NVIDIA Corporation (ticker: NVDA)

2024-01-20

NVIDIA Corporation (ticker: NVDA) stands at the forefront of the tech industry as a leading designer of graphics processing units (GPUs) for both the gaming and professional markets. In addition to their core GPU products, NVIDIA has branched out into the mobile computing sector and the burgeoning field of artificial intelligence. Founded in 1993, NVIDIA has been a key driver in the evolution of the gaming industry through its GeForce product line. Over the years, the company has expanded its reach, providing GPU solutions for professional visualization (Quadro), data centers (Tesla), and automotive markets. NVIDIA's advancements in AI technology have positioned it as a critical player in the development of deep learning and autonomous vehicles. The corporation's commitment to innovation continues to keep it competitive in a rapidly evolving tech landscape, as evidenced by its ongoing developments in ray-tracing technology and cloud-based gaming services. NVDA's financial performance reflects its leading position, often demonstrating robust growth and market resilience.

NVIDIA Corporation (ticker: NVDA) stands at the forefront of the tech industry as a leading designer of graphics processing units (GPUs) for both the gaming and professional markets. In addition to their core GPU products, NVIDIA has branched out into the mobile computing sector and the burgeoning field of artificial intelligence. Founded in 1993, NVIDIA has been a key driver in the evolution of the gaming industry through its GeForce product line. Over the years, the company has expanded its reach, providing GPU solutions for professional visualization (Quadro), data centers (Tesla), and automotive markets. NVIDIA's advancements in AI technology have positioned it as a critical player in the development of deep learning and autonomous vehicles. The corporation's commitment to innovation continues to keep it competitive in a rapidly evolving tech landscape, as evidenced by its ongoing developments in ray-tracing technology and cloud-based gaming services. NVDA's financial performance reflects its leading position, often demonstrating robust growth and market resilience.

| Address | 2788 San Tomas Expressway, Santa Clara, CA, 95051, United States | Phone | 408 486 2000 | Website | https://www.nvidia.com |

| Industry | Semiconductors | Sector | Technology | Full Time Employees | 26,196 |

| Dividend Rate | 0.16 | Dividend Yield | 0.03% | Payout Ratio | 2.11% |

| Beta | 1.642 | Trailing PE | 78.69 | Forward PE | 28.94 |

| Market Cap | $1,469,427,744,768 | Enterprise Value | $1,462,173,696,000 | Profit Margins | 42.10% |

| Shares Outstanding | 2,470,000,128 | Book Value | 13.489 | Price to Book | 44.10 |

| Net Income | $18,889,000,960 | Trailing EPS | 7.56 | Forward EPS | 20.56 |

| Total Cash | $18,281,000,960 | Total Debt | $11,027,000,320 | Total Revenue | $44,870,000,640 |

| Operating Cash Flow | $18,838,999,040 | Free Cash Flow | $14,114,499,584 | Earnings Growth | 12.74% |

| Revenue Growth | 2.06% | Gross Margins | 69.85% | EBITDA Margins | 49.39% |

| Operating Margins | 57.49% | Return on Assets | 27.23% | Return on Equity | 69.17% |

