Monolithic Power Systems, Inc. (ticker: MPWR)

2024-01-27

Monolithic Power Systems, Inc. (ticker: MPWR) is a leading company in the semiconductor industry that specializes in high-performance power solutions. Established in 1997 and headquartered in Kirkland, Washington, MPWR has gained recognition for its integrated power semiconductor solutions and power delivery architectures, catering to a wide range of industries including computing, automotive, industrial, communications, and consumer markets. The company's product portfolio boasts a variety of energy-efficient power modules, analog ICs, and discrete components designed to optimize power conversion efficiency. Monolithic Power Systems prides itself on its innovative design approach and robust intellectual property portfolio, which includes numerous patents for its advanced technologies. Financially, MPWR is known for its strong growth, profitability, and consistent investment in research and development, positioning it as a formidable player in the power semiconductor market. As of the knowledge cutoff in 2023, MPWR remains a key competitor and technological innovator in its sector, with a reputation for quality, performance, and customer service.

Monolithic Power Systems, Inc. (ticker: MPWR) is a leading company in the semiconductor industry that specializes in high-performance power solutions. Established in 1997 and headquartered in Kirkland, Washington, MPWR has gained recognition for its integrated power semiconductor solutions and power delivery architectures, catering to a wide range of industries including computing, automotive, industrial, communications, and consumer markets. The company's product portfolio boasts a variety of energy-efficient power modules, analog ICs, and discrete components designed to optimize power conversion efficiency. Monolithic Power Systems prides itself on its innovative design approach and robust intellectual property portfolio, which includes numerous patents for its advanced technologies. Financially, MPWR is known for its strong growth, profitability, and consistent investment in research and development, positioning it as a formidable player in the power semiconductor market. As of the knowledge cutoff in 2023, MPWR remains a key competitor and technological innovator in its sector, with a reputation for quality, performance, and customer service.

| Full Time Employees | 3,247 | Previous Close | 615.68 | Open | 609.08 |

| Day Low | 598.81 | Day High | 609.91 | Dividend Rate | 4.0 |

| Dividend Yield | 0.67% | Payout Ratio | 40.63% | Five Year Avg Dividend Yield | 0.72% |

| Beta | 1.215 | Trailing PE | 64.92 | Forward PE | 46.67 |

| Volume | 367,795 | Average Volume | 507,244 | Average Volume (10 days) | 473,110 |

| Market Cap | 28,801,820,672 | 52 Week Low | 383.19 | 52 Week High | 648.0 |

| Price to Sales (TTM) | 15.76 | Price to Book | 14.81 | Enterprise Value | 27,767,500,800 |

| Profit Margins | 24.61% | Float Shares | 45,930,360 | Shares Outstanding | 47,912,000 |

| Shares Short | 1,130,732 | Held Percent Insiders | 2.632% | Held Percent Institutions | 97.84% |

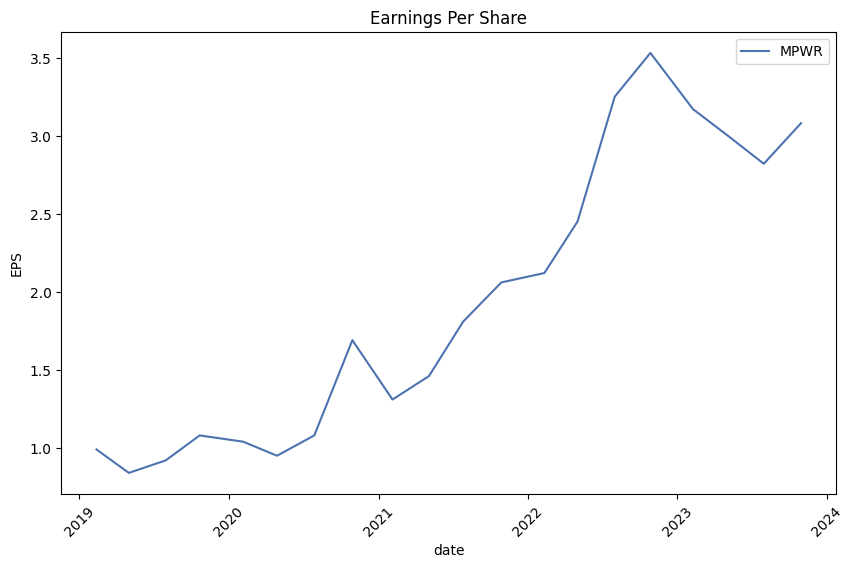

| Book Value | 40.593 | Net Income to Common | 449,559,008 | Trailing EPS | 9.26 |

