Regions Financial Corporation (ticker: RF)

2024-02-11

Regions Financial Corporation (ticker: RF) stands as a notable entity within the banking sector, primarily engaging in providing retail and commercial banking, trust, securities brokerage, mortgage, and insurance products and services. As of the latest data, it operates a network spanning multiple states, primarily in the Southern and Midwestern U.S., positioning it strategically within key economic regions. The corporation's financial health, evident from recent earnings reports, showcases a stable growth trajectory, supported by a robust asset portfolio and a diligent focus on expanding its digital banking capabilities to meet evolving consumer preferences. Despite the challenges posed by economic fluctuations and the competitive banking landscape, Regions Financial has displayed resilience, attributed to its strategic diversification and a strong emphasis on customer service. This adaptability, combined with solid fiscal management, suggests a promising outlook for the corporation's performance, making it a subject of interest for investors and analysts closely monitoring the financial sector.

Regions Financial Corporation (ticker: RF) stands as a notable entity within the banking sector, primarily engaging in providing retail and commercial banking, trust, securities brokerage, mortgage, and insurance products and services. As of the latest data, it operates a network spanning multiple states, primarily in the Southern and Midwestern U.S., positioning it strategically within key economic regions. The corporation's financial health, evident from recent earnings reports, showcases a stable growth trajectory, supported by a robust asset portfolio and a diligent focus on expanding its digital banking capabilities to meet evolving consumer preferences. Despite the challenges posed by economic fluctuations and the competitive banking landscape, Regions Financial has displayed resilience, attributed to its strategic diversification and a strong emphasis on customer service. This adaptability, combined with solid fiscal management, suggests a promising outlook for the corporation's performance, making it a subject of interest for investors and analysts closely monitoring the financial sector.

| Full Time Employees | 20,101 | President and CEO Pay | $7,361,012 | Senior EVP & CFO Pay | $2,950,250 |

| Dividend Rate | 0.96 | Dividend Yield | 5.33% | Payout Ratio | 41.71% |

| Five Year Avg Dividend Yield | 3.83 | Beta | 1.226 | Trailing PE | 8.53 |

| Forward PE | 8.18 | Volume | 9,466,408 | Market Cap | $16,632,000,512 |

| Fifty Two Week Low | $13.72 | Fifty Two Week High | $24.02 | Price to Sales Trailing 12 Months | 2.37 |

| Shares Outstanding | 924,000,000 | Profit Margins | 29.54% | Book Value | 17.067 |

| Price to Book | 1.05 | Net Income To Common | $1,976,000,000 | Trailing Eps | 2.11 |

| Forward Eps | 2.2 | Revenue Growth | 15.6% | Operating Margins | 46.98% |

| Total Revenue | $7,021,000,192 | Revenue Per Share | 7.501 | Return On Assets | 1.349% |

| Return On Equity | 12.403% | Held Percent Insiders | 0.228% | Held Percent Institutions | 81.495% |

| Current Price | 18.0 | Target High Price | 27.0 | Target Low Price | 17.35 |

| Target Mean Price | 20.96 | Target Median Price | 21.0 | Recommendation Mean | 2.6 |

| Sharpe Ratio | -0.5824797825576791 | Sortino Ratio | -8.745782640112383 |

| Treynor Ratio | -0.1309047946471565 | Calmar Ratio | -0.5386191201698587 |

Analyzing the provided dataset, we identify several crucial elements concerning the financial and market performance of RF. The technical indicators, fundamental analysis, and balance sheet data offer a comprehensive view of the company's present condition and potential future direction.

