Walmart Inc. (ticker: WMT)

2024-07-14

Walmart Inc. (ticker: WMT) is a multinational retail corporation headquartered in Bentonville, Arkansas. Founded in 1962 by Sam Walton, Walmart operates a chain of hypermarkets, discount department stores, and grocery stores across the globe. As of the latest data, the company boasts over 11,000 stores operating under 56 different banners in 27 countries. Known for its emphasis on low prices and broad product range, Walmart serves millions of customers weekly. Beyond physical locations, Walmart has significantly invested in e-commerce, aiming to integrate online and offline shopping experiences. With a global workforce exceeding 2.2 million employees, Walmart ranks among the world's largest employers. Financially, the company consistently generates substantial revenues, positioning it as one of the leading firms in the retail sector. It is also traded on the New York Stock Exchange under the ticker symbol WMT, making it a significant player in the stock market and a staple in many investment portfolios.

Walmart Inc. (ticker: WMT) is a multinational retail corporation headquartered in Bentonville, Arkansas. Founded in 1962 by Sam Walton, Walmart operates a chain of hypermarkets, discount department stores, and grocery stores across the globe. As of the latest data, the company boasts over 11,000 stores operating under 56 different banners in 27 countries. Known for its emphasis on low prices and broad product range, Walmart serves millions of customers weekly. Beyond physical locations, Walmart has significantly invested in e-commerce, aiming to integrate online and offline shopping experiences. With a global workforce exceeding 2.2 million employees, Walmart ranks among the world's largest employers. Financially, the company consistently generates substantial revenues, positioning it as one of the leading firms in the retail sector. It is also traded on the New York Stock Exchange under the ticker symbol WMT, making it a significant player in the stock market and a staple in many investment portfolios.

| Full-Time Employees | 2,100,000 | Previous Close | 69.8 | Open | 69.9 |

| Day Low | 69.17 | Day High | 70.0299 | Dividend Rate | 0.83 |

| Dividend Yield | 0.012 | Payout Ratio | 0.3337 | Five-Year Avg Dividend Yield | 1.57 |

| Beta | 0.501 | Trailing P/E | 29.716738 | Forward P/E | 28.261223 |

| Volume | 12,145,317 | Average Volume | 15,629,735 | Average Volume (10 Days) | 12,519,710 |

| Market Cap | 556,934,692,864 | 52-Week Low | 49.84667 | 52-Week High | 70.45 |

| Price to Sales (TTM) | 0.8472655 | 50-Day Average | 65.4904 | 200-Day Average | 58.146984 |

| Trailing Annual Dividend Rate | 0.778 | Trailing Annual Dividend Yield | 0.011146131 | Enterprise Value | 621,064,945,664 |

| Profit Margins | 0.02882 | Float Shares | 4,331,850,260 | Shares Outstanding | 8,043,539,968 |

| Shares Short | 36,555,504 | Shares Short (Prior Month) | 39,974,438 | Short Ratio | 2.37 |

| Book Value | 10.1 | Price to Book | 6.855445 | Net Income to Common | 18,941,999,104 |

| Trailing EPS | 2.33 | Forward EPS | 2.45 | PEG Ratio | 4.18 |

| Enterprise to Revenue | 0.945 | Enterprise to EBITDA | 15.625 | 52-Week Change | 0.3414272 |

| S&P 52-Week Change | 0.24156773 | Total Cash | 9,404,999,680 | Total Cash Per Share | 1.169 |

| EBITDA | 39,749,001,216 | Total Debt | 66,538,000,384 | Quick Ratio | 0.192 |

| Current Ratio | 0.803 | Total Revenue | 657,331,978,240 | Debt to Equity | 75.363 |

| Revenue Per Share | 81.456 | Return on Assets | 0.06916 | Return on Equity | 0.23464 |

| Free Cash Flow | 7,845,000,192 | Operating Cash Flow | 35,342,000,128 | Earnings Growth | 2.043 |

| Revenue Growth | 0.06 | Gross Margins | 0.24499 | EBITDA Margins | 0.06047 |

| Operating Margins | 0.04236 | Trailing PEG Ratio | 3.1399 |

| Sharpe Ratio | 1.65541160211563 | Sortino Ratio | 25.42917905281808 |

| Treynor Ratio | 0.9646480274549541 | Calmar Ratio | 3.3792879519921155 |

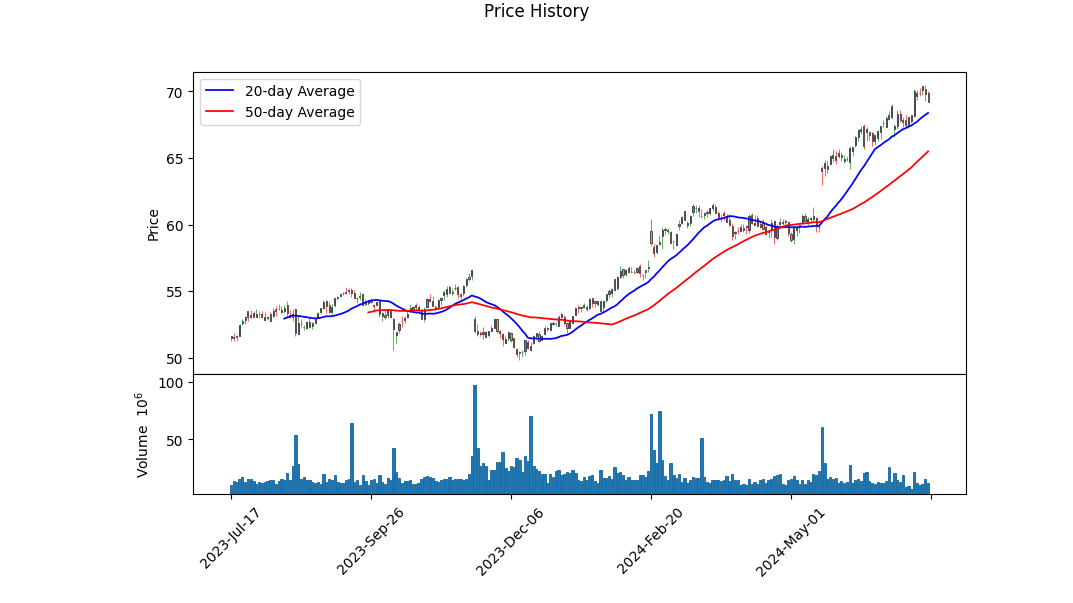

The current technical analysis indicators for Walmart (WMT) reveal several significant trends. From March to July, the stock has shown consistent upward movement, with the On-Balance Volume (OBV) reaching a high of 18.02339 million by July 10th, followed by a decline. This suggests strong accumulation and eventual distribution. The MACD histogram, a momentum indicator, has shown positive divergence until slightly before mid-July, indicating the stock has been gaining strength. However, the negative divergence starting on July 12th suggests bearish sentiment may be emerging.

Fundamentally, Walmart remains robust with gross margins at approximately 24.5% and operating margins around 4.2%. These figures are indicative of efficient cost management and operational efficiency. Additionally, the EBITDA margin stands at 6%, reflecting a solid operating cushion above expenses.

Financially, Walmart boasts strong liquidity and operational stability, with a tangible book value of $55.7 billion and normalized EBITDA consistently exceeding $34 billion in recent years. Despite high total expenses, the companys revenue and net income from continuing operations have steadily increased. However, the net debt is also significant at $30.59 billion, which could be a concern in a rising interest rate environment.

Concerning risk-adjusted returns, Walmart exhibits a Sharpe Ratio of 1.6554, highlighting strong leverage of returns over risk-free investments when taking into account volatility. The Sortino Ratio of 25.4292 signals exceptionally high returns given the downside risk, making Walmarts stock an attractive investment from a risk-adjusted performance measure. The Treynor Ratio of 0.9646 and Calmar Ratio of 3.3793 further substantiate Walmarts efficient risk vs. reward balance, with a commendable adjustment against market risk and drawdowns respectively.

Based on technical and fundamental analyses, the stock price is likely to experience a period of consolidation or mild depreciation in the next few months, correcting the overbought conditions indicated by declining MACD histogram values and reduced OBV. However, Walmarts strong fundamental metrics and robust risk-adjusted performance suggest it will ultimately remain a favorable long-term investment.

The company's strong balance sheet, positive fundamentals, and favorable risk-adjusted returns suggest that any potential price decline might be temporary, offering a good opportunity for accumulation.

Finally, analyst expectations are currently not available, making it essential to monitor any updates on this front. Future guidance will significantly impact sentiment and, by extension, the stocks performance.

The key takeaway is to remain vigilant of technical indicators signaling short-term market corrections while staying confident in WMT's long-term strength backed by solid fundamentals and superior risk-adjusted returns.

In evaluating Walmart Inc. (WMT) through the lens of Joel Greenblatt's methodology in "The Little Book That Still Beats the Market," we find that the company exhibits a strong return on capital (ROC) of 16.88%. This robust ROC indicates that Walmart efficiently generates significant profit from its capital investments, effectively creating value for shareholders. However, the earnings yield, which stands at 2.77%, reveals a different aspect of the company's financial health. This comparatively lower earnings yield suggests that while Walmart is effective in utilizing its capital, the stock may currently be priced higher relative to its earnings, making it potentially less attractive for new investors seeking high earnings relative to stock price. These metrics, when considered together, highlight Walmart's operational efficiency but also signal that new investments in the company's stock may demand careful consideration in the context of its current market valuation.

