VanEck Gold Miners ETF (ticker: GDX)

2024-03-03

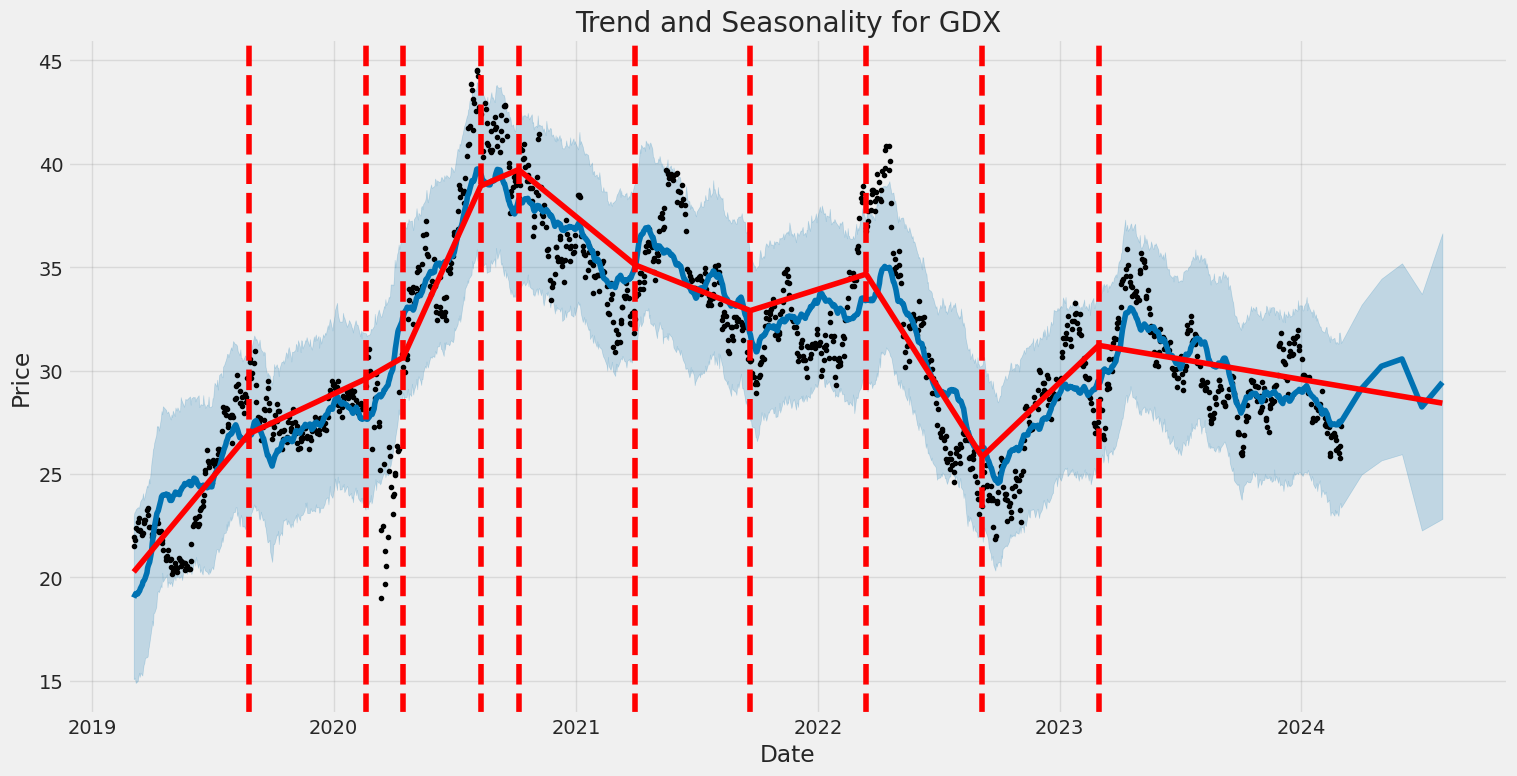

The VanEck Gold Miners ETF (GDX) is a widely recognized exchange-traded fund that offers investors an opportunity to gain exposure to the gold mining industry. By tracking the NYSE Arca Gold Miners Index, GDX seeks to replicate the performance of a basket of companies involved in the gold mining sector. This includes both major and junior miners, thus providing a diversified portfolio within the niche but potentially lucrative area of gold mining. The ETF is popular among investors looking to hedge against economic uncertainty or inflation, as gold and gold mining stocks often move inversely to the broader market trends. The fund's assets are predominantly allocated across companies based in Canada, Australia, and the United States, which are pivotal regions for gold mining activities. GDX offers a liquid and cost-efficient way for investors to gain direct exposure to the gold mining industry without the need for direct investment in physical gold or individual mining companies. As such, it stands as a strategic option for those looking to diversify their investment portfolio or capitalize on the dynamics of the gold market.

