The Sherwin-Williams Company (ticker: SHW)

2023-12-22

The Sherwin-Williams Company (ticker: SHW), founded in 1866 and headquartered in Cleveland, Ohio, has grown to become one of the largest manufacturers of paints, coatings, and related products in the United States and around the world. With a rich history spanning over 150 years, Sherwin-Williams offers a wide variety of products for professional, industrial, commercial, and retail customers. Its extensive product line includes paints, stains, primers, and supplies under well-known brands such as Sherwin-Williams, Valspar, Dutch Boy, and Minwax, among others. The company operates through three main segments: The Americas Group, Consumer Brands Group, and Performance Coatings Group. Sherwin-Williams has a strong distribution network that consists of more than 4,900 company-operated stores and facilities. Its integrated business model and strategic acquisitions have allowed it to maintain a significant market presence and capitalize on global growth opportunities. SHW's consistency in delivering innovative products and expanding its global footprint make it a key player in the coatings industry.

The Sherwin-Williams Company (ticker: SHW), founded in 1866 and headquartered in Cleveland, Ohio, has grown to become one of the largest manufacturers of paints, coatings, and related products in the United States and around the world. With a rich history spanning over 150 years, Sherwin-Williams offers a wide variety of products for professional, industrial, commercial, and retail customers. Its extensive product line includes paints, stains, primers, and supplies under well-known brands such as Sherwin-Williams, Valspar, Dutch Boy, and Minwax, among others. The company operates through three main segments: The Americas Group, Consumer Brands Group, and Performance Coatings Group. Sherwin-Williams has a strong distribution network that consists of more than 4,900 company-operated stores and facilities. Its integrated business model and strategic acquisitions have allowed it to maintain a significant market presence and capitalize on global growth opportunities. SHW's consistency in delivering innovative products and expanding its global footprint make it a key player in the coatings industry.

| As of Date: 12/22/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 78.56B | 65.59B | 68.28B | 57.97B | 61.50B | 53.06B |

| Enterprise Value | 89.94B | 77.72B | 81.13B | 70.28B | 73.82B | 65.25B |

| Trailing P/E | 32.86 | 28.31 | 32.58 | 29.12 | 32.12 | 30.74 |

| Forward P/E | 27.62 | 24.27 | 31.95 | 26.53 | 22.73 | 19.49 |

| PEG Ratio (5 yr expected) | 2.56 | 2.56 | 3.57 | 2.42 | 1.96 | 1.70 |

| Price/Sales (ttm) | 3.46 | 2.89 | 3.07 | 2.66 | 2.88 | 2.60 |

| Price/Book (mrq) | 20.78 | 17.98 | 21.56 | 18.69 | 23.65 | 23.85 |

| Enterprise Value/Revenue | 3.91 | 12.71 | 13.00 | 12.91 | 14.11 | 10.79 |

| Enterprise Value/EBITDA | 21.52 | 69.96 | 72.19 | 97.05 | 108.16 | 58.05 |

| Full Time Employees | 64,366 | Previous Close | 306.93 | Dividend Rate | 2.42 |

| Day Low | 306.17 | Day High | 311.32 | Dividend Yield | 0.79% |

| Payout Ratio | 25.86% | Five Year Avg Dividend Yield | 0.85% | Beta | 1.109 |

| Trailing PE | 33.36 | Forward PE | 27.67 | Volume | 1,043,261 |

| Average Volume | 1,518,431 | Average Volume 10 Days | 1,689,240 | Bid | 306.87 |

| Ask | 310.34 | Market Cap | 79,674,531,840 | 52 Week Low | 205.43 |

| 52 Week High | 311.87 | Price to Sales Trailing 12 Months | 3.460 | 50 Day Average | 267.05 |

| 200 Day Average | 252.56 | Trailing Annual Dividend Rate | 2.415 | Trailing Annual Dividend Yield | 0.79% |

| Enterprise Value | 89,940,271,104 | Profit Margins | 10.50% | Float Shares | 235,447,848 |

| Shares Outstanding | 255,966,000 | Shares Short | 3,361,444 | Shares Short Prior Month | 2,952,499 |

| Held Percent Insiders | 8.202% | Held Percent Institutions | 78.768% | Short Ratio | 2.58 |

| Book Value | 14.768 | Price To Book | 21.08 | Last Fiscal Year End | 2022-12-31 |

| Net Income To Common | 2,418,899,968 | Trailing EPS | 9.33 | Forward EPS | 11.25 |

| PEG Ratio | 2.11 | Enterprise To Revenue | 3.905 | Enterprise To Ebitda | 21.459 |

| Total Cash | 503,400,000 | Total Cash Per Share | 1.967 | Ebitda | 4,191,300,096 |

| Total Debt | 11,879,999,488 | Current Ratio | 0.936 | Total Revenue | 23,030,200,320 |

| Debt To Equity | 314.286 | Revenue Per Share | 89.865 | Return On Assets | 9.88% |

| Return On Equity | 75.85% | Gross Profits | 9,325,100,000 | Free Cash Flow | 2,323,225,088 |

| Operating Cash Flow | 3,244,300,032 | Earnings Growth | 12.60% | Revenue Growth | 1.10% |

| Gross Margins | 45.37% | Ebitda Margins | 18.20% | Operating Margins | 18.24% |

Technical Indicators:

- The Adjusted Close price stands at 306.93.

