Equinix, Inc. Common Stock REIT (ticker: EQIX)

2023-12-27

Equinix, Inc., operating under the ticker EQIX, is a global leader in the data center REIT (Real Estate Investment Trust) sector, providing critical infrastructure for internet and technology companies. The company offers a wide array of services including colocation, interconnection, and managed IT infrastructure solutions, allowing for secure and reliable data storage and connectivity. With a vast network of data centers spread across multiple continents, Equinix caters to a diverse clientele, ranging from cloud service providers to financial institutions. Its business model capitalizes on the increasing shift towards cloud computing and data consumption, positioning the company to benefit from the growing reliance on digital infrastructure. As a REIT, Equinix is required to distribute at least 90% of its taxable income to shareholders, offering investors potential income through dividends alongside capital growth opportunities as the company expands its global footprint and enhances its service offerings. Equinixs financial performance and strategic acquisitions typically make it a focus for investors seeking exposure to the burgeoning digital economy and the infrastructure that supports it.

Equinix, Inc., operating under the ticker EQIX, is a global leader in the data center REIT (Real Estate Investment Trust) sector, providing critical infrastructure for internet and technology companies. The company offers a wide array of services including colocation, interconnection, and managed IT infrastructure solutions, allowing for secure and reliable data storage and connectivity. With a vast network of data centers spread across multiple continents, Equinix caters to a diverse clientele, ranging from cloud service providers to financial institutions. Its business model capitalizes on the increasing shift towards cloud computing and data consumption, positioning the company to benefit from the growing reliance on digital infrastructure. As a REIT, Equinix is required to distribute at least 90% of its taxable income to shareholders, offering investors potential income through dividends alongside capital growth opportunities as the company expands its global footprint and enhances its service offerings. Equinixs financial performance and strategic acquisitions typically make it a focus for investors seeking exposure to the burgeoning digital economy and the infrastructure that supports it.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 75.50B | 67.95B | 73.35B | 67.43B | 60.62B | 52.64B |

| Enterprise Value | 90.52B | 82.79B | 87.72B | 81.99B | 74.14B | 67.08B |

| Trailing P/E | 86.56 | 83.86 | 88.88 | 94.01 | 85.74 | 81.03 |

| Forward P/E | 71.94 | 66.23 | 82.64 | 74.07 | 67.57 | 60.24 |

| PEG Ratio (5 yr expected) | 3.60 | 3.22 | 4.05 | 3.66 | 3.10 | 2.72 |

| Price/Sales (ttm) | 9.46 | 8.74 | 9.62 | 9.12 | 8.43 | 7.47 |

| Price/Book (mrq) | 6.35 | 5.67 | 6.10 | 5.86 | 5.44 | 4.95 |

| Enterprise Value/Revenue | 11.39 | 40.17 | 43.46 | 41.03 | 39.63 | 36.44 |

| Enterprise Value/EBITDA | 27.91 | 95.85 | 109.09 | 94.66 | 104.36 | 87.18 |

| Full Time Employees | 13,046 | Previous Close | 804.14 | Open | 801.99 |

| Day Low | 801.99 | Day High | 807.87 | Dividend Rate | 17.04 |

| Dividend Yield | 0.0212 | Payout Ratio | 143.49% | 5 Year Avg Dividend Yield | 1.69 |

| Beta | 0.642 | Trailing PE | 86.48 | Forward PE | 74.09 |

| Volume | 216,313 | Average Volume | 394,495 | Average Volume 10days | 506,450 |

| Market Cap | 75,751,702,528 | 52 Week Low | 648.23 | 52 Week High | 824.86 |

| Price to Sales Trailing 12 Months | 10.11 | Fifty Day Average | 773.20 | Two Hundred Day Average | 752.31 |

| Trailing Annual Dividend Rate | 13.33 | Trailing Annual Dividend Yield | 1.66% | Enterprise Value | 90,543,882,240 |

| Profit Margins | 11.62% | Float Shares | 93,576,425 | Shares Outstanding | 93,883,400 |

