enCore Energy Corp. (ticker: EU)

2024-03-25

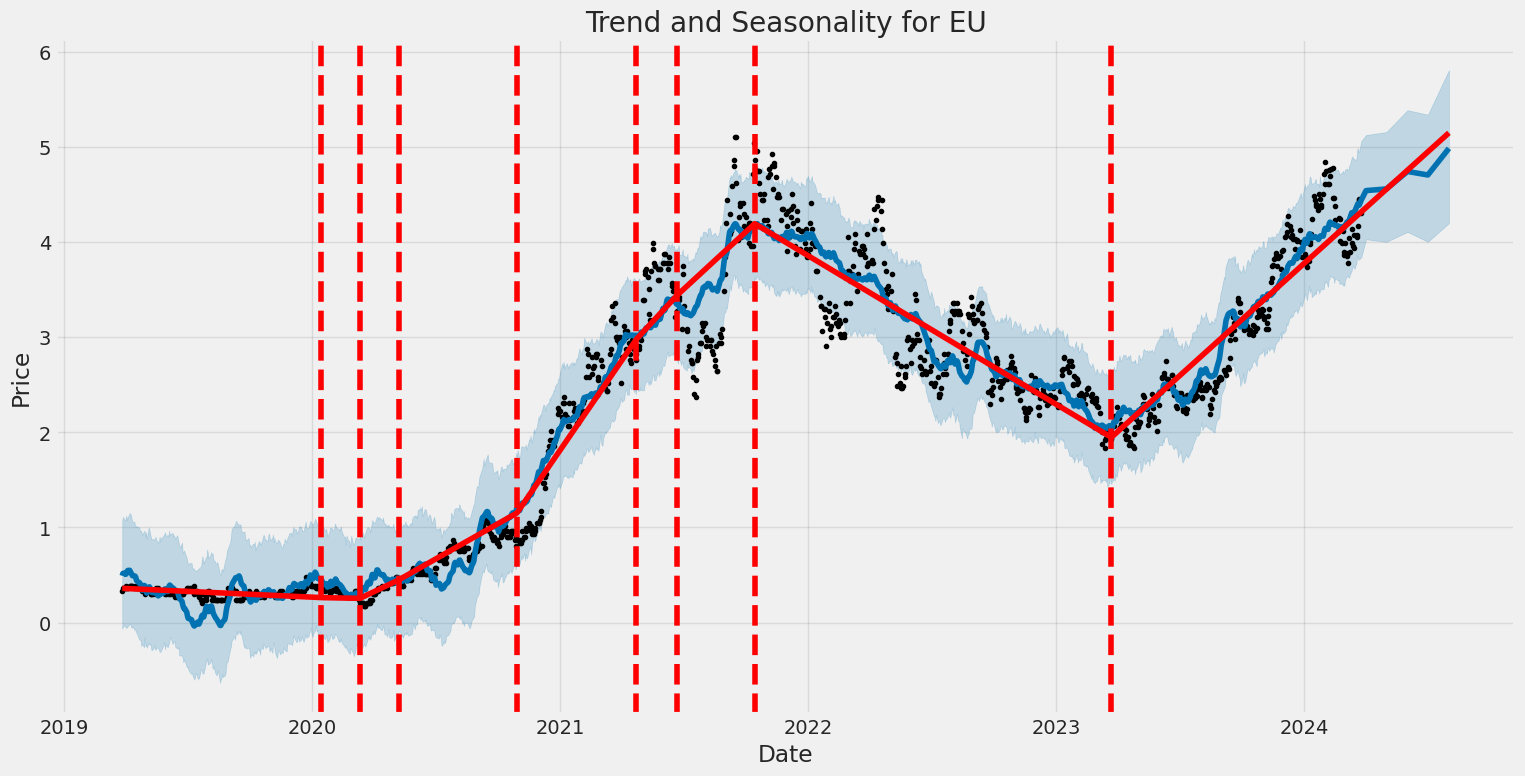

EnCore Energy Corp., traded under the ticker symbol EU, stands as a prominent player in the uranium sector, primarily focused on the acquisition and development of uranium properties within the United States. The company leverages its strategic asset base and expertise to position itself within the rapidly growing nuclear energy market. With an emphasis on sustainable and responsible mining practices, EnCore aims to meet the increasing demand for clean energy sources, addressing both environmental concerns and energy security. The company's portfolio includes several promising projects at various stages of exploration, development, and licensing, which are poised to capitalize on the anticipated upswing in uranium prices. Given the global shift towards cleaner energy solutions and the pivotal role of uranium in this transition, EnCore Energy Corp.'s strategic initiatives and assets underline its potential for growth and its contribution to the energy sector's evolution.

