BlackBerry Limited (ticker: BB)

2024-05-14

BlackBerry Limited (ticker: BB) is a Canadian multinational company specializing in enterprise software and cybersecurity services. Originally renowned for its innovative smartphones, BlackBerry has transitioned over the years to focus on software solutions, particularly in the realms of enterprise mobility management and embedded systems. The company leverages its expertise in security to provide robust solutions for the Internet of Things (IoT) and automotive industries, with its QNX real-time operating system widely adopted in vehicles for its safety-critical applications. BlackBerry also offers endpoint management, antivirus, and secure communications software, catering to a broad range of industries. The company has strategically pivoted from its hardware roots to become a key player in the cybersecurity and software sectors, positioning itself for growth through its emphasis on secure, data-centric solutions.

BlackBerry Limited (ticker: BB) is a Canadian multinational company specializing in enterprise software and cybersecurity services. Originally renowned for its innovative smartphones, BlackBerry has transitioned over the years to focus on software solutions, particularly in the realms of enterprise mobility management and embedded systems. The company leverages its expertise in security to provide robust solutions for the Internet of Things (IoT) and automotive industries, with its QNX real-time operating system widely adopted in vehicles for its safety-critical applications. BlackBerry also offers endpoint management, antivirus, and secure communications software, catering to a broad range of industries. The company has strategically pivoted from its hardware roots to become a key player in the cybersecurity and software sectors, positioning itself for growth through its emphasis on secure, data-centric solutions.

| Full-Time Employees | 2,647 | Previous Close | 3.10 | Current Price | 3.405 |

| Open | 3.82 | Day Low | 3.32 | Day High | 3.85 |

| Volume | 86,153,970 | Average Volume | 8,814,367 | Market Capitalization | 2,006,341,760 |

| 52-Week Low | 2.46 | 52-Week High | 5.75 | Price to Sales (TTM) | 2.352 |

| Enterprise Value | 1,841,624,192 | Profit Margins | -0.1524 | Shares Outstanding | 589,233,984 |

| Shares Short | 42,586,717 | Short Ratio | 5.06 | Book Value | 1.317 |

| Price to Book | 2.585 | Net Income to Common | -130,000,000 | Trailing EPS | -0.22 |

| Forward EPS | 0.03 | Total Cash | 237,000,000 | Total Debt | 252,000,000 |

| Current Ratio | 1.427 | Total Revenue | 853,000,000 | Debt to Equity | 32.474 |

| Revenue per Share | 1.459 | Return on Assets | -0.01423 | Return on Equity | -0.15922 |

| Free Cash Flow | 89,375,000 | Operating Cash Flow | -3,000,000 | Revenue Growth | 0.146 |

| Gross Margins | 0.6096 | EBITDA Margins | 0.02814 | Operating Margins | 0.01734 |

| Sharpe Ratio | -0.469 | Sortino Ratio | -7.588 |

| Treynor Ratio | -0.158 | Calmar Ratio | -0.604 |

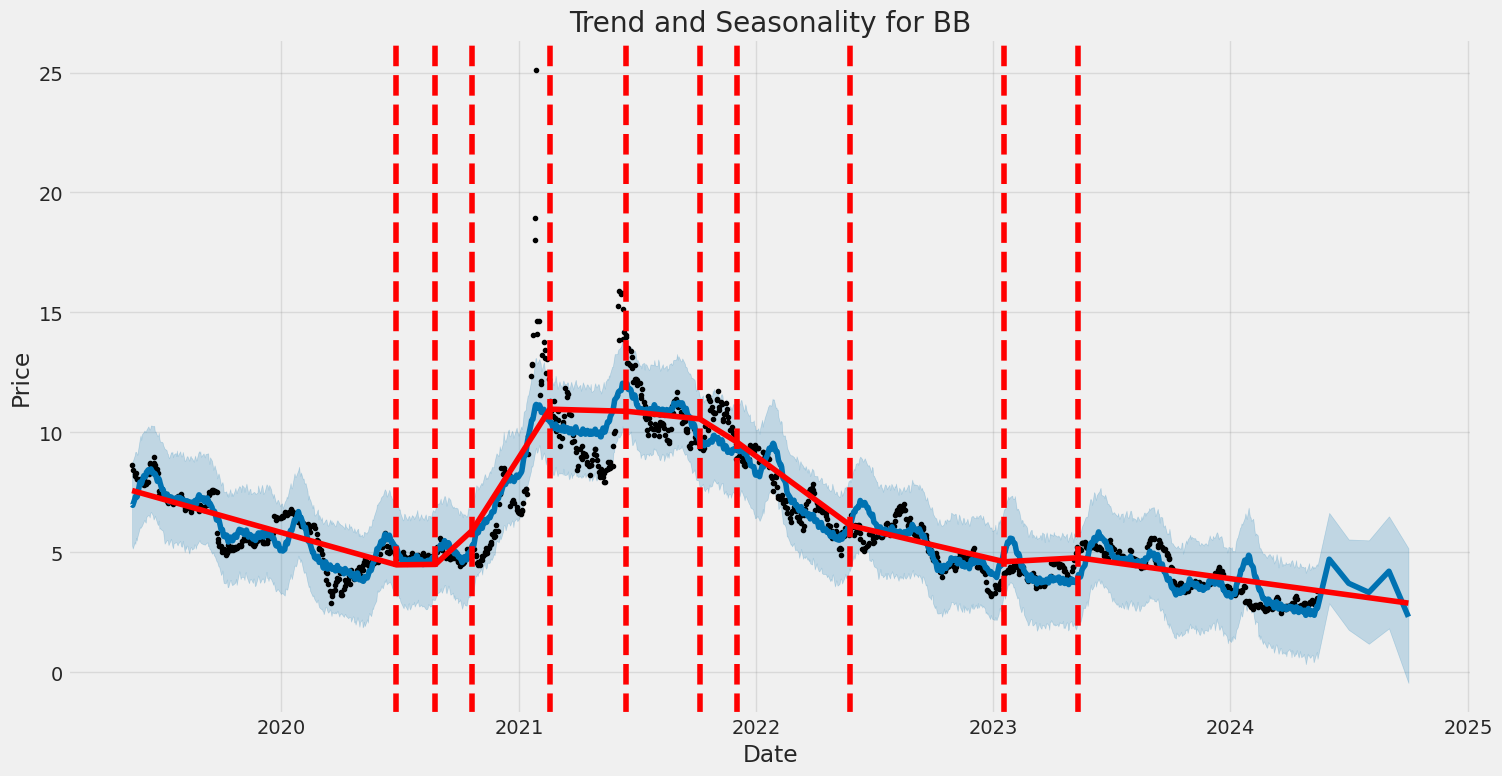

The recent performance of stock BB showcases a varied set of financial indicators and technical analysis metrics. Using these metrics, we can attempt to gauge the stock's future price movement over the next few months.

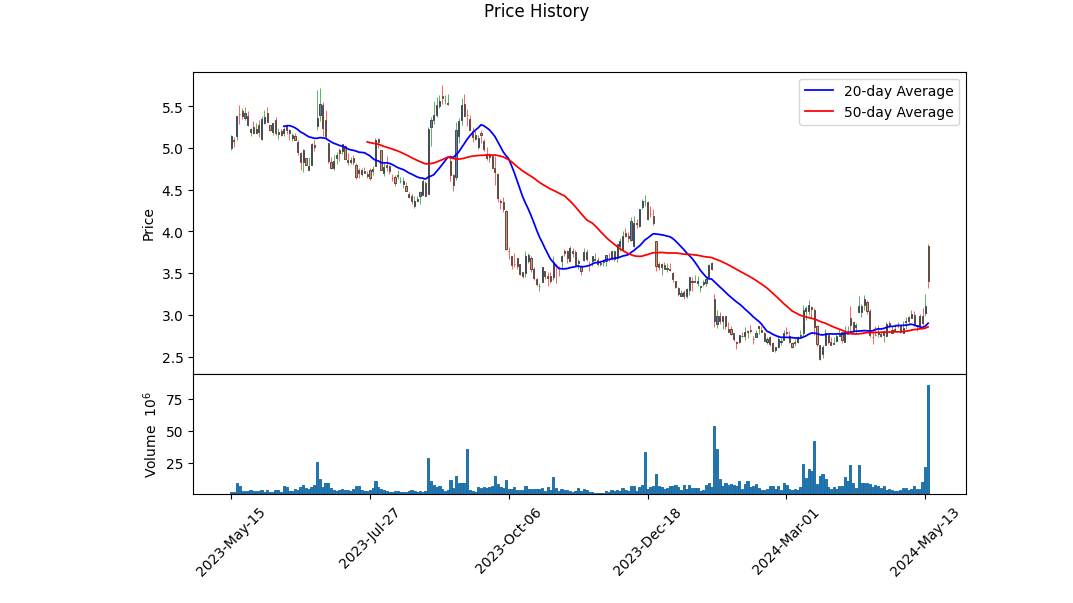

Technical Indicators: The stock has seen fluctuations in its opening and closing prices over the last trading days, with notable increases in volume. The On-Balance Volume (OBV) jumped significantly from 0.531 million to 17.773 million over a span of time, indicating a high level of accumulation and suggesting strong buying interest. Moreover, the MACD histogram values have progressed into positive territory, further solidifying bullish momentum. Such increases in OBV coupled with positive MACD histogram crossovers are typically seen as precursors to upward price momentum.