| Sharpe Ratio | -5.9124 | Sortino Ratio | -124.8958 |

| Treynor Ratio | 0.6372 | Calmar Ratio | 12.8516 |

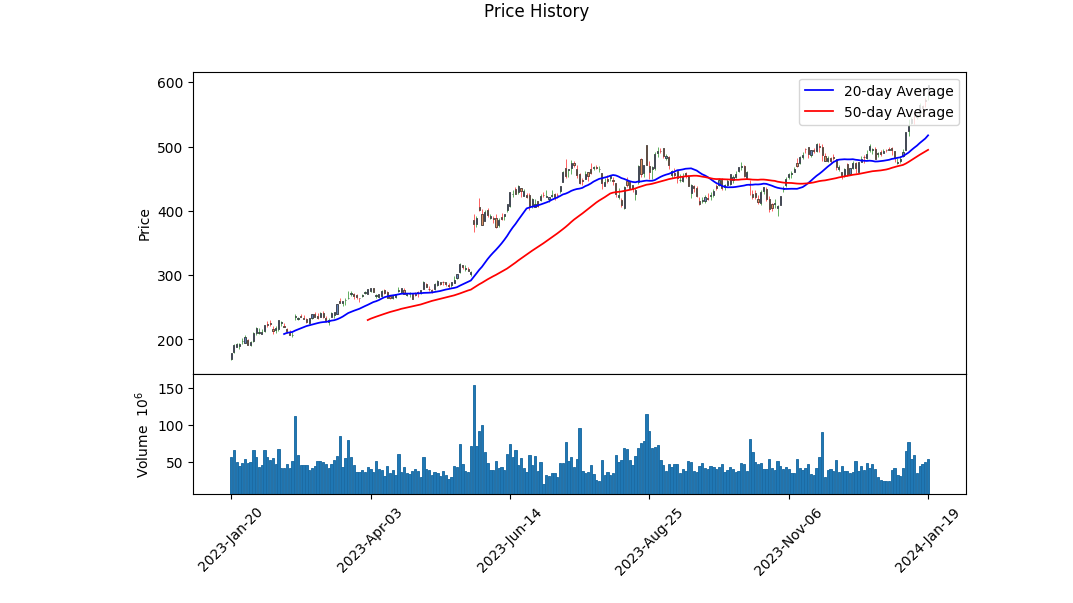

Technical Analysis Overview: NVDA (Nvidia Corporation) has presented a consistent upward movement as evidenced by the data from the last trading day. The positive progression can be observed in the OBV (On-Balance Volume) increasing to 82.01 million, signifying accumulating volume as the price ascends, a traditionally bullish signal. Additionally, the MACD histogram values indicate a positive momentum, with the latest reading at 7.88 suggesting that the short-term momentum is outpacing the long-term trend, reinforcing the bullish outlook.

Fundamental Analysis Perspective: Assessing the companys fundamentals, NVDA displays a robust financial structure with impressive gross (69.853%) and operating (57.489%) margins that exceed industry norms, indicative of the firm's pricing power and efficient operations. The companys EBITDA and gross profit figures underpin a strong earnings capacity which, coupled with a trailing PEG ratio of 0.5977, reflects a company that is potentially underpriced concerning its growth profile.

Balance Sheets and Cash Flows Examination: The balance sheet totals exhibit a healthy treasury with an outstanding total of $13.296 billion in cash, cash equivalents, and short-term investments, which can address the companys $7.564 billion net debt. The consistency in the companys cash flows, particularly the $3.808 billion in free cash flow, highlights NVDA's operational efficiency and liquidity, ensuring the company can fund operational needs and strategic investments without strain.

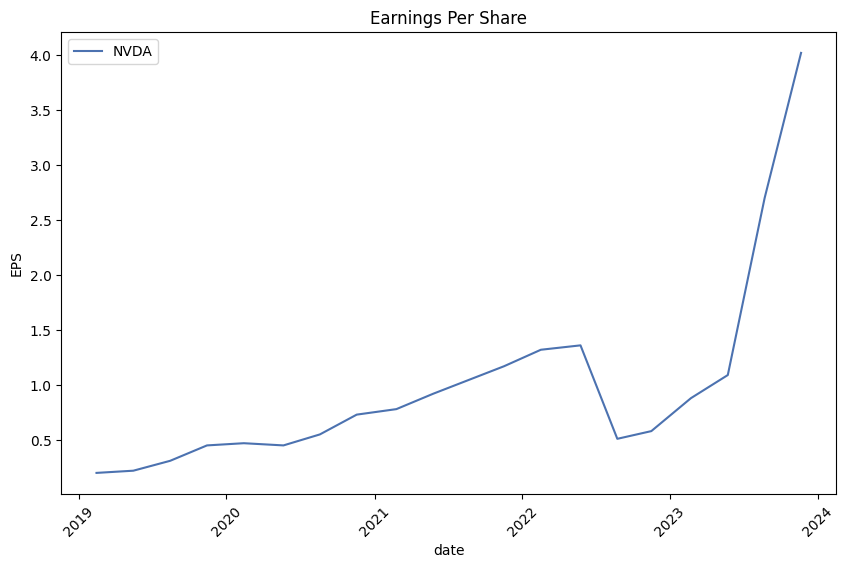

Analyst Expectations and Sentiment: Analyst expectations set forth a highly optimistic outlook for NVDA, with the consensus projecting a significant increase in earnings per share (EPS) from the current year to the next. Moreover, the revenue estimates show a remarkable sales growth expectation, suggesting confidence in NVDA's market position and product offerings. The recent trend in EPS revisionswith upgrades in the last 7 to 30 daysfurther underscore the analysts' positive sentiment toward the company.

Market Sentiment and Scoring: NVDA's extremely high Altman Z-Score of 45.38 indicates a very low probability of financial distress, which is supportive of investment confidence. Furthermore, the Piotroski Score of 8 out of 9 asserts the company's robust financial health. Together with a substantial market capitalization of approximately $1.469 trillion, these metrics advocate NVDA as a leader with strong performance potential.

