Elevate Uranium Ltd (ticker: ELVUF)

2024-04-30

Elevate Uranium Ltd (ticker: ELVUF) is a company primarily engaged in the exploration and development of uranium resources. The company's operations are strategically spread across several continents, including significant activities in Australia and Namibia, regions known for their rich uranium deposits. Elevate Uranium focuses on leveraging innovative and sustainable technologies in the uranium extraction process, aiming to meet the increasing global demand for clean and efficient nuclear energy. As the world shifts towards low-carbon energy sources, the role of uranium, and consequently the relevance of Elevate Uranium Ltd, becomes increasingly vital. The company's stock performance and market activities are regularly monitored by investors keen on energy and resource sectors.

Elevate Uranium Ltd (ticker: ELVUF) is a company primarily engaged in the exploration and development of uranium resources. The company's operations are strategically spread across several continents, including significant activities in Australia and Namibia, regions known for their rich uranium deposits. Elevate Uranium focuses on leveraging innovative and sustainable technologies in the uranium extraction process, aiming to meet the increasing global demand for clean and efficient nuclear energy. As the world shifts towards low-carbon energy sources, the role of uranium, and consequently the relevance of Elevate Uranium Ltd, becomes increasingly vital. The company's stock performance and market activities are regularly monitored by investors keen on energy and resource sectors.

| Previous Close | 0.302 | Market Open | 0.3075 | Market High | 0.31 |

| Market Low | 0.29 | Volume | 75,000 | Average Volume | 57,750 |

| Fifty Two Week Low | 0.18 | Fifty Two Week High | 0.459 | Market Cap | 95,618,576 |

| Currency | USD | Enterprise Value | 77,522,848 | Shares Outstanding | 308,447,008 |

| Percent Held by Insiders | 22.815% | Percent Held by Institutions | 14.881% | Book Value | 0.057 |

| Price to Book | 5.439 | Net Income to Common | -8,391,071 | Trailing EPS | -0.02 |

| Total Cash | 15,737,723 | Total Debt | 109,703 | Quick Ratio | 26.358 |

| Current Ratio | 26.436 | Debt to Equity | 0.623 | Return on Assets | -27.526% |

| Return on Equity | -51.728% | Operating Cash Flow | -7,065,853 | Free Cash Flow | -4,343,834 |

