Energy Fuels Inc. (ticker: UUUU)

2023-12-16

Energy Fuels Inc., operating under the ticker UUUU, is a leading uranium producer in the United States, primarily engaged in the extraction and recovery of uranium and, to a lesser extent, vanadium. The company prides itself on providing a critical component for carbon-free nuclear energy, which is an integral part of the global movement toward sustainable and clean energy generation. Energy Fuels Inc. owns and operates strategic facilities such as the White Mesa Mill in Utah, which is the only conventional uranium mill operating in the U.S., and the Nichols Ranch ISR facility in Wyoming. They also hold a portfolio of uranium production assets at various stages of permitting and development, as well as a robust potential for scalable ISR production. In recent times, the company has diversified by entering the rare earth element sector, recognizing the growing demand for materials essential for various advanced technologies. Their commitment to environmental stewardship and community engagement is a critical aspect of their operational ethos, as they navigate the complexities of mining operations in accordance to strict regulatory standards.

Energy Fuels Inc., operating under the ticker UUUU, is a leading uranium producer in the United States, primarily engaged in the extraction and recovery of uranium and, to a lesser extent, vanadium. The company prides itself on providing a critical component for carbon-free nuclear energy, which is an integral part of the global movement toward sustainable and clean energy generation. Energy Fuels Inc. owns and operates strategic facilities such as the White Mesa Mill in Utah, which is the only conventional uranium mill operating in the U.S., and the Nichols Ranch ISR facility in Wyoming. They also hold a portfolio of uranium production assets at various stages of permitting and development, as well as a robust potential for scalable ISR production. In recent times, the company has diversified by entering the rare earth element sector, recognizing the growing demand for materials essential for various advanced technologies. Their commitment to environmental stewardship and community engagement is a critical aspect of their operational ethos, as they navigate the complexities of mining operations in accordance to strict regulatory standards.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 1.17B | 1.31B | 982.72M | 880.93M | 974.44M | 971.52M |

| Enterprise Value | 1.05B | 1.21B | 879.75M | 807.29M | 885.93M | 873.67M |

| Trailing P/E | 11.33 | 15.81 | 14.51 | - | - | - |

| Forward P/E | - | - | - | - | - | - |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 30.65 | 44.05 | 33.81 | 70.22 | 70.86 | 81.98 |

| Price/Book (mrq) | 3.08 | 3.70 | 2.78 | 3.67 | 3.82 | 3.62 |

| Enterprise Value/Revenue | 35.49 | 110.19 | 128.19 | 41.16 | 4.98k | 297.88 |

| Enterprise Value/EBITDA | -29.02 | -194.04 | -87.98 | 3.23k | -65.07 | -68.18 |

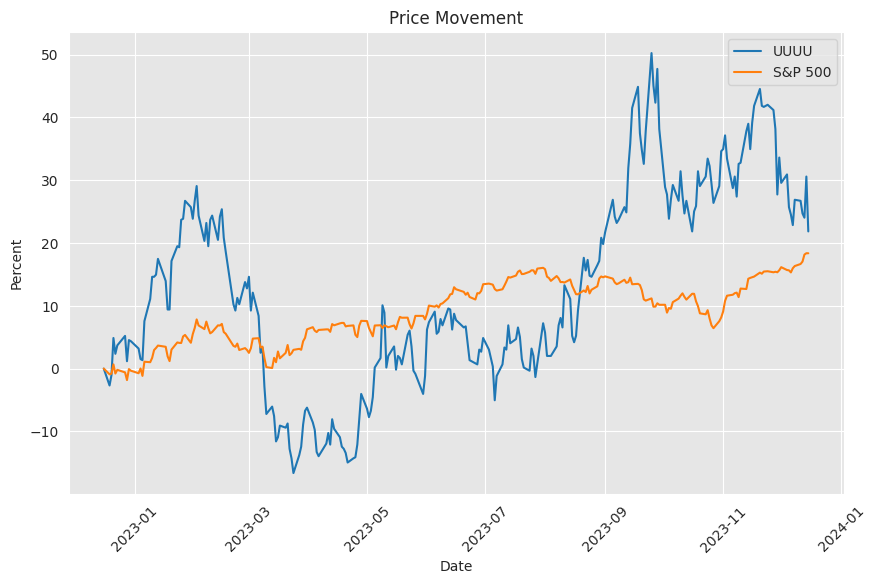

Based on the provided technical indicators and company fundamentals for UUUU, the following is an analysis of the potential stock price movement in the coming months:

