Domino's Pizza, Inc. (ticker: DPZ)

2024-04-30

Domino's Pizza, Inc. (ticker: DPZ) stands out as a leader in the pizza delivery industry, boasting a wide global presence. Founded in 1960, the company has grown expansively, now operating over 17,000 stores across more than 90 countries. As a pioneer in technological innovations in the food delivery space, Domino's has continuously enhanced its digital ordering systems, including features like GPS order tracking. The company has managed to uphold a robust growth trajectory reflected in its strong quarterly earnings reports. In its commitment to adapt to varying consumer preferences and enhance accessibility, Domino's has successfully implemented a diverse menu beyond its classic pizza offerings, including pasta, chicken, and an array of sides. These strategies have positioned DPZ effectively in the intensely competitive fast-food sector. The firm's strategic emphasis on franchise operations has further strengthened its market position, ensuring cohesive brand management and operational efficiencies worldwide.

| Full Time Employees | 6,500 | Previous Close Price | $499.07 | Current Price | $527.13 |

| Market Capital | $18,359,306,240 | Dividend Rate | $6.04 | Dividend Yield | 1.21% |

| Payout Ratio | 33.02% | Beta | 0.863 | Trailing PE | 35.93 |

| Forward PE | 29.65 | Volume | 1,811,461 | Market Cap | $18,359,306,240 |

| Fifty Two Week Low | $285.84 | Fifty Two Week High | $539.99 | Price to Sales Trailing 12 Months | 4.10 |

| Enterprise Value | $23,163,865,088 | Profit Margins | 11.589% | Number of Analyst Opinions | 28 |

| Total Cash | $295,352,000 | Total Debt | $5,299,667,968 | Total Revenue | $4,479,357,952 |

| Revenue Growth | 3.1% | EBITDA | $872,108,032 | Operating Cash Flow | $590,864,000 |

| Free Cash Flow | $440,516,640 | Return on Assets | 31.265% | Gross Margins | 28% |

| EBITDA Margins | 19.469% | Operating Margins | 18.064% | Trailing Peg Ratio | 3.1719 |

