Telecom Argentina S.A. (ticker: TEO)

2024-02-04

Telecom Argentina S.A. (ticker: TEO), a leading telecommunications company, serves as a primary provider of telephony, internet, and television services within Argentina. With its operations pivoting towards integrating digital platforms and advanced technological infrastructure, the company strives to meet the growing demand for high-speed connectivity and multimedia solutions. Telecom Argentina's strategic focus on expanding its broadband and mobile services footprint has positioned it to capitalize on the increasing consumption of digital content and the surge in online activities among consumers and businesses alike. Financially, TEO has demonstrated resilience and adaptability, navigating the challenges posed by regulatory changes and market competition. The company's performance is closely monitored by investors, given its significant role in Argentina's telecom sector and its potential for growth in the evolving digital landscape. As of the last reported period, Telecom Argentina continues to invest in network enhancement and customer experience, setting the stage for future revenue growth and sustained market leadership.

Telecom Argentina S.A. (ticker: TEO), a leading telecommunications company, serves as a primary provider of telephony, internet, and television services within Argentina. With its operations pivoting towards integrating digital platforms and advanced technological infrastructure, the company strives to meet the growing demand for high-speed connectivity and multimedia solutions. Telecom Argentina's strategic focus on expanding its broadband and mobile services footprint has positioned it to capitalize on the increasing consumption of digital content and the surge in online activities among consumers and businesses alike. Financially, TEO has demonstrated resilience and adaptability, navigating the challenges posed by regulatory changes and market competition. The company's performance is closely monitored by investors, given its significant role in Argentina's telecom sector and its potential for growth in the evolving digital landscape. As of the last reported period, Telecom Argentina continues to invest in network enhancement and customer experience, setting the stage for future revenue growth and sustained market leadership.

| City | Buenos Aires | Country | Argentina | Industry | Telecom Services |

| Sector | Communication Services | Full Time Employees | 21,562 | CEO Name | Mr. Roberto Daniel Nobile |

| CEO Age | 56 | Previous Close | 7.92 | Open | 7.85 |

| Day Low | 7.84 | Day High | 8.06 | Dividend Rate | 0.21 |

| Dividend Yield | 0.0264 | Volume | 97,024 | Market Cap | 3,627,385,088 |

| Fifty Two Week Low | 4.08 | Fifty Two Week High | 8.87 | Price to Sales Trailing 12 Months | 0.005687892 |

| Trailing PE | 10.493333 | Forward PE | -14.574073 | Average Volume | 213,436 |

| Market Capitalization | 3,627,385,088 | Enterprise Value | 891,582,545,920 | Net Income to Common | 266,333,995,008 |

| Profit Margins | 0.41762 | Total Cash | 137,160,998,912 | Total Debt | 977,559,027,712 |

| Revenue Per Share | 1480.57 | Return on Assets | -0.0114 | Return on Equity | 0.22729 |

| Operating Cash Flow | 208,152,002,560 | Revenue Growth | -0.056 | Ebitda Margins | 0.2259 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | 0.8332370761226537 | Sortino Ratio | 15.459897248866817 |

| Treynor Ratio | 0.8678657752903977 | Calmar Ratio | 1.3690675525148017 |

Analyzing the summary of technical indicators, fundamentals, balance sheets, cash flow, analyst expectations, and risk-adjusted return ratios provides a comprehensive view on the potential stock price movement of TEO in the upcoming months.

