GitLab Inc. (ticker: GTLB)

2024-02-16

GitLab Inc. (ticker: GTLB) is a significant player in the DevOps industry, offering a web-based DevOps lifecycle tool that provides a Git-repository manager providing wiki, issue-tracking, and CI/CD pipeline features, utilizing an open-source license. The platform is designed to support the entire software development lifecycle, from project planning and source code management to CI/CD, monitoring, and security. Incorporated in 2014, GitLab has rapidly grown to serve a broad spectrum of customers from startups to large enterprises seeking to streamline their development processes. The company went public in October 2021, listing on the NASDAQ stock exchange, which marked a milestone in GitLab's journey, demonstrating strong investor confidence in its business model and growth prospects. GitLab Inc.'s comprehensive suite of features and its commitment to an open-core development model differentiate it from competitors, allowing it to capture a significant market share in the rapidly evolving DevOps space.

GitLab Inc. (ticker: GTLB) is a significant player in the DevOps industry, offering a web-based DevOps lifecycle tool that provides a Git-repository manager providing wiki, issue-tracking, and CI/CD pipeline features, utilizing an open-source license. The platform is designed to support the entire software development lifecycle, from project planning and source code management to CI/CD, monitoring, and security. Incorporated in 2014, GitLab has rapidly grown to serve a broad spectrum of customers from startups to large enterprises seeking to streamline their development processes. The company went public in October 2021, listing on the NASDAQ stock exchange, which marked a milestone in GitLab's journey, demonstrating strong investor confidence in its business model and growth prospects. GitLab Inc.'s comprehensive suite of features and its commitment to an open-core development model differentiate it from competitors, allowing it to capture a significant market share in the rapidly evolving DevOps space.

| City | San Francisco | State | CA | Zip | 94104-3503 |

| Country | United States | Phone | 415 829 2854 | Website | https://about.gitlab.com |

| Industry | Software - Infrastructure | Sector | Technology | Full Time Employees | 2,170 |

| Previous Close | 74.1 | Open | 74.62 | Day Low | 73.31 |

| Day High | 76.5725 | Beta | 0.522 | Market Cap | 11,515,572,224 |

| Volume | 1,693,412 | Average Volume | 2,597,796 | Bid Size | 2,200 |

| Ask Size | 1,200 | Shares Outstanding | 107,900,000 | Book Value | 3.51 |

| Total Cash | 989,633,984 | Total Debt | 576,000 | Total Revenue | 539,033,984 |

| Revenue Per Share | 3.531 | Gross Margins | 89.334% | Ebitda Margins | -34.615% |

| Operating Margins | -26.895% | Current Price | 73.96 | Revenue Growth | 32.5% |