EnCore Energy Corp., traded under the ticker symbol EU, stands as a prominent player in the uranium sector, primarily focused on the acquisition and development of uranium properties within the United States. The company leverages its strategic asset base and expertise to position itself within the rapidly growing nuclear energy market. With an emphasis on sustainable and responsible mining practices, EnCore aims to meet the increasing demand for clean energy sources, addressing both environmental concerns and energy security. The company's portfolio includes several promising projects at various stages of exploration, development, and licensing, which are poised to capitalize on the anticipated upswing in uranium prices. Given the global shift towards cleaner energy solutions and the pivotal role of uranium in this transition, EnCore Energy Corp.'s strategic initiatives and assets underline its potential for growth and its contribution to the energy sector's evolution.

| Address | 101 North Shoreline Boulevard, Suite 450, Corpus Christi, TX, 78401, United States | Phone | 361 239 5449 | Website | https://www.encoreuranium.com |

|---|---|---|---|---|---|

| Industry | Uranium | Sector | Energy | Previous Close | 4.44 |

| Day Low | 4.29 | Day High | 4.6 | Volume | 812,564 |

| Average Volume | 1,345,377 | Market Cap | 808,103,360 | 52 Week Low | 1.76 |

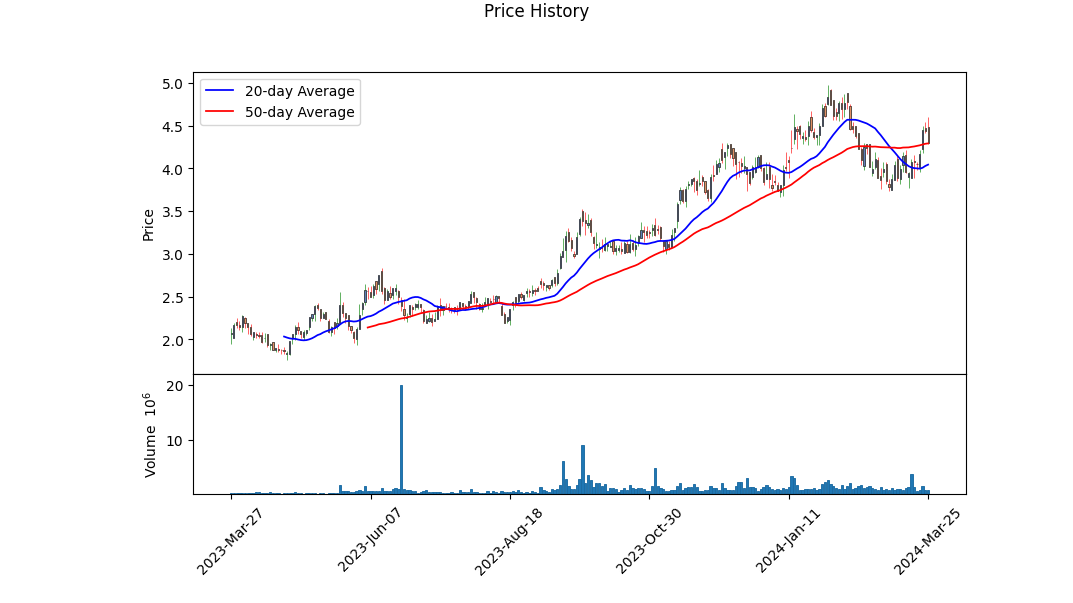

| 52 Week High | 4.97 | Fifty Day Average | 4.2876 | 200 Day Average | 3.3535 |

| Shares Outstanding | 183,894,000 | Float Shares | 157,959,682 | Shares Short | 3,517,261 |

