Fifth Third Bancorp (ticker: FITB)

2024-02-11

Fifth Third Bancorp (FITB), a diversified financial services company headquartered in Cincinnati, Ohio, operates within the United States as a key player in the banking sector. As of the latest financial analysis, Fifth Third Bancorp offers a broad spectrum of financial products and services to its customers, including but not limited to, personal banking, commercial banking, lending, payment processing, and wealth management services. The bank serves clients across various states, leveraging both a significant physical branch network and digital platforms to cater to the evolving needs of its customer base. Financial performance indicators highlight its commitment to growth, stability, and shareholder value, with recent quarters showing solid earnings, asset growth, and a focus on strategic acquisitions to enhance its market presence further. FITB's efforts in embracing technological advancements and prioritizing customer satisfaction have been pivotal in its ability to maintain competitiveness in a rapidly changing financial landscape.

Fifth Third Bancorp (FITB), a diversified financial services company headquartered in Cincinnati, Ohio, operates within the United States as a key player in the banking sector. As of the latest financial analysis, Fifth Third Bancorp offers a broad spectrum of financial products and services to its customers, including but not limited to, personal banking, commercial banking, lending, payment processing, and wealth management services. The bank serves clients across various states, leveraging both a significant physical branch network and digital platforms to cater to the evolving needs of its customer base. Financial performance indicators highlight its commitment to growth, stability, and shareholder value, with recent quarters showing solid earnings, asset growth, and a focus on strategic acquisitions to enhance its market presence further. FITB's efforts in embracing technological advancements and prioritizing customer satisfaction have been pivotal in its ability to maintain competitiveness in a rapidly changing financial landscape.

| Full Time Employees | 18,724 | Previous Close | 33.39 | Dividend Rate | 1.36 |

| Dividend Yield | 0.0404 | Five Year Avg Dividend Yield | 3.72 | Beta | 1.291 |

| Trailing PE | 10.450311 | Forward PE | 9.66954 | Volume | 4,090,796 |

| Market Cap | 22,919,856,128 | Fifty Two Week Low | 22.11 | Fifty Two Week High | 37.51 |

| Price to Sales (TTM) | 2.7974925 | Fifty Day Average | 33.5872 | Two Hundred Day Average | 27.9012 |

| Trailing Annual Dividend Rate | 1.36 | Trailing Annual Dividend Yield | 0.04073076 | Enterprise Value | 40,428,855,296 |

| Profit Margins | 0.28671 | Float Shares | 677,440,114 | Shares Outstanding | 681,124,992 |

| Shares Short | 16,696,926 | Held Percent Insiders | 0.474% | Held Percent Institutions | 82.589% |

| Short Ratio | 2.8 | Book Value | 25.041 | Price to Book | 1.3437963 |

| Last Fiscal Year End | 1703980800 | Next Fiscal Year End | 1735603200 | Most Recent Quarter | 1703980800 |

| Net Income to Common | 2,212,000,000 | Trailing EPS | 3.22 | Forward EPS | 3.48 |

| Peg Ratio | 2.17 | Total Cash | 4,040,999,936 | Total Debt | 19,434,000,384 |

| Total Revenue | 8,192,999,936 | Revenue Per Share | 11.975 | Return on Assets | 0.01113 |

| Return on Equity | 0.12872 | Earnings Growth | -0.288 | Revenue Growth | -0.016 |

| Operating Margins | 0.30879 | Current Price | 33.65 | Target High Price | 43.0 |

| Target Low Price | 28.65 | Target Mean Price | 38.35 | Target Median Price | 38.46 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | -0.0651094730472816 | Sortino Ratio | -0.988769764186914 |