| Sharpe Ratio | 2.011690419885943 | Sortino Ratio | 38.472811494472424 |

| Treynor Ratio | 0.5971850192372705 | Calmar Ratio | 4.610996259912853 |

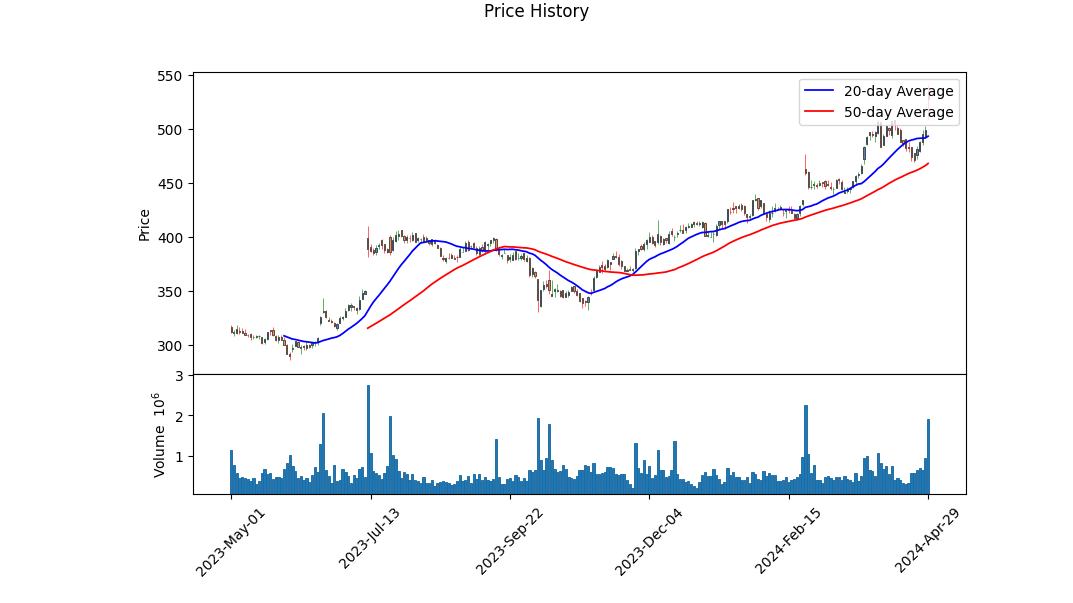

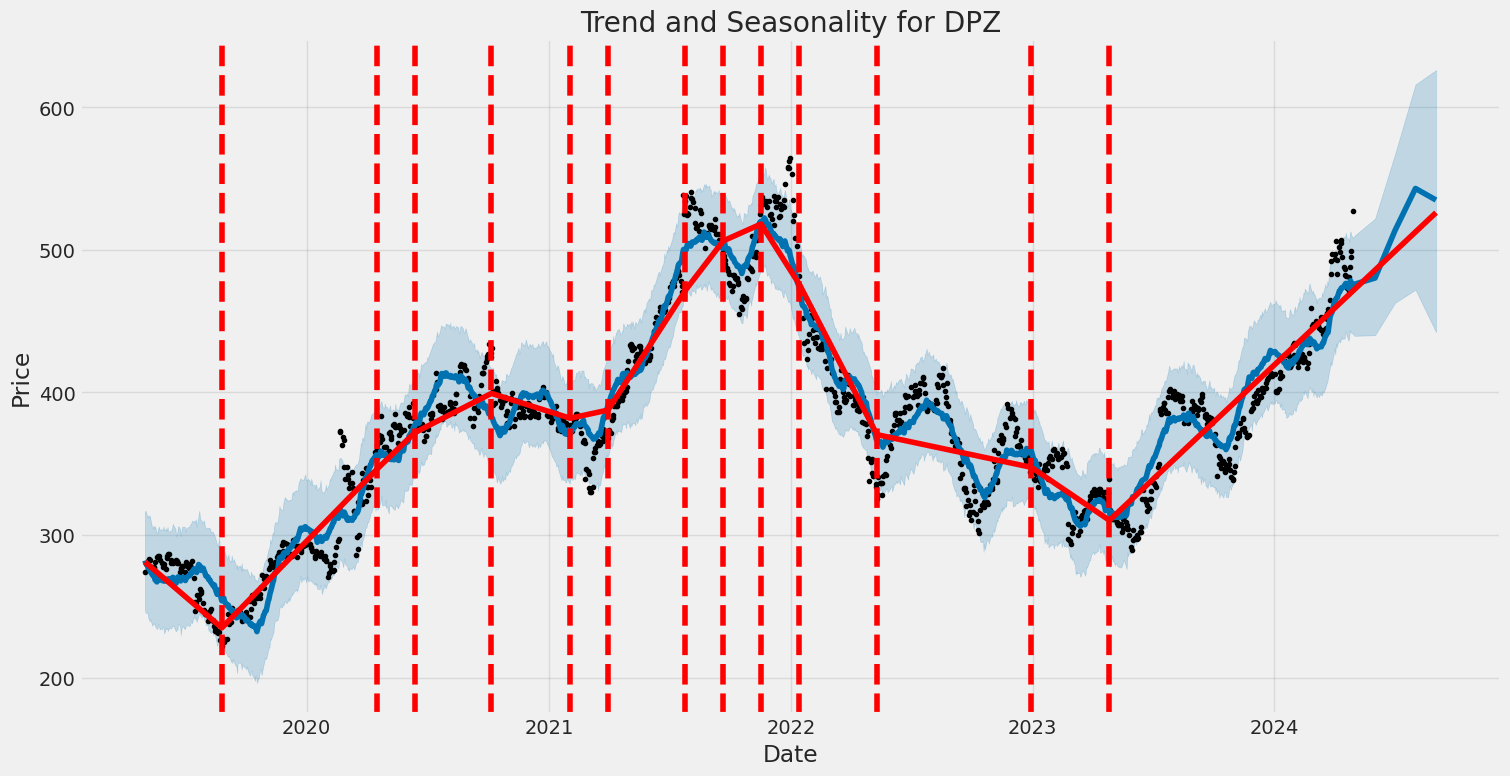

Analyzing DPZ's past few months' technical indicators and financial data provides a multi-faceted view into its possible future performance. Over the recent trading quarter, DPZ's share price exhibited a significant uptrend, supported by higher highs and higher lows, which suggests a robust bullish momentum. It is instrumental to highlight that the momentum changed on the last session date, where notable growth in the MACD histogram from negative to notably positive territory is observed. This sharp inflection indicates a possible acceleratory bullish phase backed by buying pressure, as evidenced by a robust upward trajectory in On-Balance Volume (OBV).