- MACD is positive at 11.55, indicating bullish momentum, with the MACD histogram at 0.62 suggesting an increasing momentum as the shorter-term EMA pulls away from the longer-term EMA.

- The Relative Strength Index (RSI) is high at 76.33, often considered overbought, possibly indicating a pullback or consolidation in the near term.

- Bollinger Bands show the price near the upper band (BBU at 310.98, BBM at 307.30, BBL at 303.62), hinting at overextension to the upside.

- The Simple Moving Average (SMA) over the last 20 days is 291.26, with the current price above this level, indicating an overall uptrend.

- Exponential Moving Average (EMA) for the last 50 days is 278.12, also below the current price, confirming bullish sentiment.

- On-Balance Volume (OBV) is 1.49 million, implying positive volume flow and potential continued interest from buyers.

- Stochastic %K (83.99) and %D (87.11) are both signaling overbought conditions, suggesting a possible price reversal.

- Average Directional Index (ADI) is very strong at 62.42, showing that the current trend is strong and likely to continue.

- Williams %R (WILLR) at -14.78 is in overbought territory, aligning with RSI and Stochastic readings.

- Chaikin Money Flow (CMF) of 0.10 shows moderate buying pressure.

- Parabolic SAR (PSAR) is currently below the price at 303.44, suggesting the trend is upwards.

Fundamental Analysis:

- The Market Cap has shown significant growth over the past quarters.

- The Enterprise Value (EV) has also grown, outpacing the Market Cap in the current period.

- The Trailing P/E is relatively high at 32.86, which could suggest the stock is overvalued compared to earnings, but the Forward P/E of 27.62 predicts improved earnings.

- The PEG Ratio (5 yr expected) is 2.56 which might indicate the stock is overpriced relative to its expected growth.

- Price/Sales (ttm) at 3.46 and Price/Book (mrq) at 20.78 reflect a market that values the company's sales and book value highly.

- The Enterprise Value/Revenue and Enterprise Value/EBITDA ratios suggest a quite substantial valuation in terms of revenue and earnings before interest, taxes, depreciation, and amortization.

- The review of financial statements indicates steady growth in net income and operating income, with net income increasing in the past years.

The technical indicators combined with the fundamental analysis suggest that SHW stock currently displays a bullish trend, supported by positive volume flow and an overall strong market sentiment as evidenced by the consistent increase in Market Cap and Enterprise Value. However, caution is warranted due to overbought signals from RSI, WILLR, and Stochastics that could predict a short-term pullback or consolidation in the stock price.

Given the strong ADX reading, we can expect the bullish trend to continue, but the overbought conditions indicate that the stock might experience some volatility or a brief corrective phase in the near future. Looking ahead, if the fundamentals remain strong and the company continues to post solid financial results, any pullback may be viewed as a buying opportunity in the context of a longer-term uptrend.

However, there is some concern regarding the stock's valuation metrics, such as the high P/E, PEG ratio, and Price/Book that suggest the stock is being traded at a premium. Investors should be aware of the potential for price correction if the company does not continue to post growth that justifies these multiples. Nevertheless, the solid financial performance and growth potential indicated by the improving Forward P/E ratio may support current price levels in the longer term.

Considering these factors, over the next few months, we may anticipate SHW stock to continue its upward trajectory but also experience episodes of price volatility and potential short-term pullbacks. Investors might watch for a solid consolidation above the EMA_50 to confirm persistent bullish sentiment. Additionally, a retreat and stabilization near SMA_20 might serve as a healthier base for the continuation of the upward trend. In summary, the stock presents an optimistic outlook, but vigilance in monitoring the key technical levels and the company's fundamental performance is essential.

The Sherwin-Williams Company (SHW) has established itself as a major player in the production of paints and coatings. Amidst the volatile economic conditions of 2023, highlighted by a challenging bull market and the Federal Reserve's indications of maintaining elevated interest rates possibly until mid-2025, SHW emerged as a strong candidate for dividend growth investment (DGI). Seeking Alpha's selection of Sherwin-Williams accentuates the strategy of investing in large-cap, dividend-paying companies that are currently undervalued relative to their historical norms.