| Treynor Ratio | -0.015159859223299627 | Calmar Ratio | -0.15484800068422905 |

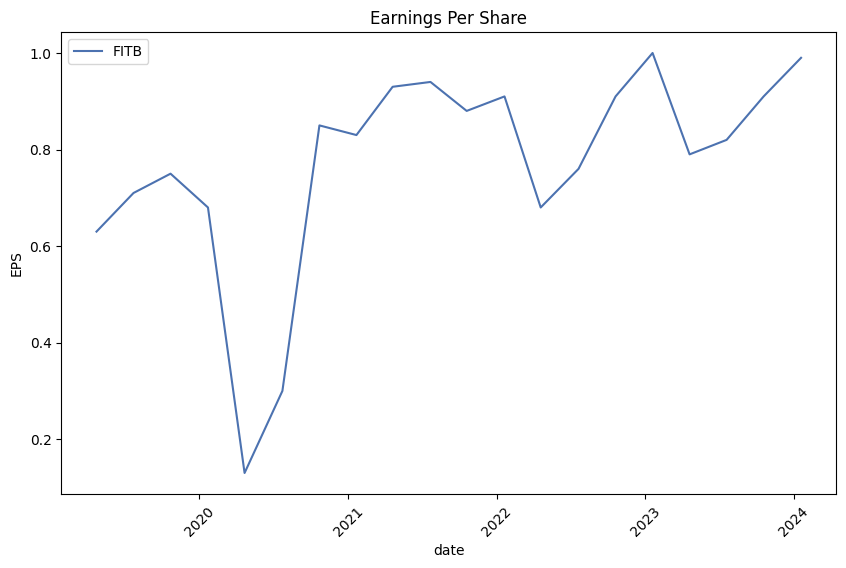

Analyzing the provided data for FITB, one notices a complex interplay between various technical indicators, fundamental metrics, and balance sheet figures that can potentially forecast the stock's trajectory in the upcoming months. Initially, examining the fundamental aspect reveals key performances and strategic positioning. Notably, a sharp decline in earnings growth (-28.8%) coupled with a slight downturn in revenue growth (-1.6%) positions FITB in a challenging situation. However, it manages an operating margin of 30.879% which underlines operational efficiency despite the revenue hurdles.

The balance sheet reflects strength with tangible book value and retained earnings illustrating a solid foundation; although, it's crucial to observe a net debt figure that has increased over the past financial years, underscoring a leveraging trend. This significant debt level could have implications for future flexibility and profit allocations. Considering cash flows, the robust free cash flow figure shows operational capability to generate cash, providing a cushion or enabling debt repayments and investment in growth avenues.

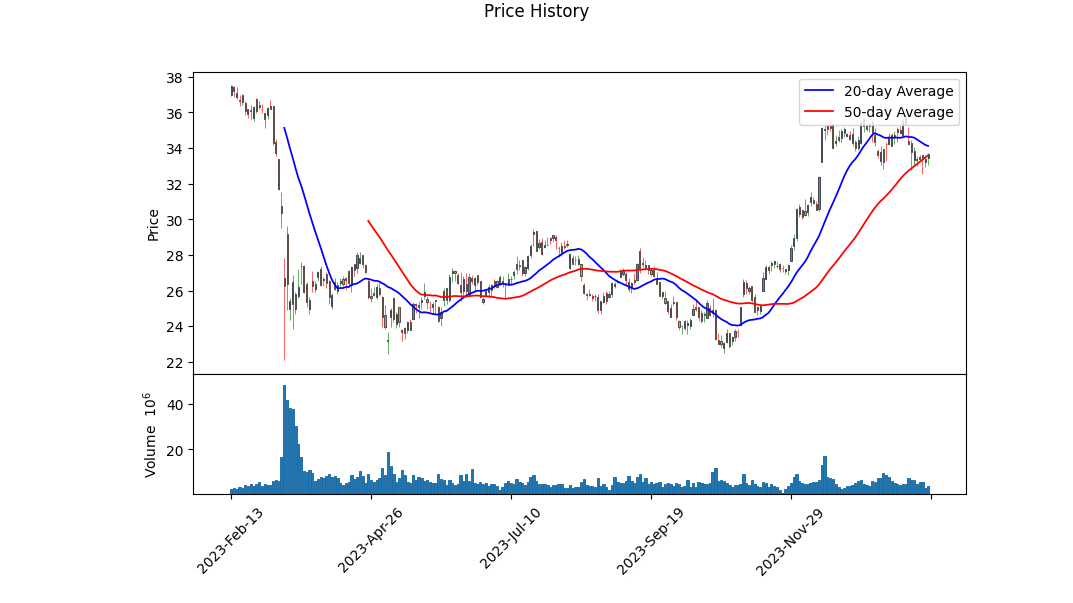

On the other hand, the technical indicators expose layers of market behavior and sentiment. The closing prices exhibit an upward trend over the reviewed period, signaling positive momentum. However, the negative MACD histogram values near the end might suggest a cooling off or a possible reversal, making it a focal point for further observation. The On-Balance Volume (OBV) shows a consistent increase, underpinning the accumulation phase and potentially forecasting upward price continuity.