| Sharpe Ratio | 1.002271645205591 | Sortino Ratio | 17.121801934671204 |

| Treynor Ratio | 0.3585079055757833 | Calmar Ratio | 1.2916481276929475 |

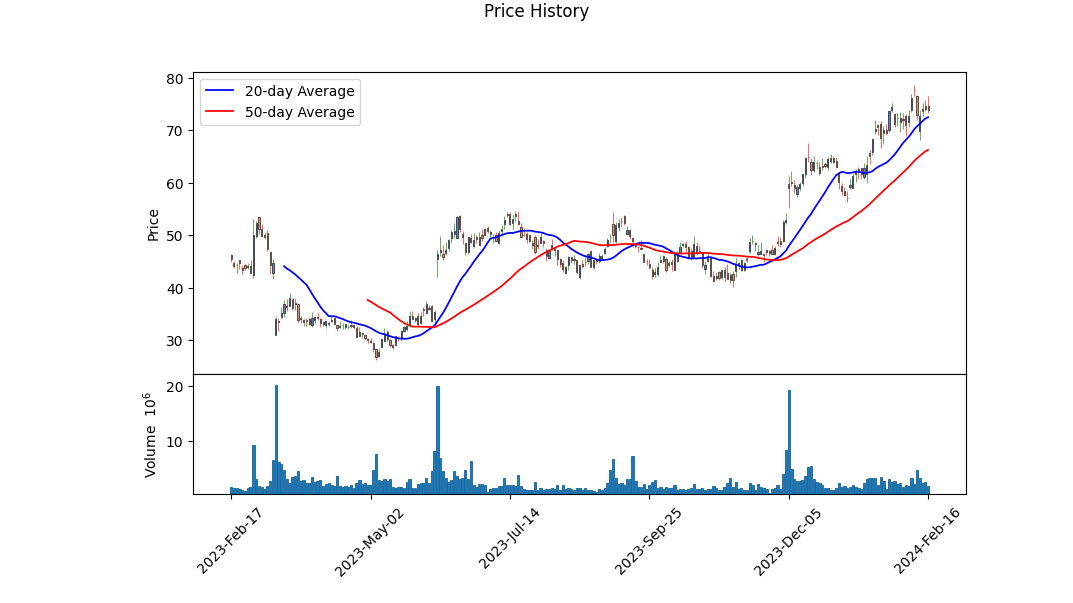

Analyzing the current market and financial position of GTLB, through a holistic view of technical analysis, fundamental analysis, and balance sheet indicators, provides a comprehensive understanding of its future stock price movement. The technical indicators show a positive OBV (On Balance Volume) trend towards the latest date, indicating buying pressure. This positive momentum is further accentuated by the MACD (Moving Average Convergence Divergence) histogram approaching a less negative terrain, hinting at potential bullish behavior in the upcoming months, provided the trend continues in this manner.

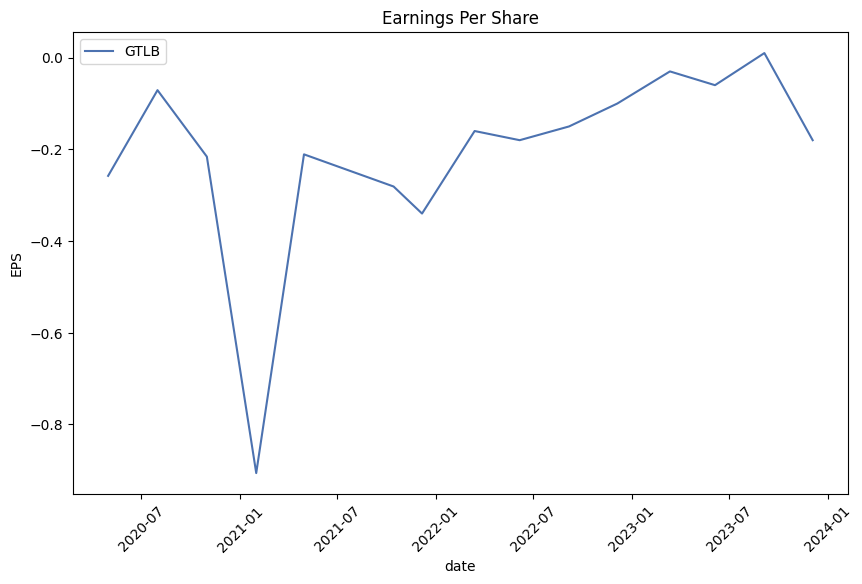

Fundamental analysis reveals GTLB's substantial gross margins of 0.89334, illustrating its efficiency in managing production costs and marketing its products. However, its EBITDA and operating margins are negative, -0.34615 and -0.26895, respectively, indicating operational challenges and the company's current inability to generate profit from its operational expenses. Among revenue and expense trends, a significant investment in research and development is notable, potentially paving the way for future innovation and revenue streams.

The balance sheet data showcases a strengthening financial position with a robust cash and cash equivalents increase, reinforcing the companys liquidity stance. Despite a significant free cash flow, investments in the company's growth and expansion are evident, displaying confidence in long-term strategies.

