Financial Select Sector SPDR Fund (ticker: XLF)

2023-12-29

The Financial Select Sector SPDR Fund (XLF) is an exchange-traded fund (ETF) that aims to provide investment results that correspond generally to the price and yield performance of the Financial Select Sector Index. This index encompasses a broad range of industries within the financial sector, including diversified financial services, insurance, commercial banks, capital markets, real estate investment trusts (REITs), consumer finance, thrifts, and mortgage finance services. XLF is managed by State Street Global Advisors and offers investors exposure to some of the largest and most influential U.S. financial institutions. The fund's composition mirrors the sector allocations of the S&P 500, making it a useful tool for investors seeking to capture the performance of the financial segment of the U.S. equity market. Launched in 1998, XLF has become a popular instrument for both individual and institutional investors due to its liquidity, cost-efficiency, and transparent structure. It is widely used for both long-term investment and short-term trading strategies, potentially serving as a barometer for investor sentiment towards the U.S. financial industry.

The Financial Select Sector SPDR Fund (XLF) is an exchange-traded fund (ETF) that aims to provide investment results that correspond generally to the price and yield performance of the Financial Select Sector Index. This index encompasses a broad range of industries within the financial sector, including diversified financial services, insurance, commercial banks, capital markets, real estate investment trusts (REITs), consumer finance, thrifts, and mortgage finance services. XLF is managed by State Street Global Advisors and offers investors exposure to some of the largest and most influential U.S. financial institutions. The fund's composition mirrors the sector allocations of the S&P 500, making it a useful tool for investors seeking to capture the performance of the financial segment of the U.S. equity market. Launched in 1998, XLF has become a popular instrument for both individual and institutional investors due to its liquidity, cost-efficiency, and transparent structure. It is widely used for both long-term investment and short-term trading strategies, potentially serving as a barometer for investor sentiment towards the U.S. financial industry.

| Previous Close | 37.72 | Open | 37.71 | Day Low | 37.4901 |

| Day High | 37.77 | Trailing P/E | 17.06 | Volume | 30,076,252 |

| Average Volume | 42,319,511 | Average Volume (10 days) | 39,867,240 | Bid | 37.57 |

| Ask | 37.58 | Bid Size | 45,900 | Ask Size | 27,000 |

| Yield | 1.86% | Total Assets | $32,566,542,336 | 52 Week Low | 30.39 |

| 52 Week High | 37.8 | 50 Day Average | 34.928 | 200 Day Average | 33.7358 |

| Trailing Annual Dividend Rate | 0.58 | Trailing Annual Dividend Yield | 1.54% | NAV Price | 37.72012 |

| Year to Date Return | 12.38% | Beta (3 Year) | 1.07 | Three Year Average Return | 11.14% |

| Five Year Average Return | 12.14% |

After a comprehensive examination of the Financial Select Sector SPDR Fund (XLF), several technical and fundamental aspects have been scrutinized. The technical indicators on the last trading day show a closing price slightly below the open, with a relatively tight range between the high and low of the day. This may indicate a moment of consolidation in the market. The On-Balance Volume (OBV) in millions highlights a trend of accumulating volume, evidenced by the increasing positive value leading up to the latest trading day, which could be a sign of bullish sentiment among investors.

The Moving Average Convergence Divergence (MACD) histogram values show a negative trend towards the end of the observed period, suggesting a potential loss of momentum for the bullish movement. It is pertinent to observe how this indicator will evolve in the subsequent days since a continued downward trend could signal a bearish reversal or a weakening uptrend.

From a broader perspective, the Price SAR (PSAR) indicator is another tool to consider. The lack of PSAR on the short side (PSARs_0.02_0.2) and the upward trend of the PSAR long (PSARl_0.02_0.2) implies that the general trend remains bullish.

Fundamentals also play a vital role in assessing the potential movement of XLF's stock price. With a trailing PE ratio of just over 17, the ETF is valued reasonably compared to historical averages for the financial sector. The fund's total assets are robust, providing a reliable foundation for investment. The fund also shows a positive year-to-date (YTD) return as well as commendable three-year and five-year average returns, which may allure long-term investors.