The risk-adjusted performance metrics present a slightly pessimistic view. Negative Sharpe, Sortino, Treynor, and Calmar ratios indicate underperformance on a risk-adjusted basis over the past year. Such figures often signal caution, especially for risk-averse investors, reflecting the unsatisfactory trade-off between return and risk in the observed period.

Forecasting stock price movements incorporates synthesizing the above data points with broader market and economic contexts. Given the underlying operational efficiencies and cash generation capabilities amidst a challenging revenue growth scenario, there's a nuanced perspective. Assuming an improving macroeconomic environment and effective debt management, one might forecast gradual price appreciation in the medium term. Yet, this outlook bears close monitoring of the mentioned negative indicators and broader market sentiments.

In sum, while immediate technical indicators point towards optimism bolstered by historical price movements and volume trends, fundamental and risk-adjusted performance metrics signal caution. Investors should weigh the solid operational foundations against the financial leverage risks and subdued growth prospects. This balanced view suggests a cautiously optimistic outlook for FITB's stock price in the next few months, underscored by vigilant monitoring of financial health and market dynamics.

In our analysis of Fifth Third Bancorp (FITB) for generating a comprehensive investment research report, we have scrutinized two critical financial metrics that are essential for evaluating the company's profitability and attractiveness as an investment opportunity: Return on Capital (ROC) and Earnings Yield. The Return on Capital (ROC) for Fifth Third Bancorp stands at 2.004%, which represents how effectively the company is utilizing its capital to generate profits. Although this figure might appear modest, it is crucial to assess it in the context of the banking sector's overall performance and the prevailing economic conditions. On the other hand, the Earnings Yield for Fifth Third Bancorp is calculated to be 10.04%, providing an attractive proposition for investors. This higher earnings yield indicates that the company is generating considerable earnings relative to its share price, suggesting that it could potentially offer good value for investors seeking income or growth at a reasonable price. These metrics together serve as pivotal indicators in assessing Fifth Third Bancorps financial health and potential for generating profitable returns, steering informed investment decisions.

| Statistic Name | Statistic Value |

| R-squared | 0.471 |

| Adj. R-squared | 0.470 |

| F-statistic | 1117 |

| Prob (F-statistic) | 1.17e-175 |

| Log-Likelihood | -2674.0 |

| No. Observations | 1257 |

| AIC | 5352 |

| BIC | 5362 |

| coef (const) | -0.0182 |

| coef (0) | 1.4548 |

| std err (const) | 0.057 |

| std err (0) | 0.044 |

| t (const) | -0.317 |

| t (0) | 33.417 |

| P>|t| (const) | 0.752 |

| P>|t| (0) | 0.000 |

| [0.025 (const) | -0.131 |

| 0.975] (const) | 0.094 |

| [0.025 (0) | 1.369 |

| 0.975] (0) | 1.540 |

| Omnibus | 158.586 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 1597.753 |