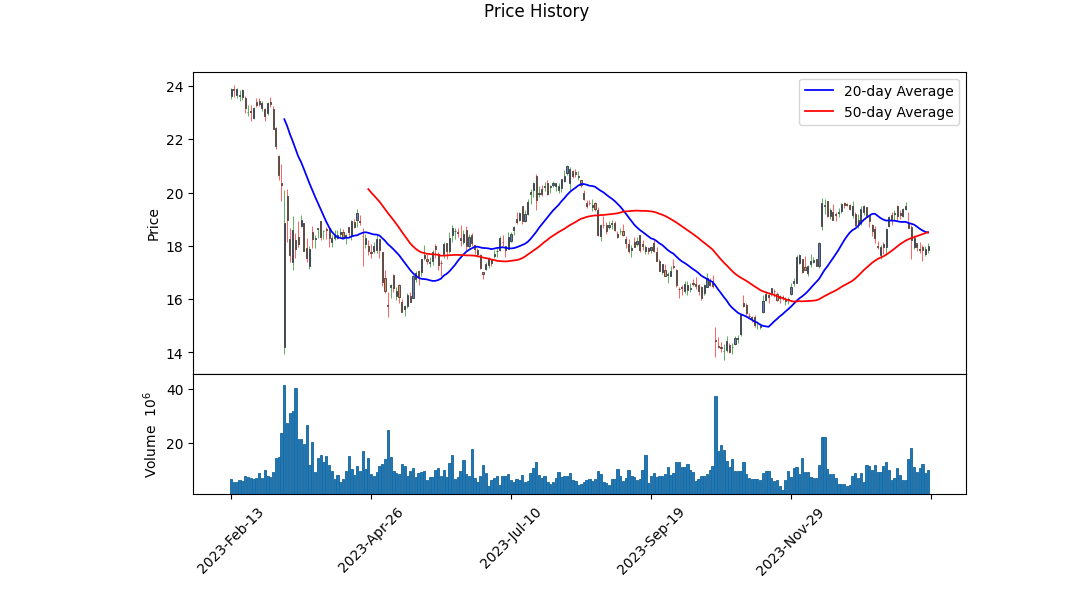

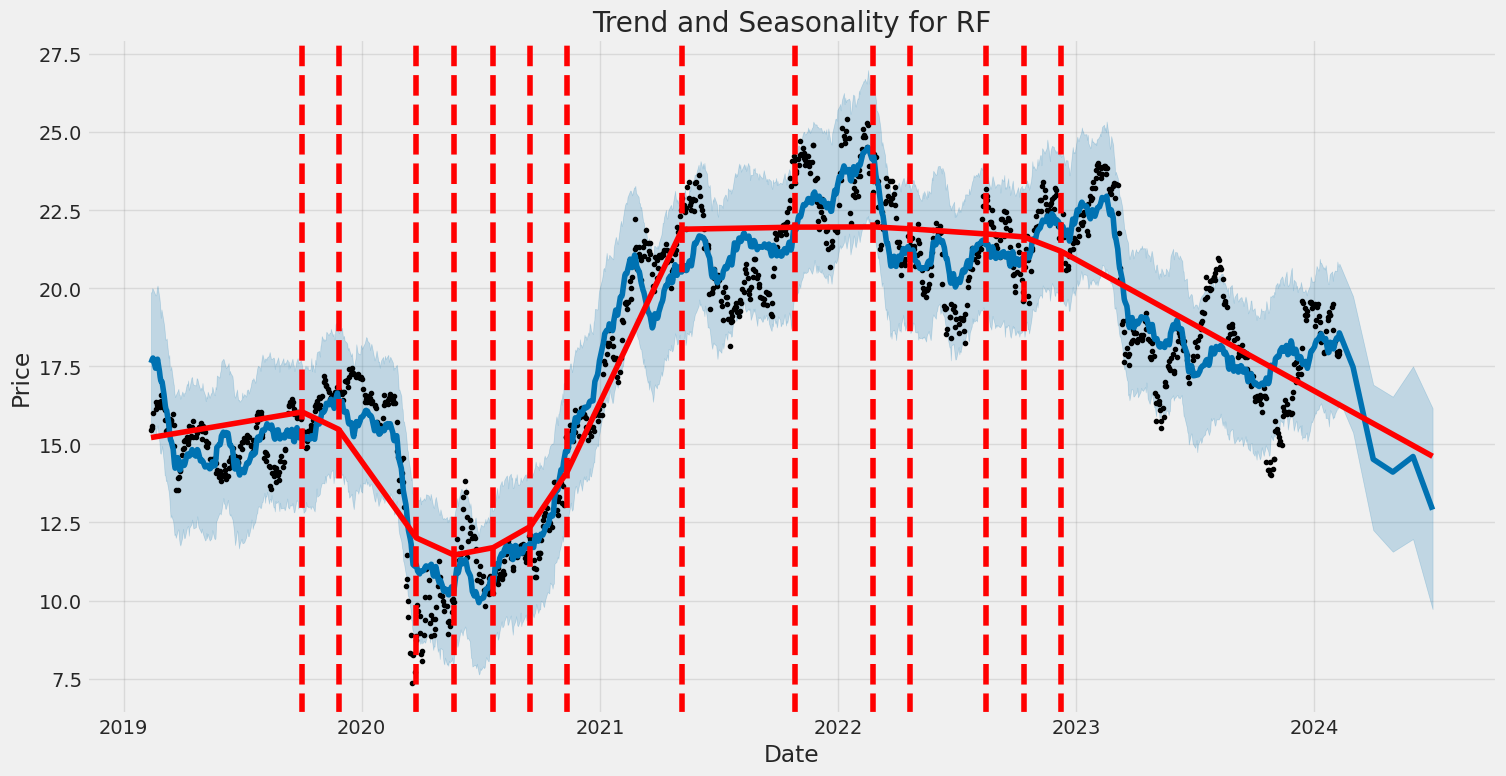

The technical analysis markers highlight a concerning downtrend in the stock price from the opening high of 16.549999 on October 16, 2023, experiencing a notable decline to an opening of 17.830000 by February 9, 2024. Such a trajectory indicates a loss of investor confidence or external market pressures that have led to a suppressive effect on the stock valuation. The absence of the Moving Average Convergence Divergence (MACD) histogram value until the latest dates suggests a period of unmeasured momentum, which only recently has begun to show a possible negative trend, as implied by the negative MACD histogram values.

Furthermore, the fundaments of RF demonstrate a company with a robust basis. With significant net income growth, an impressive operating margin, and a tangible book value that signifies a strong underlying asset base, RF appears fundamentally sound. However, the financial statements also reveal areas that could be causing concern among investors, such as the decrease in cash and cash equivalents, indicating a significant use of cash over the respective period or potential challenges in liquidity management.

The risk-adjusted return ratios, including the Sharpe, Sortino, Treynor, and Calmar ratios, all present negative values. These figures often suggest a return that does not compensate for the risk taken by the investors over the past year. A negative Sharpe ratio of -0.5825, for instance, indicates that the investment's return was less than the risk-free return, adjusted for volatility, portraying an unfavorable risk-to-reward scenario for investors.

The cash flows, balance sheets, and income statements further provide an intricate view of the company's operations and financial health. Despite an upswing in operational revenues, the increased investment in intangibles and a significant change in cash flows highlight strategic shifts that may not yet have yielded anticipated profitability increases.