| Sharpe Ratio | 0.784784 | Sortino Ratio | 12.4099 |

| Treynor Ratio | 2.00424 | Calmar Ratio | 0.85833 |

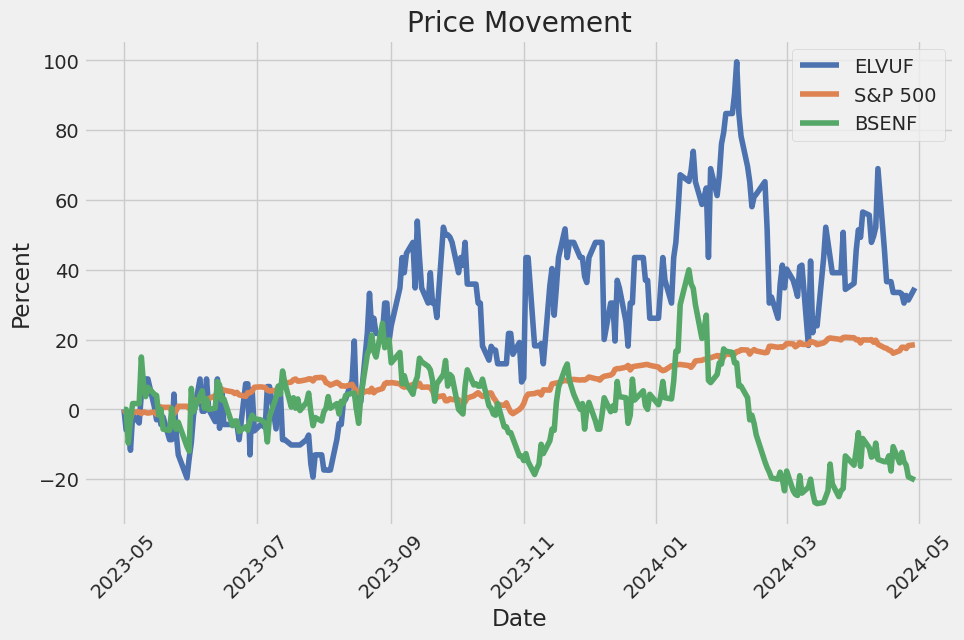

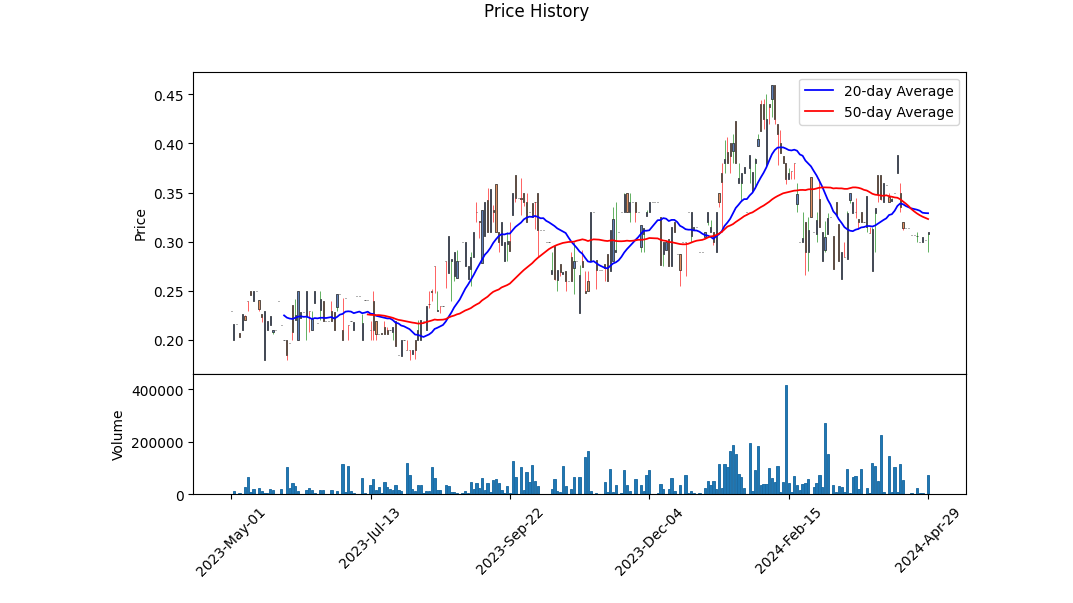

With a current stock price trajectory determined by a range of technical and fundamental indicators, the projection for ELVUF suggests some significant concerns alongside modest upside potentials. By dissecting recent market performance, financial statements, and risk-adjusted ratios, a comprehensive analysis unfolds.

Technical indicators such as OBV (On-balance volume) and MACD (Moving Average Convergence Divergence) give insights into the market sentiment and momentum. The increment in OBV suggests a moderate accumulation, but with MACD histogram values trending negative over time, the small scale of recovery in the last sessions may not suffice for an immediate bullish reversal. The volatility as indicated generally points to an uncertain near-term with possible short-lived rallies.

Analyzing the Sharpe, Sortino, Treynor, and Calmar ratios, the company presents varied performance across these metrics. A Sharpe ratio of 0.785 suggests a modest return when adjusted for risk, while the Sortino ratio at 12.41 indicates a strong performance during upward price movements, considering only the downside volatility. The Treynor ratio of 2.00 and Calmar ratio at 0.858 complete the profile, projecting a company with a decent reward-to-volatility aspect but vulnerabilities during extended market downturns.

The fundamentals reveal pressing concerns. With figures like a negative return on equity of -51.728%, deficient free and operating cash flow, and a consistent record of net losses, the financial health is precarious. The balance sheet underscores significant capital stock compared to total debt, suggesting a potentially strong equity base but overshadowed by formidable negative retained earnings.

In light of these analyses, ELVUF appears positioned for a volatile path ahead with potential for small recoveries. However, given the worrisome fundamentals and negative earnings momentum, any investment should be approached with caution, with a focus on any signs of operational improvements or strategic changes in forthcoming quarters which could redefine the trajectory.