Risk-adjusted return ratios such as the Sharpe, Sortino, Treynor, and Calmar, further cement the analysis, displaying favorable returns when adjusted for risk, with especially high remarks on the Sortino ratio. This indicates that GTLB's returns exceed the risk-free rate of return to a considerable degree, adjusted for downside risk, making it an attractive investment for those who are risk-averse, yet seeking growth.

Analyst expectations, revealing an optimistic outlook on earnings and revenue estimates for the forthcoming years, coupled with a substantial increase in EPS estimates, suggest confidence in GTLB's strategic direction. Notably, the reported growth estimates anticipate considerable earnings growth in subsequent quarters, thereby potentially elevating the stock's appeal to investors seeking growth opportunities.

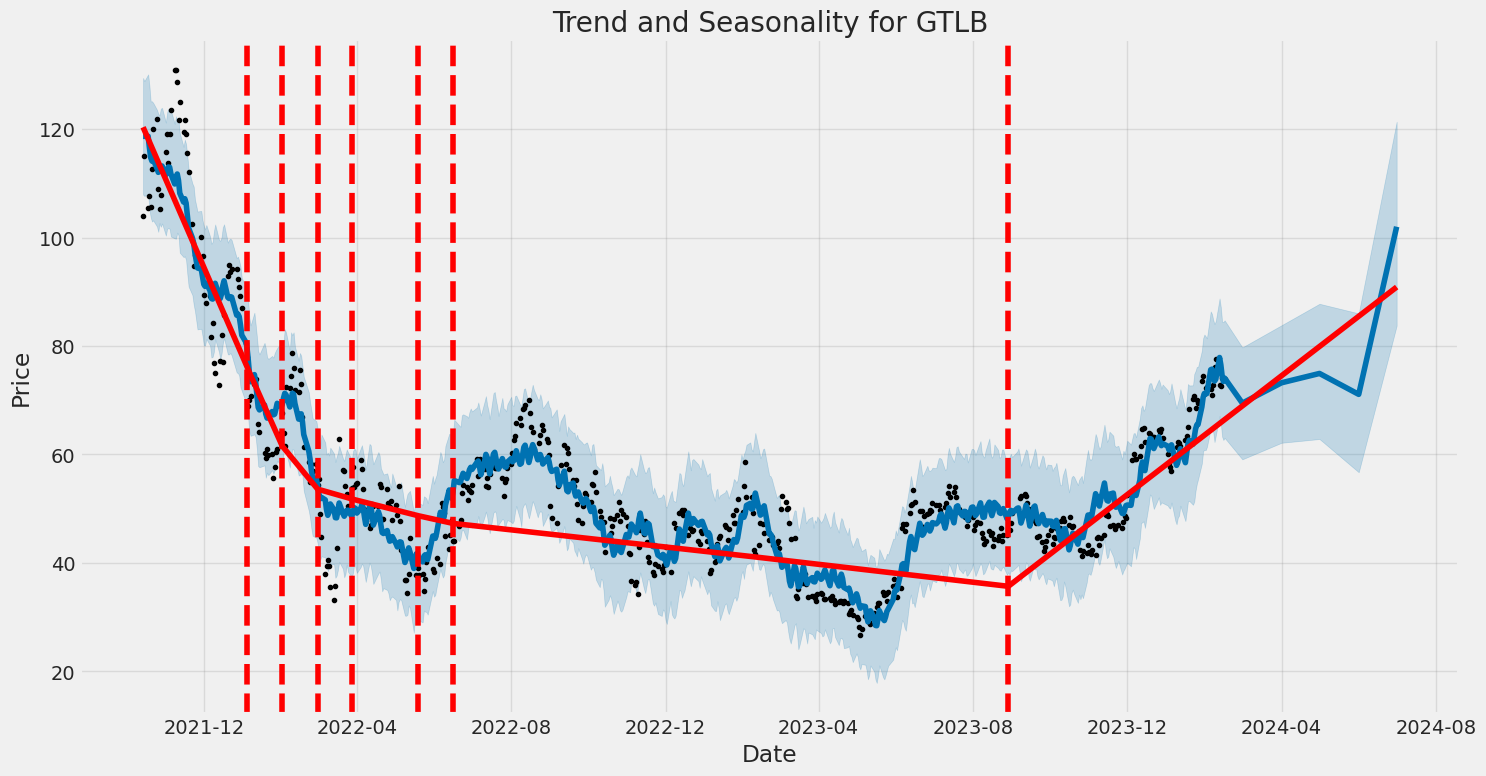

Encapsulating the technical, fundamental, and analytical perspectives, GTLB exhibits traits of a resilient company with substantial growth potential. Its positive technical indicators, coupled with robust fundamentals in certain areas, significant cash reserves, and optimistic growth estimates, delineate a favorable outlook. Hence, it's reasonable to anticipate an upward trajectory in GTLBs stock price over the next few months, barring unforeseen market volatilities or operational setbacks. Investors, however, should continually reassess the stocks performance against market dynamics and company developments to fine-tune their investment decisions.

In the analysis of GitLab Inc. (GTLB) applying principles from "The Little Book That Still Beats the Market," we scrutinize two essential metrics: Return on Capital (ROC) and Earnings Yield. GitLab Inc. has demonstrated a Return on Capital (ROC) of -24.5%, which indicates that the company is currently not generating a positive return on the investments it has made in its business operations. This figure can raise concerns about the company's efficiency in employing its capital to drive growth and profitability. Similarly, the Earnings Yield for GitLab Inc. stands at -1.65%, revealing that the company's earnings relative to its share price are negative. This implies that investors are not currently obtaining positive earnings from their investment, which could impact the attractiveness of GitLab Inc.'s shares from an investment perspective. Together, these metrics suggest that GitLab Inc. is facing challenges with profitability and capital utilization, which investors should carefully consider when evaluating the company's financial health and investment potential.

