Toro Company (The) (ticker: TTC)

2023-12-23

The Toro Company (NYSE: TTC) is a leading worldwide provider of innovative solutions for the outdoor environment, including turf, snow and ground engaging equipment, and irrigation and outdoor lighting solutions. Founded in 1914, the company has built a reputation for quality, reliability, and customer-centric innovation. With a diverse product portfolio, Toro caters to a broad range of sectors including professional landscaping, golf course management, agricultural, rental and specialty construction, residential yard care, and snow removal. The Toro brand is recognized for its extensive range of lawn mowers, snow blowers, aerators, sprinkler systems, and outdoor lighting equipment. Toro's commitment to sustainability and innovation is evident in their R&D investments and efforts to make their products more eco-friendly, aligning with growing environmental awareness and regulatory trends. The company's financial performance is characterized by consistent revenue growth and strategic acquisitions that expand its market presence and product line. As of the latest reports, Toro has demonstrated solid market share, brand loyalty, and a strong balance sheet, maintaining its position as a significant player in the industry.

The Toro Company (NYSE: TTC) is a leading worldwide provider of innovative solutions for the outdoor environment, including turf, snow and ground engaging equipment, and irrigation and outdoor lighting solutions. Founded in 1914, the company has built a reputation for quality, reliability, and customer-centric innovation. With a diverse product portfolio, Toro caters to a broad range of sectors including professional landscaping, golf course management, agricultural, rental and specialty construction, residential yard care, and snow removal. The Toro brand is recognized for its extensive range of lawn mowers, snow blowers, aerators, sprinkler systems, and outdoor lighting equipment. Toro's commitment to sustainability and innovation is evident in their R&D investments and efforts to make their products more eco-friendly, aligning with growing environmental awareness and regulatory trends. The company's financial performance is characterized by consistent revenue growth and strategic acquisitions that expand its market presence and product line. As of the latest reports, Toro has demonstrated solid market share, brand loyalty, and a strong balance sheet, maintaining its position as a significant player in the industry.

| As of Date: 12/23/2023Current | 10/31/2023 | 7/31/2023 | 4/30/2023 | 1/31/2023 | 10/31/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 10.34B | 8.39B | 10.56B | 10.87B | 11.67B | 10.96B |

| Enterprise Value | 11.31B | 9.43B | 11.53B | 11.87B | 12.56B | 11.86B |

| Trailing P/E | 31.56 | 22.58 | 20.70 | 22.91 | 26.55 | 28.88 |

| Forward P/E | 17.04 | - | - | 17.42 | 18.66 | 20.88 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 2.28 | 1.80 | 2.22 | 2.33 | 2.61 | 2.60 |

| Price/Book (mrq) | 6.79 | 5.68 | 6.77 | 7.53 | 8.64 | 8.52 |

| Enterprise Value/Revenue | 2.48 | 9.59 | 10.65 | 8.86 | 10.93 | 10.12 |

| Enterprise Value/EBITDA | 19.56 | 68.50 | 843.39 | 46.83 | 72.28 | 76.64 |

| Statistic Name | Value | Statistic Name | Value | Statistic Name | Value |

|---|---|---|---|---|---|

| Full Time Employees | 10,706 | Previous Close | $99.56 | Market Cap | $10,341,672,960 |

| Open | $99.82 | Day Low | $97.92 | Day High | $99.93 |

| Dividend Rate | $1.44 | Dividend Yield | 1.46% | Payout Ratio | 43.45% |

| Five Year Avg Dividend Yield | 1.23% | Beta | 0.749 | Trailing PE | 31.56 |

| Forward PE | 21.29 | Volume | 676,823 | Average Volume | 715,635 |

| Fifty Two Week Low | $78.35 | Fifty Two Week High | $117.66 | Price to Sales (TTM) | 2.27 |

| Enterprise Value | $11,230,694,400 | Profit Margin | 7.24% | Float Shares | 97,474,521 |

| Shares Outstanding | 103,874,000 | Shares Short | 3,251,210 | Held Percent Insiders | 0.355% |

| Held Percent Institutions | 90.766% | Short Ratio | 6.32 | Short Percent of Float | 3.14% |

| Book Value | $14.55 | Price to Book | 6.79 | Earnings Quarterly Growth | -40.10% |

| Net Income to Common | $329,700,000 | Trailing EPS | $3.13 | Forward EPS | $4.64 |

| EBITDA | $701,800,000 | Total Debt | $1,163,100,032 | Quick Ratio | 0.633 |

| Current Ratio | 1.896 | Total Revenue | $4,553,200,128 | Debt to Equity | 76.981 |

| Revenue Per Share | $43.613 | Return on Assets | 10.114% | Return on Equity | 23.035% |

| Gross Profits | $1,506,781,000 | Free Cashflow | $79,237,504 | Operating Cashflow | $306,800,000 |

| Revenue Growth | -16.10% | Gross Margins | 34.653% | EBITDA Margins | 15.413% |

| Operating Margins | 9.635% | Enterprise to Revenue | 2.467 | Enterprise to EBITDA | 16.003 |

