Advanced Micro Devices, Inc. (ticker: AMD)

2024-01-26

Advanced Micro Devices, Inc. (AMD), a global semiconductor company headquartered in Santa Clara, California, has emerged as one of the leading players in the design and production of microprocessors, motherboard chipsets, graphics processors, and server processors. Founded in 1969, AMD positions itself as a significant competitor to Intel, especially in the CPU market with its Ryzen series, which has gained substantial market share due to its performance and value proposition. The company's graphics division, branded under Radeon, competes with NVIDIA, offering GPUs for both consumer and professional markets. In the server sector, AMD's EPYC processors have also seen increasing adoption for enterprise and cloud computing services. With a focus on innovation and performance, AMD continues to invest in research and development to drive the next generation of computing and graphics technologies. As the industry evolves towards high-performance computing, artificial intelligence, and data center expansion, AMD stands poised to capitalize on these trends. The company trades on the NASDAQ stock exchange under the ticker symbol AMD.

Advanced Micro Devices, Inc. (AMD), a global semiconductor company headquartered in Santa Clara, California, has emerged as one of the leading players in the design and production of microprocessors, motherboard chipsets, graphics processors, and server processors. Founded in 1969, AMD positions itself as a significant competitor to Intel, especially in the CPU market with its Ryzen series, which has gained substantial market share due to its performance and value proposition. The company's graphics division, branded under Radeon, competes with NVIDIA, offering GPUs for both consumer and professional markets. In the server sector, AMD's EPYC processors have also seen increasing adoption for enterprise and cloud computing services. With a focus on innovation and performance, AMD continues to invest in research and development to drive the next generation of computing and graphics technologies. As the industry evolves towards high-performance computing, artificial intelligence, and data center expansion, AMD stands poised to capitalize on these trends. The company trades on the NASDAQ stock exchange under the ticker symbol AMD.

| Address | 2485 Augustine Drive | City | Santa Clara | State | CA |

| Zip | 95054 | Country | United States | Phone | 408 749 4000 |

| Website | https://www.amd.com | Industry | Semiconductors | Sector | Technology |

| Full Time Employees | 25,000 | Beta | 1.695 | Trailing PE | 1,611.3636 |

| Forward PE | 45.682987 | Volume | 106,672,364 | Average Volume | 66,804,073 |

| Average Volume 10 days | 105,136,670 | Market Cap | $286,347,395,072 | Fifty Two Week Low | $72.03 |

| Fifty Two Week High | $184.92 | Price to Sales (TTM) | 12.950449 | Fifty Day Average | $138.1574 |

| Two Hundred Day Average | $114.38435 | Enterprise Value | $288,399,917,056 | Profit Margins | 0.94099% |

| Shares Outstanding | 1,615,500,032 | Shares Short | 45,244,379 | Shares Percent Shares Out | 2.7999% |

| Held Percent Insiders | 0.496% | Held Percent Institutions | 72.225% | Short Ratio | 0.73 |

| Book Value | $34.037 | Price to Book | 5.2075686 | Last Fiscal Year End | Dec 31, 2022 |

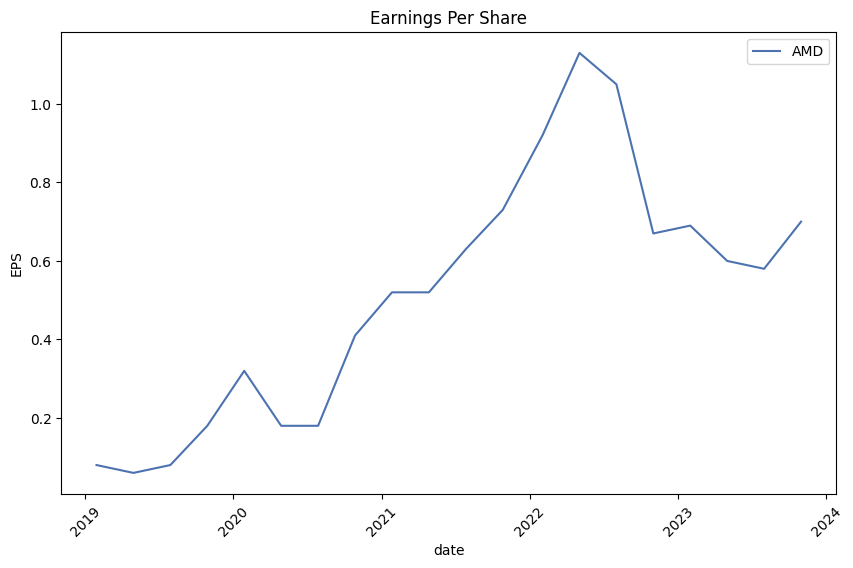

| Next Fiscal Year End | Dec 31, 2023 | Most Recent Quarter | Sep 30, 2022 | Earnings Quarterly Growth | 3.53% |