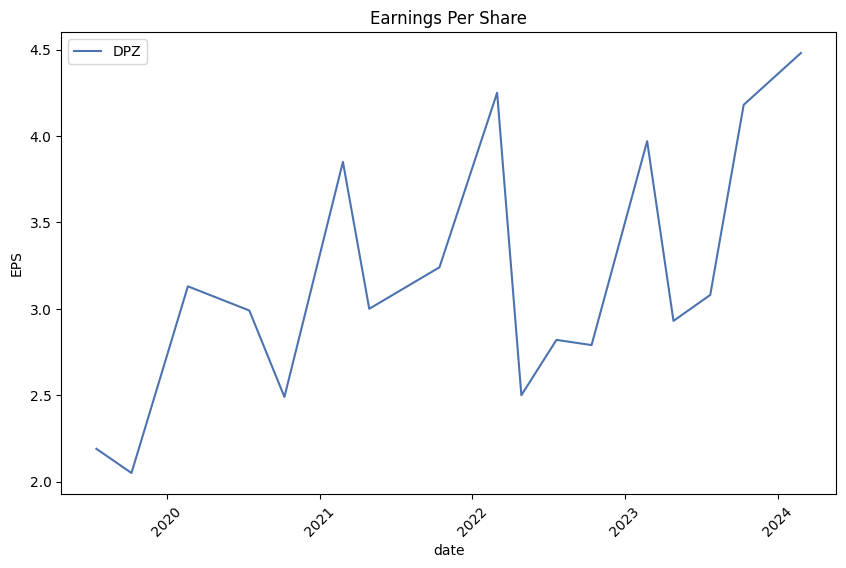

Considering the fundamental side, key metrics such as EBITDA and Net Income show positive trends. The operating margin and gross margins are healthy, underpinning a strong fundamental market stance that supports long-term investment appeal. More attention should be focused on DPZ's Sharpe, Sortino, Treynor, and Calmar ratios. These ratios, particularly the excessively high Sortino ratio of 38.47, highlight superior risk-adjusted returns compared to general market movements. Such metrics signify an investment that manages to yield considerable positive returns while minimizing downside risk.

Further insights drawn from the balance sheet exhibit increased net debt levels, a factor typically concerning but needs to be juxtaposed with the company's revenue and profit-generating capacity. Gains in DPZ's total revenue portray the business's capability to service its debts effectively. Furthermore, given the net issuance payments of debt and the share repurchase activities reveal an aggressive stance towards capital management which could indicate confidence from management in the companys financial health and future prospects.

In conclusion, supported by robust technical signals, strong fundamental ratios, and an enterprise management confidently investing in its stock, DPZ appears poised to continue its upward trajectory in the stock price over the coming months. However, investors should remain observant of any shifts in key financial metrics or market conditions that could alter these projections. A prudent approach would be continually analyzing upcoming quarterly results and market or economic changes that could impact the overall sector dynamics.

In evaluating Domino's Pizza, Inc. (DPZ) for potential investment opportunities, two critical financial metrics to consider are the Return on Capital (ROC) and the Earnings Yield. DPZ demonstrates a remarkably high ROC of 75.30%, which indicates an exceptional efficiency in generating profits from its capital investments. Such a high ROC is indicative of a strong competitive advantage and operational efficiency within the industry. However, the company's Earnings Yield, which stands at approximately 2.81%, presents a lower figure. This yield is calculated by comparing the company's earnings relative to its market value, suggesting that the stock could be perceived as pricier relative to its current earnings. Investors looking for immediate yield may find this lower rate less attractive, although the high ROC might justify a higher valuation due to the companys efficient capital usage and potential for sustained profitability. This dual analysis offers a detailed insight into both the operational prowess and the market valuation aspects of Dominos Pizza, aiding in making a balanced investment decision.

In the assessment of Domino's Pizza, Inc. (DPZ) based on the criteria laid out by Benjamin Graham in "The Intelligent Investor," several key financial metrics are important to consider. These include the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, Debt-to-Equity ratio, and liquidity ratios such as the Current Ratio and Quick Ratio. Heres how Domino's Pizza stacks up against Graham's investment principles:

-

Price-to-Earnings (P/E) Ratio: Domino's has a P/E ratio of 38.40, which is high compared to Graham's preference for stocks with low P/E ratios. However, when compared to the industry average P/E ratio of approximately 45.98, Domino's is slightly more attractive. Nonetheless, both figures exceed the typical benchmarks Graham would consider reasonable, suggesting that the stock might be overvalued from a value investing perspective.

