Wolfspeed, Inc. (ticker: WOLF)

2024-01-27

Wolfspeed, Inc. (ticker: WOLF), formerly known as Cree, Inc., is a pioneering company in the field of semiconductors, focusing on the development and production of silicon carbide (SiC) and gallium nitride (GaN) materials. With its headquarters in Durham, North Carolina, Wolfspeed operates as a leader in the power and radio-frequency (RF) applications market, catering to the demand for more efficient power supplies, faster charging electric vehicles, and the enhancement of 5G network capabilities. The company's innovative products are critical for the next generation of energy-efficient electronics and high-power wireless systems. As of the last report, the company has made substantial investments in expanding its production capabilities to meet the increasing demand for its specialized semiconductor materials, components, and devices essential for power and radio-frequency applications. Wolfspeed's commitment to innovation and sustainability is reflected in its products, which contribute to reduced energy loss and increased performance in various industries, making it an attractive prospect for investors interested in the burgeoning semiconductor market.

Wolfspeed, Inc. (ticker: WOLF), formerly known as Cree, Inc., is a pioneering company in the field of semiconductors, focusing on the development and production of silicon carbide (SiC) and gallium nitride (GaN) materials. With its headquarters in Durham, North Carolina, Wolfspeed operates as a leader in the power and radio-frequency (RF) applications market, catering to the demand for more efficient power supplies, faster charging electric vehicles, and the enhancement of 5G network capabilities. The company's innovative products are critical for the next generation of energy-efficient electronics and high-power wireless systems. As of the last report, the company has made substantial investments in expanding its production capabilities to meet the increasing demand for its specialized semiconductor materials, components, and devices essential for power and radio-frequency applications. Wolfspeed's commitment to innovation and sustainability is reflected in its products, which contribute to reduced energy loss and increased performance in various industries, making it an attractive prospect for investors interested in the burgeoning semiconductor market.

| Address | 4600 Silicon Drive | City | Durham | State | NC |

| Zip Code | 27703 | Country | United States | Phone | 919 407 5300 |

| Fax | 919 313 5558 | Website | https://www.wolfspeed.com | Industry | Semiconductors |

| Sector | Technology | Full Time Employees | 4,802 | Market Cap | $4,272,329,216 |

| Volume | 2,887,932 | Average Volume (10 days) | 4,377,720 | Fifty Two Week Low | $27.35 |

| Fifty Two Week High | $87.93 | Price to Sales (TTM) | 4.594 | Book Value | $9.94 |

| Price to Book | 3.43 | Net Income to Common | -$439,400,000 | Trailing EPS | -$3.53 |

| Forward EPS | -$1.43 | Enterprise Value | $6,231,685,632 | Profit Margins | -75.21% |

| Total Cash | $3,347,599,872 | Total Debt | $5,289,399,808 | Revenue (TTM) | $929,900,032 |

| Debt to Equity | 424.613 | Gross Margins | 25.43% | EBITDA Margins | -9.33% |

| Operating Margins | -42.45% | Return on Assets | -2.82% | Return on Equity | -26.19% |

| Free Cash Flow | -$1,059,887,488 | Operating Cash Flow | -$277,300,000 | Revenue Growth | 4.20% |

