Duke Energy Corporation (ticker: DUK)

2024-01-08

Duke Energy Corporation (ticker: DUK) is one of the largest electric power holding companies in the United States, with its headquarters based in Charlotte, North Carolina. The company operates in three core areas of the power sector: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables. Duke Energy serves approximately 7.7 million electric retail customers located in six states in the Southeast and Midwest regions, and it also supplies natural gas to more than 1.6 million customers in the Carolinas, Ohio, Kentucky, and Tennessee. The company's electric utility business generates, transmits, and distributes electricity to residential, commercial, and industrial customers, while the natural gas business does the same for natural gas consumers. With a growing portfolio in renewable energy, Duke Energy is actively investing in solar and wind energy assets and exploring emerging technologies to transition towards more sustainable energy solutions. The company's commitment to providing reliable service while reducing carbon emissions is an essential part of its long-term strategy. Duke Energy's stock (DUK) is a component of the S&P 500 index and is widely followed by investors who value its dividend-oriented performance and its role in the evolving energy sector.

Duke Energy Corporation (ticker: DUK) is one of the largest electric power holding companies in the United States, with its headquarters based in Charlotte, North Carolina. The company operates in three core areas of the power sector: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables. Duke Energy serves approximately 7.7 million electric retail customers located in six states in the Southeast and Midwest regions, and it also supplies natural gas to more than 1.6 million customers in the Carolinas, Ohio, Kentucky, and Tennessee. The company's electric utility business generates, transmits, and distributes electricity to residential, commercial, and industrial customers, while the natural gas business does the same for natural gas consumers. With a growing portfolio in renewable energy, Duke Energy is actively investing in solar and wind energy assets and exploring emerging technologies to transition towards more sustainable energy solutions. The company's commitment to providing reliable service while reducing carbon emissions is an essential part of its long-term strategy. Duke Energy's stock (DUK) is a component of the S&P 500 index and is widely followed by investors who value its dividend-oriented performance and its role in the evolving energy sector.

| Full Time Employees | 27,859 | Previous Close | 98.54 | Market Cap | 76,439,216,128 |

| Open | 98.38 | Day Low | 98.06 | Day High | 99.21 |

| Dividend Rate | 4.06 | Dividend Yield | 0.0412 | Payout Ratio | 0.8541 |

| Beta | 0.47 | Volume | 1,133,855 | Average Volume | 3,314,440 |

| Shares Out | 770,712,000 | Book Value | 61.017 | Price to Book | 1.6255 |

| Net Income | 3,699,000,064 | Trailing EPS | 4.73 | Forward EPS | 5.97 |

| Total Cash | 324,000,000 | Total Debt | 79,437,996,032 | Total Revenue | 28,750,000,128 |

| Return on Assets | 0.02385 | Return on Equity | 0.07364 | Free Cashflow | -4,492,749,824 |

Technical and fundamental analyses of Duke Energy Corporation's (NYSE: DUK) stock provide a multifaceted view of its potential future price movements. The following report outlines a predictive assessment based on technical indicators, company fundamentals, balance sheet data, and cash flows.

Technical and fundamental analyses of Duke Energy Corporation's (NYSE: DUK) stock provide a multifaceted view of its potential future price movements. The following report outlines a predictive assessment based on technical indicators, company fundamentals, balance sheet data, and cash flows.

Technical Indicators:

- The Parabolic SAR (stop and reverse) has been fluctuating, indicating a lack of a strong bullish or bearish trend.

- The On-Balance Volume (OBV) has seen an overall increase in the analyzed period, a positive sign suggesting accumulation.

- The Moving Average Convergence Divergence (MACD) histogram shows a recent trend towards bullish momentum, albeit with minor fluctuations indicating that the trend is not purely one-directional.

Fundamental Analysis:

DUK shows a robust gross margin of approximately 47% and an EBITDA margin of around 44%, indicating a strong ability to generate earnings relative to their revenue. The operating margin of around 27% is also a testament to efficient operational cost management.

