RPM International, Inc. (ticker: RPM)

2023-12-22

RPM International, Inc., trading under the ticker symbol RPM on the New York Stock Exchange, is a multinational holding company at the forefront of the specialty coatings, sealants, building materials, and related services industry. With its headquarters in Medina, Ohio, RPM boasts a diverse portfolio of subsidiaries that manufacture and market high-performance coatings, sealants, and specialty chemicals, primarily for maintenance and improvement applications. Founded in 1947, the company has grown substantially through numerous acquisitions and now operates across four reportable segments: Consumer, Construction Products, Performance Coatings, and Specialty Products. RPM prides itself on its combination of entrepreneurial culture and professional corporate management, which has fueled consistent revenue growth and a reliable dividend track record appealing to investors. Through its broad range of products, RPM serves a variety of end markets including industrial, commercial, and consumer sectors, with a global reach that extends to over 170 countries and territories.

RPM International, Inc., trading under the ticker symbol RPM on the New York Stock Exchange, is a multinational holding company at the forefront of the specialty coatings, sealants, building materials, and related services industry. With its headquarters in Medina, Ohio, RPM boasts a diverse portfolio of subsidiaries that manufacture and market high-performance coatings, sealants, and specialty chemicals, primarily for maintenance and improvement applications. Founded in 1947, the company has grown substantially through numerous acquisitions and now operates across four reportable segments: Consumer, Construction Products, Performance Coatings, and Specialty Products. RPM prides itself on its combination of entrepreneurial culture and professional corporate management, which has fueled consistent revenue growth and a reliable dividend track record appealing to investors. Through its broad range of products, RPM serves a variety of end markets including industrial, commercial, and consumer sectors, with a global reach that extends to over 170 countries and territories.

| As of Date: 12/22/2023Current | 8/31/2023 | 5/31/2023 | 2/28/2023 | 11/30/2022 | |

|---|---|---|---|---|---|

| Market Cap (intraday) | 14.38B | 12.86B | 10.27B | 11.43B | 13.38B |

| Enterprise Value | 16.93B | 15.62B | 13.19B | 14.29B | 16.27B |

| Trailing P/E | 28.12 | 26.81 | 19.60 | 21.51 | 25.52 |

| Forward P/E | 22.83 | 20.49 | 17.24 | 18.76 | 22.83 |

| PEG Ratio (5 yr expected) | 2.28 | - | - | - | 2.28 |

| Price/Sales (ttm) | 1.96 | 1.77 | 1.42 | 1.61 | 1.92 |

| Price/Book (mrq) | 6.30 | 6.01 | 5.00 | 5.47 | 6.70 |

| Enterprise Value/Revenue | 2.31 | 7.76 | 6.54 | 9.43 | 9.08 |

| Enterprise Value/EBITDA | 17.31 | 45.33 | 47.09 | 127.99 | 80.14 |

| Address | 2628 Pearl Road, Medina, OH 44256, United States | Phone | 330 273 5090 | Fax | 330 225 8743 |

| Website | https://www.rpminc.com | Industry | Specialty Chemicals | Sector | Basic Materials |

| Full Time Employees | 17,274 | Founded | 1947 | Headquarters | Medina, Ohio |

| Previous Close | 111.64 | Open | 112.06 | Day Low | 111.8 |

| Day High | 112.77 | Dividend Rate | 1.84 | Dividend Yield | 1.65% |

| Payout Ratio | 42.32% | Five Year Avg Dividend Yield | 1.89% | Beta | 0.987 |

| Trailing PE | 28.28 | Forward PE | 19.94 | Volume | 252,036 |

| Market Cap | $14,463,518,720 | Fifty Two Week Low | 78.52 | Fifty Two Week High | 113.37 |

| Price to Sales | 1.97 | Fifty Day Average | 100.4864 | Two Hundred Day Average | 92.42425 |

| Enterprise Value | $16,928,437,248 | Profit Margins | 6.962% | Float Shares | 117,040,479 |