| Net Income To Common | $208,000,000 | Trailing EPS | $0.11 | Forward EPS | $3.88 |

| Peg Ratio | 5.3 | Total Cash | $5,784,999,936 | Total Cash Per Share | $3.581 |

| EBITDA | $3,046,000,128 | Total Debt | $2,862,000,128 | Quick Ratio | 1.421 |

| Current Ratio | 2.188 | Total Revenue | $22,111,000,576 | Debt To Equity | 5.206 |

| Revenue Per Share | $13.697 | Return On Assets | -0.083% | Return On Equity | 0.38% |

| Free Cashflow | $2,758,500,096 | Operating Cashflow | $1,852,999,936 | Last Split Factor | 2:1 |

| Last Split Date | Aug 1, 2000 | Enterprise To Revenue | 13.043 | Enterprise To EBITDA | 94.682 |

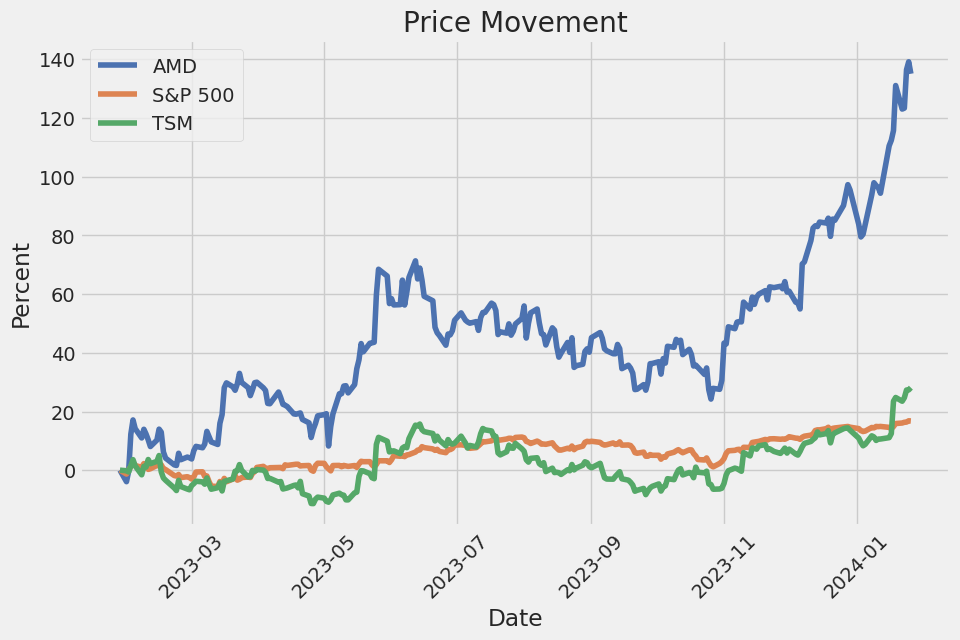

| 52 Week Change | 139.16445% | S&P 52 Week Change | 20.23308% | Number Of Analyst Opinions | 38 |

| Revenue Growth | 4.2% | Gross Margins | 50.319% | EBITDA Margins | 13.776% |

| Operating Margins | 3.862% | Trailing PEG Ratio | 2.5152 | Target High Price | $220.00 |

| Target Low Price | $60.00 | Target Mean Price | $156.76 | Target Median Price | $157.50 |

| Recommendation Mean | 1.9 | Current Price | $177.25 | Earnings Growth | 3.5% |

| Sharpe Ratio | -6.687168937910114 | Sortino Ratio | -123.67921457958907 |

| Treynor Ratio | 0.483885841334015 | Calmar Ratio | 4.938120276060599 |

Based on the provided data for AMD, it is essential to consider both technical and fundamental analysis to anticipate potential stock price movement over the coming months.