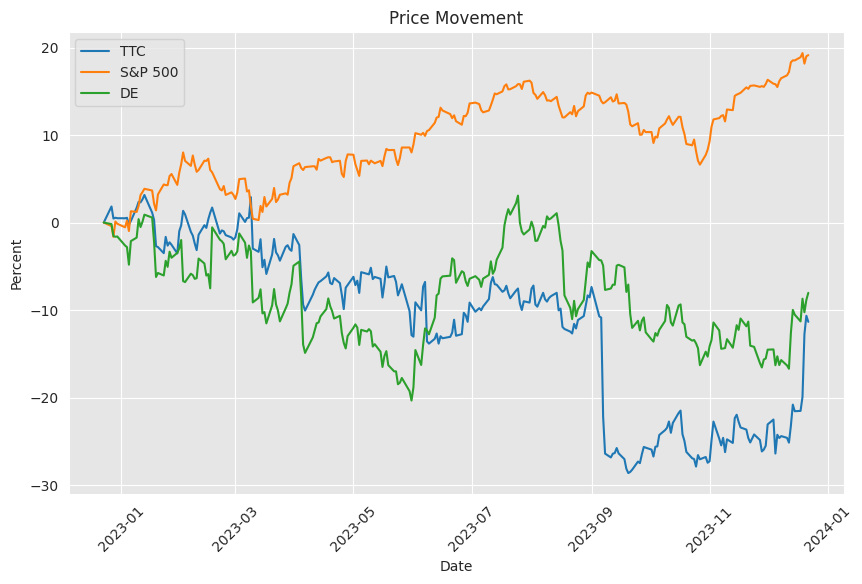

The current technical and fundamental analysis of Company TTC offers a multi-faceted view into its stock price potential over the coming months. The technical indicators suggest a bullish trend; however, when juxtaposed with the fundamentals, the outlook requires a nuanced assessment.

Technical indicators show that the stock is currently in a strong uptrend, as evidenced by the following:

- The Adjusted Close price is above both the 20-day Simple Moving Average (SMA_20) and the 50-day Exponential Moving Average (EMA_50), indicating that the current price momentum is positive.

- The Moving Average Convergence Divergence (MACD) indicator is above the signal line, with a significant MACD histogram value, which denotes a continuing bullish trend.

- The Relative Strength Index (RSI_14) is in an overbought territory at 75, which typically points to strong buying pressure, though caution should be taken as it also suggests the possibility of a near-term pullback or consolidation.

- Stochastic oscillators, with both STOCHk and STOCHd well above 80, signal overbought conditions but also confirm the current momentum.

- The Chaikin Money Flow (CMF_20) remains positive, indicating buying pressure and inflow of money into the stock.

- Bollinger Bands also reflect the bullish sentiment with the Adjusted Close price hovering closer to the upper Bollinger Band (BBU_5_2.0).

- The Average Directional Index (ADX_14) value of 24 suggests a growing trend strength but is not yet indicative of an extremely strong trend.

However, the overbought indications from RSI and Stochastics, coupled with the proximity to the upper Bollinger Band, increase the risk of a short-term pullback or volatility increase. The sustained positive bias in the market may require a period of consolidation or slight correction before continuing its upward trajectory.

On the fundamental side:

- The company's market capitalization has seen fluctuations over the past year, which could reflect a dynamic response to the company's performance and broader market sentiments.

- A trailing P/E of 31.56 and a forward P/E of 17.04 suggest that while the stock may be valued higher based on past earnings, future earnings expectations are more favorable and may support further price increases if the company meets these expectations.

- The absence of a PEG Ratio could make it challenging for some long-term growth investors to assess the company's potential value.

- The Price/Sales and Price/Book ratios have decreased over time, indicating the stock might be becoming more attractively valued in relation to its sales and book value.

- The Enterprise Value multiples are relatively high, which could reflect either a premium being paid for expected growth or a current overvaluation in the market.