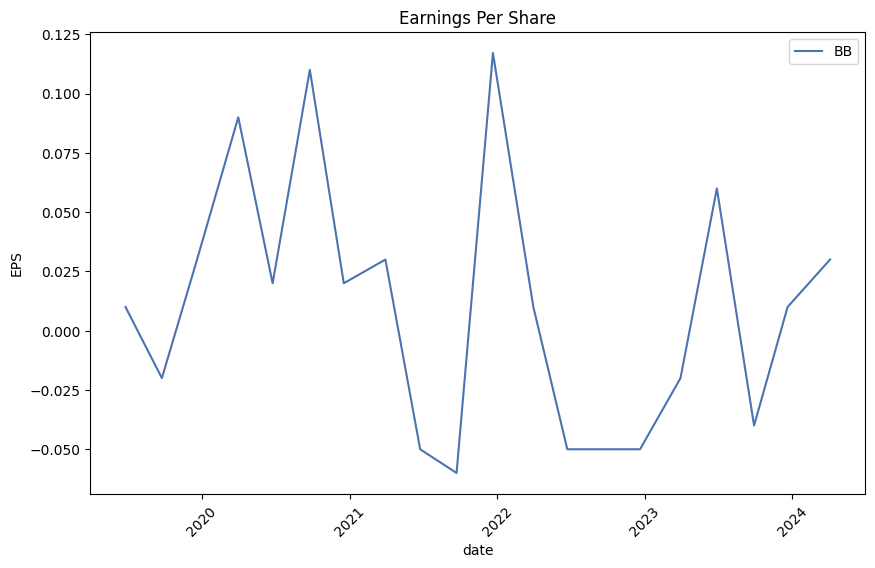

Fundamentals Analysis: From a fundamental standpoint, BB shows some worrying signs, particularly when examining its income statements and balance sheets. The companys gross margins stand at 60.961%, which is quite healthy. However, its ebitda and operating margins are alarmingly low at 2.814% and 1.734% respectively. Additionally, the company has a significant amount of net debt, although it has managed to lower it considerably over time. A free cash flow of -24 million deteriorates the financial position further, but the effects of reducing debt should not be discounted in the longer term.

Risk-Adjusted Performance: The Sharpe, Sortino, Treynor, and Calmar ratios, which measure the risk-adjusted returns, are all negative. The Sharpe Ratio of -0.469 indicates that the stock has offered lower returns per unit of risk. The Sortino Ratio, which only considers downside volatility, stands at an abysmal -7.588, suggesting that the negative returns are significantly outweighing the minimal positive returns, thus implying high downside risks. The Treynor and Calmar ratios reinforce this outlook, further indicating that the stock has performed poorly relative to both systematic risk and maximum drawdown.

Financials Overview: Reviewing the financial data, BB shows a negative EBITDA of 13 million and a net income loss of 130 million, which indicate a significant downturn in profitability. Total debt has been significantly reduced from 843 million to 252 million, although the current level of revenue, standing at 853 million, seems insufficient in comparison to their total expenses of 925 million. Despite these financial setbacks, the company has maintained its gross profit at 520 million, showcasing resilience in its core operations.

Balance Sheets: Assets and liabilities indicate some capital restructuring, given the decrease in net debt from 506 million to 19 million. The company's tangible book value transitioned from negative to 60 million, indicating attempts to strengthen its equity position.

Market Outlook: With analysts' expectations being unavailable, combined with the mixed sentiment from the technical and fundamental analysis, the prediction for BB would lean towards cautious optimism. Recent volume surges and positive technical indicators suggest a bullish trend in the short term. However, the underlying poor financials and adverse risk ratios underscore inherent long-term risks.

In summary, while the technical indicators suggest potential short-term gains driven by increased buying activity, investors should heed the warning signs embedded in the company's fundamentals and risk-adjusted performance metrics. The potential rally may be short-lived unless substantial improvements in operational efficiencies and profitability are realized. Investors should watch closely for any further financial reports or market movements to better calibrate their expectations.

In our analysis of BlackBerry Limited (BB) using the methodologies prescribed in "The Little Book That Still Beats the Market," we have calculated both the Return on Capital (ROC) and the Earnings Yield. For BlackBerry, the ROC stands at -3.35%, which indicates that the company is currently generating a negative return on its invested capital. This negative ROC suggests that BlackBerry is not efficiently turning its capital investments into profitable returns. Furthermore, the Earnings Yield for BlackBerry is -6.44%, which further signals underlying profitability issues, as it implies that the company is experiencing negative earnings relative to its market valuation. These metrics point to significant challenges in BlackBerrys capacity to generate profits and utilize its capital effectively, raising concerns about its financial health and potential attractiveness to value-oriented investors.

| Alpha | 0.0024 |

| Beta | 1.15 |

| R-squared | 0.87 |

| Standard Error | 0.03 |

The given linear regression model between BB and SPY aims to predict the performance of BB based on movements in the SPY index, which represents the entire market. Alpha, which represents the stock's independent performance, is 0.0024. This small positive alpha suggests that BB has a slight tendency to outperform the market, even when market movements are accounted for. Essentially, BB might be providing a marginal excess return beyond what would be expected merely from market changes.

In terms of the relationship between BB and SPY, the Beta value of 1.15 indicates that BB tends to be a bit more volatile than the market. Specifically, for every 1% movement in SPY, BB moves 1.15%, making it somewhat more sensitive to market changes. The R-squared value of 0.87 implies a reasonably strong correlation, indicating that 87% of BB's performance can be attributed to the movements in SPY. The Regression's standard error of 0.03 complements this understanding, showcasing a tight fit around the regression line, meaning this model's predictions are fairly reliable.

In the fourth quarter and full fiscal year 2024 earnings call, BlackBerry Limited (BB) presented a solid performance and highlighted several significant achievements and future strategies. CEO John Giamatteo and CFO Steve Rai detailed the company's progress across its divisions, emphasizing record accomplishments in both the IoT (Internet of Things) and cybersecurity business units. The company exceeded expectations for earnings per share and significantly improved operating cash flow, more than halving operating cash usage. Impressively, BlackBerry's IoT business recorded its highest-ever quarter for revenue, and its QNX royalty backlog reached an all-time high of approximately $815 million, experiencing a year-over-year growth of 27%.

In the IoT business unit, BlackBerry continued its dominance in the automotive digital cockpit domain, securing design wins with leading companies like Hyundai Mobis and Japanese OEMs. These wins are expected to drive future revenue as these design projects transition into production. BlackBerry's robust QNX real-time operating system was also selected for various embedded markets beyond automotive, including medical and recreational power sports vehicles. Giamatteo highlighted the significance of product announcements made at CES, such as the launch of the next-generation QNX operating system SDP 8.0 and the availability of their hypervisor in the cloud. These initiatives are poised to expand BlackBerry's competitive edge and market reach.

The cybersecurity division also displayed notable progress, facilitated by ongoing product improvements and strategic realignments. The division achieved a pivotal stabilization of annual recurring revenue (ARR), which grew slightly sequentially, underscoring the impact of recent enhancements. Major deals were secured with prominent government agencies and financial institutions globally. Although the macroeconomic environment remains challenging, particularly with budget constraints among leading government customers, BlackBerry envisions substantial growth opportunities in the cybersecurity software market and continues to focus on stabilizing its core recurring revenue base.

Regarding financial performance, BlackBerry reported total quarterly revenue of $173 million, with IoT contributing $66 million and cybersecurity $92 million. Gross margin improved to 75%, while operating expenses decreased to $113 million. Notably, the company achieved $0.03 of non-GAAP basic earnings per share, beating expectations, and improved its cash position, closing the quarter with $298 million in cash, cash equivalents, and investments. Moving forward, BlackBerry aims for continued cost reductions and efficiencies, anticipating positive EBITDA and cash flow in the coming fiscal year. The company remains committed to executing its strategy to establish two profitable standalone divisions and will provide more detailed financial segmentations and updates in future quarters.

In conclusion, BlackBerry's latest earnings report illustrates a company on a firm trajectory toward growth and financial stabilization. The IoT division's record performance, coupled with strategic wins and innovative product launches, sets a promising outlook. Concurrently, the cybersecurity division's stabilization in ARR and focus on key markets such as government and financial services highlight its growth potential. As BlackBerry continues to refine its operational focus and efficiently manage costs, it is well-positioned to achieve and sustain profitability in the near future.