Given the current technical and fundamental analysis, the outlook for XLF over the next few months appears cautiously optimistic. Key factors such as a stable trailing PE, positive YTD performance, and long-term average returns suggest that fundamentals could offer a supportive backdrop. However, caution is warranted due to emerging signs of potential weakening in the technical momentum, as indicated by the MACD histogram.

To conclude, if the fund can sustain its current level of support and see a reversal in the negative MACD histogram trend, there could be an opportunity for continued growth. Investors should monitor for signs of a breakout from the current consolidation patternwhich could signal the next directional move. Nevertheless, they should remain vigilant for any shifts in volume, fundamental financial metrics, and broader market sentiment that may impact XLF's performance moving forward.

The Financial Select Sector SPDR Fund (XLF) is among the most closely watched exchange-traded funds (ETFs) for those investing in the broad financial sector of the U.S. economy, including industries such as banking, investment brokerage, mortgage finance, insurance, and diversified financial services. Given the sector's interconnection with the overall health of the economy, the performance of XLF offers crucial insights into both macroeconomic trends and market sentiments towards financial stocks.

As 2023 has unfolded, the financial sector has been at the forefront of many key economic discussions, particularly as companies within this sector face the outcomes of a changing interest rate environment and ongoing regulatory adjustments. The sector's dynamics have been significantly influenced by decisions made by the Federal Reserve and economic indicators, which then reverberate through the stock performances of companies within the XLF. The following report aims to dissect several components that influence the outlook for XLF and, by extension, its constituent companies.

JPMorgan Chase & Co. has cemented its position as America's largest bank by market capitalization, surpassing the combined value of its competitors, Bank of America and Citibank, after consolidations and shakeups in the regional banking sector that took place in 2023. Despite challenges in the financial industry, JPMorgan's strategic maneuvering and conservative play have helped it avoid some of the pitfalls that have plagued other institutions in the space.

During the last quarter of 2023, JPMorgan is projected to post profits comparable to the GDP of Jordan, a testament to its substantial size and influence in the banking sector. Central to JPMorgan's success has been its adept handling of the banking fundamentals, namely taking deposits and making loans, a dynamic in which scale plays a significant role. Smaller banks have struggled with higher costs amid rising interest rates, a situation from which larger banks like JPMorgan have profited.

Significantly, JPMorgan acquired First Republic Bank from the Federal Deposit Insurance Corporation (FDIC), outbidding smaller banks and demonstrating the advantages of size and scale in such transactions. This acquisition highlights JPMorgan's ability to capitalize on strategic opportunities, positioning the bank for continued dominance in the market.

In contrast, some of JPMorgan's main competitors are grappling with long-term issues. Citigroup is in the midst of an overhaul to address organizational bloat and complexity, and Wells Fargo is still dealing with the aftermath of its fake account scandals from the 2010s, which has led to a regulatory cap on its ability to grow assets. Bank of America, while managing to maintain profitability, is contending with substantial unrealized bond losses that have cast a shadow on its earnings potential, leading to its stock performance lagging behind other major banks.

Looking ahead to 2024, JPMorgan faces the challenge of surpassing its record profits from the previous year. However, if the banking sector overall experiences a favorable year, there is a chance that investors might seek riskier opportunities within the sector, possibly considering JPMorgan's solid standing as "too safe." Portfolio managers have acknowledged this sentiment, but JPMorgan's consistent track record of exceeding earnings expectations might well continue to attract investors looking for stability and proven growth.

The XLF ETF is a mirror reflecting not only the stature of its largest holdings but also the cumulative strength and weaknesses across its constituent companies. Herein, we provide a quick glance at the distribution of the fund's top ten holdings:

| company | symbol | percent |

|---|---|---|

| Berkshire Hathaway Inc Class B | BRK-B | 13.21 |

| JPMorgan Chase & Co | JPM | 9.13 |

| Visa Inc Class A | V | 8.30 |

| Mastercard Inc Class A | MA | 6.93 |

| Bank of America Corp | BAC | 4.24 |

| Wells Fargo & Co | WFC | 3.28 |

| S&P Global Inc | SPGI | 2.72 |

| The Goldman Sachs Group Inc | GS | 2.27 |

| BlackRock Inc | BLK | 2.12 |

| Morgan Stanley | MS | 2.04 |

With the upcoming release of full-year earnings in early January, analysts and investors are keen to see whether JPMorgan can sustain its financial performance and justify its towering valuation. The bank's impressive trajectory thus far suggests that it may continue to be a formidable player in the banking sector, benefiting from economies of scale, strategic acquisitions, and prudent financial management.