Risk-Adjusted Performance Ratios: The adverse Sharpe and Sortino ratios reflect a troubling past performance relative to volatility and downside volatility, respectively. However, the positive Treynor and Calmar ratios suggest that, despite the risk, the potential rewards relative to market returns and maximum drawdown are favorable.

Forward-Looking Sentiment: Given the optimistic technical signals, solid fundamentals, and positive analyst sentiment, NVDA's stock price movement looks to maintain its upward trajectory over the next few months. The technical indicators of on-balance volume and MACD histogram hold momentum that favors growth. Harmonized with commanding market ratios and a robust balance sheet, these attributes lay down a promising terrain where NVDA is expected to perform well, notwithstanding the usual market uncertainties and inherent risks of volatility. Investors should anticipate a continuation of the bullish trend, substantiated by technical support levels and a constructive outlook on the company's fundamentals.

| Statistic Name | Statistic Value |

| R-squared | 0.506 |

| Adjusted R-squared | 0.506 |

| F-statistic | 1287 |

| Prob (F-statistic) | <0.001 |

| Log-Likelihood | -2821.7 |

| AIC | 5647 |

| BIC | 5658 |

| Alpha | 0.1646 |

| Beta | 1.7565 |

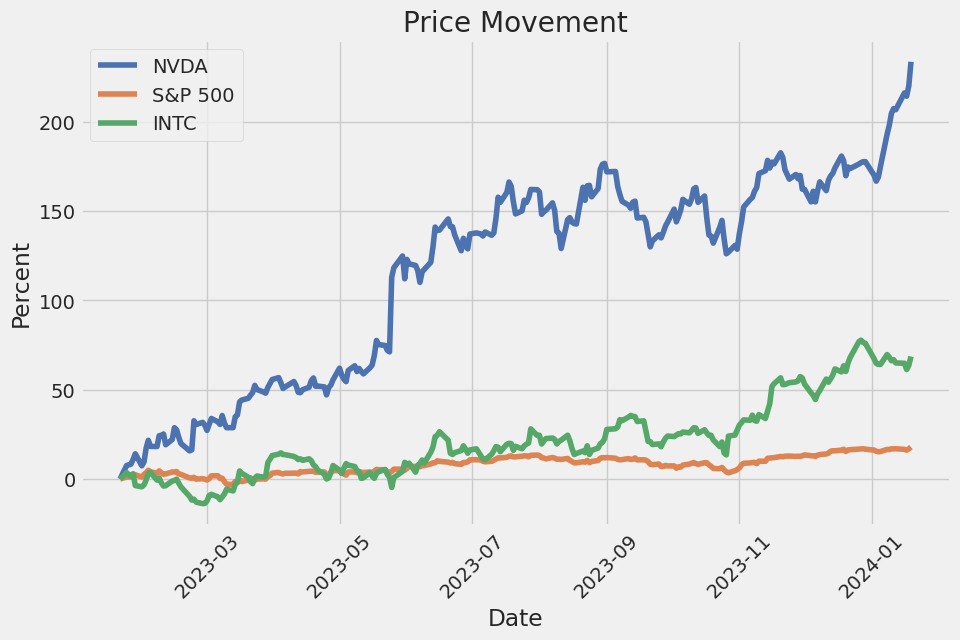

The linear regression model illustrates the relationship between the stock performance of NVIDIA Corporation (NVDA) and the S&P 500 Index (SPY) up to the current date. The intercept, or alpha, of the model is approximately 0.1646, indicating that NVDA has an average expected return of 16.46% above the return predicted by the model when the SPY's return is zero. This positive alpha suggests that NVDA has been performing better than what would be expected based on the market's performance alone.

The R-squared value of the model is 0.506, reflecting that approximately 50.6% of the variation in NVDA's returns can be explained by the movements in the SPY. A beta of 1.7565 shows a strong positive correlation with the market, implying that NVDA is more volatile than the market. For every 1% change in the SPY, NVDA's return is expected to change by approximately 1.7565%. This relationship has been statistically significant as evidenced by the low p-value of the F-statistic indicating that the model is reliable at explaining the variation in NVDA's returns using the market index as a predictor.