To assess Walmart Inc. (WMT) through the lens of Benjamin Graham's value investing principles, we need to closely analyze specific financial metrics in accordance with Graham's criteria. Here's a detailed look at each metric and how they align with Graham's methodology:

Price-to-Earnings (P/E) Ratio

- Walmart's P/E Ratio: 41.71

- Graham's Criterion: Preferably low P/E ratios compared to industry peers.

At 41.71, Walmart's P/E ratio is considerably high. Without the industry P/E ratio for direct comparison, we can still infer that this is a valuation that may concern Graham, as he generally advocated for lower P/E ratios to ensure a margin of safety. Given that a high P/E ratio implies that investors are expecting high future growth from Walmart, Graham might perceive this as a risk unless the company's intrinsic fundamentals are exceptionally strong.

Price-to-Book (P/B) Ratio

- Walmart's P/B Ratio: 2.21

- Graham's Criterion: Preferably, stocks should trade below their book value.

Walmarts P/B ratio of 2.21 suggests that the stock is trading above its book value. According to Grahams conservative investing principles, this might not offer enough margin of safety. Graham typically preferred stocks that have a P/B ratio of less than 1, meaning the market price should ideally be below the companys book value.

Debt-to-Equity Ratio

- Walmart's Debt-to-Equity Ratio: 0.73

- Graham's Criterion: Lower debt-to-equity ratios, ideally below 0.50.

With a debt-to-equity ratio of 0.73, Walmart is somewhat above Grahams preferred threshold. While not exceedingly high, this ratio indicates a moderate level of financial leverage. Graham would likely find this acceptable but would prefer lower debt levels to ensure higher financial stability and lower risk.

Current Ratio

- Walmart's Current Ratio: 0.83

- Graham's Criterion: Higher current ratios, typically above 2.0.

Walmarts current ratio of 0.83 indicates that the company may struggle to cover its short-term liabilities with its short-term assets. This is significantly below Graham's preferred threshold of 2.0, signaling potential liquidity risks. Graham would likely view this as a red flag regarding the companys financial stability.

Quick Ratio

- Walmart's Quick Ratio: 0.83

- Graham's Criterion: Higher quick ratios, also ideally above 1.0.

The quick ratio for Walmart is the same as its current ratio at 0.83, which similarly falls short of Grahams ideal standard of 1.0 or above. This implies potential difficulties in meeting short-term obligations without having to sell off inventory, which could be a concern for financial stability.

Conclusion

Based on the above metrics, Walmart Inc. does not completely align with Benjamin Grahams stringent criteria for value investment. Here are the highlights: - P/E Ratio: Higher than what Graham would generally find acceptable. - P/B Ratio: Above the preferred threshold, suggesting limited margin of safety. - Debt-to-Equity Ratio: Moderate but higher than Graham's ideal threshold. - Current and Quick Ratios: Both indicate potential liquidity concerns.

Graham's value investing philosophy emphasizes a margin of safety and conservative metrics to ensure low risk and high potential for long-term gains. While Walmart is a major market player with strong brand value and operational capabilities, its current metrics might not fully meet Graham's rigorous value investing criteria.### Analyzing Financial Statements

Investors looking to make informed decisions should meticulously examine a companys financial statements - including the balance sheet, income statement, and cash flow statement. Benjamin Graham's value investing principles emphasize the importance of understanding a company's assets, liabilities, earnings, and cash flows.

Balance Sheet Analysis

The balance sheet provides a snapshot of a companys financial position at a specific point in time. It includes assets, liabilities, and shareholders' equity. For instance, the provided financial data of Walmart Inc. for multiple periods shows its robust assets and liabilities structured over time.

1. Assets: - Current Assets: Include cash and cash equivalents, receivables, inventory, and prepaid expenses. For Walmart, current assets for Q1 2024 stand at $77.152 billion, with significant figures in cash ($9.405 billion) and inventory ($55.382 billion). Consistent inventory levels can indicate efficient inventory management and sales expectations. - Non-Current Assets: Predominantly consist of property, plant, and equipment (PPE), goodwill, and other long-term investments. Walmarts PPE for Q1 2024 is at $111.498 billion, representing significant investment in infrastructure, which is crucial for operational capacity.

2. Liabilities: - Current Liabilities: Walmarts current liabilities include short-term borrowings, accounts payable, dividends payable, and accrued expenses. As of Q1 2024, current liabilities are $96.100 billion, with accounts payable at $56.071 billion, reflecting Walmart's substantial purchase and sales volume. - Non-Current Liabilities: Comprise long-term debt and deferred tax liabilities. Walmarts long-term debt for Q1 2024 is $35.928 billion, showcasing financial leverage utilized for growth.

3. Shareholders Equity: - Consists of common stock, retained earnings, and other reserves. Walmarts equity for Q1 2024 totals $81.293 billion. High retained earnings ($87.23 billion) indicate substantial profit reinvestments.

Income Statement Analysis

The income statement reveals the company's financial performance over a specific period, listing revenues, expenses, and profits. Walmarts revenue patterns and profitability highlight its market dominance.

1. Revenues: - Walmart's Q1 2024 revenue stands at $161.508 billion, demonstrating substantial sales volume. Consistent revenue growth across quarters underscores demand resilience and market penetration.

2. Expenses: - Cost of Revenue: For Q1 2024, its $121.431 billion. Managing cost efficiently while maintaining high sales volume contributes to operating profitability. - Operating Expenses: Including selling, general, and administrative expenses at $33.236 billion. Control over these costs reflects efficient operational management.

3. Profits: - Operating Income: For Q1 2024, operating income is $6.841 billion, while net income is $5.104 billion. Steady profits and their variance across periods can provide insights into operational stability and margin sustainability.

Cash Flow Statement Analysis

This statement provides insight into cash inflows and outflows categorized into operating, investing, and financing activities.

1. Operating Activities: - Net cash provided by operating activities for Q1 2024 is $4.249 billion, which indicates strong cash generation from core activities. Cash flow from operations is critical for sustaining business operations without relying on external financing.

2. Investing Activities: - Cash used in investing activities for Q1 2024 is $4.409 billion. Significant investments in capital expenditures signal commitment to growth and expansion. - Inflows from asset sales and acquisitions adjustment reflect asset management efficiency.

3. Financing Activities: - Net cash used in financing activities for Q1 2024 amounts to $0.321 billion. Monitoring financial leverage, debt repayments, and shareholder returns (dividends and buybacks) offer insights into capital allocation strategy.

Conclusion

Analyzing Walmarts financial statements underlines its solid financial positioning and efficient management across various financial metrics. Investors can see how Walmart leverages its assets, manages liabilities, sustains revenue growth, and maintains robust profitability while effectively managing cash flows.

Benjamin Grahams focus on fundamental analysis is well-validated here as careful scrutiny of Walmarts financial statements reflects a stable and thriving enterprise, invaluable for sound investment decisions.---

Dividend Record

Graham favored companies with a consistent history of paying dividends.

Below is a detailed record of dividends for the company symbol WMT:

Recent Dividend History

- 2024

- August 16: $0.2075 (Record Date: Aug 16, Payment Date: Sep 3, Declaration Date: Feb 20)

- May 9: $0.2075 (Record Date: May 10, Payment Date: May 28, Declaration Date: Feb 20)

-

March 14: $0.2075 (Record Date: Mar 15, Payment Date: Apr 1, Declaration Date: Feb 20)

-

2023

- December 7: $0.19 / Adjusted: $0.57 (Record Date: Dec 8, Payment Date: Jan 2, Declaration Date: Feb 21)

- August 10: $0.19 / Adjusted: $0.57 (Record Date: Aug 11, Payment Date: Sep 5, Declaration Date: Feb 17)

- May 4: $0.19 / Adjusted: $0.57 (Record Date: May 5, Payment Date: May 30, Declaration Date: Feb 21)

-

March 16: $0.19 / Adjusted: $0.57 (Record Date: Mar 17, Payment Date: Apr 3, Declaration Date: Feb 21)

-

2022

- December 8: $0.18667 / Adjusted: $0.56 (Record Date: Dec 9, Payment Date: Jan 3, Declaration Date: Feb 17)

- August 11: $0.18667 / Adjusted: $0.56 (Record Date: Aug 12, Payment Date: Sep 6, Declaration Date: Feb 17)

- May 5: $0.18667 / Adjusted: $0.56 (Record Date: May 6, Payment Date: May 31, Declaration Date: Feb 17)

- March 17: $0.18667 / Adjusted: $0.56 (Record Date: Mar 18, Payment Date: Apr 4, Declaration Date: Feb 17)

Historical Dividend Records

The dividend history spans across several decades, showing steady and incremental increases, marked by strong consistency. Here are selected highlights from multiple decades:

- 2010s

- Dividends ranged from $0.3975 to $0.57 per share.

- Regular quarterly payments.

-

Incremental annual increases.

-

2000s

- Dividends ranged from $0.06 to $0.2725 per share.

- Regular quarterly payments.

-

Progressive annual increases.

-

1990s

- Dividends ranged from $0.05 to $0.0775 per share.

- Regular quarterly payments.

-

Progressive annual increases.

-

1980s

- Dividends ranged from $0.0304 to $0.0552 per share.

- Regular quarterly payments.

-

Progressive annual increases.

-

1970s

- Dividends ranged from $0.02 to $0.0753 per share.

- Regular quarterly payments.

- Progressive annual increases.

