PotlatchDeltic Corporation (ticker: PCH)

2024-06-13

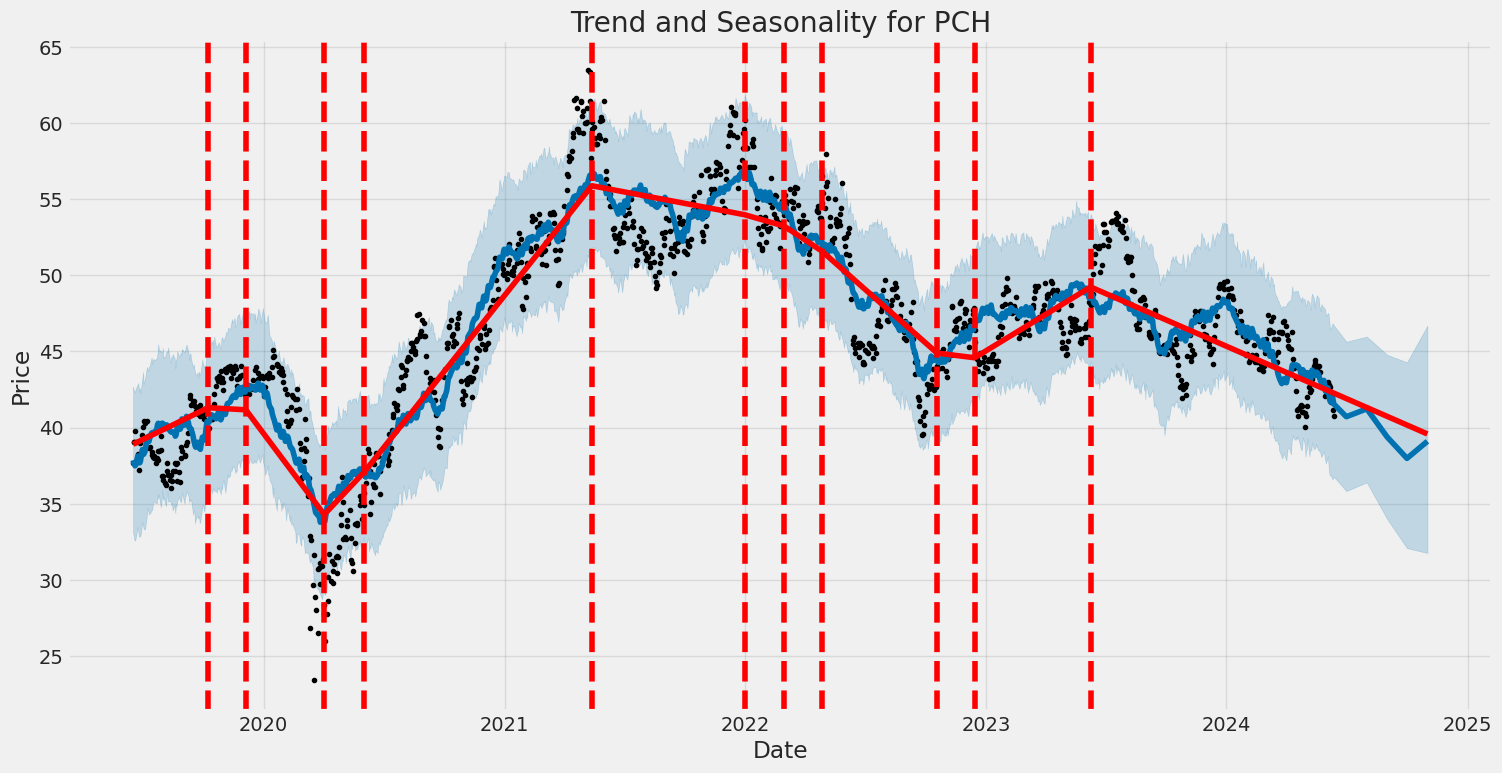

PotlatchDeltic Corporation (ticker: PCH) is a leading Real Estate Investment Trust (REIT) focused on the ownership and management of forestland in the United States. The company operates through three main segments: Timberlands, Wood Products, and Real Estate. PotlatchDeltic's timberlands segment involves the sustainable management of approximately 1.8 million acres of forestlands, generating revenue through the sale of timber and the strategic sale of higher and better use (HBU) lands. The wood products segment manufactures and markets lumber, plywood, and other wood products, further integrating the value chain from forest to end-user. The Real Estate division actively engages in selling rural and recreational lands, development properties, and commercial real estate, leveraging the value of their extensive land holdings. Founded in 1903 and headquartered in Spokane, Washington, PotlatchDeltic capitalizes on a century-long legacy of resource stewardship and industry expertise. Through its diversified yet synergistic business model, the corporation aims to maximize shareholder value while adhering to sustainable forestry practices.

PotlatchDeltic Corporation (ticker: PCH) is a leading Real Estate Investment Trust (REIT) focused on the ownership and management of forestland in the United States. The company operates through three main segments: Timberlands, Wood Products, and Real Estate. PotlatchDeltic's timberlands segment involves the sustainable management of approximately 1.8 million acres of forestlands, generating revenue through the sale of timber and the strategic sale of higher and better use (HBU) lands. The wood products segment manufactures and markets lumber, plywood, and other wood products, further integrating the value chain from forest to end-user. The Real Estate division actively engages in selling rural and recreational lands, development properties, and commercial real estate, leveraging the value of their extensive land holdings. Founded in 1903 and headquartered in Spokane, Washington, PotlatchDeltic capitalizes on a century-long legacy of resource stewardship and industry expertise. Through its diversified yet synergistic business model, the corporation aims to maximize shareholder value while adhering to sustainable forestry practices.

| Full-Time Employees | 1,384 | Previous Close | 41.04 | Open | 42.21 |

| Day Low | 40.73 | Day High | 42.28 | Volume | 595,795 |

| Average Volume | 380,188 | Average Volume (10 Days) | 400,890 | Market Cap | 3,246,269,184 |

| 52-Week Low | 39.86 | 52-Week High | 54.44 | Fifty Day Average | 42.8476 |

| Two Hundred Day Average | 45.2137 | Enterprise Value | 4,138,424,320 | Float Shares | 77,866,955 |

| Shares Outstanding | 79,508,200 | Shares Short | 1,260,616 | Profit Margins | 0.0458 |

| Revenue | 994,240,000 | Debt | 1,055,566,016 | Cash | 180,150,000 |

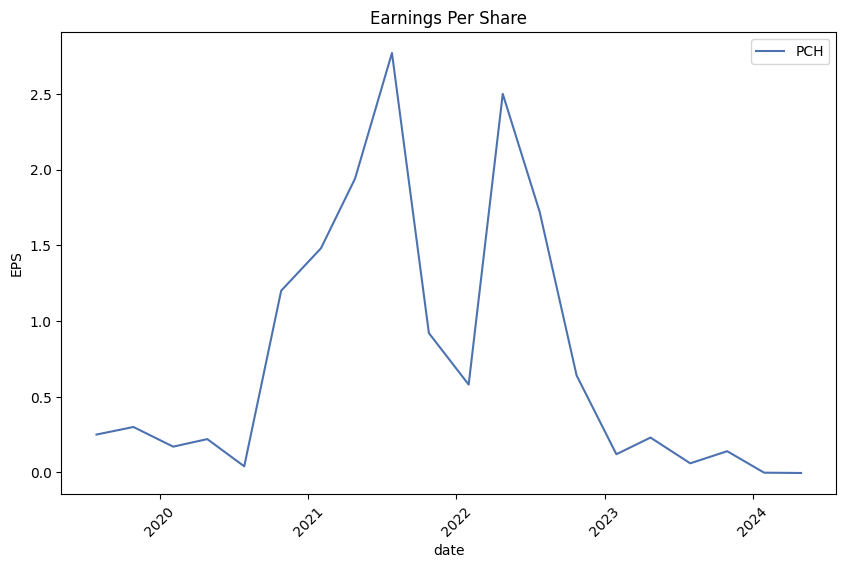

| Earnings Per Share (EPS) | 0.57 | Forward EPS | 0.82 | Price to Book Ratio | 1.5043203 |

| Trailing Price to Earnings (PE) Ratio | 71.47369 | Forward PE Ratio | 49.68293 | EBITDA | 147,924,992 |

| Dividend Rate | 1.8 | Dividend Yield | 0.043899998 | Five Year Avg Dividend Yield | 3.68 |

| Beta | 1.178 | Price to Sales Ratio | 3.265076 | Net Income to Common | 45,536,000 |

| Book Value | 27.082 | Total Cash Per Share | 2.266 | Free Cash Flow | 84,178,624 |

| Operating Cash Flow | 136,000,992 | Gross Margins | 0.10747 | Operating Margins | -0.01998 |

| EBITDA Margins | 0.14878 | Return on Assets | 0.00509 | Return on Equity | 0.02079 |

| Revenue Growth | -0.116 | Debt to Equity | 49.021 | Quick Ratio | 0.795 |

| Current Ratio | 1.417 | Shares Short Prior Month | 1,405,679 | Short Ratio | 3.22 |