NVIDIA Corporation Earnings Summary for Q3 Fiscal 2024

Performance Highlights and Financial Metrics The key takeaway from NVIDIA's earnings call for the third quarter of fiscal 2024 is a record-breaking revenue of $18.1 billion, which represents a 34% increase from the previous quarter and a staggering 200% year-over-year growth. This exceeded the company's projected outlook of $16 billion. Colette Kress, NVIDIA's CFO, attributed this success primarily to the robust growth in the Data Center segment driven by the ramp-up of the NVIDIA HGX platform based on the Hopper Tensor Core GPU architecture and InfiniBand end-to-end networking. This resulted in record data center revenue of $14.5 billion, a 41% sequential and 279% year-over-year surge. Strong demand for AI applications and inferencing has fueled NVIDIA's data center growth, where consumer internet companies and enterprises made up about half of the data center revenue with exceptional sequential growth in Q3.

Emerging Trends and Expansions The earnings call revealed a clear trend towards AI adoption, both in consumer internet companies and enterprises. Businesses like Adobe, Databricks, Snowflake, and ServiceNow are incorporating AI into their platforms, signaling the beginning of widespread AI adoption in the enterprise segment. NVIDIA's AI computing is now a major workload, particularly for inferencing, where large language models and generative AI applications are becoming increasingly prevalent. The company's data center compute revenue has quadrupled from the previous year, demonstrating the substantial opportunity that AI represents.

Regulatory Challenges and Strategic Shifts One potential headwind noted was the newly announced U.S. export control regulations, which are expected to significantly impact NVIDIA's sales to China and other affected areas. Historically, these regions accounted for 20-25% of data center revenue, but NVIDIA anticipates this will decline notably in Q4. To mitigate this obstacle, the company plans to expand its product portfolio with regulation-compliant solutions across various performance levels and is engaging with some customers in China and the Middle East to pursue U.S. government licenses. Alongside this, NVIDIA is also working with governments and large tech companies in regions like India and France to bolster sovereign AI infrastructure, recognizing the growing importance of national compute capacity investment.

Product Innovation and Market Leadership The earnings call put a spotlight on NVIDIA's product innovations, which are driving considerable demand. Introducing the NVIDIA HGX platform with the Hopper GPU and InfiniBand networking has established NVIDIA's stronghold in the AI supercomputing and data center infrastructures. The launch of the new L40S GPU, along with the first revenue quarter for the GH200 Grace Hopper Superchip, showcases NVIDIA's expansion into new product lines anticipated to become multi-billion dollar revenue generators. In the realm of inferencing, NVIDIA AI stands out for performance and versatility, with rapid cost reduction being a key focus. Announcements like TensorRT-LLM and the H200 GPU reflect the company's commitment to innovation, substantially boosting inference performance while concurrently reducing costs for customers.

Concluding Remarks and Forward Outlook

Closing the call, Jensen Huang, NVIDIA's CEO, emphasized the transformative potential of generative AI across various sectors and the strategy behind NVIDIA's rapid product development and ecosystem expansion. He noted the strategic importance of architecture compatibility, ensuring that resources like NVIDIA's domain-specific libraries and software stack can be broadly utilized across the company's growing product portfolio. Huang envisages generative AI's role in the transition from general-purpose computing to AI factories and anticipates strong growth for the Data Center segment beyond fiscal 2025. NVIDIA is set to accelerate the reach of AI across new data center contexts and product innovations, supporting the transformation into an AI-driven industrial era.

