NexGen Energy Ltd. (ticker: NXE)

2023-12-16

NexGen Energy Ltd. (ticker: NXE) is a Canadian-based uranium exploration and development company, predominantly known for its significant investments in the Athabasca Basin in Saskatchewan, which is a region renowned for having the worlds richest uranium deposits. The company's most notable project is the Arrow deposit, discovered in 2014, which is part of their Rook I property. NexGen Energy has been focused on advancing the Arrow project towards production, with a comprehensive set of pre-feasibility studies showcasing the deposits potential to become one of the largest and most significant uranium mines in the world. The firm is well-positioned to capitalize on the growing demand for clean energy sources, as nuclear power gains recognition for its role in reducing carbon emissions. Investors watch NXE closely, anticipating the progression from exploration to potential commercial production, and its implications for the uranium market and clean energy sector. As of the knowledge cutoff date, NexGen Energy Ltd. continues to explore strategic options, including partnerships and collaborations, to further develop its assets and enhance shareholder value.

NexGen Energy Ltd. (ticker: NXE) is a Canadian-based uranium exploration and development company, predominantly known for its significant investments in the Athabasca Basin in Saskatchewan, which is a region renowned for having the worlds richest uranium deposits. The company's most notable project is the Arrow deposit, discovered in 2014, which is part of their Rook I property. NexGen Energy has been focused on advancing the Arrow project towards production, with a comprehensive set of pre-feasibility studies showcasing the deposits potential to become one of the largest and most significant uranium mines in the world. The firm is well-positioned to capitalize on the growing demand for clean energy sources, as nuclear power gains recognition for its role in reducing carbon emissions. Investors watch NXE closely, anticipating the progression from exploration to potential commercial production, and its implications for the uranium market and clean energy sector. As of the knowledge cutoff date, NexGen Energy Ltd. continues to explore strategic options, including partnerships and collaborations, to further develop its assets and enhance shareholder value.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 3.55B | 2.96B | 2.32B | 1.87B | 2.12B | 1.76B |

| Enterprise Value | 3.41B | 2.94B | 2.27B | 1.83B | 2.07B | 1.68B |

| Trailing P/E | - | - | - | - | - | - |

| Forward P/E | - | - | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | - | - | - | - | - | - |

| Price/Book (mrq) | 7.52 | 8.97 | 6.88 | 6.04 | 6.88 | 5.55 |

| Enterprise Value/Revenue | - | - | - | - | - | - |

| Enterprise Value/EBITDA | -31.92 | -47.50 | -134.81 | -208.76 | -106.98 | -63.67 |

Technical Analysis of NXE:

Technical Analysis of NXE:

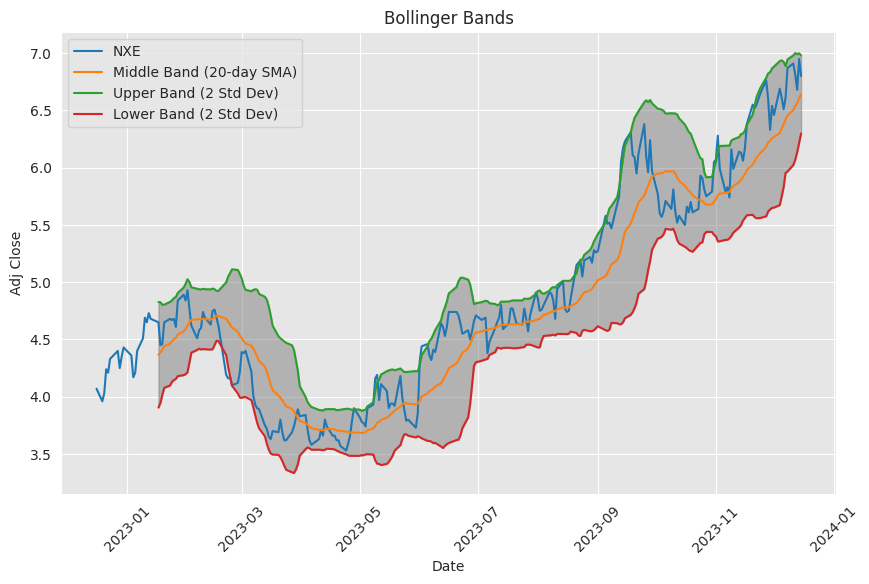

Based on the provided technical data for NXE on the last trading day, the analysis of several technical indicators gives mixed signals, with both bullish and bearish potential trends in view. To start with, NXE's Adjusted Close price is slightly below the Bollinger Band Middle (BBM_5_2.0), indicating there might be some bearish pressure in the short term. However, the stock price is above the 20-day Simple Moving Average (SMA_20) and the 50-day Exponential Moving Average (EMA_50), typically a bullish signal.

The Moving Average Convergence Divergence (MACD) is above the signal line, with the histogram value close to zero. This could suggest a slowing momentum, but it is still on the positive side, indicating potential upside in the near term. The Relative Strength Index (RSI_14) is 57.74, which is neither overbought nor oversold, signaling there is room for the stock price to move either direction without running into immediate resistance because of sentiment.

Stochastic indicators (STOCHk_14_3_3 and STOCHd_14_3_3) are showing overbought conditions which might signal a pullback or consolidation. The Average Directional Index (ADX_14) reading of 20.21 indicates a weak trend, suggesting that the stock may not show strong directional movement in the immediate future. The Williams %R (WILLR_14) offers a somewhat bullish outlook being above its oversold threshold.

The Chaikin Money Flow (CMF_20) is positive, which indicates buying pressure and suggests that there might be an inflow of money into the stock. However, in contradiction, the Parabolic SAR (PSAR) is below the current price, which typically suggests a bullish trend.

Examining the fundamental data, we see that NXE's market capitalization has been growing consistently over the past year, which reflects positively on investors' sentiment and could imply a growing company or greater investor interest. However, absence of P/E ratio and a negative enterprise value to EBITDA may concern investors, as it indicates the company may not be profitable currently.

The financials suggest that there has been a trend of negative net income, resulting in no reported earnings per share (EPS), which could dampen investor sentiment in the medium to long term. However, investors often look beyond current profitability towards future potential, especially within certain sectors where upfront investment and growth prospects are significant.

In conclusion, based on the technical indicators and fundamentals, NXE appears to have both positive and negative signals in the market, indicating potential volatility in the coming months. While technicals illustrate a stock that is in a mild bullish trend, potentially ready for a consolidation or minor retreat due to overbought conditions, the fundamentals make the picture less clear with the company's financial performance lacking profit. Investors should consider the growth in market cap as a sign of possible investor confidence but remain cautious due to the company's negative earnings and high price to book ratio. The potential price movement could therefore see some upside based on investor sentiment, but caution is warranted due to underlying financials. Continued observation of the technical indicators and market conditions, along with future performance updates and industry-specific news, will be crucial in forming a more solid stance on the stock's probable trajectory.

Uranium has long played a critical role in the global energy sector, serving as the key fuel for nuclear power generation. The industry faced a significant downturn following the Fukushima Daiichi nuclear disaster, an event that reshaped public perception and policy toward nuclear energy, causing Japan, a major uranium consumer, to shut down its reactors. This led to an oversupply of uranium and a prolonged period of depressed prices, adversely affecting companies such as NexGen Energy Ltd. (NXE), which saw their stocks perform poorly as demand dwindled.

This narrative began to change for NexGen Energy and its peers in the uranium industry on August 24, 2022, when Japan's Prime Minister announced a shift in the country's energy policy. With plans to reactivate idled reactors and construct new ones, Japan signaled a renewed commitment to nuclear energy. This strategic pivot played a role in potentially rejuvenating the global uranium market, offering a beacon of hope for suppliers that had long suffered from market oversupply.