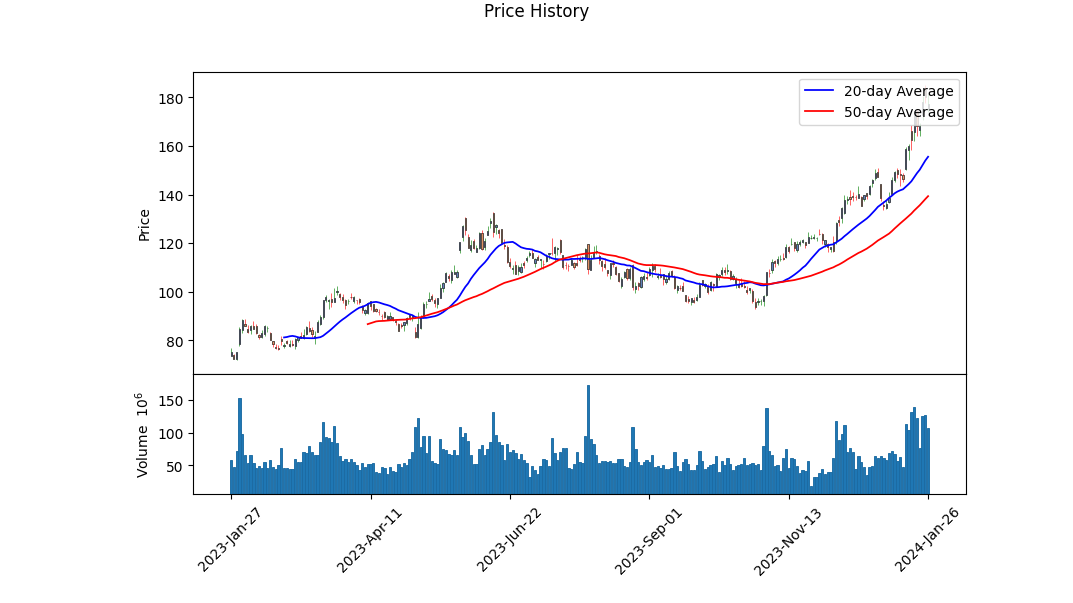

Technical analysis of the recent trading pattern reveals AMD's stock price has been in an uptrend, as indicated by the progressive increase in the On-Balance Volume (OBV) from 5.60 million to 129.37 million, which typically signifies growing investor interest and bullish sentiment. However, the absence of MACD histogram values for earlier data precludes any comprehensive reading on momentum trends across the period under review.

Examining the stocks fundamentals, AMD has a robust gross margin of approximately 50%, demonstrating significant efficiency in its cost control relative to sales. A trailing PEG ratio of 2.5152 suggests that the stock might be overvalued relative to its growth expectations. However, in the realm of innovation-driven sectors where AMD operates, higher PEG ratios are not uncommon.

The high Altman Z-Score of 14.30 hints at financial stability and low bankruptcy risk for AMD. Moreover, with a Piotroski Score of 8, AMD exhibits healthy financial signals across profitability, leverage, liquidity, and efficiency. A noteworthy concern is the substantial negative values for both the Sharpe and Sortino Ratios, which commonly indicate poor risk-adjusted returns. Oppositely, the high Calmar Ratio suggests that, for the risk related to its maximum drawdown, AMD has performed quite well over the past year.

Incorporating the insights gathered from AMD's cash flows and balance sheets further strengthens the understanding of the company's capacity. A significant increase in free cash flow, followed by a considerable net income growth, confirms a strong profitability trajectory. Furthermore, the substantial operating cash flow supports prospective strategic investments and further expansion.

Analyst expectations reveal a consensus that earnings will grow in the subsequent quarters, with a marked optimism for next year's sales and earnings growth of 18.3% and 46.4%, respectively. These optimistic growth estimates align with the company's aggressive R&D expenditure that underpins innovation, a critical success factor for AMD in maintaining its competitiveness.

Overall, despite some concerns over risk-adjusted return metrics in the short term, AMD's future outlook appears promising based on strong underlying fundamentals, evident growth potential, and solid financial health. As such, barring unforeseen market shifts or industry disruptions, the stock may continue its upward trajectory underpinned by robust financial performance and positive analyst sentiment. Investors should keep an eye on the broader economic environment and sector-specific developments that may influence AMD's stock price.

| Statistic Name | Statistic Value |

| Alpha (Intercept) | 0.1278 |

| Beta (Slope) | 1.6035 |

| R-squared | 0.396 |

| Adjusted R-squared | 0.396 |

| F-statistic | 823.5 |

| Prob (F-statistic) | 1.11e-139 |

| Log-Likelihood | -2989.9 |

| AIC | 5,984 |

| BIC | 5,994 |

| No. Observations | 1,258 |

| Df Residuals | 1,256 |

| Df Model | 1 |

The linear regression analysis of AMD as the dependent variable and SPYrepresenting the overall marketas the independent variable, illustrates a positive relationship between the two up to the present day. The model's alpha value, which is the intercept of the regression line, is approximately 0.1278. This indicates that when SPY is at zero, the expected return of AMD is about 12.78%. In financial terms, alpha represents the portfolio's return in excess of the benchmark, or in this case, the part of AMD's performance that is not explained by the market's (SPY's) movements. A positive alpha suggests that AMD, on average, has performed better than the baseline market return, independently of the market ecosystem.