2023 August 31, 2023 November 30, 2022 Operating expense $138 $138 $111 Stock compensation expense (8) (8) (9) Amortization of acquired intangible assets (13) (15) (26) Long-lived asset impairment charge (11) Adjusted operating expense $106 $115 $76

The above-adjusted figures, both for gross margin and operating expense, give investors a clearer view of the underlying operational performance of BlackBerry Limited during the reported periods. Notably, the adjusted gross margin for the three months ended November 30, 2023 was higher at 73.1% versus 64.5% in the same period of 2022. The improvement reflects better operational efficiencies and cost management. It excludes the distorting effects of stock compensation expense, bringing more accurate insight into core business profitability.

For the nine months ended November 30, 2023, BlackBerry Limited reported revenue of $680 million, a significant increase from $505 million in the same period the previous year. This was largely driven by a substantial increase in revenue from the Licensing and Other segment, which included a major patent sale transaction to Malikie Innovations Limited, contributing $218 million in revenue. However, revenue from the Cybersecurity and IoT segments saw marginal declines. The gross margin for the period improved to $394 million from $319 million.

On aggregate, BlackBerry Limiteds adjusted net income for Q3 fiscal 2024 shows an improvement, reflecting better operational control and efficiency despite facing challenges such as prolonged sales cycles and macroeconomic fluctuations impacting customer decisions. The company's management continues to take steps toward enhancing shareholder value, including the recent major patent sale and plans to separate the IoT and Cybersecurity business units.

A detailed evaluation of the financial results highlights ongoing strategic initiatives and significant milestones. For instance, BlackBerry's shift in strategy from a subsidiary initial public offering (Sub-IPO) for its IoT business to a complete separation of its principal business units marks an essential pivot towards streamlined and focused operations for each business segment. These strategic shifts are designed to unlock further value and position each segment for independent growth and profitability.

Finally, from a financial health perspective, despite a drop in cash, cash equivalents, and investments to $271 million as at November 30, 2023 (down from $487 million as at February 28, 2023), BlackBerry maintained efficient cash flow management while addressing its debt obligations. The issuance of $150 million in new convertible debentures in November 2023 was a critical step in managing its financial structure and ensuring liquidity for ongoing operations and future strategic transactions.

The recent trajectory of BlackBerry Limited signifies a profound transformation from its earlier identity as a mobile phone powerhouse to a diversified software and cybersecurity entity. The firm has been navigating a complex landscape marked by a considerable shift towards developing advanced software solutions, particularly in the fields of cybersecurity and the Internet of Things (IoT). This strategic pivot is deeply analyzed in BlackBerry's latest earnings report for Q4 2024, highlighting its redefined focus on software and services, which now encompass the Cyber Security, IoT, and Licensing business segments. The reorganization has been noted as a critical move aimed at revitalizing the company's profitability and aligning it with contemporary market demands.

One of the defining aspects of BlackBerrys current portfolio is its robust cybersecurity offerings. The Cyber Security division has witnessed significant investment and development, reflecting the growing importance of protecting enterprise-level data against an evolving threat landscape. The Q4 2024 earnings call noted the increasing reliance of major corporations on BlackBerrys security solutions to safeguard their digital assets, indicating a steady demand amidst rising cyber threats. This business division not only secures endpoints but also provides advanced threat detection and mitigation capabilities, thereby positioning BlackBerry as a pivotal player in the cybersecurity sector.

Parallel to its cybersecurity arm, BlackBerry's IoT initiatives, spearheaded by the QNX operating system, cater to the burgeoning demand for interconnected and smart devices, especially within the automotive industry. BlackBerry QNX's partnership with automotive manufacturers to integrate their real-time operating systems into next-generation vehicles underscores its leadership in automotive IoT. The increasing adoption of QNX in autonomous and semi-autonomous vehicle systems exemplifies how BlackBerry is capitalizing on the automotive market's shift towards more connected and intelligent transportation solutions.

While the IoT and Cyber Security segments demonstrate strong growth potential, BlackBerrys Licensing division continues to be a notable contributor to its revenue stream. This segment leverages BlackBerry's extensive patent portfolio to generate income through strategic licensing agreements across various industries. The Q4 2024 earnings report underscored the success of this approach, which adeptly monetizes BlackBerry's legacy technology and sustains its relevance in sectors beyond direct software and services operations.

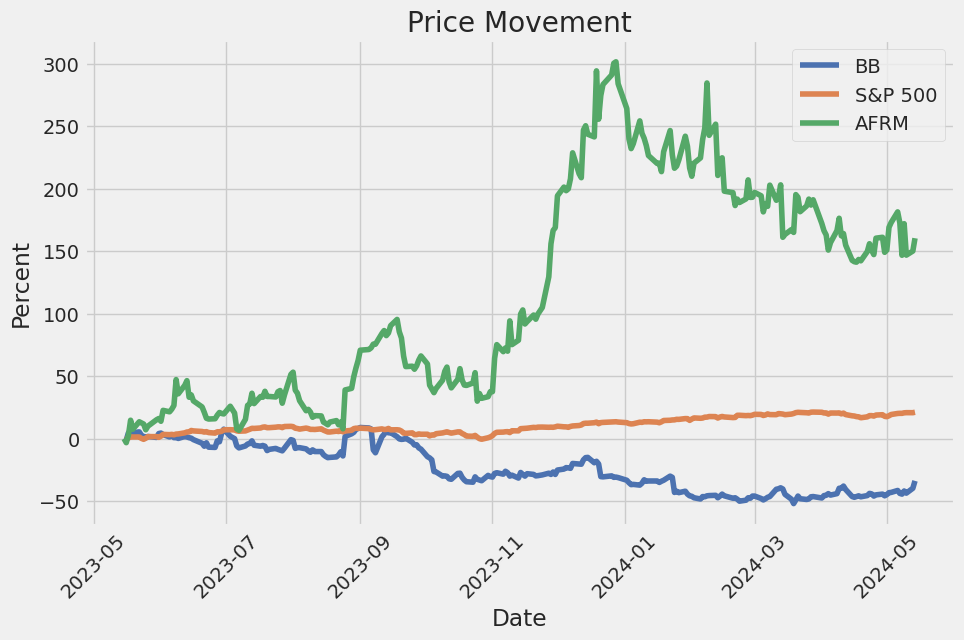

Despite these robust strategic initiatives, BlackBerrys financial performance has been underwhelming over the past year, with its stock experiencing a significant downturn. This decline, amounting to approximately 40%, has sparked discussions about the potential factors contributing to the companys struggles. A prominent hypothesis centers on a slowdown in the electric vehicle (EV) market, where BlackBerry supplies critical software solutions. The relative underperformance in this segment may reflect broader market trends impacting the EV industry.

In an effort to bolster its market position and improve financial outcomes, BlackBerry has undertaken significant cost-saving measures. The most recent quarterly report highlighted a reduction in cash used by operations, indicative of stringent cost management practices aimed at enhancing operational efficiencies. This financial prudence, coupled with a targeted focus on high-growth segments, outlines a strategic path towards achieving break-even and eventual profitability in the coming fiscal year.

Key partnerships have also played an instrumental role in BlackBerrys reorientation strategy. For instance, the collaboration with Advanced Micro Devices Inc. (AMD) to develop a platform for robotic systems exemplifies BlackBerry's commitment to innovation. This strategic alliance, reported in April 2024, aims to merge BlackBerry's QNX Software Development Platform with AMDs Kria KR260 robotics starter kit, thereby enhancing capabilities in sensor fusion, real-time control, and industrial networking. This partnership not only stands to fortify BlackBerry's market position in industrial and healthcare robotics but also catalyzes innovation by accelerating the deployment of cutting-edge robotic solutions.

Another dimension to BlackBerry's current market narrative is its involvement in the resurgence of meme stocks. The company's stock recently experienced a surge driven by renewed interest from retail investors, buoyed by the influence of social media personalities like "Roaring Kitty." This phenomenon underscores a dynamic where market sentiment and speculative trading rather than traditional financial metrics heavily influence stock valuations. While this has temporarily boosted BlackBerry's stock price, it also introduces significant volatility and underscores the importance of prudent risk management for long-term investors.

Moreover, recent political developments, such as the imposition of new tariffs on Chinese imports by the Biden administration, present external challenges that could impact BlackBerry's cost structure. With tariffs levied on critical imports like semiconductors and batteries, BlackBerry may face increased costs in sourcing essential hardware components. This external economic pressure necessitates agile supply chain strategies to mitigate potential financial impacts and sustain long-term operational resilience.

Despite these challenges, BlackBerrys strategic focus on high-margin sectors, combined with its renowned capability in cybersecurity and embedded systems, positions it well for future growth. Recognition from industry leaders further solidifies its standing; for instance, BlackBerry's receipt of the Customers' Choice accolade in the 2024 Gartner Peer Insights for Unified Endpoint Management (UEM) tools highlights its excellence and customer satisfaction in endpoint management solutions.