While the company's operating income and net income show stability, the presence of substantial unusual items and a high tax provision may warrant closer inspection of the company's financial health and one-time events that could affect future profitability.

Considering these factors, the stock price might see continued bullish behavior in the near term, supported by strong technical signals. Nevertheless, overbought conditions caution against potential pullbacks. Fundamental analysis suggests a mixed outlook, where the company has strong income numbers but also indicates potential overvaluation risks. Investors might expect moderate to high volatility in the stock price, with likely continuation of the upward trend if the company can support the expected earnings growth reflected in the forward P/E ratio. It is key for investors to keep abreast of any corporate or external market developments that could significantly impact these dynamics.

The Toro Company, an established leader in the outdoor maintenance and landscaping equipment manufacturing industry, demonstrated mixed financial performance in its latest report for the fiscal year ending in 2023. With full-year revenue holding steady at US$4.55 billion, in line with the previous fiscal year's results, the company faced challenges in maintaining its profitability. A notable decrease in net income, down by 26%, yielded a lower profit margin of 7.2%. The decline in profitability, though significant, was partially offset by a better-than-expected performance in terms of earnings per share (EPS). With reported EPS at US$3.16, Toro exceeded market predictions by 3.1%, suggesting strong per-share earnings despite the profit downturn.

For Toro, the future appears cautiously optimistic, with analysts projecting modest revenue growth over the next three years. The average annual growth rate is pegged at 2.7%, slightly trailing behind the broader U.S. Machinery industry's expected growth rate of 3.4%. The company's resilience in the face of a challenging economic landscape remains a key observation.

Investor sentiment following the earnings announcement was positive, reflected by a 14% appreciation in Toros share price in the week after the release. This uplift signals market confidence bolstered by the company's stronger-than-expected EPS and revenue growth forecast, which, while modest, points to potential resilience and a steady growth trajectory.

However, stakeholders must remain vigilant, as two warning signs indicated in the report require attention. While specifics were not provided, these warnings highlight the importance of comprehensive risk assessment for anyone considering investment or business operations with Toro.

In the realm of income investing, Toro's upcoming ex-dividend date, set for December 26th, necessitates investor awareness for those seeking dividend payments. The company plans to distribute a quarterly dividend of $0.36 per share, contributing to a total annual payout of $1.44 per share. Given the recent stock value of $99.56, this puts the trailing dividend yield at 1.4%.

The sustainability of Toro's dividend is a focal point of evaluation. With a dividend payout ratio of 44% of profit, initial indicators point towards a comfortable dividend coverage. Conversely, the high cash payout ratiowhere 90% of its free cash flow over the last year was committed to dividendspresents a cautionary tale about the company's financial flexibility.

Despite a sustainable payout ratio, Toro's cash flow condition, if it persists, could pose risks to future dividend commitments. The company's revenue growth, with EPS expanding moderately at an annual rate of 4.4% over the past five years, offers a counterbalance; yet, the consumptive nature of dividends on the company's cash flow remains a cause for circumspection. On a brighter note, the history of consistent dividend growthaveraging 18% annually over the past decadedemonstrates Toro's shareholder value orientation.

Investing in Toro necessitates a balance of considerations: the company's growth potential, financial health, and dividend sustainability. Current yield attractiveness must be contextualized within the broader financial picture, keeping an eye on the high cash payout ratio and broader company risks.

Considering stable investment options, Toro stands out in comparison to entities like Home Depot, especially for investors with excess liquidity seeking returns that potentially outpace high-yield savings accounts while minimizing risk. Toro's track record of consistent performance and sustainable dividend growth, spanning 14 years, marks it as a robust investment choice for the risk-averse. Financial vigor, as evidenced by the increase in dividend payouts, augments the company's attractiveness and implies a financially sound organization.

The partnership anticipated to start early in 2024 with Lowe's is a significant development for Toro. By expanding the company's retail presence, it could positively impact sales volumes, thereby influencing Toro's financial outcomes. Trading at a favorable price-to-earnings (P/E) ratio, and given its imminent partnership and current valuation, Toro presents an appealing investment choice compared to the lower appeal of traditional savings amid a low-interest-rate environment.

Notwithstanding the near-term challenges faced by Toro in Q4 of the fiscal year 2023, the company's upward adjustment of its share price following its earnings release indicates investor confidence. Toro's management has implemented strategies to mitigate the negative impact of a decrease in sales volume, resulting in an adjusted EPS that beat their guidance for the quarter. While the fiscal year 2024 outlook flags moderate growth, the overall perspective is that Toro is on course to maintain a position of strength and profitability.