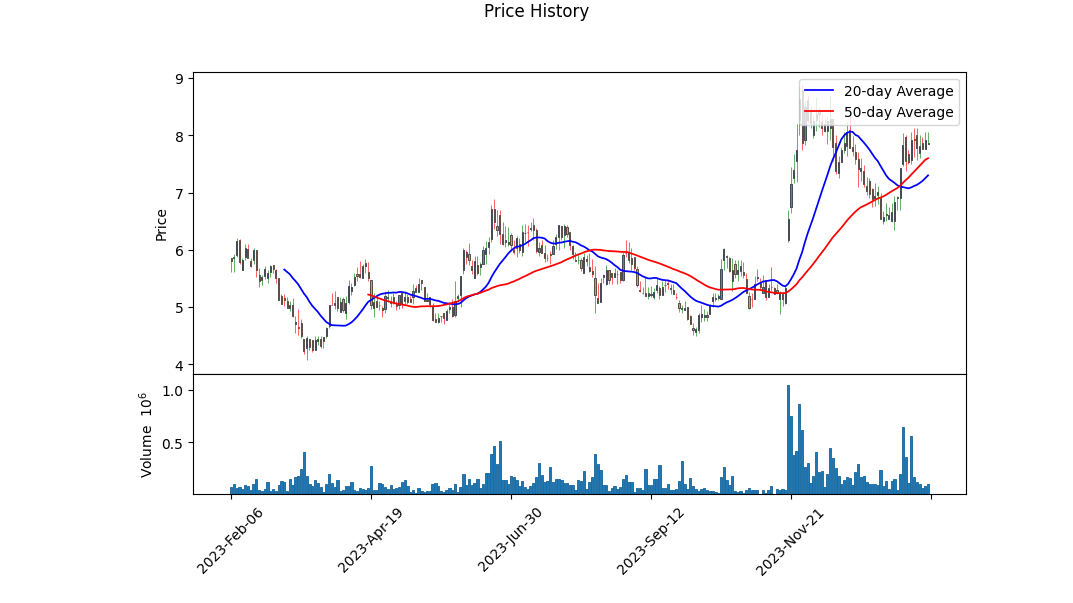

The technical indicators, notably the MACD histogram, display a trend that after a period of potential consolidation or bullish momentum, we observe a steady upward trend further substantiated with increasing OBV (On-Balance Volume) metrics, indicating buying pressure. The exit of the dataset with an upward MACD histogram suggests a bullish sentiment that could be short or medium-term.

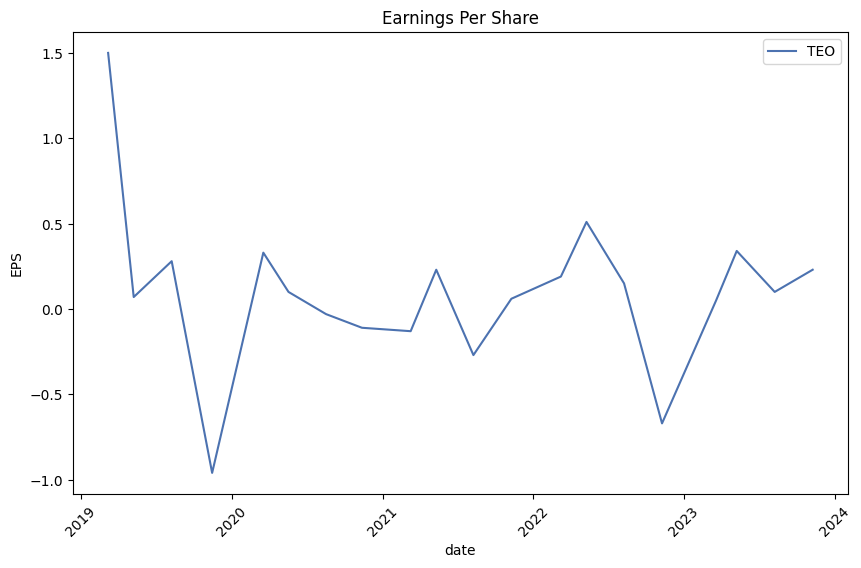

Fundamentally, the company shows a mix of strengths and weaknesses. The gross margins stand at a robust 0.73049, pointing to efficient operations and pricing power. However, operating margins being negative (-0.04889) flag concerns around operating efficiency and cost management. This dichotomy requires investors to weigh operational efficiency against apparent financial robustness. The financial statements highlight significant debt levels but also a tangible book value that suggests some degree of underlying asset support to the company's valuation. Moreover, analyst expectations are mixed, revealing a potential for both upside and downside given the projected EPS and sales growth figures.

