SBA Communications Corp (ticker: SBAC)

2023-12-24

SBA Communications Corp (ticker: SBAC) is a prominent player in the telecommunications industry, operating as a real estate investment trust (REIT) primarily engaged in the leasing of wireless communications towers to a variety of cellular service providers. The company offers its clients, which include major national wireless carriers, infrastructure that is essential for their wireless communication networks. SBA Communications not only leases space on its own towers but also manages site locations, provides services like tower erection, and offers other operational assistance related to the telecommunication infrastructure. With a robust portfolio of towers, both domestically within the United States and internationally, SBA Communications is well-positioned to capitalize on the growing demand for wireless data and the rollout of advanced network technologies such as 5G. Its business model is characterized by long-term leases that provide stable revenue streams and the potential for growth as additional equipment is deployed on its infrastructure. SBAC's financial performance often reflects the growing trend toward mobile communication and the critical need for reliable network coverage, making it a potentially valuable consideration for investors looking into real estate and telecommunication sectors.

SBA Communications Corp (ticker: SBAC) is a prominent player in the telecommunications industry, operating as a real estate investment trust (REIT) primarily engaged in the leasing of wireless communications towers to a variety of cellular service providers. The company offers its clients, which include major national wireless carriers, infrastructure that is essential for their wireless communication networks. SBA Communications not only leases space on its own towers but also manages site locations, provides services like tower erection, and offers other operational assistance related to the telecommunication infrastructure. With a robust portfolio of towers, both domestically within the United States and internationally, SBA Communications is well-positioned to capitalize on the growing demand for wireless data and the rollout of advanced network technologies such as 5G. Its business model is characterized by long-term leases that provide stable revenue streams and the potential for growth as additional equipment is deployed on its infrastructure. SBAC's financial performance often reflects the growing trend toward mobile communication and the critical need for reliable network coverage, making it a potentially valuable consideration for investors looking into real estate and telecommunication sectors.

| As of Date: 12/25/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 27.13B | 21.69B | 25.12B | 28.28B | 30.26B | 30.73B |

| Enterprise Value | 41.70B | 36.38B | 40.09B | 43.31B | 44.67B | 45.29B |

| Trailing P/E | 55.26 | 43.05 | 67.57 | 61.86 | 75.56 | 88.13 |

| Forward P/E | 37.74 | 29.67 | 45.45 | 50.25 | 52.36 | 46.73 |

| PEG Ratio (5 yr expected) | 1.97 | 1.53 | 2.36 | 2.66 | 2.20 | 1.96 |

| Price/Sales (ttm) | 10.07 | 8.05 | 9.42 | 10.84 | 12.10 | 12.78 |

| Price/Book (mrq) | - | - | - | - | - | - |

| Enterprise Value/Revenue | 15.32 | 53.30 | 59.08 | 64.11 | 65.11 | 67.04 |

| Enterprise Value/EBITDA | 24.38 | 95.46 | 86.51 | 97.99 | 105.45 | 120.79 |

| Full Time Employees | 1,834 | Previous Close | 251.81 | Open | 252.89 |

| Day Low | 249.19 | Day High | 254.57 | Dividend Rate | 3.4 |

| Dividend Yield | 0.0135 | Payout Ratio | 0.7165 | Beta | 0.61 |

| Trailing PE | 55.26 | Forward PE | 41.91 | Volume | 500,782 |

| Average Volume | 874,692 | Market Cap | 27,167,010,816 | 52 Week Low | 185.23 |

| 52 Week High | 312.34 | Price to Sales Trailing 12 Months | 9.9781 | 50 Day Average | 227.5342 |

| 200 Day Average | 230.128 | Trailing Annual Dividend Rate | 3.26 | Trailing Annual Dividend Yield | 0.0129 |

| Enterprise Value | 41,737,224,192 | Profit Margins | 0.1820 | Shares Outstanding | 107,887,000 |

| Shares Short | 2,756,678 | Shares Percent Shares Out | 0.0256 | Held Percent Insiders | 0.01126 |

| Held Percent Institutions | 0.9856 | Short Ratio | 3.43 | Book Value | -47.785 |

| Earnings Quarterly Growth | -0.126 | Net Income to Common | 495,563,008 | Trailing EPS | 4.55 |

| Forward EPS | 6.0 | PEG Ratio | 3.69 | Enterprise to Revenue | 15.33 |

| Enterprise to EBITDA | 23.541 | 52 Week Change | -0.1099 | S&P 52 Week Change | 0.2417 |

| Current Price | 251.43 | Target High Price | 343.0 | Target Low Price | 206.0 |