on our reported revenue or forecasted demand. The demand for, and future price volatility of, cryptocurrency may lead to further reductions in demand, or increases in returns, of our products used by miners. We have had to take significant steps in response to this misuse of our products, have incurred impairment and inventory write-offs, and implemented programs to encourage miners to return to purchase specific cryptocurrency mining processor, or CMP, products. If cryptocurrency values were to significantly decline or our products face competition from application-specific integrated circuits, which are being used to mine cryptocurrencies, the demand for our CMP products or any successors could rapidly decrease, potentially leading to a significant oversupply and subsequent inventory write-downs. We have undertaken and may undertake additional actions. However, such actions may fail to be effective or may negatively impact the gaming market. For example, our use of a low hash rate driver for certain of our Gaming GPUs may not be effective. Further, significant and rapid changes in cryptocurrency values have occurred in the past and are likely to occur in the future. A significant and rapid decline in cryptocurrency values, or action by certain governments restricting or regulating the mining or use of cryptocurrencies, has led to and may lead to reduced demand for our GPUs for cryptocurrency mining and increased returns of our products, which could materially and adversely affect our business, financial condition and results of operations. Our revenue has been and our revenue and business could be significantly affected by global trade conditions, including related to export controls and government regulations. The U.S. government has announced licensing requirements that, with certain exceptions, impact exports to China (including Hong Kong and Macau) and Russia of our A100 and H100 integrated circuits, DGX or any other systems or boards which incorporate A100 or H100 integrated circuits. We expect sales to these destinations will decline significantly in the fourth quarter of fiscal year 2024 as these licensing requirements have impacted and are expected to continue to impact our China business. The USG has further informed us of an additional licensing requirement for a subset of A100 and H100 products destined to certain customers and other regions, including some in the Middle East. 38 On October 17, 2023, the USG announced new and updated licensing requirements effective in our fourth quarter of fiscal year 2024 for exports to China and Country Groups D1, D4, and D5 (including but not limited to Saudi Arabia, the United Arab Emirates, and Vietnam, but excluding Israel) of our products exceeding certain performance thresholds, including A100, A800, H100, H800, L4, L40, L40S and RTX 4090. The licensing requirements also apply to the export of products exceeding certain performance thresholds to a party headquartered in, or with an ultimate parent headquartered in, Country Group D5, including China. On October 23, 2023, the USG informed us the licensing requirements were effective immediately for shipments of our A100, A800, H100, H800, and L40S products. Our sales to China and other affected destinations, derived from products that are now subject to licensing requirements, have consistently contributed approximately 20-25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal year 2024, though we believe the decline will be more than offset by strong growth in other regions. We are working to expand our Data Center product portfolio to offer new regulation-compliant solutions, including those for which the USG does not wish to have any advance notice before each shipment. To the extent that a customer requires products covered by the licensing requirements, we may seek a license for the customer but have no assurance that the USG will grant such a license, or that the USG will act on the license application in a timely manner, or at all. Our competitive position has been harmed, and our competitive position and future results may be further harmed over the long-term, if there are further changes in the USGs export controls. Additionally, the USG has imposed and could impose additional tariffs or export and import restrictions that could limit our ability to conduct aspects of our business or increase the costs of conducting aspects of our business. Given the increasing strategic importance of AI and rising geopolitical tensions, the USG has changed and may again change the export control rules at any time and further subject a wider range of our products to export restrictions or licensing requirements, further negatively impacting our business and financial results. In the event of such change, we may be unable to sell our inventory of such products and may be unable to develop replacement products not subject to the licensing requirements, effectively excluding us from all or part of the China market, as well as other impacted markets, including the Middle East. In addition, the EU may change or impose tariffs or export and import restrictions, further negatively impacting our business and financial results. Further, we are named as a party to an investigation into the pricing of the share purchase and funding agreement signed in December 2019 by the U.K. Secretary of State for Business, Energy, and Industrial Strategy (the "Secretary") under the Enterprise Act 2002, in connection with the proposed Arm acquisition. While we believe that our actions were lawful and appropriate, the outcome of the Secretary's investigation could result in unfavorable findings and/or penalties. Further, our operations, business or financial results could be adversely impacted if, as a result of existing or future trade restrictions, our customers are subject to or become hesitant to engage with us. ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES, USE OF PROCEEDS, AND ISSUER PURCHASES OF EQUITY SECURITIES Issuer Purchases of Equity Securities The following table provides information about shares of our common stock that we repurchased during the quarter ended October 29, 2023: Total Number of Shares Maximum Number Purchased as (or Approximate Part of Publicly Dollar Value) of Period Total Number of Announced Plans Shares Purchased Average Price or Programs Purchased (1) as Part of Publicly Paid per Share Announced Plans or Programs August 1, 2023 through August 28, 2023 $ August 29, 2023 through October 1, 2023 1,995,168 $ 336.72 $ 673,000,000 1,995,168 October 2, 2023 through October 29, 2023 6,310,000 $ 364.60 $ 3,047,000,000 6,310,000 Total (2) 8,305,168 $ 359.10 $ 3,720,000,000 8,305,168 (1) In May 2022, our Board authorized the repurchase of up to $15.00 billion in shares of our common stock through December 2024 (the Initial 2022 Repurchase Plan). In August 2023, our Board authorized the repurchase of up to an additional $25.00 billion in shares, which has no expiration (the Additional 2022 Repurchase Plan and, together with the Initial 2022 Repurchase Plan, the 2022 Repurchase Plan). As of October 29, 2023, we had $25.24 billion of the repurchase authorization remaining from the Combined 2022 Repurchase Plan. (2) In the third quarter of fiscal year 2024, we repurchased 8,305,168 shares held back to satisfy employee tax obligations related to employee stock awards for $366.29 per share. These repurchases were made as part of publicly announced share repurchase programs and were retired upon repurchase and returned to the status of authorized but unissued shares of common stock. 39 We repurchase shares from employees to satisfy withholding tax obligations in connection with the vesting of RSUs. These repurchases are not made pursuant to our publicly announced plans or programs; and as a result, they are not included in the table above. For information regarding share repurchases made to satisfy employee withholding tax obligations, see Note 14 of the Notes to Condensed Consolidated Financial Statements. 40