Given the analysis of the technical, fundamental, and balance sheet data, RF's stock price may experience further volatility in the near term. The adverse risk-adjusted performance metrics suggest that unless there's a substantial improvement in financial health or operational outcomes, investor sentiment may remain lukewarm. However, the company's solid operational margins and revenue growth paint a potentially brighter future if these strengths are leveraged effectively against the backdrop of its financial strategy.

It is essential for RF to address the challenges implied by the negative trend in its risk-adjusted returns and the decline in its stock price through strategic initiatives that bolster investor confidence and translate its fundamental strengths into shareholder value. The analysis thus anticipates a cautiously optimistic outlook, with an emphasis on vigilant monitoring of the company's financial health and market performance in the coming months.

In analyzing Regions Financial Corporation (RF) through the lens of the principles discussed in "The Little Book That Still Beats the Market," we have calculated two fundamental metrics that underline the financial health and attractiveness of this investment. Firstly, the Return on Capital (ROC) stands at 2.056%, a measure that indicates how efficiently the company generates profits from its capital. Although this figure might seem modest, it is crucial to look at it in conjunction with the company's earnings yield to get a comprehensive view. The earnings yield for RF is notably higher at 12.72%, offering an enticing perspective on its profitability in relation to its share price. This high earnings yield suggests that RF is generating significant earnings compared to its market valuationa positive signal for investors looking for undervalued opportunities with the potential for good returns. Combining these insights, while the ROC gives a glimpse into the efficiency of capital use, the earnings yield positions RF as an attractive investment from an earnings perspective, marking it as a noteworthy consideration for our investment strategy as advised by the practical wisdom in "The Little Book That Still Beats the Market."