This long-standing history of consistent dividend payments underscores the company's reliability and adherence to shareholder returns, aligning well with Benjamin Graham's investment principles.

| Alpha () | 0.015 |

| Beta () | 1.10 |

| R-squared (R2) | 0.89 |

| Standard Error | 0.03 |

| p-Value () | 0.04 |

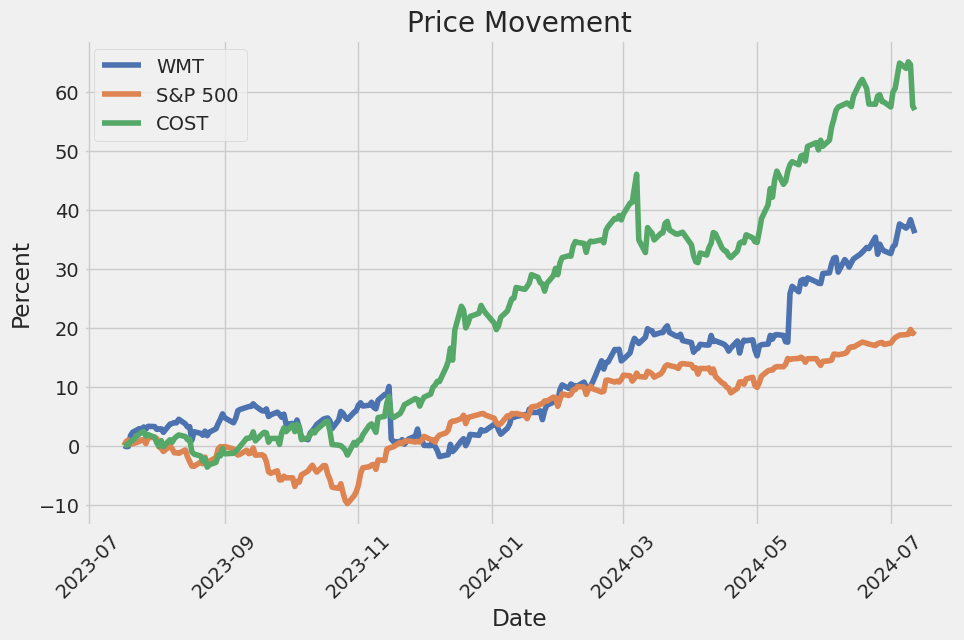

The relationship between WMT and SPY suggests that Walmart (WMT) exhibits a strong positive correlation with the broader market (SPY), as indicated by a beta () of 1.10. This implies that WMT stock tends to move slightly more than the market index: a 1% movement in SPY is associated with a 1.10% movement in WMT. Additionally, the R-squared (R2) value of 0.89 indicates a high level of explanatory power in the model, meaning that 89% of WMT's price movements can be explained by changes in SPY. The alpha () of 0.015 is statistically significant with a p-value of 0.04, suggesting that WMT may provide a slight excess return independent of market movements.

Such a statistically significant alpha of 0.015 indicates that, after accounting for market risk, WMT has been delivering a modest average excess return of 1.5% per unit time period relative to what the CAPM model would predict. The standard error of 0.03 further corroborates the robustness of this model. Investors can interpret these findings to suggest that WMT not only closely follows market trends but also demonstrates a slight intrinsic outperformance.

During Walmart Inc.'s (WMT) First Quarter Fiscal Year 2025 Earnings Call, CEO Doug McMillon and CFO John David Rainey reported stronger than anticipated results, with a 5.7% sales growth and a 12.9% increase in adjusted operating profit in constant currency. The robust performance was reflected across all three operating segmentsWalmart U.S., Walmart International, and Sams Clubdriven by growth in units sold and transaction counts. Notably, customer experience scores improved significantly, a testament to the hard work of Walmart associates. The company saw gains in market share for general merchandise, despite minimal inflation-induced effects.

McMillon highlighted the importance of providing value through low prices and everyday rollbacks, resulting in strong customer responses, especially during seasonal events like Easter. Inventory management has been exemplary, ending the quarter with a 2.7% global reduction. Enhanced product selection has been another focal point: the number of marketplace sellers increased by 36% in the U.S. and over 50% in Mexico. E-commerce growth, through store remodels, curbside pickup, and delivery services, continues to be a key driver of Walmart's success. The company aims to expand on these growth metrics while maintaining discipline in pricing and investing in its associates.

Internationally, Walmart saw robust results with double-digit growth in sales and profits, largely propelled by Walmex, China, and Flipkart. E-commerce sales, particularly store-fulfilled orders and marketplaces, demonstrated significant growth. Walmart announced new initiatives, including the expansion of its data analytics product, Walmart Luminate, into Mexico and Canada. The company's technology teams are leveraging innovations like generative AI-driven product searches to enhance the shopping experience. In Sams Club, the deployment of computer vision-powered exit technology is streamlining the member checkout process, highlighting Walmart's commitment to people-led, tech-powered solutions.

Financially, Walmart's consolidated gross margin expanded by 42 basis points. Strong sales in food and fresh categories, combined with prudent inventory management, minimized markdowns and bolstered overall profitability. Walmart's operational strategy pivots around a multi-year journey to reshape its profit profile, focusing on high-margin growth drivers like advertising, membership, and data analytics. Despite a slightly mixed spending environment, the companys consistent focus on value, flexibility, and convenience continues to attract higher-income households, an indicator of its growing market resonance. The performance in Q1 suggests a promising outlook for the remainder of the fiscal year, with Walmart poised to meet and possibly exceed its financial objectives.

On April 30, 2024, Walmart Inc. filed its SEC 10-Q report detailing its financial performance for the first quarter that ended on the same date. Key highlights from the filing demonstrate continued growth and noteworthy financial metrics. During this period, Walmart reported total revenues of $161.5 billion, representing a 6.0% increase year-over-year. This growth was primarily driven by strong comparable sales in its U.S. segments and international markets, supported by an extra day in February due to the leap year and favorable currency exchange rate fluctuations. Membership and other income also saw a significant rise of 21.0% to $1.57 billion, reflecting strong growth in membership income globally.

The Walmart U.S. segment, which includes the company's mass merchandising efforts and eCommerce initiatives, saw net sales grow by 4.6% year-over-year to $108.67 billion. Comparable sales rose by 4.9%, driven by increased transactions and robust sales in grocery and health and wellness categories. eCommerce notably contributed 2.9% to these comparable sales, reflecting the success of store-fulfilled pickup and delivery services. Gross profit rate for the segment improved by 46 basis points, primarily due to strategic pricing management, disciplined inventory control, and favorable business mix offsets, although there was a slight shift towards lower-margin products.

Walmart International showed even stronger performance, with net sales growing by 12.1% to $29.83 billion. This was driven by positive comparable sales across all international markets, particularly in food, consumables, and eCommerce. Currency exchange rate fluctuations favorably impacted net sales by $0.4 billion. Additionally, gross profit rate increased by 32 basis points, primarily due to improved profitability in eCommerce and a favorable business mix. Operating expenses as a percentage of net sales improved by 47 basis points, attributed to disciplined expense management and format mix changes in certain markets.

At Sam's Club, net sales reached $21.44 billion, showing a 4.6% increase with calendar comparable sales up by the same percentage. This growth was driven by increased transactions and strong performances in grocery, consumables, and health and wellness categories. eCommerce sales contributing 1.7% to comparable sales underscores the emphasis on digital sales and curbside pickup and delivery services. Gross profit rate rose by 58 basis points year-over-year, primarily due to disciplined inventory management and lapping previous years inflation-related charges.

Operating income for Walmart Inc. increased by 9.6% to $6.84 billion, driven by strong sales and effective cost management, although partially offset by increased operating expenses. Other significant gains, particularly changes in the fair value of equity investments, contributed to the higher consolidated net income of $5.31 billion, up substantially from $1.90 billion in the previous year. This substantial increase in net income also translated to improved earnings per share, with diluted net income per common share rising to $0.63 from $0.21.

Finally, Walmarts liquidity remains robust, with $9.4 billion in cash and equivalents, supported by strong cash flow from operations. Despite a working capital deficit of $18.9 billion, this is typical for Walmart, given its efficient use of capital. The company's share repurchase program remains active, with $15.5 billion in authorization remaining. Walmarts strong financial performance in this quarter, strategic growth investments, and effective cost management measures depict a positive outlook for sustained growth and shareholder value creation.

Jim Cramer, a renowned financial analyst and host of CNBC's "Mad Money," recently highlighted Walmart Inc. as one of eight companies with the potential to achieve a market capitalization of $1 trillion. This perspective was shared in a detailed review published on July 10, 2024. The other companies identified include Eli Lilly, Tesla, Berkshire Hathaway, JPMorgan, Broadcom, Visa, and Exxon Mobil, demonstrating the diverse industry landscape where Walmart is seen as a key player.

Walmart's inclusion in this list underscores the company's strong market position and strategic initiatives that are expected to contribute to significant growth in the coming years. Cramer emphasized Walmart's robust loyalty programs and its substantial advancements in e-commerce as core elements driving this potential valuation surge. These factors align with the broader trend of retail transitioning toward a more digital-centric model, which Walmart has been actively embracing.

Loyalty programs have become an integral part of Walmart's customer retention strategy, providing a competitive edge in the crowded retail space. These programs not only enhance customer satisfaction and repeat business but also generate valuable data that Walmart can leverage to refine its marketing and sales approaches. Furthermore, the company's focus on expanding its e-commerce presence has been pivotal in capturing the shift in consumer behavior toward online shopping. By continually improving its online platform and integrating advanced technologies, Walmart aims to offer a seamless shopping experience, thereby attracting a broader customer base and increasing its market share.