The Beta of the model, which measures AMD's volatility in relation to SPY, is approximately 1.6035. This is indicative of a higher sensitivity to market movements; when the SPY returns change by 1%, the AMD returns are expected to change by about 1.6035%. Furthermore, the R-squared value of 0.396 tells us that approximately 39.6% of the variability in AMD's returns is explained by the variability in the SPY's returns. While this establishes a moderate directional relationship, it also implies that other factors beyond the market index influence AMD's stock price to a significant extent.

Advanced Micro Devices, Inc. (AMD) Q3 2023 Earnings Call Summary

During the third quarter of 2023, AMD reported robust financial performance, achieving strong growth in revenue and profits. These positive results were driven by record server CPU revenue and solid sales of Ryzen processors. Lisa Su, AMD's CEO, highlighted several achievements, including advances in AI hardware and software roadmaps and significant traction with AI solutions among customers. In the PC market, the adoption of AMD's processors has been growing, supported by a deeper collaboration with Microsoft to leverage AMD's AI Engine for Windows. The Data Center segment showcased impressive growth, particularly with the 4th Gen EPYC CPU family.

In terms of Data Center GPU business, AMD's attention to both hardware and software led to substantial customer interest in their next-generation Instinct MI300 accelerators. Performance indicators meet or exceed expectations, with production of the MI300A APUs underway to support supercomputing needs. AMD's AI software ecosystem has also expanded with integration into major frameworks like PyTorch and TensorFlow. Strategic acquisitions, like Mipsology and Nod.ai, aim to bolster AI software capabilities and optimize performance for AMD's processors. The expected Data Center GPU revenue is projected to cross $400 million in Q4 and exceed $2 billion in 2024, with the MI300 potentially being AMD's fastest product to reach $1 billion in sales.

The Client segment revenue climbed significantly, primarily fueled by Ryzen 7000 processors. This growth was observed as the PC market approaches normalization and exhibits signs of returning to seasonal patterns. Commercial segment expansion was also evident with the release of AMD's Threadripper Pro workstation CPUs.

However, the Gaming segment saw a decrease in revenue due to lower semi-custom sales, which was partially offset by increased sales of Radeon GPUs. The Embedded segment also experienced a reduction in revenue attributed to inventory adjustments among customers in various end markets, despite new product launches like adaptive SoCs with on-chip HBM memory.

Looking ahead, AMD expects solid growth in the Data Center business, balanced by softer demand in the Embedded segment and reduced semi-custom revenue. The PC market's shift to seasonality and AMD's strong product portfolio position the company to gain market share profitably. AMD's focus on expanding its enterprise computing presence and accelerating AI capabilities remains central to its strategy.

Financially, Jean Hu, AMD's CFO, noted a better than expected performance in Q3 with a revenue increase year-over-year and sequential growth led by the Client and Data Center segments. Operating expenses increased, mainly due to higher R&D investment in AI. The cash flow was strong, with a notable return to shareholders through share repurchases. For Q4, AMD expects increased revenue with growth in Data Center and Client segments. Gross margins are expected to improve, operating expenses to upsurge slightly, and an effective tax rate of 13%. AMD's priority is to drive top line revenue growth faster than OpEx growth and leverage operating models to expand profits more rapidly than revenue, setting the stage for long-term profitable growth.

pliance with other intellectual property laws and regulations to protect our proprietary rights. The laws of certain jurisdictions in which our products are or may be developed, manufactured, or sold may not protect our products and intellectual property rights to the same extent as the laws of the United States. Failure to protect these rights could result in the loss of competitive advantage, which could harm our business. Additionally, the effort to protect our proprietary rights is costly and may require significant time and resources. Our inability to protect our proprietary rights could reduce the value of our products, our brand, and our business. The measures we have taken may not provide significant protection for our proprietary rights, and we may be unable to detect or prevent the unauthorized use of our intellectual property or products.

Unfavorable currency exchange rate fluctuations could adversely affect us. Our international sales account for a significant portion of our business, with transactions often conducted in currencies other than the U.S. dollar. Fluctuations in currency exchange rates may affect demand for our products or affect our profitability in U.S. dollars when foreign currencies are converted. While we use derivative instruments to hedge certain exposures, these measures may not adequately protect us from long-term changes in exchange rates.