Risk-adjusted return ratios, including the Sharpe, Sortino, Treynor, and Calmar ratios, underscore the investment attractiveness of TEO from a risk-return perspective within the past year. The high Sortino Ratio, in particular, suggests that the stock is delivering considerable returns on bad volatility, indicating a favorable scenario for risk-averse investors. These ratios are pivotal for understanding the risk-reward balance, suggesting that TEO, despite its operational challenges, offers an attractive risk-adjusted return profile.

Considering these intricate factors, the next few months for TEO's stock price seem to be on an optimistic trajectory, bolstered by solid fundamental margins, a strong risk-adjusted return profile, and positive technical indicators. However, potential investors should be mindful of the mixed analyst projections and the operational efficiency issues which could impact the company's long-term growth prospects. Based on the detailed analysis, TEO's stock could likely experience upward momentum in the short to medium term, contingent upon the market conditions and the company's execution on improving its operational efficiencies.

In the analysis of Telecom Argentina S.A. (TEO) based on the principles outlined in "The Little Book That Still Beats the Market," we examined two critical financial metrics: Return on Capital (ROC) and Earnings Yield. The Return on Capital (ROC) for Telecom Argentina stands at -17.93%. This negative figure indicates that the company is not generating a positive return on the investments it has made in its business operations, suggesting inefficiency in utilizing its capital to generate profit. Furthermore, the Earnings Yield is calculated to be -6066.20%, which is extraordinarily negative. Typically, a high earnings yield indicates that a company is undervalued or generating high earnings relative to its share price; however, the extremely negative figure here points towards potential accounting anomalies, significant losses, or other financial distress situations. It's crucial to note that such atypical values may necessitate a deeper investigation into the company's financial health, recent earnings reports, and potential extraordinary events that could have skewed these metrics. This analysis suggests that investors should exercise caution and possibly look for more stable investment opportunities, pending a thorough understanding and resolution of the underlying issues contributing to these negative figures.

Based on the calculated key metrics for Telecom Argentina S.A. (TEO) and comparing them to Benjamin Graham's criteria for stock selection, here's how TEO stands against the established investment principles:

-

Price-to-Earnings (P/E) Ratio: TEO's P/E ratio is calculated to be -0.05032612866095408, which indicates that the company had negative earnings over the period in question. Graham typically looked for companies with low but positive P/E ratios as a sign of undervaluation. TEO's negative P/E ratio suggests the company may have faced financial difficulties or losses in the reported period, making it a less attractive choice based on this criterion alone.

-

Price-to-Book (P/B) Ratio: With a P/B ratio of 0.001960648277376223, TEO is trading significantly below its book value. This aligns perfectly with Graham's method of looking for companies trading at prices below their intrinsic value to ensure a margin of safety.

-

Debt-to-Equity Ratio: TEO's debt-to-equity ratio stands at 0.6254443762157166, which is relatively moderate. Graham preferred companies with low debt-to-equity ratios to minimize financial risk. TEO's ratio suggests that while it does carry debt, the level might still be acceptable within Graham's conservative investment framework, provided other indicators are strong.

-

Dividend History: TEO has a history of paying dividends, albeit with some fluctuations in the amounts. Graham favored companies with consistent dividend records as an indicator of financial health and stability. While the dividend payments have varied, the continued commitment to paying dividends could be seen positively through Graham's lens.

-

Current and Quick Ratios: Both the current and quick ratios for TEO are 0.3918685031094894, indicating a relatively low level of short-term financial stability. Graham preferred higher current and quick ratios as they would indicate a company's ability to cover its short-term liabilities. In this case, TEO's lower ratios may raise concerns about its liquidity and short-term financial health.