| Statistic Name | Statistic Value |

| R-squared | 0.438 |

| Adj. R-squared | 0.438 |

| F-statistic | 978.7 |

| Prob (F-statistic) | 2.62e-159 |

| Log-Likelihood | -2677.7 |

| No. Observations | 1257 |

| AIC | 5359. |

| BIC | 5370. |

| Alpha | -0.0203 |

| Beta | 1.3659 |

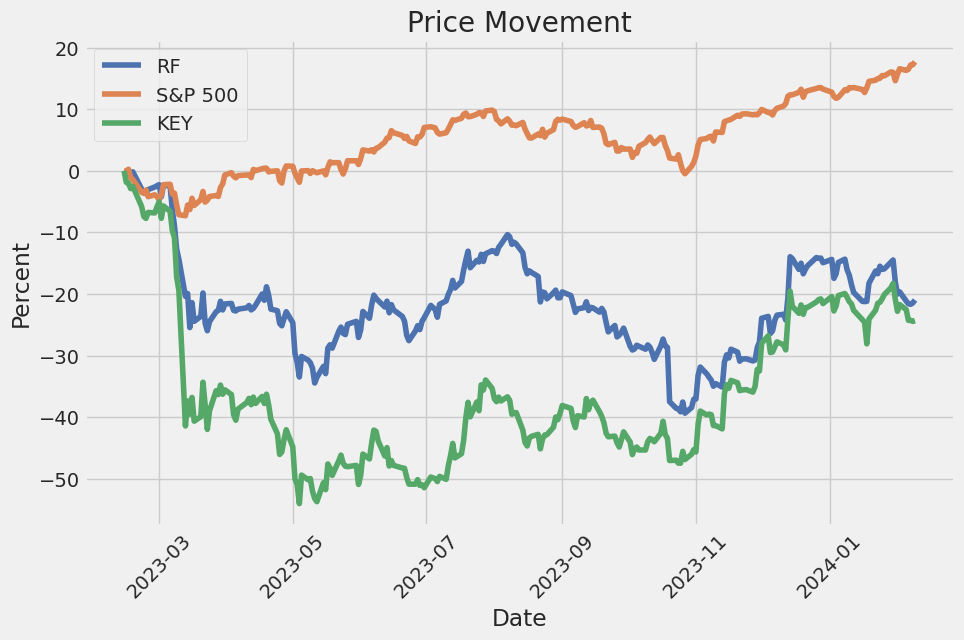

The regression analysis between RF and SPY reveals an interesting dynamic for the examined period. The alpha value of -0.0203 suggests a slight negative average return of the RF in excess of the market return, regardless of the market's performance. This might imply that RF, on average, underperforms the market by a small margin when the market's movements are accounted for. This is critical for investors to note because it touches upon the expected performance of RF in comparison to broader market movements, represented here by SPY.

Additionally, the beta value of approximately 1.366 indicates how RF's returns are expected to move in relation to SPY. A beta greater than 1 suggests that RF is more volatile than the market, thus it is expected to increase more than the market in a rally and decrease more in a downturn. This relationship, combined with the negative alpha, positions RF in a risky spot for investors looking for steady excess returns over the market. However, the substantial F-statistic and its associated probability confirm the robustness of this model, offering a degree of confidence in these projections.

Regions Financial Corporation (RF) held its fourth-quarter 2023 earnings call, heralding a year of noteworthy achievements despite a backdrop of economic and geopolitical uncertainties. The corporation reported a substantial $2 billion in earnings for the full year, underlined by a record pre-tax pre-provision income of $3.2 billion and a remarkable 22% return on average tangible common equity. This performance is attributed to a decade of strategic enhancements in risk management and capital allocation, positioning the company for consistent, sustainable earnings. The ongoing challenges from economic uncertainties and regulatory changes were acknowledged, but the strong balance sheet, sound liquidity, and solid capital, along with efficient credit risk management, are believed to position Regions well for the future.