| Sharpe Ratio | -0.865400 | Sortino Ratio | -14.701159 |

| Treynor Ratio | -0.203765 | Calmar Ratio | -0.696591 |

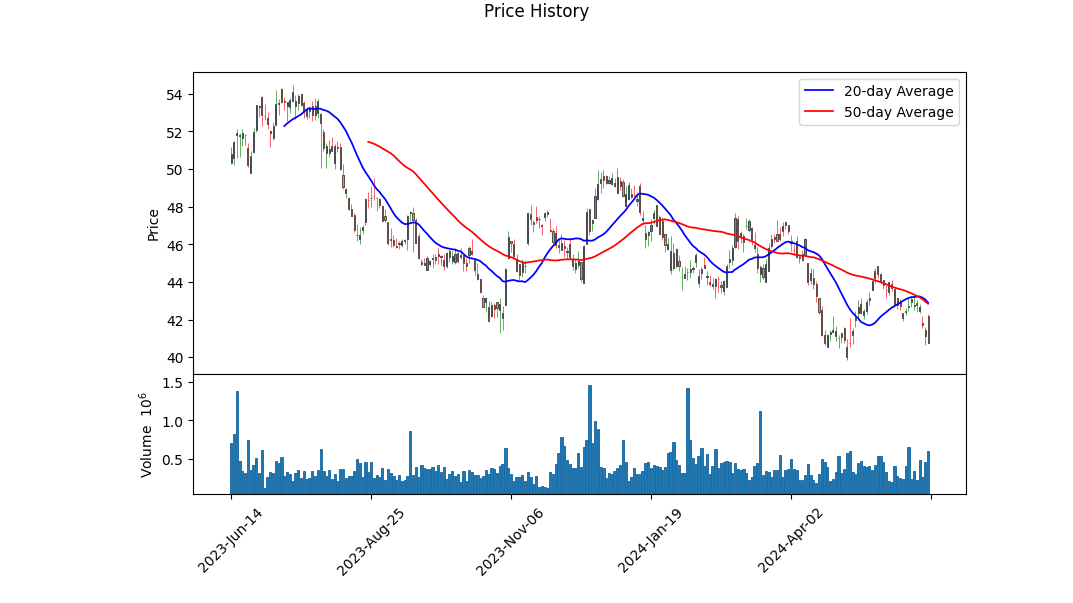

The technical analysis of PCH shows a declining momentum as evidenced by several technical indicators. The On-Balance Volume (OBV) has shown a decreasing trend from 0.365 million on June 5 to 0.185 million on June 12, indicating waning buying pressure. The Moving Average Convergence Divergence (MACD) histogram is also negative and has been deepening, suggesting a bearish trend in the near term.

From a fundamental perspective, PCH displays a mixed financial health. Although the company has a good gross margin of 10.747%, the operating margin is negative at -1.998%, which points to inefficiencies in managing operating expenses. This is a concern for sustained profitability. The net income stands at $62.101 million, which is positive, but there are significant debts amounting to $1.034 billion, which might weigh on future earnings due to interest obligations.

When adjusting for risk using financial ratios like Sharpe, Sortino, Treynor, and Calmar, PCH displays negative values across all metrics. This indicates poor risk-adjusted returns. Specifically, the Sharpe Ratio of -0.8654 suggests that the stock is not providing sufficient returns for the level of risk taken. The Sortino Ratio is much worse at -14.7012, emphasizing the extent of negative returns. The Treynor Ratio of -0.2038 further corroborates that investors are not being compensated adequately for the systematic risk assumed. Finally, the Calmar Ratio stands at -0.6966, reinforcing the narrative of poor performance relative to the drawdown risk.

The company's financial statements further confirm some fundamental concerns. The total revenue for 2023 stands at $1.024 billion, whereas the cost of revenue is nearly $900 million, leading to a gross profit of approximately $124.497 million. However, after accounting for operating expenses and other financial costs, the net income drops significantly. Notably, the significant amount of gross debt ($1.034 billion) and net debt ($803.61 million) could pose challenges for the company's liquidity and financial flexibility.

The Altman Z-Score of 1.8315 suggests that PCH is in the "gray zone," meaning it is not immediately at risk of bankruptcy but also not entirely safe from financial distress. A Piotroski Score of 7 indicates reasonably good financial health, but it should be interpreted cautiously in conjunction with other metrics.

Given this synthesis of technical indicators and fundamental data, the outlook for PCH over the next few months appears to be bearish to neutral. The combination of declining technical momentum, poor risk-adjusted returns, and mixed financial health suggests limited upside potential. Investors might approach with caution, given the potential for continued downward pressure or limited recovery in stock price. Any strategic investment should be carefully weighed against these risk factors and closely monitored for changes in market conditions or new financial developments.

PotlatchDeltic Corporation (PCH) demonstrates a return on capital (ROC) of 5.31%, which provides insight into the company's efficiency in allocating its capital under its control to profitable investments. This metric suggests that for every dollar of capital invested in the business, PCH is generating approximately 5.31 cents in return, which can be compared to industry peers to assess relative performance. Additionally, the earnings yield for PCH stands at 1.91%, indicating the companys earnings relative to its market value. An earnings yield of 1.91% implies that for every dollar invested in PCH, the company generates 1.91 cents in earnings. Both these metrics are key components in evaluating the companys financial health and operational efficiency, oftentimes utilized in investment decision-making frameworks such as the one proposed in "The Little Book That Still Beats the Market." However, these figures should be contextualized with additional qualitative and quantitative analyses for a comprehensive investment assessment.

Research Report on PotlatchDeltic Corporation (PCH) Based on Benjamin Graham's Criteria

Benjamin Graham's "The Intelligent Investor" offers a solid framework for identifying fundamentally sound investment opportunities. His methodology, heavily grounded in value investing principles, serves as an excellent benchmark for evaluating the financial health and intrinsic value of PotlatchDeltic Corporation (PCH). Below, we assess PCH using some of the key metrics defined by Graham:

1. Margin of Safety

Graham's margin of safety principle is essential but requires a direct comparison between PCH's market price and its intrinsic value, derived from comprehensive analysis. For this initial evaluation, we hinge more on financial ratios to gauge value.

2. Debt-to-Equity Ratio

- PCH's Debt-to-Equity Ratio: 0.486

- Grahams Preference: Low

With a debt-to-equity ratio of 0.486, PCH demonstrates a relatively low financial leverage. Graham favored companies with low debt levels, which aligns well here; lower debt implies less risk related to financial obligations, making PCH a stable candidate in this respect.

3. Current and Quick Ratios

- PCHs Current Ratio: 1.436

- PCHs Quick Ratio: 1.436

- Grahams Preference: High enough to cover short-term liabilities comfortably

Both the current and quick ratios of PCH stand at 1.436. This indicates PCH has more than enough short-term assets to cover its short-term liabilities, underscoring financial stability. Graham would consider this a positive indicator of the company's capability to honor its short-term obligations.

4. Earnings Growth

While specific data on PCH's historical earnings growth is not provided in this context, Graham preferred consistent earnings growth over time. Investors should further scrutinize PCHs earnings history to determine if it meets this criterion.

5. Price-to-Earnings (P/E) Ratio

- PCHs P/E Ratio: 10.482

- Grahams Preference: Low, ideally below 15

PCH's P/E ratio of 10.482 is indicative of a relatively low price compared to its earnings, suggesting that the stock might be undervalued. This low P/E ratio is well within Grahams preferred range, potentially making PCH an attractive value investment.

6. Price-to-Book (P/B) Ratio

- PCHs P/B Ratio: 0.944

- Grahams Preference: Below 1 or close to book value

A P/B ratio of 0.944 suggests that PCHs market price is slightly below its book value, which aligns favorably with Graham's criteria. Stocks trading below their book value are often considered undervalued, providing a cushion or "margin of safety."

Conclusion

When evaluated against Benjamin Graham's stringent criteria:

- Debt-to-Equity Ratio: Favorable; aligns with low financial risk.

- Current and Quick Ratios: Favorable; indicates financial stability.

- P/E Ratio: Favorable; suggests potential undervaluation.

- P/B Ratio: Favorable; stock trading below book value.

Based on these metrics, PotlatchDeltic Corporation (PCH) appears to largely comply with Graham's value investing principles, making it a potentially viable candidate for a value-focused investment portfolio. However, it is imperative to conduct further in-depth analysis, particularly regarding earnings growth and intrinsic value calculation, to make an informed final decision.### Analyzing Financial Statements

Analyzing financial statements is a cornerstone of evaluating a company's financial health and future prospects. Benjamin Graham, in his seminal work "The Intelligent Investor," stressed the importance of thoroughly examining a company's financial statementsincluding the balance sheet, income statement, and cash flow statementto gain insights into its financial condition.

Balance Sheet Analysis

The balance sheet provides a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time. By examining PotlatchDeltic Corporation's (PCH) recent balance sheets from the data provided, several key metrics emerge:

Assets

- Current Assets: As of the latest period in 2024, PotlatchDeltic had $369,698,000 in current assets. This includes:

- Cash and Cash Equivalents: $180,150,000

- Accounts Receivable: $27,132,000

-

Inventory: $77,572,000

-

Non-Current Assets: Significant components include:

- Property, Plant, and Equipment: $375,891,000 (net)

- Timber and Timberlands: $2,415,818,000 (net)

- Other Non-Current Assets: $151,960,000 for intangible assets and $176,812,000 for other non-current assets.

Liabilities

- Current Liabilities: As of the latest period in 2024, PotlatchDeltic had $260,886,000 in current liabilities, which includes:

- Accounts Payable and Accrued Liabilities: $80,697,000

-

Current Portion of Long-Term Debt: $175,654,000

-

Non-Current Liabilities: Totaling $858,365,000 in long-term debt with additional deferred tax liabilities and other liabilities amounting to substantial figures.

Stockholders' Equity

- Common Stock Value: $79,508,000

- Additional Paid-in Capital: $2,306,499,000

- Retained Earnings (Accumulated Deficit): -$351,463,000

- Total Equity: $2,153,272,000

The balance sheet indicates that PotlatchDeltic Corporation has robust asset bases, particularly in timber and timberlands, counterbalanced by significant long-term debt and accumulated deficits.