| Held Percent Insiders | 1.82% | Held Percent Institutions | 31% | Short Ratio | 2.55 |

| Book Value | 1.726 | Price To Book | 2.4913096 | Current Price | 4.3 |

| Total Cash | 19,516,764 | Total Cash Per Share | 0.121 | Total Debt | 39,854,216 |

| Quick Ratio | 6.216 | Current Ratio | 6.216 | Debt To Equity | 15.134 |

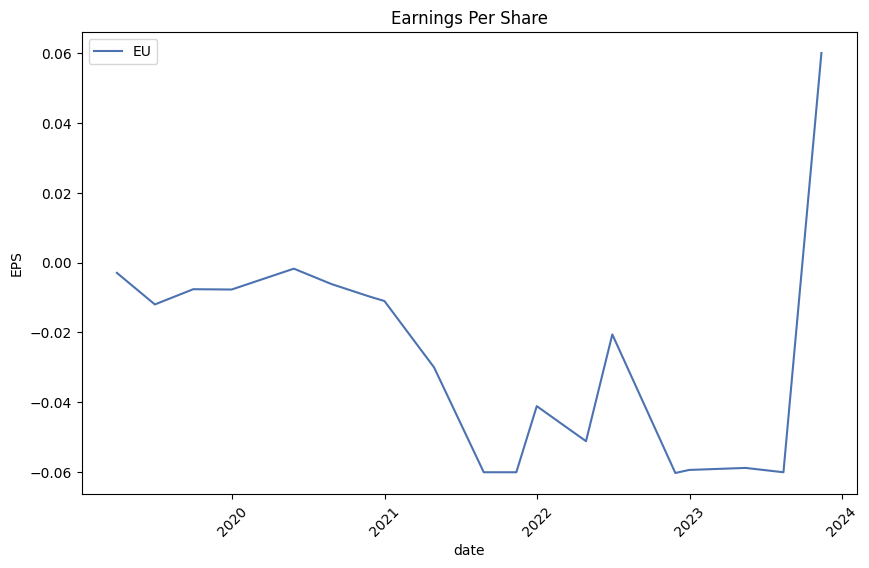

| Return On Assets | -6.416% | Return On Equity | -5.333% | Free Cash Flow | -78,674,512 |

| Sharpe Ratio | 1.604838202887734 | Sortino Ratio | 29.60226688741472 |

| Treynor Ratio | 0.5887630270922585 | Calmar Ratio | 4.942810541112091 |

Evaluating the technical, fundamental, and market sentiment indicators provides a comprehensive view of EU's potential stock price movement over the next few months. The analysis is based on a detailed examination of technical indicators, balance sheets, cash flows, and risk-adjusted return ratios.