Considering these metrics in light of Benjamin Graham's principles: - The negative P/E ratio is a red flag that may deter value investors seeking undervalued companies with solid earnings. - The low P/B ratio suggests potential undervaluation, adhering to Graham's margin of safety principle. - The debt-to-equity ratio, while not exceedingly high, would necessitate a closer look to ensure it aligns with Graham's preference for companies with minimal debt. - The track record of paying dividends aligns with Graham's criteria for selecting companies with a consistent dividend record, though the variability in dividend amounts requires further analysis. - The concerning low current and quick ratios signal potential liquidity issues that could pose risks in covering short-term obligations, deviating from Graham's criteria for financial stability.

In summary, while TEO holds some appeal based on its P/B ratio and history of dividend payments, the concerns raised by its negative P/E ratio, moderate debt levels, and low liquidity ratios suggest a cautious approach would be prudent for investors following Benjamin Graham's value investing principles. Further fundamental analysis and context-specific considerations are recommended before making an investment decision on TEO.

| Statistic Name | Statistic Value |

| R-squared | 0.054 |

| Adj. R-squared | 0.053 |

| F-statistic | 71.93 |

| Prob (F-statistic) | 6.19e-17 |

| Log-Likelihood | -3237.9 |

| No. Observations | 1257 |

| AIC | 6480. |

| BIC | 6490. |

| coef (const) | -0.0237 |

| coef | 0.5780 |

| Std Err | 0.090 |

| t | 8.481 |

| P>|t| | 0.000 |

| [0.025 | 0.444 |

| 0.975] | 0.712 |

| Omnibus | 286.883 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 6730.153 |

| Skew | -0.455 |

| Prob(JB) | 0.00 |

| Kurtosis | 14.299 |

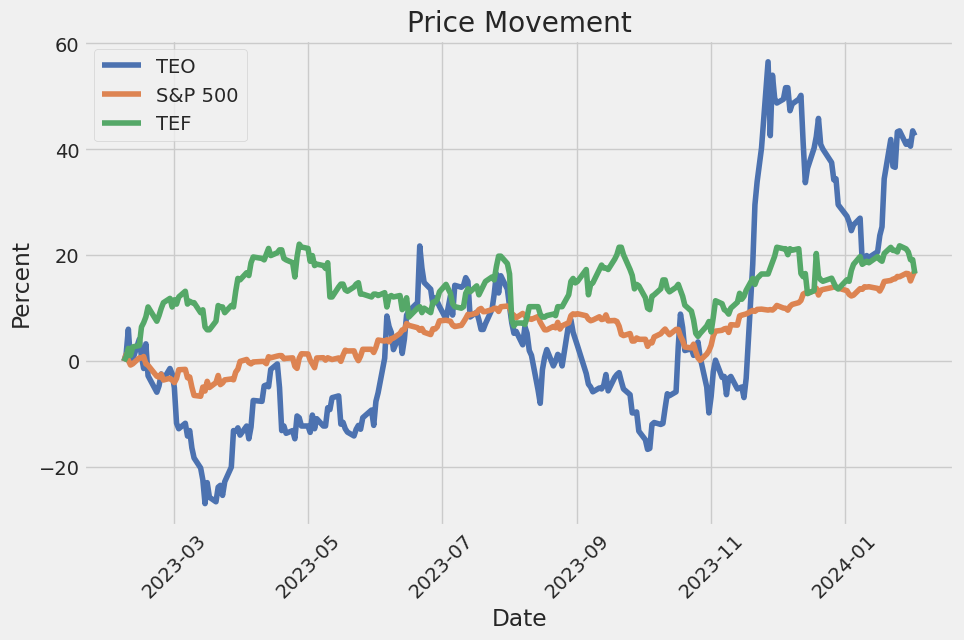

In the linear regression model comparing the performance of stock TEO against the broad market index SPY, the analysis presents a nuanced picture of their relationship up to the present day. The model's alpha, being -0.0237, suggests that TEO has underperformed against the SPY by a small margin when the market's movement is not taken into account. This alpha value implies that TEO's returns have been slightly below expectations based on the market performance alone. This underperformance might hint at factors specific to TEO that are not captured by the market's overall performance, thereby offering insights into the stock's behavior beyond general market movements.