| Shares Outstanding | 128,828,000 | Shares Short | 1,364,649 | Shares Short Prior Month | 1,320,454 |

| Shares Percent Shares Out | 1.06% | Held Percent Insiders | 1.298% | Held Percent Institutions | 81.364% |

| Short Ratio | 2.63 | Book Value | 17.688 | Price to Book | 6.347 |

| Total Cash | $240,586,000 | Total Cash Per Share | 1.867 | EBITDA | $949,449,024 |

| Total Debt | $2,784,943,104 | Quick Ratio | 1.365 | Current Ratio | 2.453 |

| Total Revenue | $7,335,950,848 | Debt to Equity | 121.995 | Revenue per Share | 57.532 |

| Return on Assets | 7.299% | Return on Equity | 23.912% | Free Cash Flow | $490,391,360 |

| Operating Cash Flow | $912,760,000 | Earnings Growth | 19.3% | Revenue Growth | 4.1% |

| Gross Margins | 38.607% | EBITDA Margins | 12.942% | Operating Margins | 14.141% |

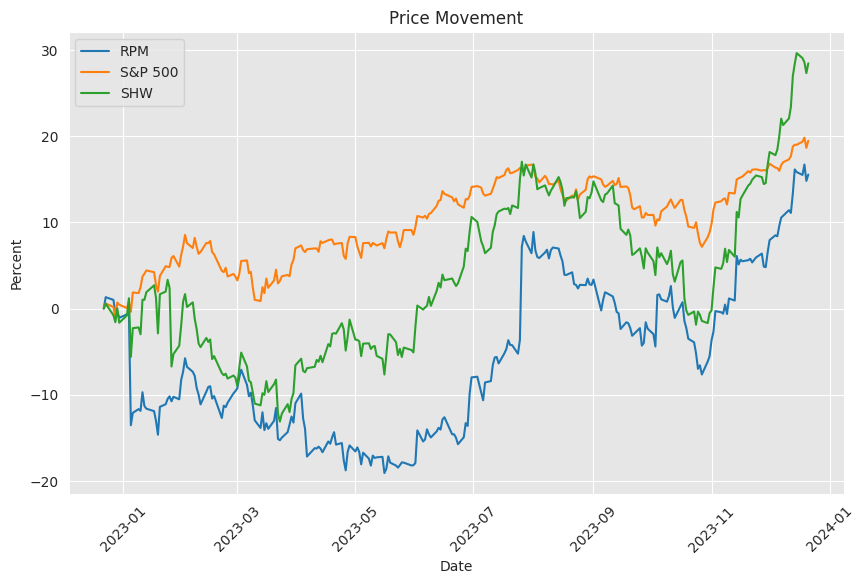

Based on the provided technical analysis (TA) data and company fundamentals, the current stock price trajectory for RPM International Inc. exhibits a bullish trend. Considering the stock's adjusted closing price is $111.63, with several key indicators supporting an upward momentum:

- The Moving Average Convergence Divergence (MACD) is positive at 3.291662, indicating sustained buying interest. The MACD histogram also presents a positive value of 0.230450, suggesting the continuation of the current trend.

- The Relative Strength Index (RSI) at 71.638814 is above 70, typically interpreted as overbought conditions; however, it can also indicate strong buying pressure in a bull market.

- The stock price is trading near the upper Bollinger Band (BBU at 112.963258), signifying potential resistance but also reflecting the strength of the current trend if the price does not reverse.

- The ADX (Average Directional Index) value of 49.236821 is high, implying a strong trend presence, and often precedes a continuation of the current trend.

- The On Balance Volume (OBV) is negative, which could be a concern for the sustainability of the trend if the indicator diverges from the price.

- Other indicators like the Stochastic Oscillator (STOCHk at 85.994628) and Williams %R (WILLR at -16.845206) are in overbought territory, which may signal a pause or pullback, yet they can remain at these levels during strong trends.