A brief delve into Toro's Q3 performance for fiscal 2023 reveals a steep decline in stock performance precipitated by a reduction in net sales, with notable implications pertaining to the company's acquisition and ensuing strategies. The unexpected drop in the residential segment's demand stands out as a major contributor to the quarter's downturn. However, the introduction of a significant partnership with Lowe's and Toro's persistently strong operational capabilities suggest potential for recovery.

The Toro Company presents an advantageous investment opportunity for individuals considering its current undervalued status, upcoming retail partnership with Lowe's, and a dividend policy that has seen consistent growth. With a considerable decrease in its share price, reflecting post-pandemic dynamics, Toro shows exceptional valuation underpinnings that could attract long-term investment.

The Toro Company's financial performance for the full year, as conveyed in its earnings conference call, reflects a company navigating through a complex operating environment, yet showcasing durability and a capacity for growth. The company's strategic initiatives, including a significant cost-saving program (AMP), complement the conservative yet positive sales growth expectations for fiscal 2024. With a return to average free cash flow conversion rates and emphasis on segments with strong demand, Toros strategic financial planning bodes well for the company's future.

Toros fourth-quarter fiscal 2023 earnings reflect a company adept at maintaining performance across diverse market conditions. Despite a decline in net sales and EPS for the quarter, the company's full-year results illustrate Toro's ability to manage through adverse conditions while continuing to show growth in its professional segment. The upcoming strategic partnership with Lowe's is another expected growth catalyst. Toro's conservative approach and its aim to return to historical cash flow conversion rates are indicative of prudent management practices.

In its fourth-quarter earnings, Toro reported a decrease in net sales, with the residential segment showing signs of strain. However, the company's better-than-projected adjusted EPS and future partnership with Lowe's position Toro for continued market standing and growth opportunities, despite recent downturns and conservative projections for fiscal year 2024.

Lastly, The Toro Company's latest fiscal quarter results exceeded Wall Streets projections, with stronger earnings per share and higher than expected revenue. Despite a slight decline in stock price post-announcement, the company's robust annual profitability, alongside confident projections for the upcoming fiscal year, reinforce Toro's market strength. With a nationwide presence in Lowe's stores on the horizon, Toro is positioned to capitalize on growth opportunities, illustrating its resilience in the face of sector-specific challenges.

Similar Companies in Farm & Heavy Construction Machinery:

Report: Deere & Company (DE), Deere & Company (DE), Report: The Home Depot, Inc. (HD), The Home Depot, Inc. (HD), Report: Lowe's Companies, Inc. (LOW), Lowe's Companies, Inc. (LOW), AGCO Corporation (AGCO), Briggs & Stratton Corporation (BGG), Stanley Black & Decker, Inc. (SWK), MTD Products Inc (Private), Ariens Company (Private), Stihl Holding AG & Co. KG (Private), Husqvarna Group (Private)

News Links:

https://finance.yahoo.com/news/toro-full-2023-earnings-eps-112002207.html

https://finance.yahoo.com/news/income-investors-look-toro-company-114114494.html

https://www.fool.com/investing/2023/09/18/sitting-on-cash-these-2-stocks-are-great-buys/

https://finance.yahoo.com/m/757a1bec-f8bd-36e3-83f0-61862eaee7be/why-toro-stock-popped-today.html

https://www.fool.com/investing/2023/09/07/heres-why-the-toro-company-stock-plunged-today/

https://www.fool.com/investing/2023/12/20/have-500-2-absurdly-cheap-stocks-long-term-investo/

https://www.fool.com/investing/2023/07/31/4-dividend-stocks-to-double-up-on-right-now/

https://finance.yahoo.com/news/q4-2023-toro-co-earnings-094412102.html

https://www.fool.com/earnings/call-transcripts/2023/12/20/toro-ttc-q4-2023-earnings-call-transcript/

https://finance.yahoo.com/news/toro-fiscal-q4-earnings-snapshot-214442000.html

https://www.fool.com/investing/2023/12/20/why-toro-stock-popped-today/

https://www.fool.com/investing/2023/09/08/why-the-toro-company-stock-plummeted-by-21-this-we/

https://finance.yahoo.com/news/heres-analysts-forecasting-toro-company-144133986.html

https://www.fool.com/investing/2023/09/24/3-top-stocks-that-just-went-on-sale/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: H6VDtn

https://reports.tinycomputers.io/TTC/TTC-2023-12-23.html Home