| Statistic Name | Statistic Value |

| Alpha | 0.0127 |

| Beta | 2.3892 |

| R-squared | 0.262 |

| Adj. R-squared | 0.261 |

| F-statistic | 208.5 |

| Prob (F-statistic) | 1.17e-40 |

| No. Observations | 588 |

| AIC | 3,495 |

| BIC | 3,504 |

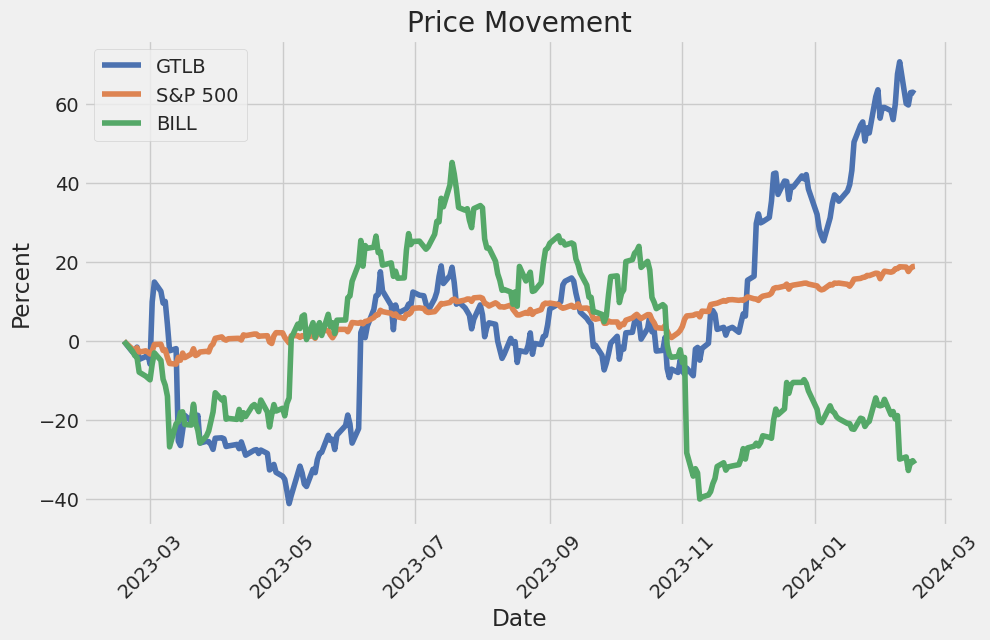

Alpha is a critical component in evaluating the relationship between GTLB and SPY, indicating GTLB's performance relative to the expected return derived from the market (SPY) movements. With an alpha of 0.0127, the model suggests that GTLB has had a minor performance advantage that is not explained solely by the market's movements. This alpha value is particularly noteworthy when considering the notion that it represents the intercept of the regression, providing insights into GTLB's average return beyond what the market's performance could predict.

The beta coefficient of 2.3892 further illustrates GTLB's relationship with the market. As beta measures GTLB's volatility or sensitivity to the movements in SPY, a beta greater than 1 indicates that GTLB is theoretically more volatile than the market. This implies that for every percent change in the SPY, GTLB's return is expected to change by approximately 2.39 percent in the same direction. The model's R-squared of 0.262 signifies that roughly 26.2% of GTLB's movements can be explained by movements in SPY, emphasizing a considerable but not overwhelming market influence on GTLB's returns.

GitLab Inc. recently held its third-quarter fiscal year 2024 earnings call, providing insights into the company's financial health and future directions. Sid Sijbrandij, Co-Founder and CEO, alongside Chief Financial Officer Brian Robins, outlined key achievements and plans, focusing on the continued adoption of GitLab's DevSecOps Platform. The company reported a significant revenue growth of 32% year-over-year, with their broad platform integrating security, AI, and agile planning features driving this performance. GitLab's competitive edge, as highlighted by Sijbrandij, is its unique offering that streamlines the entire software development lifecycle under one platform, significantly improving engineering productivity and compliance management.

Sijbrandij delved into the details of new security and governance capabilities, emphasizing how their platform simplifies vulnerability detection and compliance processes. GitLab has introduced a security findings workflow extension, allowing developers to address security concerns directly within their integrated development environment (IDE) without interrupting their workflow. This seamless integration of security features, alongside the Dedicated single-tenant SaaS solution for heightened data isolation, marks GitLab's robust response to complex regulatory requirements across industries.