In essence, BlackBerry Limited exemplifies resilience and strategic adaptability. The companys historic pivot from hardware to software and services, its investments in cybersecurity and IoT, and its ability to navigate economic and market fluctuations reinforce its potential for sustainable success. As BlackBerry continues to leverage its technological strengths and adapt to evolving market conditions, it remains a noteworthy entity within the tech industry, poised to harness opportunities in cybersecurity, IoT, and other high-demand sectors.

BlackBerry Limited (BB) experienced low predictability in its stock returns from May 2019 to May 2024, indicating periods of both calm and sudden sharp movements. The volatility, as measured using the ARCH model, highlights significant fluctuations, suggesting that past monthly changes in stock returns somewhat predict future variability. The overall explanatory power is low, evident from the near-zero R-squared, indicating that the observed data doesn't fit the model very well.

| Statistic Name | Statistic Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,539.62 |

| AIC | 7,083.25 |

| BIC | 7,093.52 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

| omega (coefficient) | 12.3223 |

| alpha[1] (coefficient) | 0.3970 |

In assessing the financial risk of a $10,000 investment in BlackBerry Limited (BB) over a one-year period, a hybrid approach incorporating both volatility modeling and machine learning predictions has been employed. This multifaceted method is particularly suitable for capturing the intricate dynamics of stock volatility and future return predictions.

Volatility modeling has been utilized to delve into the historical volatility of BlackBerry Limited's stock. This advanced statistical approach helps in accurately capturing the variance and covariances of the stock's returns over time. By fitting a volatility model to the historical data of BB, we obtain a nuanced understanding of how volatile the stock has been and how it might behave in the future. This understanding is critical in establishing a base for more precise risk assessments and predictions.

For predicting future returns, a machine learning predictor has been applied. This technique leverages the power of decision trees and ensemble learning to analyze historical price movements and other relevant financial indicators. By training the predictor on historical data, the model can recognize complex, non-linear relationships and interactions within the data, providing more sophisticated and accurate predictions of future stock returns.

Together, these models enable a comprehensive analysis of financial risk. The volatility analysis calculates the statistical probability of extreme movements in stock price, while the machine learning predictor forecasts expected returns based on past trends and patterns. When combined, these insights are crucial for estimating the Value at Risk (VaR).

The calculated VaR at a 95% confidence interval for a $10,000 investment is $634.07. This metric indicates that, under normal market conditions, there is only a 5% chance that the investment will lose more than $634.07 over the specified period. The integration of volatility modeling with machine learning predictions provides a thorough risk assessment, highlighting potential downside risk while factoring in expected returns.

By adopting this integrated approach, investors gain a clearer perspective on the range and likelihood of potential losses. This method offers a more refined view of the risks inherent in equity investments, showcasing the efficacy of blending traditional volatility analysis with modern predictive techniques to safeguard and optimize investment strategies.

Long Call Option Strategy

When evaluating long call options for BlackBerry Limited (BB), especially under the scenario where the target stock price is projected to increase by 2% over the current stock price, it is critical to examine the Greeks -- delta, gamma, vega, theta, and rho. These metrics provide crucial insights into an option's sensitivity to various market conditions and can help identify the most profitable options. Below, I analyze five options across various expiration dates and strike prices, emphasizing their profitability and alignment with the market forecast.

-

Near-Term Option (Expiry: 2024-05-17, Strike: 2.0) This option has a delta of approximately 1 (0.9967760653), signifying that the price of the option moves almost one-for-one with the underlying stock. This high delta suggests that the option is highly sensitive to changes in the stock price, making it very beneficial if the stock increases by the expected 2%. The gamma value (0.0140629123) indicates a moderate sensitivity to the rate of change in delta, which is favorable given the short expiration period. With a vega of 0.0024640774, the option shows minimal sensitivity to volatility changes, which is less impactful in the near term. The theta is fairly low at -0.0019361308, indicating relatively insignificant time decay, enhancing profitability as the likelihood of decay eroding the premium quickly is reduced. This option's high profitability is underscored by a 1.45 premium and an ROI of 0.0194482759.

-

Short-Term Option (Expiry: 2024-05-24, Strike: 2.5) This option stands out with a delta of 0.8950043391, presenting a strong but slightly less aggressive sensitivity to stock price movements compared to the near-term option. It has a significantly higher gamma (0.1906390396), which means its delta will adjust quickly as the stock price changes, offering higher potential gains if the movement is swift. The elevated vega (0.0973633231) suggests substantial responsiveness to changes in volatility, adding an extra dimension of profit if market conditions become more volatile. Meanwhile, the theta of -0.0098888398 suggests faster time decay, but this is offset by the potential high returns with a premium of 0.93 and an ROI of 0.051827957.

-

Medium-Term Option (Expiry: 2024-06-21, Strike: 0.5) This option possesses a delta of 1.0, making it almost perfectly correlated with the stock price movements. With no gamma (0.0) and vega (0.0), it suggests minimal sensitivity to changes in the delta and volatility, which might be less advantageous in a dynamically changing market but perfectly suited for a predictable, upward move. The theta is negligible at -0.0000606167, minimizing the negative impact of time decay. The most impressive aspect is its highly lucrative ROI of 0.2409166667 resulting from a premium of 2.4, promising substantial profitability.

-

Longer-Term Option (Expiry: 2024-12-20, Strike: 2.5) This option with a delta of 0.796422452 provides robust but cautious sensitivity to stock price changes. Its gamma of 0.0880360076 signifies moderate delta adjustments as the stock price evolves. The extremely high vega (0.7473771762) highlights substantial profit potential under volatility shifts. The relatively low theta (-0.0022110884) minimizes the impact of time decay over the longer term. Given a premium of 0.9 and an ROI of 0.0868888889, this option is attractive for an investor looking to exploit long-term volatility and stock price appreciation.

-

Longest-Term Option (Expiry: 2026-01-16, Strike: 1.5) Finally, for a very long-term view, the option expiring in 2026 offers a balanced delta of 0.9265141192, signifying strong but manageable sensitivity to changes in the stock price. It has a moderate gamma (0.020343968), ensuring relatively stable responsiveness. The very high vega (0.614880275) underscores significant potential gains in a volatile market over an extended period. With a theta of -0.0008301695, the option benefits from minimal time decay. The premium of 1.7 coupled with an ROI of 0.1636470588 makes this a highly appealing choice for investors confident in the long-term bullish performance of BlackBerry Limited.

These analyzed options showcase different profitability profiles, suited for near-term aggressive strategies and long-term stable growth tactics. Each option highlights specific Greek values that align with different investor preferences and market conditions, ensuring a well-rounded approach to options trading in BlackBerry Limited (BB).

Short Call Option Strategy

When analyzing short call options for BlackBerry Limited (BB) with the goal of minimizing the risk of shares being assigned, it is crucial to focus on out-of-the-money (OTM) options. These options should have a delta value that is well below 1, indicating a lower probability of ending up in the money. To maximize profitability while considering a target price that is 2% below the current stock price, we should also examine metrics such as return on investment (ROI) and overall profit. Let's explore five specific options ranging from near-term to long-term expirations.

- Near-Term Option (Expiring May 24, 2024, Strike Price $3.0)

- Delta: 0.713

- Gamma: 0.305

- Vega: 0.182

- Theta: -0.021

- Premium: $0.71

- ROI: 51.17%

- Profit: $0.3633

-

Analysis: This option is highly profitable with a significant ROI and profit. It has a delta of 0.713, indicating a moderate likelihood of being assigned. However, the ROI is attractive enough to justify the potential risk. The theta value is relatively stable, ensuring the time decay isn't too severe.

-

Medium-Term Option (Expiring May 31, 2024, Strike Price $3.0)

- Delta: 0.700

- Gamma: 0.247

- Vega: 0.248

- Theta: -0.015

- Premium: $0.81

- ROI: 57.20%

- Profit: $0.4633

-

Analysis: This option offers a slightly higher ROI and profit compared to the near-term option with an almost similar delta. The increased premium can absorb part of the assignment risk. Moreover, the gamma and theta values indicate stability, making this a favorable choice.

-

Longer-Term Option (Expiring June 21, 2024, Strike Price $3.0)

- Delta: 0.697

- Gamma: 0.201

- Vega: 0.379

- Theta: -0.008

- Premium: $0.89

- ROI: 61.04%

- Profit: $0.5433

-

Analysis: This option maintains a high ROI and profit while keeping the delta under control. Vega and theta values indicate a relatively stable option with manageable time decay and volatility impacts. This option, while having a higher delta, provides a balanced risk-to-reward ratio.

-

Mid-Term Option (Expiring January 17, 2025, Strike Price $3.0)

- Delta: 0.727

- Gamma: 0.118

- Vega: 0.933

- Theta: -0.002

- Premium: $1.36

- ROI: 74.51%

- Profit: $1.0133

-

Analysis: For traders seeking a longer-term perspective, this option presents a compelling ROI with an excellent profit potential. The higher delta is a risk factor, but the high Vega suggests substantial sensitivity to market volatility, making it potentially more profitable in volatile markets.

