Crown Castle Inc. (ticker: CCI)

2023-12-27

Crown Castle Inc. (CCI) operates as a real estate investment trust (REIT), specializing in the ownership, operation, and leasing of wireless infrastructure in the United States. The company primarily owns and manages an extensive network of cell towers, which are critical to the operations of wireless telecommunications service providers. Beyond towers, Crown Castle has expanded its portfolio to include a significant amount of small cell nodes, which are essential for enhancing network capacity in dense urban areas, and fiber optic cable networks that support both small cells and enterprise-level connectivity solutions. As of the latest financial reports, Crown Castle boasts a considerable footprint in the telecommunications infrastructure space, offering a mixture of long-term leases and recurring revenue streams from major telecom operators. The company's strategy focuses on accommodating the burgeoning demand for data and connectivity, anticipating that the continued rollout of 5G technology across the U.S. will drive further growth and investment opportunities for its infrastructure assets. With its focus on high-quality assets and strategic expansion, Crown Castle Inc. maintains a prominent position in the industry, often seen as a key enabler of wireless communication advancements.

Crown Castle Inc. (CCI) operates as a real estate investment trust (REIT), specializing in the ownership, operation, and leasing of wireless infrastructure in the United States. The company primarily owns and manages an extensive network of cell towers, which are critical to the operations of wireless telecommunications service providers. Beyond towers, Crown Castle has expanded its portfolio to include a significant amount of small cell nodes, which are essential for enhancing network capacity in dense urban areas, and fiber optic cable networks that support both small cells and enterprise-level connectivity solutions. As of the latest financial reports, Crown Castle boasts a considerable footprint in the telecommunications infrastructure space, offering a mixture of long-term leases and recurring revenue streams from major telecom operators. The company's strategy focuses on accommodating the burgeoning demand for data and connectivity, anticipating that the continued rollout of 5G technology across the U.S. will drive further growth and investment opportunities for its infrastructure assets. With its focus on high-quality assets and strategic expansion, Crown Castle Inc. maintains a prominent position in the industry, often seen as a key enabler of wireless communication advancements.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 50.13B | 39.91B | 49.45B | 58.09B | 58.74B | 62.59B |

| Enterprise Value | 78.74B | 68.15B | 77.78B | 85.89B | 86.33B | 89.96B |

| Trailing P/E | 32.29 | 23.42 | 29.52 | 34.67 | 36.36 | 40.49 |

| Forward P/E | 28.90 | 22.99 | 29.50 | 34.72 | 34.97 | 34.84 |

| PEG Ratio (5 yr expected) | 3.81 | 3.03 | 3.75 | 5.10 | 3.25 | 2.65 |

| Price/Sales (ttm) | 7.09 | 5.59 | 7.05 | 8.31 | 8.56 | 9.30 |

| Price/Book (mrq) | 7.52 | 5.66 | 6.85 | 7.80 | 7.65 | 7.96 |

| Enterprise Value/Revenue | 11.14 | 40.88 | 41.66 | 48.44 | 48.94 | 51.52 |

| Enterprise Value/EBITDA | 19.14 | 74.07 | 70.20 | 81.72 | 83.66 | 87.93 |

| Full Time Employees | 5,000 | Previous Close | 115.59 | Dividend Rate | 6.26 |

| Open | 115.72 | Day Low | 114.99 | Day High | 116.4 |

| Dividend Yield | 0.0542 | Payout Ratio | 1.7486 | 5 Year Avg Dividend Yield | 3.6 |

| Beta | 0.763 | Trailing PE | 32.421787 | Forward PE | 39.614334 |

| Volume | 1,058,156 | Market Cap | 50,338,279,424 | FiftyTwo Week Low | 84.72 |

| FiftyTwo Week High | 153.98 | Price to Sales Trailing 12 Months | 7.118976 | Trailing Annual Dividend Rate | 6.26 |

| Trailing Annual Dividend Yield | 0.054156937 | Enterprise Value | 78,742,093,824 | Profit Margins | 0.21962999 |

| Shares Outstanding | 433,688,992 | Shares Short | 5,195,995 | Held Percent Insiders | 0.00389 |

| Held Percent Institutions | 0.92874 | Short Ratio | 1.46 | Book Value | 15.366 |

| Price to Book | 7.55369 | Net Income to Common | 1,552,999,936 | Trailing EPS | 3.58 |

| Forward EPS | 2.93 | Enterprise to Revenue | 11.136 | Enterprise to EBITDA | 18.739 |

| 52 Week Change | -0.1428889 | Total Cash | 117,000,000 | Total Debt | 28,728,999,936 |

| Total Revenue | 7,071,000,064 | Debt to Equity | 430.784 | Revenue Per Share | 16.302 |

| Return on Assets | 0.040370002 | Return on Equity | 0.21648 | Gross Profits | 4,918,000,000 |

| Free Cashflow | 1,445,124,992 | Operating Cashflow | 3,097,999,872 | Earnings Growth | -0.37 |

| Revenue Growth | -0.045 | Gross Margins | 0.71051 | EBITDA Margins | 0.59426 |

| Operating Margins | 0.33953 | Target High Price | 133.0 | Target Low Price | 91.0 |

| Target Mean Price | 111.79 | Target Median Price | 110.5 | Recommendation Mean | 2.7 |

| Number of Analyst Opinions | 14 | Current Price | 116.07 | Last Dividend Value | 1.565 |

Based on the technical analysis data provided for the stock in question, the following interpretations are derived for possible stock price movements over the next few months:

- The stock has experienced a steady increase in its closing price from the end of August to late December, suggesting a bullish trend.

