Denison Mines Corp (ticker: DNN)

2023-12-17

Denison Mines Corp (ticker: DNN), headquartered in Toronto, Canada, operates as a uranium exploration and development company with interests primarily in the Athabasca Basin region of northern Saskatchewan. The company is also engaged in mine decommissioning and environmental services through its Denison Environmental Services division, providing a unique integrated service offering to the industry. Denison's flagship project is the Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure-rich eastern portion of the Athabasca Basin region. Wheeler River is at an advanced stage with a pre-feasibility study completed, indicating promising economics and potential to become a leading uranium mining operation. The company's portfolio also encompasses several other projects at various stages of exploration and development. In the context of growing demand for clean energy and the resurgence of nuclear power as a carbon-free energy source, Denison Mines Corp maintains a strategic position in the uranium sector with a combination of operational experience and a significant resource base.

Denison Mines Corp (ticker: DNN), headquartered in Toronto, Canada, operates as a uranium exploration and development company with interests primarily in the Athabasca Basin region of northern Saskatchewan. The company is also engaged in mine decommissioning and environmental services through its Denison Environmental Services division, providing a unique integrated service offering to the industry. Denison's flagship project is the Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure-rich eastern portion of the Athabasca Basin region. Wheeler River is at an advanced stage with a pre-feasibility study completed, indicating promising economics and potential to become a leading uranium mining operation. The company's portfolio also encompasses several other projects at various stages of exploration and development. In the context of growing demand for clean energy and the resurgence of nuclear power as a carbon-free energy source, Denison Mines Corp maintains a strategic position in the uranium sector with a combination of operational experience and a significant resource base.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 1.55B | 1.38B | 1.05B | 907.89M | 940.16M | 967.96M |

| Enterprise Value | 1.49B | 1.34B | 997.06M | 864.74M | 892.55M | 910.98M |

| Trailing P/E | 33.71 | - | - | 73.72 | 155.89 | 27.12 |

| Forward P/E | - | - | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 192.17 | 176.12 | 99.27 | 72.11 | 74.37 | 56.54 |

| Price/Book (mrq) | 3.86 | 4.12 | 3.07 | 2.82 | 2.96 | 3.08 |

| Enterprise Value/Revenue | 144.09 | 484.19 | 285.61 | 797.73 | 299.81 | 299.37 |

| Enterprise Value/EBITDA | 24.31 | 22.35 | 476.84 | 842.83 | -250.08 | -198.77 |

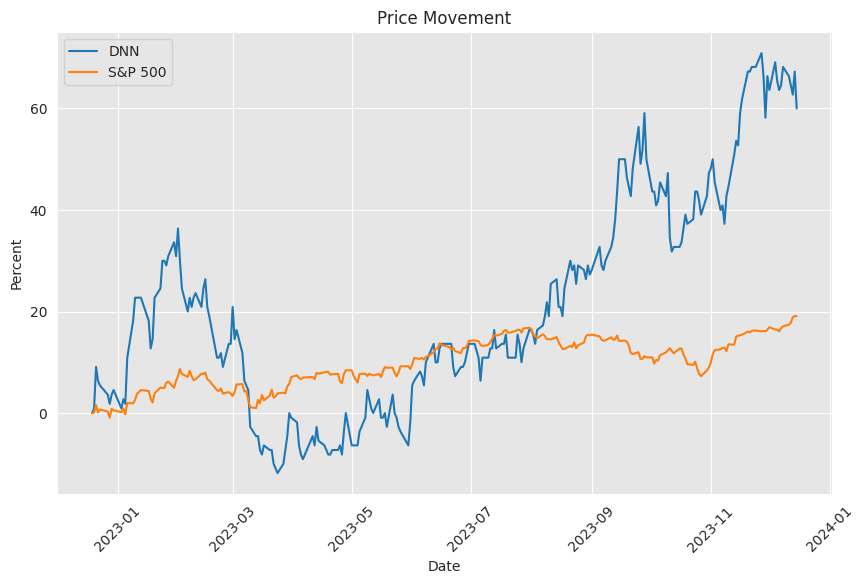

Upon analyzing the provided technical analysis (TA) data and company fundamentals, a delineation of the anticipated stock price movement for the upcoming months can be articulated as follows:

Upon analyzing the provided technical analysis (TA) data and company fundamentals, a delineation of the anticipated stock price movement for the upcoming months can be articulated as follows:

Technical Assessment:

The technical indicators of the stock present a mix-and-match scenario:

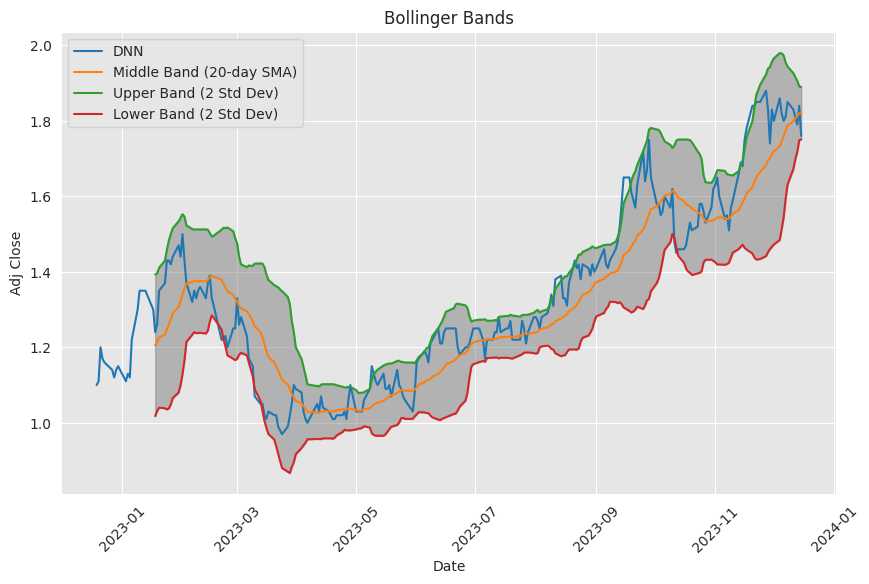

- The stock's Adjusted Close is below the Simple Moving Average (SMA) for the last 20 days (SMA_20) and also marginally below the Exponential Moving Average for the last 50 days (EMA_50), which can be a bearish signal indicating a downtrend.

- The Moving Average Convergence Divergence (MACD) is positive, suggesting a potential upward price momentum, although the MACD histogram is negative, thereby hinting at some bearish undercurrents and a possible weakening of the bullish trend.

- The Relative Strength Index (RSI) is close to the neutral 50 mark, indicating a lack of strong momentum in either direction.

- Bollinger Bands indicate that the stock is trading near the lower band, which oftentimes is indicative of an oversold condition, with the potential for a price reversal to the upside.

- The OBV (On-Balance volume) is relatively high at 11.061770 million, suggesting that there is a significant volume supporting current price levels, which can be a positive sign for future price stability or increases.

- The stochastic oscillators (STOCHk and STOCHd) are below the 50 level but are not indicating oversold conditions, leaving the short-term momentum as rather indeterminate.

- The Average Directional Index (ADX) presents a moderate trend strength, which means the current trend is neither strong nor weak.

- The Williams %R (WILLR) indicates the stock might be oversold, which could precede a short-term reversal in price.

- The Chaikin Money Flow (CMF) shows positive buying pressure, which might support a forthcoming price increase.

- The Parabolic SAR (Stop and Reverse) is indicating a downtrend since the PSARs_0.02_0.2 value is above the current price.

Fundamental Analysis:

- The market capitalization of the company has shown a significant increase from the dates given, indicating an overall market confidence, potentially due to external factors or the company's performance relative to its sector.

- An escalating Price/Sales ratio suggests that the market is attributing a higher value to each unit of sale, although such high figures could also point towards overvaluation risks.

- The Price/Book ratio has moderately increased, potentially reflecting a market sentiment that the companys intrinsic value is growing.

- The enterprise value measures indicate higher valuation in terms of revenue and EBITDA, which might infer optimistic future expectations by investors.

- The financials show a pattern of mixed profitability and operational results, with normalized EBITDA and operating income indicating challenges, yet a net income from continuing operations that has stayed positive.

Outlook and Movement Prediction:

Considering the balance of technical indicators and fundamental signals, the stock demonstrates indications of potential fluctuation in the near term. The technical analysis suggests a possible upside correction, especially if the stock price rebounds from the lower Bollinger Band and the oversold conditions signaled by Williams %R. However, the negative MACD histogram and the PSAR indicator imply an existing pressure that may keep the prevailing trend tilted downwards. Additionally, the neutral RSI and ambiguous STOCH indicators do not prescribe a strong momentum either way.

From a fundamental standpoint, the market appears to grant an elevated valuation to the company, which may limit significant short-term upward price movement, especially unless further positive financial results or business developments justify such valuation.

The coming months could witness a continued period of lateral movement with the risk of marginal downside, unless either the technicals skew more positively, e.g., through a sustained MACD uptrend or the fundamentals are underpinned by stronger earnings reports, improved operational efficiency, or favorable market conditions specific to the company's sector.