The NVIDIA Corporation (NVDA) is solidifying its reputation as a formidable force in the technology sector, leveraging strategic partnerships and anticipating market trends while navigating a competitive landscape.

In the data center arena, NVIDIA's role has been significantly amplified with the prospect of partnering with YTL in Malaysia in a move set to enhance AI and cloud computing services in Southeast Asia. This initiative is indicative of NVIDIA's global expansion strategy, seeking to capitalize on the burgeoning demand for AI capabilities. Such global partnerships reflect the increasing dependency on NVIDIA's advanced GPU architectures like Hopper and Ampere, which have proven crucial for generative AI technologies. The company's financial results underscore this trend, with the Datacenter end-market business witnessing a revenue spike to $14.51 billion in Q3, indicating sustained enthusiasm in AI investments.

Elsewhere, the company's financial muscle is flexing with optimistic forecasts of $20 billion in revenues for Q4 fiscal 2024. This optimism rides high on the wave of AI adoption across industries, signaling NVIDIA's pivotal role in next-generation computing chips. Indeed, Zacks Equity Research bestows a #1 (Strong Buy) rank upon NVIDIA, reflecting its zealous market ascent in the face of stiff competition from other tech stalwarts.

The relationship between NVIDIA and the cryptocurrency market has also been prominently featured in analyses, as the company's GPUs are central to crypto-mining operations. As Bitcoin stages a 2023 resurgence, NVIDIA is poised to benefit from anticipated regulatory changes in the crypto arena and upcoming Bitcoin halving, enhancing its growth trajectory. The Zacks.com report propounds NVIDIA as an attractive investment choice, underlying the company's strong foothold in cutting-edge technology and its potential for leveraging trends in the volatile cryptocurrency market.

At the heart of NVIDIA's success story is its unparalleled contribution to the AI sector, securing a top spot amidst AI stock winners of 2023. As tech giants deploy significant AI service updates, an ongoing AI revolution is nurturing NVIDIA's meteoric rise, prompting a striking market cap milestone of $1-trillion. The company's GPUs are at the core of this AI fervor, enabling sophisticated AI computations and emerging as the cornerstone of technological progressions.

In comparison with other prominent tech players, NVIDIA's strategic focus on chipset innovations positions it as a preferred choice for investors enthralled by AI's transformative potential. Contrasting NVIDIA's P/S ratio to Amazon's suggests that NVIDIA's current market valuation is steep; however, NVIDIA's dedicated domination in AI chips offers a lucrative prospect against Amazon's multifaceted business approach.

Amid this competitive environment, NVIDIA's initiative to strengthen Vietnam's semiconductor sector serves as testament to its global ambition, fortifying its presence and enhancing Vietnam's technological prowess. Enhancing Vietnam's chip design and manufacturing capabilities, NVIDIA positions itself at the nexus of geopolitical trade diversification, while contributing to the country's escalating tech ambitions.

Investor interest has been further piqued by NVIDIA's financial resilience as the company demonstrated robust performance, with the Zacks Equity Research report from December 8, 2023, showcasing modest stock fluctuations and anticipating strong earnings growth. The consensus estimate revisions and favorable revenue projections fortify NVIDIA's trajectory, buoyed by an impressive 205.5% year-over-year revenue increase in the last reported quarter and consistent EPS estimate beats.

Despite its remarkable performance, NVIDIA has been speculated to partake in stock splits, aligning with the actions of other 'Magnificent Seven' companies like Meta Platforms. Technological advancements and proliferating stock prices render such speculation plausible, signifying NVIDIA's potential accessibility to a more diverse investor base.

Comparing NVIDIA's impressive stock price gains of nearly 11,950% over the past decade to that of its contemporaries, the company's agility in AI and the semiconductor industry cannot be understated. Thus, the discussion arising from The Motley Fool's December 9, 2023 analysis of another potential stock split for NVIDIA is telling of the company's market preeminence and the possible future considerations for investor involvement.