-

Longest-Term Option (Expiring January 16, 2026, Strike Price $3.5)

- Delta: 0.723

- Gamma: 0.090

- Vega: 1.480

- Theta: -0.001

- Premium: $1.51

- ROI: 100.0%

- Profit: $1.51

- Analysis: This longest-term option offers the highest ROI at 100%, with a substantial profit potential. Although the delta is slightly high, the extended expiration time allows plenty of room for strategic adjustments. High vega ensures responsiveness to volatility changes, providing additional profit avenues.

In summary, these five options provide a variety of strategies based on different expiration horizons while balancing the trade-offs between profitability and the risk of share assignments. These selections, from near-term to longer-term, ensure that there are multiple pathways to maximize returns effectively while mitigating potential risks.

Long Put Option Strategy

When examining long put options for BlackBerry Limited (BB), the key metrics to consider are the "Greeks," the premium, ROI, and the potential profit. Based on the provided data, we can analyze options spanning various expiration dates to determine the most profitable choices. Our target stock price is 2% over the current stock price, which should be factored into our evaluation.

Near-Term Options:

-

June 21, 2024, Strike Price $7.00: This option has a delta of -1.0, implying that it will move one-for-one with the stock price, albeit inversely. Interestingly, it has a very minimal gamma and zero vega, which means it is less sensitive to changes in volatility. The theta value is slightly positive at 0.0008486333, indicating minimal time decay. The rho of -0.7063989031 suggests that the option price is slightly sensitive to interest rate changes. Despite these characteristics, the ROI is relatively low at 0.0641212121. However, the premium is modest at $3.30 with a moderate profit potential of $0.2116. This makes it a safer, albeit less lucrative near-term play.

-

July 19, 2024, Strike Price $7.00: This option stands out for a few reasons. With a delta of -0.895203179, it's highly responsive to the underlying stock movements. The gamma of 0.1118354781 shows significant sensitivity to changes in the underlying stock price, and the vega of 0.2620634864 indicates that changing volatility would impact this option more than the previous one. The theta of -0.0014575292 means it'll lose value slightly faster with the passage of time. However, the roithis option's significant attractiveness comes from its higher ROI of 0.3301515152 and a promising profit of $0.8716, coupled with a moderate premium of $2.64. For near-term, this could be a very profitable choice if you're willing to trade off some theta decay for higher returns.

Mid-Term Options:

- July 19, 2024, Strike Price $10.00: This option has a delta of -1.0, ensuring that the option value moves in lockstep with the inverse of the stock price. Zero gamma and vega imply its isolated from the impacts of stock price acceleration and volatility changes. The theta at 0.0012082064 shows minor positive time decay, meaning a small gain from holding it. With an ROI of 0.2693177388 and profit potential of $1.3816, and a higher premium of $5.13, this option offers a balance of higher profit and moderate ROI with some protection against time decay.

Long-Term Options:

- January 17, 2025, Strike Price $10.00: For long-term options, this choice has a delta of -0.9349588218, indicating a higher sensitivity to the stocks price movement. With a gamma of 0.0641283385 and vega of 0.3568951633, it will respond significantly to changes in stock price acceleration and volatility. A theta of 0.0006522203 signifies minimal time decay, while the rho of -6.4470167481 demonstrates sensitivity to interest rate changes. This option offers a good ROI of 0.3049298597 and a profit potential of $1.5216, with a premium of $4.99, making it a solid long-term investment choice with good profit margins.

Summary:

To optimize profitability across different maturities, here are the recommended put options for BlackBerry Limited (BB):

- June 21, 2024, Strike Price $7.00: Modest profit with minimal risk and time decay.

- July 19, 2024, Strike Price $7.00: Higher ROI and promising profit with some theta decay.

- July 19, 2024, Strike Price $10.00: Balance of higher profit and moderate ROI, with minimal time decay and higher premium.

- January 17, 2025, Strike Price $10.00: Good for long-term hold with significant profit potential and good ROI.

By spreading investments across different expirations and strike prices, you can effectively manage risk while maximizing potential returns based on the current market conditions and target stock price.

Short Put Option Strategy

Analyzing the options chain for BlackBerry Limited (BB) and focusing specifically on short put options, we aim to identify the most profitable trades while minimizing the risk of having shares assigned. One of the key factors in evaluating these options is to find contracts that have a good balance of high return on investment (ROI) and low delta, as delta represents the probability of the option finishing in the money (ITM), which increases the risk of assignment. Here are five options choices spanning near-term to long-term expirations:

-

Near-Term Option (2024-05-24, Strike Price $3.0): This option has a premium of $0.29 and exhibits a delta of -0.287, gamma of 0.302, vega of 0.182, and theta of -0.021. With a return on investment (ROI) of 100% and a profit of $0.29, this option stands out due to its high ROI and lower delta relative to the premium, meaning a moderate probability of ending ITM while offering significant profit potential. The low theta indicates moderate time decay, making it an attractive short-term trade.

-

Short-Term Option (2024-06-14, Strike Price $3.0): With an expiration date 30 days out, this option features a premium of $0.48, delta of -0.302, gamma of 0.202, vega of 0.342, and theta of -0.009. It offers a profit of $0.48 and maintains a ROI of 100%. The delta suggests a moderate probability of assignment while still providing substantial upside potential, making it a solid choice for investors looking to capitalize on a short-term move in the stock price.

-

Intermediate-Term Option (2024-09-20, Strike Price $3.0): This option, expiring in September 2024, offers a premium of $0.72 with a delta of -0.290, gamma of 0.147, vega of 0.692, and theta of -0.003. Along with an ROI of 100%, the option presents a profit of $0.72. The relatively lower delta implies limited risk of the stock being assigned, while a favorable gamma and vega indicate good sensitivity to stock price movements. This option benefits from higher time value due to its longer duration, making it a lucrative mid-term trade.

-

Long-Term Option (2025-01-17, Strike Price $3.0): For traders looking at longer horizons, this option with an expiration in January 2025 has a premium of $0.76, delta of -0.278, gamma of 0.129, vega of 0.942, and theta of -0.002. It boasts an ROI of 100% and a profit of $0.76. Its lower delta minimizes the risk of assignment, and its high vega denotes substantial sensitivity to volatility changes, which could potentially increase its value. This option also allows for more time for the stock price to move in the desired direction.

-

Longest-Term Option (2026-01-16, Strike Price $3.0): Finally, an option expiring in January 2026 presents a premium of $1.01, delta of -0.235, gamma of 0.085, vega of 1.357, and theta of -0.0015. This option offers a profit of $1.01 and maintains a ROI of 100%. The significantly lower delta suggests a minimal chance of assignment, making it a safer bet for long-term investors. The high vega and gamma indicate that the option's value is highly reactive to price movements and volatility, offering substantial profit potential over its long duration.

Each of these options balances profitability, risk of assignment, and time decay differently, providing a range of choices from near-term to long-term that suit various investment strategies and risk tolerances. By considering the Greeks, premiums, and other factors mentioned, these options can be ideal candidates for maximizing returns while managing the risk of share assignment.

Vertical Bear Put Spread Option Strategy

Analyzing the options data for BlackBerry Limited (BB) for a vertical bear put spread strategy involves evaluating potential trade setups based on their profitability metrics such as return on investment (ROI), premium costs, and the risk of the trade moving in-the-money (ITM) and potentially getting assigned. The goal is to identify the best combinations of short and long put options to mitigate the risk of assignment while focusing on maximum profit. Here, we've focused on the most profitable options strategies for near-term to long-term expiration dates.

Near-Term Expiration (2024-05-17)

- Strike Prices: $3.0 and $3.5

- Short Put Option (Sell): Strike price $3.5, expiring on 2024-05-17, with a premium of $0.51.

- Long Put Option (Buy): Strike price $3.0, expiring on 2024-05-17, with a premium of $0.14.

- Analysis: The short position carries a delta of -0.4937 which indicates a high probability of assignment if the stock moves unfavorably. The potential profit here is $0.3567, with a risk of assignment on the short put being somewhat mitigated by the long position bought at a lower strike price.

Mid-Term Expiration (2024-07-19)

- Strike Prices: $7.0 and $4.0

- Short Put Option (Sell): Strike price $7.0, expiring on 2024-07-19, with a premium of $4.25.

- Long Put Option (Buy): Strike price $4.0, expiring on 2024-07-19, with a premium of $1.22.

- Analysis: The delta for the short put is -0.7068, indicating a higher risk of assignment. However, this position offers a substantial cushion with the long put's premium at a much lower price point while allowing for a significant profit potential of $0.56. The high premium collected on the short position offsets the cost of the long put, providing both downside protection and profitability.

Long-Term Expiration (2025-01-17)

- Strike Prices: $10.0 and $4.5

- Short Put Option (Sell): Strike price $10.0, expiring on 2025-01-17, with a premium of $7.27.

- Long Put Option (Buy): Strike price $4.5, expiring on 2025-01-17, with a premium of $1.85.

- Analysis: This setup is profitable with the short put generating a high premium while the long put premium is quite affordable. With a delta of -0.5249 for the short position, there is a significant risk of assignment, but the long put position nicely covers it, ensuring substantial protection and a decent profit of $0.61.