The VanEck Gold Miners ETF (GDX) is a widely recognized exchange-traded fund that offers investors an opportunity to gain exposure to the gold mining industry. By tracking the NYSE Arca Gold Miners Index, GDX seeks to replicate the performance of a basket of companies involved in the gold mining sector. This includes both major and junior miners, thus providing a diversified portfolio within the niche but potentially lucrative area of gold mining. The ETF is popular among investors looking to hedge against economic uncertainty or inflation, as gold and gold mining stocks often move inversely to the broader market trends. The fund's assets are predominantly allocated across companies based in Canada, Australia, and the United States, which are pivotal regions for gold mining activities. GDX offers a liquid and cost-efficient way for investors to gain direct exposure to the gold mining industry without the need for direct investment in physical gold or individual mining companies. As such, it stands as a strategic option for those looking to diversify their investment portfolio or capitalize on the dynamics of the gold market.

| Previous Close | 26.36 | Open | 26.71 | Day Low | 26.3 |

| Day High | 27.45 | Volume | 40,834,466 | Average Volume | 23,669,596 |

| Average Volume 10 Days | 24,291,020 | Bid | 27.35 | Ask | 27.4 |

| Bid Size | 36,100 | Ask Size | 34,100 | Yield | 0.0178 |

| Total Assets | 11,611,704,320 | Fifty Two Week Low | 25.62 | Fifty Two Week High | 36.26 |

| Fifty Day Average | 28.3608 | Two Hundred Day Average | 29.2905 | NAV Price | 27.19 |

| YTD Return | -0.118671395 | Three Year Average Return | -0.0237881 | Five Year Average Return | 0.0604071 |

| Sharpe Ratio | -0.018963262329702208 | Sortino Ratio | -0.32005517595458516 |

| Treynor Ratio | -0.010569129660666544 | Calmar Ratio | -0.039086956489586655 |

Analyzing the VanEck Gold Miners ETF (GDX) using a combination of technical, fundamental, and risk-adjusted return measures provides a holistic view of its future potential in the stock market.

