Energy Select Sector SPDR Fund (ticker: XLE)

2023-12-29

The Energy Select Sector SPDR Fund, trading under the ticker symbol XLE, represents a sector-specific exchange-traded fund (ETF) that aims to provide investment results corresponding to the performance of the Energy Select Sector Index. This index is composed of companies from the energy sector of the S&P 500, encompassing those engaged in the development and production of energy products such as oil, natural gas, and coal. Managed by State Street Global Advisors, XLE offers investors diversified exposure to the energy sector, which includes industry giants in exploration, production, and energy equipment services. As an ETF, XLE presents the advantages of real-time trading, liquidity, and lower expense ratios compared to actively managed funds. Its performance is reflective of the overall health of the energy industry, making it a potential indicator for energy market trends and a strategic choice for investors looking to gain exposure to energy equities. As with any investment, potential investors should consider the inherent volatility of the energy market, which can be influenced by global economic factors, political events, and advancements in alternative energy sources.

The Energy Select Sector SPDR Fund, trading under the ticker symbol XLE, represents a sector-specific exchange-traded fund (ETF) that aims to provide investment results corresponding to the performance of the Energy Select Sector Index. This index is composed of companies from the energy sector of the S&P 500, encompassing those engaged in the development and production of energy products such as oil, natural gas, and coal. Managed by State Street Global Advisors, XLE offers investors diversified exposure to the energy sector, which includes industry giants in exploration, production, and energy equipment services. As an ETF, XLE presents the advantages of real-time trading, liquidity, and lower expense ratios compared to actively managed funds. Its performance is reflective of the overall health of the energy industry, making it a potential indicator for energy market trends and a strategic choice for investors looking to gain exposure to energy equities. As with any investment, potential investors should consider the inherent volatility of the energy market, which can be influenced by global economic factors, political events, and advancements in alternative energy sources.

| Previous Close | 84.03 | Open | 84.32 | Day Low | 83.59 |

| Day High | 84.4 | Trailing P/E | 7.761626 | Volume | 12,155,755 |

| Average Volume | 20,870,951 | Average Volume 10 Days | 17,486,410 | Bid | 83.72 |

| Ask | 83.85 | Bid Size | 3,200 | Ask Size | 4,000 |

| Yield | 0.0359 | Total Assets | 37,500,207,104 | 52 Week Low | 75.36 |

| 52 Week High | 93.69 | 50 Day Average | 84.9234 | 200 Day Average | 84.49215 |

| Trailing Annual Dividend Rate | 2.16 | Trailing Annual Dividend Yield | 0.025705107 | NAV Price | 84.02305 |

| Currency | USD | YTD Return | -0.0041915 | Beta 3 Year | 0.74 |

| Three Year Average Return | 0.3586194 | Five Year Average Return | 0.136972 | Exchange | PCX |

Based on the provided technical indicators and fundamentals for XLE (Energy Select Sector SPDR Fund), the following insights can be discerned about the potential stock price movement in the upcoming months:

Technical Indicators:

- The Parabolic SAR (PSAR) values are not available in the initial records but show an uptrend development as the PSAR values are below the price towards the end, indicating a bullish sentiment.

- The On-Balance Volume (OBV) has been decreasing, which may indicate a reduction in buying pressure or an increase in selling pressure. This divergence between OBV and price can signal potential weakness.

- The Moving Average Convergence Divergence (MACD) histogram values are positive but show a decreasing trend, which suggests the momentum could be slowing down.

Fundamentals:

- The trailing PE ratio of 7.761626 is relatively low, which may indicate the ETF is undervalued compared to the overall market, potentially presenting a buying opportunity.

- The dividend yield stands at 3.59%, which may be attractive to income-focused investors, providing a floor for the stock price.

- XLE has experienced a slight year-to-date return decrease, but the three-year and five-year average returns are positive, which may be appealing to long-term investors.

- The beta of 0.74 suggests that XLE is less volatile than the overall market, making it potentially a safer investment during turbulent times.

- The fund is part of the Equity Energy category, which could be influenced by energy prices, geopolitical events, and policy changes related to energy.

Price Movement Analysis:

The technical and fundamental analysis provides a mixed view. While the positive MACD histogram values initially suggest potential gains in momentum, the decreasing OBV and the lowering trajectory of the MACD histogram could indicate a loss of bullish strength.

Considering the fundamental aspects, the attractive trailing PE ratio and dividend yield could provide support for the ETFs price. However, the fund's performance is closely tied to the energy sector, which is subject to volatility based on oil prices and energy policies.