David Turner provided a detailed insight into the quarter's financials, emphasizing a modest sequential decrease in average and ending loans, with a slight year-over-year growth. The business portfolio witnessed a 1% quarter-over-quarter drop, attributed to cautious capital reserving for fully-fledged relationships amidst soft loan demand. The consumer loan segment remained stable with a focus on strategic growth areas like mortgage and EnerBank, despite declines in home equity loans. Looking forward to 2024, Regions anticipates low single-digit loan growth, backed by a granular deposit base and a proactive banking approach.

On the fronts of net interest income and deposits, 2023 saw a dip in the former due to normalization in deposit cost and mix, alongside the initiation of $3 billion in incremental hedging. However, Regions managed a strategical rebound by fully reinvesting pay-downs in the securities portfolio and leveraging market rates. For 2024, the expectation is set for stabilization and growth in net interest income, driven by a continuation of sound deposit management strategies and beneficial asset yield replications. Turner's projection includes a potential net interest income range of $4.7 to $4.8 billion, assuming variations in interest rates and deposit beta.

Regions Financial also highlighted adjustments in non-interest income and expenses, with the former seeing a modest quarterly rise and the latter a significant quarterly increase due to special assessments and severance costs. Despite these fluctuations, investments in business growth and diligent expense management are priorities. The asset quality was also discussed, showcasing a normalization in credit performance with an anticipated full-year net charge-off ratio between 40 to 50 basis points. Finally, maintaining a common equity Tier 1 ratio around 10% was outlined as a strategy for balancing regulatory requirements with growth objectives, alongside a continued commitment to dividends and share repurchases depending on capital availability.

In summary, despite facing a milieu of economic headwinds and regulatory uncertainties, Regions Financial Corporation concludes 2023 on a strong note, with strategic plans set to instigate sustainable growth and sound financial health into 2024. The bank's strategic orientation towards risk management, judicious capital allocation, and an emphasis on relational banking positions it well to navigate the future landscape.

Regions Financial Corporation (RF), a Delaware corporation, filed its quarterly report (10-Q) for the period ended September 30, 2023. The financial statements included were prepared in compliance with the United States Generally Accepted Accounting Principles (GAAP) and reflect all adjustments, consisting solely of normal recurring adjustments, which, in the opinion of management, are necessary for a fair statement of the financial position, results of operations, and cash flows for the interim periods.

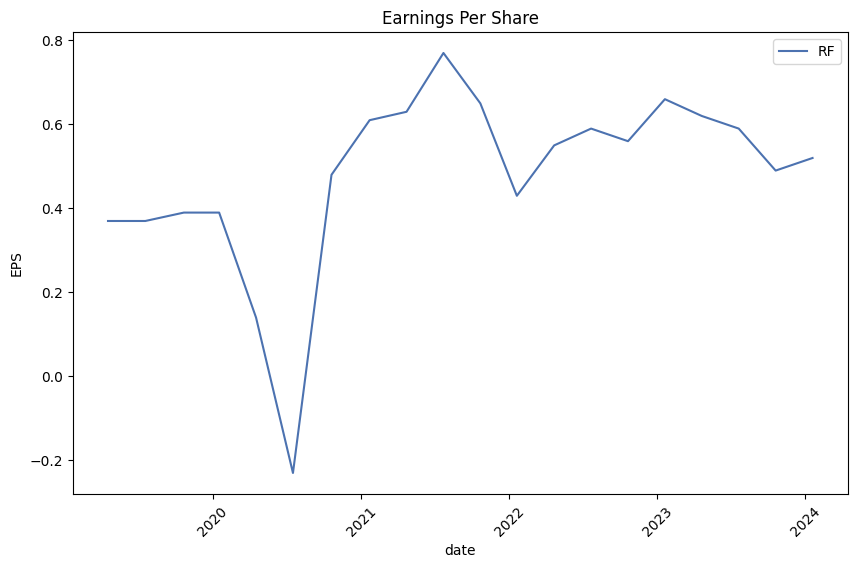

Regions Financial Corporation and its subsidiaries (the "Company") reported net income of $490 million for the three months ended September 30, 2023, an increase from $429 million for the same period in 2022. The income before income taxes was $619 million for the three months ended September 30, 2023, compared to $562 million for the same period in the previous year. The provision for credit losses was $145 million for the third quarter of 2023, compared to $135 million for the same quarter in 2022, indicating an increase in credit provisioning.