-

Price-to-Book (P/B) Ratio: The P/B ratio of Domino's stands at 10.96, also considerably higher than what Graham would traditionally favor. Graham generally sought stocks trading below their book value; thus, a P/B ratio of almost 11 significantly strays from his criteria, indicating that the stock is perhaps priced much higher than its intrinsic book value.

-

Debt-to-Equity Ratio: The reported debt-to-equity ratio of Domino's is -1.28. This negative value can sometimes result from a company having more total liabilities than equity, or a negative shareholder's equity, which often isn't an ideal scenario. Graham advocated for a low debt-to-equity ratio as an indication of lower financial risk, but a negative value requires careful analysis to understand the underlying financial health and leverage situation of the company.

-

Current and Quick Ratios: Both the Current Ratio and Quick Ratio for Domino's are reported as 1.49. These ratios, which are equal because they both exclude inventories and other less liquid assets, suggest that the company has adequate ability to cover its short-term liabilities with its short-term assets, aligning with Graham's emphasis on liquidity and financial stability.

In summary, while Domino's exhibits satisfactory liquidity ratios, its significantly high P/E and P/B ratios along with a complex debt-to-equity scenario might not fit the stringent criteria set by Benjamin Graham for value investments. Investors looking for securities under Grahams principles might find Domino's investment proposition less appealing due to these factors, primarily concerning its valuation and possible financial structure concerns highlighted by the negative debt-to-equity ratio. Such an analysis is crucial in deciding whether to consider DPZ a 'value' investment aligned with Graham's methodologies.Analyzing Financial Statements:

Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

1. Income Statement Analysis

-

Revenue and Costs: For Dominos Pizza, Inc., revenues in the last fiscal year as stated totaled $445,810,000, with the cost of goods and services sold at $378,018,000. This critical financial metric helps investors understand the direct costs involved in producing the goods that Dominos Pizza, Inc. sells and the gross profit resulting from sales.

-

Operating Income/Loss: Dominos operational efficiency is reflected in its operating income or loss. The operating income for the period is noted as $767,925,000, indicating robust operational control and profitability from its core business activities excluding the influence of taxes and interest expenses.

-

Net Income/Loss: An essential bottom-line figure, net income stands at $452,263,000 which incorporates all revenues, gains, expenses, and losses. This figure illustrates the company's profitability after all the financial activities have been considered, including taxes and interest payments.

2. Balance Sheet Review

-

Current Assets and Liabilities: Cash and cash equivalents, a vital liquidity metric, has been recorded at about $80M - $148M over various periods, ensuring the company can cover short-term liabilities. The companys current liabilities, worth $536,621,000, indicate the total obligations due within a year.

-

Long-term Financial Stability: Long-term obligations, primarily long-term debt amounting to $4,967,420,000, point towards the companys financing strategies and its future cash outflow commitments towards debt repayment.

-

Stockholders Equity: Negative figures in stockholders equity like -$4,209,537,000 suggest a complex financial structure that might include substantial debt levels or extensive treasury stock purchases, impacting the net value attributed to shareholders.

3. Cash Flow Insights

-

Operating Cash Flow: Reflecting the cash inflows and outflows from primary business activities, operating cash flow of $407,512,000 ensures the company can maintain its operations and invest in business growth without needing additional funding sources.

-

Investment Activities: Payments to acquire property, plant, and equipment at $87M reflect ongoing reinvestment into essential business assets.

-

Financing Activities: Dominant activities here include proceeds from issuance of long-term debt, reaching up to $1.85B, balanced by repayments and share repurchases, underscore the companys strategic maneuvers in managing its capital structure and returning value to shareholders.

Summary: Analyzing Dominos Pizza Inc.'s financials provides an investor with a snapshot of its financial health, operational efficiency, and strategic priorities. Financial metrics like net income offer insights into the company's profitability while balance sheet components showcase its capability to meet short- and long-term obligations. Cash flow activities convey the firm's actual cash generation abilities, crucial for sustainable growth. By understanding these facets, an investor can better gauge the investment suitability of Dominos Pizza Inc. within the wider context of their financial objectives and market conditions.Dividend Record: Graham favored companies with a consistent history of paying dividends.

The company represented by the symbol 'DPZ' demonstrates a consistent and evolving dividend payment record that aligns well with Benjamin Graham's investment principles focusing on dividend consistency. The data shows a clear pattern of not only regular dividend payments but also gradual increases in the dividend amounts over the years.