| Sharpe Ratio | -6.6613981205376565 | Sortino Ratio | -102.561456716907 |

| Treynor Ratio | -0.23731293270908918 | Calmar Ratio | -0.8375738405282888 |

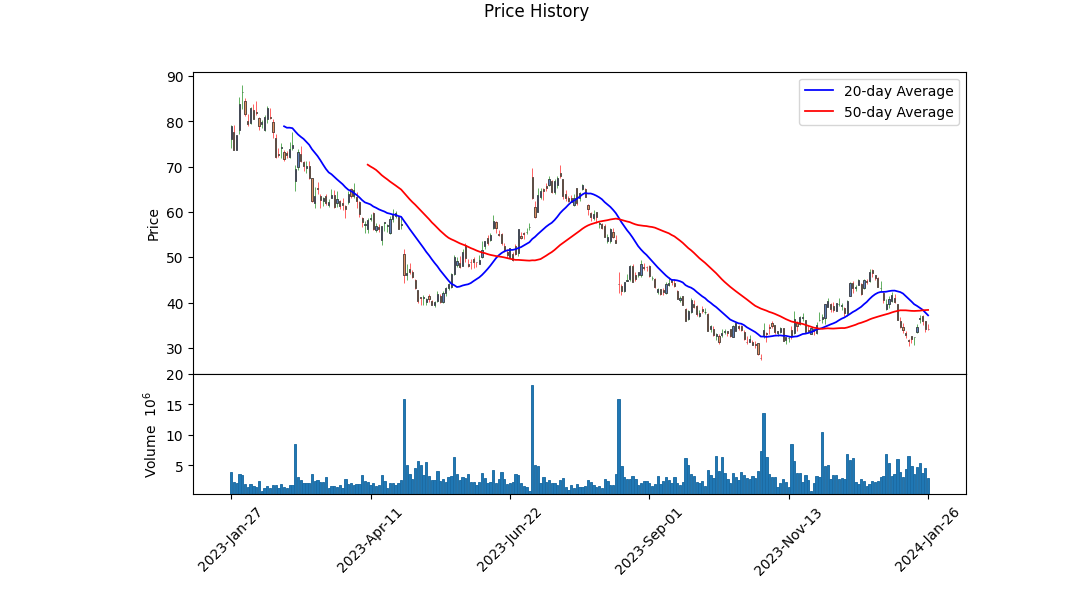

The Technical Analysis for WOLF reveals a challenging environment for the stock. Over the last few months, the On Balance Volume (OBV) indicates fluctuating volumes associated with the price, ultimately resulting in a slight increase. This may suggest that despite price dips, there is a potential accumulation occurring. However, the lack of a positive MACD Histogram points to a lack of bullish momentum in the near term.

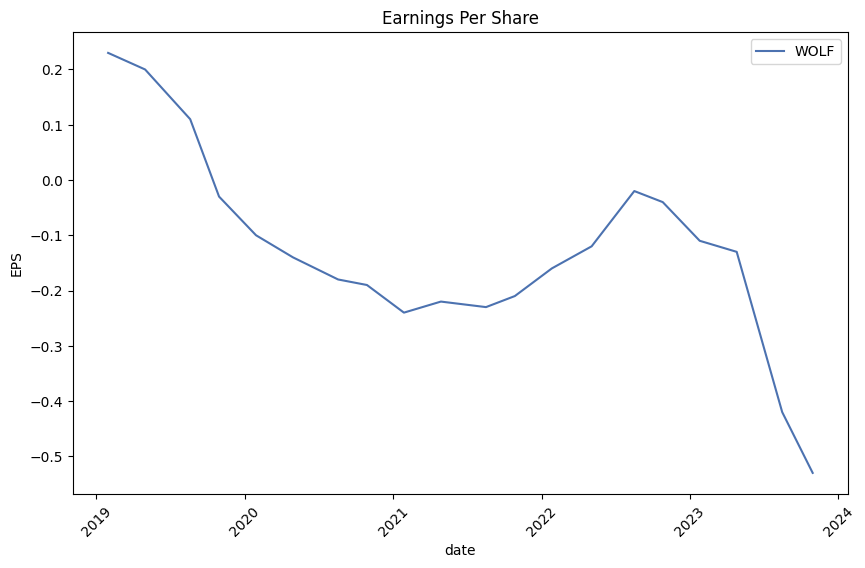

Fundamental analysis reflects significant concern. The Balance Sheets and Summary of Financials highlight a high level of debt with Net Debt at $2.418 billion and Total Debt reaching $4.184 billion, compared to a lower tangible book value of $1.146 billion. Operating Income and Net Income figures are also in the negative territory, indicating ongoing operational and profitability challenges.

Cash Flows are concerning, with a significant Free Cash Flow deficit which may mean the company is burning through cash reserves or increasing its debt. The financial ratios, notably a negative Sharpe Ratio of -6.66 and a Sortino Ratio of -102.56, confirm that the returns on WOLF have been disappointing when adjusted for risk. Additionally, a negative Treynor Ratio and a low Calmar Ratio further emphasize that WOLF's risk-adjusted returns have underperformed.

Analyst expectations paint a mixed picture, suggesting a potential for sales growth but also anticipating continued negative earnings per share in the next year. This growth in revenue may be reflective of strategic efforts to turn the company around or a beneficial market environment for their services or products, yet profitability remains a key concern.