Technical Analysis

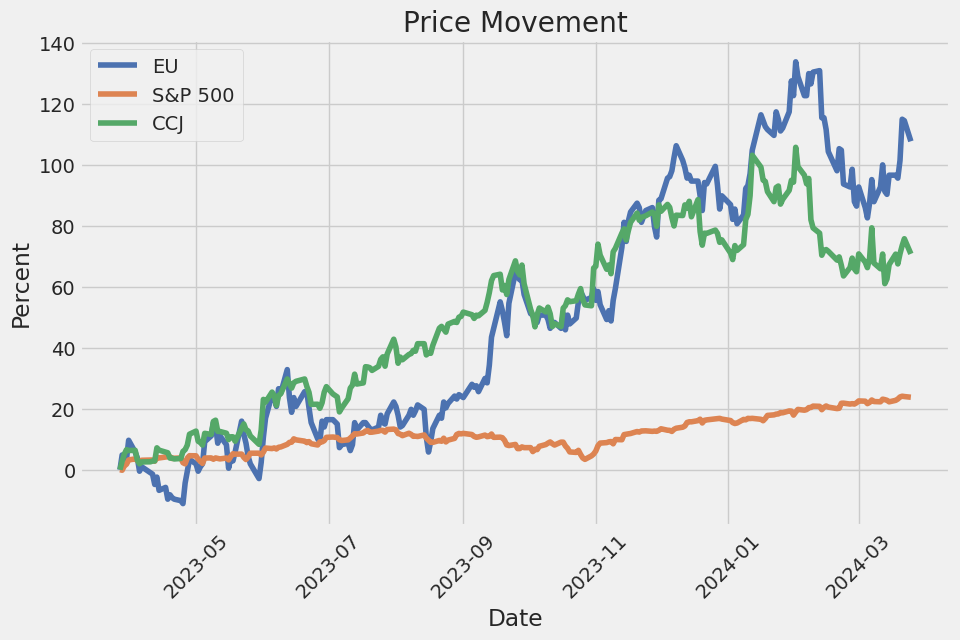

The technical indicators over the last recorded period provide significant insights into the stock's price movement. Starting with the Open and High figures showing a gradual increase and the On-Balance Volume (OBV_in_million) indicating heightened trading activity, it became evident that investor sentiment towards the stock has been positive. Particularly, the MACD histogram's upward trend towards the end of the period underlines a strong bullish momentum. This pattern, along with increasing OBV, suggests a potential continuation of the upward price movement.

Fundamental Analysis

The financial health of a company is vital in supporting its stock price. Despite the negative return on equity and substantial free and operating cash flow deficits revealing financial distress, the company's ability to generate revenue remains crucial. Analyst expectations indicating modest revenue estimates provide a glimmer of hope for financial recovery and stability. Nevertheless, the absence of earnings growth estimates could raise concerns about the company's future profitability and sustainability.

Risk-Adjusted Return Ratios

The risk-adjusted return ratios - including the Sharpe, Sortino, Treynor, and Calmar ratios - are significantly favorable, suggesting that the stock might offer valuable investment returns relative to its risk. The notably high Sortino Ratio implies that the stock is efficiently managing bad volatility, underscored by a strong Calmar Ratio, which indicates resilient performance during downturns.

Balance Sheets and Cash Flows

Reviewing the balance sheet data, the increase in ordinary shares number points to dilution or capital raising efforts, likely aimed at financing operations or repaying debt. The relatively stable tangible book value and invested capital suggest underlying asset value that could support future growth. However, the negative free cash flow and concerning cash flow from operating activities indicate liquidity risks that could affect short-term operational capabilities.

Conclusion

Considering the blend of technical and fundamental analyses with risk-adjusted performance metrics, it appears that the stock has potential for further price appreciation, driven by positive market sentiment and technical momentum. However, investors should be cautious of the financial strain indicated by the fundamentals, including negative returns and cash flow issues, that could pose significant risks. Optimistically, if the company can leverage its assets and capitalize on market opportunities to improve its revenue and earnings, there could be a positive outlook for the stock price movement in the upcoming months. Investors are advised to monitor the company's performance closely, with particular attention to any shifts in financial health and market sentiment.

In our analysis of enCore Energy Corp. (EU), two pivotal metrics were assessed: Return on Capital (ROC) and Earnings Yield, both of which are integral for evaluating the company's financial health and investment appeal. The Return on Capital for enCore Energy Corp. stands at -8.676511982284648%. Typically, ROC is a measure of how efficiently a company generates profits from its capital, but in this case, the negative ROC indicates that the company is currently not generating profits from its capital, but rather incurring losses. This could signal inefficiencies in the company's operations or perhaps investments that have yet to yield returns. Similarly, the Earnings Yield, which is calculated as the inverse of the Price-to-Earnings ratio and gives investors an idea of the earnings generated from each dollar invested in the company's stock, is -3.7209302325581395%. Like the ROC, a negative Earnings Yield denotes that enCore Energy Corp. is currently unprofitable, which might deter investors looking for immediate returns on their investments. These figures suggest that the company is facing financial challenges, thus warranting a cautious approach for investors considering enCore Energy Corp. as a potential investment. However, it's also important to consider the broader context, including market conditions and future potential, when evaluating these numbers.