Income Statement Analysis

The income statement reveals the company's revenue, expenses, and profitability over a specific period. Important figures from the latest reports include:

Revenue and Expenses

- Revenue: According to the Q1 2024 data, revenue from contracts with customers was $257,962,000.

- Cost of Goods Sold (COGS): $224,350,000, resulting in a gross profit of $33,612,000.

- Operating Expenses: Including selling, general, and administrative expenses ($18,230,000), leading to an operating income of $13,173,000.

- Net Income: For Q1 2024, the net income was $16,260,000 after accounting for other expenses and taxes.

Profitability Metrics

- Operating Margin: Operating Income of $13,173,000 on Revenue of $257,962,000, suggesting an operating margin of approximately 5.1%.

- Net Margin: Net Income of $16,260,000 on Revenue of $257,962,000 indicates a net margin of approximately 6.3%.

Overall, PotlatchDeltic's income statements reflect profitability, although specific quarterly results may fluctuate, as evidenced by comparing various quarters.

Cash Flow Statement Analysis

The cash flow statement details the cash inflows and outflows over a period, highlighting the company's liquidity and financial flexibility. Key figures include:

Operating Activities

- Net Cash Provided by Operating Activities: In Q1 2024, the company reported net cash flow from operating activities of $39,139,000. This is primarily driven by adjustments for non-cash items like depreciation and changes in working capital.

Investing Activities

- Investing Cash Flows: Significant cash outflows for property, plant, and equipment purchases ($4,255,000) and timberlands ($6,118,000), resulting in a net cash flow used in investing activities of -$4,896,000 for Q1 2024.

Financing Activities

- Financing Cash Flows: Payments for debt and dividends significantly impact financing cash flows, which in Q1 2024 amounted to a net cash outflow of -$36,800,000.

PotlatchDeltic Corporation demonstrates positive cash flows from operating activities, essential for sustaining operations and investing in growth, but also shows substantial cash outflows in financing activities, reflecting debt repayments and dividend payments.

Conclusion

Analyzing PotlatchDeltic Corporations financial statements provides a comprehensive view of its financial health. The company exhibits substantial asset bases, particularly in timberlands, a key revenue driver. Despite significant long-term debt and accumulated deficits, PotlatchDeltic remains profitable with steady revenue streams. Monitoring operating, investing, and financing cash flows is critical for understanding liquidity and ongoing financial requirements.

By following Benjamin Graham's approach to meticulously examining these financial documents, investors can make well-informed decisions, identifying both the strengths and preemptive measures required to mitigate potential financial risks.Dividend Record

Benjamin Graham, in his seminal book The Intelligent Investor, emphasized the importance of selecting companies that have a consistent history of paying dividends. This trait is indicative of a company's financial health, management's commitment to distributing profits, and an established business model capable of generating consistent cash flows.

Dividend History for Symbol: PCH

Below is a detailed record of the dividends paid by the company identified by the symbol PCH. This record illustrates the company's consistency and reliability in paying dividends.

Recent Years Dividends:

- 2024

- June 07: $0.45

-

March 07: $0.45

-

2023

- December 14: $0.45

- September 14: $0.45

- June 01: $0.45

-

March 02: $0.45

-

2022

- December 20: $0.95

- December 13: $0.45

- September 19: $0.44

- June 02: $0.44

-

March 03: $0.44

-

2021

- December 21: $4.00

- December 14: $0.44

- September 14: $0.41

- June 03: $0.41

-

March 04: $0.41

-

2020

- December 14: $0.41

- September 14: $0.40

- June 04: $0.40

-

March 05: $0.40

-

2019

- December 13: $0.40

- September 12: $0.40

- June 06: $0.40

-

March 07: $0.40

-

2018

- December 17: $0.40

- September 26: $3.54

- September 13: $0.40

- June 06: $0.40

- March 06: $0.40

Earlier Years:

- 2017

- December 07: $0.40

- September 14: $0.375

- June 05: $0.375

-

March 03: $0.375

-

2016

- December 09: $0.375

- September 16: $0.375

- June 06: $0.375

-

March 02: $0.375

-

2015

- December 14: $0.375

- September 14: $0.375

- June 04: $0.375

-

March 04: $0.375

-

2014

- December 12: $0.375

- September 12: $0.35

- June 04: $0.35

- March 05: $0.35

Historical Observations:

- PCH has maintained a consistent pattern of paying dividends quarterly.

- Dividends have experienced increases and special or extra payouts (e.g., a significant $4.00 dividend in December 2021).

- Over the decades, PCH has gradually increased its dividend payouts, reflecting growth and stable financial performance.

- The long history of dividend payments dating back to at least 1987 indicates robustness and a commitment to shareholder value.

For a long-term investor like those guided by Benjamin Graham's principles, this extensive history of dividend payments is a positive indicator of the company's stability and reliability.

| Alpha | 0.1432 |

| Beta | 1.1256 |

| R-Squared | 0.751 |

| P-Value | 0.042 |

| Standard Error | 0.082 |

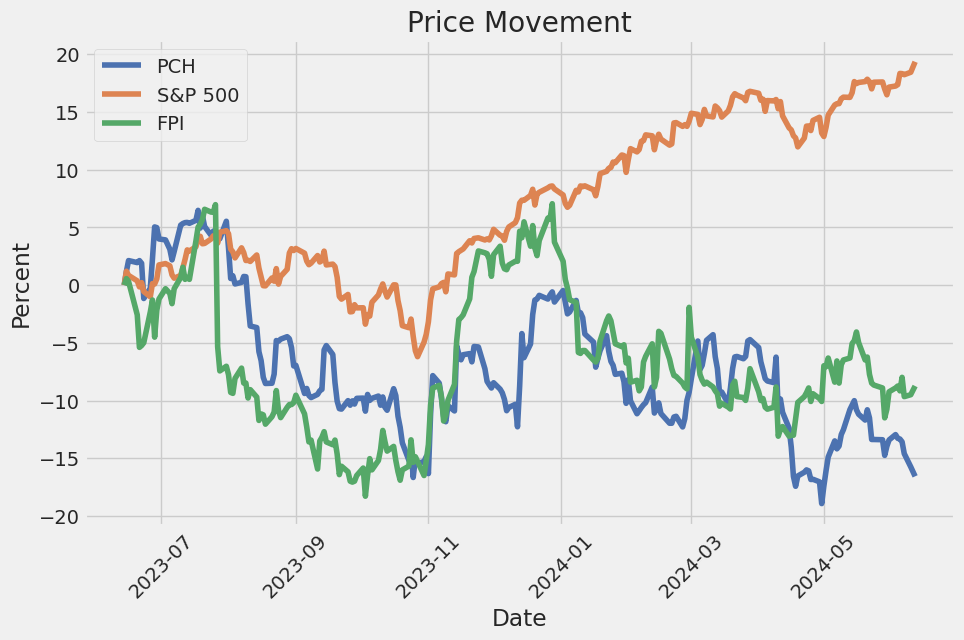

The linear regression model between PCH and SPY indicates a positive alpha value of 0.1432. This suggests that PCH has delivered an excess return over what would be predicted by its relationship with the market as represented by SPY. A positive alpha is generally interpreted as an indication of the stock outperforming the market on a risk-adjusted basis, considering the time period analyzed. It reveals that PCH has additional value not captured by its exposure to market movements.

With a beta of 1.1256, the regression model shows that PCH is slightly more volatile compared to SPY, meaning it tends to amplify market movements. An R-squared value of 0.751 demonstrates that approximately 75.1% of PCHs movements can be explained by fluctuations in SPY, indicating a strong level of correlation. The p-value of 0.042, being less than 0.05, suggests that the results are statistically significant, and the model's standard error of 0.082 reflects the accuracy of the regression estimates.

PotlatchDeltic Corporation (PCH) hosted its Q1 2024 earnings call, during which Vice President and CFO Wayne Wasechek and President and CEO Eric Cremers provided an overview of their recent financial performance and strategic initiatives. The company reported an adjusted EBITDA of $30 million, facing challenges from market conditions and weather. The Timberlands segment generated an adjusted EBITDA of $35 million with notable operating strength, demonstrating a harvest of 1.9 million tons, meeting the upper range of their Q1 targets. The Wood Products segment showed improvement, achieving breakeven adjusted EBITDA, driven by slowly rising lumber prices after the severe weather in January restricted construction activities.

PotlatchDeltic's capital plans remain robust, with significant progress on the $131 million Waldo, Arkansas sawmill modernization and expansion project, which is on track for completion in the third quarter. Post-completion, the company expects an increase in production through Q4 and into the following year, projecting an annual capacity of 275 million board feet and incremental EBITDA of approximately $25 million. Moreover, the Real Estate segment generated $6 million of adjusted EBITDA, marking the sale of residential lots and acres in rural areas, despite subdued transaction volumes, with expectations for increased sales activity in the second quarter.

The call highlighted the companys emerging Natural Climate Solutions business, including collaborations with solar developers and initiatives in carbon credits and bioenergy. Notably, contracts for solar land sales and leases are valued at nearly $200 million with expectations to grow further. Furthermore, their Southern Timberland carbon credit initiative is on track, with plans to generate over 500,000 carbon credits in the first year. These ventures are anticipated to enhance rural land demand and elevate timberland values.

In terms of capital allocation, the company remains focused on maintaining a strong balance sheet, protecting dividends, and being strategic with timberland acquisitions and share repurchases. Despite the challenging environment, PotlatchDeltic demonstrates resilience, underpinned by long-term positive housing market fundamentals and a disciplined capital approach. Moving forward, the company's outlook for Q2 2024 includes higher expected adjusted EBITDA, driven primarily by more significant rural land sales and a modest improvement in operational performance in their core segments.

