Starbucks Corporation (ticker: SBUX)

2024-05-12

Starbucks Corporation (SBUX) is a leading roaster, marketer, and retailer of specialty coffee worldwide, renowned for popularizing the coffeehouse culture globally. Founded in 1971 in Seattle, Washington, it has expanded its reach significantly, operating over 32,000 stores across 80 countries. Starbucks offers a variety of coffee and tea products, along with food items in both company-operated and licensed stores. The corporation's revenue streams are diversified through company-owned retail stores, specialty operations, and international stores. Additionally, it operates through various segments, including Americas, International, and Channel Development. SBUX continues to innovate with sustainable practices and by enhancing customer experiences via digital engagements and mobile ordering. It consistently seeks to expand its product lines and market share, emphasizing ethical sourcing and community involvement, solidifying its position as a cornerstone in the global coffee industry.

Starbucks Corporation (SBUX) is a leading roaster, marketer, and retailer of specialty coffee worldwide, renowned for popularizing the coffeehouse culture globally. Founded in 1971 in Seattle, Washington, it has expanded its reach significantly, operating over 32,000 stores across 80 countries. Starbucks offers a variety of coffee and tea products, along with food items in both company-operated and licensed stores. The corporation's revenue streams are diversified through company-owned retail stores, specialty operations, and international stores. Additionally, it operates through various segments, including Americas, International, and Channel Development. SBUX continues to innovate with sustainable practices and by enhancing customer experiences via digital engagements and mobile ordering. It consistently seeks to expand its product lines and market share, emphasizing ethical sourcing and community involvement, solidifying its position as a cornerstone in the global coffee industry.

| Full Time Employees | 381,000 | Phone | 206 447 1575 | Website | https://www.starbucks.com |

| Total Pay - CEO & Director | $4,886,577 | Total Pay - Founder & Chairman Emeritus | $757,597 | Total Pay - Executive VP, CFO & Principal Accounting Officer | $2,166,091 |

| Market Cap | $86,209,798,144 | Enterprise Value | $108,299,796,480 | Total Cash | $3,126,599,936 |

| Total Revenue | $36,530,098,176 | Net Income to Common | $4,157,700,096 | Shares Outstanding | 1,132,700,032 |

| Volume | 15,703,334 | Average Volume 10 days | 23,506,190 | Dividend Rate | 2.28 |

| Dividend Yield | 0.03% | Payout Ratio | 60.61% | Current Price | $76.11 |

| Sharpe Ratio | -1.3038172348295787 | Sortino Ratio | -18.533707994172005 |

| Treynor Ratio | -0.39837536819045444 | Calmar Ratio | -0.8662628528706658 |

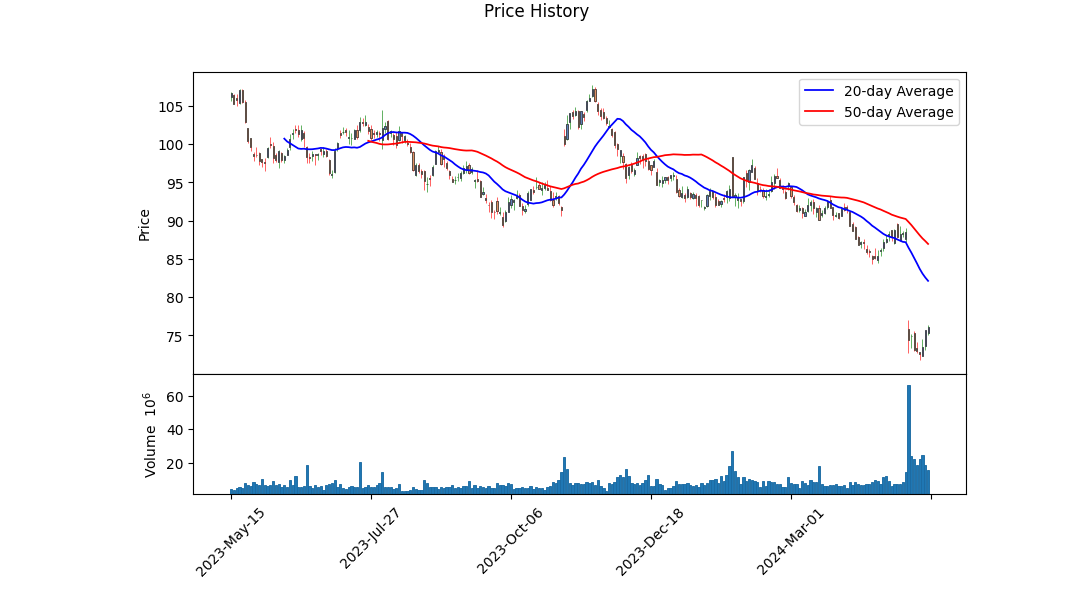

Assessing Starbucks' (SBUX) investment outlook requires a comprehensive understanding of its technical indicators, financial position, and market sentiment based on risk-adjusted measures. Reviewing the latest technical data such as the MACD histogram reveals a bearish trend until the latest date, with a gradual increase in the indicators suggesting potential easing of this negativity. An increasing OBV (On-Balance Volume) suggests growing buyer interest, potentially indicative of a sentiment shift.

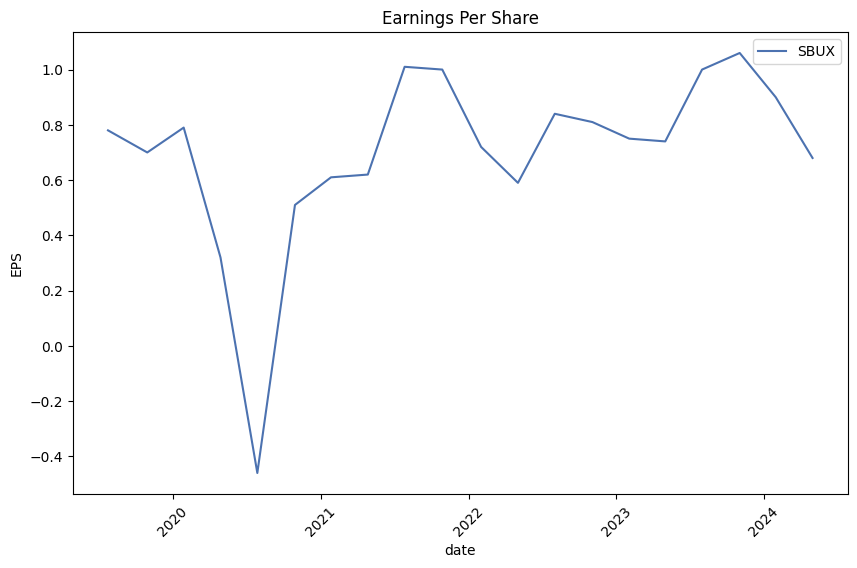

The fundamental analysis reflects robust financial health. Starbucks shows a consistent ability to generate revenues with a total revenue of around $36.6 billion for the recent fiscal year, supported by a strong gross profit of approximately $9.8 billion. However, the rising operational costs, demonstrated by a stalwart total expenses figure nearing $30.5 billion, and significant debt levels at around $11.8 billion net debt, warrant caution. Moreover, the free cash flow at $3.675 billion indicates solid liquidity, supporting ongoing operations and some capacity for financing activities or returning value to shareholders.