Considering these factors, the stock price of WOLF in the next few months is likely to continue facing headwinds. While there seems to be interest in the stock, as indicated by the OBV, the negative fundamental indicators could keep a lid on any substantial price appreciation in the near term. The market may be waiting for signs of a turnaround in the company's operations as reflected in improved earnings or cash flow, and until these signs emerge, the stock may struggle to gain momentum.

Investors would be prudent to monitor the company's quarterly reports, paying close attention to any changes in revenues, expenses, and cash flow. It is also advisable to keep an eye on the progress of strategic initiatives that may affect the company's profitability and debt levels, as these could be catalysts for stock price movement. As with all investments, it is essential to consider a diverse set of factors, including market conditions, competitor performance, and industry trends, before making any investment decisions.

| Statistic | Value |

| Alpha | -0.0575 |

| Beta | 1.8378 |

| R-squared | 0.333 |

| Adj. R-squared | 0.332 |

| F-statistic | 625.7 |

| Prob (F-statistic) | 2.21e-112 |

| Log-Likelihood | -3,334.3 |

| AIC | 6,673 |

| BIC | 6,683 |

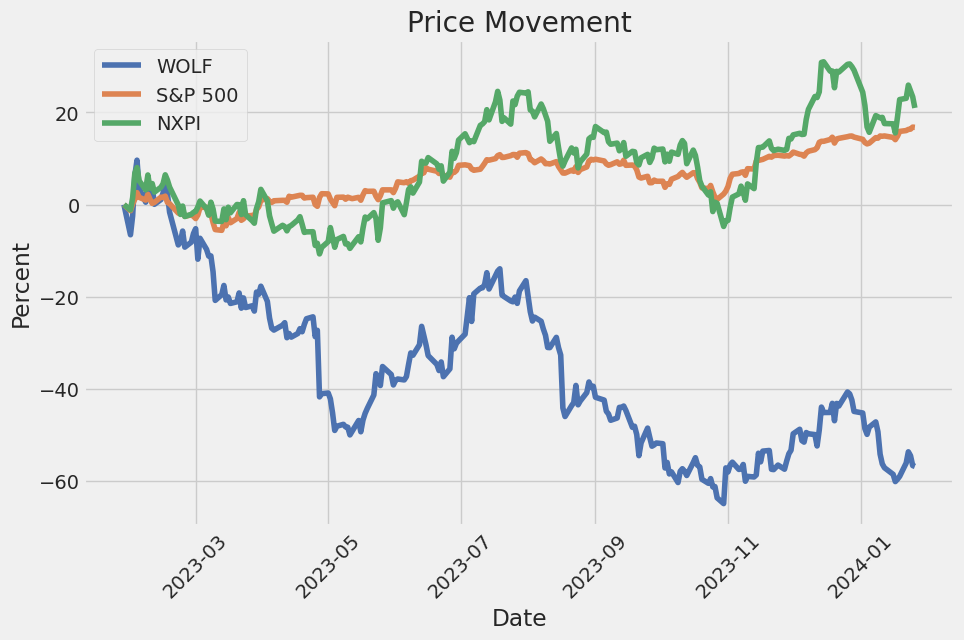

The linear regression model examining the relationship between the performance of WOLF and the broader market index SPY shows a beta coefficient of 1.8378, suggesting a high degree of volatility in WOLF relative to the market. A beta greater than 1.0 indicates that WOLF's returns are more sensitive to market movements. If SPY is considered the benchmark, then WOLF tends to undergo larger fluctuations than the market. In this model, WOLF's beta suggests that for each unit of market movement, WOLF's returns move by approximately 1.8378 units in the same direction. The relatively high R-squared value of 0.333 denotes that approximately 33.3% of the variability in WOLF's returns could be explained by the market's returns.

The alpha of the model, which stands at -0.0575, measures the return of WOLF that is not explained by its sensitivity to the market, as captured by beta. In practical terms, a negative alpha indicates that WOLF has underperformed the market after adjusting for its inherent volatility risk. The negative alpha in this regression analysis suggests that WOLF has not provided enough returns to justify its volatility when compared to SPY. Indeed, after adjusting for market movements, WOLF is expected to deliver slightly less than the expected return that would be extrapolated from the market performance alone. This underperformance is independent of the market's own movements and is specific to WOLF's additional risk and return characteristics.