On the other hand, the beta value of 0.5780 indicates that TEO is less volatile compared to the SPY, meaning that its price movements are less pronounced relative to the market's changes. This could be interpreted as TEO having a more stable performance, albeit with less sensitivity to market trends, which might appeal to investors seeking less risk. The overall relationship between TEO and SPY, as indicated by a low R-squared value of 0.054, shows that only a small fraction of TEO's variance is explained by the movements in the SPY. This insight suggests that TEO's performance is influenced by many other factors, not just the general market trends represented by SPY, pointing towards a relatively independent dynamic in its stock behavior.

Telecom Argentina S.A. (ticker: TEO) conducted its earnings call to discuss financial results for the six-month period and second quarter ended June 30, 2023. The call featured key company executives including Chief Executive Officer Roberto Nobile, Chief Financial Officer Gabriel Blasi, and Luis Rial Ubago, who provided an overview of the company's operational and financial achievements during the period. Despite the challenging economic conditions characterized by rising inflation and tighter import restrictions, Telecom Argentina reported a solid EBITDA margin of 28.4% for the first half of 2023 and a strong free cash flow generation, underlining the company's effective cost containment measures and successful execution of its capital expenditure (CapEx) plan.

Telecom Argentina has made significant strides in its operational segments, particularly in expanding its FTTH network, which is central to its strategy to consolidate its position in the fixed market. This focus is reflected in the nearly 3% year-over-year growth in the mobile subscriber base, and a substantial 15% increase in mobile data usage per user. Additionally, the company has seen growth in its FTTH technology customer base, contributing to the stability of its overall customer base and outperforming other technologies. Furthermore, Telecom Argentina's Pay TV business continued to grow in Paraguay, and its fintech venture, Personal Pay, saw impressive growth, reaching almost 1.2 million onboarded clients in the first half of 2023.

Financially, Telecom Argentina encountered headwinds due to the economic environment, with revenues in constant pesos down by 9% year-over-year for the first half of 2023. This decline was largely mitigated by the company's adaptive pricing policy, which included more frequent price increases starting in March 2023 to better match the rising inflation scenario, helping to maintain service revenue variation year-to-year flat in real terms. Importantly, the company has effectively managed its debt commitments, canceling all financial debts up to date and significantly clearing its maturity profile for the remainder of the year.

Telecom Argentina's efforts to navigate through the economic uncertainties are evident in its comprehensive cost management strategies and adjusted price policies aimed at retaining and expanding its customer base across various segments. Despite the decrease in broadband accesses driven primarily by reductions in xDSL accesses, the company has experienced encouraging growth in FTTH during the second quarter of 2023. Moreover, the company's focus on enhancing its digital and international operations, particularly in Paraguay, underlines its strategic direction toward leveraging growth opportunities beyond its traditional markets. With a robust free cash flow and a clear debt maturity profile, Telecom Argentina appears well-positioned to continue its strategic investments in technology and infrastructure, thereby strengthening its market presence and competitive advantage.

In the vibrant sphere of the Utilities sector, discerning investors are constantly on the lookout for entities that stand out with the potential to surpass their counterparts in performance. An intriguing piece of analysis by Zacks Equity Research, dated January 25, 2024, provides a rich tapestry of insights into how various stocks within this sector, particularly NRG Energy and Telecom Argentina S.A., fare against each other and the sector's broader trends. The dialogue between these companies' performances, aligned with their year-to-date returns and shifting earnings estimates, offers a compelling narrative for stakeholders interested in the utilities landscape.

Situated within a grouping of 104 companies, NRG Energy occupies a noteworthy stance in the Utilities Sector. This group finds itself ranked at #9 among 16, according to the Zacks Sector Rank, which evaluates companies based on the collective average of the Zacks Rank within each sector. This ranking underscores the importance of earnings estimate revisions and underscores the value in firms showcasing an upward trajectory in their earnings outlook. NRG Energy, with a Zacks Rank of #1 (Strong Buy), emerges as a beacon of positive analyst sentiment and a promising earnings outlook, amplified by an 11.9% increase in the Zacks Consensus Estimate for its annual earnings over a recent three-month period.