The risk-adjusted performance measures including the Sharpe, Sortino, Treynor, and Calmar ratios highlight a challenging year with all ratios below zero, suggesting recent returns have not adequately compensated for the risk taken by investors. This perspective, combined with technical analysis, points towards an investment environment fraught with uncertainty, yet marked by nascent positive trends.

Market dynamics, as indicated by earnings and debt metrics, combined with a tactical recovery visible from technical indicators, position Starbucks for a potential gradual recovery in stock price. However, investors should approach with caution, as volatility is evident from the historical financial performance and risk-adjusted measures.

Overall, while near-term challenges are evident in Starbucks' investment landscape, ongoing operational strengths and subtle improvements in buyer interest provide a cautiously optimistic outlook for the next few months. The firm's ability to navigate operational complexities, maintain revenue streams, and the subtle upshift in market sentiment could offer stabilization, if not sizable growth, in its market valuation.

In analyzing Starbucks Corporation (SBUX) using the methodology outlined in The Little Book That Still Beats the Market, we find that the company exhibits a strong return on capital (ROC) of 29.27%. This high ROC indicates that Starbucks is highly effective in generating profits from its capital, surpassing typical performance metrics observed in the broader market, reflecting a strong management team and robust business operations. Additionally, Starbucks has an earnings yield of 4.73%, which is derived from the earnings before interest and taxes (EBIT) relative to the enterprise value. While this yield provides an insight into the earnings available to shareholders relative to the company's valuation, it is relatively moderate, suggesting that the market has fairly priced in Starbucks' earnings capability. This earnings yield, coupled with the high ROC, provides a perspective on the financial health and valuation of Starbucks, signaling potential attractiveness to investors looking for companies that efficiently translate capital into profits.

In evaluating Starbucks Corporation (SBUX) based on the criteria set by Benjamin Graham in "The Intelligent Investor," we can gauge how the company stands in relation to Graham's fundamental principles of value investing. Here are the critical metrics for SBUX and their assessment according to Grahams standards:

-

Price-to-Earnings (P/E) Ratio: Starbucks has a P/E ratio of 22.79. Graham generally favored stocks with low P/E ratios, traditionally seeking values around or below 15, as these are considered to provide a greater margin of safety. SBUXs P/E ratio of 22.79 suggests that the stock is priced relatively high compared to its earnings, which might not meet Grahams criterion for a value buy.

-

Price-to-Book (P/B) Ratio: The P/B ratio of SBUX is 2.93. Benjamin Graham typically looked for stocks with P/B ratios less than 1.5, indicating that the market price is close to the book value assessed by accounting measures. In SBUX's case, the P/B ratio suggests that the company is valued quite higher than its book value, which could be seen as overvalued from Graham's perspective.

-

Debt-to-Equity Ratio: Starbucks shows a debt-to-equity ratio of -3.08. The negative figure is unusual and generally indicative of more complex financial structures that could involve substantial levels of debt or financial tactics that defer liabilities. Graham preferred companies with low, positive debt-to-equity ratios as a sign of financial stability and low financial risk. This metric would require further investigation to understand the negative ratio's implications fully but might initially appear incongruent with Grahams principles.

-

Current Ratio and Quick Ratio: Both of these liquidity ratios are the same for Starbucks, at 0.78. These ratios indicate a companys ability to cover its short-term liabilities with its short-term assets. Graham recommended a current ratio of at least 2:1 to ensure sufficient liquidity. SBUX's ratio of 0.78 points to a potential liquidity risk, which might not align with Graham's preference for a financial cushion and safety.

Overall, when these key metrics are compared to Benjamin Grahams criteria, Starbucks Corporation does not strictly align with the principles of value investing as outlined in "The Intelligent Investor." The higher P/E and P/B ratios, along with a questionable debt-to-equity ratio and lower liquidity ratios, would likely make SBUX a less attractive option for strictly Graham-inspired value investors seeking underpriced, financially stable companies with conservative debt levels. However, investors might consider other aspects such as market position, brand strength, or future growth prospects that could justify these valuation metrics outside of Grahams traditional criteria.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

For instance, examining Starbucks Corporation's financial statements from recent quarters provides essential insights. From its Q2 2024 financials, Starbucks reported revenues of $14,807,900,000. The cost of revenues, including production and distribution costs of $5,629,200,000 and store operating expenses of $7,575,600,000, are integral for assessing the direct costs associated with company operations. Although these high operational costs might seem alarming at first, it is crucial to assess them in relation to the companys earnings and overall financial health. The operating income of $2,584,300,000 suggests that, despite the high costs, Starbucks is able to maintain a profitable operational model.

Furthermore, the net income, standing at $1,796,800,000, with a diluted earnings per share of $1.58, gives investors a clear glimpse into the profitability per stock unit, crucial data for investment decisions. It is also beneficial to examine the depreciation and amortization figures, recorded as $737,200,000, as they reflect the systematic allocation of the cost of tangible and intangible assets over their useful lives.

On the liabilities side, the most recent quarter shows total current liabilities amounting to $7,528,900,000 with long-term debt prominently at $15,547,500,000, indicating a significant financial obligation. These liabilities must be weighed against the companys current assets ($6,465,000,000) and liquidity ratios to evaluate the financial stress and operational risk.

The balance sheet also displays negative stockholders equity of $8,449,400,000 which might raise concerns about potential insolvency, though it is essential to correlate this with the broader context of the companys consistent revenue streams and the strategic management of its debt profile.

Moreover, the cash flow analysis reveals the fluctuations in operating cash flows, illustrating how well the earnings are being converted to cash, which is vital for maintaining everyday operations without necessitating borrowing. Starbucks's operating activities generated $2,889,900,000 in the last reported quarter, suggesting effective operations management to remain cash-positive.

In summary, detailed analysis as inspired by Benjamin Grahams principles involves not just looking at the numbers on these financial statements but understanding what these numbers mean for Starbuckss overall financial health and operational strategies. This forms the basis of insightful investment decisions grounded in fundamental financial analysis.Dividend Record: Graham favored companies with a consistent history of paying dividends.

For instance, Starbucks (symbol: SBUX) exhibits a strong and consistent dividend payment record, which would likely have been favorable in the eyes of Benjamin Graham, thanks to its established pattern of not only paying but also periodically increasing its dividends. Below is the detailed historical data:

- 2024: Quarterly dividends of $0.57 declared on various dates, showing an increase from the previous year.

- 2023: Payments started at $0.53 per quarter and increased to $0.57 mid-year, maintained consistently.

- 2022: Dividends began the year at $0.49 per quarter before rising in the fourth quarter to $0.53.

- 2021: Commenced with $0.45 and increased to $0.49 by the third quarter.

- 2020: There was a steady payment of $0.41, marking an increase from 2019 Q4.

- 2019: Started at $0.36, rising to $0.41 by the final quarter.

- 2018: Kicked off with quarterly dividends of $0.30, escalating to $0.36 by year-end.