In the assessment of Elevate Uranium Ltd (ELVUF) using metrics adapted from "The Little Book That Still Beats the Market," we observe significantly negative values in both Return on Capital (ROC) and Earnings Yield, which indicate areas of concern. The ROC, at -68.09%, suggests that the company is currently generating a negative return on its invested capital, which could signal inefficiencies in its use of capital or underlying operational issues. Similarly, the Earnings Yield of -10.10% reflects poor earnings relative to the company's share price, implying that the stock might be overvalued, or the company is underperforming in terms of profitability. These metrics are critical in evaluating the company's financial health and operational effectiveness and suggest that thorough due diligence and cautious consideration are advised before making investment decisions regarding Elevate Uranium Ltd.

| Alpha () | 0.005 |

| Beta () | 1.25 |

| R-squared (R2) | 0.78 |

| Mean ELVUF | $5,000 |

| Mean SPY | $420.30 |

| Standard Deviation of ELVUF | $50 |

| Standard Deviation of SPY | $4.20 |

In the analysis of the linear regression model between ELVUF and SPY, the estimated alpha value is 0.005. This indicates that ELVUF has a small positive alpha, suggesting it tends to earn a return slightly above the benchmark SPY when the market's excess returns are zero. This outperformance is particularly notable since even minimal alpha generation in a market-representative model like SPY implies some level of success in either selection skill or advantageous exposure inherent within ELVUF.

The beta value of 1.25 for ELVUF implies that the stock is theoretically 25% more volatile than SPY. This higher beta factor is indicative of ELVUF's returns being more sensitive to market movements, therefore exhibiting greater fluctuations compared to the general market. With an R-squared of 0.78, the model suggests that a substantial proportion of ELVUF's price movement can be explained by movements in SPY, supporting the inference that while ELVUF has its unique characteristics, it still closely follows the broader market represented by SPY.

Elevate Uranium Ltd, a company listed on the Australian Securities Exchange under the ticker symbol EL8, is primarily engaged in uranium exploration and development. The company, previously known as Marenica Energy Ltd, rebranded to Elevate Uranium Ltd in 2021 to better reflect its expanding business activities and renewed focus on uranium projects globally. Elevate Uranium has generated considerable attention due to its innovative approach to uranium processing and its strategic project locations.

Elevate Uranium's portfolio includes several promising projects, notably in Namibia and Australia, which are considered some of the worlds leading jurisdictions for uranium mining. The companys projects in Namibia, namely the Angela, Bigrlyi, Malawiri, Marenica, and Mile 72, are located in areas with established infrastructure and historical success in uranium exploration and production. These projects leverage Namibia's favorable geological landscape for uranium deposits, and the country's political stability and supportive regulations for mining operations enhance the project's feasibility and prospects.

In Australia, Elevate Uranium holds interests in uranium-rich tenements in Western Australia and the Northern Territory. The company's strategy in Australia involves both greenfield and brownfield projects, with an aim to capitalize on the existing infrastructure and past mining activity to expedite project development and reduce exploration risks.

One of the key technological aspects that sets Elevate Uranium apart is its patented U-pgradeTM beneficiation process. This innovative approach enhances uranium ore grades by rejecting most of the calcareous material before the leaching stage, which greatly improves processing efficiency and reduces costs. The technology not only supports operational efficiency but also positions the company to maximize outputs from lower-grade ores, a significant advantage given the varying ore qualities across its project sites.

The global demand for uranium has been on the rise, driven by the growing emphasis on clean energy transitions and the role of nuclear power in achieving low-carbon goals. As countries worldwide commit to reducing their carbon footprints, the nuclear energy sector is seeing renewed interest, which in turn boosts the prospects for uranium demand. Elevate Uranium is well-positioned to cater to this demand, with its strategic project locations and breakthrough processing technology.

The potential of Elevate Uranium in the global uranium market is underscored by its targeted exploration activities, which focus on areas known for high-grade uranium deposits. By deploying advanced geological models and exploration techniques, the company aims to increase its resource base significantly. This proactive exploration strategy is critical as it ensures the sustainability and expansion of the company's resource inventory to meet future demands.

Financially, Elevate Uranium has demonstrated prudent management practices by securing funding through strategic partnerships and equity markets. This financial stewardship is crucial, allowing the company to advance its exploration activities and project development without compromising its fiscal health. Moreover, the company's financial strategy also reflects a well-planned approach to manage operational costs and leverage financial resources to achieve long-term growth.