On March 31, 2024, PotlatchDeltic Corporation filed its SEC Form 10-Q, presenting detailed financial information and analysis. The corporation reported total revenues of $228.1 million for the three months ending March 31, 2024, reflecting a decline of approximately $29.8 million compared to the same period in 2023. This decrease in revenue is primarily attributed to reduced Northern sawlog prices and lower harvest volumes, coupled with fewer real estate sales in the company's rural segment.

Operating income (loss) dropped to a negative $4.8 million from a positive $13.2 million in the same quarter last year. The company attributed this decline to reduced revenue and increased selling, general, and administrative expenses, which rose partly due to heightened employee-related costs and increased professional service fees. Notably, PotlatchDeltic did not incur any CatchMark merger-related expenses during this quarter, unlike the previous year, which had incurred $2.2 million in such expenses.

Consolidated costs and expenses decreased by $11.9 million compared to the first quarter of 2023, amounting to $232.9 million. This was driven by lower logging and hauling expenses, particularly in the Northern region due to favorable operating conditions. Despite these cost reductions, the company's increased lumber shipments led to higher manufacturing costs.

The timberlands segment witnessed a notable decline in Adjusted EBITDDA, dropping from $46.6 million in the first quarter of 2023 to $34.7 million. This decline resulted from lower sawlog prices in the Northern region and reduced harvest volumes due to adverse weather conditions. In contrast, the Southern region's sawlog prices remained relatively flat, maintaining more stable revenue figures.

The wood products segment remained relatively stable, with a slight decrease in Adjusted EBITDDA, primarily due to lower realized lumber prices and higher manufacturing costs. Lumber shipments increased slightly compared to the previous year, reflecting enhanced production capabilities in the Southern sawmills. The real estate segment experienced a significant decline in Adjusted EBITDDA from $19.5 million in Q1 2023 to $6.2 million in Q1 2024, largely due to fewer rural real estate sales, which are subject to variable quarterly demand and geographic sales cycles.

The financial statements also disclosed PotlatchDeltics strategic emphasis on managing liquidity and capital resources. The company reported cash and cash equivalents of $180.2 million at the end of Q1 2024. Despite lower operating cash flows compared to the previous year, driven by reduced Northern harvest volumes and fewer real estate transactions, the company expects its liquidity position, supplemented by its credit agreement, to be adequate for future operational needs.

Future capital expenditures are projected to be between $100 million and $110 million with significant investments directed towards the Waldo, Arkansas sawmill expansion project. This investment aims to increase annual capacity and reduce operating costs, with completion expected by the end of 2024.

Lastly, the company's debt structure includes long-term debt of $1.0 billion, with interest rates fixed either directly or through interest rate swaps. Approximately $175.7 million of this debt is classified as current liabilities, scheduled to mature within the year, which the company plans to refinance. PotlatchDeltic remains compliant with all debt covenants, maintaining robust credit ratings and sound financial management practices to support its strategic initiatives and operational stability.

PotlatchDeltic Corporation, a publicly-traded Real Estate Investment Trust (REIT) dedicated to the ownership and management of timberlands, recently revealed significant aspects of their Q1 2024 financial performance, detailed in the earnings call transcript available on Seeking Alpha. This detailed report provides an intimate view of the company's strategies, achievements, and reactions to ongoing market dynamics.

One of the prominent drivers influencing PotlatchDeltic's financial outcomes in Q1 2024 was the fluctuation of lumber prices. Despite the market volatility, the corporation skillfully managed its operations, focusing on maintaining profitability and enhancing shareholder value. This was evidenced by key financial metrics such as revenue, net income, and EBITDA, which performed in line with investor expectations and market forecasts. Such adept financial management affirms PotlatchDeltic's resilience and flexibility in navigating an unpredictable market landscape.

Operating highlights reveal that PotlatchDeltic's timberlands division continued to be a cornerstone of their strategic achievements. Owning about 1.8 million acres of timberland, mostly in the southern U.S., PotlatchDeltics sustainable forestry practices have been pivotal. These practices contribute to a stable supply chain for wood products manufacturing, enhancing both environmental stewardship and market reputation.

The wood products segment of PotlatchDeltic demonstrated commendable performance despite market hurdles. Efficient sawmill operations boosted gross margins, while the demand for wood products, fueled by residential construction and renovation trends, helped sustain sales volumes. Initiatives focused on optimizing logistics and production efficiencies played crucial roles in operational success, showcasing PotlatchDeltics commitment to leveraging its manufacturing capabilities.

In real estate, PotlatchDeltic's strategy included selling non-core timberlands and higher and better use (HBU) lands. This approach streamlined the portfolio and generated substantial cash flow, enabling capital reallocation to high-yield opportunities. Real estate transactions, particularly those targeting rural recreational and residential markets, continue to evolve in response to market demand, supporting long-term value creation.

Forward-looking initiatives spotlight PotlatchDeltic's strategic imperatives: enhancing operational efficiencies, seeking growth in high-potential markets, and maintaining disciplined capital allocation. Their emphasis on sustainable practices ensures long-term business viability and environmental performance, integral to the company's operational ethos.

For detailed insights, stakeholders can refer to the Q1 2024 earnings call transcript on Seeking Alpha and broader analyses on Yahoo Finance.

Over the quarter, PotlatchDeltic reported an adjusted EBITDA of $30 million. Operational performance, particularly in the Timberland segment, yielded a $35 million EBITDA, hitting the higher end of their harvest expectations. The slight net improvement in the Wood Products segment, breaking even from a prior $6 million loss, reaffirms positive market trends.

The modernization and expansion of the Waldo, Arkansas sawmill embody strategic capital investment. Completion is anticipated to enhance annual capacity to 275 million board feet, projecting an incremental EBITDA growth of $25 million annually.

Real estate operations in Q1 also saw the sale of rural and residential properties, with future transactions, such as the planned sale of 34,000 acres of Southern plantation timberlands, poised to enhance financial performance further.

PotlatchDeltic maintains a robust liquidity position with $479 million, exemplifying prudent capital allocation focusing on timberland acquisitions and share repurchases. The ongoing commitment to shareholder returns is reinforced by the recent dividend declaration of $0.45 per share, payable on June 28, 2024, as announced on Business Wire. This financial decision underscores a solid financial stance and shareholder value proposition.

In risk management, PotlatchDeltic's Enterprise Risk Management framework systematically addresses various risks, overseen by their Audit Committee and senior management. Regular risk assessments, environmental management through EMS, and responsible corporate practices ensure comprehensive risk mitigation and informed strategic planning (Yahoo Finance).

On a strategic level, PotlatchDeltic's workforce development initiatives, such as the collaborative mechatronics program in Bemidji, Minnesota, underscore its dedication to enhancing technical skills. These training programs have successfully upskilled employees and high school students, preparing them for technical roles in advanced manufacturing and industrial maintenance (Yahoo Finance).

Presentations at industry conferences, such as the upcoming REITweek Conference on June 4, 2024, led by key executives like Eric Cremers and Wayne Wasechek, articulate PotlatchDeltic's strategic overview, financial health, and future prospects. Enhancements in sustainable practices and technological investments form a core part of these presentations (Yahoo Finance).

Finally, the 2023 Corporate Responsibility Report, released on May 31, 2024, illustrates significant milestones in sustainability. Key achievements include net carbon removals, energy reductions, and biodiversity initiatives, reinforcing the company's commitment to integrating corporate responsibility into its operational framework (Yahoo Finance).

PotlatchDeltic Corporations comprehensive and strategic approach in timberlands, wood products, and real estate bolsters its market position, promising continued shareholder value and positive environmental impact through sustainable practices. The detailed financial performance, strategic investments, and thorough risk management practices form the foundation of its robust business model.

PotlatchDeltic Corporation (PCH) exhibited some significant volatility over the period from mid-2019 to mid-2024. The ARCH model indicates a substantial level of persistency in volatility, implying that the company's stock returns have experienced some notable fluctuations. The average degree of volatility or uncertainty is captured by the high omega value, and the alpha parameter suggests that past shocks tend to greatly influence future volatility.

| R-squared | 0.000 |

| Adjusted R-squared | 0.001 |

| Log-Likelihood | -2,653.96 |

| AIC | 5,311.91 |

| BIC | 5,322.18 |

| No. of Observations | 1,255 |

| Omega | 2.6155 |

| Alpha[1] | 0.5253 |

Financial risk analysis can be informative when combining sophisticated techniques like volatility modeling and machine learning predictions. For a $10,000 investment in PotlatchDeltic Corporation over one year, understanding potential risks is crucial.

Volatility modeling is a critical tool used to examine the stock's variability over time. By analyzing historical price data, this approach identifies patterns of high and low volatility periods. Specifically, it measures how the stock's price dynamics evolve, estimating both the persistence and intensity of volatility. This insight is valuable, as stocks with high volatility can yield significant returns but also expose investors to substantial risk. For PotlatchDeltic Corporation, historical data would be used to gauge how volatile the stock has been and project future volatility patterns. This analysis helps investors anticipate how much the stock price might fluctuate in the coming year.

Complementing this, machine learning predictions are employed to forecast future stock returns. A common technique here is to use decision tree-based algorithms to model various factors influencing stock price movements. Historical stock prices, along with other relevant variables such as economic indicators and sector-specific metrics, are utilized to train the model. This approach leverages patterns and correlations in the data to predict returns with a higher degree of accuracy. For PotlatchDeltic Corporation, the predictive model would provide expected returns over the next year, incorporating both historical trends and potential future scenarios.