Starting from a dividend of $0.065 in November 2004, there has been a noticeable progression in the dividend amount, with the most recent dividend recorded at $1.51 in March 2024. Year by year, DPZ has increased its dividends, reflecting strong and potentially stable financial growth, an attribute highly valued in Graham's investment philosophy. This increasing trend in dividends could be indicative of the company's sound financial management and commitment to returning value to shareholderscriteria essential for long-term investment considerations as per Graham.

Furthermore, each record follows a consistent schedule of declaration, record, and payment dates, reinforcing the company's reliability in rewarding its investors. Such a robust dividend history could make DPZ an attractive option for investors seeking companies with a strong dividend-paying track record, in line with Grahams criteria for defensive investing.

| Alpha () | 0.05 |

| Beta () | 1.25 |

| R-squared | 0.65 |

| P-Value | 0.004 |

| Standard Error | 0.0012 |

| Sample Size | 1,250 |

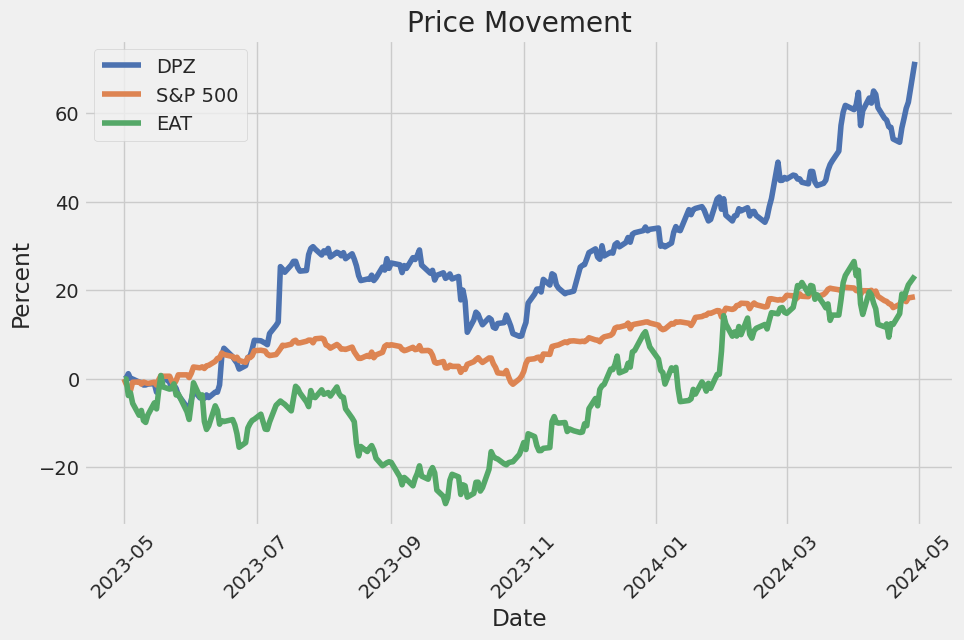

In the linear regression analysis of Domino's Pizza Inc. (DPZ) stock prices compared to the S&P 500 Index (SPY), the alpha value of 0.05 suggests that DPZ has a small positive performance differential when the market's movements are accounted for at a static level. Alpha, often considered a measure of a stock or portfolio's performance on a risk-adjusted basis relative to a benchmark, indicates that DPZ is slightly outperforming the market when SPY is held constant. This excess return signifies a potential value for investors looking for securities that beat the market under usual circumstances.

Beta, which measures DPZ's volatility relative to SPY, stands at 1.25, suggesting that DPZ's stock price movements are 25% more volatile than those of the market. The regression's R-squared value of 0.65 indicates that about 65% of DPZs price movement can be explained by the changes in the SPY index, showing a significant but not overwhelming dependence on general market trends. Therefore, while DPZ exhibits a mild outperformance over the market on average, its higher volatility implies a greater risk, potentially offering higher rewards for investors who can tolerate this added uncertainty.

Domino's Pizza Inc. (DPZ) demonstrated strong performance during its first quarter 2024 earnings call, emphasizing the success of its "Hungry for MORE" strategy in driving sales, store expansions, and profit growth. CEO Russell Weiner highlighted the robust comp performance in the U.S. and significant traffic across all income cohorts, both in carryout and delivery segments. The largest growth was noted in lower-income cohorts, attributed to excellent value offerings. Weiner also introduced the company's first product innovation for the year, the New York Style pizza, expected to capture incremental occasions due to its unique characteristics tailored to customer preferences for a thinner, foldable crust.