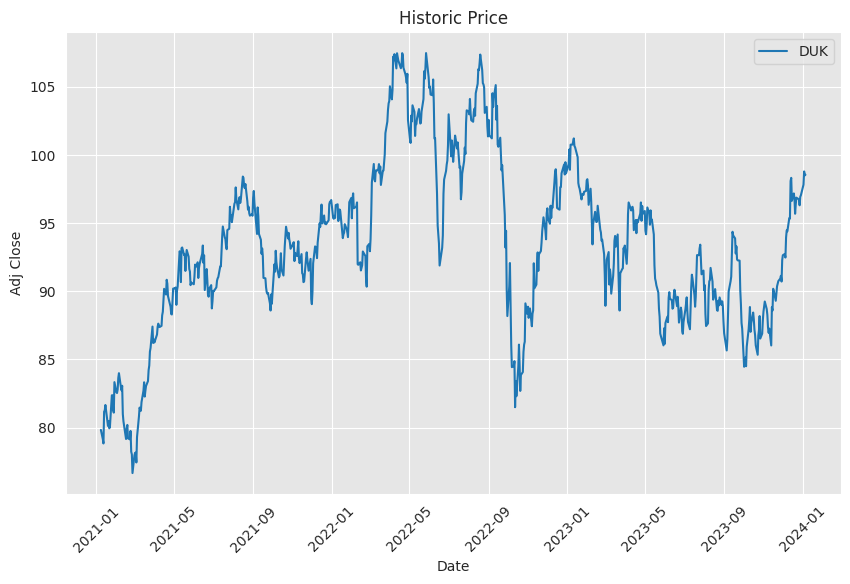

Over the last three years, DUK has maintained positive net income, although there has been a slight decline in net income from 2021 to 2022. The capital expenditures are high, emphasizing investment in their operational capabilities. These expenses are significant factors to watch as they can affect free cash flows. However, Duke Energy's financial stability appears unwavering, given its consistent operating revenue growth year over year.

Balance Sheet and Cash Flows:

- DUK has a high level of debt with an incremental increase from 2020 to 2022, though it is somewhat mitigated by the company's ability to generate solid operating cash flows.

- Cash and cash equivalents are relatively stable, suggesting that DUK maintains sufficient liquidity for short-term obligations.

- Free cash flow saw a dip from 2021 to 2022 but remains positive, which is essential for dividend payments and debt management.

With the above synthesis, the following can be concluded about the possible future stock price movement for Duke Energy:

- Short-term fluctuations may persist as the technical indicators suggest a lack of consensus on directional movement.

- Accumulation patterns reflected in the OBV and the slight bullish turn in the MACD histogram imply there is potential for upward price movement.

- However, investors should also consider the high level of outstanding debt, which could constrain significant gains.

- Given the robust margins and steady cash flows, DUK appears to be a stable investment that could potentially offer modest growth and solid dividend returns in the following months.

Investors might expect Duke Energy's stock price to experience a mild uptrend or consolidation in the absence of any significant market or industry shocks, whereas the consistent operational performance and financial stability indicated by the fundamentals may appeal to those looking for longer-term investment security. As always, it is prudent to monitor further financial releases and market conditions, as these factors contribute considerably to the stock's trajectory.