Reflecting upon the year-to-date performance metrics offers another layer of insight into the dynamics governing the Utilities sector's narrative. NRG Energy has recorded a moderate return of approximately 0.6% since the year's inception, offering a stark contrast to the broader Utilities sector's average return, which has seen an 8.8% decrease. This positioning suggests NRG Energys superior stance within its sector, highlighting its resilience and better-than-average market performance.

Telecom Argentina S.A., on the other hand, signals an impressive narrative with a year-to-date return of 5.5%. This performance is particularly remarkable, considering the consensus EPS estimate for Telecom Argentina has witnessed a staggering 280% increase over the past three months. This exponential surge underscores a significant enhancement in the company's earnings outlook. Assimilated into this narrative is Telecom Argentina's Zacks Rank of #1 (Strong Buy), projecting the company not just as an outlier within its sector for outperforming its peers, but also for its promising future prospects anchored on bullish analyst expectations.

Through the comparative lens furnished by Zacks Equity Research, the storyline between NRG Energy and Telecom Argentina unravels key insights into their market performances and prospective outlooks within the Utilities sector. It becomes evident that both companies share a common thread of potential for outperformance, attributed largely to favorable earnings estimate revisions and an overall optimistic outlook from analysts.

The discourse around these two companies, framed within the larger context of the utilities sector's dynamics, paints a vivid picture of operational and market performance excellence. It is this detailed analysis and comparison that illuminate the prospects and positions of NRG Energy and Telecom Argentina, guiding stakeholders toward informed decisions. The comprehensive analysis offered by Zacks, as detailed in their original article, stands as a valuable resource for those keen on delving deeper into the intricacies of this sector. For access to the full scope of insights and recommendations presented by Zacks Equity Research, one may refer to the original article via the Zacks Investment Research link.