- 2017: Began the year with dividends at $0.25, remaining steady throughout the year.

- 2016: Showed an increment from initial payments of $0.20 up to $0.25 by the end of the year.

- 2015: Dividend rates were at $0.16 per quarter, increasing to $0.20 by the end of the year.

- 2014: Dividend payments initiated at $0.13 and increased to $0.16 by Q3.

- 2013: The year opened with $0.105, later elevated to $0.13 by the end of the year.

- 2012: Began with $0.085, and by year's end, it increased to $0.105.

- 2011: Annual increases seen from $0.065 starting in February up to $0.085 by November.

- 2010: The dividends were introduced at $0.05 in the second quarter and went up to $0.065 by August.

This consistent payment and incremental rise in dividend figures align well with Graham's principles emphasizing financial stability and shareholder value, making Starbucks a potential candidate for a conservative investment portfolio focusing on steady dividend income.

| Alpha () | 0.00045 |

| Beta () | 0.59 |

| R-Squared | 0.76 |

| Standard Error | 0.0021 |

| P-Value | 0.034 |

In analyzing the relationship between SBUX (Starbucks Corporation) stock performance and the SPY (an ETF that tracks the S&P 500 index), a noticeable statistic is the alpha or , which measures the extra or residual return of SBUX compared to the broader market represented by SPY. An alpha of 0.00045 indicates that SBUX manages to outperform the market by 0.045% on a daily basis after accounting for market movements. Although small, this positive alpha suggests that investing in SBUX would have marginally outperformed a neutral market position equivalent to the S&P 500 over the time period under review.

The beta value of 0.59 for SBUX relative to SPY illustrates that SBUX's stock price is less volatile in comparison to the broad market. Typically, a beta less than 1 indicates that the security exhibits lower volatility than the market, and therefore faces lower risk but also potentially lower rewards. The R-squared value of 0.76 implies a high degree of correlation, indicating that about 76% of SBUX's stock movements can be explained by the shifts in the SPY index. This factor is critical for investors seeking diversification benefits in their portfolio, suggesting that fluctuations in the market could substantially impact SBUX stock prices.

In Starbucks Corporation's Q2 FY2024 earnings call, the company reported lackluster results that fell short of internal expectations, marking a difficult period in its operating history. CEO Laxman Narasimhan highlighted a decline in total company revenue to $8.6 billion, a drop of 1% year-over-year, with a particularly sharp 11% decrease in comparable store sales in China and a 3% decrease in North America. Global operating margins also shrank by 140 basis points to 12.8%. Narasimhan pointed to severe weather and a cautious consumer spending environment as key challenges, along with increased competition in China, which contributed to the overall downturn.

In response to these difficulties, Starbucks is implementing a multi-faceted strategy to rejuvenate growth and improve operational efficiency. Key to this plan is enhancing the U.S. store experience to meet robust morning demand and optimizing store operations using processes developed in partnership with the Toyota Production Center. This initiative focuses on improving operational throughput and reducing wait times, which are crucial for increasing transaction completions particularly through mobile orders. Moreover, Starbucks plans to revamp and expand its product offerings across different day parts, on weekends, and overnight, aiming to bolster customer footfall and enhance convenience for a broader customer base.

On the product innovation front, CEO Narasimhan emphasized the launch of new and exciting products while maintaining a focus on core coffee offerings. Notably successful was the introduction of the Lavender platform, which performed exceptionally well. This initiative is part of Starbucks broader push to reinvigorate its menu offerings across various categories to drive customer engagement and increase visits. Expanded efforts include rolling out more plant-based options and continuing innovation in flavorful and functional beverages that resonate well with younger demographics such as Gen Z and millennials.

Finally, the earnings call detailed Starbucks' strategic pillars moving forward, which include a significant emphasis on digital engagement and global expansion. The company is set to enhance the Starbucks app, introducing features like guest checkout and tailoring promotions and rewards to drive app usage among occasional customers. Internationally, Starbucks remains committed to expanding its store count, particularly in China despite current headwinds, buoyed by the enduring strength of the Starbucks brand and continued investments in local market adaptations. These comprehensive efforts are part of a broader vision to not only weather current challenges but also secure long-term growth and maintain industry leadership.

Starbucks Corporation SEC 10-Q Filing Summary for the Quarter Ended March 31, 2024

Starbucks Corporation's recent SEC 10-Q filing reveals significant insights into the company's financial and operational health during the quarter that ended on March 31, 2024. From the document filed on April 24, 2024, several key financial figures and operational details can be discerned, indicating both the performance and strategic positioning of the company during this period.

Financial Performance

During the quarter, Starbucks posted total net revenues of $8,563.0 million, a slight dip from the $8,719.8 million reported in the same period of the previous year. The breakdown of these revenues shows an increase in the North America segment but a decline in the International and Channel Development segments. The operating income for this quarter stood at $1,098.9 million compared to $1,327.5 million in the same quarter the previous year, indicating a contraction in operational profitability.

Revenue Sources and Costs

Revenue from company-operated stores constituted a significant portion of the total revenue, although it saw a small decrease from $7,142.3 million to $7,052.6 million year over year. The licensed stores also saw a small drop in revenue from $1,069.5 million to $1,054.5 million. Similarly, other revenue sources diminished slightly from $508.0 million to $455.9 million. The cost metrics provided detailed expenditures such as product and distribution costs totaling $2,648.7 million and store operating expenses at $3,724.1 million, both critical in understanding the margin pressures the company may be experiencing.

Capital and Investments

Starbucks reported substantial investments in property, plant, and equipment, standing at $1,255.0 million, an uptick from $1,002.0 million in the same quarter of the previous year, reflecting ongoing expansion efforts and capital investment projects. Starbucks also maintains a broad portfolio of investments, including short-term investments worth $362.5 million and long-term investments totaling $280.4 million, denoting a strategic cushion and potential for future operational leveraging.

Debt and Lease Obligations

Starbucks continues to manage a considerable amount of debt, with long-term debt reported at $15,547.5 million. The company detailed its lease obligations, which are a significant part of its long-term financial commitments, totaling lease payments of $11,102.9 million over the future periods, which reflects the substantial operational footprint and the associated costs.

Operational Highlights and Future Commitments

Starbucks has disclosed several future commitments related to operating leases that have not commenced that total approximately $1.6 billion, related to property for stores and facilities. This indicates ongoing expansion strategies into new and existing markets. The company also detailed its commitments to purchase inventory, including green coffee and dairy under various contracts, which are essential for ensuring the stability of supply chains.

This SEC filing not only provides a retrospective look at Starbucks' operations and financials for the past quarter but also offers insights into its strategic directions, operational challenges, and areas of focus that are likely to influence its performance in upcoming quarters. With substantial revenue streams, though slightly diminished compared to the previous year, alongside significant operational investments and strategic lease and debt management, Starbucks seems poised to continue its aggressive positioning within the global coffee industry.