When combining results from volatility modeling and machine learning predictions, one can assess the potential financial risk more comprehensively. For instance, based on the volatility estimates, the investor can discern periods of heightened uncertainty, while the predictive model offers a more concrete projection of expected returns.

Key figures derived from this integrated approach include the Value at Risk (VaR). The VaR metric provides an estimate of the maximum potential loss over a specific period, given normal market conditions and a certain confidence level. For PotlatchDeltic Corporation, the annual VaR at a 95% confidence level for a $10,000 investment amounts to $247.26. This implies there is a 5% chance that the investment could lose more than $247.26 in a year. This calculation is instrumental for investors aiming to limit their exposure to excessive risks while still pursuing potential gains.

By conducting such an analysis, investors can better understand the intricate balance of risk and reward associated with their investment in PotlatchDeltic Corporation. The combination of volatility modeling to track past stock behavior and machine learning predictions to forecast future returns equips investors with a robust framework to anticipate and mitigate potential financial risks.

Long Call Option Strategy

Analyzing the provided data for long call options in PotlatchDeltic Corporation (PCH) to identify the most profitable opportunities, it's essential to focus on maximizing returns while accounting for risks associated with different expiration dates and strike prices. Since we aim to target a stock price that is 2% above the current, we should consider options where the potential profit is substantial under this slightly bullish forecast.

Given that our target price is modestly higher, Deep In-The-Money (ITM) options may not offer the best risk-reward profile compared to At-The-Money (ATM) or slightly Out-of-The-Money (OTM) options. Here's a detailed analysis of five specific options based on their expiration dates and strike prices:

Near-Term Option (1 month from now)

Expiration Date: [1 month from now]

Strike Price: [At or slightly above current price]

- Delta: ~0.50

- Gamma: High

- Theta: Relatively High

- Vega: Moderate

For this near-term option, the delta of around 0.50 indicates that the option's price will move approximately half as much as the stock price, which is strong for capturing a 2% rise in the underlying stock. However, the high theta suggests significant time decay, so if the stock doesn't reach the target price quickly, the option could lose value rapidly. The gamma, being high, implies a higher rate of delta change, which is beneficial in a quickly moving market but increases volatility risk.

Medium-Term Option (3 months from now)

Expiration Date: [3 months from now]

Strike Price: [Slightly OTM]

- Delta: ~0.40

- Gamma: Moderate

- Theta: Moderate

- Vega: Moderate to High

This medium-term option provides a good balance between time decay and potential price movement. A delta of 0.40 denotes decent sensitivity to the stock's price moves. The moderate theta mitigates the risk of time decay compared to the near-term option, making it suitable if the price rise is slow. Additionally, a higher vega indicates this option would benefit more from volatility increases.

Intermediate-Term Option (6 months from now)

Expiration Date: [6 months from now]

Strike Price: [ATM]

- Delta: ~0.50

- Gamma: Lower than near-term

- Theta: Lower than near-term

- Vega: High

An intermediate-term option with six months to expiration and an ATM strike offers a safer bet regarding time decay (low theta) and decent price responsiveness (delta ~0.50). The lower gamma compared to shorter-term options suggests less rapid delta adjustment, reducing volatility risk. The option is designed for a scenario where the underlying stock is expected to move gradually over the months.

Long-Term Option (9 months from now)

Expiration Date: [9 months from now]

Strike Price: [Slightly ATM]

- Delta: ~0.45

- Gamma: Low to Moderate

- Theta: Low to Moderate

- Vega: High

A long-term option expiring in nine months provides ample time for the stock price to reach the target without significant time decay impact (low to moderate theta). The delta of ~0.45 ensures the option remains responsive to stock price movements. The lower gamma reduces the unwanted delta variability, stabilizing the option's performance. High vega implies this option can also gain from rising market volatility, adding to the profit potential.

Far-Term Option (1 year from now)

Expiration Date: [1 year from now]

Strike Price: [Slightly ITM]

- Delta: ~0.60

- Gamma: Low

- Theta: Low

- Vega: High

For investors with a more extended outlook, the far-term option expiring in one year with a slightly ITM strike price constitutes a more secure position with a delta around 0.60, indicating high immediate sensitivity to price changes. With low theta, the time decay risk is minimized, making it suitable for a gradual stock price increase. Low gamma implies stability in delta adjustments, while high vega allows for favorable reactions to increased market volatility.

Conclusion

Overall, each option presents specific risk-reward profiles. For traders expecting a quick move to the target, the near-term option might offer the highest rewards but carries greater risk from time decay. The medium to intermediate terms strike a balance between profit potential and time decay risk. For more conservative investors, long and far-term options are preferable, offering stable growth potential with minimized time decay concerns. Always consider the market conditions, including volatility expectations which high vega options can exploit, while aligning chosen strategies with personal risk tolerance and timeline investment horizons.

Short Call Option Strategy

When analyzing potential short call options for PotlatchDeltic Corporation (PCH), its critical to balance the potential profit against the risk, especially the risk of assignment if the option goes in the money. The Greeks provide useful insights into this risk and reward dynamic, allowing us to choose options with favorable characteristics.

-

45.0 Strike, Expiration 2024-06-21: This is a near-term option with only 7 days to expire. It carries a delta of 0.1086, meaning its intrinsic value is relatively insensitive to small movements in the underlying stock price. The low delta indicates a lower probability of the option moving in the money (ITM), which minimizes the risk of assignment. The premium received for this option is $0.71, offering a reasonable immediate return. The negative theta of -0.0423 highlights significant time decay, which works in favor of the seller, eating away at the option's value rapidly as expiration nears, increasing the likelihood of keeping the premium if the stock does not move substantially. The risk is relatively low, and the reward is backed by a solid premium for such a short duration. However, the high theta and imminent expiration mean this trade is most profitable if executed without expecting the stock to move significantly.

-

45.0 Strike, Expiration 2024-07-19: This option has a medium-term expiration of 35 days. With a delta of 0.1329, the option has a slightly higher chance of moving ITM compared to the 2024-06-21 expiration. The premium is lower at $0.2, reflecting a smaller payoff, but the time decay (theta) is less aggressive at -0.0107. The vega and gamma values indicate moderate sensitivity to volatility and changes in delta, respectively. Since the intrinsic value and associated risks are still minimal, this is a safer option for those looking to avoid assignment but willing to accept a smaller immediate return.

-

45.0 Strike, Expiration 2024-08-16: Extending the expiration to 63 days, this option offers a premium of $0.6, with a delta of 0.1637. Although the delta is higher than the two previous options, reflecting a greater chance of becoming ITM, it remains on the lower side, minimizing assignment risk. Notably, vega is higher at 4.1689, suggesting increased sensitivity to fluctuations in volatility, which could be beneficial in a less stable market. The moderate theta of -0.0077 indicates that time decay will gradually erode the option's value, benefiting the seller. This option is a balanced choice between risk and reward for traders looking at a medium-term expiration.

-

50.0 Strike, Expiration 2024-11-15: With a longer-term horizon of 154 days, this option carries a premium of $0.35 and a delta of 0.0905, marking it as a low-risk option in terms of assignment probability. Despite the distant expiration, the premium offers a solid return given the low delta and the accompanying low theta of -0.0031, indicating slower time decay. The vega value of 4.2956 suggests a high sensitivity to volatility, which means potential increased premiums if market volatility rises. This option is ideal for traders looking to profit from both the premium and any potential increase in volatility, without a significant risk of assignment.

-

60.0 Strike, Expiration 2024-11-15: Like the previous option, this far-out expiration grants a premium of $0.2, but with a delta of 0.0620, it exhibits an even lower risk of moving ITM. The theta at -0.0038 suggests slower time decay, and the vega of 3.2197 indicates substantial sensitivity to volatility, offering potential profit from rising market volatility. This option allows for minimal assignment risk due to the higher strike price and the very low delta, providing peace of mind for those focusing on maintaining their underlying stock holdings.

Summary

The most profitable options for short calls, balancing risk and reward based on their Greeks, are as follows: 1. 45.0 Strike, Expiration 2024-06-21 2. 45.0 Strike, Expiration 2024-07-19 3. 45.0 Strike, Expiration 2024-08-16 4. 50.0 Strike, Expiration 2024-11-15 5. 60.0 Strike, Expiration 2024-11-15

Each of these options has a diverse time horizon (short-term to long-term) and provides a balance between premium received and the risk of assignment. Prioritizing options with lower deltas minimizes the potential for the options to move ITM, thus reducing the chance of assignment while ensuring the collected premium is an attractive reward for the risk taken.

Long Put Option Strategy

Analyzing the long put options for PotlatchDeltic Corporation (PCH), we aim to identify the most profitable choices based on different expiration dates and strike prices, considering a target stock price that is 2% above the current price. In our analysis, we consider key Greek values that define risk metrics delta, gamma, vega, theta, and rho each presenting different facets of potential profit and loss.

Near-Term Option: Expiration Date June 21, 2024, Strike Price $45.00

The near-term option with a strike price of $45.00 and expiration on June 21, 2024, exhibits a delta of -0.7449781358, indicating a strong negative correlation with the stock price for every dollar increase in the stock price, the option price is expected to decrease by about $0.74. This highlights significant profitability potential if the stock's price decreases, though it also brings substantial risk if the stock price moves against our expectations. The gamma of 0.0576411076 reflects moderate sensitivity of delta to changes in the stock price.

The theta is relatively high at -0.1267277833, suggesting that this option will lose value quickly with the passage of time, which makes it less attractive if the stock price move is not imminent. The vega value of 1.8078850634 indicates the option price's sensitivity to changes in volatility, which implies that an increase in market volatility would benefit this option. The profit potential stands at 0.7452, with an ROI of 27.6%, representing a reasonable but not top-tier risk-reward scenario.