Non-interest income for the quarter ending September 30, 2023, was $566 million, a slight decrease from $605 million in the corresponding period in 2022. This was attributed to various income streams including service charges on deposit accounts, card and ATM fees, investment management and trust fee income, capital markets income, and mortgage income among others. Non-interest expenses for the third quarter of 2023 amounted to $1,093 million, showing a decrease from $1,170 million for the same period in 2022.

In terms of balance sheet strength, total assets as of September 30, 2023, were recorded at $153.624 billion, slightly lower than the $155.220 billion reported as of the year-end 2022. The decrease in total deposits from $131.743 billion at the end of 2022 to $126.199 billion at the end of the quarter reflects the dynamic nature of the banks funding base. Loans, net of unearned income, stood at $98.942 billion, showing a slight increase from $97.009 billion by year-end 2022.

On the liabilities side, borrowed funds increased significantly from $2.284 billion at the end of 2022 to $6.290 billion at the close of the quarter under review. This reflects the company's financing and capital management strategies over the period. Additionally, the company reported comprehensive income losses of $306 million for the three-month period ended September 30, 2023, a stark contrast to the $1.136 billion loss in the same period in 2022, highlighting an improvement in the comprehensive income position.

Overall, the quarterly financial results point to Regions Financial Corporation's ability to generate higher net income amidst rising provision for credit losses and slightly reduced non-interest income. With strategic management of expenses leading to reduced non-interest expenses, the corporation's financial health and performance metrics indicate solid operational management and adaptability in changing economic conditions.

Regions Financial Corporation has emerged as a focus of interest within the banking sector, especially for income-seeking investors such as retirees. The significance of its dividend policy, highlighted in a Seeking Alpha article dated October 1, 2023, emphasizes its appeal in providing steady income streams, marking it as a noteworthy option for those planning their retirement investments. This focus on dividends underscores the corporation's perceived financial stability and reliability, essential for retirees concerned with income generation alongside capital preservation.

However, the bank's financial landscape is not without its challenges. A report published on January 19, 2024, detailed a downturn in fourth-quarter earnings, spotlighted by a decrease in interest income and the impact of additional charges, including an industry-wide special assessment by the FDIC. Despite these hurdles, Regions Financial's EPS of $0.52 still managed to exceed Wall Street predictions. The difficulties faced in the latter part of the year reflect broader issues within the banking industry, including regulatory pressures and economic uncertainties. Yet, the company's leadership, including President and CEO John Turner, displayed confidence in navigating these challenges, affirming the bank's resilience and strategic adaptability.

In response to the evolving banking landscape, the corporation has aggressively pursued digital transformation and innovation, emphasizing technology investments aimed at enhancing customer experience. The earnings call discussion, as summarized by Seeking Alpha on January 20, 2023, also brought to light the corporation's robust risk management strategies and its commitment to maintaining a strong capital position. These strategic initiatives demonstrate an understanding of the need to adapt to both customer demands for digital service delivery and the necessity of safeguarding against economic volatility.

Despite exceeding analysts EPS expectations for Q4 2023 and reporting a stable financial performance with key strategic investments highlighted in a Yahoo Finance article dated January 23, 2024, RF was not among the top 30 stocks favored by hedge funds at the end of the third quarter. This indicates a possible mismatch between the banks financial performance and market sentiment, suggesting areas for strategic communication and investor relations improvement.

Furthermore, Regions Financial's commitment to the community and social responsibility initiatives offers a broader view of the corporations values. The bank's involvement in affordable housing projects, like Freedom Village in Montgomery, Alabama, signifies its dedication to addressing societal needs such as senior housing. Additionally, Regions Financial Corporation's partnership with Big Brothers Big Sisters of Eastern Missouri and its engagement in mentoring programs underscore a commitment to nurturing youth and community development.

The recognition of Tara Plimpton as a Woman of Impact by Alabama-based Yellowhammer News on February 6, 2024, reflects the corporation's leadership both within the industry and in the wider community. Her achievements in promoting diversity, equity, and inclusion further illustrate Regions Financial Corporations contribution beyond banking, enhancing its corporate reputation and societal impact.