| Skew | 0.089 |

| Prob(JB) | 0.00 |

| Kurtosis | 8.520 |

| Cond. No. | 1.32 |

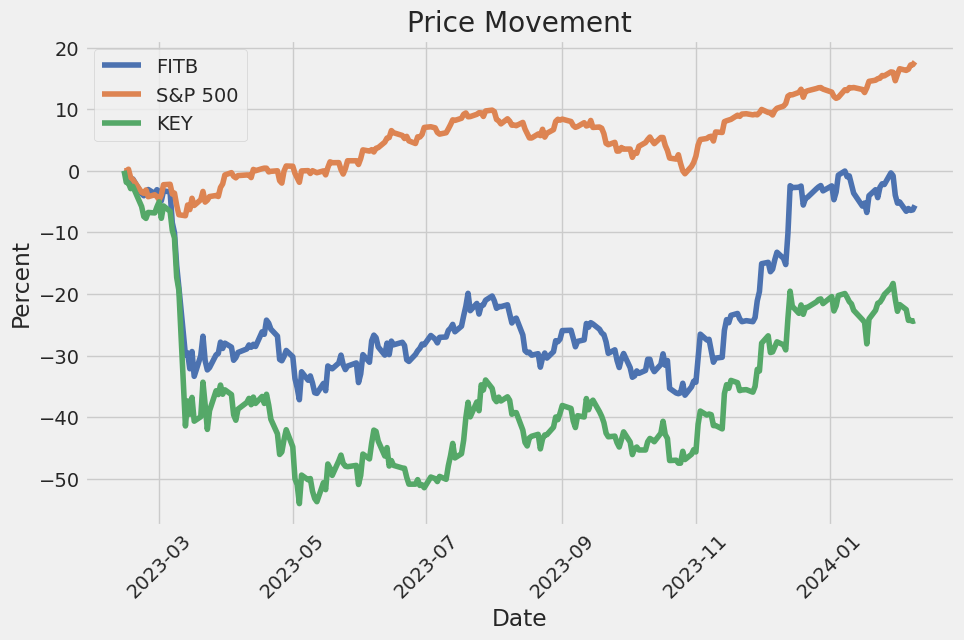

The linear regression model analyzing the relationship between FITB (Fifth Third Bancorp) and SPY (SPDR S&P 500 ETF Trust) for the period ending today showcases interesting dynamics in terms of market behavior and investment analysis. The model highlights a beta coefficient of approximately 1.4548, suggesting that FITB has a relatively strong and positive correlation with the movements of the SPY, which represents the broader market. This indicates that for every unit increase in SPY's returns, FITB's returns are expected to increase by about 1.4548 units, underlying a higher sensitivity to market movements. However, the model's alpha, which is approximately -0.0182, suggests a slight negative average return for FITB when the market's returns are zero. This could imply that without the buoyant conditions of the broader market, FITBs performance might underperform slightly, highlighting the importance of market conditions for FITBs stock performance.

Despite the slightly negative alpha, the R-squared value of 0.471 indicates that nearly 47% of the variations in FITB's returns can be explained by the model's predictors, mainly the performance of the SPY. This level of explanation underscores a significant but not exhaustive relationship between the ETF's performance and the stock's returns, pointing towards other factors also playing pivotal roles in influencing FITBs returns. The F-statistic and its associated probability emphasize the statistical significance of the model, reassuring the strength of the relationship between FITB and SPY within the explored timeframe. This analysis divulges essential insights for investors, particularly in understanding how FITBs stock might behave in relation to broader market movements, while also hinting at the potential for unexplained factors or unique company-specific events to impact its stock performance.

In the Q4 2023 earnings call for Fifth Third Bancorp (FITB), the company's senior leadership, including Chairman, President, and CEO Tim Spence, and CFO Bryan Preston, discussed the financial results for the quarter and provided an outlook on the company's plans for 2024. They highlighted the bank's strong performance amidst a challenging year for the industry, boasting top-quartile profitability, impressive deposit growth, and robust credit performance. The bank achieved a record full-year revenue of $8.7 billion and managed to grow consumer households by 3%, with a notable 6% growth in the Southeast. The commercial segment also saw significant expansion, with an 11% increase in quality middle market relationships over the prior year. These achievements were attributed to a defensive balance sheet positioning, strategic investments made in previous years, and diligent expense discipline.

Tim Spence underscored the bank's balance sheet strength, noting its defensive positioning and quick adaptation to proposed regulatory changes as key factors enabling it to approach 2024 on a strong footing. Achieving full Category 1 LCR compliance and completing an RWA (Risk-Weighted Assets) reduction strategy were highlighted as achievements that fortified the bank's liquidity and capital positions. Spence also mentioned the potential to resume share repurchases in the second half of 2024, contingent on stable economic conditions and the finalization of capital rules.

Spence further outlined the bank's profitability strategy, emphasizing the focus on expense discipline, strong returns, and positive operating leverage. Through technology modernization and optimizing value streams, the bank managed a 4% reduction in full-time employment from its peak in 2023, avoiding the need for a company-wide expense program. Despite the challenges, they anticipate returning to positive operating leverage in the latter half of 2024.

The bank's growth strategy was also detailed, with Spence describing a consistent approach to expanding in the Southeast, enhancing fee revenue mix, and leveraging differentiating software. The plan to open additional branches in the Southeast, coupled with investments in treasury management, wealth and asset management, and the capital markets business, is expected to drive mid-to-high single-digit growth in these areas. Noteworthy were the acquisitions of Rize and Big Data Healthcare and the launch of Newline, supporting high performance in treasury management.

In conclusion, Fifth Third's earnings call painted a picture of a bank that navigated the uncertainties of 2023 adeptly, thanks to strategic foresight and disciplined execution. The leadership expressed confidence in the bank's positioning for growth and stability in 2024, supported by a strong balance sheet, focused investment in growth areas, and continued emphasis on operational efficiency.

The SEC 10-Q filing for Fifth Third Bancorp (FITB) provides a comprehensive overview of the company's financial performance and position for the third quarter of the fiscal year ending on September 30, 2023. The report outlines various financial metrics, accounting policies, and key operational highlights that indicate the company's current financial health and strategic direction.