Taking a holistic view, it appears that there might be short-term bullish potential for XLE, given the favorable PSAR signals and undervaluation, assuming the energy sector remains stable. However, the declining momentum observed in the technical indicators could limit upward price movement, suggesting that gains might be moderate or accompanied by periods of consolidation.

Investors should monitor oil and energy market developments, as significant changes in this sector will likely have a direct impact on XLE's price. Additionally, given the recent decrease in OBV, it would be prudent to look for signs of sustained volume to accompany any price increase to confirm the strength of the uptrend.

In conclusion, the next few months could see XLE experiencing slight to moderate growth, with potential resistance from technical indicators that suggest waning momentum. Fundamentally, the ETF seems to be in a decent position, provided that the context of the energy market remains favorable. Investors are encouraged to weigh these mixed signals carefully and consider the broader market context when making investment decisions.

Recent geopolitical events have significantly influenced global oil markets and consequently, the sector's investment landscape, including instruments like the Energy Select Sector SPDR Fund (XLE). Escalating tensions in the Middle East due to an attack on a Gaza hospital have seen crude oil prices spike. The geopolitical sensitivity of the energy sector was further exposed when the Iranian Foreign Minister pushed for sanctions against Israel, leading to market volatility.

Iran is not a player to overlook; its status as a major oil producer and OPEC+ member grants it weighty influence over global oil supply dynamics. The country's sizable production and export volumes mean that any shifts in its oil policy could send ripples across the market. Oil prices have indeed reacted, propelled partly by geopolitical tensions and partly by the cancellation of a meeting between President Biden and Arab nations, sending a negative signal to oil traders and investors alike.

Amid these geopolitical undercurrents, significant inventory data emerged. The Energy Information Administration (EIA) reported a drawdown of 4.9 million barrels of crude oil, a bullish indicator for the oil market. The drawdown in Cushing, Oklahoma's inventories, nearing operational minimum levels, hinted at increased demanda positive note for investors eyeing the sector.

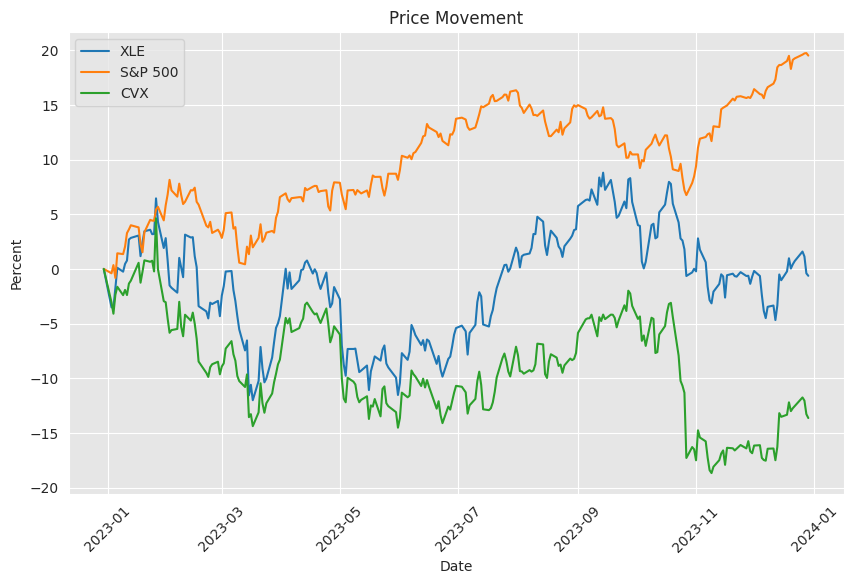

The compounding effects of geopolitical events, policy reactions, and inventory dynamics are mirrored in the performance of energy stocks. For example, the XLE, which aggregates a portfolio of energy companies, experienced a 12% uptick over the previous three months. While day-to-day fluctuations are a given, year-to-date metrics still show a 5% increase for the fund amidst broader economic pressures, illustrating the connection between oil price movements and energy stock valuations.

Looking at the industry's macroeconomic context, the sector faces the challenge of dealing with an expected oil glut in 2024. A report from Citi analysts, led by Alastair Syme, paints a picture of substantial spare capacity potentially depressing oil prices. Historically, energy equities tend to lag the broader market when excess capacity crosses the 3 million barrel per day threshold, a scenario played out nine times out of ten since 2000.