To enhance understanding of NVIDIA's market tactics and competitive pursuits, alternative perspectives are offered where other businesses, too, venture into AI chip production. The increasingly diverse ecosystem challenges NVIDIA's supremacy in the AI chips market. This shift underscores NVIDIA's need to navigate a space where competitors like AMD and Intel are also contending for AI chip market share, as highlighted by the analysis from The Motley Fool, dated December 9, 2023.

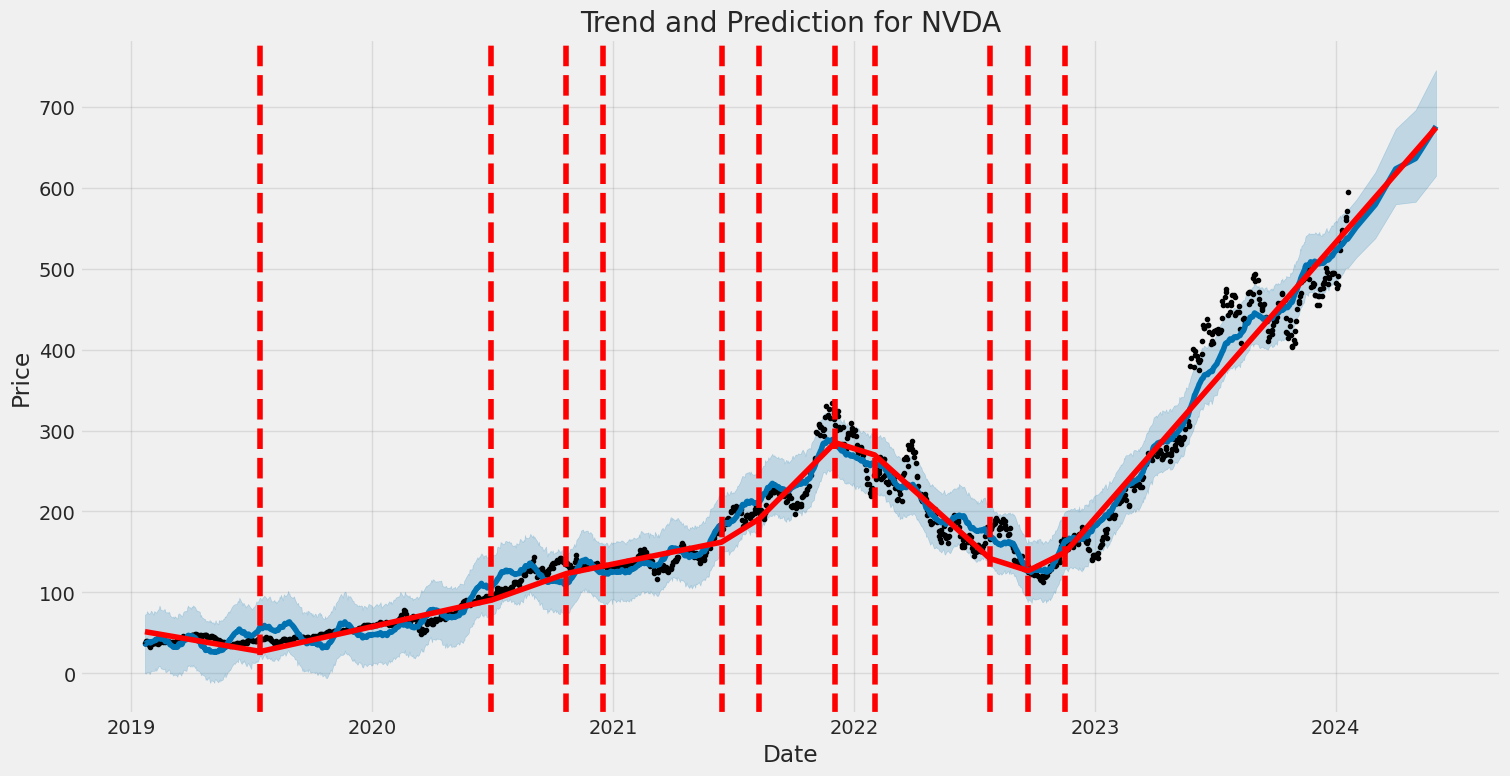

Over the span of 2019 to 2024, NVIDIA Corporation (NVDA) experienced a degree of volatility that can be summarized through statistical measures obtained from an ARCH model. Notably, the model shows that the variance of returns (a measure of volatility) changes over time, indicated by coefficients that dictate how past returns influence current volatility. Key features of this volatility include a base level of volatility (omega) significantly different from zero and the impact of previous returns on current volatility (alpha[1]), revealing a persistent characteristic in NVIDIA's return fluctuation.