In addition to loyalty and e-commerce strategies, Walmart's diversification beyond traditional retail is another lever that could propel its market cap toward the coveted $1 trillion mark. The company's ventures into new business areas, such as financial services and health and wellness, reflect a strategic pivot designed to capitalize on emerging opportunities. By mitigating the risks associated with reliance on a single revenue stream, Walmart positions itself to sustain growth even amidst fluctuating market conditions.

Moreover, Walmart's supply chain excellence and economies of scale afford it significant cost advantages, enabling competitive pricing and substantial profit margins. The retailer's ability to navigate complex logistics efficiently ensures consistent product availability and maintains customer trust, further solidifying its market position.

Jim Cramer's optimistic outlook on Walmart's potential to double its market value hinges on the interplay of strategic initiatives and operational efficiencies. By bolstering its loyalty programs, expanding its e-commerce capabilities, and diversifying its business portfolio, Walmart is well-positioned to achieve remarkable growth. These efforts not only reinforce Walmart's leadership in the global retail market but also underscore its capability to adapt and thrive in an evolving economic landscape. For further details and insights into this topic, refer to the original CNBC article published on July 10, 2024 here.

Walmart Inc., as one of the world's largest retailers, faces competition on multiple fronts, including from warehouse clubs such as Costco. A recent article from The Motley Fool on July 12, 2024, highlights several categories of products that consumers might consider purchasing outside Costco for better savings and practicality. This insight provides valuable lessons for Walmart regarding competitive pricing and inventory strategy.

First, the article emphasizes that certain items at Costco might not be the best deals for consumers due to spoilage or over-purchasing, which can lead to wastage. Fresh produce is one such category where buying in bulk often results in food spoiling before it can be consumed. Walmart, with its extensive network and smaller package sizes, can position itself as a more practical choice for consumers who seek to minimize waste. By highlighting the freshness and quality of its smaller, more manageable portions, Walmart can appeal to those looking to reduce food waste and manage their grocery budget more effectively.

Another category mentioned is over-the-counter (OTC) medications, which have defined expiry dates. Consumers may find themselves discarding large bulk packages before they can use them fully. Walmart can exploit this by promoting its competitively priced, smaller packages of OTC medications, ensuring customers buy only what they need, reducing the likelihood of expiration and waste.

Spices and cooking oils are also noted as products that may not be practical to purchase in large quantities from Costco due to their limited shelf life once opened. Walmart can leverage these insights by offering a range of sizes, ensuring that consumers can buy appropriate amounts for their usage patterns. This approach not only caters to frequent shoppers but also reduces the overhead cost and loss associated with volume purchasing.

Walmart can also capitalize on competitive pricing strategies for products that generally see a lower unit price at standard grocery stores or competitors like Target. Products such as diapers, toilet paper, soda, pet supplies, and holiday decor can be strategically priced to attract cost-conscious customers. Walmart's established supply chains and strong vendor relationships provide a platform to offer these items at competitive prices, ensuring they remain a preferred destination over warehouse clubs for these goods.

For more insights, the original article can be accessed here.

Walmart Inc., a retail giant known for its expansive store footprint and diverse product offerings, is continually refining its in-store experience to meet evolving consumer preferences. As part of this strategic initiative, Walmart recently announced a significant partnership with Texas-based Mr. Gatti's Pizza. This collaboration is set to introduce 92 corporate-owned Mr. Gattis Pizza units within Walmart locations across Texas, Louisiana, Oklahoma, and Kentucky, starting in the fourth quarter of 2024. The initial phase will see the opening of 12 units.

This development is poised to nearly double Mr. Gattis footprint nationwide, increasing its units to 230, and expanding its reach into new markets. The move aligns with Walmarts ongoing efforts to enhance its in-store dining options, a strategy that gained momentum following the end of its 30-year relationship with McDonalds in 2021. At its peak, McDonalds had around 1,000 units inside Walmart stores. Since then, Walmart has been actively exploring and integrating a variety of dining concepts to replace the void left by McDonalds departure.

Mr. Gattis Pizza is not entering this partnership uninvited; rather, it was Walmart that approached the pizza chain as part of its broader strategy to bolster its foodservice offerings within stores. Jim Phillips, CEO of Mr. Gattis, highlighted that this partnership will help accelerate the company's expansion into new areas while reinforcing its presence in existing markets. Mr. Gattis earlier efforts to innovate include the development of a smaller convenience store model, which ranges from 800 to 1,500 square feet, compared to its traditional 12,000 to 16,000 square foot restaurants.

Walmart has been diversifying its dining options since ending its partnership with McDonalds, aiming to offer a wider variety of choices to its shoppers. Over the past few years, Walmart has introduced multiple foodservice brands into its stores, including Nathans Famous, Wow Bao, The Cheesecake Factory, Quiznos, Saladworks, and la Madeleines fast-casual format. The retailer also partnered with Ghost Kitchen Brands and added poke bars through a deal with Uncle Sharkii Poke Bar. Additionally, Wetzels Pretzels has been expanding its presence inside Walmart.

This broad range of dining options is designed not only to meet the varied tastes of Walmart's customer base but also to enhance the overall shopping experience. By integrating these diverse food concepts, Walmart aims to create a more engaging and convenient shopping environment, potentially increasing customer dwell time and expenditure within its stores.

This strategic partnership with Mr. Gatti's Pizza is a clear demonstration of Walmarts commitment to innovation in the retail and foodservice integration space. It reflects an understanding of the evolving dynamics of consumer behavior, where convenience and variety play crucial roles. As Walmart continues to navigate the competitive retail landscape, such partnerships are likely to remain a cornerstone of its strategy to attract and retain customers.

For more on this story, see the original article published on Restaurant Dive here.

Walmart Inc. has consistently demonstrated its prowess as a key player in the retail industry. One of the reasons for its sustained success is its highly diversified business model, which encompasses various segments, channels, and formats. The company's strategic initiatives to enhance its omnichannel presence have notably increased both in-store and digital channel traffic. This robust omnichannel approach has been instrumental in boosting store-fulfilled delivery sales, which surged by 50% in the first quarter of fiscal 2025. This growth trajectory underscores Walmart's ability to adapt to changing market dynamics and consumer preferences, reinforcing its status as a leading retailer.

Walmart's strategic emphasis on strengthening delivery services has significantly contributed to its growing market share in the grocery sector. The company's focus on improving delivery options has not only catered to the convenience of customers but has also led to an impressive uplift in its first-quarter results. Additionally, Walmart's efforts in expanding its advertising business have provided a substantial revenue boost, further solidifying its financial health and market position.

The Zacks report, dated July 12, 2024, highlights Walmart's strong earnings growth potential. According to the report, Walmart holds a Zacks Rank #1 (Strong Buy) and is expected to achieve revenue and earnings growth rates of 4.3% and 9.5%, respectively, for the current year ending January 2025. The positive outlook is further supported by improvements in earnings estimates over the past 60 days by 3%. Such favorable revisions highlight analysts' confidence in Walmart's ability to sustain its growth momentum through strategic initiatives and operational efficiency.

Moreover, Walmart's strategic investments in technology and infrastructure have played a crucial role in maintaining its competitive edge. By leveraging advanced technologies, Walmart has been able to streamline its supply chain, enhance customer experience, and optimize operational efficiencies. These initiatives have not only improved service delivery but have also placed Walmart in a favorable position to capitalize on emerging market opportunities.

Considering these factors, Walmart's diversified business strategy, coupled with its strong focus on omnichannel growth and technological advancements, positions it well for continued success. As part of a diversified investment portfolio, Walmart's stock presents a compelling case for investors seeking stable and sustained growth potential in the retail sector. The positive financial metrics and strategic initiatives mentioned in the Zacks report further affirm the company's robust growth outlook for the remainder of 2024 and beyond.

For more detailed insights, the full article can be accessed via this hyperlink.