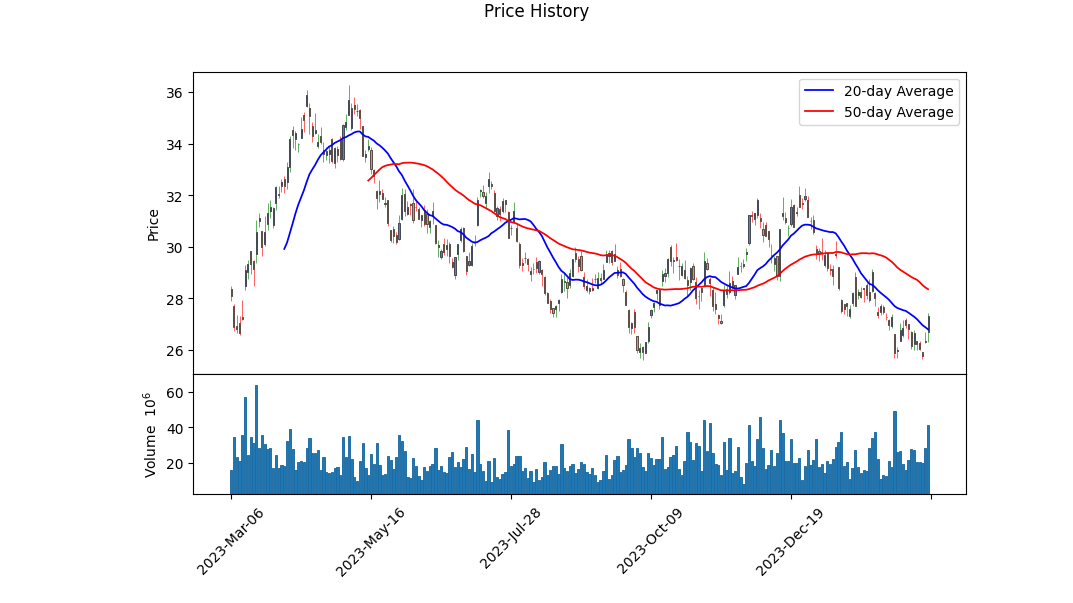

Technical Analysis indicates a downtrend with the stock price falling from a high of $29.549999 to a low of $25.920000 over the observed period, closing slightly higher at $26.709999 on the last day. This descending trajectory is marked by high volatility, as evidenced by the fluctuating On-Balance Volume (OBV) and a mixed Movement Average Convergence Divergence (MACD) histogram. The negative trend in OBV suggests that volume is following the price downwards, indicating selling pressure. The MACD turning positive towards the end of the period suggests potential for a change in trend but needs to be viewed cautiously given the overall bearish context.

On the fundamentals side, the ETF's NAV stands at $27.19 with a PE Ratio (TTM) of 22.99, indicating moderate valuation relative to its earnings. Its dividend yield of 1.78% and a total asset value of $11.61B showcase a sizeable and fundamentally strong fund. However, the YTD Daily Total Return of -11.87% and a beta closely aligned with the market (0.98) imply a challenging year thus far, mirroring broader market trends rather closely.

The funds performance relative to risk-adjusted return ratios paints a cautionary picture. Negative values across the Sharpe, Sortino, Treynor, and Calmar ratios indicate that the fund has underperformed on a risk-adjusted basis over the last year. Particularly, the negative Sortino Ratio emphasizes poor downside risk management, which investors often scrutinize closely.

Given these insights, the outlook for GDX in the forthcoming months remains cautiously bearish. While there are sporadic signs of potential trend reversals, the preponderance of negative risk-adjusted returns, coupled with ongoing selling pressure and fundamental vulnerabilities, suggest that the ETF may continue to face challenges. Potential investors should remain vigilant, prioritizing defensive strategies and considering the broader market dynamics and precious metal sector trends before making investment decisions. As always, diversification and risk management should be paramount in navigating these uncertain waters.

In evaluating the VanEck Gold Miners ETF (GDX) in accordance with the principles outlined in "The Little Book That Still Beats the Market," it's essential to consider two fundamental metrics: return on capital (ROC) and earnings yield. However, when applying these metrics to GDX, a unique situation arises. The ROC and earnings yield for GDX are not directly calculable in the traditional sense, primarily because GDX is an Exchange-Traded Fund (ETF) that tracks an index composed of stocks of gold mining companies, rather than a single company with its own operational capital and earnings.

The concept of ROC, which measures how efficiently a company uses its capital to generate profits, does not directly apply to GDX due to its nature as an aggregate of multiple companies. Similarly, the earnings yield, which is essentially the inverse of the Price-to-Earnings (P/E) ratio, used to assess the per-dollar earning power of an investment, cannot be straightforwardly determined for GDX, as it reflects the collective performance of its constituent stocks, rather than the operating performance of a singular entity.

Investors interested in the performance of GDX should instead evaluate the aggregate metrics and fundamental indicators of the constituent companies, alongside the ETF's broader market performance, price trends, and the economic and geopolitical factors influencing the gold mining sector. This holistic approach provides a more nuanced understanding of GDX's potential for return, within the context of a diverse portfolio.