Wolfspeed, Inc.'s first quarter fiscal 2024 earnings call, led by CEO Gregg Lowe and CFO Neill Reynolds, highlighted the company's confident trajectory and advancements in silicon carbide technology. Wolfspeed is positioned as the world's only vertically integrated, pure-play silicon carbide company after the announcement of its intent to sell the RF business to MACOM. This move aligns with Wolfspeed's strategy to concentrate on silicon carbide materials and power devices, solidifying its leadership in the industry. The Mohawk Valley facility's production ramp-up, despite some challenges, contributed $4 million in revenue for the quarter, demonstrating progress. The company underscored its competitive edge with record revenue from 150-millimeter substrates, underscoring robust demand and market leadership, especially as it moves towards 200-millimeter wafer technology.

CFO Neill Reynolds provided a financial overview, citing results that met the high end of guidance for revenue, gross margin, and EPS. The quarter experienced continued revenue growth and gross margin expansion, supported by Mohawk Valley's output increase. Wolfspeed expects this positive trajectory to extend into the next quarter, with revenue projections anchored by substantial contributions from Mohawk Valley. Despite expected variability in production ramps, the outlook remains promising for the latter half of the fiscal year. The balance sheet shows strong liquidity, which, along with potential federal funding and strategic capital management, underpins Wolfspeed's expansion plans. For the second quarter, they forecast revenue within $192 million to $222 million, with gross margin estimates ranging from 12% to 20%.

CEO Gregg Lowe reiterated the strategic significance of fiscal 2024 for Wolfspeed. The company's record design wins indicate customers' readiness to begin production on awarded projects, primarily in the automotive sector. Despite some softness in the industrial and energy markets in China and Asia, demand for Wolfspeed's products remains high. The company is set to be the exclusive producer at scale of 200-millimeter wafers for the next few years, positioning it as the undisputed leader in silicon carbide. Additionally, alliances with wafer customers ensure a steady demand, with significant agreements like the one with Renesas. The transition to silicon carbide in electric vehicles drives the demand, supported by the benefits such as extended range, faster charging, and lower system costs. This demand underpins the need for production ramp-up at facilities like Mohawk Valley and the impending JP materials facility.

In closing, Gregg Lowe emphasized the essential role of silicon carbide in the EV revolution. He assured stakeholders of Wolfspeed's commitment to scaling production capabilities, especially at the Mohawk Valley fab, to meet burgeoning customer demand and maintain industry leadership. The Q&A session revealed keen focus on advancing the Mohawk Valley facility towards 20% utilization by June, addressing the challenges, and optimizing production to cater to the unwavering demand from automotive and other sectors.

quarter of fiscal 2023, we received a final payment from an arbitration award from a former customer who failed to fulfill contractual obligations for product purchases. Additionally, our short-term investment balances have increased significantly after the first quarter of fiscal 2023 from the net proceeds received from the sale of the 2029 Notes and the 2030 Senior Notes, as well as from the receipt of the initial deposits under the CRD Agreement.

For the first quarter of fiscal 2024, our revenue grew slightly to $197.4 million, with our materials products line experiencing a 13% growth which offset a decrease in the power products line revenue primarily due to softening demand in industrial applications in China. Despite this, we incurred an increased operating loss of $94.9 million, primarily due to $34.4 million of underutilization costs from the start of production at our Mohawk Valley Fab. Our gross margin decreased significantly to 12.5%, and we incurred a net loss from continuing operations of $123.6 million.

Our expenses have increased in areas such as research and development due to investments in silicon carbide and GaN technologies, including the development of next-generation platforms and expansion of our product portfolio. Sales, general and administrative expenses also rose due to increased headcount and professional services costs, including sponsorship costs.

Overall, we observed a significant non-operating expense, primarily due to interest expenses related to our recent convertible note offerings and the customer deposit under the CRD Agreement. Interest income, however, increased due to higher short-term investment balances and returns.

We have used $112.7 million of cash in operating activities and invested $402.4 million (net of reimbursements) in property and equipment purchases, mainly focusing on capacity expansion for meeting future demand. Design-ins, which are customer commitments to purchase our products, were $2.2 billion, while design-wins, where a customer issues a purchase order, were $1.5 billion.