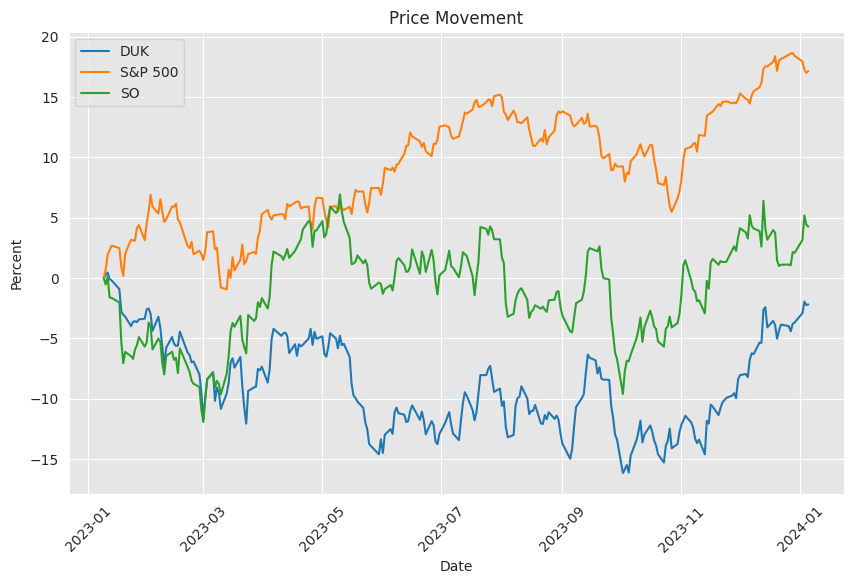

The alpha value for the linear regression model between DUK (Duke Energy Corporation) and SPY (SPDR S&P 500 ETF Trust) stands at approximately -0.0026, suggesting that DUK has underperformed the broader market as represented by SPY by a small margin during the analyzed period. An alpha of zero would have indicated that DUK's performance matched the performance of SPY, taking into account the risk or volatility represented by the beta. In this case, the negative alpha indicates that, after adjusting for market movements, DUK's returns were slightly lower than what might have been expected.

The model itself, having an R-squared value of 0.329, explains around 32.9% of the variance of DUK's returns based on SPY's returns, signifying a modest level of correlation between the two. A beta of 0.6627 implies that for every 1% change in the market (SPY), DUK's value is expected to change by approximately 0.6627%. However, the alpha remains the focal point here, and despite the beta indicating a positive correlation with the market, the negative alpha highlights that DUK's specific factors or systematic risk has led to a slightly underwhelming performance compared to the market as a whole.

Duke Energy Corporation, a leading energy company, conducted its Q3 2023 earnings call where the company reported earnings per share (EPS) that were in line with expectations at $1.94, matching analysts' forecasts. During the earnings review, Duke Energy's leadership, including CEO Lynn Good and CFO Brian Savoy, discussed the company's financial performance, regulatory developments, operational achievements, and strategic objectives. The results showed an increase in adjusted EPS from the previous years $1.78 for the same quarter, thanks to regulatory outcomes, simplification efforts, and continued operational excellence in growing jurisdictions.

The company confirmed its commitment to a long-term earnings growth rate of 5% to 7%. Even with challenges such as mild weather and weaker industrial volumes impacting 2023, Duke Energy has undertaken cost structure optimizations and efficiency improvements to maintain its guidance range, though trending towards the lower half. Notably, Duke Energy Progress in North Carolina achieved a significant milestone in performance-based regulation with approved increased retail rate base and capital investments, setting a supportive precedent for future cash flows and customer value delivery.

In discussing operations, CEO Lynn Good highlighted the updated Carolinas resource plan, reflecting Duke Energys leading role in the energy transition. The plan presents a unified approach to resource diversity, including solar procurement, additional natural gas generation, and potential exploration of advanced nuclear options. This strategic roadmap is expected to undergo regulatory hearings in 2024. Additionally, Good pointed out the completion of the commercial renewables sale, transitioning Duke Energy into a fully regulated entity poised to benefit from investments across various states, with examples such as grid hardening resulting in faster power restoration post-Hurricane Idalia in Florida.

CFO Brian Savoy provided a detailed financial breakdown, emphasizing a robust finish to the year despite initial mild weather and volume softness, thanks in part to cost mitigation efforts totaling $0.30 in savings. The company is also observing cautious optimism in the industrial sector, with expected future load increases driven by major economic developments and continued residential customer growth. Looking into 2024 and beyond, the company anticipates further earnings and capital growth, supported by constructive regulatory environments, sustained cost management, and organic growth facilitators such as robust economic development activities in their service territories.

Conclusively, Duke Energy reinforced its position on delivering sustainable value and growth, maintaining balance sheet strength, and continuing investments in cleaner energy resources. Through well-structured rate plans, ongoing strategic investments, and robust load growth projections, Duke Energy established confidence in its ability to offer compelling risk-adjusted returns for its shareholders while facilitating a balanced energy transition for customers. The company's leadership concluded the call by expressing enthusiasm for the fully regulated company's prospects and the ability to achieve its financial and operational targets.

Duke Energy Corporation (DUK), an energy company with a diversified portfolio, filed its quarterly report (10-Q) for the period ending September 30, 2023. As an integrated utility, Duke Energy operates in various segments including Electric Utilities and Infrastructure, and Gas Utilities and Infrastructure. The report provides detailed information on the financial and operational performance of the company during the quarter.