| Statistic Name | Statistic Value |

| Alpha | 0.0234 |

| Beta | 0.4431 |

| R-squared | 0.055 |

| Adj. R-squared | 0.055 |

| F-statistic | 73.54 |

| Prob (F-statistic) | 2.86e-17 |

| Log-Likelihood | -2891.3 |

| AIC | 5787 |

| BIC | 5797 |

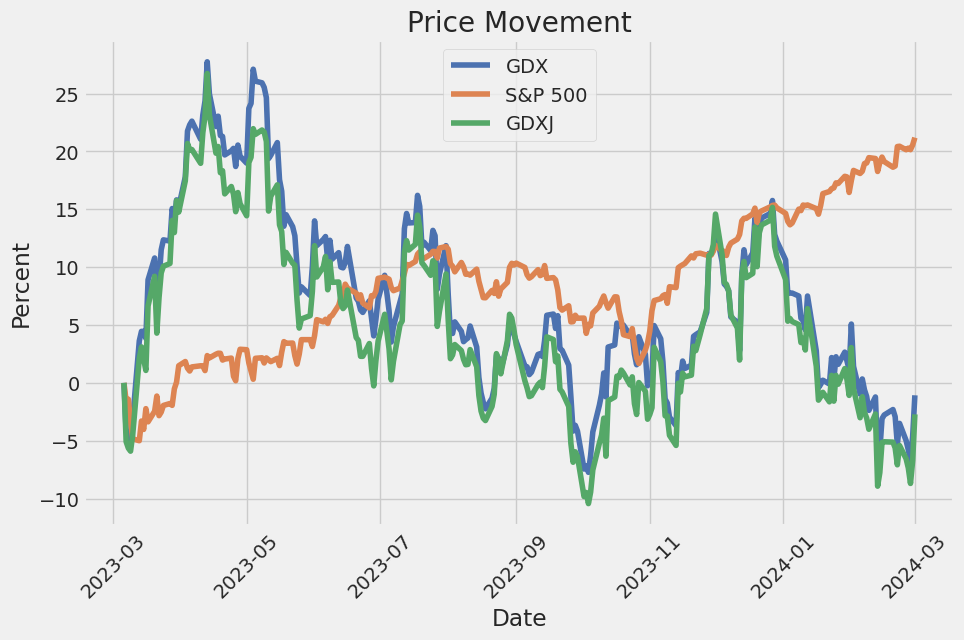

In analyzing the linear regression model between GDX (a gold miners ETF representing a specific sector of the market) and SPY (a broader market ETF representing the overall market), we delve into the dynamics of their relationship for the period leading up to today. Alpha, measured at 0.0234, is particularly noteworthy as it represents the intercept of the regression line essentially, the expected return of GDX when SPY's return is zero. This alpha suggests a slight positive performance of GDX against the market baseline, independent of the market's movements.

Moreover, the relationship is quantified by a beta value of 0.4431, indicating GDX's sensitivity to movements in the SPY. A beta lower than 1 suggests that GDX is less volatile than the market. However, with an R-squared value of 0.055, only a small fraction of GDXs variability can be explained by movements in the SPY. This insight points to a relatively weak correlation between the two, hinting that factors other than the general market movements have a more significant influence on GDX's performance. Despite the weak correlation, the positive alpha signals that GDX can offer returns over and above the market under certain conditions.

The VanEck Gold Miners ETF (GDX) is a comprehensive investment vehicle that enables exposure to the gold mining industry, facilitating investors to potentially benefit from the operational performance and stock valuations of companies within this sector. As economies grapple with various challenges, including inflationary pressures and geopolitical uncertainties, the allure of gold as a safe haven has surged, underscoring the relevance of GDX in a diversified investment portfolio.

The ETF's strategy of focusing on gold mining companies offers a distinct advantage. Unlike direct investment in physical gold, which may yield no income, investing in gold miners can offer returns through company growth, dividends, and operational efficiencies. Such an approach inherently provides operational leverage; as gold prices increase, the profitability of gold mining companies can exponentially grow due to fixed operating costs, leading to potentially higher returns for investors in GDX.

Investors in GDX benefit from diversification within the gold mining sector, spreading risk across various companies and geographical regions. This diversification is critical given the sector-specific risks inherent in gold mining, such as operational hazards, regulatory changes, and commodity price volatility. By pooling investments in a broad array of mining companies, GDX mitigates the impact that any single company's performance may have on the overall investment.

A vital aspect of the appeal of GDX lies in its liquidity. Being an ETF, GDX offers a level of liquidity not always available through direct investment in gold or individual gold mining stocks. Investors can buy or sell shares of GDX throughout the trading day at market prices, providing flexibility and ease of entry or exit according to market conditions and individual investment strategies.

The performance and appeal of GDX closely mirror the fluctuations in the gold market. As investors seek refuge during times of economic uncertainty, the demand for gold can increase, potentially driving up the prices of gold and the stocks of companies that mine it. Consequently, GDX can serve as a hedge against market volatility and inflation, offering a store of value that can protect against the erosion of purchasing power.

While the advantages of investing in GDX are clear, it's essential to consider the dynamic nature of the gold market and the mining sector. The cost of extraction, environmental considerations, and the geographic distribution of gold resources all play into the complexities of gold mining investments. Additionally, as global economic conditions evolve, so too does the demand for gold, influenced by factors such as real interest rates, currency values, and global economic performance.