| Statistic Name | Statistic Value |

| R-squared | 0.057 |

| Adj. R-squared | 0.056 |

| F-statistic | 75.83 |

| Prob (F-statistic) | 9.59e-18 |

| Log-Likelihood | -3991.1 |

| No. Observations | 1,256 |

| AIC | 7986. |

| BIC | 7996. |

| coef (const) | 0.3098 |

| coef (0) | 1.0831 |

| std err (const) | 0.164 |

| std err (0) | 0.124 |

| t (const) | 1.888 |

| t (0) | 8.708 |

| P>|t| (const) | 0.059 |

| P>|t| (0) | 0.000 |

| [0.025 | -0.012 |

| 0.975] (const) | 0.632 |

| [0.025 (0) | 0.839 |

| 0.975] (0) | 1.327 |

| Omnibus | 320.534 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 2674.752 |

| Skew | 0.939 |

| Kurtosis | 9.898 |

| Cond. No. | 1.32 |

The linear regression analysis between the EU stock index and the SPY, which represents the overall market, reveals a relatively low R-squared value of 0.057. This suggests that the model, despite being statistically significant, explains just a small fraction of the variance between the EU index movements and the broader market as captured by SPY. The alpha, or intercept, of the model is measured at approximately 0.3098, indicating that if the SPY experienced no movements (zero percent change), the expected movement in the EU index would be a 0.3098% increase. The beta coefficient, representing the change in the EU index for each percentage change in SPY, stands at 1.0831, suggesting that the EU index moves in the same direction as the SPY but with slightly more volatility.

The additional statistics such as the F-statistic and its corresponding probability highlight the significance of the model among the observed variables. The relatively low p-value for the coefficients suggests that both the constant term (alpha) and the slope (beta) are statistically significant predictors of the relationship between EU stock index movements and the broader market trends represented by SPY. Nonetheless, the modest R-squared value points towards a large amount of unexplained variance, hinting at other factors outside this model influencing EU index performance. The analysis, dated Mon, 25 Mar 2024, based on 1256 observations, brings into focus the primary role of SPY market movements in predicting the direction, though not the magnitude, of EU stock index changes over the observed period.

EnCore Energy Corp. represents a pivotal advancement in the U.S. energy sector, particularly emphasizing the significance of uranium in the clean energy transition. In its strategic movement, the company recently marked an impactful milestone through a transaction with Boss Energy Limited, demonstrating not only its financial acumen but also its commitment to operational growth and sustainability. The sale of a 30% stake in the Alta Mesa project for US$60 million, alongside a US$10 million investment in common shares, not only strengthens enCore's financial standing but also positions it strategically within the proliferating uranium market.

The implications of such a transaction extend beyond financial increments; they embolden enCore to expedite the development of its critical uranium projects across South Texas, signaling a robust approach towards securing America's clean energy future. With an untethered focus on the Dewey Terrace and Dewey-Burdock projects as well as the Gas Hills endeavor in Wyoming, enCore leverages this partnership to assure its stakeholders of an aggressive yet prudent production ramp-up.

Intriguingly, the partnership with Boss Energy is not merely transactional but also operational, as evidenced by the structured agreements focusing on uranium loan, PFN technology development, and a joint venture governing framework. These agreements holistically fortify the operational and strategic avenues for both entities, ensuring a synergetic progression towards uranium production acceleration, especially at the Alta Mesa site. Scheduled for a production reboot in the second quarter of 2024, Alta Mesa's historical significance and potential for substantial uranium output resonate with enCore's strategic ambitions and its overarching narrative of contributing to the clean energy matrix.

Financially, enCore's positioning is remarkably strong, with its zero-debt status and ongoing production at the Rosita plant signaling operational efficacy and financial health. This framework not only attracts potential investments but also reassures stakeholders of the company's sustainable growth trajectory, further amplified by strategic corporate actions documented in recent TSX Venture Exchange bulletins.

The recent developments underscored by Newsfile Corp., highlighting enCore's zero-debt status, financial robustness, and operational milestones, particularly the revenue generation from the Texas plant, delineate the company's strategic advancements in the clean energy domain. Such accomplishments not only elevate enCore's market position but also accentuate its role in fostering a sustainable energy future, reflecting a balanced amalgamation of financial stability and operational success.