| Shares Short | 1,709,921 | Shares Short Prior Month | 1,494,611 | Shares Percent Shares Out | 1.82% |

| Held Percent Insiders | 0.318% | Held Percent Institutions | 97.209% | Short Ratio | 4.75 |

| Short Percent Of Float | 2.37% | Implied Shares Outstanding | 94,108,800 | Book Value | 126.61 |

| Price to Book | 6.37 | Most Recent Quarter | 09/30/2022 | Earnings Quarterly Growth | 30.20% |

| Net Income To Common | 870,372,992 | Trailing EPS | 9.33 | Forward EPS | 10.89 |

| PEG Ratio | 3.31 | Enterprise To Revenue | 12.09 | Enterprise To Ebitda | 32.69 |

| 52 Week Change | 23.23% | S&P 52 Week Change | 26.21% | Total Cash | 2,357,497,088 |

| Total Cash Per Share | 25.11 | EBITDA | 2,769,467,904 | Total Debt | 17,381,287,936 |

| Quick Ratio | 1.789 | Current Ratio | 2.052 | Total Revenue | 7,489,844,224 |

| Debt To Equity | 145.92 | Revenue Per Share | 80.37 | Return On Assets | 1.93% |

| Return On Equity | 7.55% | Gross Profits | 2,971,686,000 | Free Cash Flow | 2,781,564,160 |

| Operating Cash Flow | 2,978,070,016 | Earnings Growth | 27.40% | Revenue Growth | 16.50% |

| Gross Margins | 45.17% | EBITDA Margins | 36.98% | Operating Margins | 14.59% |

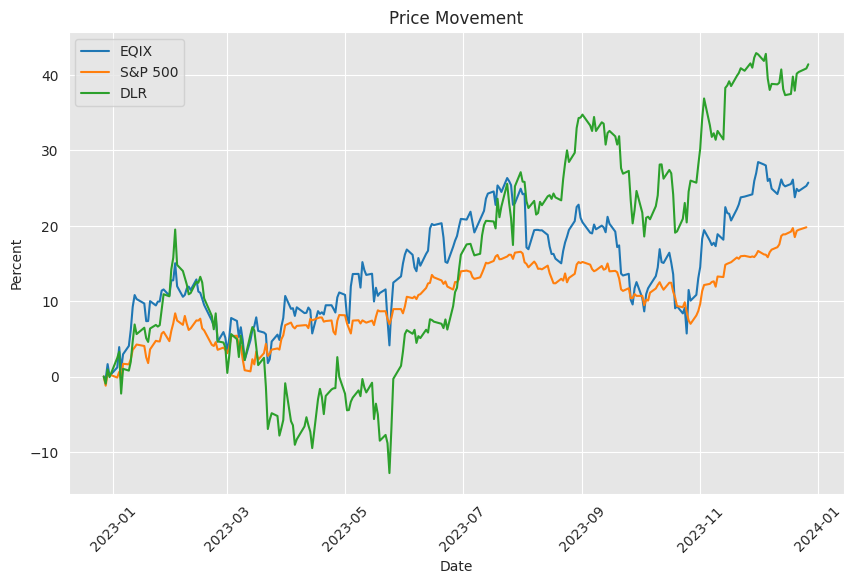

Equinix Inc. (EQIX) has been demonstrating a complex behavior pattern across its technical indicators and stock fundamentals. The examination of the technical analysis data and fundamental data suggests several noteworthy trends and potential outcomes for the equity's price movement over the following months.

In the realm of technical analysis, significant attention must be given to the Parabolic SAR (PSAR), On-Balance Volume (OBV), and Moving Average Convergence Divergence (MACD) Histogram:

- The PSAR indicator has not shown a clear trend change signal, as the PSAR dots have not yet flipped on top of the price, suggesting that the bearish sentiment is abating but not yet overturned.

- OBV has seen a slight uptick to 0.067381 million, indicating a moderate increase in buying pressure, which can be considered a positive sign.