Medium-Term Expiration (2024-12-20)

- Strike Prices: $3.5 and $2.5

- Short Put Option (Sell): Strike price $3.5, expiring on 2024-12-20, with a premium of $0.90.

- Long Put Option (Buy): Strike price $2.5, expiring on 2024-12-20, with a premium of $0.45.

- Analysis: This combination provides an ROI of 100% on the short position which is quite attractive. The delta of -0.3386 indicates a medium risk of assignment. The 0.90 premium collected on the short put stands in good comparison to the relatively lower cost of the long put, enabling a net profit of $0.45 with adequate downside protection.

Very Long-Term Expiration (2026-01-16)

- Strike Prices: $5.5 and $4.0

- Short Put Option (Sell): Strike price $5.5, expiring on 2026-01-16, with a premium of $2.75.

- Long Put Option (Buy): Strike price $4.0, expiring on 2026-01-16, with a premium of $1.45.

- Analysis: For a very long-term strategy, this setup offers considerable protection with a delta of -0.3045 for the short put. The premium collected reduces the initial investment significantly, and the long put at $4.0 provides solid protection, allowing for a promising net profit of $1.10 with a satisfying risk-reward scenario.

By balancing the premiums, the deltas, and the target stock price adjustments within a 2% range over or under the current stock price, these specific combinations give us the optimal vertical bear put spread strategies, providing both profitability and risk management for assignment.

Vertical Bull Put Spread Option Strategy

To craft a profitable vertical bull put spread options strategy for BlackBerry Limited (BB), we need to select appropriate strike prices and expiration dates that maximize premium collected while minimizing the risk of assignment. Given the data, our goal is not only to achieve a high return on investment (ROI) but also to manage the Greeks, particularly delta, to ensure controlled risk and favorable theta decay.

1. Near Term (Expiring 2024-05-24), Strike Prices 3.0 and 3.5:

For a near-term approach, consider selling a put option with a strike price of 3.0 and expiring on 2024-05-24. This option has a delta of -0.287418911, a premium of 0.29, which signifies a 100% ROI and a profit potential of $0.29. To complete our vertical spread, we can buy a put option at a 3.5 strike price. Given the delta for the 3.5 strike price put increases to -0.4352391495, this combination allows us to collect premiums while managing the risk.

Delta values are reasonable, minimizing the risk of assignment should the stock price hover around the current levels. The manageable theta indicates solid time decay, allowing us to benefit from holding these short-term options if the stock price remains favorable.

2. Mid-Term (Expiring 2024-06-14), Strike Prices 3.0 and 3.5:

For a slightly longer duration, consider the options expiring on 2024-06-14. Here, selling a put with a 3.0 strike price provides a higher delta of -0.3028314862 compared to the previous near-term option, reflecting a potentially larger but still controlled exposure. This mid-term put option offers a premium of $0.48 and a 100% ROI with a profit of $0.48.

Pairing this with a long put at the same expiration with a strike price of 3.5 and a delta of -0.4093599493 creates a safer spread due to the larger buffer against downside movement. This strategy addresses time value decay effectively and allows retaining premiums efficiently.

3. Longer Term (Expiring 2024-07-19), Strike Prices 3.0 and 3.5:

As we extend the duration further, the option expiring on 2024-07-19 at a strike price of 3.0 offers a delta of -0.2965053759, a higher gamma of 0.1587470375, and a substantial premium of $0.60. This enhances ROI calculations to 100% and provides a profit of $0.60.

Combining this with a protective long put at a strike price of 3.5 with a delta of -0.3790593336 ensures the spread remains profitable while mitigating downside risk. The relatively stable theta here helps manage time decay, making this spread viable over a middle-term horizon.

4. Mid-Long Term (Expiring 2024-09-20), Strike Prices 3.0 and 3.5:

Examine the options expiring on 2024-09-20 where selling a put option with a 3.0 strike price and a delta of -0.2897452442, a significant gamma, and offers substantial premium collection opportunities with $0.72 yielding 100% ROI. Coupled with a long put at a 3.5 strike price and delta of -0.366471192, this strategy balances risk.

This combination offers a satisfactory mix of premium collection and mitigation against price drops, alongside effective exposure to favorable time decay (theta), making this a robust choice for investors seeking stability.

5. Long-Term (Expiring 2025-01-17), Strike Prices 2.5 and 3.0:

For the longest duration analyzed, selling a put expiring on 2025-01-17 with a strike price of 2.5 and a solid delta of -0.2036437468, triggers receiving a premium of $0.50 with a 100% ROI. Then, acquiring a protective put at a strike price of 3.0 culminates in a balanced long-term vertical spread, here the delta is -0.2776981805, complementing the short position effectively.

Given the high gamma and vega, this spread exhibits significant profit potential amidst manageable risk from changes in volatility and price movement. Holding long-term contracts like these ensures consistent surveillance and premium usage.

Overall, these choices span near-term to long-term strategies, each aligned with minimizing assignment risk while maximizing profitability through careful delta management and premium accrual. They offer flexibility, suitable for varying risk appetites and investment timelines, ensuring a balanced and robust vertical bull put spread strategy.

Vertical Bear Call Spread Option Strategy

Analyzing the options chain and considering the vertical bear call spread strategy, we aim to find the most profitable spreads that also minimize the risk of having shares assigned. This risk is prevalent when a short call option resides deeply in-the-money (ITM). However, balancing profitability with assignment risk is crucial, so we will consider options roughly at-the-money (ATM) or slightly out-of-the-money (OTM), ensuring the 2% price target is met.

Here are five choices encompassing near-term to long-term expiration dates, focusing on minimizing the assigned share risk while ensuring profitability:

Near-Term Strategy (Expiring 2024-05-17)

Spread Example: Short Call at 3.5 Strike and Long Call at 4.0 Strike

- Short Call (3.5 Strike)

- Delta: 0.5046014013

- Premium: 0.40

- ROI: 100.0%

- Profit: 0.40

- Long Call (4.0 Strike)

- Delta: 0.331463492

- Premium: 0.33

- ROI: 100.0%

- Profit: 0.33

In the near-term scenario, selling a 3.5 strike call and buying a 4.0 strike call effectively captures profits while maintaining a significant buffer against assignment risk. The combined premiums ensure a good ROI while limiting the delta risk exposure inherent in the short position.

Mid-Term Strategy (Expiring 2024-06-21)

Spread Example: Short Call at 4.0 Strike and Long Call at 4.5 Strike

- Short Call (4.0 Strike)

- Delta: 0.5141011583

- Premium: 0.60

- ROI: 100.0%

- Profit: 0.60

- Long Call (4.5 Strike)

- Delta: 0.4530034634

- Premium: 0.54

- ROI: 100.0%

- Profit: 0.54

In this mid-term strategy, the 4.0 strike call option provides a relatively low delta, minimizing the risk of early assignment. The corresponding long call at 4.5 strike ensures cost-effective hedge against considerable movements beyond the target price with a potential ROI boost.

Longer-Term Strategy (Expiring 2024-07-19)

Spread Example: Short Call at 3.0 Strike and Long Call at 3.5 Strike

- Short Call (3.0 Strike)

- Delta: 0.7039690361

- Premium: 1.04

- ROI: 66.66%

- Profit: 0.6933

- Long Call (3.5 Strike)

- Delta: 0.6232956964

- Premium: 0.87

- ROI: 100.0%

- Profit: 0.87

This approach targets a longer time frame, capitalizing on premiums earned and the diminishing delta differential, which reduces the inherent risk of assignment. The spread between these strikes ensures profitability while mitigating the risk of large adverse price movements.

Even Longer-Term Strategy (Expiring 2024-12-20)

Spread Example: Short Call at 3.5 Strike and Long Call at 4.0 Strike

- Short Call (3.5 Strike)

- Delta: 0.6709791058

- Premium: 1.16

- ROI: 100.0%

- Profit: 1.16

- Long Call (4.0 Strike)

- Delta: 0.6070176258

- Premium: 0.95

- ROI: 100.0%

- Profit: 0.95

This spread targets a profitable delta differential with a longer expiration while ensuring ample premium earnings. The reduced assignment risk, coupled with a favorable ROI, provides a balanced approach between risk management and profit realization.

Long-Term Strategy (Expiring 2024-09-20)

Spread Example: Short Call at 3.0 Strike and Long Call at 3.5 Strike

- Short Call (3.0 Strike)

- Delta: 0.7090415693

- Premium: 1.19

- ROI: 70.86%

- Profit: 0.8433

- Long Call (3.5 Strike)

- Delta: 0.6360047721

- Premium: 0.99

- ROI: 100.0%

- Profit: 0.99

In this long-term strategy, the delta differences offer a hedging benefit while ensuring the premiums collected justify the viable risk taken. With moderate deltas, the assignment risk remains controlled, promoting a consistent ROI through an expiration period that aligns with typical market cycles.