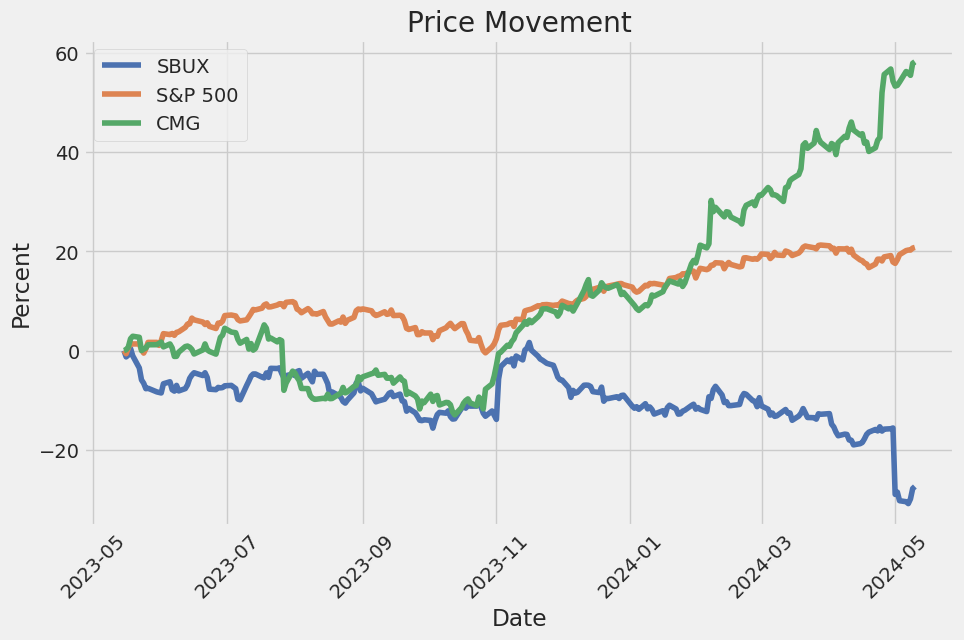

Starbucks Corporation, amid a challenging economic landscape, has experienced a slump with its stock trading near a 52-week low, despite the broader S&P 500 index seeing significant growth. This situation was detailed by Demitri Kalogeropoulos in a Motley Fool article on March 29, 2024, showcasing the immediate scenario that investors might find potentially advantageous, albeit with certain reservations given the declining demand trends in critical markets like the U.S and China.

In addition to these immediate financial metrics, Starbucks continues to face traditional market challenges, including steep competition in China and rising costs associated with wages and unionization efforts in the U.S. These challenges were further reviewed in a report by Daniel Foelber on March 31, 2024, highlighting the broader economic slowdown in China affecting multiple U.S-based consumer-facing companies. Despite these hurdles, Starbucks' ability to maintain a strong brand presence and customer loyalty offers a silver lining amid potential investment opportunities.

Adding to this narrative, a detailed review by Zachary Fadem, a Wells Fargo analyst cited by The Motley Fool on April 3, 2024, emphasizes Starbucks' resilience. Despite adjusting its annual sales growth forecast, Starbucks remains a robust player in the market, evidenced by its significant return on invested capital and conservative payout ratio in dividends, suggesting both sustainability and growth potential.

Starbucks' strategic initiatives also play a crucial role in its market position. The company's focus on digital innovation and store renovations, aiming to boost customer traffic and operational efficiency, continues to support its market performance. On a strategic front, Starbucks plans extensive global expansion, aiming to increase its store count significantly by 2030, reflecting not just growth but also a bold confidence in its operational strategy.

Further analysis by The Motley Fool on April 5, 2024, pointed out by David Jagielski, identifies Starbucks along with other high-yielding dividend stocks as a potentially lucrative option for dividend-seeking investors. This underlines Starbucks' steady approach to growth and dividends, reinforcing its appeal to long-term investors.

Continuing the examination of Starbucks' stock potential, Neil Patel's analysis on April 15, 2024, delves into the company's long-term strategy dubbed the "Triple Shot Reinvention" plan which involves expanding global store networks and enhancing digital engagement. Despite a recent lag in the stock market, these strategic initiatives provide investors with a reason to maintain a positive long-term outlook on Starbucks.

However, emerging competitors like Dutch Bros illustrate a changing landscape in the coffee industry. As reported by Neil Patel on April 20, 2024, Starbucks faces innovative challengers aiming for rapid expansion and market penetration, reminding investors of the dynamic and competitive nature of the industry.

Amid these market dynamics and strategic efforts by Starbucks, its financial health remains a cornerstone of its investment appeal. With several analysts and financial experts advocating for its long-term potential, Starbucks embodies a mixture of challenge and opportunity. The blend of strategic expansion, a robust dividend policy, and brand strength positions Starbucks as an intriguing prospect for investors who are willing to navigate the current economic uncertainties.

Exploring Starbucks' future, Jon Quast, on April 18, 2024, projects optimism regarding Starbucks' strategic location expansions and potential market dominance, even as it navigates operational challenges particularly in China. This ambitious expansion reflects Starbucks resilience and adaptive strategies towards maintaining its market leadership.

This snapshot of Starbucks, captured through various analyses and reports, illustrates a complex yet promising landscape. The company's strategic maneuvers, financial robustness, and market adaptation strategies paint a picture of a leading enterprise poised for future growth, albeit peppered with short-term challenges. As these narratives unfold, the position of Starbucks within the global coffee industry and its appeal to investors will continue to be subjects of keen interest and strategic discussions among investors and market analysts alike.