Seeking Alpha's research began with a broad analysis of around 7,500 U.S. publicly traded companies. The proprietary filtering process was meticulous, focusing on identifying stocks that exhibit strong fundamentals, lower debt levels, and attractive valuations. Sherwin-Williams, with its storied history of consistent dividend payments and stable business operation, was chosen for its resilience against economic headwinds and potential for long-term appreciation combined with dividends.

The selection is part of a broader DGI strategy aimed at constructing income-generating portfolios, especially befitting conservative investors in the current economic context. Market sentiment has been cautious, in line with the S&P 500's retreat from its peak, with a particular watch on companies that hold significant debentures maturing before 2026 as they might face refinancing challenges if high interest rates persist. In light of such economic headwinds, SHW's inclusion as a relatively safe investment with a track record of steady revenue growth is compelling.

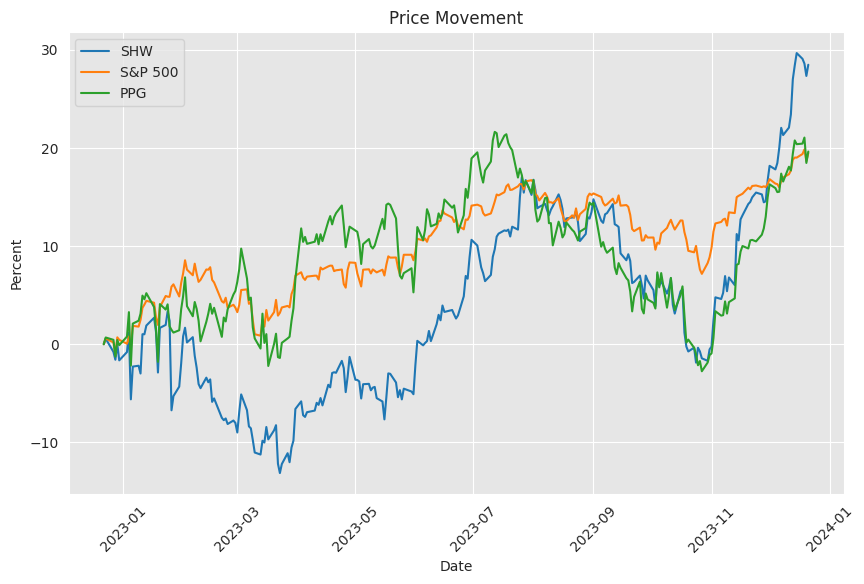

Argus Research's Market Digest offered insights into Sherwin-Williams' financial performance and stock activity, recognizing the company's resilience in market fluctuations. SHW's stock performance, when juxtaposed with market indices such as the S&P 500 and Dow 30, affirms its integral role in reflecting market trends. Additionally, being part of a sector that experiences impacts from commodity prices and currency exchange rates, Sherwin-Williams nonetheless demonstrates operational prowess in managing cost pressures and maintaining profitability.

Sherwin-Williams caters to a diverse range of market segments, including residential, commercial, and industrial customers. The company's growth in these segments, and its adaptability to economic trends, reinforces investor confidence. Market analysts and investors closely observe the companys response to industry dynamics, operational strategies, and corporate developments, which provide indicators of its potential to sustain and improve market positioning.

A pivotal moment in Sherwin-Williams' history was the strategic acquisition of Valspar in 2017. This move not only enhanced the company's technological capabilities and product offerings but also expanded market access. The consequent synergy from this merger contributes to Sherwin-Williams continued success and establishes a greater foothold in the industry.

Sherwin-Williams stands out within the DGI space due to its long heritage of not only sustaining but often increasing its dividend payouts. For instance, a notable decision made by a shareholder, captured in a Seeking Alpha article, to liquidate some SHW holdings for financing a real estate transaction illuminates the balancing act between investing for income and capitalizing on life opportunities. In this scenario, the shareholder weighed the benefits of holding dividend-growth stocks like SHW against immediate personal financial goals such as homeownership.

Investors sometimes face decisions that encompass assessing mortgage rates, potential returns from investments, and overall changes in the bond market. This particular investor leveraged their SHW holdings, along with a choice selection of other securities, to align with their broader financial strategy, emphasizing the level of analysis and flexibility integral to effective portfolio management.

The valuation of Sherwin-Williams through the Discount Cash Flow (DCF) method sheds light on the company's financial health and growth potential. Our DCF estimation suggests an intrinsic fair value of around US$270 per share, slightly below its current trading price. Calculations based on the companys projected ten-year Free Cash Flow (FCF) forecast show a healthy and positive growth trajectory, while the cost of equity used for discounting purposes is 7.2%. Despite this robust outlook, investors should engage with various analyses before making investment decisions due to the intrinsic limitations of any DCF model.