Here is the HTML table with the table of statistics:

| Dep. Variable | asset_returns |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3,252.20 |

| AIC | 6,508.41 |

| BIC | 6,518.68 |

| No. Observations | 1,257 |

| omega | 9.1276 |

| alpha[1] | 0.1423 |

An investigation into the financial risk of a $10,000 investment in NVIDIA Corporation (NVDA) over a one-year span necessitates a detailed look at the company's past stock performance to forecast potential future volatility and returns. To achieve a nuanced understanding of the stock's volatility, a specific volatility modeling technique is employed. This methodology is centered around statistical models that are often used to estimate the level of variability in financial market returns, engendered by the intrinsic nature and dynamics of the market.

Utilizing this volatility modeling approach, historical stock prices are analyzed to model the conditional variance of NVDA's returns. It represents the fluctuations around the mean return that a stock has exhibited in the past, with a focus on persistency and mean reversion of volatility, providing an estimate of future volatility based on the latest market information. This is especially useful for understanding the risk profile of the stock and gauges the expected range of price movements which could occur with a certain probability.

To complement the understanding derived from the volatility model, a machine learning predictions technique is employed to forecast future stock returns. This particular method involves inputting historical stock data into an algorithmic model that can learn from the data patterns and predict future values. The role of this algorithmic model is to analyze complex relationships within the data that might not be immediately apparent or may not be captured by traditional statistical models. The prediction model yields insights into potential future performance by identifying underlying trends and features from historical price points, trading volumes, and other relevant financial indicators.

In assessing the potential risks of the investment, one pivotal metric that arises from the integration of volatility modeling and machine learning predictions is the Annual Value at Risk (VaR) at a 95% confidence level. The calculated VaR of $447.47 for a $10,000 investment represents the estimated maximum loss with a 95% probability that the investor should be prepared for over the course of a year, given normal market conditions. This metric offers a quantified risk assessment, providing a monetary figure that investors can use to gauge the extent of potential financial damage within the set probability threshold.

By understanding the stock's volatility as depicted by the mathematical volatility model and incorporating forecasts from the advanced predictive technique, investors are equipped with a sophisticated assessment of the risk associated with investing in NVIDIA Corporation. The resulting VaR figure synthesizes these analytical approaches, ultimately serving as a robust gauge for the investor's risk exposure over the designated time horizon.

Similar Companies in Semiconductors:

Intel Corporation (INTC), Report: Taiwan Semiconductor Manufacturing Company Limited (TSM), Taiwan Semiconductor Manufacturing Company Limited (TSM), Marvell Technology, Inc. (MRVL), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Advanced Micro Devices, Inc. (AMD), Broadcom Inc. (AVGO), Qualcomm Incorporated (QCOM), Texas Instruments Incorporated (TXN), Applied Materials, Inc. (AMAT), ASML Holding N.V. (ASML), Lam Research Corporation (LRCX)

https://www.zacks.com/stock/news/2195279/nvidia-nvda-ytl-reportedly-in-talks-on-data-center-deal

https://www.zacks.com/stock/news/2195317/3-stocks-to-buy-as-bitcoin-breaches-the-44-000-price-mark

https://www.proactiveinvestors.com/companies/news/1035676?SNAPI

https://seekingalpha.com/article/4656838-nvidia-shares-now-look-cheap-rating-upgrade

https://www.youtube.com/watch?v=WNPh6VZtDUQ

https://www.fool.com/investing/2023/12/08/better-artificial-intelligence-ai-stock-nvidia-vs/

https://www.fool.com/investing/2023/12/08/stock-split-watch-2-unstoppable-magnificent-seven/

https://www.fool.com/investing/2023/12/09/nvidia-is-not-the-only-company-making-ai-chips-her/

https://www.fool.com/investing/2023/12/09/stock-split-watch-is-nvidia-next/

https://www.fool.com/investing/2023/12/10/my-2-best-stocks-of-2023-not-named-nvidia/

https://www.zacks.com/stock/news/2195995/what-s-in-store-for-s-p-500-in-2024-5-top-picks

https://www.proactiveinvestors.com/companies/news/1035822?SNAPI

https://www.sec.gov/Archives/edgar/data/1045810/000104581023000227/nvda-20231029.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: aPt8Np

Cost: $1.19226

https://reports.tinycomputers.io/NVDA/NVDA-2024-01-20.html Home