| Target Mean Price | 268.21 | Target Median Price | 266.0 | Recommendation Mean | 2.2 |

| Total Cash | 190,544,992 | Total Cash Per Share | 1.766 | EBITDA | 1,772,967,936 |

| Total Debt | 14,766,687,232 | Quick Ratio | 0.569 | Current Ratio | 0.692 |

| Total Revenue | 2,722,653,952 | Revenue Per Share | 25.161 | Return on Assets | 0.0644 |

| Gross Profits | 1,937,997,000 | Free Cash Flow | 1,233,282,688 | Operating Cash Flow | 1,400,416,000 |

| Earnings Growth | -0.121 | Revenue Growth | 0.01 | Gross Margins | 0.7557 |

| EBITDA Margins | 0.6512 | Operating Margins | 0.4071 | Last Dividend Value | 0.85 |

Upon reviewing the technical analysis data and the fundamentals of the company in question, the prognosis for the stock price movement over the next few months can be summarized as follows:

-

The Parabolic SAR (PSAR) indicators suggest a potential trend reversal, indicated by the switch from a bullish to bearish sentiment as we observe PSAR values alternating between highs and lows.

-

On Balance Volume (OBV) has seen some volatility but overall has inclined, suggesting that buying pressure has been prevalent. However, the trend needs to be watched closely for any sudden changes, which could indicate a shift in market sentiment.

-

The Moving Average Convergence Divergence (MACD) histogram values are negative and appear to be converging towards zero, which may suggest a loss in downward momentum or an upcoming bullish crossover.

Considering the fundamentals:

-

Market Cap has seen a decline from the previous year, but there has been some recovery in subsequent quarters.

-

Trailing P/E and Forward P/E ratios are high, indicating the stock may be overvalued based on earnings.

-

The Enterprise Value multiples are also high, suggesting the company is valued significantly in terms of revenue and EBITDA.

-

Net Income has shown growth over the last few years, which is a positive sign.

-

The company has maintained a healthy EBITDA, and the normalized income has improved annually.

-

However, the Price/Sales ratio has declined, indicating a decrease in valuation relative to sales.

Combining these insights with the technical analysis, it seems the stocks high valuation could be a concern for some investors, but the improved net income and stabilizing enterprise value multiples may counteract these worries. Technically, the recent PSAR signal could indicate the possibility of a trend reversal, although confirmation would be required from additional indicators to support this. The OBV suggests there is buying pressure despite the market cap decline, which might foreshadow price stability or an uptick.

In conclusion, due diligence is suggested for investors looking at this stock. There appears to be potential for price stability or a moderate upwards price movement based on the technicals, especially if the positive OBV trend continues and the MACD shows a bullish crossover. However, the high valuation ratios warrant careful consideration, as they might cap significant gains unless backed by robust earnings growth or an increase in investor sentiment. As market conditions and investor perceptions are subject to change, ongoing analysis, with a focus on both technicals and evolving fundamentals, is critical for timely investment decisions in the given stock.

SBA Communications Corporation (SBAC) finds itself at the epicenter of investor scrutiny following an insider sell alert for Executive Vice President Mark Ciarfella, who recently offloaded 5,000 shares of the company's stock. As EVP, Ciarfella's actions carry significant import, conveying signals that investors and analysts dissect for potential insight into the company's prospects and valuation. His choice to sell, while insightful, remains a single data point in the complex mosaic of investment decision-making.

The pattern of Ciarfella's transactions over the past year reinforces a trend that sees the EVP consistently selling his shares without a recorded purchase. This liquidation of 6,000 shares within a year could be subject to various interpretations, but when an operations executive sells regularly, questions about the company's future valuation and growth prospects naturally arise. A look across SBA Communications' insider activity reveals a leaning towards sales and a notable absence of buys, fueling speculation about market valuation and investment opportunities that might be more alluring elsewhere.

SBA Communications has carved out a reputation in the telecom industry for its lucrative business model of leasing antenna space on its multi-tenant towers to wireless service providers. This segment has seen substantial growth, fueled by an insatiable demand for wireless data and the progressive rollout of 5G technology. When Ciarfella's sell alert came to the fore, SBAC shares traded at $245.05 with a hefty $27.033 billion market cap. Despite this robust foundation, the stock's price-earnings ratio towered at 55.19, markedly higher than the 17.49 industry median, perhaps suggesting that SBAC shares trade at a premium.