One of the critical aspects of the report is the detailed breakdown of Fifth Third Bancorp's loan portfolio, highlighting significant segments such as commercial, residential, consumer, and lease financing. The report elaborates on the composition of these loan portfolios, including commercial and industrial loans, construction loans, commercial mortgage loans (both owner-occupied and non-owner occupied), residential mortgages, home equity loans, automobile loans, and credit card receivables. Emphasis is placed on the distribution, performance, and changes within these loan categories, providing insight into the bank's lending practices and exposure to various risks.

Additionally, the filing discloses information on the bank's asset quality, including nonperforming assets, allowances for loan and lease losses, and changes in loan classifications. This includes a detailed discussion on the risk ratings assigned to different loan types, ranging from pass and special mention to substandard and doubtful loans. The report indicates how these classifications and risk assessments have evolved over the reporting period, providing a nuanced understanding of the bank's credit risk management.

Fifth Third Bancorp's investment portfolio is another pivotal focus area in the filing. This includes investments in U.S. Treasury and government securities, U.S. states and political subdivisions, residential and commercial mortgage-backed securities (issued by both U.S. government-sponsored enterprises and private enterprises), asset-backed securities, other debt securities, and equity investments. The filing describes the composition, valuation, and performance of these investments, including their fair value measurements and the levels within the fair value hierarchy (Level 1, Level 2, and Level 3).

The filing also provides insights into Fifth Third Bancorp's capital structure, detailing the company's equity, preferred stock, and debt instruments. Recent activities such as stock repurchases, dividends, and changes in preferred stock are discussed to inform shareholders and potential investors about the company's capital management strategies.

Throughout the report, the bank also delves into various aspects of its operational and financial risk management practices. This includes discussions on interest rate risk, credit risk, market risk, and operational risk. The report outlines the bank's hedging activities, derivative transactions, and other financial instruments used to manage exposure to these risks. By presenting comprehensive data on these risk management strategies, the filing illuminates the bank's proactive measures to safeguard its financial position amidst uncertainties in the economic environment.

In summary, the SEC 10-Q filing for Fifth Third Bancorp for the quarter ending September 30, 2023, offers a granular view of the bank's financial status, operational highlights, risk management practices, and strategic initiatives. Through detailed disclosures on its loan portfolio, investment activities, capital structure, and risk management strategies, the report provides stakeholders with critical insights into Fifth Third Bancorp's current conditions and future outlook.

Fifth Third Bancorp, a distinguished name in the financial services sector, has recently been at the forefront of discussions among investors for several compelling reasons. As a company that has historically demonstrated resilience and innovation, Fifth Third Bancorp's strategies and financial maneuvers in recent times present a fascinating case study of how a regional bank can excel in a challenging economic landscape.

One of the significant highlights for Fifth Third Bancorp has been its remarkable performance in terms of dividend growth. The importance of reinvesting dividends and its subsequent impact on compounding the investment growth over time cannot be overstated. Such a strategy, as highlighted in a report from December 29, 2023, on The Motley Fool, is central to understanding the bank's approach toward ensuring sustainable investment growth. The increase in dividends from $0.33 to $0.35 per share per quarter further cements Fifth Third Bancorp's commitment to delivering value to its shareholders.

The intelligence displayed by Fifth Third Bancorp in navigating the turbulent conditions following the collapse of Silicon Valley Bank earlier in 2023 also showcases the bank's adeptness at strategic decision-making. This scenario was particularly challenging for smaller banks, as it spooked investors about the stability of such institutions. Yet, Fifth Third's operational stability and financial health enabled it to steer clear of the aggressive competition for deposit attraction through high CD rates, a move that several other banks possibly undertook to reassure their customers.

The bank's Q4 2023 earnings call provides a wealth of insights into its financial health, strategic direction, and the efficacy of its risk management frameworks. Maintaining strong net interest income, improving the efficiency ratio, and witnessing healthy growth in the loan and deposit portfolios are just some of the critical financial performances highlighted in the call. Moreover, Fifth Third Bancorp's strategic investments in digital banking platforms underscore its commitment to enhancing customer experiences and operational efficiencies.

A significant aspect of Fifth Third Bancorp's current and future strategy revolves around strategic growth and expansion, especially in the Southeastern United States. The decision to open 31 new branches, with a strong focus on South Carolina, reflects a well-thought-out strategy to tap into one of the country's fastest-growing regions. This expansion is bolstered by Fifth Third's plan to increase its workforce in the Southeast commercial banking sector, emphasizing the bank's ambition to deepen its market penetration and reinforce its presence in a competitively dense market.