Amid intensifying regulatory scrutiny and economic shifts, the banking sector's increased lobbying activities, with Regions Financial Corporation marking a post-crisis high in lobbying expenditures in 2023, underscore the industrys efforts to navigate a complex regulatory landscape. This demonstrates a strategic push to influence policy and safeguard operations against potential regulatory challenges that could affect profitability.

The corporation's initiative to honor Black History Month by celebrating influential Black leaders and promoting diversity, equity, and inclusion through personal reflections from associates demonstrates a committed approach to fostering an inclusive culture and recognizing significant contributions to society and the corporate landscape.

As Regions Financial Corporation prepares to engage in the 2024 RBC Capital Markets Global Financial Institutions Conference, it further signifies the corporations active engagement with the financial community. This participation underscores the company's strategic intent to communicate its financial health, outlook, and developments, ensuring transparency and fostering relationships with investors and industry stakeholders.

Through these multifaceted initiatives and strategic responses to industry challenges, Regions Financial Corporation illustrates a comprehensive approach towards financial stability, community engagement, and inclusive growth, positioning itself as a resilient and socially responsible entity within the banking sector.

Regions Financial Corporation (RF) has experienced notable volatility within the analyzed period, with the ARCH model indicating fluctuations in asset returns. The model highlights a significant omega value, suggesting a certain level of volatility inherent to the stock's returns. The alpha coefficient further confirms this volatility, indicating that past return shocks have a substantial impact on future volatility.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -2926.68 |

| AIC | 5857.36 |

| BIC | 5867.63 |

| omega | 4.3294 |

| alpha[1] | 0.4324 |

To evaluate the financial risk tied to a $10,000 investment in Regions Financial Corporation (RF) over the span of a year, leveraging an intricate blend of volatility modeling and machine learning predictions presents a dynamic approach. This analysis embarks on a twofold journey: firstly, understanding the erratic nature of the stock via volatility modeling and secondly, employing a machine learning framework to forecast future returns.

Volatility modeling steps into the realm of quantifying the stock's fluctuation magnitude over time. By scrutinizing past market prices and returns of RF, this technique elucidates the intrinsic volatility pattern embedded within the stock's movements. It's paramount in capturing temporal changes and providing a structured framework to gauge future volatility. Here, the model delves into historical data, extrapolating the stock's volatility kinetics, thus offering insights into expected variation rates moving forward. Such an approach is instrumental in anticipating the degree of risk associated with the investment by discerning the possible swings in the stock's value.

Transitioning to the second analytical layer, machine learning predictions come into play, specifically utilizing an ensemble learning strategy. This segment focuses on assimilating historical stock performance data, alongside other influential factors, to forecast the potential trajectory of RF's returns. The methodology pivots on identifying patterns and dependencies within the data, enabling the prediction model to estimate future stock returns based on learned historical behaviors. This is particularly useful in complementing the volatility analysis by providing a potential return outlook, hence offering a more rounded perspective on the investment's risk-reward profile.

The synthesis of both methodologies culminates in the calculation of the Annual Value at Risk (VaR) for the $10,000 investment in Regions Financial Corporation, established at a 95% confidence level. The computed VaR stands at $388.38, delineating the maximum expected loss forecasted under normal market conditions within a one-year horizon, with a 95% certainty. This metric is crucial as it encapsulates both the predicted volatility and return tendencies of the investment, furnishing investors with a quantitative risk measure. Through the amalgamation of volatility modeling to track the stock's potential price fluctuations, and machine learning predictions to project future returns, this comprehensive analysis delivers an in-depth understanding of the financial risk landscape surrounding the investment. Thus, these insights afford investors the clarity needed to gauge the extent of risk they are embarking upon with the investment in Regions Financial Corporation.

Analyzing the options chain for Regions Financial Corporation (RF) and focusing on call options, we can identify the most profitable options by considering a combination of the Greeks and other metrics provided. Our objective is to select options that offer a high probability of profitability given the stock price target, which is 5% above the current stock price. The Greeks (Delta, Gamma, Vega, Theta, and Rho) alongside the premium, days to expire (DTE), return on investment (ROI), and profit are instrumental in this analysis.