| Forward EPS | 12.88 | PEG Ratio | 2.09 | Enterprise to Revenue | 15.20 |

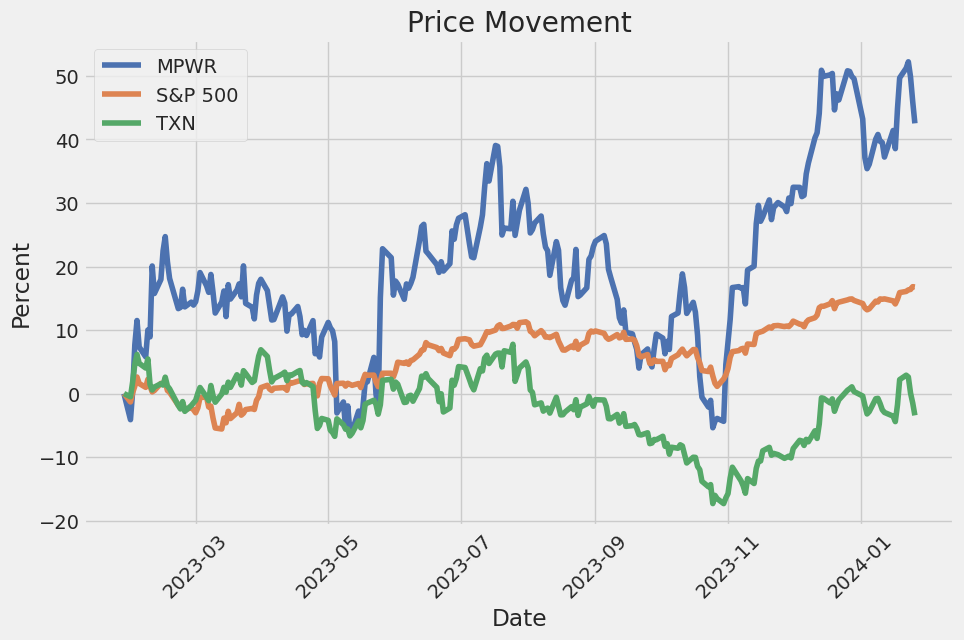

| Enterprise to EBITDA | 49.96 | 52 Week Change | 47.48% | S&P 52 Week Change | 21.73% |

| Total Cash | 1,042,300,992 | Total Cash Per Share | 21.754 | EBITDA | 555,764,992 |

| Total Debt | 7,983,000 | Quick Ratio | 4.927 | Current Ratio | 6.941 |

| Total Revenue | 1,827,072,000 | Debt to Equity | 0.41 | Revenue Per Share | 38.57 |

| Return on Assets | 15.17% | Return on Equity | 25.87% | Free Cash Flow | 302,529,504 |

| Operating Cash Flow | 537,102,976 | Earnings Growth | -3.5% | Revenue Growth | -4.1% |

| Gross Margins | 56.80% | EBITDA Margins | 30.42% | Operating Margins | 28.55% |

| Sharpe Ratio | -7.782443476504321 | Sortino Ratio | -135.93417959628118 |

| Treynor Ratio | 0.2213208415986115 | Calmar Ratio | 1.3365434928438935 |

Technical Analysis and Fundamental Overview for MPWR:

Upon thorough examination of the technical and fundamental data of MPWR, there are several key points to consider for the projected stock price movements in the upcoming months:

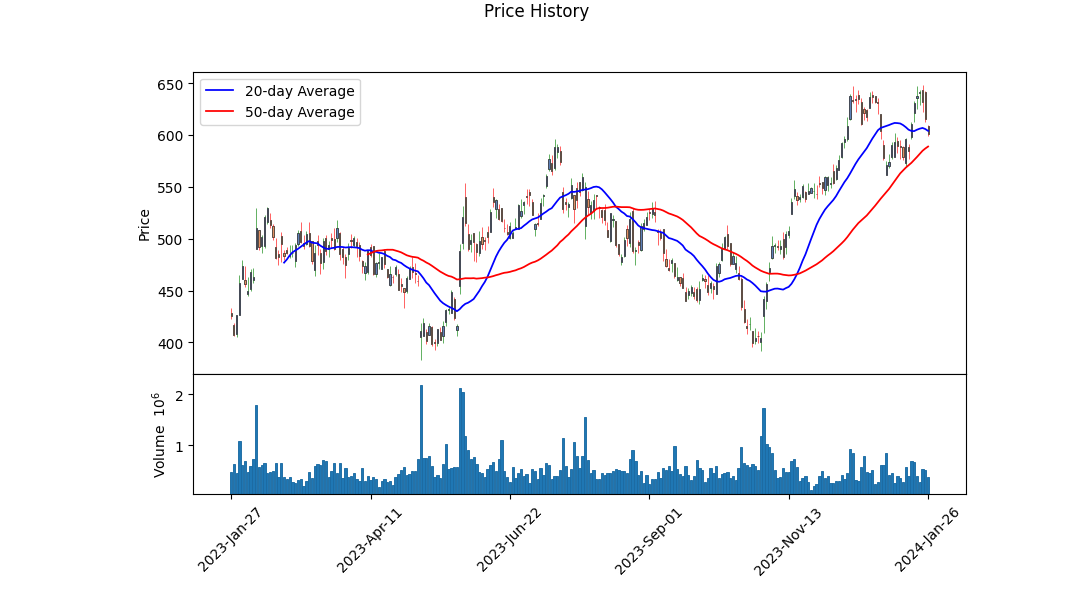

- The technical indicators from the last trading day reflect a strong uptrend, evidenced by a significant increase in the stock's price and a marked improvement in the On-Balance Volume (OBV). This suggests a growing accumulation among investors.

- The MACD histogram on the last observed day indicates a reversal of momentum, transitioning from positive to negative territory, signaling potential caution ahead.

- The financial ratios, including Gross Margins and EBITDA Margins, hold robust values, denoting a healthy operational efficiency of the company.

- A high trailing PEG ratio often suggests that the stock may be overvalued based on earnings growth predictions.

- Low and negative values for risk-adjusted performance metrics such as the Sharpe, Sortino, and Treynor Ratios often indicate a poor risk-return profile historically. However, the Calmar Ratio presents a more favorable view suggesting resilience over a longer-term period with respect to maximum drawdowns.

Given the mixed but generally strong performance indicators, MPWR shows a complex narrative for the next few months:

- The price momentum, supported by buying pressure, suggests an initial continuation of the uptrend. However, caution should be taken due to the potential for momentum shifts indicated by the MACD histogram.

- Examining the company's Fundamentals, Analyst Expectations, and Score Summary, the overall condition of MPWR is robust but linked to higher earnings multiples and mixed growth estimates.

- Analyst expectations for EPS and Revenue particularly for 2024 point to optimism, albeit with an indication of a potential downturn in the very short termpossibly reflected in the earnings growth contraction in the current and next quarters.

- The Altman Z-Score being exceedingly high suggests that the company is not at risk for bankruptcy in the near term, providing further confidence to investors.

In summary, MPWR's stock price is likely to experience volatility in the short term due to mixed signals from both technical indicators and analyst expectations. However, its strong operational efficiencies and solid financial health may serve as a counterbalance, and the growth estimates looking further out could imply a longer-term potential upside. Therefore, prudent investors might be optimistic but also wary of short-term fluctuations influenced by market sentiment and external factors.

| Statistic Name | Statistic Value |

| Alpha () | 0.0682 |

| Beta () | 1.7126 |

| R-squared | 0.512 |

| Adjusted R-squared | 0.511 |

| F-statistic | 1,316 |

| Prob (F-statistic) | 1.15e-197 |

| Log-Likelihood | -2,778.0 |

| AIC | 5,560 |

| BIC | 5,570 |

| No. Observations | 1,258 |

| Df Residuals | 1,256 |

| Df Model | 1 |

The linear regression model illustrates the relationship between the performance of MPWR (Monolithic Power Systems, Inc.) stock and the SPY (SPDR S&P 500 ETF Trust), which is often utilized as a proxy for the U.S. stock market. The alpha () value in the regression represents the intercept term or the stocks expected return when the return on SPY is zero. An alpha of 0.0682 implies that MPWR is expected to earn a return of 6.82% in excess of the risk-free rate when the market's excess return is zero, if the linear relationship holds. However, the statistical significance of the alpha is not confirmed in this model, as indicated by its p-value of 0.273, suggesting alpha is not significantly different from zero.