The company's strategic embrace of AI throughout the software development lifecycle is also noteworthy. With 14 AI features already available, GitLab continues to enhance developer efficiency without compromising privacy or security. Among the innovations is GitLab Duo, an AI-powered suite of DevSecOps workflows, and features like vulnerability summarization and code suggestions, which are designed to accelerate the development process while maintaining high-quality outputs. GitLab's AI approach, focusing on integration, privacy, and diverse AI models, resonates well with clients, including notable names like Nasdaq and NatWest, who have acknowledged the productivity gains from these AI functionalities.

Furthermore, GitLab's push into enterprise agile planning signifies a strategic expansion to attract a wider non-technical audience while adding value for existing technical users. The attempts to consolidate portfolio and project management tools into their platform present a direct challenge to competitors like Atlassian's Jira. This move, combined with the feedback on easier migration and integration processes, underscores GitLab's commitment to offering a comprehensive DevSecOps platform.

On the financial front, Brian Robins reported a non-GAAP operating profit for the first time, underlining GitLab's efficient scaling and targeted investment in key product areas. The CFO laid out the financial metrics that demonstrated robust year-over-year growth and provided forward-looking guidance anticipating continued revenue growth and operational efficiency. The emphasis on strong adoption of the Ultimate tier, mainly driven by security and compliance use cases, alongside the potential impact of planned pricing adjustments, sets a positive outlook for GitLab's future performance.

oadmap public. All of our code and documentation and much of our broader operations are also public and open source. We believe our open-core model and transparency is at the heart of our success and enables us to innovate faster, deliver better software, and empower our users and contributors. Our comprehensive DevSecOps platform enables organizations to change how they function, developing a culture built around rapid innovation, tight feedback loops, and reduced time to market. The potential for The DevSecOps Platform is immense as it addresses critical and evolving needs across the software development lifecycle.

