Uranium Energy Corp. (ticker: UEC)

2023-12-16

Uranium Energy Corp. (UEC) is a U.S.-based uranium mining and exploration company engaged in the acquisition, exploration, and development of uranium projects. With a strategic focus on creating a pipeline of projects that can provide domestic sources of uranium for energy generation, UEC has positioned itself in key jurisdictions with historically significant uranium production. The company's portfolio includes projects at various stages, from exploration to permitted development, as well as a state-of-the-art ISR (In-Situ Recovery) mining technology that positions it favorably to capitalize on the growing global demand for nuclear energy. UEC's corporate strategy is underpinned by a goal to establish low-cost production capabilities and increase its resource base while adhering to strict environmental and safety standards. The company's stock is publicly traded, providing an investment vehicle for those looking to gain exposure to the uranium sector and the clean energy trend.

Uranium Energy Corp. (UEC) is a U.S.-based uranium mining and exploration company engaged in the acquisition, exploration, and development of uranium projects. With a strategic focus on creating a pipeline of projects that can provide domestic sources of uranium for energy generation, UEC has positioned itself in key jurisdictions with historically significant uranium production. The company's portfolio includes projects at various stages, from exploration to permitted development, as well as a state-of-the-art ISR (In-Situ Recovery) mining technology that positions it favorably to capitalize on the growing global demand for nuclear energy. UEC's corporate strategy is underpinned by a goal to establish low-cost production capabilities and increase its resource base while adhering to strict environmental and safety standards. The company's stock is publicly traded, providing an investment vehicle for those looking to gain exposure to the uranium sector and the clean energy trend.

| As of Date: 12/16/2023Current | 10/31/2023 | 7/31/2023 | 4/30/2023 | 1/31/2023 | 10/31/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 2.49B | 2.32B | 1.36B | 979.77M | 1.50B | 1.54B |

| Enterprise Value | 2.47B | 2.30B | 1.34B | 957.36M | 1.48B | 1.52B |

| Trailing P/E | 634.00 | - | 334.32 | 37.29 | 201.50 | 210.50 |

| Forward P/E | 158.73 | 169.49 | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 22.38 | 13.20 | 10.07 | 7.52 | 15.16 | 50.91 |

| Price/Book (mrq) | 3.65 | 3.67 | 2.19 | 1.57 | 2.59 | 4.71 |

| Enterprise Value/Revenue | 23.03 | 21.26k | 34.40 | 47.35 | 30.93 | 26.51 |

| Enterprise Value/EBITDA | 524.78 | 1.86k | 465.44 | -90.43 | 132.58 | -490.40 |

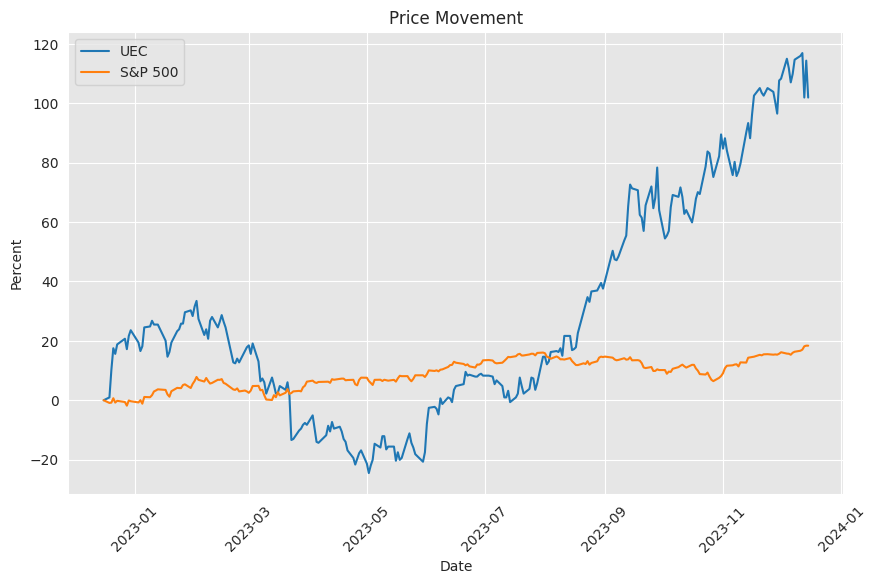

Upon reviewing the provided technical analysis data for UEC on the last trading day alongside its fundamental backdrop, there is a blend of indicators suggesting a moderate sentiment amongst investors, with potential catalysts for both bullish and bearish movements in the stock price.

Upon reviewing the provided technical analysis data for UEC on the last trading day alongside its fundamental backdrop, there is a blend of indicators suggesting a moderate sentiment amongst investors, with potential catalysts for both bullish and bearish movements in the stock price.