Furthermore, Fifth Third Bancorp, together with Truist Financial Corp, has underscored its financial dynamism by engaging in a noteworthy spree of bond issuances, bringing $4.5 billion to the market of domestic bank debt. This maneuver not only highlights the bank's proactive approach in leveraging post-earnings momentum but also its strategic capacity to optimize its balance sheet and capital structures in anticipation of potential regulatory changes and evolving financial landscapes.

Recognition of Fifth Third Bancorp's corporate excellence has been evident, with its inclusion in Fortune's 2024 list of the World's Most Admired Companies. This accolade is a testament to the bank's enduring efforts toward operational excellence, customer empowerment, community partnerships, and fostering a vibrant organizational culture. The bank's dedication to ethical practices and responsible governance is further evidenced by its consecutive inclusion in the JUST 100 list by JUST Capital and CNBC, which ranks companies based on their commitment across various stakeholder groups including employees, customers, communities, the environment, and shareholders.

The evaluation of Fifth Third Bancorp (FITB) against Northern Trust Corporation (NTRS) by Zacks Equity Research presents yet another dimension of the bank's strategic positioning. With a forward P/E ratio of 10.49 and a PEG ratio of 1.27, Fifth Third Bancorp emerges as a more compelling value investment option in the Banks - Major Regional sector. These valuation metrics, coupled with the bank's superior Value grade of A in the Zacks Style Scores system, indicate Fifth Third Bancorp's potential for delivering value to its investors in a competitive and ever-evolving banking landscape.

In essence, Fifth Third Bancorp's strategic initiatives, financial performance, and recognition within the financial services sector illustrate a comprehensive approach toward achieving sustainable growth, operational excellence, and shareholder value. Through its calculated expansion into the Southeast, strategic financial maneuvers like bond issuances, and a consistent focus on digital innovation and customer engagement, Fifth Third Bancorp remains a pivotal player in the regional banking sector, poised for further advancements in the years to come.