We generate revenue primarily from subscriptions to our SaaS and self-managed offerings. Subscriptions can include additional products such as Premium or Ultimate tiers which provide more advanced features, capabilities, and support. We also derive revenue from professional services, which primarily consist of training, consulting, and support services that facilitate the adoption, implementation, and ongoing use of our DevSecOps platform. During the three months ended October 31, 2023, subscription revenue related to our self-managed and SaaS offerings represented 88% of our total revenue, underscoring the significant role of subscriptions to our financial performance.

Our operating expenses are mainly attributed to sales and marketing, research and development, and general and administrative expenses. Sales and marketing expenses are our largest expense category due to our focus on expanding our customer base and product offerings. Research and development expenses reflect our commitment to innovation and the ongoing development of The DevSecOps Platform. Additionally, general and administrative expenses include the operational costs of running our company, including finance, human resources, and corporate infrastructure.

We have a global footprint with our principal markets currently in the United States, Europe, and Asia Pacific. We operate as a single reportable segment, focusing on delivering The DevSecOps Platform to organizations worldwide. Our strategy includes growing our customer base, expanding within our existing customers, driving adoption of our higher-tier offerings, and increasing our engagement with the broader software development and IT operations communities. As we execute our strategy, we expect to incur significant expenses, particularly in sales and marketing, and research and development, which may impact our profitability in the short term. However, we believe these investments are critical for long-term growth and success in a rapidly evolving market.

For the three and nine months ended October 31, 2023, we experienced significant revenue growth year-over-year. Our total revenue for the three months ended October 31, 2023, was $149.7 million, representing 89% of our subscription revenue. The increase in our revenue reflects the growing acceptance of our DevSecOps platform and the expanding need for software that supports rapid innovation, enhanced productivity, and improved security across the software development lifecycle. Despite our revenue growth, we reported net losses for the three and nine months ended October 31, 2023, largely due to our substantial investments in sales and marketing and research and development. Moving forward, we will continue to focus on growing our customer base, enhancing our platform, and driving operational efficiency to improve our financial performance and deliver long-term value to our stakeholders.

In the swiftly evolving landscape of software development and IT operations (DevOps), GitLab Inc. (NASDAQ:GTLB) has cemented its position as a high-performing entity, marked by significant milestones and strategic maneuvers aimed at propelling its market presence and valuation. The comprehensive suite of tools provided by GitLab, facilitating the entire software development lifecycle, has not only garnered attention from industry analysts but has also translated into impressive financial performance and optimistic growth forecasts.

GitLab reported a remarkable 32.5% year-on-year revenue growth in Q3, reaching $149.7 million and surpassing analysts' expectations by 6.1%. This growth was powered by the widespread adoption of its DevSecOps Platform, a testament to GitLab's ability to meet the escalating demand for efficient and integrated software development tools. The company's refined focus on enhancing developer productivity, operational efficiency, and addressing security and compliance risks has rendered it a trusted partner for over 30 million registered users, including a significant portion of the Fortune 100 companies.

The strategic direction of GitLab has been further exemplified by its investments in artificial intelligence (AI) and a privacy-first approach to software development. As industries continue to prioritize AI integration, GitLab's initiative to embed AI throughout the software development lifecycle positions it at the forefront of innovation, catering to a market that demands sophisticated, AI-enhanced productivity tools.

In addition to its technological advancements, GitLab's financial strategies have also been notable. The company's Chief Financial Officer, Brian Robins, engaged in significant insider transactions, selling 75,000 shares at an average price of $70.59, totaling $5,294,250. Such insider activities, coupled with Robin Schulman's disposal of 15,712 shares, may raise questions about the financial outlook from an insider perspective. However, these transactions are part of a broader narrative of more sales than purchases over the past year within the company, inviting investors and analysts to consider the context of these movements carefully.