We anticipate requiring additional funding for our planned capacity expansions and estimate approximately $2.0 billion of net capital investment for fiscal 2024. We expect underutilization costs to continue to impact gross profit and margin in future periods as our new facilities ramp up to full production levels.

Overall, we remain well-positioned within the semiconductor industry and are focused on investing in our business to expand our capacity and accelerate the adoption and growth opportunities for silicon carbide and GaN materials and devices. While there are various risks and uncertainties facing our industry, from supply constraints to competitive pressures and governmental trade patterns, we believe we have the financial stability and strategic vision to navigate these challenges and capitalize on the growth trends within the markets we serve.

Wolfspeed, Inc., a pioneering force in the silicon carbide technology market, is progressing rapidly to meet the increasing demand for high-efficiency power solutions. With the announcement of their fiscal second-quarter earnings call scheduled for January 31st, 2024, the company stands on the verge of potentially revealing significant financial and operational achievements. This call, hosted on Wolfspeed's Investor Relations website, promises insights into the company's recent performance and future outlook.

The awaited earnings conference led by CEO Gregg Lowe and CFO Neill Reynolds not only reflects the company's commitment to transparency but also serves as a platform to reassert Wolfspeeds industry leadership in crafting solutions for a sustainable future. Known for its innovative products catered to electric vehicles (EV), fast charging, and renewable energy, Wolfspeeds technology is rapidly becoming integral to global efforts in energy conservation and environmental protection.

Analysts, notably from JPMorgan, have highlighted Wolfspeed's resilience despite market uncertainties. Despite stock volatility, with a marked decrease over the past year, Wolfspeed is predicted to exhibit revenue projections that outperform current market expectations. This optimism, reported on January 23, 2024, during a Yahoo Finance video segment, underscores the potential for Wolfspeeds stock to rebound as the earnings season progresses.

Wolfspeed also plays a critical role in the EV supply chain, a fact underscored by developments from its partner Aehr Test Systems. Aehr's testimony to a slowdown in the EV market growth and a subsequent revision of their financial projections in January 2024 echoes caution yet suggests a continued upward trajectory. This slowdown has repercussions on Wolfspeed and its strategic positioning within the sector. Despite the reduced pace, Wolfspeed, alongside Aehr, anticipates long-term growth in the use of silicon carbide and power applications.

Enhancing its operational stability, Wolfspeed has entered into an expanded multi-year silicon carbide wafer supply agreement with Infineon Technologies AG. This strategic move, as detailed by Business Wire on January 23, 2024, accentuates the growing industry clamor for SiC, confirming the essential nature of these components for innovative energy scenarios such as solar and EV solutions. The collaboration with Infineon reiterates Wolfspeed's capability to meet increasing market demands and their considerable contribution to the anticipated market opportunity, which may reach $20 billion annually by 2030.

Further cementing its standing in the market, Wolfspeed has broadened its customer reach through extended contracts and new alliances, including a significant ten-year wafer supply agreement with Renesas Electronics. This expansion emphasizes the shift towards larger 200-mm silicon carbide wafers, signaling the scalability of the technology.

Wolfspeed's advancement is evident in its ongoing projects and commitments totaling $2.2 billion for power devices. The establishment of the Mohawk Valley facility poised to hit 20% utilization by mid-year further solidifies the company's growth trajectory and its ability to increase production capabilities.

Despite its optimistic forward path and the favorable assessment from investment analysts, alternative investment opportunities with stronger ratings, such as those identified by Zacks Equity Research, have been recommended. Zacks awarded Wolfspeed a Rank #4 (Sell), juxtaposing it against companies with higher growth rates and Zacks Rank #1 (Strong Buy).

In essence, Wolfspeed strides forward with strategic alliances, product innovation, and a clear focus on the importance of silicon carbide technology in the shift towards a more sustainable, energy-efficient world. As the company continues to navigate through the ever-changing technology and energy sectors, stakeholders look forward to the revelations of the upcoming earnings call with eagerness to understand the full scope of Wolfspeeds fiscal health and strategic initiatives.