- The Parabolic SAR (PSAR) indicator, which helps to determine the direction of a stock's momentum, has flipped from bearish to bullish, as indicated by the transition from PSARs (which reflects a bearish sentiment) to PSARl (reflecting a bullish sentiment) in late December. This could indicate that the trend might continue to be bullish in the near term.

- The OBV (On-Balance Volume) has decreased on the last trading day, showing a divergence with the increasing price. This can sometimes indicate a potential pullback or consolidation, as volume is not confirming the uptrend.

- The MACD histogram, which is negative and appears to be converging towards the zero line, suggests that the bearish momentum is weakening. If the MACD crosses above the signal line, it might result in a bullish crossover, further affirming the potential for upward price movement.

Considering the company's fundamentals: - The current Market Cap and Enterprise Value show substantial market trust in the company; however, the Market Cap has seen a decrease from the previous quarter, which might be a point of concern for potential investors if the trend continues. - The Trailing P/E ratio suggests the stock is valued higher than its earnings might justify, indicating that it is currently trading at a premium. This could reflect high growth expectations or possibly an overvaluation, which investors should be cautious about. - A high PEG Ratio could mean the stock is overvalued relative to its earnings growth. This is reflected in the Price/Sales and Price/Book ratios, which also suggest a premium valuation. - Table data related to financials indicate a strong EBITDA and consistent revenue growth, which is a positive sign for the company's financial health.

From a comprehensive perspective, the stock is showing a bullish technical setup, supported by consistent financial performance, but there is a potential overvaluation risk based on its fundamental ratios. Investors should be aware of the premium they are paying for growth and keep an eye on volume indicators to confirm the continuation of the trend. It is also essential to monitor subsequent earnings reports and any changes in the broader market environment that may affect the stock's performance. Any significant changes in the company's fundamental performance or market sentiment could alter the technical prognosis provided. While the immediate trend appears positive, it is prudent to re-evaluate positions regularly due to potential volatility in the market and inherent uncertainties in stock performance predictions.

Crown Castle Inc. has undergone a transformative period in its corporate strategy and structure in the wake of pressures from the activist investor, Elliott Management. The catalyst for this significant corporate shake-up was the resignation of Jay Brown as CEO, which occurred following Elliott Management's call for a change in the company's executive leadership. These moves have signified a readiness by Crown Castle to thoroughly address investor concerns and optimally position itself for progressive growth and shareholder value enhancement.

Following Elliott Management's involvement, Crown Castle created two new committees, one committed to reviewing its fiber business and another overseeing the search for a new CEO. The fiber business, which accounts for nearly a third of the company's revenue, has faced performance challenges, signaling a need for a comprehensive review. In pursuit of these objectives, Elliott Management's Senior Portfolio Manager, Jason Genrich, and former T-Mobile executive Sunit Patel have been appointed to Crown Castle's board of directors.

The financial performance of Crown Castle has been a concern, particularly highlighted by the projected modest 2% growth in its adjusted funds from operations (FFO) for the current year and the expected 8% decrease for the subsequent year. In fact, the company has decided to put a hold on its dividend increases until at least 2025. Despite these concerns, the dividend yield has reached an attractive figure of 5.4%, and there's cautious optimism that there may be value to unlock in the near future, particularly through the sale of its fiber business, which Elliott has suggested could be valued at up to $15 billion.

The broader real estate sector, especially REITs like Crown Castle, has experienced downward pressure from higher interest rates and other macroeconomic challenges. Nevertheless, there's the potential for a market turnaround if the Federal Reserve proceeds to cut interest rates as anticipated. Such shifts could lead to improvements in Crown Castle's operational performance and an uptick in its share value, making it an interesting prospect for investment, particularly for long-term investors looking for dividend income and capital appreciation.

Crown Castle's emphasis on telecommunications infrastructure especially its portfolio of cell towers remains a shining beacon for its future potential. As indicated by The Motley Fool, Crown Castle is considered a promising REIT investment for 2024, banking on the prospective end of interest rate hikes and the consistent demand for wireless services, which suggest stable and potentially growing revenue streams due to long-term leases with major telecom operations.

Yet, this optimism isn't universally shared for all stocks in the REIT market, as Seeking Alpha's analysis points to an environment where numerous REITs are trading at low valuations, while some retain premium valuations that may not be fully justified when considering long-term asset performance and industry positioning. Crown Castle stands out in this regard, not for being overvalued, but for its stability and focus on growth opportunities in conjunction with technological advancements like 5G, which could bolster its earnings and shareholder returns.