Despite these metrics suggesting a high valuation, the GF Value, an estimate of intrinsic value, positions SBAC's shares as potentially undervaluedindicating an attractive buying opportunity. Yet, skepticism lingers as the price-to-GF-Value ratio pegs the stock as a 'possible value trap', casting doubts on the future growth prospects that the market could be pricing in. Meticulous due diligence thus becomes paramount for investors navigating these conflicting signals.

Integrating Ciarfella's disposition of shares with the company's valuation and the GF Value yields an intricate picture that demands to be assimilated into a broader analysis. The information at hand casts a spotlight on the importance of a cautious and informed approach for stakeholders and would-be investors in SBA Communications.

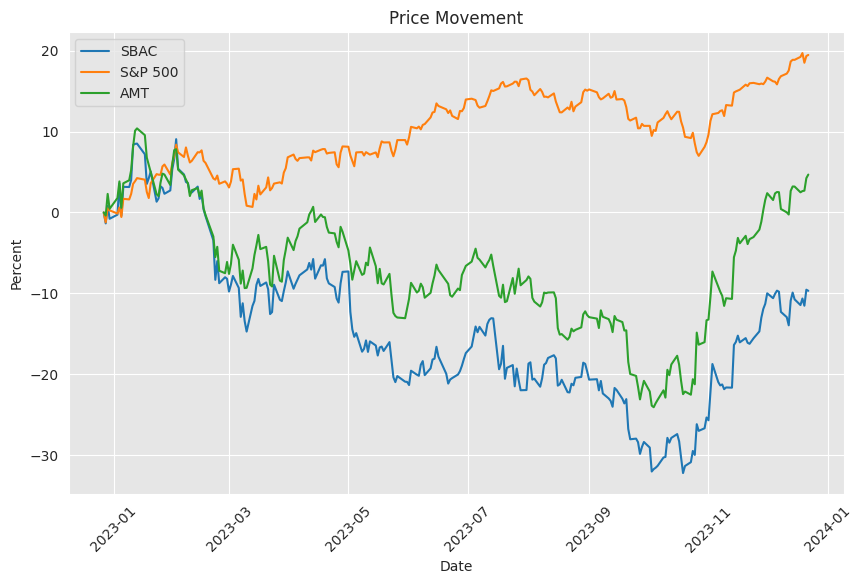

Further expanding the narrative, SBA Communications stands shoulder-to-shoulder with industry giants like American Tower (AMT) and Crown Castle (CCI), as it amplifies its investment in infrastructure crucial for the 5G movement. The REIT's transition to a dividend-paying entity only as of late 2019 and its comparably modest yield of 1.6% draws a sharp contrast to AMT's and CCI's higher yields. The distinctions don't stop there; the price-to-FFO per share ratios delineate SBAC from its peers, suggesting a more appealing valuation for Crown Castle but not definitively sanctioning investment action.

While SBAC's total return performance impresses, investors considering portfolio diversification would be prudent to examine whether adding SBAC to a spread that already includes AMT and CCI genuinely augments value or merely adds redundancy. This calculus of growth potential and income provisioning guides investment decisions, particularly for those in pursuit of income through dividends.

Turning to the boardroom, Director Krouse George R Jr's decision to sell 500 shares adds a sliver of intrigue to the insider trading puzzle at SBA Communications. Krouse, privy to strategic company insights, has extended a streak of share sales with his latest transaction, and in aggregate with other insider activity, this could read as a lack of enthusiasm about the company's stock valuation. Yet, with a price-earnings ratio below SBAC's own historical median, there may be room to argue that the stock is indeed undervalued when measured against its past performance.

The price-to-GF-Value ratio, situated at 0.63 with an alluring GF Value of $373.59, paints an image of a stock that might be ignored by the market in terms of true worth. Nonetheless, concerns linger, spurred on by market dynamics that appear to undermine the company's stock value. Investors must weigh Krouse's disinvestment against the canvas of SBA Communications' overall fiscal health and sector positioning, recognizing that insider trading data should be contextualized within a full-bodied financial analysis.

Investigation into the sentiment shift around cell-tower REITs reveals a tale of initial investor caution giving way to a recharged confidence in firms like SBA Communications Corp. Early year valuations saw a sharp downturn, possibly influenced by broader market trends and niche-specific challenges. But the landscape is changing; the essential services that SBAC provides, compounded by tax advantages endemic to the REIT structure, now poise the company as an appealing prospect in a recovering sector.

SBA Communications' ties to the omnipresence of mobile connectivity signal potential gains from the continued advancement of 5G networks and wireless communication needs. Despite previous reluctance, investors now seem to perceive cell-tower REITs as trading at discounted rates, which could offer considerable upside as digital transformation underpins telecom infrastructure demand.