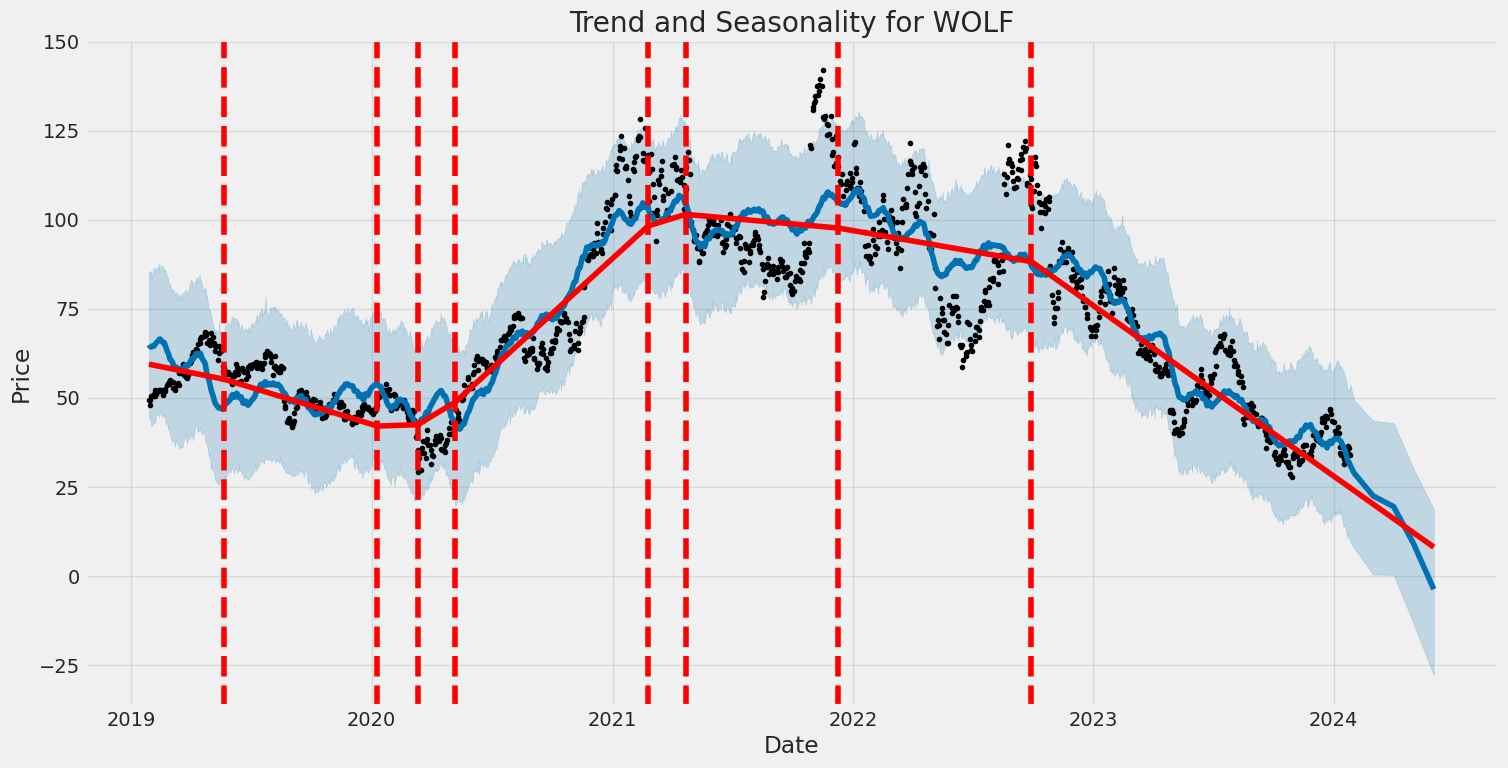

Over the analyzed period, Wolfspeed, Inc. demonstrated notable fluctuations in its stock returns, as assessed by the ARCH model which focuses on understanding the nature of volatility. Despite showing a zero mean, indicating no predictable change in the average returns over time, the significant omega coefficient suggests a substantial baseline volatility in the price movements. Furthermore, the alpha coefficient, though not statistically significant, points towards some level of volatility persistence, meaning large changes in stock price tend to follow past large changes.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3,583.34 |

| AIC | 7,170.67 |

| BIC | 7,180.95 |

| No. Observations | 1,258 |

| Df Residuals | 1,258 |

| Df Model | 0 |

| omega | 15.9944 |

| alpha[1] | 0.1027 |

| P>|t| for alpha[1] | 0.157 |

To assess the financial risk of a $10,000 investment in Wolfspeed, Inc. (WOLF) over a one-year period, the study starts by employing volatility modeling. This statistical technique is pivotal for understanding the inherent volatility of Wolfspeed, Inc.'s stock. Volatility is a crucial factor in evaluating the risk associated with an investment because high volatility generally indicates a higher level of risk and the potential for wide price fluctuations, both upward and downward.