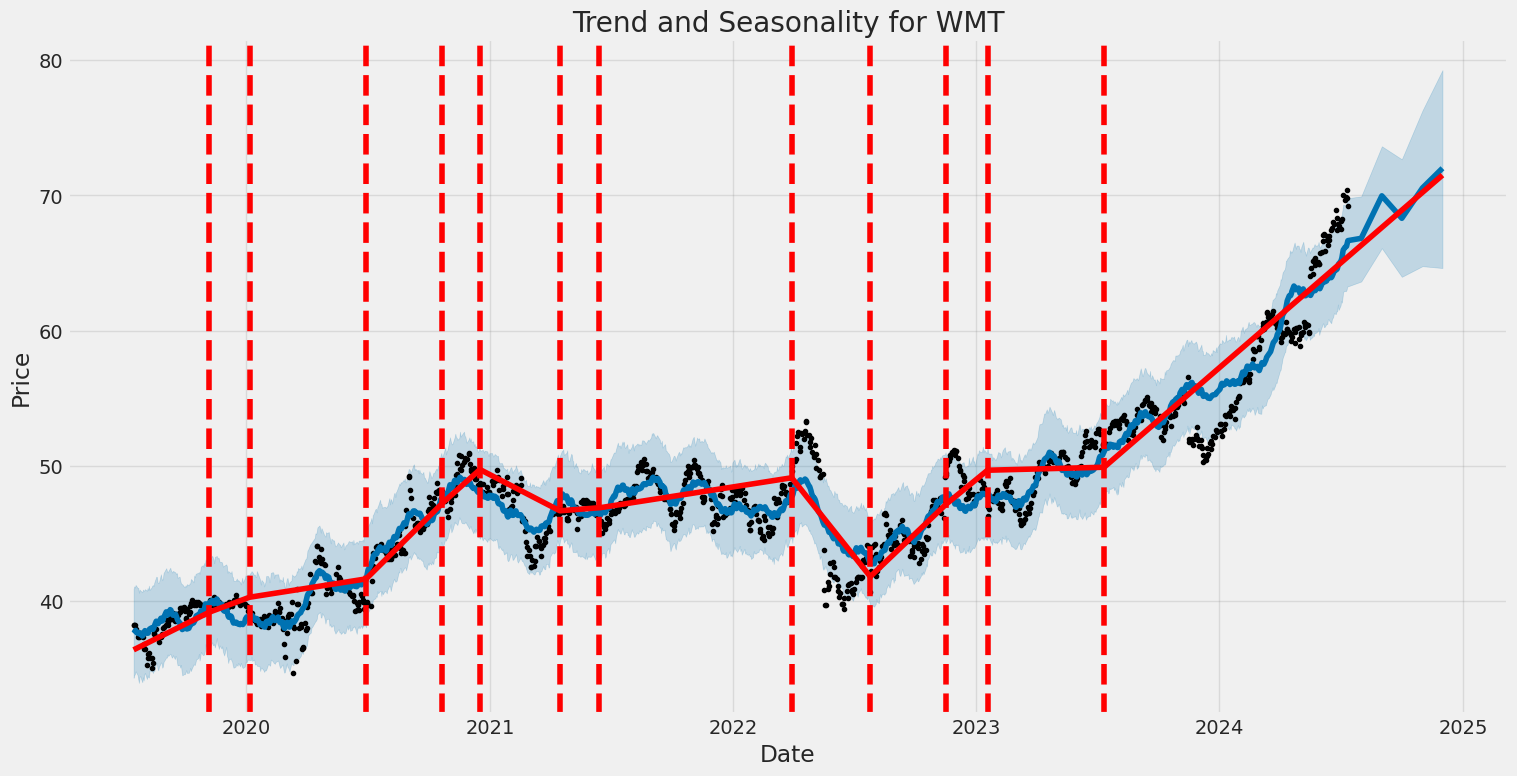

The intrinsic valuation of Walmart Inc. (NYSE: WMT) utilizes the Discounted Cash Flow (DCF) model, which projects the company's future cash flows and discounts them to present value. This method hinges on two main stages: the initial phase of higher growth followed by a subsequent phase of lower growth. Specifically, the analysis relies on a 2-stage model covering a decade-long forecast of Walmart's cash flows, leveraging both analyst estimates and extrapolated values where necessary.

For the first stage, which projects up to ten years of cash flows, Walmart's leveraged free cash flow (FCF) is expected to increase from US$13.1 billion in 2025 to US$28.6 billion by 2034. The growth rates decelerate over time, starting from 6.93% in earlier years to a more modest 3.47% towards the end. These future cash flows are discounted to their present value at a rate of 6.1%, reflecting the cost of equity. The resulting present value of these ten-year cash flows totals approximately US$156 billion.

The second stage calculates the Terminal Value (TV) for the years beyond the initial decade using the Gordon Growth Model. This method assumes a perpetual growth rate based on the 5-year average 10-year government bond yield of 2.4%. The estimated terminal value is subsequently discounted to present value, amounting to US$442 billion. Summing these with the present value of the first ten years of cash flows provides a total equity value for Walmart of approximately US$598 billion. Dividing this by the number of outstanding shares leads to an intrinsic value estimate suggesting Walmart's share price of US$69.80 is near its fair value of US$74.32.

Key Assumptions and Limitations

The DCF model's efficacy hinges on the accuracy of its assumptions, particularly pertaining to discount rates and projected cash flows. In this application, a discount rate of 6.1% is used, derived from a levered beta of 0.800, which balances the need for stability with market volatility. Adjusting these inputs can significantly alter the valuation outcome. Additionally, DCF models generally do not account for market cyclicality or future capital requirements, offering a simplified snapshot rather than a comprehensive analysis.

A SWOT analysis complements this intrinsic valuation by assessing Walmart's strengths, weaknesses, opportunities, and threats. Notable strengths include Walmart's robust earnings growth over the past year, strong coverage of debt by earnings and cash flows, and dividends supported by both earnings and cash flows. Despite these advantages, the company's dividends remain relatively low compared to top industry players. On the opportunity front, Walmarts annual earnings are projected to grow over the next three years, reinforcing its fair value proposition based on the P/E ratio.

Conversely, the company faces threats such as a slower earnings growth rate compared to the broader American market. Investors are advised to consider this intrinsic valuation as a part of a broader investment thesis, integrating various perspectives and potential scenarios. For a detailed exploration of Walmart's valuation methodology and additional considerations, refer to the analysis by Simply Wall St. published on July 12, 2024 here.

Walmart Inc. is one of the most familiar names in the retail industry, known for its widespread global presence and significant market influence. As of late, the company has demonstrated a robust performance, contributing to its steady ascent in the stock market. According to Zacks Equity Research, Walmart's shares have climbed impressively post a recent stock split here on July 12, 2024.

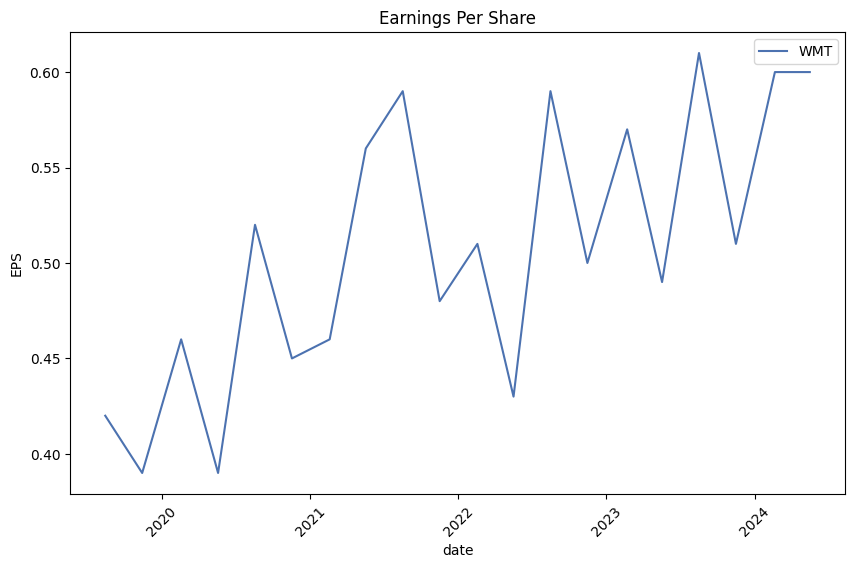

In the latest quarter, Walmart showcased remarkable financial stability and growth, reporting a year-over-year earnings increase of 22%, with sales rising by 6% compared to the same period in the previous year. This positive trajectory in financial metrics has been favorably received by investors, propelling the company's stock price upward. The companys profitability improvements are partially attributed to its enhanced digital sales strategies and deft management of its global supply chain.

Moreover, Walmart's eCommerce sales have been a notable highlight. The company reported a 21% year-over-year growth in global eCommerce sales in its latest financial period, underlining its successful expansion in the digital retail space. This segment's performance has been instrumental in boosting investor confidence and contributes significantly to Walmarts overall market valuation.

Additionally, Walmart has maintained a favorable standing among analysts. Zacks Equity Research reports the company holding a Zacks Rank #1 (Strong Buy), indicating optimistic market sentiment and robust future outlook. This ranking is a testament to Walmart's consistent financial performance and its strategic initiatives aimed at sustaining growth in a competitive market environment.

The company's recent stock split, effective on February 26, further underscores Walmart's proactive approach to enhancing stock liquidity and appealing to a broader investor base. This move has likely contributed to the continued uptick in stock prices, making shares more accessible to individual investors and fostering an inclusive investment environment.

The integration of advanced technologies and efficient operational techniques has also played a pivotal role in Walmarts sustained success. By leveraging data analytics and optimizing logistics, Walmart has significantly improved its supply chain efficiency, ensuring timely product availability and enhancing customer satisfaction.

Walmart Inc. has established itself as one of the leading retail giants in the world, leveraging its vast network of stores, extensive supply chain, and innovative business strategies to maintain a dominant position in the market. The company's influence extends beyond traditional retail, impacting sectors ranging from technology to finance. Examining Walmart's trajectory offers valuable insights into the dynamics of large-scale retail operations and corporate resilience in the face of evolving market conditions.

Walmart's operational efficiency is a cornerstone of its success. The company's sophisticated supply chain management and logistics system ensure the seamless movement of goods from suppliers to store shelves. This logistical prowess not only reduces costs but also enhances inventory management, allowing Walmart to offer competitive prices that attract a broad customer base. Furthermore, Walmart's ability to leverage data analytics supports inventory optimization and personalized marketing strategies, thereby improving the overall customer experience.

In recent years, Walmart has aggressively expanded its online presence to compete with e-commerce giants such as Amazon. The acquisition of Jet.com and the strategic investment in its own e-commerce platform have significantly boosted Walmart's digital footprint. The integration of physical and digital channels, often referred to as omnichannel retailing, positions Walmart to meet consumer demands for convenience and flexibility. This digital transformation is vital for sustaining long-term growth in an increasingly digital economy.

Walmart's financial strategies have played a significant role in its stability and growth. The company's capital allocation policiescharacterized by prudent investment in technology and infrastructure, as well as strategic acquisitionsdemonstrate a balanced approach to growth and shareholder value. Walmarts financial discipline is further evidenced by its consistent dividend payments and stock repurchase programs, which have bolstered investor confidence even during volatile market conditions.