SBA Communications strikes a distinct pose within the REIT sphere, maintaining a strong financial profile amidst industry-wide interest rate adversities. The various communication towers overlooked by SBAC are testament to a strategy that mitigates common risks seen in other REIT sectors. With shares trading at notable discounts and a keen focus on its debt amidst high-interest rates, the company's stable growth and commitment to reducing its debt are made visible by an increase in leasing revenues and same-tower recurring cash leasing revenue, positioning SBAC as an attractive investment proposition.

While the REIT landscape evolves, SBAC acknowledges the value of its wireless communications assets, which remain fundamental for telecommunications. Hedge fund sentiment, though slightly cooling, has not removed the company from its pedestal of investment potential. SBA Communications navigates the real estate terrain strategically, maintaining long-term leases and robust tenant agreements that underscore the company's resilience and capacity for potentially sustained returns.

SBA Communications' recent shares' performance exceeds industry norms, propelled by robust spending from wireless carriers. With the AFFO exceeding estimates and a boost in site-leasing revenues, SBAC leverages the shift to advanced network technologies. This positions the company beneficially for further growth, underpinning its stability with long-term leases and rent escalators. The company confidently broadens its international footprint, growing its site portfolio with a favorable outlook on AFFO projections and financial health buoyed by strategic debt handling and strong leadership in revenue growth.

Kevin Beebe's insider sell transaction at SBA Communications offers another data layer in assessing the company's stock prospects. Insider sales often provide a nuanced view of the company's outlook, and the absence of insider purchases points towards the potential full valuation of SBAC's shares. Even with SBAC trading at a premium with a high P/E ratio and the price-to-GF-Value ratio signaling a possible value trap, these insider actions alone should not dictate investment strategies. Investors ought to deliberate on a broader range of indicators, combining insider dealings with an all-encompassing analysis of the company's market position, valuation, and sector dynamics.

Turning towards insider activity that drew the market's observation: executive Jason Silberstein's sizeable sale of 16,465 shares stirred a dialogue on investment concerns and the valuation of SBA Communications. Silberstein's consistent tendency to sell his holdings over the past year could be construed as an alignment with the company's perceived stock valuation or for personal portfolio considerations. While such sales might prompt shareholder apprehension, they should be positioned within a larger investigative scope that includes financial health and market positioning, dovetailed with comprehensive due diligence.

Discerning investment decisions regarding SBAC require an analytical approach that doesn't singularly hinge on insider trades but instead integrates them within a fabric of financial assessments and industry outlooks. These collective insights will craft a more robust investment thesis around SBA Communications Corporation, a company with a commanding role in a sector marked by transformative growth rates and the steady demand for wireless infrastructures.

SBA Communications' interplay with the market is encapsulated by its performance, debt reduction efforts, and revenue forecasts. While correlations with bond prices and movements offer investors an intriguing consideration, SBAC's focus has been firmly on growth and low dividend yields with the intent of long-term value. This strategic direction is expected to fuel the company's trajectory, regardless of immediate interest rate trends, and positions SBA Communications as an investment with growth potential in the low-yield REIT segment.

Similar Companies in Diversified Communication Services:

Report: American Tower Corporation (AMT), American Tower Corporation (AMT), Report: Crown Castle International Corp (CCI), Crown Castle International Corp (CCI), Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), Report: Equinix, Inc. (EQIX), Equinix, Inc. (EQIX)

News Links:

https://finance.yahoo.com/news/insider-sell-alert-evp-mark-180455073.html

https://www.fool.com/investing/2023/09/20/sbac-is-a-great-business-heres-why-i-dont-own-the/

https://finance.yahoo.com/news/insider-sell-alert-director-krouse-220402089.html

https://finance.yahoo.com/m/2affdc7c-0ec6-329e-ab4e-d17e9d5d8b11/cell-tower-reits-are.html

https://finance.yahoo.com/news/sba-communications-nasdaq-sbac-pinnacle-222745536.html

https://finance.yahoo.com/news/12-best-reit-stocks-buy-140257970.html

https://finance.yahoo.com/news/sba-communications-sbac-soars-16-173100735.html

https://finance.yahoo.com/news/insider-sell-alert-director-kevin-080331207.html

https://finance.yahoo.com/news/insider-sell-evp-jason-silberstein-100134800.html

https://seekingalpha.com/article/4656486-sba-communications-stock-my-top-pick-low-yield-reit-sector

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: glH3JW

https://reports.tinycomputers.io/SBAC/SBAC-2023-12-24.html Home