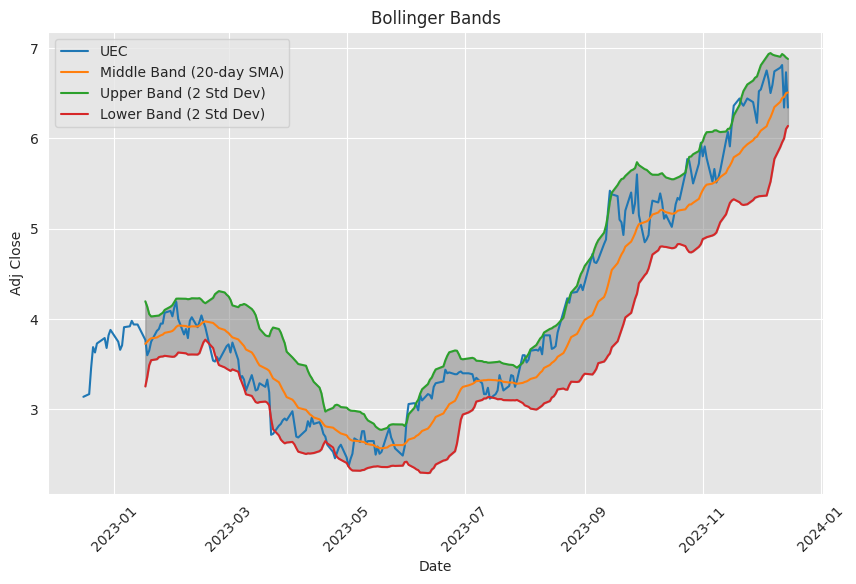

Technical Indicators: - The Adjusted Closing Price is positioned above the 20-day simple moving average (SMA) and the 50-day exponential moving average (EMA), demonstrating short-term and moderately long-term positive momentum. - MACD is above the signal line but with a negative histogram value, which may indicate a slow-down in the bullish momentum or potential consolidation. - A relatively neutral RSI (50.16) points towards a balanced force between buyers and sellers. - Bollinger Bands show the price hovering closer to the upper band, often an indicator of strength; however, caution is warranted for possible pullbacks. - The ADX (26.54) suggests a present but not strong trend, which could mean the potential for trend continuation or trend weakness. - The Stochastic Oscillator (STOCHk) and its 3-day moving average (STOCHd) are not in oversold or overbought territory, which allows for flexibility in directional movement. - The Chaikin Money Flow (CMF) indicator is positive, which could mean buying pressure and possible continuation of an uptrend.

Fundamental Analysis: - Looking at the fundamentals, there has been an increase in Market Cap indicating investor confidence and potential growth. - However, the company faces high valuations with a substantial trailing P/E ratio, which may deter value investors. - A high Price/Sales ratio suggests the market is pricing in strong future sales growth, but it also increases risk. - The Enterprise Value/Revenue is quite elevated, reflecting investor expectations for future profitability. - Financials reveal a history of losses and unusual items impacting profits, which may raise concerns over the company's ability to sustain profitability.

Given the combination of technical and fundamental factors, the stock may experience some volatility in the coming months, with a possible uptrend if investor sentiment remains positive and the company demonstrates improvements in operational efficiency and earnings. However, the high valuation ratios pose a risk of correction should the market reassess its growth expectations or should any negative company-specific or economic news arise. The stock appears to be in a bit of equilibrium with an equal possibility for continuation of an uptrend or a retraction to mean value. Investors are recommended to watch for signs such as a clear break above resistance levels, maintaining a positive MACD and CMF, or conversely, warning signs including breaks below key support levels, a negative trend in MACD, and declining CMF values.

In conclusion, while current technical indicators coupled with fundamental business growth aspects hint at continued investor optimism and might support a gradual upward trend in UECs stock price, caution is advised in light of its high valuation multiples and recent financial performance that may constrain rapid price appreciation. A careful monitoring of market sentiment, financial developments within the company, and broader economic conditions will be crucial for investors looking to navigate the months ahead.

Investing in penny stocks like Uranium Energy Corp. (UEC) requires an appreciation of both the potential rewards and the specific factors that contribute to the heightened risk and volatility characteristic of low-priced equities. Research and a strategic approach to investment, detailed analysis of financial health, management team assessment, and regulatory considerations form the cornerstone of penetrating the nuanced market space in which UEC operates.

An understanding of industry and market trends is essential in this sector. The uranium market and the demand for nuclear energy are primary drivers for a company like UEC. With the world increasingly turning towards cleaner energy, the appetite for nuclear power is rising, potentially providing a tailwind for companies engaged in uranium mining and exploration. The ever-evolving policies surrounding clean energy initiatives also play a crucial role in influencing the trajectory of companies like UEC. So too does the regulatory environment, which can either facilitate or hinder the operations of such entities, depending on legislative changes and international treaties.

Analyzing a company's financial health is paramount. UEC's financial statements reveal the underlying strength of its assets, potential revenue streams, profitability, and cash flow all indicative of its ability to sustain operations and expand. The potential for growth in UEC is predicated on its being able to capitalize on its assets while maintaining a prudent level of debt and positive cash flow.

The competency of the management team is a significant factor in the future success of UEC. An experienced team with a strong strategy can prove to be an asset for the company, fostering growth and innovation. Rigorous scrutiny of the team's industry knowledge, historical performance, and strategic initiatives offers investors valuable insight into the management's capability to navigate the complexities of the uranium sector.