Based on the provided technical indicators and company fundamentals for UUUU, the following is an analysis of the potential stock price movement in the coming months:

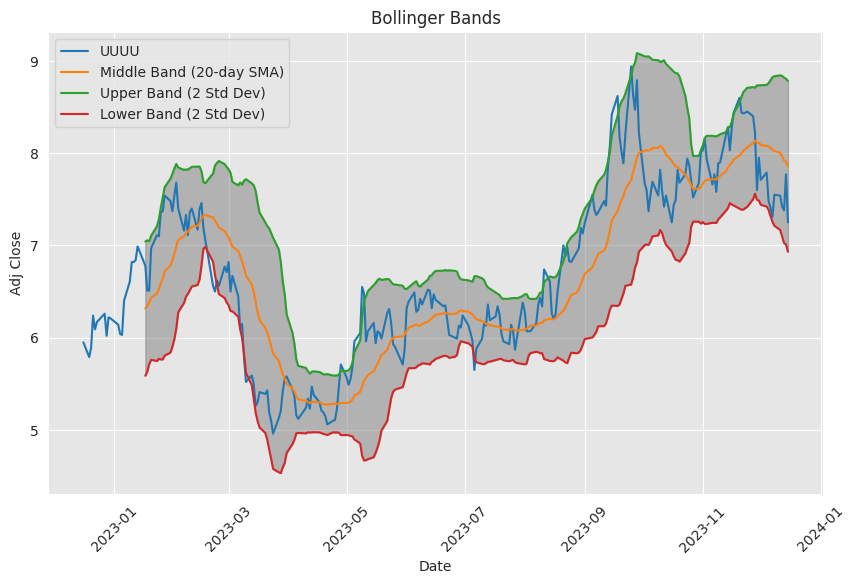

Technical Analysis: - The MACD line is negative, indicating bearish momentum. The MACD histogram is also negative but less so than the MACD line, which could suggest a slowdown in the downward momentum. - RSI at 40.72 is not yet in the oversold territory, implying there's room before a potential reversal might be expected. - Bollinger Bands indicate that the stock is trading near the lower band, suggesting the stock may be oversold in the very short term. - The stock is trading below both its 20-day SMA and 50-day EMA, which signals a bearish trend in the intermediate term. - OBV is fairly low, which could indicate a lack of buyer enthusiasm. - Stochastic oscillators (STOCHk and STOCHd) are below the 30 level, which usually indicates oversold conditions, potentially presaging a bounce if other conditions align. - The ADX, at above 20 but below 25, indicates a developing trend, whether bullish or bearish. - The Williams %R is near -100, which signals that the stock may be oversold. - Chaikin Money Flow (CMF) below zero indicates bearish pressure with a lack of buying interest. - The Parabolic SAR (stop and reverse) is below the price, suggesting the current bearish trend might be nearing its end.

Fundamental Analysis: - The company has experienced growth in its market cap over time, but there is a significant drop from the 9/30/2023 figures. - Trailing P/E is reasonably low at 11.33, which can be appealing to value investors, provided the industry average is considered. - High Price/Sales ratio could indicate that the stock is overvalued based on sales, which might deter some investors. - EV/Revenue is also quite high, suggesting the company might be overvalued in terms of its enterprise value against its revenue. - Negative values in EV/EBITDA and EBITDA suggest financial distress or at least profitability challenges. - Examining net income and other financial metrics, we observe the company has had significant losses in recent periods.

Projection: Considering both technical and fundamental perspectives, the outlook appears cautiously bearish. The negative financial indicators are a concern, as they indicate that the company may struggle to sustain profitability in the short to medium term. However, if the stock has been excessively sold-off and investor sentiment shifts, there could be a short-term rebound.

Several scenarios should be anticipated: - If the overall market sentiment improves and the company shows any positive changes in fundamentals or news released that might improve earnings expectations, UUUU could see short-term price gains. - Conversely, if the market continues to recognize the financial struggles of the company and the broad market undergoes a correction, UUUU's price could continue to fall, potentially testing previous support levels.

Investors should monitor key levels highlighted by the TA indicators. If the stock sustains above PSAR levels and RSI moves away from oversold conditions with volume increase and improving MACD, this could signal a bull case scenario for the stock. On the flip side, continued weakness in OBV and failure to break above the moving averages may reinforce the bear case.