Operational and Technology Risks

We rely on third parties to manufacture our products, and if they are unable to do so on a timely basis in sufficient quantities and using competitive technologies, our business could be materially adversely affected. We rely on third-party semiconductor foundries, such as TSMC, and assembly and test vendors to manufacture and package our products. Any interruptions in these third-party services, or diminished performance or quality issues, could affect our ability to deliver our products on a timely basis, which could harm our relationships with our customers and our reputation, and may lead to lost sales and higher costs.

Failure to achieve expected manufacturing yields for our products could negatively impact our financial results. Our gross margin and profitability are affected by our ability to achieve acceptable manufacturing yields. Lower-than-anticipated yields could lead to higher product costs and reduced margins or delayed product shipments, any of which could materially impact our financial results.

The success of our business is dependent upon our ability to introduce products on a timely basis with features and performance levels that provide value to our customers while supporting and coinciding with significant industry transitions. Rapid technological changes require high levels of innovation and timely product introductions. Delays in the development or introduction of new products and technologies, or failure to accurately predict and respond to emerging technological trends and our customers' changing needs, could result in product obsolescence, increased costs, and loss of revenue and market share.

Our products may be subject to security vulnerabilities that could have a material adverse effect on us. Security vulnerabilities can impact the integrity, reliability, and performance of processors and other products. Such vulnerabilities may lead to negative publicity, loss of customer confidence, demands for product returns or discounts, indemnification claims, litigation, regulatory inquiries or actions, or other liabilities, all of which could harm our business and financial results.

IT outages, data loss, data breaches and cyber-attacks could disrupt operations and compromise our intellectual property or other sensitive information, be costly to remediate or cause significant damage to our business, reputation and financial results. A breach of information technology systems could jeopardize our or our customers' and suppliers' confidential information processed and stored in, and transmitted through, our computer systems and networks. An actual or perceived breach could damage our reputation, lead to legal and financial exposure, and disrupt our operations.

The absence of a robust market for ARM-based semiconductor designs could limit growth and future business opportunities. While we see significant opportunity in ARM-based designs, the demand in the market may not reach the level necessary for us to achieve success or compete effectively with other companies. Additionally, we may face challenges as customers integrate ARM-based processors into their designs and as we develop and grow the ecosystem required to support ARM technology. If ARM-based designs do not continue to gain market acceptance, our business could be materially adversely affected.

Legal and Regulatory Risks

Government actions and regulations such as export regulations, tariffs, and trade protection measures may limit our ability to export our products to certain customers. Changes in these regulations or unfavorable international trade regulations could limit our ability to export our products to certain customers, influence our profitability, or lead to retaliatory measures by other countries. Export embargoes, trade sanctions, and other regulatory requirements could limit our ability to sell products to certain customers or could impose additional compliance requirements on us, which could have a material adverse effect on our business.

Liquidity and Capital Resources Risks

Our ability to generate sufficient cash to meet our working capital requirements could be adversely affected if we fail to generate sufficient revenue and operating cash flow. An inability to generate sufficient cash flows could lead to a shortfall, forcing us to reduce or delay investments, refuse new business opportunities, sell assets, or issue debt or equity securities, all of which could negatively affect our growth strategy and our ability to compete successfully.

The agreements governing our notes, our guarantees of Xilinxs 2.95% and 2.375% Notes, and our Revolving Credit Agreement impose restrictions on us that may adversely affect our ability to operate our business. These restrictions may impede our ability to finance future operations or capital needs or to engage in other business activities that may be in our interest. Failure to comply with these restrictions and covenants, including financial and operating covenants, could result in a default under these debt instruments, which could negatively affect our financial condition and increase our cost of capital.

Advanced Micro Devices, Inc. (AMD) is currently attracting considerable investor attention due to its dynamic market performance and strategic technological advancements, especially in the realm of artificial intelligence (AI). With a new chip on the horizon and its stock price experiencing significant momentum, the company is gaining a reputation as a robust investment option regardless of any fluctuating federal interest rate decisions.

An expert from Jewel Financial, discussed in a YouTube video, highlights AMD's potential for strong earnings growth, driven by developments in AI technology. AMD's new AI chip is expected to drive earnings and is seen as a competitive edge that may currently render the stock undervalued. With no debt in its financials, AMD is presented as an attractive prospect for investors looking for strong fundamentals in tech stocks.