In terms of strategic developments, Crown Castle has committed to a crucial evaluation of its fiber operations whose outcome could dramatically impact its future direction and shareholder equity. The Fiber Review Committee's mandate, assisted by financial and legal advisors, aims to explore all options to optimize shareholder value.

While the company navigates through these strategic adjustments, the financial markets keenly anticipate major disruptions as projected for 2024. With a defensive business model and regular cash flow, Crown Castle could find itself well-suited in a potential deflationary economic phase, where consistent dividend payers are especially valued. This assumes greater relevance if analysts' expectations of the Federal Reserve reducing interest rates come to fruition, bolstering the appeal of such high-yielding investments.

In light of the anticipated positive shift in the market due to the potential for rate cuts, the forecasted downturn in REIT performance could reverse, offering Crown Castle a chance at a bull run in the coming years. The company's solid fundamentals and significant role in the 5G space make it an integral player in discussions on market investments and position it as a stock that could witness substantial growth in the near future.

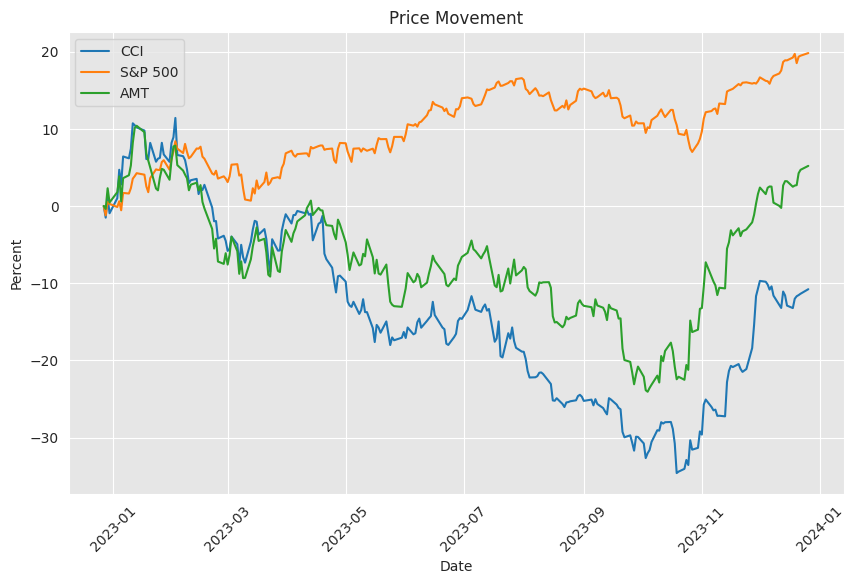

Crown Castle's performance in the stock market, notably with its recent surge among S&P 500 gainers, telegraphs market confidence not just in the broader economic outlook but also in the company's strategic initiatives and its positioning in communication infrastructure development. As a dividend stock to watch over the long term, Crown Castle's journey forward, marked by an anticipated 5G-led growth and its prospective restructuring of the fiber business, makes it an attractive option for investors seeking to tap into the telecom infrastructure domain.

Overall, Crown Castle's proactivity in addressing the various challenges it faces outlines a narrative of a company in transition. With several institutional movements, including board reconstitution, leadership changes, and business segment reviews, Crown Castle is making significant strides towards unlocking its inherent value and crafting a strong prospect for future appreciation and shareholder return. As the telecommunications sector continues to evolve, fuelled by burgeoning demand for data and connectivity, Crown Castle's strategic assets could allow the company to build on its industry-leading position and emerge stronger from the economic headwinds that have clouded its immediate financial outlook.

Similar Companies in REIT - Specialty:

Report: American Tower Corporation (AMT), American Tower Corporation (AMT), Report: SBA Communications Corporation (SBAC), SBA Communications Corporation (SBAC), AT&T Inc. (T), Report: Verizon Communications Inc. (VZ), Verizon Communications Inc. (VZ)

News Links:

https://finance.yahoo.com/m/f3ab8eeb-15b2-3fdd-bc09-9d29f8613ea0/bull-market-buys%3A-3-dividend.html

https://finance.yahoo.com/news/crown-castle-gives-elliotts-demands-145640716.html

https://finance.yahoo.com/news/crown-castle-cci-stock-dips-231519834.html

https://www.fool.com/investing/2023/12/12/10-of-the-best-reits-for-2024/

https://www.fool.com/investing/2023/11/28/could-these-3-ultra-high-yield-stocks-help-you-ret/

https://finance.yahoo.com/news/crown-castle-announces-comprehensive-fiber-130000513.html

https://seekingalpha.com/article/4654356-sell-alert-2-reits-getting-risky

https://seekingalpha.com/article/4658423-major-market-disruption-underway-how-to-invest-2024

https://www.fool.com/investing/2023/12/26/bull-market-buys-3-dividend-stocks-to-own-for-the/

https://seekingalpha.com/article/4655580-wall-street-breakfast-what-moved-markets

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: zacXwx

https://reports.tinycomputers.io/CCI/CCI-2023-12-27.html Home