Investors would be wise to closely monitor the interplay of technicals and fundamentals for clearer signs of sustained directional movement while remaining cognizant of the company's relatively high valuation metrics that could potentially constrain swift upward price advances.

Denison Mines Corp (ticker: DNN), headquartered in Toronto, Canada, is a uranium exploration, development, and production company. With its primary focus on the Athabasca Basin region of northern Saskatchewan, the company holds interests in several uranium projects. The most significant of these is the Wheeler River project, which is the largest undeveloped uranium asset in the eastern portion of the basin.

Wheeler River's exploration and development have depicted promising results, showing high-grade uranium deposits. Denison Mines has reported that Wheeler's Phoenix deposit has one of the highest grades of undeveloped uranium in the world. This makes Wheeler River a central piece in Denison's portfolio, especially given the burgeoning demand for nuclear energy as a cleaner energy alternative.

The uranium market has seen a resurgence in interest due to the growing recognition of the role of nuclear power in achieving low-carbon energy goals. Denison stands to benefit from this shift as nations look to secure reliable sources of uranium to fuel nuclear reactors. The companys strategic position in Saskatchewan, a jurisdiction known for its high-grade uranium mines and favorable mining laws, offers a competitive advantage.

Denison's environmental initiatives should also be highlighted. The company has taken steps to minimize its environmental impact by employing in-situ recovery (ISR) mining techniques at its Wheeler River project. This method is generally considered to have a lower environmental footprint compared to conventional mining. ISR involves dissolving the uranium underground and pumping the uranium-laden water to the surface, a less disruptive process that reduces surface disturbance and waste generation.

On the financial front, Denison Mines Corp has made strategic decisions to stabilize its financial standing and fund its resource exploration and development activities. This includes the management of a diversified portfolio that includes a 22.5% stake in the McClean Lake joint venture, which is significant due to its licensed uranium mill one of the few in the Athabasca Basin capable of processing high-grade uranium ore. This investment not only provides potential revenue streams but also strategic processing capabilities for ore from Wheeler River and other regional projects.

The company's exploration strategy continues to focus on high-grade uranium deposits in the Athabasca Basin. Exploration activities are data-driven, making use of innovative techniques and technologies to effectively target promising new areas and expand known deposits. Geophysical surveys and drilling programs are routinely conducted to enhance the understanding of the geology and to de-risk the projects.

Denison's leadership team consists of individuals with substantial experience in mining, geology, and finance. The board and management understand the complexities of uranium mining and the nuclear industry. Strong governance and a clear strategic direction have positioned the company to navigate the intricacies of uranium markets and regulatory environments.

The company maintains close ties with local communities and Indigenous groups. As part of its commitment to corporate social responsibility, Denison engages in ongoing dialogue and partnership development to ensure that its presence and operations result in mutual benefits. Sustaining good relationships with these stakeholders is integral, since the social license to operate is of paramount importance in the mining sector.

Denison Mines Corp is also involved in several joint ventures and partnerships. These collaborations offer additional resources and expertise, and share the costs and risks inherent to the mining industry. This collaborative approach opens opportunities to leverage the strengths of various players in the industry and accelerates the path towards production.

Investor interest in Denison Mines has increased, mirrored by the rising volume of trading of its shares. In the broader context of clean energy trends and favorable uranium market dynamics, Denison is well-positioned to capitalize on the opportunities that arise. While it focuses on advancing the Wheeler River project, the company continues to evaluate potential acquisitions and opportunities to further enhance its project portfolio.

In summary, Denison Mines Corp is an active player in the uranium sector with a promising principal project in Wheeler River and a compelling exploration portfolio in a stable jurisdiction. The company has demonstrated a commitment to environmental stewardship, collaboration with local stakeholders, and responsible financial management. As the global demand for uranium is expected to grow, Denison Mines may become an increasingly relevant figure in the industry's landscape. The breadth of activities from exploration to stakeholder engagement illustrates the company's multifaceted approach to developing its assets and securing its position in the uranium market.

Similar Companies in Uranium Mining:

Report: Cameco Corporation (CCJ), Cameco Corporation (CCJ), Report: NexGen Energy Ltd. (NXE), NexGen Energy Ltd. (NXE), Report: Energy Fuels Inc (UUUU), Energy Fuels Inc (UUUU), Ur-Energy Inc (URG), Fission Uranium Corp. (FCUUF)

News Links:

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 89R80y

https://reports.tinycomputers.io/DNN/DNN-2023-12-17.html Home