Moreover, the beta () coefficient for MPWR is 1.7126, which measures the stocks volatility relative to that of SPY. A beta that is greater than 1 suggests that MPWR is more volatile and therefore moves more than the market, on average. The R-squared value of 0.512 indicates that approximately 51.2% of the variability in MPWR's returns can be explained by the returns of SPY. This suggests a moderate degree of correlation between the returns of MPWR and the market benchmark. However, the models adjusted R-squared of 0.511 takes into account the number of predictors in the model and is slightly lower, which represents a more accurate measure of how well the regression explains the dependent variable.

Monolithic Power Systems, Inc. (MPS) conducted its third-quarter 2023 earnings webinar hosted by Genevieve Cunningham, with CEO and Founder Michael Hsing and EVP and CFO Bernie Blegen participating. They prefaced the discussion with a Safe Harbor statement, noting the forward-looking nature of statements made during the call and the associated risks. The financial results were presented on both a GAAP and non-GAAP basis, with reconciliations available in their earnings release, and these figures were not to be considered substitutes for GAAP measures. Attendees were reminded that the call was being webcast live and would be available for replay.

In Q3 2023, MPS saw a revenue increase to $474.9 million, up 7.6% sequentially but down 4.1% year-over-year. There was significant growth in enterprise data, driven by GPU and CPU program sales, and in storage and computing, attributed to increased commercial notebook sales. However, the consumer, communications, automotive, and industrial segments experienced revenue declines. Blegen remarked on volatile customer ordering patterns and the difficulty in forecasting beyond the current quarter, though fundamentals remain strong with an expanding customer base and design win pipeline.

Blegen noted that GAAP gross margin decreased to 55.5%, with both GAAP and non-GAAP margins affected by an unfavorable product mix. Operating expenses on a non-GAAP basis were stable and stock compensation was a primary difference between GAAP and non-GAAP expenses. Net income for Q3 2023 was higher, with GAAP net income at $121.2 million and non-GAAP net income at $150.3 million. Looking at the balance sheet, cash and equivalents rose to $1.04 billion. Operating cash flow increased significantly, and while accounts receivable rose slightly, inventory levels decreased. The forecast for Q4 suggests a revenue range of $442 million to $462 million with expectations of gross margin at about 55.4% to 56% on a non-GAAP basis.

During the Q&A session, analysts inquired about specific business segments and the outlook for 2024. Hsing pointed out that while the market is difficult to forecast, MPS's strategic position in high-performance sectors like AI GPUs and automotive bodes well for future growth. He also mentioned that the company is working on new, diversified products that would contribute to revenue in various markets including USB-C technology and battery management.

Further, Blegen and Hsing discussed MPS's strategy to manage industry cycles through inventory control and capacity expansion. They affirmed their commitment to consumer market diversification, emphasizing the importance of their design win pipeline over immediate revenue fluctuations. There were also discussions highlighting the planned share buyback program, indicating strong free cash flow and future confidence, with an intent to offset dilution.

In conclusion, MPS is navigating an unstable market environment with strong fundamentals and strategic positioning across diverse sectors. The company is poised for growth with a focus on high-performance solutions and is managing its resources strategically to adapt to market demands and future opportunities.

Monolithic Power Systems, Inc. (MPWR) filed its 10-Q report with the SEC for the quarterly period ended September 30, 2023. The 10-Q provides insights into the company's financial performance, notable commitments, stock activity, and other vital operational aspects.

During the reported quarter, MPWR generated revenue of $474.9 million, a 4.1% decrease compared to $495.4 million in the same quarter the previous year. The reduction in revenue was primarily attributed to a lower shipment volume, despite an increase in the average selling prices due to product mix. MPWR's cost of revenue saw an increase to $211.3 million or 44.5% of revenue, up from $204.5 million, even as gross profit declined from $290.9 million to $263.5 million, leading to a gross margin decrease from 58.7% to 55.5%. The decrease in gross margin was mainly driven by product mix and offset by lower inventory write-downs as a percentage of revenue.

Operating expenses totaled $127.9 million, or approximately 26.9% of revenue, down from $139.0 million a year earlier. This reflected a decline in research and development (R&D) expenses, which amounted to $64.8 million (13.6% of revenue), and a decrease in selling, general, and administrative (SG&A) expenses to $63.2 million (13.3% of revenue). The lower SG&A was due to a decrease in stock-based compensation expenses and litigation expenses.

