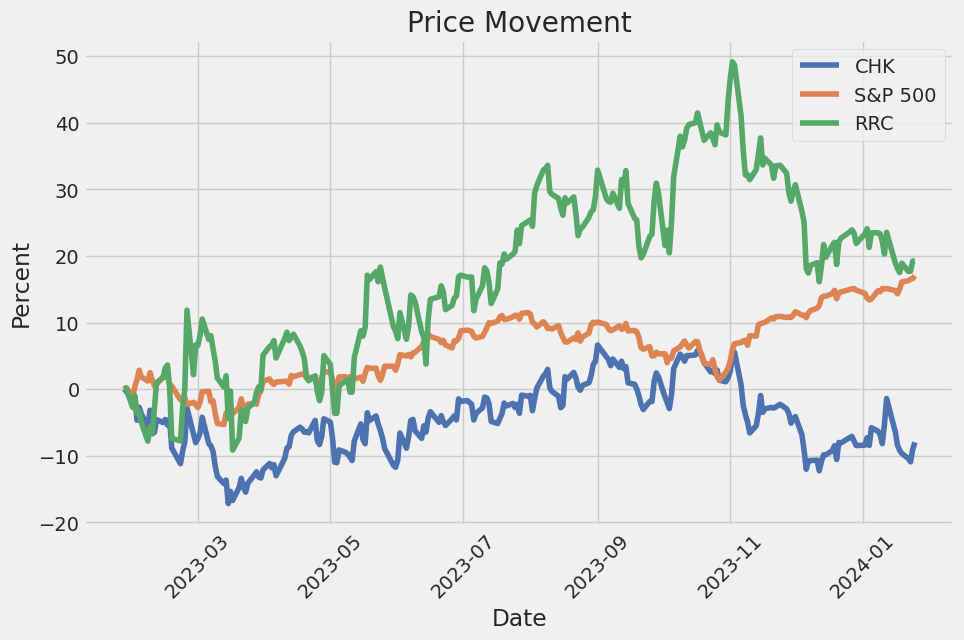

Similar Companies in Oil & Gas E&P:

Range Resources Corporation (RRC), Antero Resources Corporation (AR), Report: EQT Corporation (EQT), EQT Corporation (EQT), Comstock Resources, Inc. (CRK), Report: Southwestern Energy Company (SWN), Southwestern Energy Company (SWN), Matador Resources Company (MTDR), Coterra Energy Inc. (CTRA), Diamondback Energy, Inc. (FANG), Pioneer Natural Resources Company (PXD), Permian Resources Corporation (PR), Devon Energy Corporation (DVN), EOG Resources, Inc. (EOG), ConocoPhillips (COP), APA Corporation (APA), Hess Corporation (HES), Cabot Oil & Gas Corporation (COG), Cimarex Energy Co. (XEC)

https://www.zacks.com/stock/news/2207064/chesapeake-southwestern-to-form-a-17b-natural-gas-giant

https://www.youtube.com/watch?v=TyBail9yITE

https://finance.yahoo.com/m/022f1b31-1c27-3d68-bc4e-ad01de78027d/the-chesapeake-southwestern.html

https://finance.yahoo.com/m/14831794-b8a1-3e71-981e-8c1ce5295e36/the-energy-industry.html

https://finance.yahoo.com/video/oil-prices-tick-iran-seizes-221744992.html

https://finance.yahoo.com/m/c1c1c611-0c08-34e8-8e82-bfd55c3b0b34/russian-war%2C-energy.html

https://finance.yahoo.com/video/oil-prices-spike-us-uk-151552538.html

https://finance.yahoo.com/news/ultimate-growth-trio-3-stocks-152305602.html

https://finance.yahoo.com/m/24976398-180a-31c6-b115-5a6a5c07fa91/buy-chesapeake-stock.-a.html

https://www.sec.gov/Archives/edgar/data/895126/000089512623000123/chk-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: sw80jW

Cost: $0.69438

https://reports.tinycomputers.io/CHK/CHK-2024-01-26.html Home