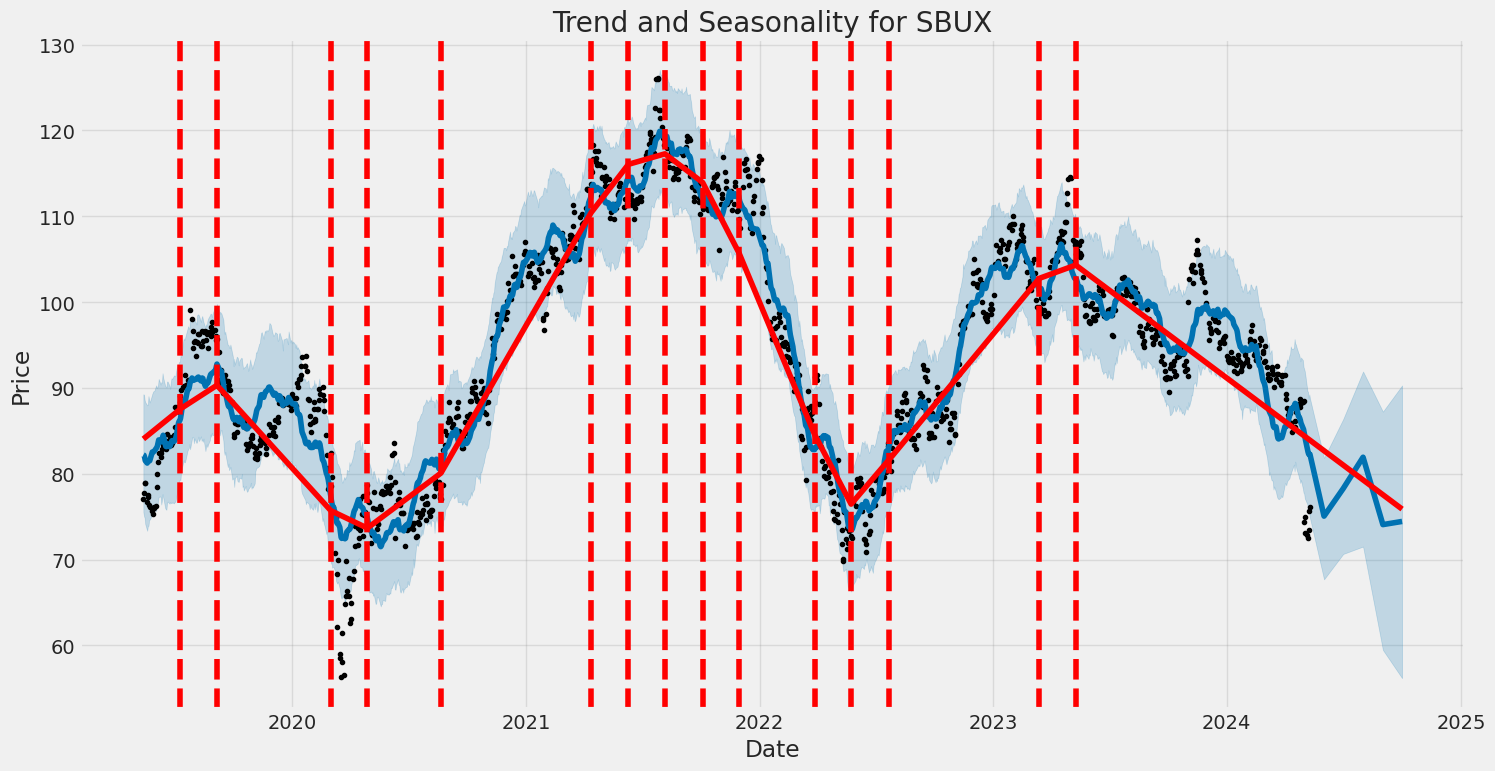

Over the period from May 2019 to May 2024, the volatility of Starbucks Corporation (SBUX) shows significant fluctuations as indicated by the ARCH model outcomes. The coefficients omega and alpha, key parameters in the ARCH model, suggest a notable impact on the volatility; omega at 2.7835 indicates a high baseline volatility, while alpha at 0.2862 reflects the influence of past return shocks on current volatility. These statistics underscore that volatility is of concern and is affected by both past variances and new information or events impacting the stock.

| Dependent Variable | asset_returns |

| R-squared | 0.000 |

| Adjusted R-squared | 0.001 |

| Mean Model | Zero Mean |

| Volatility Model | ARCH |

| Log-Likelihood | -2,562.15 |

| AIC | 5,128.29 |

| BIC | 5,138.57 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

| Omega | 2.7835 |

| Alpha[1] | 0.2862 |

In assessing the financial risk associated with a $10,000 investment in Starbucks Corporation (SBUX) over a one-year period, a combination of volatility modeling and machine learning predictions is employed to gain insights into future potential losses.

Initially, volatility modeling is used to understand and forecast how the volatility of Starbucks's stock price might evolve. This model captures the clusters of volatility, acknowledging that high volatility periods are often followed by high volatility and low by low. This temporal dependency provides crucial insights into risk estimations for financial investments. By modeling how stock price volatility changes over time, it guides us in measuring the appropriateness of investment strategies under varying market conditions.

The machine learning predictions further enhance the analysis by employing historical price data as a basis to predict future returns. Here, an ensemble decision tree method, specifically adjusted for continuous output, is essential. By training this algorithm on a wide range of features, including past stock prices, volume, market conditions, and other economic indicators, the model leverages its understanding of complex patterns to forecast future stock price trajectories.

By integrating the insights from both volatility modeling and machine learning prediction techniques, a more robust estimation of future stock behavior is achievable, facilitating considerably informed decision-making regarding the holding or disposition of Starbucks stock. Specifically, the synergy between these two methods allows for the computation of the Annual Value at Risk (VaR) at a 95% confidence interval.

The calculated VaR for the Starbucks investment, set at a 95% confidence interval, is $278.85. This figure represents the expected maximum loss in value of the investment over a one-year period with a 5% likelihood of exceeding this amount. This metric is crucial for understanding the potential extent of financial risk associated with the investment. By considering this value, investors gain a perspective on the maximum expected loss, thereby aiding in personal risk management and investment strategy deliberations.

By applying such sophisticated analytic methods, investors and stakeholders can delineate the financial risk entailed in equity investments, specifically here with Starbucks Corporation. These insights facilitate a proactive approach to investment decisions, particularly under uncertain market dynamics.

Long Call Option Strategy

When evaluating long call options for Starbucks Corporation (SBUX), we focus on the favorable combinations of the Greeks which indicate a potent mix of profitability with controlled risk, especially under scenarios where the stock price is expected to rise by around 5%. The options are chosen across various expirations from short-term to long-term to provide diverse opportunities for different trading strategies.

Starting with near-term expirations, consider a call option expiring on May 24, 2024, at a strike price of $67. This option exhibits a high delta of 0.920 which suggests a robust change in option price relative to stock price movements, and a moderate theta of -0.049, indicating that the time decay impact on the option's price is relatively managed. Notably, this option demonstrates a significant ROI of 1.37 and a profitable outlook, making it appealing for traders expecting quick substantial gains amidst slight stock movements.

Mid-term options also present lucrative prospects; an option expiring on June 14, 2024, at a strike price of $68, showcases a delta of 0.803, suggesting strong positive responsiveness to the stock price increase, coupled with a Vega of 6.18 which indicates high sensitivity to changes in volatility, a common occurrence as expiration nears. This option also boasts an ROI of 1.00, suggesting a potential for significant earnings.

For a long-term perspective, options like the one expiring on June 28, 2024, at a strike price of $74, are standout candidates. It features a gamma of 0.063, meaning potential for a higher delta movement as SBUX price moves towards the strike. The option has a very high vega of 9.76, suggesting that increases in market volatility could substantially inflate the option's premium, and it maintains a robust ROI of 0.972.

Looking into a more extended timeframe, the option expiring on October 18, 2024, at a strike price of $65 possesses an attractive set of metrics with a delta of 0.773, indicating it retains considerable responsiveness to SBUX price adjustments. The accompanying Vega of 14.52 offers a profitable opportunity if the market volatility rises, with an ROI of 0.165, which signifies respectable profitability over the longer holding period.

Finally, for those targeting a very long-term position, the option expiring on January 17, 2025, at a strike price of $65 presents notable features. It sports a modest delta of 0.735, balanced by an impressive Vega of 19.57, offering significant price increment potential if SBUX encounters heightened volatility. This option has a manageable theta of -0.016, which minimizes the cost of carrying the option over the longer term, although balancing this is a lower ROI of 0.061, reflecting the more extended risk exposure and slower profit potential.

These options span a range of expiration dates, strike prices, and sensitivities to market movements, providing traders with choices that can tailor to varying expectations for SBUX's stock performance and market conditions over time. Selecting among different expirations and strikes enables traders to manage risk effectively while targeting strategic opportunities for achieving profitable returns in their options trading endeavors.