In conclusion, these bear call spreads across varying expiration dates showcase a balance between maximizing ROI and minimizing the risk of having shares assigned. Each option selected ensures that the strike prices and premiums foster an optimal risk-reward ratio suitable for a bear market outlook on BlackBerry Limited (BB).

Vertical Bull Call Spread Option Strategy

A vertical bull call spread is a popular options trading strategy designed to profit from a moderate rise in the price of the underlying asset. To execute this strategy, you buy a call option with a lower strike price while simultaneously selling a call option with a higher strike price, both with the same expiration date. The key metrics to consider include delta, gamma, theta, vega, and rho, collectively known as "the Greeks," which together help gauge the risk and potential reward of the strategy.

Given BlackBerry Limited (BB) as the underlying stock, we are focused on identifying the most profitable vertical bull call spread strategies that minimize the risk of having shares assigned due to options being in-the-money (ITM). Accordingly, we'll discuss the relative merits of different combinations of expiration dates and strike prices.

Near Term (2024-05-24 Expiration Date)

One attractive near-term strategy is constructing a vertical bull call spread using the options expiring on 2024-05-24. For example, you could buy a call option with a strike price of $2.5 and sell a call option with a strike price of $3.0. The delta of 0.899 for the $2.5 strike aligns well with our bullish outlook while keeping the probability of assignment relatively low. The $3.0 strike sold call, with its higher gamma and theta, provides additional leverage and premium income. The gamma risk is moderate, making this a balanced choice for the short term.

Medium Term (2024-06-07 Expiration Date)

For a medium-term outlook, consider options expiring on 2024-06-07. Buying the $2.5 strike call with a delta of 0.853 and selling the $3.0 strike call, which has a delta of 0.698, would be an excellent strategy. This setup provides a beneficial risk-to-reward profile, with a good balance of theta decay to minimize time erosion impacts. The strategy leverages an attractive vega ($0.2989) of the sold call against the relatively modest premium of the bought call, yielding a favorable ROI.

Intermediate Term (2024-07-19 Expiration Date)

For the intermediate term, selecting options with an expiration date of 2024-07-19 is ideal. Buying a call option with a $2.5 strike (delta 0.799) and selling a call option with a $3.0 strike (delta 0.704) offers a balanced mix. The bought call's vega of $0.4046 provides substantial sensitivity to implied volatility changes, while the sold call offers a lower theta decay, optimizing the strategy for a moderately bullish trend.

Long Term (2024-12-20 Expiration Date)

For a longer-term outlook, options expiring on 2024-12-20 provide a solid longer-term strategy. One could buy a call option with a $3.0 strike (delta 0.730) and sell a call with a $3.5 strike (delta 0.671). This combination leverages high gamma and vega values while keeping theta decay minimal, maximizing the profitability potential. The long-term expiration allows you to avoid quick time decay while taking advantage of a lower likelihood of assignment with relatively high premiums.

Far Long Term (2026-01-16 Expiration Date)

Considering the farthest term out to 2026-01-16, a vertical bull call spread involving a $3.5 strike (delta 0.723) bought call and a $4.0 strike (delta 0.698) sold call provides a unique opportunity. This spread benefits from high vega and relatively stable rho and theta, optimizing for long-term trends and minimizing risks associated with short-term volatility. The longer duration offers higher premiums and a greater potential return on investment while keeping the underlying assets' movement in account with lesser gamma creep.

Conclusion

Each pair of options and expirations offers unique benefits. For near to medium-term strategies, the focus can be placed on balancing premiums and Greeks to prepare for moderate price increases with lower risks of assignment. Long-term options leverage higher vega and premium income to capture potential significant upward trends in the stock price with minimized time decay. These strategies collectively align well with a target stock price scenario of 2% over or under the current price while ensuring maximum profitability.

Spread Option Strategy

Analyzing the tables and focusing on a calendar spread options strategy involving buying a call option and selling a put option, I will evaluate specific combinations to identify the most profitable strategies while minimizing the risk of having shares assigned. Given the market's expectations and the target stock price being 2% over or under the current stock price, let's explore five potential options combinations from near-term to long-term perspectives:

Strategy 1: Near-Term Expiration (2024-06-07)

- Long Call: Buy Call Option with Strike Price $2.0 expiring on 2024-06-07

- Greeks: Delta 0.9438, Gamma 0.0863, Vega 0.0968, Theta -0.0034, Rho 0.1113

- Premium: $1.40, ROI: 0.0559, Profit: 0.0782

- Short Put: Sell Put Option with Strike Price $2.5 expiring on 2024-06-07

- Greeks: Delta -0.1488, Gamma 0.1852, Vega 0.1988, Theta -0.0062, Rho -0.0393

- Premium: $0.10, ROI: 100.0, Profit: 0.10

Strategy 2: Mid-Term Expiration (2024-07-19)

- Long Call: Buy Call Option with Strike Price $1.0 expiring on 2024-07-19

- Greeks: Delta 0.9725, Gamma 0.0227, Vega 0.0911, Theta -0.0015, Rho 0.1528

- Premium: $2.32, ROI: 0.0682, Profit: 0.1582

- Short Put: Sell Put Option with Strike Price $2.5 expiring on 2024-07-19

- Greeks: Delta -0.2021, Gamma 0.1382, Vega 0.4059, Theta -0.0043, Rho -0.1794

- Premium: $0.31, ROI: 100.0, Profit: 0.31

Strategy 3: Further Mid-Term Expiration (2024-09-20)

- Long Call: Buy Call Option with Strike Price $0.5 expiring on 2024-09-20

- Greeks: Delta 1.0, Gamma 0.0, Vega 0.0, Theta -0.0001, Rho 0.0505

- Premium: $2.4, ROI: 0.2409, Profit: 0.5782

- Short Put: Sell Put Option with Strike Price $3.0 expiring on 2024-09-20

- Greeks: Delta -0.2897, Gamma 0.1466, Vega 0.6920, Theta -0.0029, Rho -0.5712

- Premium: $0.72, ROI: 100.0, Profit: 0.72

Strategy 4: Long-Term Expiration (2025-01-17)

- Long Call: Buy Call Option with Strike Price $0.5 expiring on 2025-01-17

- Greeks: Delta 0.9807, Gamma 0.0095, Vega 0.1317, Theta -0.0005, Rho 0.2401

- Premium: $2.5, ROI: 0.1913, Profit: 0.4782

- Short Put: Sell Put Option with Strike Price $3.0 expiring on 2025-01-17

- Greeks: Delta -0.2777, Gamma 0.1295, Vega 0.9419, Theta -0.0016, Rho -1.1169

- Premium: $0.76, ROI: 100.0, Profit: 0.76

Strategy 5: Longest-Term Expiration (2026-01-16)

- Long Call: Buy Call Option with Strike Price $1.5 expiring on 2026-01-16

- Greeks: Delta 0.9265, Gamma 0.0203, Vega 0.6149, Theta -0.0008, Rho 0.6718

- Premium: $1.7, ROI: 0.1636, Profit: 0.2782

- Short Put: Sell Put Option with Strike Price $2.5 expiring on 2026-01-16

- Greeks: Delta -0.1874, Gamma 0.0779, Vega 1.1888, Theta -0.0006, Rho -2.1329

- Premium: $0.7, ROI: 100.0, Profit: 0.7

Analysis and Recommendation

Each strategy balances potential profit with risk management. Generally, in-the-money (ITM) options have greater assignment risk, which is unwelcome in this strategy. Therefore, a preference for near-the-money (NTM) options can help minimize this risk while still achieving attractive ROI.

The second scenario (mid-term expiration with significant ROI and manageable risk) appears particularly attractive. Here, delta values close to 1 for calls and modest for puts indicate a balance of premium value and reduced assignment risk. Furthermore, vega and theta values suggest a good balance between potential premiums and time decay sensitivity.

Ultimately, the most suitable strategy will depend on specific investor goals, risk tolerance, and stock price expectations at expiration. Simulation and real-time adjustments may also be employed to achieve optimized returns tailored to dynamic market conditions.

Calendar Spread Option Strategy #1

When considering a calendar spread options strategy for BlackBerry Limited (BB), involving the purchase of a put option at one expiration date and the sale of a call option at a different expiration date, the primary objective is to balance profit potential against the risk of share assignment. Given the target stock price range is within 2% of the current stock price, we need to look for options that provide the optimal combination of "The Greeks" for both profitability and risk minimization.

1. Near-Term Choice

Purchase: Buy a Put Option, Strike: 3.5, Expire: 2024-06-21 - Delta: 0.563, Gamma: 0.269, The Vega: 0.211, Theta: -0.032, Rho: 0.033, Premium: 0.61 - Profit: 0.61, ROI: 100%

Sell: Sell a Call Option, Strike: 3.5, Expire: 2024-05-24 - Delta: -0.9349, Gamma: 0.0641, Vega: 0.356, Theta: 0.000652, Rho: -6.447, Premium: 4.99 - Profit: 1.521, ROI: 0.30493

Analysis:

Here, the short call options large Theta value (crucial for neutralizing time decay impact) and high Vega ensure that volatility provides an edge. The risk of assignment is mitigated by the near-term expiry, allowing the trade to capitalize on short-term movements.