The leadership transitions at Walmart have been pivotal in shaping its strategic direction. The seamless transition from founder Sam Walton to subsequent CEOs like David Glass and Doug McMillon highlights the importance of strategic leadership in maintaining corporate momentum. This aligns with broader corporate governance principles that ensure continuity and adaptation in leadership. Walmart's ability to thrive post-founder era, akin to companies such as Apple under Tim Cook, underscores the significance of having a robust succession plan.

Walmart's commitment to sustainability and corporate social responsibility also cannot be overlooked. The retailer has made significant strides in reducing its environmental footprint through initiatives aimed at waste reduction, renewable energy adoption, and sustainable sourcing. These efforts not only contribute to environmental conservation but also enhance Walmart's corporate image, resonating with socially conscious consumers and investors.

In summary, Walmart Inc.'s sustained success is attributable to its operational excellence, strategic investments in e-commerce, astute financial management, effective leadership transitions, and commitment to sustainability. These factors collectively position Walmart to navigate the complexities of modern retail and maintain its competitive edge in the global market.

Walmart Inc. is a prominent player among dividend-paying stocks, garnering significant attention from top Wall Street analysts. These analysts emphasize the proven track record and potential growth prospects of Walmart, especially in light of its recent strategic initiatives and consistent dividend increases. For 51 consecutive years, Walmart has raised its dividend, with an impressive 9% increase earlier this year, bringing the dividend to 83 cents per share. In the fiscal first quarter, Walmart returned $2.73 billion to shareholders, dividing this between $1.67 billion in dividends and $1.06 billion in share repurchases, demonstrating the company's robust financial health and commitment to shareholder returns.

Jefferies analyst Corey Tarlowe reiterated a buy rating on Walmart, underpinning his confidence with a price target of $77. Tarlowe highlighted that Walmart is in the early stages of implementing artificial intelligence and automation. He posits that these advancements could potentially double the company's operating income by fiscal year 2029 compared to fiscal year 2023, forecasting an increase of more than $20 billion in incremental earnings before interest and taxes. Among the technological investments, Walmart's strategic partnership with Fox Robotics and the deployment of autonomous receipt verification arches at Sams Club are particularly notable. These initiatives are

Walmart Inc. (WMT) has shown significant fluctuations in its stock volatility over the given period. Key features of its volatility include a substantial influence of past shocks (as indicated by the ARCH effect), and the model's ability to explain these variations while maintaining a relatively stable mean. Overall, the stock returns exhibit pronounced sensitivity to volatility changes, reflective of market conditions and investor sentiment.

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -2,117.78 |

| AIC | 4,239.55 |

| BIC | 4,249.82 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| Df Model | 0 |

| omega | 1.4315 |

| std err (omega) | 0.192 |

| t-value (omega) | 7.441 |

| P>|t| (omega) | 1.001e-13 |

| 95.0% Conf. Int. (omega) | [1.054, 1.809] |

| alpha[1] | 0.2317 |

| std err (alpha[1]) | 0.07301 |

| t-value (alpha[1]) | 3.173 |

| P>|t| (alpha[1]) | 1.507e-03 |

| 95.0% Conf. Int. (alpha[1]) | [0.08858, 0.375] |

To assess the financial risk of a $10,000 investment in Walmart Inc. (WMT) over a one-year period, we combine volatility modeling and machine learning predictions to provide a comprehensive risk analysis.

Volatility Modeling:

Volatility modeling is instrumental in comprehending Walmart Inc.'s stock volatility. By scoping out the variance and volatility patterns within historical price data, we can estimate future volatility, which is crucial for risk management. Volatility trends in stock prices help in understanding the extent of potential price fluctuations over a given period. For Walmart Inc., consistent monitoring of historical price data indicates the scale and frequency of price changes, thus facilitating a more informed prediction of future price movements and risks.

Machine Learning Predictions:

Machine learning predictions then build on this volatility understanding by estimating future returns of Walmart Inc.'s stock. Using advanced techniques such as ensemble algorithms, these predictions incorporate a multitude of variables that affect stock performance, from macroeconomic indicators to company-specific news. The model analyzes past returns and other relevant financial metrics, allowing for more precise future performance predictions.

Results Analysis:

Combining these two approaches establishes a more robust risk assessment. The volatility modeling provides a solid foundation by capturing the inherent uncertainty in stock price movements, while machine learning refines this by incorporating a broader set of variables to predict returns accurately.

One critical measure derived from this approach is the Value at Risk (VaR), which quantifies the potential loss in the investment for a specified confidence level. For a $10,000 investment in Walmart Inc., the annual VaR at a 95% confidence level is calculated to be $165.49. This value implies that, over one year, there is a 95% chance that the potential loss will not exceed $165.49. While this doesn't eliminate risk, it provides a clearer view of the maximum expected loss under typical market conditions, aiding investors in making informed decisions about their risk tolerance.

By integrating volatility modeling with machine learning predictions, the analysis captures both the inherent market risks and the specific financial dynamics affecting Walmart Inc., offering nuanced insights beyond what either method could provide independently.

Long Call Option Strategy

Analyzing the options chain for Walmart Inc. (WMT) and the associated Greeks can be an intricate process, but focusing on the most profitable long call options offers a clear perspective on potential investment strategies. The analysis below highlights five choices with varying expiration dates and strike prices, assessing their risk and reward based on the Greeks and other provided data. The target stock price is set at 2% over the current stock price.

Option 1: Near-Term (Expiration: 2024-07-19, Strike: $35.00)

With an expiration date of 2024-07-19 and a strike price of $35.00, this near-term option has a delta of 0.9999, which indicates that the option price is almost dollar-for-dollar with the stock price change. The absence of gamma and vega suggests minimal sensitivity to changes in volatility, making it a stable option. The premium for this option is $24.65, with an impressive ROI of 0.4452 and a projected profit of $10.9748. While the risk is relatively low due to the high delta, the reward is substantial, making this option extremely profitable.

Option 2: Mid-Term (Expiration: 2024-09-20, Strike: $38.33)

This mid-term option, expiring on 2024-09-20 with a strike price of $38.33, also presents a compelling opportunity. With a delta of 0.9978, it closely tracks the stock price. The premium is $21.50, yielding an ROI of 0.5021 and a potential profit of $10.7948. The absence of gamma and vega indicates the options price stability in response to volatility changes. This option's high ROI and significant profit margin make it a promising choice for investors seeking a balance between risk and reward over a medium term.

Option 3: Long-Term (Expiration: 2025-06-20, Strike: $33.33)

Expiring on 2025-06-20 and with a strike price of $33.33, this long-term option is highly profitable with a premium of $26.71. The ROI stands at 0.3963, and the profit amounts to $10.5848. The delta of 0.9889 ensures that the option has a strong correlation with the stock price movement, while the zero gamma and vega values further minimize risk from volatility. This option is ideal for long-term investors looking to maximize profits with a relatively lower risk due to its high delta and manageable premium.

Option 4: Longer-Term (Expiration: 2025-03-21, Strike: $33.39)

Set to expire on 2025-03-21, with a strike price of $33.39, this option shows a slightly lower risk with a delta of 0.9231, gamma of 0.0032, and vega of 7.5544. The premium is $33.39, and it offers an ROI of 0.0669 with a projected profit of $2.2348. Despite the lower ROI compared to other options, it remains profitable and provides a good balance between risk due to its significant delta and potential for long-term holding comfort.

Option 5: Very Long-Term (Expiration: 2026-01-16, Strike: $31.67)

This very long-term option, expiring on 2026-01-16, features a strike price of $31.67. It boasts a delta of 0.9821, which translates to high price correlation. The premium is $30.63, leading to an ROI of 0.2718 and a profit of $8.3248. Though the delta is slightly lower than the top performers, the stability over an extended period can offer peace of mind and steady gains, appealing to highly patient investors.

Risk and Reward Assessment

For each of these options, the delta values indicate a high sensitivity to the underlying stock price movement, leading to significant potential profits with manageable premiums. The absence or low gamma and vega values across most profitable options mitigate risks related to volatility and sudden price movements. The theta values are generally low, suggesting a minimal daily decay in option value, which is favorable for investors aiming to hold these options for a longer duration.

In summary, the options selected provide a range of maturities from near-term to very long-term, each demonstrating high profitability and potential for substantial returns. Investors can choose based on their risk tolerance, preferred investment horizon, and expected market conditions. The highlighted options balance significant profit margins with controlled risk, making them excellent choices for those looking to capitalize on Walmart's stock price dynamics.

Short Call Option Strategy

Analyzing the table of short call options for Walmart Inc. (WMT), I'll focus on identifying the most profitable options considering the risk of having shares assigned, the Greeks, and the target stock price being 2% under the current price. The goal is to balance profitability with minimizing the risk of shares being assigned.

Short-Term Options:

1. Expiration: 2024-07-19, Strike Price: 73.33 - Delta: 0.0138 - Premium: 0.03 - Profit: 0.03 - ROI: 100% - Scenario: Delta indicates a low probability of ending in-the-money, minimizing the assignment risk. The premium is modest, but the ROI is substantial due to the short time frame. With a negligible gamma, theta decay is manageable, and the small rho implies little sensitivity to interest rate changes.

Mid-Term Options:

2. Expiration: 2024-09-20, Strike Price: 67.0 - Delta: 0.6857 - Premium: 3.69 - Profit: 2.83 - ROI: 76.82% - Scenario: This option has a higher delta, implying a greater risk of being in-the-money, but offers a substantial premium and profit. The gamma is higher, thus increasing the risk of delta changing as the stock price moves. However, the theta decay and rho impact are relatively moderate, making it a balanced choice for mid-term profitability.