Other income, net, was $2.3 million for the quarter, a significant increase from $5 thousand in the same period in 2022, mainly due to a rise in net interest income and partially offset by increased charitable contributions.

Income before taxes was $137.9 million, and the company reported net income of $121.2 million or 25.5% of revenue, compared to $124.3 million or 25.1% of revenue for the same period in the previous year. The company's effective tax rate for the quarter was 12.1%, vastly lower than the federal statutory rate due to lower statutory tax rates in Bermuda and China and excess tax benefits from stock-based compensation.

MPWR's 10-Q reveals that the company made a significant investment of $170 million under a long-term wafer supply agreement to secure manufacturing production capacity for silicon wafers over a four-year period. Additionally, the companys Board of Directors authorized a new stock repurchase program up to $640 million through October 29, 2026.

The condensed consolidated balance sheets indicate that as of September 30, 2023, MPWR's total assets were $2.33 billion, and total liabilities and stockholders' equity were also $2.33 billion. The main components of current assets include cash and cash equivalents at $421.2 million and short-term investments at $621.1 million.

Overall, MPWR's financial filings show the company managing its income and expenses effectively, achieving profitability and responding to market shifts, while investing in future growth and demonstrating commitment to shareholder return through a stock repurchase program.

Monolithic Power Systems, Inc. (NASDAQ: MPWR) demonstrated a strong ability to navigate a challenging economic climate according to their third-quarter financial results, as highlighted in a January 19, 2024, article by Anthony Lee. The company posted revenues of $474.9 million, a decrease of 4.1% compared to the previous year, which met analyst expectations. Furthermore, the release of these figures corresponded with a notable increase in the company's stock price by 52.8%, trading at $616.98, showcasing investor confidence in MPWR's resilience.

Despite broader industry headwinds, Monolithic Power Systems succeeded in steadying its revenues and significantly enhancing inventory management, while minor concerns emerged with the contraction of its gross margin. Founded in 1997 by CEO Michael Hsing, the fabless semiconductor company has carved out a niche in providing power management solutions across industrial, computing, telecommunications, automotive, and consumer applications sectors. Its consistent performance is a product of its substantial system-level knowledge, robust semiconductor design expertise, and path-breaking innovations in semiconductor processes, system integration, and packaging.

Monolithic Power Systems' performance in the quarter should be seen in context with the performance of the analog chip sector at large. The sector, which enjoys longer product cycles averaging 5-7 years, faced a mixed quarter with companies displaying varied results. Texas Instruments (NASDAQ:TXN), Sensata Technologies (NYSE:ST), Impinj (NASDAQ:PI), and Skyworks Solutions (NASDAQ:SWKS) were among the companies that experienced declines in their revenue figures.

This performance among peers offers invaluable insights, as noted by Jabin Bastian in an article dated January 23, 2024, explaining that unlike digital chipmakers, analog semiconductor companies tend to have longer product cycles and typically manufacture most of their chips. This allows them to be less reliant on rapidly advancing but costly manufacturing technology, providing a more stable market position.

Noteworthily, MPWR's stock gains stood in contrast to other companies within the segment some of which suffered misses on revenue estimates or offered weaker future guidance indicating investor confidence might be particularly robust for Monolithic Power Systems. Revenue forecasts for the next quarter across the sector were generally down by an average of 8% relative to consensus estimates.

Looking forward, MPS is set to report its fourth-quarter and full-year financial results for the year ending December 31, 2023, on February 7, 2024. The event, announced in a January 16, 2024, press release, will be broadcast via a live webinar, with a replay available on their website's Investor Relations section. These results are anticipated to provide further indicators for the company's performance and future business trajectory.

According to Max Juang's analysis on Yahoo Finance, the strong third-quarter performance of MPWR indicates a well-managed operation capable of navigating the semiconductor sector's volatility, which has faced supply chain issues and fluctuating demands.

Interestingly, Monolithic Power Systems was also recognized for reflecting investment criteria often linked to Warren Buffett, as part of an investment screen covered by Investor's Business Daily on January 19, 2024. The inclusion in this Buffett-inspired list suggests that Monolithic Power Systems possesses financial health and a competitive advantage within the industry, further bolstering its appeal to value-seeking investors.