AMD's performance has been linked not only to its own merits but also to wider industry and economic trends. Mega-cap stocks like AMD tend to perform well in times of economic uncertainty, and despite some forecasts that suggest a shift in investor preferences, AMD's robust market position and technological advancements sustain its appeal. This is underlined by the insight on market dynamics provided in a YouTube discussion regarding the relative value of mega-caps.

Competitive pressures, however, are always a consideration in the tech industry. Intel's release of new AI server CPUs, as reported by The Motley Fool on December 14, 2023, introduces new challenges for AMD. Intel's aggressive push into the AI market signifies increased competition for AMDs server CPU segment. Nevertheless, AMD's diverse product lineup and consistent innovation may well help it maintain a strong market position despite these challenges.

Amid this competitive landscape, analysts also consider the comparative strengths of AMD over its industry rivals like Nvidia. In a December 13, 2023, analysis by Keith Speights on The Motley Fool, AMD is positioned favorably as it is seen offering customers a viable and cost-effective alternative to Nvidia's widely utilized GPUs. However, despite expected growth in AMD's AI technologies, its stock valuation remains a crucial factor for investors to consider.

Further enhancing its market promise, AMD garnered significant attention following positive updates on its AI chip, the MI300X. In a Motley Fool report by Nicholas Rossolillo on December 14, 2023, the potential for AMD's new AI system was emphasized as a potential game-changer in the AI accelerator market. Expectations of a burgeoning market for AI chips and an optimistic revenue projection from Lisa Su indicate a substantial opportunity for growth.

The stock's performance is also noteworthy, with Zacks Equity Research reporting on December 13, 2023, an upward trend in AMD's share prices, surpassing both sectoral and S&P 500 gains. While caution is warranted due to fluctuations in earnings projections and a premium valuation, AMD's stock presents a compelling case for investors. The disclosure on Zacks.com further elucidates on this.

AMDs ambitions in AI chip technology are underscored in another Motley Fool article by Will Ebiefung dated December 15, 2023. The companys new M1300 series chips are designed to support generative AI applications, expanding its presence in a market projected to be worth $400 billion by 2027.

In a competitive response to AMD's advances, Timothy Green, writing for The Motley Fool on December 16, 2023, points out Intel's release of their new Emerald Rapids server chips as a direct challenge to AMDs Genoa server CPUs. Despite AMD's higher core count, Intel's focus on AI inference and the built-in accelerators in Emerald Rapids may tilt the balance in Intel's favor for certain market segments.

The attractiveness of AMD as a prospective investment extends further, as detailed by Jake Lerch in The Motley Fool article dated December 15, 2023. The MI300X chip positions AMD as a challenger in the AI chip market, and strong interest from major tech companies indicates a significant market awaits this technology. Yet, the article mentions that the high valuation of AMD shares may present concerns for value-conscious investors.

Harsh Chauhan's December 15, 2023, article for The Motley Fool discusses AMD's plans that could lead to a sizeable increase in revenue from AI chip sales, suggesting that the company is well-positioned for growth in the AI market. AMDs price-to-sales ratio indicates a market expectation of continued growth in line with its burgeoning AI chip sector.

In the wake of its claims of superior AI chip performance, as noted by Nicholas Rossolillo of The Motley Fool in an article dated December 19, 2023, The Motley Fool, AMD remains engaged in a heated rivalry with Nvidia. While AMD asserts that its MI300X system outperforms Nvidia's in AI inference, Nvidia argues that AMD's benchmarks lack accuracy. For investors, these competitive narratives must be reconciled with actual financial performance metrics.

AMD's performance as reported by Zacks Equity Research on December 19, 2023, demonstrates a resilient momentum, beating growth indices and holding positive near-term investor expectations. The stock's trading at a Forward P/E ratio notably higher than the industry average implies that investors are banking on future earnings growth.

Finally, in a report published on December 17, 2023, The Motley Fool places AMD alongside tech giant Microsoft, analyzing both companies' merits as tech stock investments. Although AMD holds significant potential, particularly with the upcoming MI300X GPU, it trades at higher valuation metrics compared to Microsoft. AMD's position in the gaming industry and the partnership with Microsoft for the Azure platform highlights its integral role in powering extensive segments of the tech market. The full report can be accessed at The Motley Fool.

As AMD looks to the future, its focus on AI and continued commitment to innovation position the company as a contender for significant market growth. Investors, however, remain attentive to AMD's ability to navigate the competitive and rapidly changing semiconductor landscape, especially as it challenges established giants like Nvidia and responds to Intels competitive assertions. With growth projections rooted in AI technology adoption and strategic partnerships, AMD's stock appeal continues to rise, but equally essential is careful consideration of the current valuation and the broader market conditions.