Next year's forecast sees a global spare capacity of roughly 4 million barrels per day. The United States stands out in this equation, attributed to having contributed around 80% to this capacity increase, mostly after the formation of OPEC+ in 2016.

OPEC+'s pricing strategies now face the headwaters of non-OPEC+ increases. U.S. companies, along with new producers like Guyana, may meet next year's demand, painting a challenging picture for OPEC+. They could potentially lose market share or have to sustain uncompetitively high prices.

On a corporate level, financial robustness characterizes major companies within the XLE portfolio. These firms are poised to maintain shareholder returns through dividends and share repurchases and may exploit M&A opportunities to cement their industry position. This has been exemplified by ExxonMobil's near-$60 billion acquisition of Pioneer Natural Resources, underscoring the prospect of value creation through consolidation despite market challenges.

Despite resilient company balance sheets, the energy sector's stock performance, indicated by the XLE, trailed behind, declining 3% year-to-date, contrasting starkly with an 18% rise in the broader market over the same period. Stocks such as ExxonMobil and Chevron have also seen declines, reflecting the sectoral impact of this anticipated supply glut.

The forward-looking analysis posits a significant pressure on commodity and asset prices due to the overabundance of oil, which could affect the value of energy stocks over the longer term. This viewpoint is supported by the fact that energy equities, including the XLE portfolio, are showing early signs of feeling the effects of these market dynamics.

The XLE, a proxy for the energy sector, comprises a wide range of industries, from oil and gas to consumable fuels and energy services. The fund's recent trajectory echoes market dynamics, as companies within react to oil market fluctuations, technological progress, and geopolitical developments. The energy sector has been identified as providing both value and income opportunities. Despite a collective decline of 8.2% due to receding oil prices from 2022's peak, the sector is poised for an energized performance.

Consolidation trends, notably within upstream operations, reshape the industry's fabric. Prominent E&P companies pursue mergers to leverage economies of scale and, therefore, more efficient production. Optimizing operational synergies, these companies aim to withstand fluctuations in oil prices, maintaining or potentially boosting earnings.

Companies' fiscal strategies reflect a cautious stance against market volatility. ExxonMobil's expectation to double earnings by 2027 reaffirms this sentiment, projecting profitable investments even if Brent crude prices drop significantly. Peers like Chevron and Occidental follow suit, strategically planning to endure ample market movements.

Improvements in financial health, characterized by bolstered balance sheets and reduced debts, underscore the preparedness of energy companies for potential downturns in oil prices. This financial mitigating factor endears the sector to investors concerned with stability in turbulent markets.

Moreover, various segments within the energy sector, such as midstream and downstream operations, exhibit characteristicslike high dividend returns and lower price sensitivitythat add to the sector's investment appeal. Overall, despite unpredictable oil and gas price trends, the energy sector, particularly reflected by the XLE's holdings, offers a blend of value, income, and potential for strong profitability.

The recent performance and future projection for the XLE have been susceptible to the broader market sentiments shaped by economic indicators and, notably, Federal Reserve policy stances.

The month of November saw a spike in the S&P 500, aligning with softening financial conditions following the Fed's pause in raising interest rates, as conveyed by FOMC members. This rally was cemented by lower bond yields and a weakening U.S. dollar, fuelling the market's bullish sentiments.

However, with the market pre-empting Federal Reserve Chair Jerome Powell's address prior to the December FOMC meeting, uncertainty loomed about the endurance of favorable conditions. Market sectors, including energy, represented by the XLE, showed divergent trajectories during this period, reflecting unique fundamental drivers that often transcend generalized economic conditions.

Historically, Powell's statements have carried pragmatic insights, frequently demonstrating a data-dependant framework that influences market perceptions profoundly. With each of his speeches potentially shading the direction of monetary policy, sectors like energy, encapsulated by instruments like the XLE, can be significantly impacted by market interpretation of his remarks.

In light of these dynamics, the SPY, tracking the S&P 500, alongside sector-focused funds like the XLE, become critical for investors scrutinizing the interplays between Federal Reserve communications and economic variables specific to the energy landscape.

A particularly noteworthy component of the energy markets has been the recent trends in the consolidation of major oil companies.

Market analysts suggest that the current consolidation wave within the oil industry is likely to persist, potentially resulting in the number of major oil companies in the United States dwindling significantly by the end of the decade. One significant movement within this consolidation trend was Occidental Petroleum's acquisition of CrownRock for $12 billion, notable due to its financing through debt and the private nature of the acquired company.