Amid the broader strategic and financial activities, GitLab's market valuation prospects appear robust, as evidenced by a forecast suggesting the company could see a significant surge in market valuation by 2026. This projection is underpinned by GitLab's focus on client retention, market expansion, and leveraging technological innovation, including AI and enterprise agile planning, to bolster its growth trajectory.

The company's efforts in expanding its service offerings are exemplified through the introduction of GitLab Dedicateda single-tenant SaaS solution aimed at highly regulated industries, highlighting GitLab's adaptability to meet diverse customer needs. Moreover, the strategic focus on developing a monetizable generative AI product showcases GitLab's ambition to not only enhance developer tools but also to lead in the evolving landscape of software development.

As GitLab Inc. steers towards announcing its financial outcomes for the fourth quarter and the entire fiscal year of 2024, stakeholders and the market await insights into how the company's strategies and operations have translated into its financial performance. The anticipation around the earnings call and webcast further underscores the interest in GitLab's continued growth and its impact on the software development industry.

Investor attention and analyst forecasts position GitLab as a company with significant potential for future growth. This sentiment is buoyed by the company's strategic market positioning, innovative technological advancements, and robust financial performance, marking it as a potentially lucrative investment for those focused on the intersections of technology, growth, and innovation in the rapidly evolving digital landscape.

GitLab Inc. (GTLB) has experienced notable volatility from October 2021 to February 2024, as reflected in an ARCH model analysis. This volatility is quantified by an omega coefficient of 23.8608, indicating the baseline level of variance in the returns. Additionally, the alpha[1] coefficient of 0.2356 demonstrates the extent to which past volatility impacts current volatility, suggesting a significant responsiveness to past price movements.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -1823.53 |

| AIC | 3651.05 |

| BIC | 3659.81 |

| Omega | 23.8608 |

| Alpha[1] | 0.2356 |

The financial risk associated with a $10,000 investment in GitLab Inc. (GTLB) over a one-year period can be comprehensively assessed by employing a multifaceted approach that incorporates both volatility modeling and machine learning predictions. This dual methodology allows for a nuanced understanding of the potential ups and downs GitLab Inc.s stock might face, alongside generating insights into the probable future returns of the security.

Volatility modeling, specifically tailored for financial time series data, enables us to gauge the inherent risk in GitLab Inc.s stock by examining fluctuation patterns over time. This model delves into historical price movements to predict the variability of returns, considered vital for estimating the risk level of investments in the stock market. Volatility is a key metric as it reflects the degree to which the price of an asset varies from its average price, which directly impacts the investment risk.

In parallel, the machine learning predictions approach, specifically using an algorithm designed to handle regression tasks, forecasts GitLab Inc.s future stock returns based on a wide array of features. This could include historical stock prices, financial indicators, market trends, and other relevant variables. The strength of employing this predictive method lies in its ability to learn from complex patterns within the data, making it adept at foreseeing future outcomes based on past and present inputs.

When analyzing the results, particularly focusing on the calculated Value at Risk (VaR) at a 95% confidence interval for a $10,000 investment in GitLab Inc., it's noteworthy to mention the figure: $659.70. This VaR figure implies that there is a 95% probability that the investor will not lose more than $659.70 on this investment over a one-year period, under normal market conditions. The integration of volatility modeling helps in accurately capturing the stocks risk level, while the machine learning predictions provide a forward-looking aspect to the analysis, enhancing the overall understanding of both the potential return and risk associated with investing in GitLab Inc.

This blended approach thus offers a robust framework for investors to assess the financial risk linked with equity investments by not just relying on past performance, but also on predictive insights, making it a comprehensive method for investment decision-making. By utilizing both the historical volatility of the stock and predictive forecasts, investors can reach a more informed conclusion about the potential fluctuations in the value of their investment and the associated risk levels.

Based on the options chain data for GitLab Inc. (GTLB) call options, various Greek values indicate the profitability of these options under the scenario that the target stock price is 5% higher than its current price. When analyzing the options, we consider the Greeks such as Delta, Gamma, Vega, Theta, and Rho, along with other crucial factors like days to expiration, strike price, premium paid, return on investment (ROI), and the profit that can be realized.