- The MACD histogram value has been negative but is showing a reduction in negative momentum (-2.442187), suggesting the bearish momentum may be slowing down.

Cross-referencing these technical signals with the company's fundamentals will allow for a more nuanced consideration:

- The Market Capitalization has shown steady growth over the last few quarters, indicating market confidence.

- Measures of valuation such as Trailing P/E, Forward P/E, and P/S ratios have remained at the higher end, implying that the stock is being valued at a premium compared to earnings and sales.

- The company's financial health, as seen through robust Revenue and EBITDA figures, suggests a stable base which is positive for long-term investors.

Considering both the technical and fundamental perspectives, EQIX stock may experience a cautiously bullish trend in the upcoming months. However, this outlook is contingent on whether the market can continue to support the high valuation multiples. The key levels to watch would be the recent highs as potential resistance and recent lows as support. If the price can sustain above this support level, it might create a base for a bullish trend; a breach below could lead to a reevaluation of the bullish stance.

Investors should monitor EQIX's ability to maintain its revenue growth and manage its operating expenses effectively. Moreover, any changes in the broader market conditions or sector-specific news should be considered as they can dramatically affect the stock's performance, irrespective of technical and fundamental factors.

Finally, the firm's overall financial health and growth trajectory appear robust which may help mitigate any short-term technical weaknesses, thus providing a more steady upward momentum for its stock price in the medium term. Investors would do well to keep an eye on upcoming earnings announcements and potential market-moving events which could serve as catalysts for significant price movements.

Equinix, Inc., a leading digital infrastructure company, has demonstrated its prowess in the stock market since its initial public offering in August 2000. Mirroring the growth trajectory of the Nasdaq Composite Index on a total return basis, the company based in Redwood City, California, has built an extensive portfolio of data centers that currently exceeds 250 facilities distributed in 71 metropolitan areas across six continents. Such a broad geographic footprint has enabled Equinix to serve a diverse customer base, including Fortune 500 giants, and report continuous revenue growth spanning over two decades. The growth is underpinned by the increasing demand for cloud connectivity from businesses of varying sizes and sectors.

A strategic inflection point in Equinix's financial journey was its transformation into a real estate investment trust (REIT) in 2015. This shift has solidified its market presence and enhanced shareholder value through regular and growing dividends. Given the REIT requirement to distribute at least 90% of taxable income to shareholders, Equinix has built a reputation for its dividend reliability and attractiveness. The distribution not only provides investors with a persistent income stream but also, as seen in recent years, offers a yield that surpasses that of many benchmarks, such as the Fidelity Nasdaq Composite ETF.

Looking forward, Equinix's management remains bullish, forecasting significant growth in the company's operational metrics. For instance, the company's projected 2023 performance includes a 7% to 9% increase in adjusted funds from operations (FFO) per share, with estimates suggesting a range of $31.51 to $32.15, and an anticipated revenue bump of 14% to 15%, potentially reaching over $8.2 billion. Leveraging the solid foundation of annualized dividend growth and a healthy payout ratio premised on robust cash flow, the REIT stands in a favorable position to maintain, if not enhance, its trajectory of dividend growth.

In the context of global expansion and challenges, Equinix's resilience stands out. The company's strategic acquisitions and development projects, such as its recent forays into India and Southeast Asia, and endeavors like the Southern Cross NEXT undersea cable system upgrade, earmark its ambition to harness increasing digital demand. The company is aligning its strategies with industry predictions that posit significant revenue streams from digital products and services for top global enterprises in the near future.

The real estate investment trust (REIT) segment offers Equinix a distinctive edge, presenting investors an opportunity to gain exposure to the real estate sector without the complexities associated with direct property ownership. This advantage, coupled with the liquidity and ease of investing in REIT stocks, has catered to the investors' aspiration for participating in lucrative real estate markets. Investors looking for diversification can also explore REIT ETFs, such as the Vanguard Real Estate ETF (VNQ), which aggregates exposures to various REITs, reflecting various segments within the real estate sector, including Equinix. Such investment vehicles underline the convenience and diversification at investors' disposal in the form of exchange-traded funds.