Amid these considerations, the top holdings of GDX provide further insight into the potential drivers of its performance.

| company | symbol | percent |

|---|---|---|

| Newmont Corporation | NEM | 13.09 |

| Barrick Gold Corporation | ABX.TO | 9.06 |

| Agnico Eagle Mines Limited | AEM.TO | 8.05 |

| Wheaton Precious Metals Corp | WPM.TO | 7.07 |

| Franco-Nevada Corporation | FNV.TO | 6.84 |

| Gold Fields Limited | GFI | 4.87 |

| Northern Star Resources Ltd | NST.AX | 4.55 |

| Zijin Mining Group Co Ltd | 02899 | 3.89 |

| Royal Gold Inc | RGLD | 3.42 |

| Anglogold Ashanti Limited | AU | 3.38 |

Looking at the investment composition, the ETF's emphasis on both large-cap and diversified mid-to-small-cap miners suggests a balanced approach to achieving growth while managing risk. The presence of major players like Newmont Corporation and Barrick Gold Corporation, alongside other significant contributors, underscores the ETF's focus on companies with sizable operations, proven reserves, and a strong market presence. These companies are better positioned to weather market volatilities, benefiting from economies of scale and operational efficiencies.

Moreover, the strategic inclusion of companies involved in the streaming and royalty space, such as Franco-Nevada Corporation and Wheaton Precious Metals Corp, reflects a nuanced approach to investment in the gold sector. These companies offer additional layers of risk mitigation, as their business models provide exposure to gold prices with potentially lower operational risks and capital expenditure requirements.

The VanEck Gold Miners ETF's structure and holdings showcase a pathway for investors to participate in the gold mining sector's potential for growth, profitability, and diversification. However, it is imperative for investors to conduct thorough research, continuously monitor market conditions, and consider their risk tolerance when investing in sector-specific ETFs like GDX.

Investing in GDX offers a nuanced and strategic entry into the gold mining space, juxtaposing the sector's inherent risks against the potential for significant returns. As global markets navigate through periods of both turbulence and growth, GDX represents a unique mechanism for investors seeking to leverage gold mining companies' performance.

The Volatility of VanEck Gold Miners ETF (GDX) over the specified period showcases significant fluctuation, as evidenced by the ARCH model's focus on the data's variability without considering its mean. The model highlights the significant impact of past volatility on future volatility, illustrated by the omega and alpha coefficients which are notably high, suggesting a pronounced sensitivity to market changes. The statistical significance of these parameters, with very low p-values, indicates strong confidence in the model's findings, underscoring the ETF's exposure to dynamic market forces and potential for abrupt price movements.

| Statistic Name | Statistic Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2821.94 |

| AIC | 5647.88 |

| BIC | 5658.15 |

| No. Observations | 1257 |

| omega | 4.4028 |

| alpha[1] | 0.1869 |

Analyzing the financial risk of a $10,000 investment in VanEck Gold Miners ETF (GDX) over a one-year period involves a sophisticated approach that combines volatility modeling and machine learning predictions. This dual-analysis framework offers an insightful examination into the future risk and return profile of GDX, a critical task for investors aiming to mitigate risks while eyeing potentially lucrative returns in the gold mining sector.

Volatility modeling, as applied to GDX, plays an essential role in quantifying the degree of variance we can expect from the ETF's returns over a given period. This method is particularly beneficial for understanding the inherent price volatility in GDX, driven by fluctuating gold prices, mining operational costs, and geopolitical factors that directly affect gold mining companies. By analyzing past price movements and volatility patterns, volatility modeling gives us a detailed picture of likely future short-term volatility, setting the groundwork for assessing risk in the investment.

On the other hand, machine learning predictions employ a sophisticated predictive model to forecast future returns of GDX based on a wide range of inputs, including past performance data, gold price trends, market sentiment, and economic indicators. This method leverages historical data to learn patterns and make informed predictions about the ETF's future performance.

Integrating the insights gained from volatility modeling with the forward-looking predictions from machine learning offers a robust analysis of GDX. This approach allows for a nuanced understanding of both the short-term volatility and potential long-term returns, providing a comprehensive risk assessment instrumental in making informed investment decisions.

Focusing on the calculated Annual Value at Risk (VaR) at a 95% confidence level, we find that a $10,000 investment in GDX has a projected risk of experiencing a maximum loss of $321.81 over a one-year period. This figure is derived from combining the risk metrics obtained through volatility modeling with the anticipated returns predicted by the machine learning model. The VaR calculation is critical for investors, offering a quantifiable measure of the maximum expected loss with a specific confidence level, based on the investment's historical volatility and predicted performance.