Further elevating its corporate social responsibility, enCore announced the establishment of the enCore Energy Education Society and its scholarship programs, underlining its commitment to community development and educational empowerment. This initiative, aiming at nurturing future leaders within the energy sector, showcases enCore's holistic approach to corporate responsibility, emphasizing the intertwining of operational success with community upliftment and educational advancement.

Adding to its string of achievements, enCore's inaugural shipment and delivery of uranium, in conjunction with securing a fifth long-term supply contract, emblematically represents its operational prowess and strategic foresight. These developments not only address the critical uranium shortage in the U.S. but also secure a stable revenue stream for enCore, ensuring its pivotal role in the U.S. energy sector's transformation towards sustainability.

Moreover, the announcement of enCore's Investor Day in New York City manifests its intent to engage transparently with its investors, offering insights into the company's strategic and operational directions. Coupled with the participation in the NASDAQ Opening Bell Ringing Ceremony, these endeavors exemplify enCore's commitment to stakeholder engagement and market visibility, fortifying its narrative as a leader in America's clean energy landscape.

These orchestrated efforts, from strategic transactions and operational advancements to community engagement and financial health, coalesce to position enCore Energy Corp. as a key player in the sustainable energy sector. The company's strategic orientations, underscored by a commitment to clean and reliable energy provision, not only showcase its operational excellence and financial prudence but also its profound impact on the U.S. energy landscape, echoing its vision as America's Clean Energy CompanyTM.

EnCore Energy Corp. (EU) exhibited significant volatility within the specified period, as depicted by the ARCH model results. Notably, the ARCH model, which focuses on analyzing and forecasting the variance of time series data, highlights the asset's fluctuation intensity through key parameters such as omega and alpha. The omega value at 30.7549, with a confidence interval spanning from 24.726 to 36.784, indicates a high base level of volatility. Additionally, the alpha[1] coefficient at 0.1314, confirmed by its statistically significant p-value, suggests that past squared returns greatly influence the magnitude of current volatility, pointing towards a considerable impact of past market movements on future price dynamics.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -4004.04 |

| AIC | 8012.07 |

| BIC | 8022.34 |

| omega | 30.7549 |

| alpha[1] | 0.1314 |

Analyzing the financial risk involved in a $10,000 investment in enCore Energy Corp. (EU) over a one-year period requires a sophisticated approach that combines volatility modeling and machine learning predictions. These methods together offer a nuanced understanding of potential price movements and their implications for investors.

Volatility modeling is essential for estimating the fluctuations in the stock price of enCore Energy Corp. over time. This technique helps in capturing the persistence of volatility shocks, a critical aspect when assessing investment risk. By employing this method, we gain insight into past price movement patterns, which inform the level of risk associated with the investment. It allows us to forecast future volatility based on historical data, providing a foundational element of our risk assessment.

On the other hand, machine learning predictions contribute to this analysis by utilizing historical data to forecast future returns of enCore Energy Corp.'s stock. Machine learning, particularly the approach that employs decision tree-based algorithms, excels at identifying complex nonlinear relationships within the data that might not be apparent through traditional analysis. This method leverages historical stock performance and various market indicators to predict future stock behavior, offering a forward-looking perspective on the investment's potential performance.

Integrating these two methodologies enables a comprehensive risk analysis. The volatility modeling method provides a view of the stock's inherent risk by analyzing the variability in its price. This analysis is crucial when calculating the Value at Risk (VaR), which quantifies the maximum expected loss over a specific period with a given confidence interval. Meanwhile, machine learning predictions area allows us to factor in the expected direction of the stock's movement by incorporating broader market trends and specific conditions affecting enCore Energy Corp.

For this analysis, the calculated Value at Risk (VaR) at a 95% confidence interval for a $10,000 investment in enCore Energy Corp. is found to be $503.68. This figure represents the estimated maximum loss that the investment might experience in a year, with 95% confidence. This VaR figure is instrumental for investors to understand the financial risk quantitatively, offering a specific dollar amount that encapsulates the potential downside within the context of the analyzed confidence interval.

The effectiveness of this integrated approach is evident in the calculated VaR, which combines insights from both the past and expected future performance of the stock. By harnessing both volatility modeling and machine learning predictions, investors are provided with a nuanced view of the investment's risk profile, enhancing their ability to make informed decisions.