Firstly, let's consider options with a high Delta, as this measure indicates the option's price sensitivity relative to the underlying asset's price change. A Delta near 1 suggests that the option's price will move almost in tandem with the stock, indicating a high probability of ending in-the-money if the stock price moves as anticipated. An option with a strike of $10.0, expiring on November 15, 2024, has a Delta of 0.960, indicating it's highly likely to move with the stock's price. Besides, this option shows a very high ROI of 0.934 and a substantial profit potential of $4.3, making it very attractive for a bullish outlook.

Another critical Greek to consider is Theta, which indicates the rate of decline in the value of an option due to the passage of time. Generally, traders prefer options with lower absolute Theta values to minimize time decay, especially if planning to hold the option for a longer period. The option with a strike of $16.0, expiring on March 15, 2024, exhibits one of the lowest Theta values, at -0.007, suggesting minimal value erosion over time and a decent ROI of 0.479, which is an important consideration for mid-term holding strategies.

Gamma and Vega are also noteworthy, particularly for assessing the risks associated with changes in the option's Delta and the underlying's volatility, respectively. Options with higher Gammas can be riskier as Delta can change more dramatically with price movements of the underlying stock. High Vega indicates susceptibility to volatility changes, which can be beneficial in volatile markets if the direction is correctly anticipated.

Lastly, examining options with longer DTE can provide strategic advantages, as they might offer more time for the stock to move favorably. The option with a strike of $13.0, expiring on January 16, 2026, shows a moderate Delta of 0.738, a low Theta, suggesting resilience to time decay, and a significantly high Vega, indicating a strong sensitivity to implied volatility changes. It also boasts an exceptionally high Rho, which implies that the option's price would benefit from rising interest rates. Though the ROI is modest at 0.092, the long expiration provides flexibility and a broad time frame for the stock to achieve or surpass our target.

In summary, for those bullish on Regions Financial Corporation and aiming for a target stock price increase of 5%, the most appealing call options are those with high Delta values for near-term opportunities, like the option expiring on November 15, 2024, with a strike of $10.0. For longer-term strategies, considering options with low Theta to reduce time decay and those responsive to volatility via Vega, like the option expiring on January 16, 2026, with a strike of $13.0, could provide strategic advantages while minimizing specific risks associated with time and volatility.

Similar Companies in BanksRegional:

KeyCorp (KEY), Fifth Third Bancorp (FITB), Report: New York Community Bancorp, Inc. (NYCB), New York Community Bancorp, Inc. (NYCB), Zions Bancorporation, National Association (ZION), Huntington Bancshares Incorporated (HBAN), Report: The PNC Financial Services Group, Inc. (PNC), The PNC Financial Services Group, Inc. (PNC), Comerica Incorporated (CMA), Citizens Financial Group, Inc. (CFG), M&T Bank Corporation (MTB), Western Alliance Bancorporation (WAL), Report: Bank of America Corporation (BAC), Bank of America Corporation (BAC), Report: Wells Fargo & Company (WFC), Wells Fargo & Company (WFC), JPMorgan Chase & Co. (JPM), Report: Citigroup Inc. (C), Citigroup Inc. (C), U.S. Bancorp (USB), Truist Financial Corporation (TFC)

https://seekingalpha.com/article/4662159-how-to-invest-1-million-in-retirement-for-life-long-income

https://www.proactiveinvestors.com/companies/news/1038905?SNAPI

https://finance.yahoo.com/news/regions-financial-corporation-nyse-rf-133335749.html

https://finance.yahoo.com/news/more-affordable-housing-seniors-regions-144500455.html

https://finance.yahoo.com/news/regions-financial-scheduled-participate-bank-140000912.html

https://finance.yahoo.com/news/changing-lives-big-way-154500306.html

https://finance.yahoo.com/news/tara-plimpton-named-woman-impact-181500135.html

https://finance.yahoo.com/news/analysis-us-bank-lobbyists-ranks-110543339.html

https://finance.yahoo.com/news/everyday-heroes-extraordinary-impact-161000666.html

https://finance.yahoo.com/news/regions-financial-scheduled-participate-2024-140000232.html

https://www.sec.gov/Archives/edgar/data/1281761/000128176123000057/rf-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: thyeJD

Cost: $0.67596