These assessments reaffirm Monolithic Power Systems as an established issuer benefiting from the analog semiconductor industry's resilience. The company's commitment to innovation, quality, and sustainability aligns with its strategy to offer high-energy efficient and cost-effective power solutions. For additional details regarding the performance of Monolithic Power Systems and expectations set for their upcoming financial announcement, interested readers can find comprehensive analyses on the referenced Yahoo Finance articles.

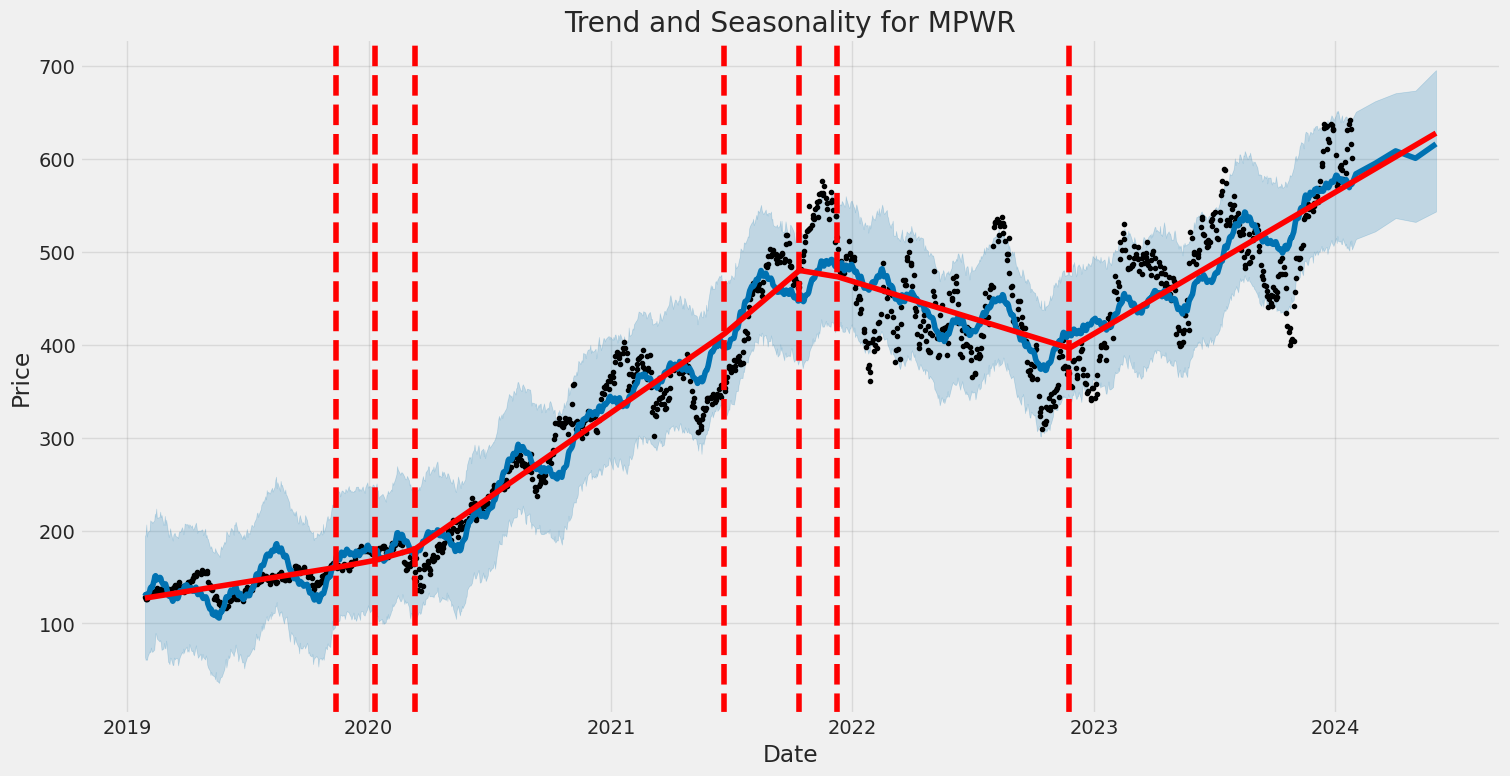

Monolithic Power Systems, Inc. (MPWR) exhibited considerable volatility between January 2019 and January 2024, as indicated by the ARCH model's parameters. The coefficient for 'omega' was found to be quite high, suggesting a significant baseline volatility present in the stock returns. Additionally, the 'alpha[1]' parameter indicates that past volatility contributed to future volatility, highlighting the stock's propensity for fluctuations in its returns.