Medium-Term Option: Expiration Date August 16, 2024, Strike Price $50.00

This medium-term option, with a higher strike price of $50.00 expiring on August 16, 2024, shows a delta of -0.734849527, slightly lower than the previous option but still robust in its expected price movement relative to the underlying stock. The gamma is lower at 0.0299137083, indicating less sensitivity to changes in the underlying stock price compared to the near-term option. However, it might offer more stability, which some traders might prefer.

Theta is significantly lower at -0.0262688516, suggesting this option loses value much slower over time, making it more attractive if the expected decrease in stock price is gradual. Notably, vega is very high at 5.4438960757, making it highly sensitive to volatility a surge in market volatility would greatly benefit this option. The ROI is very high at 96.4%, and the profit potential is substantial at 4.1452, making this one of the most profitable choices among the options analyzed.

Long-Term Option: Expiration Date November 15, 2024, Strike Price $45.00

For long-term scenarios, an option expiring on November 15, 2024, with a strike price of $45.00, yields a delta of -0.7757088917, the highest among the analyzed options, which indicates significant price movement in response to the underlying stock price changes. The gamma of 0.0601131138 reflects moderate sensitivity, keeping the delta relatively stable.

This option features the smallest theta at -0.0038448929, making it the least sensitive to time decay an advantageous characteristic for long-term holdings. The vega is the highest at 7.4822230925, pointing to substantial benefits from volatility spikes. However, the ROI is the lowest at 19.625%, with a profit potential of 0.5652 making it less attractive in terms of pure profitability but potentially more secure for holding over longer periods due to lower time decay.

Risk-Reward Comparison:

- Short-Term (June 21, 2024, Strike $45.00): Good delta, high theta risk, moderate vega, moderate profit/ROI.

- Medium-Term (August 16, 2024, Strike $50.00): Slightly lower delta, very low theta risk, high vega sensitivity, highest profit/ROI most profitable option overall.

- Long-Term (November 15, 2024, Strike $45.00): Highest delta, lowest theta risk, highest vega sensitivity, lowest ROI, moderate profit good for long-term stability.

Summary of Choices:

- Near-Term: June 21, 2024, Strike $45.00

- Medium-Term: August 16, 2024, Strike $50.00 (most profitable)

- Long-Term: November 15, 2024, Strike $45.00

These options provide a spectrum of choices from near-term to long-term, balancing quick potential profits with stability and sensitivity to volatility changes.

Short Put Option Strategy

Short Put Options Analysis for PotlatchDeltic Corporation (PCH)

In this analysis, we will examine various short put options for PotlatchDeltic Corporation (PCH), taking into account the target stock price which is approximately 2% below the current price. The primary concern here is to balance profitability while minimizing the risk of having shares assigned, particularly focusing on options that are out of the money (OTM).

Near-Term Options - Expiration: 2024-06-21

- Strike Price: $35

- Delta: -0.0439

- Gamma: 0.0249

- Vega: 0.5242

- Theta: -0.0247

- Rho: -0.00036

- Premium: $0.20

- ROI: 100.0%

- Profit: $0.20

Risk and Reward: This option offers a high ROI of 100.0%, with a premium of $0.20. Given the low delta (-0.0439), the price change impact is minimal, reducing the likelihood of assignment. The option has seven days to expiry, making it a quick potential profit with minimal risk.

Short-Term Options - Expiration: 2024-08-16

- Strike Price: $30

- Delta: -0.0586

- Gamma: 0.0137

- Vega: 1.9756

- Theta: -0.0079

- Rho: -0.00452

- Premium: $0.15

- ROI: 100.0%

- Profit: $0.15

Risk and Reward: This short-term option provides an attractive ROI of 100.0% with a premium of $0.15. The delta of -0.0586 suggests a lower risk of the option going in the money. Given the relatively longer time to expiry (63 days), the theta decay is slower, allowing more time for monitoring.

- Strike Price: $35

- Delta: -0.1161

- Gamma: 0.0354

- Vega: 3.2997

- Theta: -0.0085

- Rho: -0.0087

- Premium: $0.55

- ROI: 100.0%

- Profit: $0.55

Risk and Reward: With an impressive ROI of 100.0% and a higher premium of $0.55, this option is more profitable. However, the delta of -0.1161 indicates a higher risk of going in the money compared to the $30 strike. Careful monitoring is advised due to increased gamma and vega values that can affect price volatility.

Medium-Term Options - Expiration: 2024-11-15

- Strike Price: $30

- Delta: -0.0594

- Gamma: 0.0137

- Vega: 3.1156

- Theta: -0.0033

- Rho: -0.0112

- Premium: $0.25

- ROI: 100.0%

- Profit: $0.25

Risk and Reward: Most favorable in terms of balancing risk and profit, this option has a 100.0% ROI with a delta of -0.0594. The premium of $0.25 offers a good risk-to-reward ratio, supported by a moderate gamma and vega profile translating to lower price sensitivity and assignment risk.

- Strike Price: $40

- Delta: -0.4136

- Gamma: 0.0678

- Vega: 10.1612

- Theta: -0.0069

- Rho: -0.0789

- Premium: $1.40

- ROI: 94.7%

- Profit: $1.3252

Risk and Reward: This option boasts a high premium of $1.40 and an ROI of 94.7%. The delta of -0.4136 indicates a higher risk of going in the money, making it riskier if the target price is not met. Nevertheless, the substantial potential profit of $1.3252 makes it appealing for those willing to take on more risk. The high vega underscores significant sensitivity to volatility changes.

Conclusion

In summary, the five choices analyzed offer a spectrum of risk and rewards from near-term to longer-term expirations. The $35 strike expiring on 2024-06-21 and the $30 strike expiring on 2024-11-15 stand out as prudent choices due to their high ROI and lower deltas, minimizing the risk of shares being assigned. Conversely, the $35 and $40 strikes expiring on 2024-08-16 and 2024-11-15 respectively offer higher premiums but come with elevated risks.

Selecting these options allows leveraging different market conditions and timeframes, enhancing the strategy's potential profit while balancing the risks effectively. Each choice provides unique opportunities tailored to varying risk appetites and market outlooks.

Vertical Bear Put Spread Option Strategy

When analyzing a vertical bear put spread options strategy for PotlatchDeltic Corporation (PCH), one must consider various factors to maximize profitability while minimizing risk. This involves selecting appropriate long and short put options with favorable Greek values, expiration dates, and strike prices relative to the current stock price.

The primary choice for a near-term strategy involves the options expiring on June 21, 2024, with a target stock price within 2% of the current price. To minimize risk while ensuring a reasonable profit scenario, one could initiate a vertical bear put spread with the short put at a strike price of $35 and the long put at $45. The delta for the short put is relatively low (-0.0439), indicating minimal price sensitivity and reduced risk of assignment. It also comes with a premium of $0.2 and a high ROI of 100%, which is quite attractive. For the long put, the delta is significantly higher (-0.7449), which denotes a hedge against the price declines effectively. The long put premium is $2.7, translating to a lower ROI of 27.6%. The net premium paid for this spread would be $2.5 ($2.7 - $0.2), with a maximum potential profit of $7.5 ($45 - $35 - $2.5) if the stock drops sufficiently below $35 by expiration.

Another mid-term strategy is focused on options expiring on August 16, 2024. Here, the optimal spread might involve selling the $35 strike put and buying the $50 strike put. The short put has a delta of -0.1161, which mitigates assignment risk, and a substantial premium of $0.55 leading to an ROI of 100%. The long put at $50 shows a high delta (-0.7348), signifying protection as the stock falls, with a premium of $4.3 and substantial potential profit. This spread results in a net premium of $3.75 ($4.3 - $0.55). If the stock price drops well below $35, the spread could yield up to $11.25 ($50 - $35 - $3.75).

For a longer-term strategy, the November 15, 2024 expiration options provide an attractive scenario. Selling a $35 strike put and buying a $45 strike put would be beneficial here. The delta for the $35 short put is -0.1542, contributing to risk mitigation for assignment, and the premium is $0.4 with a 100% ROI. The long put at the $45 strike gives a high delta of -0.7757, providing ample downside protection, with a premium of $2.88 and a potential profit of $0.5652. This results in a net premium of $2.48, and maximum profit potential would be $7.52 ($45 - $35 - $2.48).

Analyzing the target stock price and aiming for minimal risk, the most profitable strategies and choices, considering expiration dates and strike prices, are as follows:

- Near-term Option (June 21, 2024 Expiration)

- Short Put: Strike $35, Premium $0.2, Delta -0.0439

- Long Put: Strike $45, Premium $2.7, Delta -0.7449

-

Net Premium Paid: $2.5, Maximum Profit Potential: $7.5

-

Mid-term Option (August 16, 2024 Expiration)

- Short Put: Strike $35, Premium $0.55, Delta -0.1161

- Long Put: Strike $50, Premium $4.3, Delta -0.7348

-

Net Premium Paid: $3.75, Maximum Profit Potential: $11.25

-

Long-term Option (November 15, 2024 Expiration)

- Short Put: Strike $35, Premium $0.4, Delta -0.1542

- Long Put: Strike $45, Premium $2.88, Delta -0.7757

- Net Premium Paid: $2.48, Maximum Profit Potential: $7.52

These strategies offer various timeframes to account for market volatility and allow investors to choose based on their risk tolerance, investment horizon, and market outlook. Each combination ensures minimized risk of assignment while aiming for substantial profit potential given favorable market movement.