The rekindled interest in nuclear energy is not isolated to Japan but represents a broader global trend. Energy independence and the pursuit of clean power alternatives have gained traction amid geopolitical conflicts, such as the disruption caused by the conflict between Russia and Ukraine. India's consideration of a mega-nuclear reactor to move away from coal is indicative of the strategic thinking that nuclear power might be integral to global clean energy ambitions.

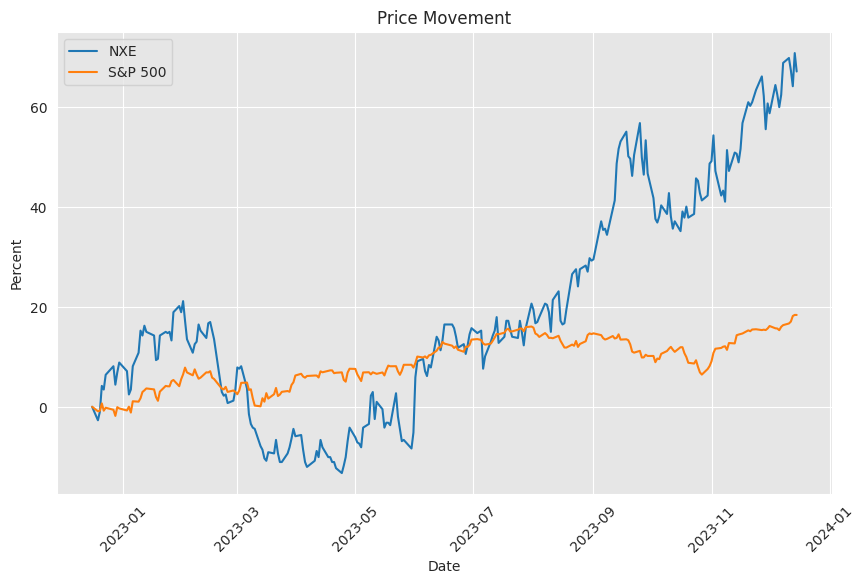

NexGen Energy's stock experienced a significant spike, demonstrating a strong market response to the prospect of increased demand for uranium. This resurgence in the sector was, however, tempered by concerns over potential oversupply with Kazatomproms announcement to increase production by 2024. Nonetheless, NexGen's prospects remain positive, buoyed by the broader nuclear energy renaissance.

Looking at NexGen's operational groundwork, the Rook I project stands out as a cornerstone asset for the company. Renowned for its high-grade uranium deposits, the Athabasca Basin of Saskatchewan is where NexGen is focusing its attention. Market performance has shown remarkable growth, with stocks soaring due to increased interest in clean energy and strategic project development.

NexGen's resilience and proactive stance amidst the pandemic position it favorably within the market. Continued exploration and drilling contribute to an optimistic investor sentiment, signaling confidence in NexGen's capabilities to supply the nuclear energy sector. Moreover, the involvement in a field with low-carbon energy potential enhances NexGen's market appeal.

Despite the appeal and NexGen's proactive strategies, it is essential to recognize these stocks' inherent volatility and risk. As a penny stock, NXE is subject to market fluctuations that can significantly impact investment outcomes. Nevertheless, the company's dedication to uranium exploration keeps it in the spotlight for investors eyeing energy sector opportunities, especially those inclined toward sustainable power sources.

The resurgence in interest for uranium investments, signaled by Japan's policy shift and global energy trends, has dramatically impacted companies like NexGen Energy. Japan's decision resonates as a broader market acknowledgment of nuclear power's essential role in future energy solutions. This redirection from a major market player like Japan can spur additional confidence and investment in the uranium sector, setting the stage for a potential long-term growth epoch.

With the Rook I project in Saskatchewan, NexGen Energy is carving a name for itself in the uranium exploration space. The significant appreciation in the company's market value reflects a positive response to both specific company developments and broader industry trends. The Athabasca Basin region provides an exciting exploration frontier for NexGen, with increased investor interest buoyed by positive drilling results.

Additionally, the broader energy penny stock market demonstrates the vibrancy and responsiveness to various stimuli, from industry news to advances in technology and regulation. The surge seen in NexGen's trading volume underlines the magnetism the company holds among investors, alongside an anticipation of potential growth within the clean energy sector.