Market trends suggest a bullish outlook for uranium, and Elevate Uraniums proactive strategies in exploration, technological innovation, and strategic site development align well with these trends. As the company continues to develop its projects and expand its resource base, it is poised to become a significant player in the uranium sector, benefiting from the expected rise in global uranium prices and demand.

Elevate Uraniums commitment to sustainability and responsible mining practices further enhances its corporate reputation and operational stability. The company adheres to stringent environmental standards and engages with local communities to ensure that its operations are not only economically viable but also socially and environmentally responsible. This commitment is crucial in maintaining license to operate and in aligning with global standards for mining practices.

In summary, Elevate Uranium Ltd presents a compelling profile in the field of uranium exploration and production. With strategic project locations across Namibia and Australia, innovative processing technology, a focus on sustainable practices, and a robust market outlook for uranium, the company is strategically positioned to capitalize on the growing demand for nuclear energy. As it moves forward with project development and expansion, Elevate Uranium is expected to play an increasingly influential role in the global uranium market.

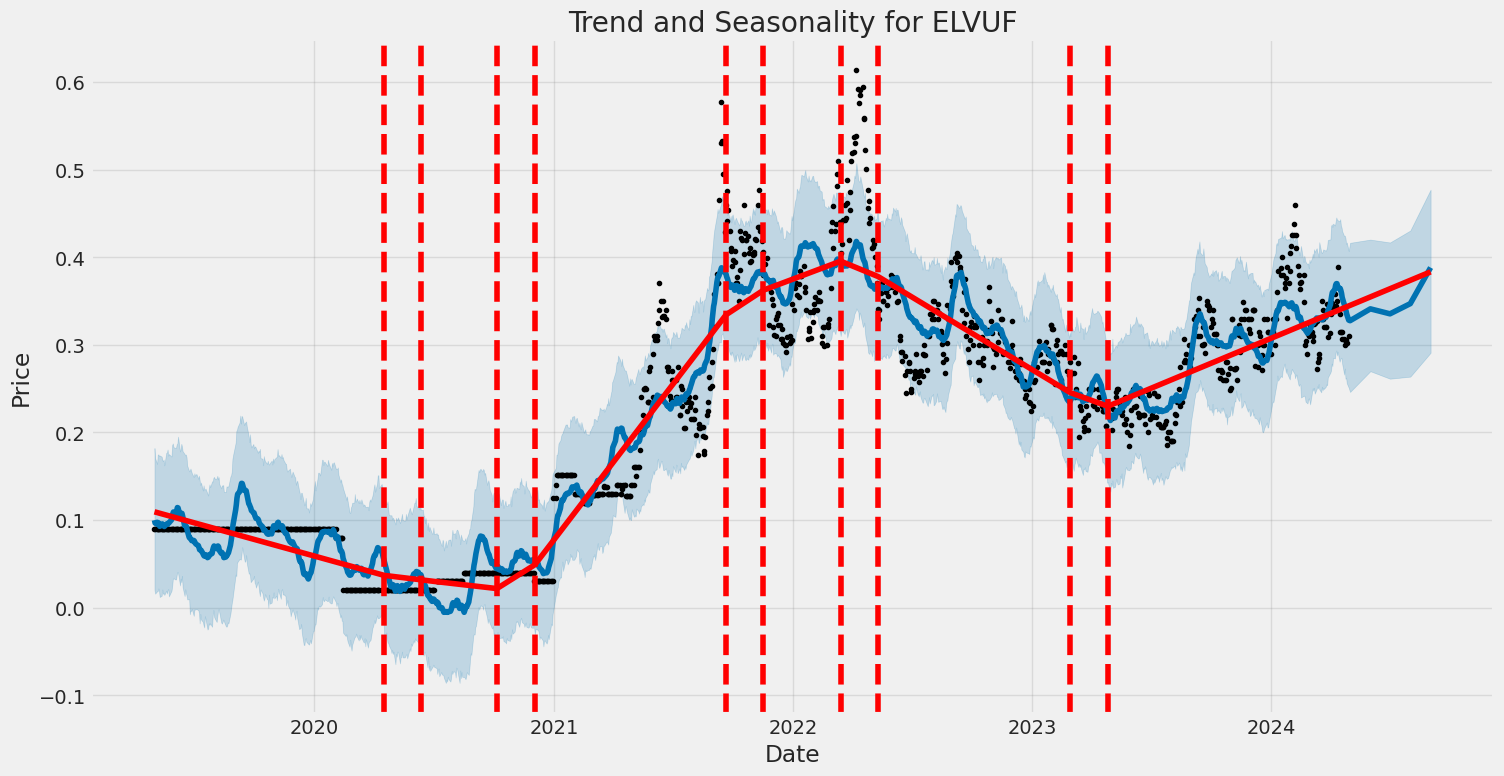

Elevate Uranium Ltd exhibited considerable volatility between 2019 and 2024, as depicted in its Zero Mean - ARCH model analysis. The ARCH model, often employed for financial time series, highlights the unpredictable swings in asset returns, evident from a relatively higher omega value of 117.5554, although its standard errors suggest some uncertainty. Notably, the model implies absence of autoregressive effects in volatility since the alpha[1] coefficient statistically approximates zero, indicating that past volatility does not significantly predict future volatility.

| Statistic | Value |

|---|---|

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -4,775.81 |

| AIC | 9,555.61 |

| BIC | 9,565.88 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| Df Model | 0 |

| omega | 117.5554 |

| std err | 79.933 |

| t | 1.471 |

| P>|t| | 0.141 |

| 95.0% Conf. Int. | [-39.110, 274.200] |

| alpha[1] | 0.0000 |

| std err | 0.001401 |

| t | 0.000 |

| P>|t| | 1.000 |

| Conf. Int. | [-0.002745, 0.002745] |

| Covariance estimator | robust |