When analyzing the options chain for enCore Energy Corp. (EU) to identify the most profitable call options, it's essential to consider the Greeks' values: Delta, Gamma, Vega, Theta, and Rho, alongside the strike price, expiration date, premium, ROI (Return on Investment), and potential profit. Given that our target is an option that performs well with the stock price increasing by 5% from its current level, let's delve into an analysis based on the provided data.

One of the options that stand out involves a strike price of $4.0, set to expire on April 19, 2024. This option has a Delta of 0.7244259177, indicating that for every dollar increase in the underlying stock price, the value of the option is expected to increase by approximately 72 cents. Its Gamma value of 0.5422983179 is quite high, suggesting that the option's Delta is sensitive to changes in the underlying stock price, which is a beneficial trait if we anticipate the stock to rise. The option's Vega is 0.3682926483, which shows it has a reasonable level of sensitivity to changes in the implied volatility of the stock. Its Theta of -0.0045995579 indicates a relatively slow rate of time decay, which is good for a call option holder. Given its premium of $0.4 and an ROI of 28.75%, coupled with a profit of $0.115, this option seems to have a favorable balance between cost, potential return on investment, and sensitivity to stock price movements.

Another intriguing option has a strike price of $3.0 and expires on October 18, 2024. It exhibits a Delta of 0.8508850129, making it highly responsive to movements in the underlying stock's price. The Gamma value is 0.1125643414, indicating a moderate sensitivity to changes in the Delta, which can be advantageous if the stock price moves favorably. The Vega of 0.7502264138 is notably high, suggesting considerable sensitivity to volatility changes, which can amplify gains if the implied volatility increases. The Theta of -0.001406112 reflects a very gradual time decay, which is beneficial for a call option. Additionally, its Rho of 1.1776032477 shows it's highly responsive to changes in interest rates, though this may be a less critical factor given the specific investment horizon. With a premium of $1.4, ROI of 8.21428571%, and a profit of $0.115, this option presents a solid opportunity for investors optimistic about the stock's price appreciation and willing to engage with higher volatility.

Notably, the option with a strike price of $1.0 expiring on October 18, 2024, demonstrates extreme sensitivity to stock price movements with a Delta of 0.9999822385, essentially moving almost 1:1 with the stock. However, its very low Gamma, Vega, and Theta values indicate that it's not expected to experience significant changes in value due to volatility or time decay, and its high premium of $2.95 reflects its deep in-the-money status, offering a different type of investment approach focused more on intrinsic value than on leverage from volatility or time sensitivity.

In summary, for an investor predicting a 5% increase in enCore Energy Corp stock price, options with a combination of high Delta for profitability, controlled Gamma for manageable sensitivity to stock price movement, reasonable Vega for benefiting from volatility changes, and lower Theta to minimize time decay are ideal. The options with strike prices of $4.0 expiring in April 2024 and $3.0 expiring in October 2024 offer compelling opportunities with balanced risk-reward profiles suitable for different strategies and market outlooks.

Similar Companies in None:

Report: Cameco Corporation (CCJ), Cameco Corporation (CCJ), Report: Energy Fuels Inc (UUUU), Energy Fuels Inc (UUUU), Ur-Energy Inc (URG), Report: Uranium Energy Corp (UEC), Uranium Energy Corp (UEC)

https://finance.yahoo.com/news/encore-energy-completes-us-70-120000969.html

https://finance.yahoo.com/news/tsx-venture-exchange-stock-maintenance-044300043.html

https://finance.yahoo.com/news/btv-highlights-founders-metals-arizona-170500012.html

https://finance.yahoo.com/news/encore-energy-launches-scholarship-programs-120000428.html

https://finance.yahoo.com/news/encore-energy-announces-first-shipment-120000813.html

https://finance.yahoo.com/news/encore-energy-host-first-investor-110000075.html

https://finance.yahoo.com/news/encore-energy-encounters-highest-grade-110000897.html

https://finance.yahoo.com/news/encore-energy-ring-nasdaq-opening-110000178.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 6zgFxn

Cost: $0.41887