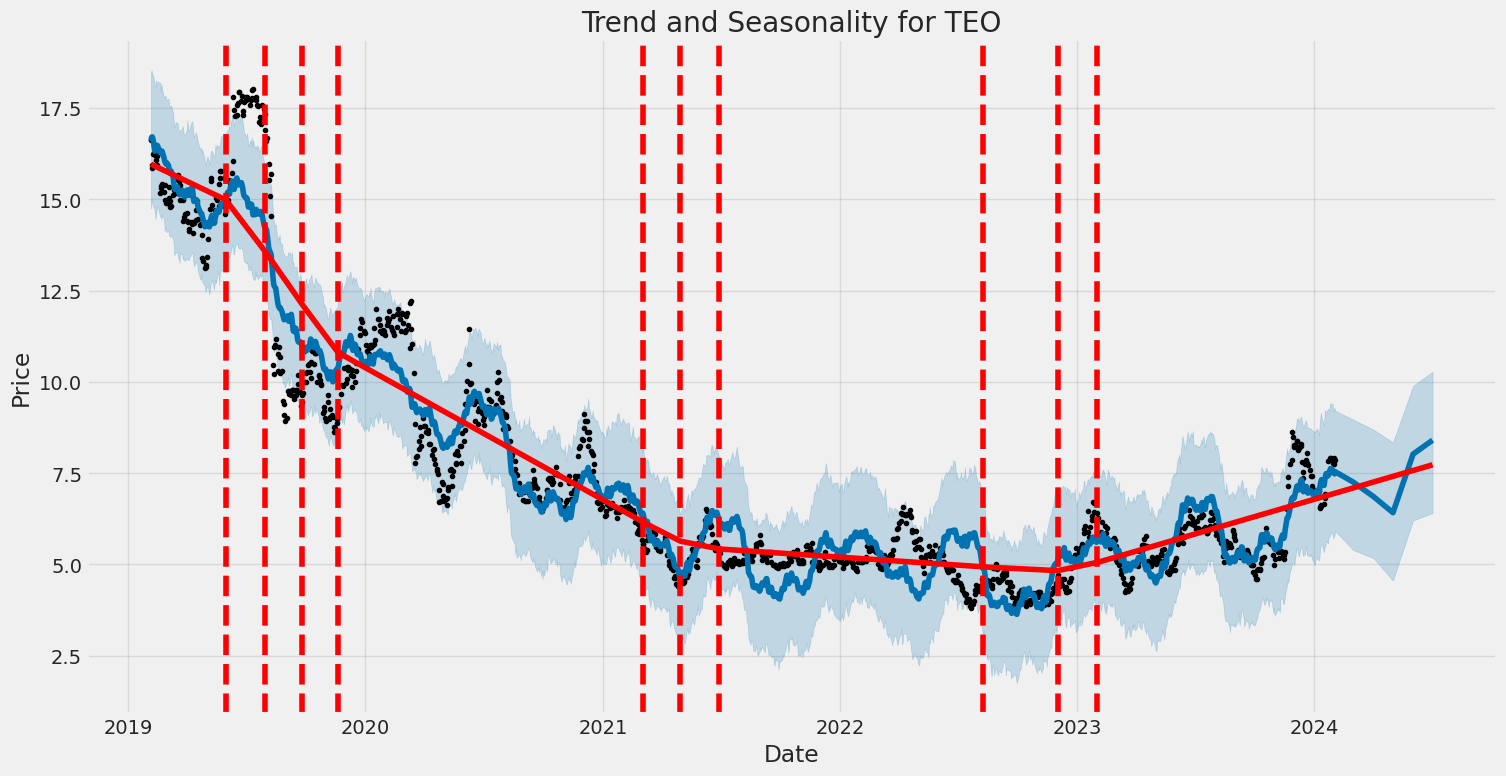

Over the period from February 5, 2019, to February 4, 2024, Telecom Argentina S.A. (TEO) exhibited notable volatility in its asset returns, as analyzed through the Zero Mean - ARCH Model. The model's omega coefficient stands at 7.4625, suggesting a base level of volatility in returns, while the alpha coefficient of 0.3261 indicates the impact of past squared returns on current volatility, showcasing the security's responsiveness to market changes. The significant coefficients, along with the statistical confidence levels provided in the model, underscore the erratic nature of TEO's performance, highlighting its sensitivity to past market movements and potential for substantial fluctuations.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -3219.98 |

| AIC | 6443.96 |

| BIC | 6454.23 |

| No. Observations | 1,257 |

| omega | 7.4625 |

| alpha[1] | 0.3261 |

Analyzing the financial risk associated with a $10,000 investment in Telecom Argentina S.A. (TEO) over a forthcoming year necessitates a deep dive into both the historical volatility of the stock and predictive analytics to forecast future movements. This dual approach, leveraging volatility modeling techniques alongside machine learning predictions, provides a nuanced understanding of the investment's potential risk profile.

Volatility modeling effectively captures the variabilities in the stock's returns over time. This method is instrumental in identifying patterns of fluctuation in Telecom Argentina S.A.'s stock, which are critical to understanding the inherent risk of the investment. By analyzing historical price data, volatility modeling generates estimates of future volatility, offering insights into the expected range of price movements based on past behavior. It serves as a foundational element in assessing financial risk, as it lays the groundwork for estimating the likelihood of various return scenarios.

Machine learning predictions, specifically employing a framework akin to the RandomForestRegressor, take this analysis further by incorporating a wide array of variables that could impact future stock performance. This approach builds upon the foundation laid by volatility modeling, refining the predictions of future returns through a comprehensive analysis that includes both historical data and potentially influential external factors. The integration of machine learning predictions allows for a more nuanced forecast, which is not solely reliant on historical volatility but also considers broader market and sector-specific dynamics.

The combined application of volatility modeling and machine learning predictions culminates in the calculation of the annual Value at Risk (VaR) at a 95% confidence level for the $10,000 investment in Telecom Argentina S.A.. The calculated VaR of $573.33 signifies the maximum expected loss over a year within a 95% confidence interval, based on the underlying assumptions and models employed. This figure is pivotal in understanding the financial risk of the investment, as it quantifies the potential downside in a manner that is both statistically robust and grounded in comprehensive analytical methodologies.