The fundamentals of the company also provide a context for the TA-based predictions. The increasing Market Cap, from $10.27B to $14.38B in nine months, and the improving Enterprise Value from $13.19B to $16.93B, reflect a growing investor confidence and potential undervaluation at earlier periods. The P/E ratio has increased proportionally with the stock price, indicating that the earnings support the company's valuation growth. Additionally, other valuation metrics such as Price/Sales, Price/Book, and Enterprise Value/Revenue show increasing investor confidence despite these figures often suggesting an increased price to fundamental value ratio.

The financial summaries highlight growth in EBITDA and Net Income compared to the previous fiscal years, showing a solid operating performance. The enlarged Gross Profit and Operating Revenue also emphasize the company's capacity to generate earnings, which should support further stock price growth.

Taking the technical and fundamental factors into account, the outlook for RPM's stock in the next few months remains optimistic. However, the near-term may experience volatility due to the current overbought conditions indicated by several TA metrics. This could lead to brief periods of consolidation or mild pullbacks. Assuming the company maintains its growth trajectory and investor sentiment remains positive, the general trend is expected to continue upwards.

Investors may look for potential bullish continuation patterns and keep an eye on whether the stock continues to respect its uptrend by bouncing off key moving averages like the EMA_50, which has been trending up. Any break below significant support levels such as the EMA_50 or the SMA_20 could signal a shift in market sentiment that could impact the stock's trajectory.

Overall, a mix of upward technical indicators and solid fundamental performance suggest that RPM's stock could continue with its bullish trend over the next few months. Diligent monitoring of volume trends, potential bearish divergences in indicators, and news flow that may affect investor sentiment will be key to understanding the stock's price movements moving forward.

RPM International Inc., founded in 1947 and based in Ohio, is a company with a legacy of over half a century, a period over which it has built a reputation as a consistent performer with a particular emphasis on dividend growth. The firm's history is marked by not only resilience in various economic climates but also a steadfast commitment to providing value to its shareholders. One of the core elements in RPM's success has been its strategic approach to acquisitions. Over the years, RPM has made a series of judicious purchases that have allowed it to expand its portfolio and deepen its penetration in the markets for industrial, consumer, and construction products.

The acquisition strategy has brought a diverse array of brands under RPM's umbrella, all contributing to the company's overall profitability and growth. This portfolio diversity allows RPM to tap into different market segments and leverage cross-selling opportunities, thereby driving revenue and supporting a stable and growing dividend payout policy. The importance of this cannot be overstated, as it has given RPM a powerful tool to manage and grow its business through various cycles and market conditions.

Indeed, RPM's financial robustness is one aspect that stands out when looking at its year-over-year profit improvements. Such steady profit growth denotes a level of fiscal discipline that investors tend to look for, suggesting that RPM's management team is capable of adjusting strategies swiftly to adapt to changing market conditions. The effective handling of company finances invariably leads to a steady stream of income, a part of which RPM has faithfully returned to its shareholders in the form of dividends. This consistency not only demonstrates corporate stability but also acts as an incentive for investment in RPM's stocks.

Moreover, a closer analysis of the company's fundamental financial metrics paints a picture of a well-managed organization with a healthy balance sheeta critical aspect for investors eyeing long-term growth. RPM's consistent revenue trajectory solidifies its ability to sustain and possibly increase its dividend offerings, thereby adding to its appeal as an investment vehicle. The company has managed to reinvest funds effectively to fuel further growth while being prudent about its capital allocation strategy; these are tangible signs that it prioritizes sustainable profitability.

With this stable and optimistic background, the expectation for RPM's future dividend performance remains high. RPM appears poised to maintainpossibly even accelerateits record of delivering growing dividends back to its investors, an outcome that is buoyed by its shrewd business model focused on sustainable growth and consistent profits.

The sentiment of investors toward RPM International tends to be positive, largely driven by the historical significance of its consistent dividend growth along with its potential for capital appreciation. Although not as widely known as some of its competitors, RPM's track record of dividend enhancement makes it a potentially lucrative investment vehicle. Its strategic growth measures, coupled with solid financial performances, support the belief that RPM will remain a reliable source of increasing dividends.