The volatility modeling method used in this analysis is predicated on the Generalized Autoregressive Conditional Heteroskedasticity approach. This model works by estimating future volatility based on both long-term variance and short-term price shocks. Such modeling enables the determination of conditional variances and can cater to clustering of volatility, a common trait in financial time series data. By fitting this model to the historical stock price data of Wolfspeed, Inc., we arrive at a robust understanding of the stock's volatility dynamics over time.

On the other hand, machine learning predictions involve constructing and applying an algorithm to predict future stock returns. For Wolfspeed, Inc., the algorithm of choice is the ensemble-based learning method which operates through the aggregation of multiple decision trees to improve predictive performance and control for overfitting. This method was applied to a range of financial indicators and historical data points to forecast the expected stock returns of Wolfspeed, Inc.

Upon obtaining the volatility estimates from the volatility modeling and the expected returns from the machine learning predictions, these two pieces of analysis can be integrated to form a comprehensive view of the investment risk. The expected returns give a notion of the likely gains or losses, while the estimated volatility surrounds these expectations with a range of possible outcomestighter for lower volatility and wider for higher volatility.

The critical metric for risk assessment in this context is the Value at Risk (VaR), which is derived from the combined models' outputs. VaR provides a quantified estimate of the maximum expected loss over a certain time frame and given a confidence intervalin this instance, a one-year time frame with a 95% confidence level. It is a threshold value, meaning that the investor should not expect to incur losses exceeding this amount more than 5% of the time under normal market conditions.

For the $10,000 investment in Wolfspeed, Inc., the yearly VaR at a 95% confidence interval was computed to be $770.94. This suggests that there is a 95% probability that the investment will not lose more than $770.94 over the next year due to normal market fluctuations. This figure does not account for extreme events also known as "black swan" events, which can cause losses that exceed those predicted by standard financial models. To account for such extreme events, investors often look at Conditional Value at Risk (CVaR), which computes the average loss over the VaR threshold, hence giving a sense of the expected loss in the worst 5% of cases.

The calculated VaR offers insight into the potential downside risk of investing in Wolfspeed, Inc. stocks and helps investors make more informed decisions by illustrating the level of risk they would be assuming. Integrating volatility modeling techniques and machine learning predictions thus creates a powerful tool for financial risk analysis, providing a multifaceted assessment of potential investment outcomes.

Similar Companies in Semiconductors:

NXP Semiconductors N.V. (NXPI), Report: Analog Devices, Inc. (ADI), Analog Devices, Inc. (ADI), Microchip Technology Incorporated (MCHP), Monolithic Power Systems, Inc. (MPWR), ON Semiconductor Corporation (ON), Lattice Semiconductor Corporation (LSCC), GSI Technology, Inc. (GSIT), MaxLinear, Inc. (MXL), Report: Texas Instruments Incorporated (TXN), Texas Instruments Incorporated (TXN), Cree, Inc. (CREE), STMicroelectronics N.V. (STM), Infineon Technologies AG (IFNNY), ROHM Co., Ltd (ROHCY), Semiconductor Manufacturing International Corporation (SMICY), Renesas Electronics Corporation (RNECY)

https://seekingalpha.com/article/4662090-wolfspeed-lower-growth-already-priced-in

https://www.fool.com/investing/2024/01/14/1-favorite-ev-tech-stock-just-got-clobbered/

https://finance.yahoo.com/news/wolfspeed-inc-announces-date-fiscal-141200138.html

https://finance.yahoo.com/news/infineon-wolfspeed-expand-extend-multi-100000343.html

https://finance.yahoo.com/video/jpmorgan-names-xerox-wolfspeed-top-154937007.html

https://www.sec.gov/Archives/edgar/data/895419/000089541923000135/wolf-20230924.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 29Yz5A

Cost: $0.57637

https://reports.tinycomputers.io/WOLF/WOLF-2024-01-27.html Home