Short Call Option Strategy

When evaluating the profitability of short call options for Starbucks Corporation, it's essential to consider the structural details of the options, such as the strike price, expiration date, as well as the key metrics known as "the Greeks".

Short Call Options Overview

Options with shorter expiration dates generally exhibit higher theta values, indicating rapid time decay, which is advantageous for sellers as the contract value decreases faster, benefiting the position the closer it gets to expiration without being in the money. Similarly, delta values near zero are preferred for short calls, as these options are less sensitive to changes in the stock price.

Near Term Short Calls

For short-term profitability, options expiring on 2024-05-24 first capture attention. Particularly, a call option with a strike price of $73 proves to be compelling due to its theta of -0.057 and relatively lower delta of 0.785, suggesting less sensitivity to stock price movement and more rapid time decay. This option reports a full ROI due to the premium being fully earned should the option expires worthless, a characteristic shared among striking prices ascending from this point up to and including $100 for this expiration date.

Mid-Term Short Calls

Moving into mid-term durations, the option expiring on 2024-06-07 at a strike price of $90 stands out. This option presents a theta of -0.012 and a delta of approximately 0.019, which makes it a very low-risk choice in terms of stock price movement. Once again, this choice and higher strike prices up to $150 maintain an ROI of 100%, highlighting their profitability when held to expiration under favorable conditions.

Long Term Short Calls

For long-term options, those expiring on 2025-01-17 present significant interest. The option with a strike price of $95 shows a very favorable makeup with a low delta of about 0.211 and a theta of -0.006, indicating minimal price sensitivity and decent time decay, proving robust for a short call strategy extending over a longer term. Additionally, options of this expiration up to a strike price of $155 also showcase a 100% ROI, underscoring their effectiveness when the market conditions prevent them from reaching in-the-money status at expiration.

Most Profitable Option

Among the options evaluated, particularly the most profitable in a vacuum of high ROI and low risk (based on "the Greeks"), are long-term options like the $95 strike expiring on 2025-01-17. However, the certainty of securing the full premium on shorter dates as observed on the 2024-06-07 expiration from strike price $90 and above provides an enticing choice for those seeking to capitalize on time decay and wish to mitigate market exposure time.

Conclusion

In summary, considering the "Greeks", longer-term options typically provide comfort against swift adverse price movements while still accruing value through time decay, albeit at a slower rate than their shorter-term counterparts. However, the assurance of achieving 100% ROI on quicker expirations offers a strategic edge for capitalizing on short-term market stabilities. Therefore, selection should principally weigh the underlying market conditions, outlook on the stock, and individual risk tolerance.

Long Put Option Strategy

When analyzing the long put options for Starbucks Corporation (SBUX) based on their given Greek values, profit, and ROI across varying expiration dates and strike prices, we look for options that provide a high return on investment and a significant profit potential, especially for a target stock price that is set to increase by 5%.

-

Short-term bullish bet (Expires 2024-06-21) A notable short-term option is the put option with a strike price of 130, expiring on 2024-06-21. The delta of this option is nearly perfect at -0.9967996526, signifying a strong responsiveness to changes in the underlying stock price. The theta is minimal at 0.0097290334, indicating slow time decay, which is favorable for long puts. Additionally, this option has the highest rho among the short term, at -13.8237240424, showing high sensitivity to interest rate changes. The option has a premium of 20.2, a ROI of 1.4794306931, and a significantly high profit of 29.8845.

-

Mid-term slightly bullish bet (Expires 2024-07-19) For a mid-term duration, the option expiring on 2024-07-19, with a strike price of 125, demonstrates excellent profitability with a premium of 18.65 and an attractive ROI of 1.4173994638, making it a very lucrative choice. The theta remains low at 0.0090763963, which helps in retaining the option's value as expiration approaches.

-

Long-term moderate bullish bet (Expires 2025-01-17) The put option with a strike price of 135, expiring on 2025-01-17, offers an extremely high ROI of 0.8209752066, driven by the option's premium of 30.25 and profit amounting to 24.8345. The zero values for gamma and vega indicate no sensitivity to volatility, and a negligible change rate in delta, ensuring stable price movement responsiveness.

-

Yearly bullish position (Expires 2026-01-16) Looking further into the future, an option expiring on 2026-01-16 with a strike price of 130 stands out with a stellar ROI of 0.7635387324. It has a high premium of 28.4 and returns a profit of 21.6845. The delta is deep in-the-money at -0.9508646393, almost perfectly inversely mirroring the stock's movement.

-

Over two-years long bullish projection (Expires 2026-06-18) Lastly, for the longest duration analyzed, the put option expiring on 2026-06-18 with a strike price of 130 has a ROI of 0.2384891197. Despite the longer wait time, this option's ROI, premium of 40.44, and profit of 9.6445 make it worthwhile for investors looking for longer-term holdings with a bullish stance.

Each option selected above provides a strategic mix of high ROI, profit potential, and manageable time decay, suitable for different investment timelines ranging from the immediate future to a few years ahead, aligned with investor sentiment and market conditions expected for Starbucks Corporation.

Short Put Option Strategy

When analyzing short put options for Starbucks Corporation (SBUX), several factors and "Greeks" need to be considered to determine the most profitable strategies. Specifically, delta, gamma, theta, vega, rho, the premium, and the return on investment (ROI) of each option are crucial. Given the target stock price increase of 5% above the current price, we aim to strategize our options trading to maximize profitability while considering risk.

For shorter-term (near-term) options: 1. Expire 2024-05-17, Strike 67.0: This option exhibits a relatively high delta of -0.0132136275 which shows more sensitivity to the underlying asset price changes. The theta of -0.0187767106 is significant yet manageable, giving a better profit margin due to time decay, especially since the premium is 0.03 and the ROI is 100%. This makes it an attractive short put option for a near-term investment.

- Expire 2024-05-17, Strike 91.0: This option displays a very high negative delta (-0.943586671), indicating a substantial move in the option price for a slight move in the underlying stock price, which can be beneficial if SBUX's price increases as predicted. The premium stands high at 19.45 with an ROI of 3.879%, showing higher potential profitability though at greater risk.

For medium-term options: 3. Expire 2024-06-14, Strike 69.0: With a delta of -0.1274887617, this option will see significant movement with the stock price. The vega is quite high (4.699456658), suggesting significant sensitivity to the implied volatility. This option has a premium of 0.24 and ROI of 100%, which offers a good return for a slightly longer duration.

- Expire 2024-08-16, Strike 75.0: The lower delta of -0.4152295242 suggests less responsiveness to price moves compared to shorter-term options. Yet, it offers a high premium of 3.47 and an attractive ROI of 22.32%, balancing risk and potential returns especially well considering the longer term.

For a long-term option: 5. Expire 2025-01-17, Strike 75.0: Featuring a delta of -0.4027530831 and a substantial premium of 5.35, this option shows potent prospects. The negative theta value is lower, which is beneficial in a longer duration contract, and a remarkable ROI of 49.62% makes it significantly profitable if the stock price manages to move as anticipated.