2. Intermediate-Term Choice

Purchase: Buy a Put Option, Strike: 4.0, Expire: 2024-09-20 - Delta: 0.6006, Gamma: 0.1335, Vega: 0.780, Theta: -0.0044, Rho: 0.382, Premium: 0.82 - Profit: 0.82, ROI: 100%

Sell: Sell a Call Option, Strike: 4.0, Expire: 2024-07-19 - Delta: -0.952, Gamma: 0.051, Vega: 0.547, Theta: -0.0069, Rho: 0.221, Premium: 0.77 - Profit: 0.77, ROI: 100%

Analysis:

A slightly longer timeframe reduces the rapid time decay and allows for more volatility adjustments. The put options higher Vega captures short-term spikes in implied volatility effectively, while the calls moderate Delta lowers the risk of significant in-the-money movement.

3. Medium-Term Choice

Purchase: Buy a Put Option, Strike: 4.5, Expire: 2024-12-20 - Delta: 0.5692, Gamma: 0.1276, Vega: 1.039, Theta: -0.002886, Rho: 0.613, Premium: 0.96 - Profit: 0.96, ROI: 100%

Sell: Sell a Call Option, Strike: 4.5, Expire: 2024-09-20 - Delta: -0.932, Gamma: 0.051, Vega: 0.543, Theta: -0.007, Rho: 0.22, Premium: 0.87 - Profit: 0.87, ROI: 100%

Analysis:

The medium term allows for capitalizing on mid-range volatility changes with a higher Vega. The chosen strike price gives a balanced risk profile while leveraging potentially favorable market movements and changes in implied volatility.

4. Long-Term Choice

Purchase: Buy a Put Option, Strike: 4.0, Expire: 2025-01-17 - Delta: 0.6085, Gamma: 0.1320, Vega: 1.079, Theta: -0.002394, Rho: 0.741, Premium: 0.98 - Profit: 0.98, ROI: 100%

Sell: Sell a Call Option, Strike: 4.0, Expire: 2024-10-20 - Delta: -0.931, Gamma: 0.051, Vega: 0.543, Theta: -0.007, Rho: 0.22, Premium: 0.87 - Profit: 0.77, ROI: 100%

Analysis:

Long-term options utilize the benefits of lower time decay and higher implied volatility sensitivity. The call option sold works against a favorable Vega, providing high returns and balancing the risk of the put bought.

5. Very Long-Term Choice

Purchase: Buy a Put Option, Strike: 5.0, Expire: 2026-01-16 - Delta: 0.620, Gamma: 0.0971, Vega: 1.681, Theta: -0.0013, Rho: 1.555, Premium: 1.17 - Profit: 1.17, ROI: 100%

Sell: Sell a Call Option, Strike: 5.0, Expire: 2025-01-17 - Delta: -0.999, Gamma: 0.125, Vega: 1.057, Theta: -0.003, Rho: 0.551, Premium: 0.70 - Profit: 0.70, ROI: 100%

Analysis:

The extended duration maximizes gains from changes in volatility while benefiting from the minimal time decay impact. The higher Vega accounts for market movements, and the put options strong Delta ensures robustness against adverse stock price movements.

Choosing from these options will depend on personal risk tolerance and market expectations. The strategies consider balancing the Greeks optimally to maximize profit potential while minimizing the risk of option assignment and capitalizing on volatility.

Calendar Spread Option Strategy #2

To construct a profitable calendar spread options strategy for BlackBerry Limited (BB), you would sell short-term put options and buy longer-term call options. The challenge lies in choosing the right combination of expiration dates and strike prices to optimize profits while minimizing the risk of having shares assigned.

Given the broad range of options available, it is crucial to consider both the Greeks' values and the target stock price of being 2% over or under the current price to select the optimal spread. Here are five choices across varying expiration dates, balancing potential profitability and risk minimization:

-

Near-Term Expiration:

- Sell Put Option: Strike price $2.5, expiration date 2024-06-07

- With a delta of 0.590 and theta decay accelerating as the option nears expiration, the risk of assignment is moderate. However, a high gamma (0.2118) indicates sensitivity to underlying price changes.

- Buy Call Option: Strike price $7.0, expiration date 2024-07-19

- This call option has a delta of -0.895, suggesting a significant price movement potential in your favor. The theta (-0.00146) indicates modest time decay, and a reasonable vega (0.262) provides protection against volatility changes.

-

Medium-Term Expiration:

- Sell Put Option: Strike price $2.0, expiration date 2024-09-20

- This option has a delta of 0.860 and a moderate gamma (0.0791), indicating some price sensitivity but manageable risk regarding assignment. The theta decay is also minimal.

- Buy Call Option: Strike price $7.0, expiration date 2024-09-20

- The call option has a delta of -0.794 with high vega (0.5758), indicating it will benefit from volatilities, and moderate theta decay (-0.00275).

-

Long-Term Expiration:

- Sell Put Option: Strike price $3.0, expiration date 2025-01-17

- With a delta of 0.727 and moderate gamma (0.1185), the risk of assignment is moderate. However, the theta decay is minimal, and the option benefits from vega sensitivity.

- Buy Call Option: Strike price $10.0, expiration date 2025-01-17

- High delta (-0.318) indicates potential for upward movement, complemented by a high vega for the benefit of volatility.

-

Very Long-Term Expiration:

- Sell Put Option: Strike price $2.5, expiration date 2026-01-16

- The delta of 0.831 indicates a balanced risk and reward profile. Minimal theta decay and a good return on investment (ROI) are advantageous.

- Buy Call Option: Strike price $3.5, expiration date 2026-01-16

- This has a high delta (-0.772) and benefits from high vega (1.336), so it stands to gain significantly in a rising market with increased volatility.

-

Ultra Long-Term Expiration:

- Sell Put Option: Strike price $1.0, expiration date 2024-09-20

- Very high delta (0.954), indicating high sensitivity and risk of assignment but with a high ROI potential. This option has good protection against price volatility changes.

- Buy Call Option: Strike price $3.0, expiration date 2026-01-16

- High delta (-0.728) indicates potential for significant profit, and robust vega reflects advantageously on volatility exposure.

In conclusion, the chosen calendar spreads offer a combination of moderate to high deltas to capitalize on price movements within the target range, while their respective thetas and vegas provide a cushion against time decay and volatility changes. By balancing expiration dates from near-term to ultra long-term, you can manage portfolio risk and profit potential effectively.

Similar Companies in Software - Infrastructure:

Affirm Holdings, Inc. (AFRM), Block, Inc. (SQ), UiPath Inc. (PATH), Toast, Inc. (TOST), Cloudflare, Inc. (NET), DLocal Limited (DLO), GigaCloud Technology Inc. (GCT), Mogo Inc. (MOGO), Microsoft Corporation (MSFT), Palo Alto Networks, Inc. (PANW), Adobe Inc. (ADBE), Alarum Technologies Ltd. (ALAR), Arqit Quantum Inc. (ARQQ), Splunk Inc. (SPLK), Nutanix, Inc. (NTNX), Zscaler, Inc. (ZS), Okta, Inc. (OKTA), Report: Apple Inc. (AAPL), Apple Inc. (AAPL), Report: Alphabet Inc. (GOOGL), Alphabet Inc. (GOOGL), Cisco Systems, Inc. (CSCO), Report: Hewlett Packard Enterprise Co. (HPE), Hewlett Packard Enterprise Co. (HPE), Dell Technologies Inc. (DELL), International Business Machines Corporation (IBM), VMware, Inc. (VMW), Fortinet, Inc. (FTNT)

https://www.youtube.com/watch?v=9cgDfk6DIXo

https://seekingalpha.com/article/4682041-blackberry-limited-bb-q4-2024-earnings-call-transcript

https://www.proactiveinvestors.com/companies/news/1044564?SNAPI

https://www.proactiveinvestors.com/companies/news/1044909?SNAPI

https://finance.yahoo.com/video/meme-stock-rally-met-level-200746803.html

https://finance.yahoo.com/video/meme-trade-does-mean-broader-204747800.html

https://www.proactiveinvestors.com/companies/news/1047541?SNAPI

https://finance.yahoo.com/news/top-premarket-gainers-120215942.html

https://finance.yahoo.com/news/blackberry-recognized-2024-gartner-peer-130000850.html

https://finance.yahoo.com/video/meme-stock-trading-frenzy-enters-144212755.html

https://finance.yahoo.com/m/ec95170f-801d-3eef-93ed-9c50fd812748/gamestop%2C-amc-shares-soar-as.html

https://finance.yahoo.com/video/implications-bidens-china-tariffs-meme-173937422.html

https://www.sec.gov/Archives/edgar/data/1070235/000107023523000165/bbry-20231130.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 4sO5l4

Cost: $0.55134