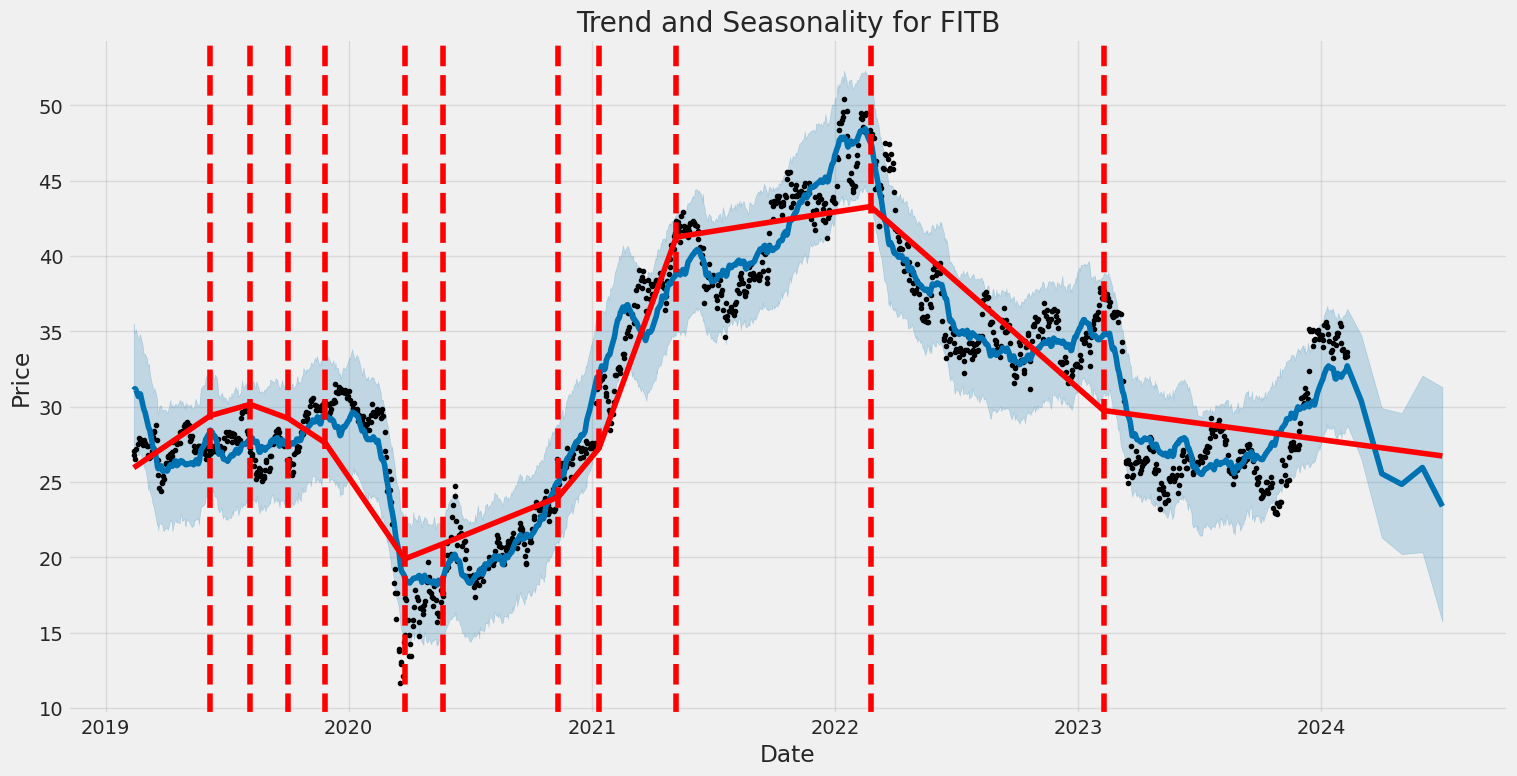

Between February 12, 2019, and February 9, 2024, Fifth Third Bancorp (FITB) displayed significant volatility, as evidenced by an ARCH model analysis. The model, devoid of a mean component, suggests that returns had fluctuations not explained by past mean values but substantially identified through past volatilities. Key features reflecting the stock's volatility include the model's omega coefficient of 3.9906, indicating a baseline volatility level, and the alpha coefficient of 0.5642, revealing the impact of previous day's squared returns on today's volatility.

| Statistic Name | Statistic Value |

| coef - omega | 3.9906 |

| std err - omega | 0.409 |

| t - omega | 9.768 |

| P>|t| - omega | 1.538e-22 |

| 95.0% Conf. Int. - omega | [3.190, 4.791] |

| alpha[1] | 0.5642 |

| std err - alpha[1] | 0.113 |

| t - alpha[1] | 5.010 |

| P>|t| - alpha[1] | 5.449e-07 |

| 95.0% Conf. Int. - alpha[1] | [0.343, 0.785] |

Analyzing the financial risk associated with a $10,000 investment in Fifth Third Bancorp (FITB) over a one-year period necessitates an intricate blend of volatility modeling and machine learning predictions. This approach permits a dual perspective by capturing both the inherent market volatility of the stock and leveraging historical data to forecast future returns.

Volatility modeling is pivotal in understanding the fluctuations in Fifth Third Bancorp's stock price. This model is adept at estimating the magnitude of price movements, providing insights into the level of risk associated with the stock. By fitting the stock's historical price data into this model, it's possible to capture the variance rate changes over time, which are crucial for risk assessment. This phase essentially sets a foundation, offering a quantifiable measure of the stock's volatility and, by extension, its risk profile.

On the other hand, machine learning predictions are instrumental in forecasting future returns of Fifth Third Bancorp. By employing a predictive framework that analyzes historical price data and identifies patterns, it is possible to generate future price predictions. This method harnesses the power of historical data, allowing for an informed speculation on the stock's performance. It is particularly useful in painting a picture of what the future holds, using past and present data points to forecast potential outcomes.

When synthesizing the insights gained from volatility modeling and machine learning predictions, a comprehensive risk assessment can be developed. This synthesis allows for the calculation of the Value at Risk (VaR) at a 95% confidence interval, a crucial metric for investors. The VaR calculated for a $10,000 investment in Fifth Third Bancorp stands at $404.70. This figure essentially indicates that there is a 95% confidence that the investor will not lose more than $404.70 over the one-year period, highlighting a quantifiable risk associated with the investment.

This analysis elucidates the significant role that merging volatility modeling with machine learning predictions plays in assessing financial risk. By leveraging the strengths of both approaches, it is possible to not only understand current stock volatility but also to forecast future performance. The VaR measure serves as a crucial risk assessment tool, offering investors a clear view of the potential financial loss involved in investing in Fifth Third Bancorp's stock. This comprehensive risk analysis highlights the effectiveness of integrating sophisticated modeling techniques and predictive analytics in evaluating the investment landscape.