Duke Energy's Electric Utilities and Infrastructure unit is its largest segment, providing electricity to approximately 7.9 million customers in the Southeast and Midwest regions of the United States. This segment includes the regulated utility companies Duke Energy Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio, and Duke Energy Indiana, each operating within their respective states. The company's Gas Utilities and Infrastructure segment, represented by Piedmont Natural Gas, serves over 1.6 million customers in the Carolinas and Tennessee.

During the reporting period, Duke Energy continued to invest in its utility infrastructure with capital expenditures to enhance grid reliability, transition to cleaner energy sources, and cater to the growth in its service territories. They also focused on strategic initiatives such as grid modernization, expanding renewable energy, natural gas infrastructure growth, and initiatives to lower carbon emissions in line with regulatory and customer expectations.

The report also detailed significant regulatory proceedings, including rate adjustments and approvals. These proceedings reflect Duke Energy's ongoing interactions with state commissions, which regulate the utility rates and services provided by the company. Rate cases and proceedings are essential in allowing Duke Energy to earn a return on its invested capital and to recover the costs of providing safe and reliable energy to its customers.

Additionally, financial performance indicators such as revenue, operating expenses, net income, and cash flows are thoroughly presented. Duke Energy's financial results are key in understanding the company's ability to maintain operations, fund capital projects, service debt, and provide returns to shareholders.

The report also touched on various risks and uncertainties, such as environmental regulations, natural disasters, and fluctuating market conditions, which could impact future performance. Management's discussion and analysis of financial condition and results of operations provides insights into the company's strategies for risk management and future growth.

Overall, the 10-Q filing from Duke Energy Corporation serves as a comprehensive source of information for stakeholders looking to understand the company's current financial position, operational performance, strategic initiatives, and future outlook as of September 30, 2023.

Duke Energy Corporation, through its subsidiary Duke Energy Florida, has announced plans to reduce customer rates starting in January 2024. This move has been approved by the Florida Public Service Commission (FPSC) and will provide financial relief to the company's customers, including residential, commercial, and industrial sectors in Florida. With the rate change, residential customers who typically use 1,000 kilowatt-hours per month are expected to see a decrease of $11.29 or about 6% compared to their December 2023 bills. This rate reduction follows a history of similar adjustments, exemplifying Duke Energy's commitment to affordability and reliable energy provision.

The utility sector is witnessing a significant transformation, gravitating toward renewable energy to reduce emissions and address climate change concerns. According to the U.S. Energy Information Administration, by 2024, solar and wind generation is poised to exceed coal generation by a notable margin. Duke Energy aligns with this shift and is working towards achieving net-zero methane emissions from its natural gas operations by 2030 and net-zero carbon emissions from its electric generation by 2050.

Other utilities, such as Avista Corporation, DTE Energy, and Xcel Energy, have made commitments to clean energy, with goals aligned with both regulatory expectations and market trends. Their aggressive timelines for reducing carbon emissions demonstrate a shared industry focus on sustainable practices.

Duke Energy's market performance has proven resilient, with its stock outpacing the general utility industry over the past six months. This performance may be credited to its responsiveness to market demands, emphasis on clean energy production, and attention to customer-centric services, all of which have contributed to its reputation and financial health.

Duke Energy's community engagement is also noteworthy. The corporation recently awarded $225,000 in grants through its Duke Energy Foundation to South Carolina organizations focused on critical home improvements for the elderly. This Senior Home Repair Program is an example of Duke Energy's commitment to corporate responsibility and improving quality of life within its service territories.

Despite these philanthropic efforts, Duke Energy Carolinas has filed for a rate review with the Public Service Commission of South Carolina to address investments enhancing electrical system reliability and diversity. Duke Energy proposes to accelerate the return of excess deferred income tax benefits to customers, which could moderate potential rate increases. The alternative would be an increase of roughly $17.83 per month for a typical residential customer beginning August 2024, followed by a further increase two years later.

Duke Energy actively engages with its customers facing potential rate increases through energy efficiency programs and tools, as well as aid from government and nonprofit programs. To ensure transparency, the company details proposed rate adjustments and the review process on its website. Their proactive initiatives and emphasis on customer communication illustrate Duke Energys dedication to reliability and sustainability.