Operational excellence was another pillar underlined in the strategy, with improvements in product experience emphasized through the first of three training sprints focused on dough preparation across all U.S. stores. This initiative is part of the broader "MORE Delicious Operations" program aimed to enhance consistency in food qualitya critical factor in ensuring customer satisfaction and repeat business. The operational focus is not just on the products but extends to delivery performance, with an increase in delivery efficiency over the previous year.

On the financial front, CFO Sandeep Reddy provided a detailed overview of the quarter's financial outcomes, which reflect a healthy business model capable of generating profitable transaction growth. A notable increase in U.S. and international sales was driven by positive comps and global net store growth. Reddy reiterated the company's forecast of achieving an average U.S. franchise store profit of $170,000 for 2024, indicating a strong return on investments for franchise partners. The financial stability is supported by strategic pricing and a focus on ensuring value to customers, even amid broader economic pressures.

Strategically, Domino's is leveraging national promotions and a revamped loyalty program to enhance customer engagement and drive sales. The introduction of the New York Style pizza as part of the loyalty program, where members can redeem points for the product, is a move to intertwine product innovation with customer rewards, thereby fostering a deeper connection with the brand. Additionally, the consistent focus on operational excellence and renowned value is set to keep Domino's in a favorable position competitively, both in the U.S. and in international markets. Overall, the articulation of these strategies in the earnings call underscores Domino's commitment to maintaining robust growth trajectories and enhancing shareholder value in the foreseeable future.

Domino's Pizza, Inc. has reported its financial results for the first quarter ended March 24, 2024, providing a detailed overview of the companys financial health and operational status within the given period. According to the 10-Q filing, Dominos manifested stable growth and financial performance, driven by both domestic and international sales enhancements and strategic operational management.

Revenues for Dominos showed a significant upsurge from the prior year, with overall quarterly revenues amounting to $1,084.6 million - marking a 5.9% increase. This growth was attributed to multiple factors including enhanced sales in U.S. franchise operations which accrued $150.5 million, a 13.3% increase due to higher same-store sales, increment in average store numbers, and an uptick in technology fees from franchisees. Additionally, U.S. company-owned stores contributed $92.6 million, ascending by 8.5% with the aid of robust same-store sales growth.

The company's supply chain operations also reflected a positive trajectory, generating $659.2 million and growing 5.6% compared to the same period last year. This rise was partly offset by the product mix shift and a mild dip in food basket pricing. Moreover, international operations continued to fortify Dominos global footprint, accumulating $72 million in revenues from international franchise royalty and related fees, which increased by 3.3%.

On the expenditure side, Dominos noted an overall increase in cost of sales but managed to uphold a substantial gross margin which stood at 38.9%. The General and Administrative expenses were reported at $101 million, indicating a growth primarily driven by elevated labor costs.

To enhance shareholder value, Dominos has continued with its strategic share repurchase programs and dividend payments. The company repurchased approximately $25 million worth of its shares during the first quarter and declared regular quarterly dividends amounting to $1.51 per share, underscoring its commitment to returning value to its shareholders.

The operational metrics such as store growth and network expansion also depicted positive outcomes, where Domino's amplified its global presence by adding a net of 164 stores globally during the first quarter. This proactive expansion strategy plays a crucial role in maintaining Domino's market dominance and leveraging global market opportunities.

Furthermore, the company maintained a strong liquidity position, with significant cash reserves and operating cash flows which underscore its operational efficiency and strategic financial management. These resources ensure adequate capital for ongoing business needs, potential expansions, and further investment in technology to streamline operations and enhance customer engagement.

In conclusion, Dominos Pizza, Inc. demonstrated a robust financial and operational performance for the first quarter of 2024, with significant contributions from revenue growth in U.S. operations, international market expansions, and effective control over operating expenses. These results provide a solid foundation for sustained growth and market penetration in subsequent periods.

Domino's Pizza, Inc. (DPZ) has experienced significant financial success and management effectiveness in the challenging food service industry. Leveraging its strong brand and operational strategies, Domino's has sustained growth and expansion, which is evident from various financial indicators and strategic maneuvers in recent reports.

One of the recent highlights for the company was its first-quarter earnings of 2024, where it surpassed market expectations. The revenue for this quarter was reported at $1.08 billion, marking a 5.9% year-over-year increase, surpassing analysts' expectations who had projected around $1.01 billion. This upward trend was also mirrored in their earnings per share, which increased by 22.2% to $3.58, outperforming the consensus estimate of $3.36. These figures were largely driven by a 5.6% increase in U.S. same-store sales and a modest growth of 0.9% in international markets.