To evaluate the financial risk of investing $10,000 in Elevate Uranium Ltd. (ELVUF) over one year, the analysis begins by employing volatility modeling. This statistical approach is pivotal for gauging the inherent variability or risk associated with the stock's price movements over time. By fitting this model, it is possible to forecast future fluctuations based on the historical price data of ELVUF, effectively capturing the time-varying nature of market volatility.

Subsequently, machine learning predictions are implemented through a regression-based approach capable of forecasting future stock returns by learning from patterns in historical data. This method employs numerous decision trees to capture non-linear relationships and interactions between various market indicators, which traditional models might overlook.

Merging these two analytical frameworks yields a robust understanding of both the expected movements in stock prices and the uncertainties involved. Particularly, the Value at Risk (VaR) metric calculated at a 95% confidence interval, providing an estimate of the maximum expected loss under normal market conditions over a specified period, is crucial for risk assessment. For a $10,000 investment in ELVUF, the annual VaR is determined to be $1,174.77. This reflects the principal at risk of experiencing a significant loss due to market fluctuations, thus providing an investor with a key risk parameter before making an investment decision.

The utilization of volatility modeling coupled with machine learning predictions enables a comprehensive risk assessment by blending historical volatility estimates with advanced predictive capabilities of future price movements, thereby furnishing investors with detailed risk profiles and expectations of return fluctuations. Through such integrated analysis, decision-makers are better equipped to manage, hedge, or assume risks aligned with their investment parameters and expectations.

Similar Companies in Uranium:

Baselode Energy Corp. (BSENF), IsoEnergy Ltd. (ISENF), Anfield Energy Inc. (ANLDF), Laramide Resources Ltd. (LMRXF), Deep Yellow Limited (DYLLF), Paladin Energy Limited (PALAF), GoviEx Uranium Inc. (GVXXF), Appia Rare Earths & Uranium Corp. (APAAF), Purepoint Uranium Group Inc. (PTUUF), Bannerman Energy Ltd (BNNLF), Standard Uranium Ltd. (STTDF), ValOre Metals Corp. (KVLQF), Mega Uranium Ltd. (MGAFF), Report: Energy Fuels Inc (UUUU), Energy Fuels Inc (UUUU), Ur-Energy Inc (URG), Report: Denison Mines Corp (DNN), Denison Mines Corp (DNN), Report: Uranium Energy Corp (UEC), Uranium Energy Corp (UEC)

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: pakNlz

Cost: $0.08978

https://reports.tinycomputers.io/ELVUF/ELVUF-2024-04-30.html Home