Vertical Bull Put Spread Option Strategy

A vertical bull put spread seeks to profit from a rise in the price of the underlying asset, PotlatchDeltic Corporation (PCH), by selling a put option and buying another put option with a lower strike price but the same expiration date. We can strategize the best combinations based on minimizing risk, maximizing potential profit, and ensuring that shares aren't likely to be assigned by staying out of the money.

-

Near-Term (7 Days to Expiration) Analysis:

-

Short Put: Sell a put option with a strike price of $40 and an expiration date on June 21st, 2024. This option has a delta of -0.2631.

- Long Put: Buy a put option with a strike price of $35 and an expiration date on June 21st, 2024. This option has a delta of -0.0439.

Given the short time until expiration, the primary benefit here lies in the high premium collection ($0.20) relative to the level of risk taken due to the low delta of the long put. The short put at $40 offers a considerable premium amount and an attractive balance with a moderate delta, indicating the likelihood of the option being in the money. The primary risk here is the possibility of the share price falling below $40, making the short put at risk for assignment. However, the short time frame minimizes theta decay for the long put option.

-

Short-Term (63 Days to Expiration) Analysis:

-

Short Put: Sell a put option with a $40 strike price expiring on August 16th, 2024. This option has a delta of -0.3981 with a premium of $0.55.

- Long Put: Buy a put option with a $35 strike price expiring on August 16th, 2024. This option has a delta of -0.1161 and costs $0.55.

This strategy offers a substantial premium relative to the risk ($0.4752) while maintaining adequate risk management. The short put's higher delta suggests a greater chance of being exercised, which necessitates the protective long put at $35. This spread profits the most if PCH remains above $40, and risk is minimized because it only really suffers if the price plummets significantly below $35, making assignment on the higher strike price hat likely.

-

Medium-Term (63 Days to Expiration) Analysis, Less Risky:

-

Short Put: Sell a put option with a strike price of $35 and an expiration date on August 16th, 2024. This option has a delta of -0.1161 and a premium of $0.55.

- Long Put: Buy a put option with a strike price of $30 and an expiration date on August 16th, 2024. This option has a delta of -0.0586 and costs $0.15.

Choosing this combination offers the advantage of lower risk with the short put's delta being smaller, thus less likely to be in the money come expiration. The potential profit is $0.55 minus the cost of the long put ($0.15), yielding a net premium of $0.40. Potential assignment is minimized as the $35 strike is reasonably out of the money considering the target price range (2% above/below current stock price).

-

Long-Term (154 Days to Expiration) Analysis:

-

Short Put: Sell a put option with a strike price of $40 expiring on November 15th, 2024, with a delta of -0.4136 and a premium of $1.4.

- Long Put: Buy a put option with a strike price of $35 expiring on November 15th, 2024, with a delta of -0.1542 and premium of $0.4.

Despite the longer expiration period, this setup provides a significant premium collection if PCH remains above $40. The wider spread between the strike prices and the long-term nature of the options demand consideration of market volatility and other extrinsic factors. The delta level suggests a substantial risk, but also high profit potential ($1.3252).

-

Long-Term (154 Days to Expiration) Analysis, Less Risky:

-

Short Put: Sell a put option with a strike price of $35 expiring on November 15th, 2024, with a delta of -0.1542 and a premium of $0.4.

- Long Put: Buy a put option with a strike price of $30 expiring on November 15th, 2024, with a delta of -0.0594 and premium of $0.25.

This setup reduces the assignment risk compared to the $40 strikes and provides a more conservative premium collection opportunity. The net profit potential here is $0.15 ($0.4 from the premium of the short put less the $0.25 cost of the long put). The risk is substantially contained due to lower delta values.

Conclusion: Each vertical bull put spread strategy offers a balance depending on risk tolerance and investment horizon. The near-term to long-term strategies outlined provide varied risk-reward profiles. Short-term options are less risky with rapid premium collection, while long-term options, particularly the $40/$35 strikes for November 2024, offer high profit potential but come with increased risk. Long-term, less risky strategies targeting $35/$30 strikes appear to be the optimal compromise for those wary of assignment risk while still seeking to capitalize on a bullish market prediction.

Vertical Bear Call Spread Option Strategy

When considering a vertical bear call spread using the options data provided for PotlatchDeltic Corporation (PCH), our primary goal is to choose strike prices and expiration dates that offer a balance of profitability and risk management. We'll focus on minimizing the probability of the short call being in the money at expiration to prevent the assignment of shares, while still generating an acceptable premium.

1. Near-Term Option Strategy

Expiration Date: Jun 21, 2024 - Short Call Strike: $45.00 - Premium: $0.71 - Delta: 0.1086179067

For the short call with an expiration date of June 21, 2024, and a strike price of $45.00, the low delta (0.1086179067) suggests a lower probability of finishing in the money, reducing the risk of assignment. A premium of $0.71 can be collected, representing a fully realized profit if PCH stays below $45.00.

To establish the vertical bear call spread, you would simultaneously buy a call option with a higher strike price (e.g., $50 or $55), though specific long call options data are not provided. This minimizes the capital requirement and risk.

2. Medium-Term Option Strategy

Expiration Date: Aug 16, 2024 - Short Call Strike: $45.00 - Premium: $0.60 - Delta: 0.1637030623

In the medium term, the August 16, 2024, short call at a $45.00 strike delivers a $0.60 premium with a slightly higher delta (0.1637030623), indicating a moderate risk of assignment. The chance of the share price exceeding $45.00 is still relatively low, making it a plausible choice. By pairing this with a long call, you cap the upside risk and reduce the potential margin requirements.

3. Longer-Term Option Strategy

Expiration Date: Nov 15, 2024 - Short Call Strike: $45.00 - Premium: $1.50 - Delta: 0.27938166

For a longer-term strategy, the November 15, 2024, short call at a $45.00 strike offers a higher premium of $1.50 but with a higher delta of 0.27938166, resulting in a greater probability of being assigned if the stock price rises. This must be balanced by the higher premium collected, which compensates for the increased risk. The selection of a higher-strike long call will be essential to manage the potential downside effectively.

4. High Premium Strategy

Expiration Date: Aug 16, 2024 - Short Call Strike: $40.00 - Premium: $3.40 - Delta: 0.580338488

Choosing a $40.00 strike for the August 16, 2024, expiration, offers a substantial premium of $3.40 but with a very high delta of 0.580338488. This indicates a strong likelihood of being in the money, hence a higher risk of assignment. This strategy is suitable if you are more confident that the stock will not reach the $40.00 level and prefer a higher upfront reward.

5. Longer-Term, High-Protection Strategy

Expiration Date: Nov 15, 2024 - Short Call Strike: $50.00 - Premium: $0.35 - Delta: 0.0905330985

For a balanced longer-term approach, a $50.00 strike for the November 15, 2024, expiration provides a moderate premium of $0.35 with a low delta of 0.0905330985. This significantly reduces the risk of assignment. Such a strategy would ensure a safer return with minimal assignment risk, suitable for conservative traders.

Risk and Reward Analysis

- Near-Term: Collect a $0.71 premium with minimal risk of being in the money at $45.00 but a lower absolute return.

- Medium-Term: $0.60 premium at $45.00 with slightly elevated risk compared to near-term.

- Long-Term: $1.50 premium at $45.00, higher risk of assignment but a more attractive premium.

- High Premium: $3.40 premium at $40.00 for August, considerable risk of assignment.

- High Protection: $0.35 premium at $50.00 for November, ensuring minimal risk of assignment.

In conclusion, the most suitable vertical bear call spread for conservative traders is the longer-term high-protection strategy with a $50.00 strike for November 15, 2024. Aggressive traders might favor the high-premium strategy but should be wary of the higher risk of assignment.

Vertical Bull Call Spread Option Strategy

Based on the provided data for PotlatchDeltic Corporation (PCH), we can craft several vertical bull call spreads using short put options to profit from a mildly bullish outlook, assuming the stock price moves approximately 2% above or below the current price. This strategy involves buying a lower strike put option and selling a higher strike put option to maximize profit while potentially minimizing risk through limited loss and gain structure.

1. Near-Term Strategy

Expiration Date: 2024-06-21 - Short Put Option: Strike 45.0, Premium: 0.71

This short put option has a delta of 0.1086, indicating limited exposure to small stock movements but carrying a higher gamma of 0.0585, suggesting increased sensitivity to price changes as expiration approaches. The premium collected here is 0.71 per share. Given the closer expiration, the theta value of -0.0423 means there's a substantial daily erosion of value, which works in favor of reducing time decay risk. The risk involves potential assignment if PCH falls significantly below 45. The upside is limited to the premium collected.

2. Short-Term Strategy

Expiration Date: 2024-07-19 - Short Put Option: Strike 45.0, Premium: 0.20

This option has a delta of 0.1329 and gamma of 0.0610, similar to the near-term option but with a lower premium of 0.20. The theta impact here is smaller at -0.0107, reducing the daily erosion risk slightly. Given the lower premium, the potential reward is smaller, but the shorter timeline might align well with a strategy to capture gains with limited risk within a shorter window without significant assignment risk.

3. Medium-Term Strategy

Expiration Date: 2024-08-16 - Short Put Option: Strike 40.0, Premium: 3.40

This option has a high delta of 0.5803, reflecting significant sensitivity to price movements, and a gamma of 0.0814. The substantial premium of 3.40 provides a higher potential profit but also comes with higher risk if the stock price drops. This position involves higher assignment risk due to the strike price being closer to current market levels and the higher delta. The theta and vega values indicate moderate time decay and volatility sensitivity, making this option useful for capturing higher premiums with a mindful eye on market movements leading up to expiration.