Navigating through the intricate investment climate of November 2023, Sherwin-Williams represents a resilient entity within the dividend stock category. Amidst financial market conditions influenced by the Federal Reserve's rigorous monetary policies, the investment strategy endorsed pivots towards periodic investment in undervalued, dividend-rich stocks. SHW is evaluated through a filtering mechanism that places premium on financial stability and dividend consistency, marking it as a worthy portfolio addition for dividend growth investing.

The company's "Dividend Quality Score" and its positioning at a discount from the peak prices further this narrative, suggesting that SHW shares are undervalued and ripe for potential investment. This aligns with the broader goal of ensuring conservative but growth-oriented investment placements among stable performing companies during periods of heightened economic unpredictability.

Sherwin-Williams has demonstrated key characteristics of a "multi-bagger" with its above-average Return on Capital Employed (ROCE), indicative of efficient capital management and profitability. The company, with its EBIT margins increasing and a strong stock price appreciation, represents sustainable growth and efficient capital use. Insider purchases, particularly by the CEO, highlight another layer of investor confidence and align with the overall positive investment sentiment toward the company.

Despite an economic backdrop featuring elevated interest rates and inflationary pressures, Sherwin-Williams is anticipated to thrive in 2024, bolstered by its massive product portfolio and brand recognition. Expectations of lowering interest rates could catalyze the housing and home improvement market sectors, boding well for SHW's growth. There is a bullish sentiment on Wall Street regarding the company, sustained by product innovation, global expansion, and strategic M&A activity, all reiterating the stock's robust prospects.

Recognized by Zacks Investment Research as a strong growth stock, Sherwin-Williams exhibits solid financial projections, with an estimated 18% increase in earnings and 3.7% revenue growth for the fiscal year 2023. The company's cash flow growth complements its solid growth fundamentals, while revisions in earnings estimates and a healthy outlook position it as an attractive investment candidate.

Sherwin-Williams' strong dividend growth trajectory is particularly attractive, with its Dividend Aristocrat status providing long-term growth and wealth enhancement. The company's robust cash flows support a sustainable dividend program despite the existing debt from the Valspar acquisition. With its consistent growth in earnings per share and expanding profitability margins, Sherwin-Williams exudes strength as an investment prospect. The backing of company insiders, through significant share ownership and stock purchases, lends further credence to its promising trajectory.

Finally, SHWs performance over the past year has been remarkable, with earnings consistently surpassing estimates and an impressive Return on Equity. The companys adaptability and steady growth, evidenced by its retail expansion and cost management, position it as an attractive construction sector investment. With raised income per share forecasts for fiscal 2023, Sherwin-Williams appears primed for future growth, making it a potentially lucrative investment option in a competitive industry that includes other notable performers like Dream Finders Homes Inc., EMCOR Group Inc., and Fluor Corporation.

Investors keeping an eye on the market trends might see the advantage of including Sherwin-Williams during market dips given its proven growth and potential for expansion. The company's history, solid market presence, and dividend growth strategy make it a portfolio candidate for those prioritizing stability and long-term growth amidst various market conditions. Thus, when the market presents an opportunity, as with companies like Home Depot and Walmart, Sherwin-Williams could be considered a prime stock for acquisition, particularly for investors with a long-term investment mindset.

Similar Companies in Specialty Chemicals:

Report: PPG Industries, Inc. (PPG), PPG Industries, Inc. (PPG), Axalta Coating Systems Ltd. (AXTA), Report: RPM International Inc. (RPM), RPM International Inc. (RPM), Masco Corporation (MAS), The Valspar Corporation (VAL), Behr Paint Company (BERY)

News Links:

https://seekingalpha.com/article/4639167-5-relatively-safe-cheap-dividend-stocks-october-2023

https://finance.yahoo.com/m/b5741df9-6540-3022-bd8c-a9cf3ef6c363/analyst-report%3A.html

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://finance.yahoo.com/news/look-fair-value-sherwin-williams-130113953.html

https://finance.yahoo.com/news/think-sherwin-williams-nyse-shw-130025362.html

https://finance.yahoo.com/news/5-large-cap-stocks-primed-211500332.html

https://finance.yahoo.com/news/heres-why-sherwin-williams-shw-144507694.html

https://www.fool.com/investing/2023/11/18/if-you-like-dividends-should-love-these-3-stocks/

https://finance.yahoo.com/news/eps-growth-more-sherwin-williams-110029210.html

https://www.fool.com/investing/2023/12/07/not-sure-which-dividend-stock-you-should-own-buy/

https://finance.yahoo.com/news/why-add-sherwin-williams-shw-131300468.html

https://www.fool.com/investing/2023/11/27/3-stocks-to-buy-if-they-take-a-dip/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: iNzDlfh

https://reports.tinycomputers.io/SHW/SHW-2023-12-22.html Home