Moving beyond individual financial institutions to take a macroeconomic view, the stock market's broad rally in late 2023 signaled robust investor confidence in various market sectors, distanced from the prior concentration in the technology sector. Recent trends demonstrated a shift in this dynamic, with more pronounced participation from financials and small-cap stocks represented by the Russell 2000 Index (^RUT). This broadening of market breadth indicated a potentially healthier and more sustainable market compared to when rallies are driven by only a few large-cap tech stocks.

Moreover, a broadened gains profile across different industry sectors suggested an overarching market confidence. Financial services, tracked by ETFs like XLF, have ridden this wave, with the financial sector being among those that benefitted from this diversified growth. This enthusiasm for the financial sector reflects expectations of a more robust market participation and improved confidence in the broader economy's path forward.

Observers have been paying special attention to the impact of higher interest rates across the financial sector, particularly in light of rising costs for entities such as smaller regional banks. However, this environment has proven in some respects beneficial for companies analogous to Wise plc (WIZEY), which benefited from higher interest rates impacting their interest income favorably. The bullish trajectory of Wise is a case in point, showing how the financial sector remains dynamic, with fintech companies carving niches that allow them to thrive amidst traditional banking challenges.

Wise's success story in H1 FY 2024 was underscored by strong revenue growth across different geographical regions. Organic growth, a robust customer base, and strategic partnerships evidenced the company's savvy in expanding its reach and outperforming benchmarks. For a diversified financial sector ETF like XLF, which captures a broad range of financial services companies, such successes enhance the overall health and prospects of the fund.

Going forward into 2024, economic observers are closely tracking the Federal Reserve's next moves in terms of interest rate cuts, which could significantly impact the financial sector. As Keith Buchanan of GLOBALT Investments noted, the anticipation of a shift from "higher for longer" to "higher for not much longer" rates is fueling strategic positioning in financial stocks. While there remains a meaningful discount compared to historical benchmarks for financial stocks, a bullish sentiment surrounds banks due to advantages gained in the current rate climate, including improved liquidity management and the potential for asset buys at favorable prices.

On the flip side, apprehensions hang heavy over the financial sector due to recent sector-specific challenges and Powell's expected hawkish tone in upcoming communications. From the intricacies of the November FOMC meeting to evolving economic data, the Financial Select Sector SPDR Fund is sensitive to these signals. A careful calibration of market confidence is essential because harsh realities could push XLF and the broader financial sector into turbulent waters.

The financial sector also faces the aftermath of regional bank collapses in early 2023. New proposed capital requirements have been a significant point of contention. The discussion has been not just about the mechanics of banking operations but also about the broader impact on lending rates, mortgage availability, and how these factors influence the consumer economy. As government and industry leaders debate the merits of the Basel III Endgame proposals, the ultimate decisions could shift the landscape for banks large and small, with corresponding effects on the financial sector's profitability and attractiveness to investors.

XLF's performance has also been shaded by broader market phenomena such as FOMO, which saw investors who had been previously cautious swing to a more optimistic investment approach as inflationary pressures seemed to ease. ETFs like XLF, which traditionally respond more conservatively to interest rate changes, are not immune to the fickle nature of market psychology. The FOMO effect highlights the reactive nature of investment markets, spurring rapid movement into and out of sectors based on the latest economic signals.

In recent weeks, a rally in the financial markets reversed earlier expectations of a downturn, with equity realignment and dovish Federal Reserve commentaries contributing to uplifts in stock values. Amidst this rally led by big-cap tech and large-cap growth stocks, analysts from firms like Valuentum urge caution, suggesting that the financial sector, as represented by XLF, may not offer the same investment security due to intrinsic characteristics like the arbitrary nature of cash flows and bank run risks.