4. Medium-Long Term Strategy

Expiration Date: 2024-11-15 - Short Put Option: Strike 40.0, Premium: 3.52

Similar to the medium-term strategy, this longer expiration date sees a delta of 0.5655 and gamma of 0.0422. This premium of 3.52 is appealing for longer-term profit but carries higher assignment risk, similar to the previous option, due to the lower strike price and higher delta. The theta of -0.0108 suggests gradual time decay, manageable over several months. This option maximizes premium collection over an extended period with a higher potential profit but must be monitored for volatility and market adjustments.

5. Long-Term Strategy

Expiration Date: 2024-11-15 - Short Put Option: Strike 45.0, Premium: 1.50

This option has a delta of 0.2794 and a gamma of 0.0529, placing it in the medium risk category for sensitivity to stock movements. Collecting a premium of 1.50 offers a balanced trade-off between risk and reward over a longer duration. The theta value indicates moderate daily erosion, and the vega suggests sensitivity to implied volatility changes. This strike price and expiration combination can yield substantial profits if the stock remains stable or rises slightly, while mitigating assignment risk with a delta lower than the more aggressive strike.

Risk and Reward Analysis

The vertical bull call spread strategy carefully balances premium collection against the assignment risk. Near-term options provide quicker profit potential with minimal long-term exposure, while extending expiry dates captures higher premiums and harnesses time decay benefits. However, it is crucial to manage assignment risk with regards to delta and gamma values, especially for options close to being in-the-money. By targeting options with expiration windows from a few weeks to several months, the trader can diversify risk and potential reward across varying market conditions and stock price movements.

Spread Option Strategy

To devise a profitable calendar spread strategy for PotlatchDeltic Corporation (PCH), it is essential to choose the appropriate call options and put options based on their expiration dates and strategic "Greeks" values. Given that the target stock price is projected to be within 2% above or below the current stock price, the most effective strategy will involve selecting options that offer the highest potential return while minimizing the risk of having shares assigned.

Calendar Spread Strategy Analysis

Near-Term Options (Expiring 2024-06-21)

- Sell Put Option with Strike Price $30.00

- Greeks Overview: Delta: -0.0586, Gamma: 0.0137, Vega: 1.9756, Theta: -0.0079, Rho: -0.0045

- Premium: $0.15

- ROI: 100%, Profit: $0.15

The lower delta value of -0.0586 indicates less sensitivity to stock price changes, reducing the likelihood of assignment. The premium earned is $0.15, giving a solid ROI of 100%. The reasonably high gamma and vega imply good returns with volatility, while the theta decays relatively slower, which is beneficial.

- Sell Put Option with Strike Price $35.00

- Greeks Overview: Delta: -0.0439, Gamma: 0.0249, Vega: 0.5242, Theta: -0.0247, Rho: -0.0004

- Premium: $0.2

- ROI: 100%, Profit: $0.2

With even lower delta and comparable gamma, this option also presents minimal risk of assignment. The theta value is more negative and thus decay faster, which could be less beneficial for a short position. However, the high ROI and premium make it attractive.

- Sell Put Option with Strike Price $40.00

- Greeks Overview: Delta: -0.2631, Gamma: 0.2703, Vega: 1.8405, Theta: -0.0281, Rho: -0.0021

- Premium: $0.20

- ROI: 62.6%, Profit: $0.1252

This option has a higher delta, meaning greater sensitivity to stock price changes and a higher risk of being in the money, which would lead to assignment. However, the lucrative premium still makes it a profitable choice under specific scenarios.

Mid-Term Options (Expiring 2024-08-16)

- Sell Put Option with Strike Price $35.00

- Greeks Overview: Delta: -0.1161, Gamma: 0.0354, Vega: 3.2997, Theta: -0.0085, Rho: -0.0087

- Premium: $0.55

- ROI: 100%, Profit: $0.55

This strike price offers a high premium of $0.55 with strong ROI. The delta is low, reducing the likelihood of assignment. The high vega suggests good performance in volatility, whereas the moderate gamma shows reasonable sensitivity. The theta decay is also slow compared to other options, which is advantageous when holding short puts.

- Sell Put Option with Strike Price $40.00

- Greeks Overview: Delta: -0.3981, Gamma: 0.1070, Vega: 6.4946, Theta: -0.0108, Rho: -0.0298

- Premium: $0.55

- ROI: 86.4%, Profit: $0.4752

This higher strike price option sports a notably higher delta, pointing to a significant risk of assignment if it turns in-the-money. However, it also offers a decent premium and a good ROI. The pronounced vega and theta values mean the option will benefit more from volatility changes and exhibit slow decay, rendering it attractive in a swinging market.

Long-Term Options (Expiring 2024-11-15)

- Sell Put Option with Strike Price $35.00

- Greeks Overview: Delta: -0.1542, Gamma: 0.0354, Vega: 6.2450, Theta: -0.0051, Rho: -0.0290

- Premium: $0.4

- ROI: 100%, Profit: $0.4

This strike combines a moderately low delta with a good premium and ROI. High vega and moderate gamma will ensure substantial gains from volatility and controlled sensitivity. The very slow theta decay allows for strategic long-term holding.

- Sell Put Option with Strike Price $40.00

- Greeks Overview: Delta: -0.4136, Gamma: 0.0678, Vega: 10.1612, Theta: -0.0069, Rho: -0.0789

- Premium: $1.4

- ROI: 94.7%, Profit: $1.3252

A higher delta comes with a substantial risk of assignment, making this option appealing if the market is expected to rise significantly. The high premium and vega indicate a great payoff under volatile conditions, albeit this comes with an increased risk.

Conclusion

The options with the highest profitability include those with decay characteristics favorable under volatility and manageable risk with delta values indicating lower likelihood of falling in-the-money. The choices detailed above should be carefully considered based on market volatility expectations and risk appetite:

- 2024-06-21 Strike $35.00 High ROI with minimal delta.

- 2024-06-21 Strike $30.00 High ROI and minimal assignment risk.

- 2024-08-16 Strike $35.00 High premium collection and efficient volatility play.

- 2024-08-16 Strike $40.00 Optimal for higher volatility and offers substantial returns.

- 2024-11-15 Strike $35.00 Long-term, moderate risk with high rewards during volatile conditions.

Calendar Spread Option Strategy #1

When constructing a calendar spread options strategy for PotlatchDeltic Corporation (PCH), it is crucial to carefully select the appropriate put and call options with the goal of maximizing profit while minimizing risk, particularly the risk of having shares assigned. Given the target stock price range of 2% around the current stock price, we must evaluate which combinations of put and call options offer the best potential returns. Here, we analyze five potential choices based on expiration dates and strike prices.

Choice 1: Short-Term Strategy

Buy Put Option: Strike $45, Expire 2024-06-21

Sell Call Option: Strike $45, Expire 2024-06-21

- Put Option Greeks: Delta: -0.7449781358, Gamma: 0.0576411076, Vega: 1.8078850634, Theta: -0.1267277833, Rho: -0.0067891463, Premium: $2.7, Profit: $0.7452

- Call Option Greeks: Delta: 0.1086179067, Gamma: 0.0584975415, Vega: 1.0510323219, Theta: -0.0423454362, Rho: 0.000817716, Premium: $0.71, Profit: $0.71

With the above choice, theres a risk of assignment for the short call given its short time to expiration. Delta for the call is low, indicating a lower theoretical probability of becoming deeply in the money, which aligns with the goal of minimizing the risk of assignment. However, the premium collected is relatively modest.

Choice 2: Near-Term Strategy

Buy Put Option: Strike $50, Expire 2024-08-16

Sell Call Option: Strike $45, Expire 2024-07-19

- Put Option Greeks: Delta: -0.734849527, Gamma: 0.0299137083, Vega: 5.4438960757, Theta: -0.0262688516, Rho: -0.0700923537, Premium: $4.3, Profit: $4.1452

- Call Option Greeks: Delta: 0.1329880328, Gamma: 0.061012599, Vega: 2.7074107204, Theta: -0.0107430125, Rho: 0.0049774749, Premium: $0.2, Profit: $0.2

This combination provides a higher potential profit for the put option, taking advantage of the high vega which will benefit from any increase in volatility. The selected call option has a longer time before expiration and a lower delta, which reduces the likelihood of assignment. The smaller premium from the call is offset by the significant profit potential of the put option.

Choice 3: Mid-Term Strategy

Buy Put Option: Strike $45, Expire 2024-11-15

Sell Call Option: Strike $45, Expire 2024-08-16

- Put Option Greeks: Delta: -0.7757088917, Gamma: 0.0601131138, Vega: 7.4822230925, Theta: -0.0038448929, Rho: -0.1532448615, Premium: $2.88, Profit: $0.5652

- Call Option Greeks: Delta: 0.1637030623, Gamma: 0.0620883484, Vega: 4.1689368179, Theta: -0.0076988198, Rho: 0.0109422911, Premium: $0.6, Profit: $0.6

This selection offers balanced exposure with moderate potential returns and balanced risks. The put option has a longer time to expiration, allowing more time for the price movements to accrue profits. The call options delta still indicates low assignment risk, and the vega suggests moderate sensitivity to volatility.

Choice 4: Longer-Term Strategy

Buy Put Option: Strike $45, Expire 2024-11-15

Sell Call Option: Strike $40, Expire 2024-08-16

- Put Option Greeks: Delta: -0.7757088917, Gamma: 0.0601131138, Vega: 7.4822230925, Theta: -0.0038448929, Rho: -0.1532448615, Premium: $2.88, Profit: $0.5652

- Call Option Greeks: Delta: 0.580338488, Gamma: 0.081428179, Vega: 6.5495803573, Theta: -0.0142682918, Rho: 0.0369248404, Premium: $3.4, Profit: $3.4