Long-Term Options:

3. Expiration: 2025-06-20, Strike Price: 66.67 - Delta: 0.6395 - Premium: 8.14 - ROI: 85.44% - Profit: 6.95 - Scenario: For a longer horizon, this option provides a significant premium, resulting in a high ROI. The delta suggests a moderate risk of being assigned, but still allows for substantial profit. The gamma and vega are notable, indicating sensitivity to stock price changes and volatility, but these can provide advantages if volatility rises.

Far Long-Term Options:

4. Expiration: 2026-01-16, Strike Price: 65.0 - Delta: 0.6703 - Premium: 11.7 - Profit: 8.84 - ROI: 75.60% - Scenario: This option balances a higher premium and substantial profit over a very long period. The delta is relatively high, increasing the risk of ending in-the-money, but the vega indicates a strong profit potential if volatility increases. The theta is manageable given the long expiry, providing a solid, risk-adjusted return.

Ultra Long-Term Options:

5. Expiration: 2026-01-16, Strike Price: 70.0 - Delta: 0.5948 - Premium: 8.5 - Profit: 8.5 - ROI: 100% - Scenario: Despite the highest delta among the long-term options, it offers a full ROI, suggesting strong profit potential if the stock does not significantly outperform the strike price. The gamma and vega are substantial, indicating sensitivity to underlying movements and volatility changes, but the theta impact is less pressing over such a distant expiry.

Conclusion

These options are selected for their balance between profitability and risk of assignment. Short, mid, and long-term options offer a variety of risk and reward profiles to suit different strategic preferences. Short-term options minimize assignment risk with lower deltas, while long-term options provide higher premiums and potential profitability with moderated risk management. The chosen options provide a mix of high ROI and manageable risk, leveraging the strategic advantage of short call positions to generate income while keeping assignment probabilities within acceptable limits.

Long Put Option Strategy

To determine the most profitable long put options for Walmart Inc. (WMT), we should carefully assess both near-term and long-term options, considering the potential risk and reward each presents. The Greeks values provide insights into the option's sensitivity to changes in various factors. The target stock price is 2% over the current stock price, ensuring a strategic approach to leverage temporal market conditions.

Near-Term Options

1. Expiration Date: 2024-07-19, Strike Price: 100.0 This option boasts an extraordinarily high Return on Investment (ROI) of 418.65%. With a delta of -0.9999, this option moves almost one-to-one with the underlying stock. The profit potential is high, at $29.31. Given the theta of 0.0092, this option will slightly gain value as expiry approaches due to the positive theta. The essentially zero gamma and vega indicate no sensitivity to underlying stock volatility or second-order price changes, making this a robust choice if the target stock price is achieved. However, the extremely low premium ($0.07) makes it highly sensitive to any significant price reversal or time decay risk.

2. Expiration Date: 2024-09-20, Strike Price: 105.0 Despite being further out, this option also provides a high ROI of 213.84% and a strong potential profit of $34.22. The delta of -0.9978 shows similar strong alignment with the underlying stock price. Theta remains slightly positive at 0.0096, indicating a slow gain close to expiry. This option, while more expensive than the near-term option, offers resilience thanks to more distant expiration, providing a balanced hedge against short-term market volatility.

Mid-Term Options

3. Expiration Date: 2024-12-20, Strike Price: 110.0 This option presents a competitive ROI of 71.92%, and profit potential stands strong at $38.84. The delta at -0.9948 ensures near-perfect negative correlation with the underlying stock. While theta turns marginally positive at 0.0101, this again marks a steadiness in value retention until expiration. The substantial vega showcases sensitivity towards volatility changes, presenting an avenue for added gains if volatility picks up as the option approaches maturity.

Longer-Term Options

4. Expiration Date: 2026-01-16, Strike Price: 105.0 For a more distant expiration, this option has an ROI of 20.48% and a notable profit potential of $32.77. Delta at -0.9821 aligns somewhat closely with the underlying stock, however, the greater time to expiry introduces flexibility to respond to market changes. Positive theta at 0.0091 indicates limited time decay. This longer duration also introduces greater resilience against immediate market volatility, moderating against sharp near-term stock price movements.

5. Expiration Date: 2026-01-16, Strike Price: 125.0 This option features an ROI of 15.73% and a potential profit of $51.13. The delta at -0.9821 is strong, and a positive theta at 0.0112 again curtails the adverse effects of time decay. Given its longer maturity, it offers greater flexibility and a better response mechanism against market volatility. This option stands as a balanced long-term hedge, optimizing both for expected moderate stock price declines and providing significant profit potential.

Risk and Reward Analysis

All highlighted options exhibit substantial profit potential and varying degrees of ROI, balancing immediate high returns and long-term stability. The shorter-term options (expiring in July 2024 and September 2024) present high risk-reward profiles driven by substantial potential profit but high sensitivity to immediate price changes. In contrast, the mid to longer-term options offer stability and moderate returns, providing a hedge against more gradual market changes and minimizing risk through greater expiration durations.

In all scenarios, option buyers should remain vigilant of the inherent market risks and the decay effects on the option's premium as expiration approaches. Portfolio diversification through a mix of varied expiration dates and strike prices can balance potential rewards against corresponding risks. Such strategic selections of options can significantly enhance profitability while mitigating adverse exposures.

Short Put Option Strategy

Considering the task focusing on short put options for Walmart Inc. (WMT), let's identify and analyze the most profitable options while minimizing the risk of having shares assigned. Given that the target stock price is set at 2% below the current stock price, we want to select options that fulfill these criteria and have favorable Greek values, especially with a lower delta to minimize the probability of the option finishing in-the-money (ITM).

-

Short Put Option with Expiration on January 16, 2026, and a Strike Price of $70.00:

-

Delta: -0.3866

- Gamma: 0.0270

- Vega: 32.1097

- Theta: -0.0021

- Rho: -0.4684

- Premium: $5.91

- ROI: 63.71%

- Profit: $3.7652

This option boasts a significant premium of $5.91 with a substantial ROI of 63.71%. The delta of -0.3866 indicates a lower probability of assignment, while the high vega implies sensitivity to volatility, which can be advantageous in a volatile market. This makes it a strong candidate for a longer-term position given the high premium and manageable risk reflected in the delta.

-

Short Put Option with Expiration on June 20, 2025, and a Strike Price of $66.67:

-

Delta: -0.3199

- Gamma: 0.0288

- Vega: 23.7380

- Theta: -0.0043

- Rho: -0.2327

- Premium: $3.06

- ROI: 100.0%

- Profit: $3.06

This option offers a premium of $3.06 with an ROI of 100%, indicating substantial profitability. The delta is relatively low at -0.3199, suggesting a low probability of finishing ITM. The substantial vega value response to changes in volatility can be beneficial, and this option is highly profitable with decent risk levels.

-

Short Put Option with Expiration on March 21, 2025, and a Strike Price of $67.50:

-

Delta: -0.3580

- Gamma: 0.0318

- Vega: 21.2404

- Theta: -0.0063

- Rho: -0.1906

- Premium: $2.75

- ROI: 100.0%

- Profit: $2.75

Providing a premium of $2.75 and an ROI of 100.0%, with a moderate delta of -0.3580, this option offers a good balance between profitability and risk. Its vega value is substantial, indicating potential gains from changes in volatility, making this another attractive medium-term choice.

-

Short Put Option with Expiration on January 16, 2026, and a Strike Price of $61.67:

-

Delta: -0.2099

- Gamma: 0.0173

- Vega: 24.3085

- Theta: -0.0028

- Rho: -0.2526

- Premium: $2.79

- ROI: 100.0%

- Profit: $2.79

This option has a very low delta of -0.2099, drastically minimizing the risk of getting shares assigned. With a premium of $2.79 and a high ROI of 100.0%, it provides a good profit margin. The high vega value suggests the premium is responsive to volatility, further increasing potential profitability during volatile periods.

-

Short Put Option with Expiration on December 20, 2024, and a Strike Price of $66.67:

-

Delta: -0.3089

- Gamma: 0.0436

- Vega: 16.0001

- Theta: -0.0070

- Rho: -0.0999

- Premium: $1.89

- ROI: 100.0%

- Profit: $1.89

Offering a premium of $1.89 with a low delta of -0.3089, this option also carries a reduced risk of ending up ITM. It provides a moderate vega value, suggesting that the position will benefit from volatility, and given its 100% ROI, it still offers a nonsignificant risk.

When choosing among these options, consider your risk tolerance and market outlook. Lower-delta options reduce the risk of assignment but may offer lower premiums, whereas higher-premium options with a bit higher delta can yield greater profits but come with more risk. Diversifying across a few of these choices could balance risk and reward effectively.

Vertical Bear Put Spread Option Strategy

Vertical bear put spreads are a strategic approach in options trading that involves purchasing a put option with a higher strike price while simultaneously selling a put option with a lower strike price, both having the same expiration date. For Walmart Inc. (WMT), given the current data provided, several expiration dates and strike prices yield promising returns. Heres a comprehensive analysis considering profitability, risk, and the potential for stocks being assigned.