UEC has redefined its market strategy through purchases and subsequent sales of uranium in the spot market, rather than extracting it through mining operations. This has produced tangible financial results for UEC, demonstrated by a substantial increase of revenue compared to previous quarters of no revenue. Strategic acquisitions such as UEX, the Roughrider project, and contracts such as the $17.85 million award from the DOE have bolstered this pivot in strategy, setting UEC on a new course of action in the energy sector.

Legislative support plays a pivotal role in the fortunes of Uranium Energy Corp. The Fiscal Responsibility Act of 2023 and the earlier Inflation Reduction Act signal ongoing government backing for the nuclear energy sector, including potential funding and incentives for companies like UEC. Furthermore, cultural shifts such as the discussions fueled by Oliver Stone's pro-nuclear power documentary and his subsequent appearance on "The Joe Rogan Experience" podcast may influence public opinion and, by proxy, investor sentiment.

Short interest in UEC shares has been a notable factor in the company's stock market performance. With financial analysts and tools indicating a possibility of a short squeeze, the company's stock presents a speculative interest for those tuned into market dynamics and fluctuations influenced by short-seller activities. The UEC spotlight has also been amplified by evolving geopolitical tensions and the increasing relevance of nuclear energy, envisaging a complex but potentially rewarding landscape for attentive investors.

The recent milestone where uranium prices soared past $60 per pound has reignited investor enthusiasm for UEC's shares. As one of the beneficiaries of this market upturn, UEC has seen its stock value surge in tandem with broader industry optimism. Projections of a rise in global uranium demand, geopolitical supply anxieties, and the company's strategic holdings have collectively positioned UEC favorably in financial markets.

Yet, even as UEC's shares enjoy speculative appeal, the risks and challenges of transitioning from a stockpiler and trader of uranium to an active mining operator loom large. The company confronts considerable uncertainties associated with such a strategic shift, including operational risks, uranium market volatility, and the arduous task of developing mining assets effectively. Despite the current stock performance, UEC's future hinges on its ability to proficiently manage the confluence of external market pressures and internal development strategies.

The investment narrative of UEC is also tied intimately to uranium commodity price movements. Given that UEC has a policy of not engaging in futures contracts for uranium sales, the company stands to benefit substantially from rising prices, yet similarly risks the fallout from any price slumps. The historic fluctuation in uranium prices further underscores the precarious nature of investment in UEC. Although the current momentum in the nuclear power industry bodes well for the company, potential investors should carefully weigh their optimism against the possibility of market contractions affected by sector-specific and worldly events.

In light of the critical report published by Kerrisdale Capital, skepticism towards UEC's operational strategy and its impact on long-term sustainability has intensified. The report raises concerns about UEC's revenue sources, the profitability of its mining endeavors at current market prices, and the potentially dilutive effect of its share issuing practices. Following the steep decline in UEC's stock price after the report's release, investors have been presented with a starkly different perspective on its prospects, emphasizing the importance of critically evaluating claims and developments when making investment decisions. It must be noted, however, that market conditions are subject to change, and should uranium prices experience an upturn or UEC enhance its mining proficiency, the narrative could shift in favor of UEC's growth.

Investing in UEC demands scrutiny and recognition of both the company's strengths and the challenges it faces. With strategic buys and sells, sector-specific knowledge, and an acute awareness of the volatility in penny stocks like UEC, investors can navigate the minefield that is speculative investing. While there is potential for gain, especially in the current energy climate, there is also a significant need for measured consideration and due diligence.

Similar Companies in Uranium:

Report: Cameco Corporation (CCJ), Cameco Corporation (CCJ), Report: Energy Fuels Inc (UUUU), Energy Fuels Inc (UUUU), Report: NexGen Energy Ltd. (NXE), NexGen Energy Ltd. (NXE), Denison Mines Corp (DNN), Ur-Energy Inc. (URG), Fission Uranium Corp. (FCUUF), Global X Uranium ETF (URA)

News Links:

https://pennystocks.com/featured/2023/03/19/research-tips-investing-penny-stocks/

https://www.fool.com/investing/2022/12/23/why-uranium-energy-stock-zoomed-this-week/

https://www.fool.com/investing/2023/06/01/why-shares-of-uranium-energy-cameco-and-energy-fue/

https://www.fool.com/investing/2023/09/15/why-shares-uranium-energy-nexgen-popped-this-week/

https://pennystocks.com/featured/2023/03/26/penny-stocks-market-timing-when-buy-sell/

https://www.fool.com/investing/2023/12/15/warning-this-skyrocketing-stock-has-a-hidden-risk/

https://www.fool.com/investing/2023/12/08/up-80-in-a-year-is-this-nuclear-power-stock-set-to/

https://www.fool.com/investing/2023/03/24/why-uranium-energy-stock-keeps-going-down/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: Kh5fQz

https://reports.tinycomputers.io/UEC/UEC-2023-12-16.html Home