The Permian Basin, with its cost-efficient and technologically advanced production capabilities, has become a prominent target for acquisitions by oil majors. Chevron's massive deal to integrate Hess and Exxon Mobil's acquisition of Pioneer Natural Resources are testaments to the strategic value attributed to this region by sector leaders.

In tandem with these industry shifts, the Energy Select SPDR ETF has seen its valuation dip by about 7%. This, despite the fact that companies like Chevron and Exxon Mobil, engaged in these major mergers, have also registered a decrease in their stock price.

Crude oil prices remain a predominant factor for the energy sector, showcasing the volatility and influence of commodity trading on related equities. With recent tendencies showing crude oil trading downwards, the sector's performance is directly implicated.

The fourth quarter performance of the XLE underlines the importance of complementing the assessment of the energy sector's outlook with a granular appraisal of the underlying assets and commodities. Devon Energy Corporation's undervaluation, with its forward P/E ratio and yield indicators, positions it as intriguing within an undervalued sector, despite the broader downturn.

Technical analysis of Devon's price points to resistance at the $42 to $44 support levels, with potential for further decline should support not hold. However, in the event of a rebound in oil and natural gas prices, the sector may experience a favorable reassessment, warranting close investor attention to these pivotal indicators.

Lastly, U.S. domestic oil inventory levels and geopolitical tensions continue to shape the near-term fortunes of oil prices. Unexpected increases in supply, such as those reported by the U.S. Department of Energy, typically exert downward pressures on oil prices, elucidating a supply surplus. Conversely, geopolitical tensions exacerbate market uncertainties, influencing investment sentiment.

Market anticipation of OPEC Plus' upcoming decision on production levels holds profound significance for oil prices. The organization's historical inclination toward restricting supply to uphold prices sets a defining backdrop against which the energy sector's immediate future unfolds.

Energy stocks, while enduring market downturns, often demonstrate resilience, decoupling from broader market trends. Consequently, earnings reports from leading oil companies such as Exxon and Chevron, housed within the XLE, are eagerly awaited for further market indications.

Each development forms a thread in the complex tapestry that is the oil marketfrom geopolitical events to sector-specific financial dataeach impacting the energy sector and linked investment vehicles like the XLE.

It is in this complex and evolving space that the top ten holdings of the XLE command significant attention, with their collective performance often dictating the fund's trajectory. The current composition of these holdings is as follows:

| company | symbol | percent |

|---|---|---|

| Exxon Mobil Corp | XOM | 22.11 |

| Chevron Corp | CVX | 16.92 |

| EOG Resources Inc | EOG | 4.76 |

| ConocoPhillips | COP | 4.54 |

| Marathon Petroleum Corp | MPC | 4.51 |

| Phillips 66 | PSX | 4.34 |

| SLB | SLB | 4.17 |

| Pioneer Natural Resources Co | PXD | 4.08 |

| Williams Companies Inc | WMB | 3.38 |

| Valero Energy Corp | VLO | 3.34 |

Investors and market analysts closely monitor the movements of these key companies, particularly how their business strategies and market positioning will enable them to navigate through the industry's various headwinds and leverage their earnings.

Similar Companies in Oil & Gas:

Chevron Corporation (CVX), Exxon Mobil Corporation (XOM), ConocoPhillips (COP), Schlumberger Limited (SLB), EOG Resources, Inc. (EOG), Pioneer Natural Resources (PXD), Duke Energy Corporation (DUK), Report: Southern Company (SO), Southern Company (SO), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Dominion Energy, Inc. (D), Kinder Morgan, Inc. (KMI)

News Links:

https://finance.yahoo.com/video/oil-prices-surge-gaza-attack-161204551.html

https://seekingalpha.com/article/4655130-spy-powell-friday-speech-kill-rally

https://finance.yahoo.com/news/energy-stocks-big-challenge-in-2024-too-much-oil-171423515.html

https://www.fool.com/investing/2023/12/18/this-stock-market-sector-could-dominate-in-2024/

https://finance.yahoo.com/video/buy-atlanta-braves-skip-energy-225144434.html

https://finance.yahoo.com/video/key-points-focus-high-yield-214458002.html

https://finance.yahoo.com/video/biden-softens-anti-oil-stance-202130504.html

https://finance.yahoo.com/video/cop28-agreement-details-behind-pledge-175948439.html

https://finance.yahoo.com/video/oil-falls-4th-day-u-170932490.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: V1XVmX

https://reports.tinycomputers.io/XLE/XLE-2023-12-29.html Home