NexGen Energy's story unfolds within the greater narrative of energy penny stocks, which are riding a bullish wave thanks to a resurgence in oil and gas demand, among other factors. With the company's stock price set against this backdrop, it reflects both the unique dynamics of the uranium market and the broader energy sector's revival. The company's focus on sustainable energy places it at an advantageous intersection in the market, considering current climate action goals.

NexGen's presence within the energy sector, and particularly the uranium segment, is further punctuated by its flagship project, the Arrow Deposit at Rook I. This asset showcases a sizable high-grade uranium resource, with promising economics that position the company for significant growth. The global push for a low-carbon future adds to the strategic value of NexGen's endeavors, setting its course in an industry on the brink of transformation.

While market sentiment can lead to short-term volatility, it is undeniable that the underlying demand for nuclear power positions NexGen Energy in a potentially favorable long-term trajectory. Geopolitical tensions and the quest for CO2 reduction solidify uranium's market relevance. As NexGen navigates these shifts, the company may find opportunities even in periods of downward pressure on stock prices.

Market sentiment and trends, such as China's exploration of thorium, can create both challenges and opportunities for companies like NexGen Energy. Despite short-term market dips, the global energy transition to cleaner sources entails an ongoing need for uranium. With the strengthening of nuclear energy prospects, NexGen Energy's focus on robust exploration and development in the uranium landscape becomes increasingly significant for investors.

With the initiation of exploration drilling programs at Rook I, NexGen Energy has raised expectations for untapped potential and expansion. Such proactive measures garner positive investor response, reflected in the companys significant stock appreciation over the year. The uptick in interest driven by the economic recovery and the shift to nuclear power underpins NexGen's growing prominence in the energy sector.

The impact of the Sprott Physical Uranium Trust on the uranium sector cannot be understated. As a large investment vehicle purchasing physical uranium, the fund has brought new liquidity and demand to the commodity. For NexGen Energy, this translates into enhanced market conditions that could drive further company growth and investor interest, capitalizing on an industry-wide resurgence.

Finally, the recent price surge in uranium to $60 per pound signifies the escalating global demand for clean energy sources. NexGen Energy's strategic developments, especially with its Rook I project, align with the demand trajectory, enhancing its market position. Amidst heightened investor interest and favorable analyst coverage, NexGen is well-poised to harness this momentum for strategic growth within the reviving uranium market.

Similar Companies in Uranium Production:

Report: Cameco Corporation (CCJ), Cameco Corporation (CCJ), Energy Fuels Inc (UUUU), Ur-Energy Inc. (URG), Denison Mines Corp (DNN), Fission Uranium Corp (FCUUF), Report: Uranium Energy Corp (UEC), Uranium Energy Corp (UEC), Paladin Energy Ltd (PALAF), Global Atomic Corporation (GLATF)

News Links:

https://www.fool.com/investing/2022/08/24/why-uranium-stocks-exploded-double-digits-today/

https://pennystocks.com/featured/2021/09/23/penny-stocks-watchlist-check-3-out/

https://www.fool.com/investing/2022/08/29/why-uranium-energy-all-uranium-stocks-jumped-today/

https://pennystocks.com/featured/2021/10/12/3-trending-penny-stocks-small-caps-watchlist-now/

https://pennystocks.com/?p=24185

https://seekingalpha.com/article/4530612-nexgen-energy-potential-delays-push-production-2030

https://www.fool.com/investing/2021/09/20/why-uranium-stocks-are-crashing-today/

https://pennystocks.com/featured/2021/09/13/these-penny-stocks-watchlist-why-should/

https://www.fool.com/investing/2021/07/20/the-big-reason-uranium-stocks-soared-today/

https://www.fool.com/investing/2023/09/15/why-shares-uranium-energy-nexgen-popped-this-week/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: NjzpXh

https://reports.tinycomputers.io/NXE/NXE-2023-12-16.html Home