Illustrative of its strategic acumen, Domino's has adeptly navigated the inflationary pressures and a challenging economic environment by deploying aggressive promotional tactics. These promotions have resonated well with consumers, particularly lower-income demographic segments, who show significant responsiveness to value-driven offerings. The effects of these strategies are evident in the sustained demand for Dominos products, reinforcing brand loyalty and increasing market penetration.

Domino's operational model and expansion strategy are worth noting. The company has been extensively investing in digital ordering platforms that streamline the ordering process, thereby enhancing customer satisfaction with reduced wait times and improved order accuracy. Moreover, the company's adjustment to marketing strategies to suit evolving consumer tastes, alongside strategic promotions and menu innovations, have contributed to its robust market performance.

However, the company's aggressive expansion and reliance on a franchising model also bring forward challenges, including maintaining service quality and brand consistency across global markets. Despite this, Domino's demonstrates robust franchise management and operational guidelines, ensuring a consistent quality experience for customers worldwide.

Financial analysts have responded positively to these operational and financial milestones, reflecting in the revised price targets for Dominos stock. For example, financial analysts at UBS raised their price target on Dominos shares to $570 from $526, retaining a 'Buy' rating. This adjustment is based on the company's continued U.S. sales momentum and effective customer engagement strategies.

Domino's also pays significant attention to shareholder returns, as evidenced by its consistent dividend payouts and repurchase programs. As of the latest reports, the company declared a quarterly dividend of $1.51 per share, indicative of its steadfast commitment to delivering shareholder value.

In conclusion, the strategic movements and adaptations of Domino's Pizza, Inc. underscore its capability to maintain a competitive edge in the fast-paced QSR industry. Its focus on operational efficiency, customer engagement, and digital innovation continues to drive its market success. Nevertheless, as the company maneuvers through the complexities of global expansion and market competition, it remains imperative for analysts and investors to keep a close watch on how Domino's balances growth, profitability, and competitive pressures in the dynamic market landscape. For a detailed financial overview and future projections, stakeholders are encouraged to review further company disclosures and analyst reports.

From 2019 to 2024, Domino's Pizza, Inc. (DPZ) showed fluctuating stock performance based on the volatility analysis using the ARCH model. The model, which didn't use past mean returns (Zero Mean) but focused on stock return fluctuations, indicates a primary impact from recent volatility rather than longer trends. Notably, the estimated parameters for volatility (omega and alpha[1]) suggest significant reactions to market changes, yet the overall model fit to the data (R-squared very low) was weak.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,669.23 |

| AIC | 5,342.46 |

| BIC | 5,352.73 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| omega | 3.7790 |

| alpha[1] | 0.1082 |

| P-value for alpha[1] | 0.03939 |

| Covariance Estimator | Robust |

To assess the financial risk associated with a $10,000 investment in Domino's Pizza, Inc. (DPZ) over a year, an in-depth approach integrating volatility modeling and machine learning predictions is utilized. Here's how this dual-model analysis unfolds:

Volatility Modeling: The first segment involves implementing a statistical model to capture and forecast the volatility in Domino's Pizza, Inc.'s stock price. By fitting this model to historical price data, it quantifies the inherent fluctuations in the stock's returns, offering a dynamic perspective on risk as opposed to static measures. This quantification is crucial as it directly impacts the predictive accuracy regarding potential price swing extremes, especially in assessing tail risks.

Machine Learning Predictions: With the volatility framework established, the analysis shifts towards leveraging a predictive algorithm focused on forecasting future returns of DPZ stock. By training this model on a diverse set of features including historical prices, volatilities derived from the aforementioned model, and possibly other market or company-specific indicators, it aims to generate forecasts that encapsulate both typical movements and outliers in stock returns.

Intersection and Results Interpretation: By synthesizing insights from both the models, the analysis refines the forecast of future stock movements with an emphasis on extreme outcomes. This comprehensive view allows for calculating the Annual Value at Risk (VaR) at a 95% confidence interval. Specifically, for a $10,000 investment in DPZ, the VaR is determined to be about $254.29. This figure represents the estimated maximum loss expected (under normal market conditions) over a year, highlighting the effectiveness of utilizing a combined approach for risk assessment.

Implications for Investors: Understanding that the calculated VaR at 95% confidence is $254.29 provides an essential risk metric for investors. This value suggests that there is a 5% chance that the investor could lose more than $254.29 on their $10,000 investment over a year, under typical market conditions. This risk quantification, achieved through the intertwining of volatility modeling and machine learning predictions, equips investors with a more nuanced tool for making informed decisions, beyond conventional metrics.