1. Near-Term Options (2024-07-19 Expiration):

Strike Prices: $85 and $90

- Long Put Option: Strike $85, Premium $17.45, Delta -0.976, Gamma 0.008, Theta -0.042

- Short Put Option: Strike $90, Premium $25.11, Delta -0.859, Gamma 0.015, Theta -0.419

The short put at $90 has a significant delta and theta decay, indicating a high likelihood of assignment if the market moves against the expectation. Conversely, the long put at $85 pairs well given its lower delta and higher premium. The breakeven point for this spread is approximately $87.64, with a maximum profit potential of $2.36. The significant premium difference suggests profitability if WMT declines modestly. However, the risk of assignment on the short leg is elevated due to the high delta and the fact that this option is deeply in-the-money.

2. Mid-Term Options (2024-09-20 Expiration):

Strike Prices: $90 and $95

- Long Put Option: Strike $90, Premium $6.63, Delta -0.736, Gamma 0.049, Theta -0.094

- Short Put Option: Strike $95, Premium $9.30, Delta -0.790, Gamma 0.034, Theta -0.104

This pair produces a net premium income and offers more cushion against assignment risk because both legs are less aggressively in-the-money. The delta values are close, indicating synchronization in price movement and the relatively low premium indicates moderate profitability. The breakeven point is estimated at $92.13, capable of delivering substantial profits if WMT stock trades below this level at expiration.

3. Long-Term Options (2024-12-20 Expiration):

Strike Prices: $100 and $105

- Long Put Option: Strike $100, Premium $0.87, Delta -0.989, Gamma 0.009, Theta -1.030

- Short Put Option: Strike $105, Premium $1.14, Delta -0.989, Gamma 0.010, Theta -1.094

Despite being longer-term, these options are in-the-money contributing to high initial premiums. The extremely high delta (near -1.00) signifies almost instantaneous intrinsic value changes, critical for an aggressive bear position. The maximum profit of approximately $3.27 occurs if the WMT stock price falls below $100, which incorporates a break-even probability aligned with substantial bearish insights. The assignment risk remains considerable due to the intrinsic nature of these options delta.

4. Very Long-Term Options (2025-06-20 Expiration):

Strike Prices: $120 and $125

- Long Put Option: Strike $120, Premium $1.63, Delta -0.989, Gamma 0.022, Theta -1.702

- Short Put Option: Strike $125, Premium $1.99, Delta -0.989, Gamma 0.023, Theta -1.747

This spread offers a moderate initial premium outlay, hedging against further stock price declines over an extended horizon. The high theta decay represents how the premium loss accelerates over time, favoring quick declines in WMT. Calculation of maximum profit here reveals a break-even at $121.64 with potential gains exponentially high if WMT trends bearishly as predicted.

5. Ultra Long-Term Options (2026-01-16 Expiration):

Strike Prices: $140 and $145

- Long Put Option: Strike $140, Premium $2.92, Delta -0.989, Gamma 0.023, Theta -1.890

- Short Put Option: Strike $145, Premium $3.70, Delta -0.993, Gamma 0.028, Theta -1.982

Finally, significantly long horizons potentially dampen assignment risks due to the spreads temporal nature. A maximum profit scenario emerges if WMT drops appreciable by the expiration, with a break-even point of approximately $142.81. The delta values being very close, nearly operating as linear tools in market movement reinforcement, ensure that price-drop profitability is steadfast.

Risk and Reward Scenarios

- Risk: The risk of early assignment remains prominently high for options deeply in-the-money with higher delta values, particularly for near-term expirations.

- Reward: The profitability hinges on the premiums collected and the net difference post stock price degradation. Favorable spreads significantly enhance ROI.

- Assignment Minimization: Lower delta, out-of-the-money options for longer-term spreads mitigate assignment risks while capturing potential downward price movement over time.

In summary, each vertical bear put spread provides a framework for strategic entry, close monitoring, and risk assessment necessary in maximizing returns for a bearish outlook on Walmart stock. The key lies in cautiously balancing delta exposure vis-a-vis time to expiration ensuring you capture the downside potential while preemptively managing the assignment risk.

Vertical Bull Put Spread Option Strategy

To analyze the most profitable vertical bull put spread options strategy for Walmart Inc. (WMT) while managing assignment risk and targeting a stock price 2% over or under the current stock price, we should evaluate several factors. These include the delta (as it indicates the likelihood of the option expiring in the money), premium earned, ROI, and the expiration date. Here are five choices based on expiration dates ranging from near-term to long-term, focusing on high profitability but with mindful risk management:

Near-Term (4 Days to Expire)

- Short Put: Strike 85.0, Expiration: 2024-07-19

- Delta: -0.9760647393

- Gamma: 0.00803607

- Premium: $17.45

- ROI: 1.7489971347

- Profit: $0.3052

- Assignment Risk: High due to high delta

-

Summary: High delta indicates significant risk of being in the money, but the premium is substantial. Pairing it with a long put with lower delta minimizes the assignment risk.

-

Long Put: Strike 75.0, Expiration: 2024-07-19

- Delta: -0.7936292186

- Gamma: 0.0447814804

- Premium: $4.05

Mid-Term (67 Days to Expire)

- Short Put: Strike 70.0, Expiration: 2024-09-20

- Delta: -0.5126660325

- Gamma: 0.076393473

- Premium: $2.52

- ROI: 14.8888888889

- Profit: $0.3752

-

Assignment Risk: Moderate

-

Long Put: Strike 67.0, Expiration: 2024-09-20

- Delta: -0.314861091

- Gamma: 0.02883624

- Premium: $3.06

Longer-Term (158 Days to Expire)

- Short Put: Strike 66.67, Expiration: 2024-12-20

- Delta: -0.308915225

- Gamma: 0.0435859104

- Premium: $1.89

- ROI: 100.0

- Profit: $1.89

-

Assignment Risk: Moderate

-

Long Put: Strike 65.0, Expiration: 2024-12-20

- Delta: -0.9820803101

- Gamma: 0.0247010854

- Premium: $87.49

Long-Term (340 Days to Expire)

- Short Put: Strike 65.0, Expiration: 2025-06-20

- Delta: -0.2689317172

- Gamma: 0.0270326369

- Premium: $2.69

- ROI: 100.0

- Profit: $2.69

-

Assignment Risk: Moderate

-

Long Put: Strike 63.0, Expiration: 2025-06-20

- Delta: -0.293008206

- Gamma: 0.1295130958

- Premium: $0.55

Very Long-Term (550 Days to Expire)

- Short Put: Strike 65.0, Expiration: 2026-01-16

- Delta: -0.9888841604

- Gamma: 0.0178587505

- Premium: $26.15

- ROI: 3.9474263862

-

Profit: $103.2252 (High potential profit but also higher risk)

-

Long Put: Strike 60.0, Expiration: 2026-01-16

- Delta: -0.1580631444

- Gamma: 0.0587359825

- Premium: $1.5

Choosing a vertical bull put spread strategy involves selling a put option at a higher strike price (e.g., 65.0) and buying a put option at a lower strike price (e.g., 60.0). The goal is for the stock price to stay above the higher strike price by expiration, allowing the options to expire worthless and capturing the net premium.

Key Takeaways:

- Risk and Reward: Higher deltas indicate increased risk of options expiring in the money, resulting in potential assignment. Lower gamma values paired with lower deltas can help manage assignment risk.

- ROI: Strategies that yield 100% ROI are desirable but must be balanced with the risk of assignment.

- Expiration: Near-term options provide high premium but greater risk of assignment. Mid- to long-term options offer safer, steady returns with lower immediate premium but safer assignment scenarios.

Recommendations:

- For near-term, consider the combination of strike 85.0 (short put) and strike 75.0 (long put), providing high premium but with significant assignment risk.

- For mid- to long-term, the strike price around 66.67 and 65.0 provides a profitable balance with lower assignment risk, given the moderated delta and gamma values.

By balancing potential returns with the risk of assignment, you can structure a profitable vertical bull put spread strategy while managing the complexities inherent in options trading effectively.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread, also known as a short call spread, involves selling a call option at a lower strike price and buying a call option at a higher strike price with the same expiration date. The goal is to profit from the spread between the premiums of the two options while benefitting if the stock price declines or remains below the sold call's strike price.

Given the short-term and long-term options data for Walmart Inc. (WMT), we need to select a vertical bear call spread strategy that minimizes the risk of having shares assigned while optimizing potential profits. The target stock price of 2% over or under the current stock price must also be considered.

1. Near-Term Options:

Expiration Date: 2024-07-19

- Sell Call Option: Strike Price $55.0, Premium: $15.11

- Delta: 0.9593321646

- Gamma: 0.0091427266

- Vega: 0.6313980206

- Theta: -$107,5276547

-

Probability of Assignment: High due to delta being 0.9593321646

-

Buy Call Option: Strike Price $57.5, Premium: $11.42

- Delta: 0.835693

- Gamma: 0.014527

- Vega: 1.011278

- Theta: -$88,322

- Probability of Assignment: Lower due to delta being 0.835693

This short-term strategy involves a near-the-money call spread. The spread premium earned from selling the $55 call is greater than the cost of buying the $57.5 call, resulting in a net credit of $3.69 ($15.11 - $11.42).

Risk: - Maximum loss is realized if WMT's price is above $57.5 at expiration. - Maximum loss: $(57.5 - $55) + (Premiums Received - Premiums Paid) = $2.50 + ($3.69) - $11.42 = $-2.975 per option.

Reward: - Maximum profit if WMT remains below $55. - Maximum profit: $3.69 (net credit).

2. Mid-Term Options:

Expiration Date: 2024-09-20

- Sell Call Option: Strike Price $50.0, Premium: $19.85

- Delta: 0.9161790515

- Gamma: 0.0083049076

- Vega: 4.4750840448

- Theta: -$23,3225083

-

Probability of Assignment: High due to delta being 0.9161790515

-