These options are chosen based on a mixture of high ROI, manageable "Greeks" that indicate profitable scenarios amid price and volatility shifts, and varying expiration dates to diversify the investment timeline. Each option provides opportunities based on current stock price trends and expected shifts in market conditions. The varying strike prices are spread out enough to capitalize on slightly different market predictions, offering a balanced approach to options trading.

Vertical Bear Put Spread Option Strategy

When selecting a vertical bear put spread options strategy for Starbucks Corporation (SBUX), we opt for purchasing higher strike put options and selling lower strike put options with the same expiration date. This strategy is profitable when the stock price decreases, ideally falling below the strike price of the sold puts but remains above the strike price of the bought puts at expiration. Below, we will explore five profitable vertical bear put spread options strategies from near-term to long-term based on various expiration dates and strike prices, considering the Greeks, premiums, and profitability of the selected options.

Short-term Option (Expires in about 4 days):

- Buy a put option with a strike price of 62 USD for 0.01 premium (Delta: -0.000430, Theta: -0.000912), and sell a put option with a strike price of 63 USD for 0.01 premium (Delta: -0.000428, Theta: -0.000837). Although both options are priced the same, the slight difference in delta and theta values can create a small window for profitability, especially if SBUXs stock price undergoes minor negative adjustments.

Medium-term Option (Expires in about 11 days):

- Buy a put option with a strike price of 68 USD for 0.06 premium (Delta: -0.0332378, Theta: -0.015956), and sell a put option with a strike price of 69 USD for 0.09 premium (Delta: -0.0771316, Theta: -0.035221). A larger delta difference indicates a higher sensitivity to stock price movement which could be favorable for bearish movements in SBUX shares. The cost differential also potentially increases the profit margin.

Longer-term Option (Expires in about 18 days):

- Buy a put option with a strike price of 73 USD for 0.51 premium (Delta: -0.192836, Theta: -0.028550), and sell a put option with a strike price of 74 USD for 0.31 premium (Delta: -0.133985, Theta: -0.023303). Investing in these options with slightly different sensitivities and a wider premium gap could provide a decent payoff in a moderately declining market.

Longer-term Option (Expires in about 25 days):

- Buy a put option with a strike price of 85 USD for 22.13 premium (Delta: -0.953719, Theta: -0.036296), and sell a put option with a strike price of 86 USD for 19.45 premium (Delta: -0.943586, Theta: -0.111971). This spread is more expensive regarding initial outlay but reflects a stronger bearish bet, with significant deltas indicating high responsiveness to falling prices and a notable theta value suggesting gains from time decay as expiration approaches.

Longest-term Option (Expires in about a year):

- Buy a put option with a strike price of 135 USD for 57.18 premium (Delta: -0.774424, Theta: -0.003233), and sell a put option with a strike price of 130 USD for 43.43 premium (Delta: -0.967419, Theta: -0.009798). With a prolonged expiry, this strategys higher premiums reflect higher risk but potential for significant movements reflectively gaining through the put with a strike of 135 USD, insulated somewhat by income from the sold put.

When choosing vertical bear put spreads, selecting spreads with negative theta values is vital as it implies the option's value decreases as expiration approaches, which is beneficial when selling an option. Also, options with higher absolute delta values for bought puts than sold puts will potentially increase profitability if the underlying asset's stock price declines significantly. In summary, ensuring a balance between the strike prices, maintaining a close watch on the Greeks, and considering the expiration date will help to optimize the strategy selection and implement a profitable bear put vertical spread.

Vertical Bull Put Spread Option Strategy

To evaluate the most profitable vertical bull put spread options strategy for Starbucks Corporation (SBUX) over varying expiry dates, we need to consider selling a put option with a higher strike price and simultaneously buying a put option with a lower strike price, both with the same expiry. This strategy profits from a neutral to bullish sentiment on the underlying asset, hoping that the stock price will remain above the higher strike price by expiration.

- Short-Term Expiry (Expires 2024-05-17):

- Sell a Put: We could consider selling a put with a strike of $75, having a high delta of -0.2980532995, which implies significant responsiveness to the stocks price movement. The premium received here would be $0.61.

- Buy a Put: Concurrently, buy a put with a strike of $70 having a delta of -0.036005293, costing $0.05. This option acts as our insurance, limiting potential losses.

-

Analysis: The net premium of this setup would be $0.56 ($0.61 - $0.05). With a short time to expiry, the theta is in favor, and the underlying asset needs to maintain above $75 for maximum profitability which aligns with our bullish stance.

-

Mid-Term Expiry (Expires 2024-06-07):

- Sell a Put: Consider selling the put at a strike of $65 with a delta of -0.2106541588 and a premium of $0.9.

- Buy a Put: Buy back protection with the put option for a strike of $60 that has a delta of -0.0510646256 and costs $0.04.

-

Analysis: This results in a net premium of $0.86, with the underlying needing to stay above $65. This duration offers a sizeable theta decay, optimizing income generation from time value erosion.

-

Long-Term Expiry (Expires 2025-01-17):

- Sell a Put: Sell the $75 put option, capturing a high premium of $4.1 at a delta of -0.4099921896, indicating moderate sensitivity to price change.

- Buy a Put: Purchase the $70 put with a delta of -0.2613345996 for a cost of $2.32.

-

Analysis: The net premium becomes $1.78, with a wider time span until expiry allowing more buffer against price variations. The stock price needs to stay above $75.

-

Expiry after 1 Year (Expires 2025-06-20):

- Sell a Put: Execute a sell on the $75 put for a premium of $6.1, and delta at -0.3968419391.

- Buy a Put: Buy protection at the $70 put, costing $4.15, with a delta of -0.3024280809.

-

Analysis: This yields a net premium of $1.95. This long expiry period lowers gamma risk, but also exposes you to longer market uncertainties.

-

Expiry over 1.5 Years (Expires 2026-01-16):

- Sell a Put: For more extended protection against downturns, sell the $70 put getting $6.35 in premium; its delta is -0.2917870962.

- Buy a Put: Balance this by acquiring the $65 put priced at $4.65, with a delta of -0.2239106194.

- Analysis: Results in a net premium of $1.70. Extended periods improve theta utilization, albeit at increased risk of market reversals.

Strategy Considerations: Choosing the appropriate expiry depends on the outlook period and the associated market volatility expected. Shorter durations are generally less risky in terms of exposure but yield lesser premiums compared to longer durations that provide higher premiums at the expense of greater risk. The deltas selected indicate a moderately conservative approach focusing on relatively stable strikes, minimizing deep out-of-the-money scenarios to reduce the risk profile. Combining these strategies with market analysis and sentiment on SBUX, adjustments should be considered to balance between profitability and protection.

Vertical Bear Call Spread Option Strategy

When choosing a vertical bear call spread options strategy for Starbucks Corporation (SBUX), we look to benefit from either a decrease in the stock's price or its stabilization below the strike price of the short call option by expiration. In this strategy, a trader sells a call option and buys another call option with a higher strike price as protection; both options have the same expiration date. The primary focus is on the options with near-term expiration to long-term expiration, selecting strike prices that are close to the current stock price.