For investors seeking robust performance underpinned by solid fundamentals, Equinix stands as a strong candidate within the REIT sector. As a leader in the global digital infrastructure network, Equinix has captivated attention by leveraging recurrent revenue streamswhich form over 90% of its total revenueillustrating financial stability and predictability. Alongside positive revisions for adjusted FFO per share for upcoming years and promising "network effect" gains within its data centers, the company's stock performance has reflected an upward trend that has surpassed broad-market real estate indices.

Equinix has not only been steadfast in its growth endeavors but also maintains a solid balance sheet with enviable liquidity reserves. Investment-grade credit ratings bolster its financial stamina, giving the company access to further debt capital for long-term growth initiatives. Investors who prioritize dividend income have lauded Equinix's consistent and climbing dividendssupported by a diversified and growing operating platform and healthy financial outlook.

The investment community has also taken note of Equinix's resilience and strategic prospects amid current market conditions. Expert investors and firms such as The Motley Fool have underscored its potential, designating Equinix as a high-quality REIT capable of delivering long-term growth. Recognizing the significance of digital infrastructure in an increasingly cloud-dependent economy, Equinix becomes a vehicle for investors to participate in the future of cloud computing and e-commerce. This recommendation by savvy industry observers lends credence to the investment case for Equinix, especially during times of market swings and interest rate upheavals.

Equinix's market prominence is further emphasized through the examination of competition and strategic moves within the data center REIT space. For instance, Realty Income Corporation's entry into the data center market has stirred debates about diversification strategies within the sector, weighing the potential for lucrative engagements against the risks of over-diversifying. The concern emerges from the tight capitalization rates sustained despite a high-interest-rate regime, coupled with potential technological disruptions that may affect the long-term profitability of data centers. Despite this, Equinix continues to monitor industry trends, potentially taking cues from the successes or missteps of its peers, adjusting its investment focus, and managing risk to uphold its commitment to delivering dependable returns.

The company's sustainability endeavors complement its financial achievements, as Equinix has fully allocated $4.9 billion raised from green bonds to various environmental and renewable energy projects. This allocation forms part of Equinix's comprehensive approach to achieving carbon neutrality across its vast operational expanse. Investments have been strategically channeled to build eco-efficient facilities, enhance energy efficiency, and commit to Power Purchase Agreements that align with science-based targets. These strides are not only environmentally responsible but also reflect Equinix's commitment to transparency and accountability, elements that have helped the company to consistently earn high scores on climate action and sustainability indices.

Similar Companies in REIT - Office:

Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), CyrusOne Inc. (CONE), CoreSite Realty Corporation (COR), QTS Realty Trust, Inc. (QTS), Report: Iron Mountain Incorporated (IRM), Iron Mountain Incorporated (IRM), Switch, Inc. (SWCH)

News Links:

https://www.fool.com/investing/2023/10/13/beat-the-nasdaq-this-dividend-stock-has-actually-d/

https://www.fool.com/investing/2023/11/20/you-dont-have-to-pick-a-winner-in-reits-heres-why/

https://www.fool.com/investing/2023/10/10/2-cheap-reits-to-buy-1-cheap-reit-to-sell/

https://finance.yahoo.com/news/5-reasons-equinix-eqix-stock-150700836.html

https://finance.yahoo.com/news/equinix-fully-allocates-4-9-130100417.html

https://seekingalpha.com/article/4653756-realty-income-is-going-down-a-concerning-path

https://finance.yahoo.com/news/companies-gaining-competitive-advantage-deploying-130100680.html

https://finance.yahoo.com/news/insider-sell-director-gary-hromadko-020514855.html

https://finance.yahoo.com/news/macerich-mac-15-8-since-163100894.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: MAnQyb

https://reports.tinycomputers.io/EQIX/EQIX-2023-12-27.html Home