By integrating insights from both volatility modeling and machine learning predictions, this analysis sheds light on the complex dynamics that influence the performance of Telecom Argentina S.A.'s stock. The calculated VaR provides a quantitative measure of risk that can be essential for investors when making informed decisions about their investment portfolios. Through the sophisticated use of analytical techniques, the potential risks of equity investment in Telecom Argentina S.A. are elucidated, delineating the challenges and considerations inherent in such financial ventures.

Analyzing the options for Telecom Argentina S.A. (TEO), we're focusing on call options with the objective of identifying the most profitable opportunities, taking into consideration a target stock price that's 5% over the current price. The analysis is based on "the Greeks," which provide insight into the behavior of options pricing relative to various factors such as the underlying stock price movement (Delta), acceleration of the option's price movement (Gamma), sensitivity to volatility (Vega), time decay (Theta), and interest rate sensitivity (Rho).

Firstly, the option with a strike price of $5.00 expiring on April 19, 2024, stands out due to its high Delta value of 0.925474569. A high Delta indicates that the option's price is expected to move significantly with a small change in the stock price, making it an attractive choice for those expecting the stock to achieve the target price. Moreover, this option has a relatively high Vega (0.4709533779), showing significant sensitivity to changes in implied volatility, which could be beneficial if volatility increases. The return on investment (ROI) for this option is at 0.1655357143, and the profit is noted as 0.4635, which are robust figures indicating a potentially profitable opportunity, especially given the relatively moderate Theta (-0.0024238423), suggesting slower time decay compared to other options.

Another notable option is the $5.00 strike price expiring on July 19, 2024, which shows a strong Delta of 0.8653800934. Despite its lower Delta compared to the April 19, 2024 option, its higher Vega value of 1.0716937816 suggests it is even more sensitive to volatility, potentially offering substantial gains if market volatility increases. However, this option's ROI (0.0010736196) and profit (0.0035) are significantly lower, likely due to its higher premium cost (3.26) and longer time to expiration, which increases the risk of time decay (Theta of -0.0023823282).

The option with a strike price of $7.50 expiring on February 16, 2024, also deserves attention despite its lower Delta (0.6467881966) compared to the others. It has the highest Gamma (0.2873619665) among the analyzed options, which could be advantageous if the stock price begins to move towards the target price rapidly, allowing traders to benefit from the acceleration of the option price's change. Nonetheless, the lower ROI (0.0604166667) and profit (0.0435) relative to its premium (0.72) indicate that it might not be as lucrative unless very specific market conditions are met.

Considering the target of achieving a stock price that's 5% over the current price, the option expiring on April 19, 2024, with a strike price of $5.00, appears to be the most balanced in terms of profitability potential and risk exposure. It offers a high sensitivity to stock price movement and a respectable sensitivity to volatility, combined with a moderate rate of time decay. Such a profile suggests this option could be the most strategic choice for traders aiming to capitalize on anticipated upward movements in Telecom Argentina S.A.'s stock price within the specified timeframe.

Similar Companies in Telecom Services - Foreign:

Telefonica, S.A. (TEF), Orange S.A. (ORAN), SK Telecom Co.,Ltd (SKM), America Movil, S.A.B. de C.V. (AMX), KT Corporation (KT), Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (TLK), PLDT Inc. (PHI), Telefonica Brasil S.A. (VIV), TIM S.A. (TIMB), Liberty Broadband Corporation (LBRDA), Report: AT&T Inc. (T), AT&T Inc. (T), Report: Verizon Communications Inc. (VZ), Verizon Communications Inc. (VZ)

https://finance.yahoo.com/news/utilities-stocks-lagging-nrg-energy-144005942.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: bGZynS

Cost: $0.20704

https://reports.tinycomputers.io/TEO/TEO-2024-02-04.html Home