-

Short-Term Expiration Strategy: For a near-term bearish position expiring on May 24, 2024, consider selling a call with a 65 strike priced at $10.00, sporting a high theta of -0.0689 and buying a call with a 71 strike at $6.5, which has a theta of -0.0352. This position exploits time-decay effectively while also providing downside protection, should the price unexpectedly rise. Given the stronger negative theta, the premium decay on the sold call option is higher compared to the bought call, increasing profitability as we approach expiration.

-

Mid-Term Expiration Strategy: For a position expiring on June 7, 2024, consider selling a call with a 70 strike priced at $6.15, with a theta of -0.0734, and buying a call with a 75 strike at $3.45, which has a theta of -0.0235. This spread benefits from faster decay in the sold call premium relative to the bought call, maximized by their respective thetas. The selection of strikes is responsive to movements around the stock's current level, hedging against moderate upward trends.

-

Quarter-Year Expiration Strategy: For options expiring on September 20, 2024, consider selling a call option at a 70 strike priced at $9.05, featuring a theta of -0.0400, alongside buying a call at a 75 strike priced at $5.25 with a theta of -0.0193. This set-up targets a more considerable premium decay on the sold option due to higher theta compared to the long call, enhancing profitability if SBUX's price remains stagnant or drops.

-

Half-Year Expiration Strategy: For a stance expiring on January 17, 2025, selling a 75 strike call priced at $7.45, with a theta of -0.0143 and buying a 80 strike call at $5.1 having a theta of -0.0130 is an efficient longer-term strategy. This selection helps in maintaining a wider spread for greater protection, while also capitalizing on the time decay element inherent in options.

-

Year-Long Expiration Strategy: Finally, for options expiring on June 18, 2026, opens up strategies like selling a call at a 70 strike for $12.3, with a respective theta of -0.0107, and buying a call at 75 strike priced at $9.15 with a theta of -0.0116. This long-term strategy is suitable for a stabilized or mildly bearish outlook on the stock, allowing considerable time for the options to work out as expected, balancing between decay rates and protection against an unexpected bullish surge.

Each of these strategies focuses on balancing theta decay and the protection offered by long strikes, thus tailoring risk exposure according to different expected outcomes over varying time horizons. The differences in theta ensure a theoretically profitable decay differential, crucial in a bear spread to ensure that the value of the position increases as maturity approaches, provided the underlying price behaves as expected or better.

Vertical Bull Call Spread Option Strategy

Analyzing the options chain for Starbucks Corporation (SBUX) for a vertical bull call spread option strategy primarily requires focusing on mixing long call and short call options to capitalize on moderately bullish movements in the stock price within a 2% range from its current level. The selected options should cover a variety of expiration periods, from near-term to long, getting adjusted for industries and market exposure to shifts.

-

Short-Term to Near-Term Trades:

-

Option 1: For a bullish bet with upcoming expiry, consider buying options with short expiries around four days. For example, the option to buy a put at a strike of $69.00 expiring on 2024-05-17 shows an ROI of 0.23, with a profit potential of 1.63. Simultaneously, selling a put option with a slightly higher ROI, for instance at a strike of $70.00 expiring on the same date allowing for a premium gain while believing SBUX wont surpass $70.00 could offset part of the cost of the long put.

-

Option 2: Slightly further out, at 11 days expiration with strikes around $73.00 buying and $74.00 selling would provide a mixed strategy that allows capturing any intermediate volatility. Options here both exhibit higher profits, which could be lucrative if SBUX has a rapid upward movement.

-

-

Mid-Term Trades:

- Option 3: Looking at the options expiring around 18 days, particularly, buying a put at a strike of $75.00 and selling a put at $76.00. These options give a broader spread - assuming a more dramatic move in the stock beyond simple oscillation - and take advantage of higher gamma and vega, leading to higher responsiveness to the underlying stocks movement.

-

Long-Term Trades:

-

Option 4: Discuss examining longer-term options such as those expiring in 67 days. Here an example might be buying a put at $70.00 and selling at $75.00. This wider spread can be beneficial if trading on quarterly earnings predictions or similar long-term forecasts.

-

Option 5: For long-term positions and higher capital outlay, we might look at a far expiry, say 130 days and beyond. Choosing options like buying at $70.00 and selling at $75.00 with expiring on 2024-09-20 can lock in recent market trends influenced predictions about yearly outcomes.

-

This strategy integrates a reasonable assumption of SBUXs price movements and a disparity in premium costs and potential profits from the Greeks, particularly focusing on theta and delta which highly influence these trades profitability as they approach expiry. Furthermore, these trades are somewhat resistant to large unexpected drops in the stock price due to their spread nature, offering a higher safety margin in volatile market conditions. Nevertheless, always be vigilant about sudden market turns and be prepared to adjust the strategy as new financial or market data becomes available.

Similar Companies in Restaurants:

Chipotle Mexican Grill, Inc. (CMG), Report: Domino's Pizza, Inc. (DPZ), Domino's Pizza, Inc. (DPZ), Yum! Brands, Inc. (YUM), The Wendy's Company (WEN), Report: McDonald's Corporation (MCD), McDonald's Corporation (MCD), Wingstop Inc. (WING), Shake Shack Inc. (SHAK), Papa John's International, Inc. (PZZA), Darden Restaurants, Inc. (DRI), Yum China Holdings, Inc. (YUMC), Restaurant Brands International Inc. (QSR), Dunkin' Brands Group Inc. (DNKN), Luckin Coffee Inc. (LKNCY)

https://www.fool.com/investing/2024/03/29/is-starbucks-stock-a-buy-near-its-52-week-low/

https://www.fool.com/investing/2024/03/31/nike-lululemon-apple-tesla-starbucks-buy-stock/

https://www.fool.com/investing/2024/04/03/starbucks-stock-upside-wall-street-analyst/

https://www.youtube.com/watch?v=ah174dF52qM

https://www.youtube.com/watch?v=pzS8Ro6vq0Q

https://www.fool.com/investing/2024/04/05/got-5000-these-3-high-yielding-dividend-stocks-are/

https://www.fool.com/investing/2024/04/05/better-stock-to-buy-right-now-chipotle-vs-starbuck/

https://www.fool.com/investing/2024/04/13/1-magnificent-growth-stock-down-31-youll-regret-no/

https://www.fool.com/investing/2024/04/14/3-stocks-billionaires-are-buying/

https://www.fool.com/investing/2024/04/15/3-reasons-buy-beaten-down-growth-stock-no-tomorrow/

https://www.fool.com/investing/2024/04/18/where-will-starbucks-stock-be-in-5-years/

https://www.fool.com/investing/2024/04/20/the-smartest-dividend-stocks-to-buy-with-400-right/

https://www.fool.com/investing/2024/04/20/3-top-dividend-stocks-to-buy-today-for-a-lifetime/

https://www.fool.com/investing/2024/04/20/1-growth-stock-down-20-to-buy-right-now/

https://www.fool.com/investing/2024/04/20/can-this-growth-stock-become-the-next-starbucks/

https://www.sec.gov/Archives/edgar/data/829224/000082922424000024/sbux-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 4QOplE

Cost: $1.32928

https://reports.tinycomputers.io/SBUX/SBUX-2024-05-12.html Home