RPM International's success is also evident in its strong Return on Equity (ROE). Sporting a ROE of 22%significantly higher than the industry average of 13%the company showcases its efficiency in generating profits from shareholders' equity. However, it's vital to acknowledge RPM's use of debt with a debt-to-equity ratio of 1.10, which may inflate the ROE but also introduces additional risks. This leverage does, however, signify an aggressive strategy for growth, though it must be carefully managed to prevent potential losses during less favorable market conditions.

Looking ahead, RPM's upcoming announcement of its fiscal 2024 second-quarter financial results on January 4, 2024, will be a focal point for the investment community. The results, which will be discussed by management in a conference call, are likely to provide keen insights into the company's performance and future guidance. RPM, with its global presence, aims to maintain transparency and a robust relationship with investorsreflected in the company's efforts to make the financial outcomes and discussions accessible through webcasts and transcripts on its investor relations page.

Investor relations for RPM are handled by Matt Schlarb, who serves as the primary touchpoint for financial analysts and other investor inquiries. The importance RPM places on investor relations is indicative of its commitment to transparency and engagement with the investment community, which plays a significant role in how the company's stock is perceived and valued in the market.

Analysts and market observers are keeping a close eye on RPM with a promising perspective on its financial health. Zacks Equity Research has given the company an encouraging Growth Style Score of A and a VGM Score of A. Presently, RPM holds a Zacks Rank #3 (Hold), suggesting that investors should keep a watchful eye on the company's progress. With an anticipated earnings growth of 16.3% and moderate sales growth of 4%, there's a strong signal of RPM's operational prowess. The upward revision of earnings estimates and an impressive history of earnings surprises of 8.5% further contribute to the company's allure as an investment opportunity.

Furthermore, RPM International is identified as a growth stock with potential for sustainable long-term gains essential for growth-oriented investors. The stock's upward trend complemented by a well-established brand portfolio and innovative product offerings. Despite the stock's non-appearance among the 30 Most Popular Stocks Among Hedge Funds, the slight increase in hedge fund portfolios holding RPM shares testifies to the level of investor interest it continues to generate.

Value investors considering RPM will likely take notice of the company's impressive valuation metrics. With a Zacks Rank #2 (Buy) and a roster of encouraging valuation ratios such as a P/E ratio lower than the industry average and a median P/B ratio that suggests market favorability, RPM presents itself as a potentially undervalued stock. The company's upward earnings revisions and solid history of earnings surprises only strengthen the case for RPM as an undervalued asset. The convergent opinion of value investors and analysts points to RPM International's strong candidacy as a quality value stock to watch, based on its undervaluation potential against its future earnings prospects.

Similar Companies in Specialty Chemicals:

Report: The Sherwin-Williams Company (SHW), The Sherwin-Williams Company (SHW), Report: PPG Industries, Inc. (PPG), PPG Industries, Inc. (PPG), Axalta Coating Systems Ltd. (AXTA), Masco Corporation (MAS), Valspar Corporation (VAL), Rust-Oleum Corporation (Private), Behr Process Corporation (Private)

News Links:

https://finance.yahoo.com/m/e70fd9d1-7c77-3864-b51b-8be8801ff6a2/buy-this-little-known-stock..html

https://finance.yahoo.com/news/rpm-international-inc-nyse-rpm-172333599.html

https://finance.yahoo.com/news/rpm-announce-fiscal-2024-second-140000178.html

https://finance.yahoo.com/news/why-1-growth-stock-could-144507740.html

https://finance.yahoo.com/news/growth-investor-1-stock-could-144506226.html

https://finance.yahoo.com/news/exit-rpm-international-rpm-092643235.html

https://finance.yahoo.com/news/rpm-international-rpm-stock-undervalued-144010427.html

https://finance.yahoo.com/news/heres-why-rpm-international-rpm-144007793.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: iRDpf2

https://reports.tinycomputers.io/RPM/RPM-2023-12-22.html Home