This calculated VaR underlines the inherent risk of investing in the volatile gold mining sector, highlighting the essential role that sophisticated analytical methods, such as volatility modeling and machine learning predictions, play in modern financial risk assessment. By providing a clearer picture of potential future volatility and returns, these advanced analytical techniques enable investors to manage risk more effectively, tailoring their investment strategies to align with their risk tolerance and financial objectives.

Analyzing the provided options chain for VanEck Gold Miners ETF (GDX) call options requires understanding how "the Greeks" influence option profitability. "The Greeks" help quantify the risks associated with options trading, including changes in the underlying asset's price (Delta), the rate of change in Delta (Gamma), the sensitivity to volatility (Vega), the time decay (Theta), and the rate of change relative to the risk-free interest rate (Rho). Given our goal is to identify the most profitable options assuming a target stock price increase of 5% over the current price, we'll focus on the options showing high potential for profitability based on their Greek values, strike prices, expiration dates, and premiums.

For shorter-term investments, options expiring on 2024-03-15 with a strike price of 24.5 show distinct potential, characterized by a Delta close to 0.9, signifying a high probability of finishing in-the-money. The Gamma value for these options is relatively low, suggesting smaller changes in Delta, which is preferable for stability. Their Vega is moderate, indicating a balanced responsiveness to volatility, which, combined with a higher Rho, suggests a good sensitivity to interest rate changes. These options have a relatively low premium, making them attractive for traders looking for a balance between cost and potential return.

In a slightly longer-term perspective, options expiring on 2024-03-22 with a strike price of 25.0 present a strong profitability profile, demonstrated by a high Delta and a substantial Vega, suggesting significant responsiveness to the underlying asset's price changes and volatility. The moderate Gamma reduces the risk of large Delta shifts, maintaining stability in the option's price sensitivity to the underlying asset. These options offer a blend of risk and reward, suitable for traders willing to bet on a moderate increase in GDX's price over a more extended period.

Looking at mid-term opportunities, the options with an expiration date of 2024-04-05 and a strike price of 25.0 strike an appealing balance. Their high Delta indicates a strong likelihood of expiring in-the-money if the target stock price is reached. These options also exhibit a high Vega, indicating profitability from anticipated market volatility increases. The relatively balanced Gamma suggests that the option's sensitivity to the stock's price changes will not be excessively volatile, making it a compelling choice for traders betting on a steady climb in GDX's stock price over a few months.

For investors with a longer horizon, options expiring on 2024-06-21 and a strike of 22.0 emerge as particularly attractive. These options combine a very high Delta, suggesting a strong alignment with the stock's price movements, with a significant Vega, implying benefits from volatility. The options moderate Gamma and favorable Theta decay rate (considering the longer timeframe) balance the risk-reward ratio, making them an excellent choice for those optimistic about GDX's price growth and willing to engage in a longer-term investment.

In conclusion, the most profitable call options for GDX span a range of expirations and strike prices but are unified by their strong Delta and balanced Vega and Gamma values. These factors, combined with reasonable premiums and ROI potentials, suggest that these options could provide lucrative opportunities for traders assuming a 5% increase in the GDX stock price. However, traders should consider their risk tolerance and investment horizon when selecting among these options.

Similar Companies in Gold:

VanEck Junior Gold Miners ETF (GDXJ), Report: iShares Silver Trust (SLV), iShares Silver Trust (SLV), Report: SPDR Gold Shares (GLD), SPDR Gold Shares (GLD), Newmont Corporation (NEM), Direxion Daily Gold Miners Index Bull 2X Shares (NUGT), Barrick Gold Corporation (GOLD), Franco-Nevada Corporation (FNV), Wheaton Precious Metals Corp. (WPM), Agnico Eagle Mines Limited (AEM), Royal Gold, Inc. (RGLD), Kinross Gold Corporation (KGC), B2Gold Corp. (BTG)

https://seekingalpha.com/article/4663690-the-more-it-drops-the-more-i-buy

https://www.etftrends.com/tactical-allocation-channel/gold-miners-etfs-see-inflows/

https://finance.yahoo.com/news/yieldmax-gdxy-name-change-162200963.html

https://seekingalpha.com/article/4671302-gdx-more-pain-in-store-for-beaten-down-gold-miners

https://seekingalpha.com/article/4674826-gdx-dont-let-poor-performance-in-recent-months-distract-you

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 78dwDl

Cost: $0.27292

https://reports.tinycomputers.io/GDX/GDX-2024-03-03.html Home