Analyzing the options chain for Fifth Third Bancorp (FITB) call options, its evident that profitability can significantly vary depending on the Greeks, premium, and target stock price adjustments. To determine the most profitable options, a deep dive into specific options characterized by their strike prices, expiration dates, and Greek values is imperative, especially considering the target stock price is forecasted to be 5% higher than the current price.

For investors aiming at short-term gains with high probabilities of success, options with expiration dates closer to the current date, high delta values nearing 1, and lower premiums could be more appealing. Notably, the call option expiring on 2024-02-16 with a strike price of 22.0 emerges as significantly profitable with a delta of approximately 0.9995, suggesting nearly a 1-to-1 movement with the stock price, and a remarkable Return on Investment (ROI) of 4.5552. Similarly, the call option with the same expiration date, a strike of 24.0, and a delta just shy of 0.986 exhibits a high profitability potential marked by an ROI of 2.8285, despite lower Gamma and Vega, indicating minimal sensitivity to the stocks volatility and negligible time decay impact over its short lifespan.

For a more medium-term perspective, the call option expiring on 2024-05-17 with a strike price of 24.0 is remarkably profitable with a high delta of approximately 0.9857 and a striking ROI of 2.8285. This option's profitability is attributed to its negligible Vega and Theta, suggesting low volatility and time decay impact, an important consideration for options with longer durations to expiration. Meanwhile, the option for the same expiration date but with a strike price of 22.0, also demonstrates considerable return prospects, driven by an ROI of 3.7616, catering to investors willing to assume slightly more risk for higher returns.

Long-term investors might find the option expiring on 2026-01-16 with a strike price of 18.0 to be of interest, which, despite its longer duration (illustrated by a delta of 0.8302), maintains a solid investment proposition indicated by an ROI of 0.08328125. Its high Vega suggests a significant price increase potential if the stock's volatility escalates.

In sum, the most profitable options span short to long-term investment horizons, each characterized by high delta values close or equal to 1, indicating a strong correlation with the underlying stock price movement. Furthermore, these options differentiate themselves by their ROI and sensitivity to the stocks volatility and time decay (Gamma and Theta), reflecting varying risk-return profiles that cater to diverse investor preferences and market views. Investors should weigh these factors alongside their market outlook, risk tolerance, and investment duration preference when selecting the most suitable call options for their portfolio.

Similar Companies in BanksRegional:

KeyCorp (KEY), Report: Regions Financial Corporation (RF), Regions Financial Corporation (RF), Report: New York Community Bancorp, Inc. (NYCB), New York Community Bancorp, Inc. (NYCB), Zions Bancorporation, National Association (ZION), Huntington Bancshares Incorporated (HBAN), Comerica Incorporated (CMA), Western Alliance Bancorporation (WAL), U.S. Bancorp (USB), Truist Financial Corporation (TFC), M&T Bank Corporation (MTB), Citizens Financial Group, Inc. (CFG), First Horizon Corporation (FHN), Report: PNC Financial Services (PNC), PNC Financial Services (PNC), SunTrust Banks (STI), BB&T Corporation (BBT)

https://www.fool.com/investing/2023/12/29/why-i-expect-to-receive-more-in-dividends-in-2024/

https://seekingalpha.com/article/4663790-fifth-third-bancorp-fitb-q4-2023-earnings-call-transcript

https://finance.yahoo.com/news/q4-2023-fifth-third-bancorp-062546485.html

https://finance.yahoo.com/m/02a85be5-953a-36d9-a406-13a6ba286a78/fifth-third-aims-to-open-31.html

https://finance.yahoo.com/news/january-set-break-record-busiest-164125593.html

https://finance.yahoo.com/news/truist-fifth-third-add-bank-203811738.html

https://finance.yahoo.com/news/fifth-third-bancorp-nasdaq-fitb-133426957.html

https://finance.yahoo.com/news/fifth-third-named-one-world-140000143.html

https://finance.yahoo.com/news/fifth-third-named-one-america-140000571.html

https://finance.yahoo.com/news/fitb-vs-ntrs-stock-better-164010433.html

https://www.sec.gov/Archives/edgar/data/35527/000003552723000254/fitb-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: aUtfNp

Cost: $0.74233

https://reports.tinycomputers.io/FITB/FITB-2024-02-11.html Home