In contrast to Duke Energy's domestic focus, NextEra Energy's diversified model offers stable utility operations coupled with a substantial clean energy portfolio. NextEra has a history of dividend increases and a growth outlook supported by aggressive expansion plans in clean energy capacities. Its model offers investors a blend of stability and growth, making it an attractive option for income-focused investors.

In anticipation of severe weather, Duke Energy Corporation is readying its systems and workforce for prompt response to potential power disruptions. With the possibility of severe storms across the Carolinas, emergency preparedness guidance is offered to customers, underscoring Duke Energy's emphasis on readiness and communication.

The proactive steps Duke Energy takes are not limited to immediate response but also involve managing water flow in river systems to mitigate flood risks. Their multifaceted response strategy is part of their larger commitment to serving millions across diverse states, alongside a focus on renewable energy and environmental stewardship.

In another strategic advancement, Ormat Technologies, Inc. has made a significant expansion by acquiring geothermal and solar assets. This move reinforces the ongoing industry transition towards renewable energy sources, paralleling major utilities' efforts to bolster renewable capacities and reduce carbon emissions.

Amid the push for growth and investment in renewable energy, Duke Energy Corporation announced a buyback of its own shares. This reflects confidence in the intrinsic value and growth trajectory of their business, coming after a significant share price decline but coupled with solid operational performance. Through strategic mergers, acquisitions, and share repurchases, Duke Energy signals its commitment to long-term growth and shareholder returns.

Duke Energy Florida is bracing for severe weather that may impact its 1.9 million customers in the state. The utility has prepped its workforce and provided safety information to customers, drawing on an established disaster preparedness strategy. Their readiness exemplifies a broader commitment to reliability and service, underpinned by a robust clean energy strategy and corporate citizenship efforts.

Lastly, Duke Energy's commitment to community support is evident through recent charitable donations in Florida, addressing food insecurity and supporting vulnerable populations. The Duke Energy Foundation's contributions enhance community resources and reflect the corporation's broader goals of community investment and ensuring well-being.

While maintaining its philanthropic presence, Duke Energy encountered a slight decrease in electricity demand. However, the company anticipates a rebound in demand, driven by continuing customer growth and economic development. Moreover, Duke Energy's dividend yield remains attractive, and the projected demand recovery coupled with ongoing customer base growth provides a solid foundation for stability and expansion in the coming years.

Overall, Duke Energy's strategies resonate with a forward-thinking vision for the energy sector. As the corporation navigates the complexities of delivering affordable power, expanding its renewable portfolio, and fulfilling corporate social responsibilities, it stands firm in its role as a significant player poised for adaptive growth and enduring customer service.

Similar Companies in Electric Utilities:

Report: Southern Company (SO), Southern Company (SO), Dominion Energy (D), Exelon Corporation (EXC), Report: NextEra Energy (NEE), NextEra Energy (NEE), Report: American Electric Power (AEP), American Electric Power (AEP), FirstEnergy Corp (FE), PG&E Corporation (PCG), Edison International (EIX), PPL Corporation (PPL), Entergy Corporation (ETR)

News Links:

https://finance.yahoo.com/news/duke-energy-awards-225-000-134500678.html

https://www.fool.com/investing/2023/12/28/heres-why-nextera-energy-is-a-no-brainer-dividend/

https://finance.yahoo.com/news/ormat-technologies-ora-acquires-renewable-103300869.html

https://finance.yahoo.com/news/duke-energy-prepares-severe-weather-170100503.html

https://finance.yahoo.com/news/duke-energy-duk-unit-cut-172300363.html

https://finance.yahoo.com/news/duke-energy-carolinas-requests-rate-182100577.html

https://finance.yahoo.com/news/duke-energy-prepares-severe-weather-161000408.html

https://www.fool.com/investing/2023/11/10/this-magnificent-high-yield-dividend-stock-thinks/

https://finance.yahoo.com/news/duke-energy-donates-425-000-145400318.html

https://www.fool.com/investing/2023/11/17/the-good-news-in-duke-energys-bad-news-is-it-a-buy/

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: XybUbU

https://reports.tinycomputers.io/DUK/DUK-2024-01-08.html Home