Looking at options with a high delta value close to 1, these options behave similarly to the stock itself, indicating that for these options, the price moves almost dollar for dollar with the stock price. Notably, options with a delta of 1.0 (for example, with a strike price of 45.0, expiring on 2024-03-15; and with a strike price of 25.0 expiring on 2024-04-19) are perfect illustrations, as they are likely deep in the money and have a very high chance of ending up in the money at expiration, making them less risky but also more expensive to purchase.

Options with shorter expiration dates (e.g., 6 days to expire) have higher theta values, signifying that time decay is a crucial factor, which could erode the option's value rapidly if the stock price does not move as expected. For instance, the option with a strike of 69.0 expiring on 2024-02-23 has a very high return on investment (ROI) and benefits significantly from small movements in the stock price, due to its relatively high delta and gamma but comes with the risk of high theta.

Longer-term options, such as those expiring in 2024-07-19 and beyond, show varying characteristics. Interestingly, options with a strike price closer to the current stock price or slightly in the money (e.g., a strike of 37.0 with an expiration on 2025-01-17) present a balanced profile, offering significant leverage with more time for the stock to move favorably but at the same time having less negative impact from time decay as indicated by their theta values.

Furthermore, the option with a strike of 47.0 expiring on 2025-01-17 offers a fascinating mix with a delta of 1.0, showing it behaves exactly like the stock, but its premium and corresponding ROI indicate it's a comparatively less risky bet for a long-term bullish outlook with substantial upside potential and somewhat lower cost compared to similar high-delta options.

Lastly, very long-term options (LEAPs), like those expiring in 2026, combine the stability of high delta values with the leverage of options trading. The option with a strike of 30.0 expiring on 2026-01-16 appears to offer an appealing risk-reward profile, given its reasonable premium for the time value, a delta suggesting considerable responsiveness to stock price movements, and vega indicating sensitivity to implied volatility changes, which could enhance profitability if volatility increases.

In sum, for an investor or trader targeting a 5% increase in GitLab Inc.'s stock price, blending short-term options for quick profits with longer-duration calls could provide a hedged and balanced approach to capitalizing on expected stock movements. The selection process should account for the Greeks' insight on risk and exposure, alongside personal risk tolerance and market outlook.

Similar Companies in SoftwareApplication:

Bill.com Holdings, Inc. (BILL), Datadog, Inc. (DDOG), Asana, Inc. (ASAN), Atlassian Corporation (TEAM), The Trade Desk, Inc. (TTD), ServiceNow, Inc. (NOW), Snowflake Inc. (SNOW), Unity Software Inc. (U), monday.com Ltd. (MNDY), ZoomInfo Technologies Inc. (ZI), HubSpot, Inc. (HUBS), DocuSign, Inc. (DOCU), Workday, Inc. (WDAY), GitHub (MSFT), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Report: Alphabet Inc. (GOOGL), Alphabet Inc. (GOOGL)

https://finance.yahoo.com/news/software-development-stocks-q3-teardown-100834678.html

https://finance.yahoo.com/news/5-surging-growth-stocks-buy-164312062.html

https://finance.yahoo.com/news/gitlab-inc-cfo-brian-robins-000148022.html

https://finance.yahoo.com/news/3-cutting-edge-stocks-eyeing-154108573.html

https://finance.yahoo.com/news/gitlab-incs-chief-legal-officer-040257529.html

https://finance.yahoo.com/news/multiple-reasons-drove-gitlab-gtlb-101918948.html

https://finance.yahoo.com/news/gitlab-announce-fourth-quarter-full-210500999.html

https://finance.yahoo.com/news/gitlab-inc-cfo-brian-robins-043509182.html

https://www.sec.gov/Archives/edgar/data/1653482/000162828023040671/gtlb-20231031.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: RwefNQ

Cost: $0.62527

https://reports.tinycomputers.io/GTLB/GTLB-2024-02-16.html Home