Investor sentiment and subsequent actions are likely to be influenced heavily by any developments in the company's operational and financial performance. Observing closely for any changes in the fundamental backdrop and market trends will be crucial to navigate the stock's movement effectively. The next earnings report and any announcements regarding changes in management strategy or operational efficiency are potentially pivotal factors that could swing investor sentiment and the projected TA pathway.

Shares of Energy Fuels Inc. (NYSE American: UUUU), alongside other notable uranium mining companies such as Uranium Energy Corp. and Cameco Corporation, have recently seen significant upward movement in the stock market, reflecting a wave of investor confidence. This bullish market behavior can be traced back to legislative and cultural milestones that have seemingly converged to bolster the investment case for uranium and nuclear energy-related stocks.

Within the legislative domain, the Fiscal Responsibility Act of 2023 has been making strides in the United States Congress. This act, considered a harbinger of sound fiscal management and economic development, follows a broader trend of rising stock market indices, suggesting a returning investor appetite for growth-oriented sectors, including energy. Notably, the policy framework it advances has implications for the uranium market and companies like Energy Fuels Inc.

Crucially, the Fiscal Responsibility Act preserves certain measures from the Inflation Reduction Act (IRA), which had set the stage for incentivizing clean energy investments. Of particular interest to the nuclear industry are provisions that favor nuclear power ventures, including an impressive $40 billion in loan funding from the Department of Energy. This loan funding, alongside a guarantee of $3.6 billion for clean energy projects, creates a substantial fiscal impetus for nuclear operations to expand.

Adding to the IRA's financially encouraging landscape is a tax credit system designed to benefit electricity production from qualified nuclear power plants. These tax credits offer attractive perks for nuclear energy producers, especially those who comply with wage requirements that safeguard worker rights and compensation. Energy Fuels Inc., as an established player in the nuclear energy sector, stands to gain from these fiscal encouragements.

Energy Fuels Inc. has a lucrative role in this evolving picture, as it engages not only in uranium mining but also in the production and recycling of rare earth elements and vanadium. Its operations span North and South America, granting it access to large and varied mineral deposits. The company has further reinforced its standing through the procurement of a federal contract to supply triuranium octoxide to the newly established US Strategic Uranium Reserve, emplacing it at the forefront of domestic uranium suppliers.

A fundamental contributor to the companys prospects is the undeniable momentum that public opinion can provide. The release of Oliver Stone's documentary "Nuclear Now," which pitches nuclear power as a pivotal solution to combat climate change, has inserted nuclear energy into cultural conversations and potentially affected investor perceptions. Stone's participation in widely heard platforms such as the Joe Rogan podcast has amplified this effect, casting a spotlight on nuclear energy's role in a sustainable future.

While Energy Fuels Inc. and its uranium-producing counterparts are receiving a considerable show of support from investors, and while legislative groundwork seems to favor their growth, the nature of the nuclear industry's expansion is characteristically gradual. The construction and commissioning of new nuclear power facilities are subject to lengthy timelines, vigorous safety protocols, and substantial capital investments. Thus, the boost in stock value may be an early bullish signal that does not fully encapsulate the time scales of operational growth.

Nevertheless, the fusion of legislative actions that facilitate funding for nuclear energy, the IRS's strategic stance on energy security, and the wave of cultural support for this low-carbon power source has positioned companies like Energy Fuels Inc. in an optimistic light. Investor sentiment, galvanized by recent legislative assurances and a positive shift in public discourse, suggests a fertile environment for nuclear energy's progressive integration into the national and global energy mix.

With the burgeoning support, further shaped by Stone's high-profile advocacy, strategic investors might be taking a long-term view of the investment potential within the energy sector.allt_budgets and transport_energy sustainability, these developments place companies like Energy Fuels Inc. in a stronger position for strategic growth and investment attraction.

Similar Companies in Uranium Production:

Report: Cameco Corporation (CCJ), Cameco Corporation (CCJ), Ur-Energy Inc. (URG), Report: NexGen Energy Ltd. (NXE), NexGen Energy Ltd. (NXE), Denison Mines Corp (DNN), Report: Uranium Energy Corp (UEC), Uranium Energy Corp (UEC)

News Links:

https://www.fool.com/investing/2023/06/01/why-shares-of-uranium-energy-cameco-and-energy-fue/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 9gFBqm

https://reports.tinycomputers.io/UUUU/UUUU-2023-12-16.html Home