For a broader perspective on AMD's trajectory and its place within the tech industry, investors are advised to look at the diverse analysis and predictions made by experts, each considering a range of variables from market trends to technological competitiveness. The company's diversification, innovation, and market agility will ultimately shape its short-term performance and long-term standing in the evolving landscape of technology investments.

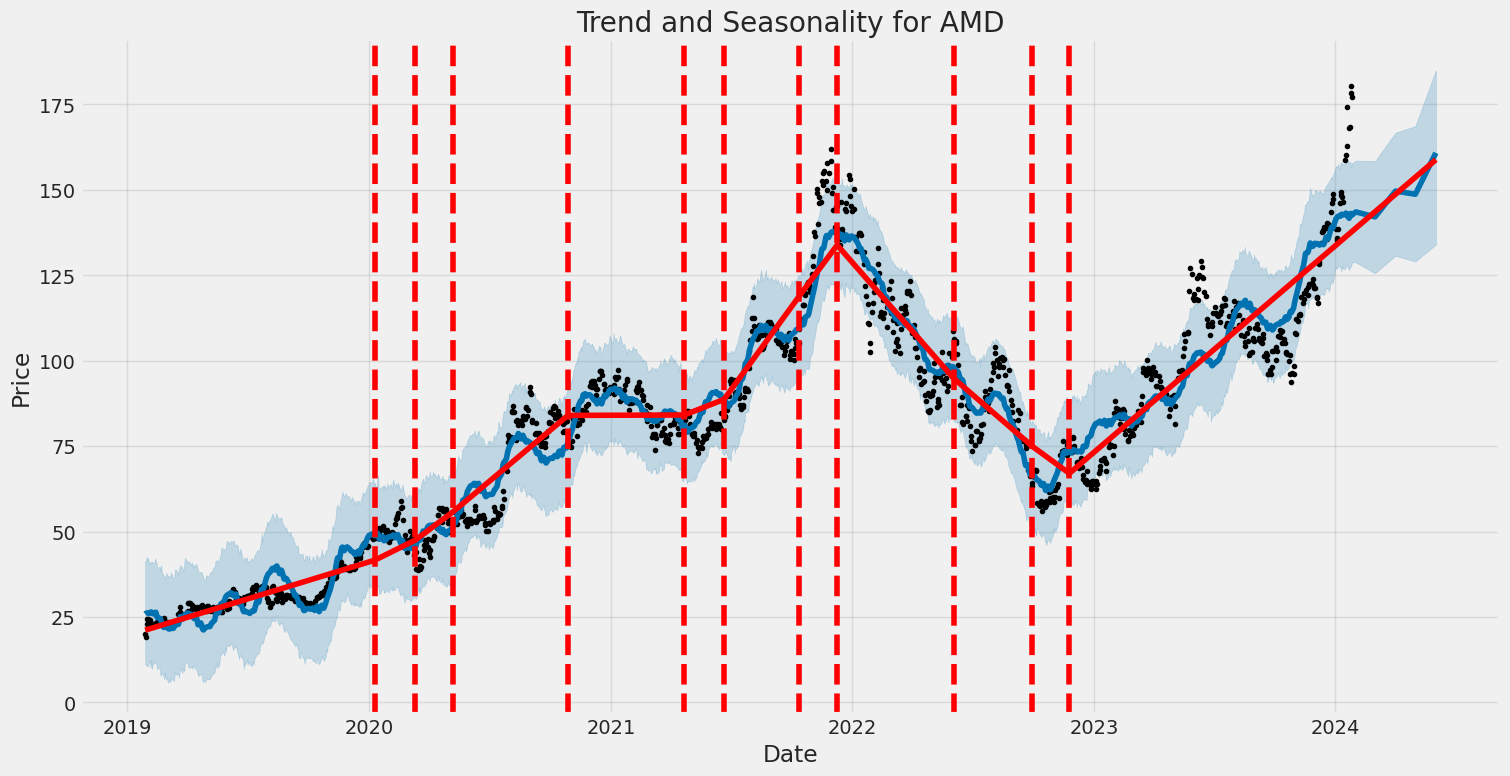

Between January 28, 2019, and January 26, 2024, the stock of Advanced Micro Devices, Inc. (AMD) experienced observable volatility, as reflected in the statistical analysis of its returns. The ARCH model, which helps in understanding volatility patterns, suggests that the stock had notable fluctuations with an omega value of approximately 10.54, which is a measure of the baseline volatility independent of previous time periods. The alpha value in the model indicates that past returns had some effect on current volatility, though the effect size was relatively small with an alpha[1] value of 0.0649, implying that recent changes in AMD's stock price had a limited but statistically significant impact on its future volatility.