Below is the provided HTML table with the requested style and formatting:

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,181.94 |

| AIC | 6,367.87 |

| BIC | 6,378.15 |

| No. Observations | 1,258 |

| Df Residuals | 1,258 |

| omega | 7.5980 |

| alpha[1] | 0.2222 |

This table summarises the main statistics from the Zero Mean - ARCH Model Results for Monolithic Power Systems, Inc. (MPWR) without inclusion of the specific dates.

In analyzing the financial risk associated with a $10,000 investment in Monolithic Power Systems, Inc. (MPWR), a two-pronged approach using volatility modeling and machine learning predictions helps provide a nuanced understanding of potential equity investment risks.

Volatility modeling, typically employed to anticipate the level of fluctuation that can be expected in a stock's price over time, is a powerful tool for risk assessment. By evaluating historical price data, this model captures the dynamic nature of volatility, which is inherently clustered and influenced by past variances and price shocks. This allows for the decomposition of a time series into predictable patterns and stochastic error terms, estimating the conditional volatility of the stock at future points. Through this time-varying volatility forecast, investors gain insight into the potential range of price movements they might experience in the short term.

Machine learning predictions, on the other hand, contribute to the forecasting of future returns by analyzing large datasets to identify complex, non-linear relationships between variables that can affect stock prices. The use of a machine learning approach like the decision-tree-based ensemble learning method allows for the combination of multiple decision trees to reduce overfitting and enhance predictive performance. The model takes into account not just historical price information but also possibly other pertinent features like trading volume, company fundamentals, market sentiment, and macroeconomic indicators to predict future stock performance.

In the context of a $10,000 investment in MPWR, when estimating the Value at Risk (VaR) at a 95% confidence interval using these methodologies, the calculated amount implies that, under normal market conditions, there is only a 5% chance that the investor would lose more than $478.75 over the one-year period. This quantifies the maximum expected loss, helping to form the risk profile of the investment.

The analysis carried out by integrating both volatility modeling and machine learning predictions gives investors a multidimensional view of risk. While the volatility model outlines the probable extent of stock price fluctuation based on historical trends, the predictive analytics from machine learning offer a forward-looking perspective on potential returns. The calculated VaR of $478.75 for a $10,000 investment provides a numerical risk estimate, underlining the potential downside in investing in Monolithic Power Systems, Inc. and supplying an important benchmark for investment decision-making.

Similar Companies in Semiconductors:

Report: Texas Instruments Incorporated (TXN), Texas Instruments Incorporated (TXN), Microchip Technology Incorporated (MCHP), NXP Semiconductors N.V. (NXPI), ON Semiconductor Corporation (ON), Navitas Semiconductor Corporation (NVTS), GLOBALFOUNDRIES Inc. (GFS), Report: Analog Devices, Inc. (ADI), Analog Devices, Inc. (ADI), Wolfspeed, Inc. (WOLF), Lattice Semiconductor Corporation (LSCC), Qorvo, Inc. (QRVO), Synaptics Incorporated (SYNA), Allegro MicroSystems, Inc. (ALGM), Maxim Integrated Products, Inc. (MXIM)

https://www.zacks.com/stock/news/2200562/monolithic-power-mpwr-soars-80-ytd-will-the-trend-last

https://seekingalpha.com/article/4661141-semiconductors-winners-losers-start-of-2024

https://finance.yahoo.com/news/q3-earnings-outperformers-power-integrations-073725926.html

https://finance.yahoo.com/news/monolithic-power-systems-report-fourth-210100416.html

https://finance.yahoo.com/news/analog-semiconductors-stocks-q3-highlights-073037723.html

https://finance.yahoo.com/news/analog-semiconductors-stocks-q3-highlights-051910888.html

https://finance.yahoo.com/news/analog-semiconductors-stocks-q3-teardown-082201441.html

https://finance.yahoo.com/news/q3-earnings-roundup-magnachip-nyse-100622976.html

https://finance.yahoo.com/news/winners-losers-q3-analog-devices-084813557.html

https://www.sec.gov/Archives/edgar/data/1280452/000143774923030929/mpwr20230930_10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ETh3x2

Cost: $0.69062

https://reports.tinycomputers.io/MPWR/MPWR-2024-01-27.html Home