As we head toward early 2024, stakeholders in XLF and the broader financial industry are weighing the implications of Mona Mahajan's 'goldilocks slowdown' thesis, which posits a mild economic deceleration followed by a later year resurgence. The calibration of Federal Reserve policy decisions, inflation moderation, and market valuations will be critical factors influencing investment choices. A diversified approach may be prudent for investors keen on navigating an anticipated environment of both mild headwinds and potential re-acceleration with strategic finesse.

The ETF industry has seen significant growth due to an overall surge in the stock market, which has increased liquidity and assets for many funds. High trade volumes translate to liquidity, lower bid-ask spreads, and better price discovery, contributing to the attractiveness of the ETF. The ProShares UltraPro Short QQQ, ProShares UltraPro QQQ, and the SPDR S&P 500 ETF were some of the notable ETFs by volume in the fourth quarter, reflecting investor interest in tech-driven market dynamics and general market tracking. The Financial Select Sector SPDR Fund itself experienced robust average daily trading volumes, signaling sustained trading interest within the financial services sector. Such trading activities highlight investor alignment with economic shifts and the ever-changing preferences and opportunities within the financial markets.

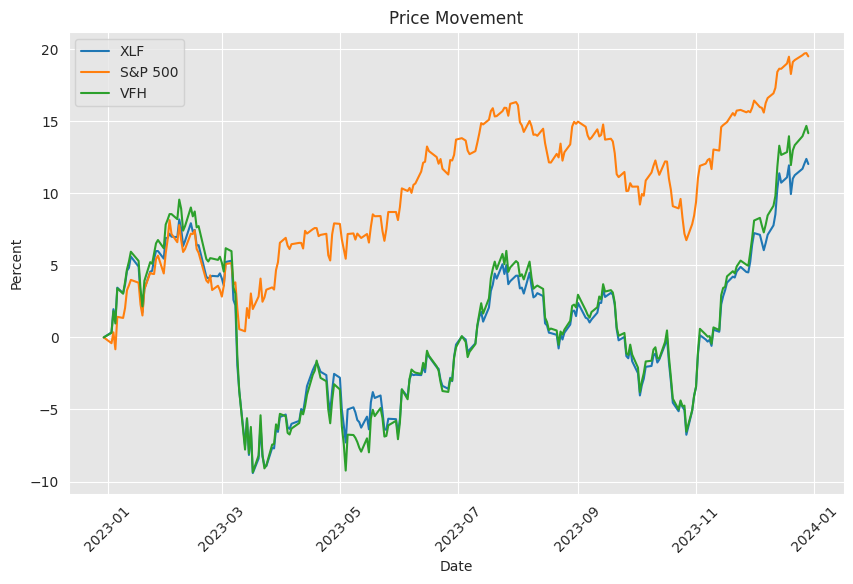

Similar Companies in Exchange-Traded Fund:

Vanguard Financials ETF (VFH), iShares U.S. Financials ETF (IYF), Fidelity MSCI Financials Index ETF (FNCL), Report: Invesco KBW Bank ETF (KBWB), Invesco KBW Bank ETF (KBWB), SPDR S&P Bank ETF (KBE), Report: SPDR S&P Regional Banking ETF (KRE), SPDR S&P Regional Banking ETF (KRE), Invesco KBW Financial Sector ETF (KBWF)

News Links:

https://finance.yahoo.com/video/economic-factors-indicate-soft-landing-213820775.html

https://finance.yahoo.com/video/jpmorgan-now-valued-more-bofa-173014102.html

https://seekingalpha.com/article/4655130-spy-powell-friday-speech-kill-rally

https://finance.yahoo.com/video/interest-rate-cuts-tailwind-banks-222204588.html

https://finance.yahoo.com/news/new-bank-rules-could-push-mortgage-rates-up-30-analyst-152116034.html

https://seekingalpha.com/article/4649482-the-crash-higher-is-coming

https://finance.yahoo.com/video/goldilocks-slowdown-likely-early-2024-214512703.html

https://finance.yahoo.com/news/10-most-actively-traded-etfs-160500953.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: MmnEyD

https://reports.tinycomputers.io/XLF/XLF-2023-12-29.html Home