| Statistic | Value |

|---|---|

| Dependent Variable | asset_returns |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3304.30 |

| AIC | 6612.59 |

| BIC | 6622.87 |

| No. Observations | 1,258 |

| Df Residuals | 1258 |

| Df Model | 0 |

| omega | 10.5427 |

| alpha[1] | 0.0649 |

To assess the financial risk associated with a $10,000 investment in Advanced Micro Devices, Inc. (AMD) over a one-year period, a synergy of volatility modeling and machine learning predictions is utilized to gauge the potential fluctuations in the stocks value and to forecast its future returns.

The use of volatility modeling, particularly a model that accounts for conditional heteroskedasticity, is to understand and capture the time-varying volatility inherent in AMD's stock price. This approach identifies periods of higher risk when investment returns are more uncertain and quantifies the level of variance that can be expected. As financial time series data often exhibit clustering of volatilityan observation that large changes in asset prices tend to be followed by more large changes, and small changes by more small changesthis model is well-suited to capture such patterns.

Once this model is fitted to historical price data, it can provide estimates of future volatility. This is crucial as it forms the basis for computing the annual Value at Risk (VaR) for AMDs stock. VaR is a standard measure that estimates the maximum expected loss over a specified time frame at a certain confidence level. With the estimation of the volatility, the VaR for a $10,000 investment at a 95% confidence interval is calculated as $460.67. This implies that theres only a 5% chance that the investment could lose more than $460.67 over the next year under normal market conditions, according to the volatility model's forecasts.

On the other side, machine learning predictions come into play. A specific algorithm, such as a decision tree-based regression model that incorporates multiple decision trees to improve predictive accuracy, is used for its ability to handle complex non-linear relationships within the dataset. After training on historical data, this method analyzes the patterns and relationships in the stock price movements to predict future returns.

By integrating the forecasting power of machine learning predictions with the risk quantification from the volatility modeling, investors gain a more comprehensive view of the potential risks. The predictive model can incorporate factors such as earnings reports, industry trends, and macroeconomic indicators, which might affect AMD's performance. Simultaneously, the volatility estimate provides a measure of how much uncertainty there is around the predicted returns.

In this case, the calculated VaR gives an investor a quantifiable risk metric which states that there is a 95% confidence level that the investor would not lose more than $460.67 on their $10,000 investment over a one-year horizon. However, it's important for investors to remember that VaR does not account for extreme events falling outside of the 95% confidence level and is also based on historical data, which may not perfectly predict future events. Therefore, this measure should be seen as one part of a broader risk management strategy.

Similar Companies in Semiconductors:

Report: Taiwan Semiconductor Manufacturing Company Limited (TSM), Taiwan Semiconductor Manufacturing Company Limited (TSM), Intel Corporation (INTC), Marvell Technology, Inc. (MRVL), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Broadcom Inc. (AVGO), Qualcomm Incorporated (QCOM), Texas Instruments Incorporated (TXN), Xilinx, Inc. (XLNX)

https://www.fool.com/investing/2023/12/13/2-reasons-why-amd-better-ai-stock-nvidia/

https://www.fool.com/investing/2023/12/14/amd-updates-on-its-new-ai-chip-is-the-stock-a-buy/

https://www.youtube.com/watch?v=rujOAadRPhA

https://www.youtube.com/watch?v=0RJ_S4Ysdso

https://www.fool.com/investing/2023/12/14/intel-announced-new-ai-chips-should-amd-stock-inve/

https://www.fool.com/investing/2023/12/15/where-will-amd-stock-be-in-3-years/

https://www.fool.com/investing/2023/12/15/forget-nvidia-2-artificial-intelligence-ai-stocks/

https://www.fool.com/investing/2023/12/15/2-reasons-to-buy-amd-and-1-reason-to-sell/

https://www.fool.com/investing/2023/12/16/intels-new-server-chips-make-gains-on-amd/

https://www.fool.com/investing/2023/12/17/better-tech-stock-amd-vs-microsoft/

https://www.fool.com/investing/2023/12/19/where-will-amd-stock-be-in-five-years/

https://www.fool.com/investing/2023/12/19/nvidia-fires-back-amd-ai-chip-claims-need-to-know/

https://www.sec.gov/Archives/edgar/data/2488/000000248823000195/amd-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: fj9LWH

Cost: $1.10689

https://reports.tinycomputers.io/AMD/AMD-2024-01-26.html Home