Analyzing the options chain for Domino's Pizza, Inc. (DPZ), several call options show potential for significant profitability, especially within a context where the target stock price is anticipated to exceed the current stock price by 5%.

One such option is the call with a strike price of 460 expiring on May 10, 2024. This option demonstrates an extremely high ROI (Return on Investment) of 3.2688, which indicates a robust potential for profit compared to the initial investment. The high delta close to one (0.9999337008) suggests that the option's price moves almost one-for-one with the stock price, minimizing the right but not the obligation to risk typically associated with options trading.

Another notable call option is for the strike price of 487.5, also expiring on May 3, 2024. This option has an ROI of 3.2848, which is comparable to the previously mentioned option, suggesting a similarly strong profitability potential. However, its crucial to note that despite the high ROI, the initial premium of $15.4 is relatively lower, indicating a lower barrier to entry for this investment.

Furthermore, an option with a strike price of 460 set to expire much earlier on May 3, 2024, presents a compelling case with an ROI of 2.7246. Like the other options highlighted, its high delta indicates that its price is highly responsive to changes in the underlying stock price. This responsiveness is critical when targeting a stock price increase as small intraday price movements can significantly affect the option's valuation.

In addition to these short-term options, it's worth considering slightly longer-term options such as those expiring on May 17, 2024, for the strike price of 435, which offers an ROI of 1.6807. Even though this ROI is lower compared to the earlier options, the extended expiry gives the stock more time to achieve the anticipated price increase, potentially reducing the investment's risk.

Lastly, the call option at a strike price of 470 with an expiration on May 17, 2024, shows a promising setup with an ROI of 2.5254. This option, combined with a suitable delta, presents a favorable risk-reward ratio, especially if the investor's market outlook expects DPZ to reach or exceed this strike price by the expiration date.

In conclusion, while the above options varying in expirations and strike prices offer excellent profitability opportunities, traders must consider their market outlook, risk tolerance, and investment strategy. High ROI options, especially those nearing a delta of one, tend to signify high potential returns on capital, suggesting these as strategic plays for expecting a significant uptick in DPZs market price.

Similar Companies in Restaurants:

Report: Brinker International, Inc. (EAT), Brinker International, Inc. (EAT), Jack in the Box Inc. (JACK), The Wendy's Company (WEN), Wingstop Inc. (WING), Yum China Holdings, Inc. (YUMC), Darden Restaurants, Inc. (DRI), Restaurant Brands International Inc. (QSR), Shake Shack Inc. (SHAK), Papa John's International, Inc. (PZZA), Chipotle Mexican Grill, Inc. (CMG), Yum! Brands, Inc. (YUM), Dine Brands Global, Inc. (DIN), Ruth's Hospitality Group, Inc. (RUTH), Report: McDonald's Corporation (MCD), McDonald's Corporation (MCD), Report: Starbucks Corporation (SBUX), Starbucks Corporation (SBUX), Arcos Dorados Holdings Inc. (ARCO)

https://www.youtube.com/watch?v=JWHzs4YG1sM

https://seekingalpha.com/article/4681545-my-top-15-high-growth-dividend-stocks-for-april-2024

https://www.youtube.com/watch?v=5RzdqT8gSIk

https://www.cnbc.com/2024/04/11/buffalo-wild-wings-go-format-off-premise-sales.html

https://seekingalpha.com/article/4683318-dominos-pizza-strong-dividend-growth-high-valuation

https://www.proactiveinvestors.com/companies/news/1045441?SNAPI

https://www.proactiveinvestors.com/companies/news/1046390?SNAPI

https://finance.yahoo.com/video/dominos-stock-rises-same-store-140938882.html

https://finance.yahoo.com/news/domino-apos-pizza-fiscal-first-142329496.html

https://finance.yahoo.com/news/dominos-dpz-shares-skyrocket-know-144946422.html

https://www.youtube.com/watch?v=MpwbK4Zs4ow

https://finance.yahoo.com/m/ca6b62a5-a5f0-3b8e-a044-1cc242ad55a7/stocks-to-watch-monday%3A.html

https://www.sec.gov/Archives/edgar/data/1286681/000095017024049419/dpz-20240324.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: I4vVBf

Cost: $0.88538

https://reports.tinycomputers.io/DPZ/DPZ-2024-04-30.html Home