Fidelity MSCI Financials Index ETF (ticker: FNCL)

2024-01-01

The Fidelity MSCI Financials Index ETF (ticker: FNCL) is an exchange-traded fund that offers investors exposure to the U.S. financial sector, tracking the performance of the MSCI USA IMI Financials Index. This index represents the universe of financial-related stocks within the American equity market, including banks, insurance companies, real estate, consumer finance, and capital markets. FNCL aims to provide a cost-effective way to gain diversified exposure to financial stocks, utilizing a passive management approach to replicate the index's composition and performance. It features a low expense ratio compared to actively managed funds, making it an attractive option for cost-conscious investors. The ETF is suitable for investors seeking exposure to the financial sector of the economy, which can be influenced by factors such as interest rate changes, economic cycles, and regulatory changes. FNCL's holdings are subject to the risks inherent to the financial industry, including credit, market, and liquidity risks.

The Fidelity MSCI Financials Index ETF (ticker: FNCL) is an exchange-traded fund that offers investors exposure to the U.S. financial sector, tracking the performance of the MSCI USA IMI Financials Index. This index represents the universe of financial-related stocks within the American equity market, including banks, insurance companies, real estate, consumer finance, and capital markets. FNCL aims to provide a cost-effective way to gain diversified exposure to financial stocks, utilizing a passive management approach to replicate the index's composition and performance. It features a low expense ratio compared to actively managed funds, making it an attractive option for cost-conscious investors. The ETF is suitable for investors seeking exposure to the financial sector of the economy, which can be influenced by factors such as interest rate changes, economic cycles, and regulatory changes. FNCL's holdings are subject to the risks inherent to the financial industry, including credit, market, and liquidity risks.

| Previous Close | 53.82 | Day Low | 53.41 | Day High | 53.85 |

| Trailing P/E | 14.04 | Volume | 108,249 | Average Volume | 126,533 |

| Average Volume (10 days) | 137,840 | Bid | 52.48 | Ask | 54.55 |

| Bid Size | 1,200 | Ask Size | 1,200 | Yield | 2.11% |

| Total Assets | 1,385,985,280 | Fifty Two Week Low | 42.42 | Fifty Two Week High | 53.91 |

| Fifty Day Average | 49.331 | Two Hundred Day Average | 47.31155 | NAV Price | 53.54478 |

| YTD Return | 14.70% | Beta (3-Year) | 1.09 | Three Year Average Return | 11.15% |

| Five Year Average Return | 12.05% | Exchange | PCX | Symbol | FNCL |

Based on the recent technical indicators and company fundamentals, the following report provides an analysis of the possible stock price movements for FNCL over the next few months.

Based on the recent technical indicators and company fundamentals, the following report provides an analysis of the possible stock price movements for FNCL over the next few months.

Technical Indicators Summary:

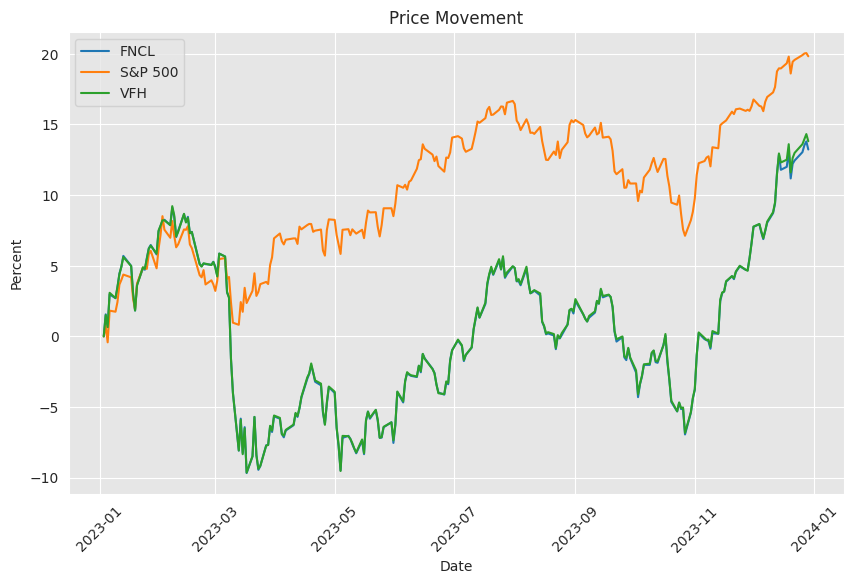

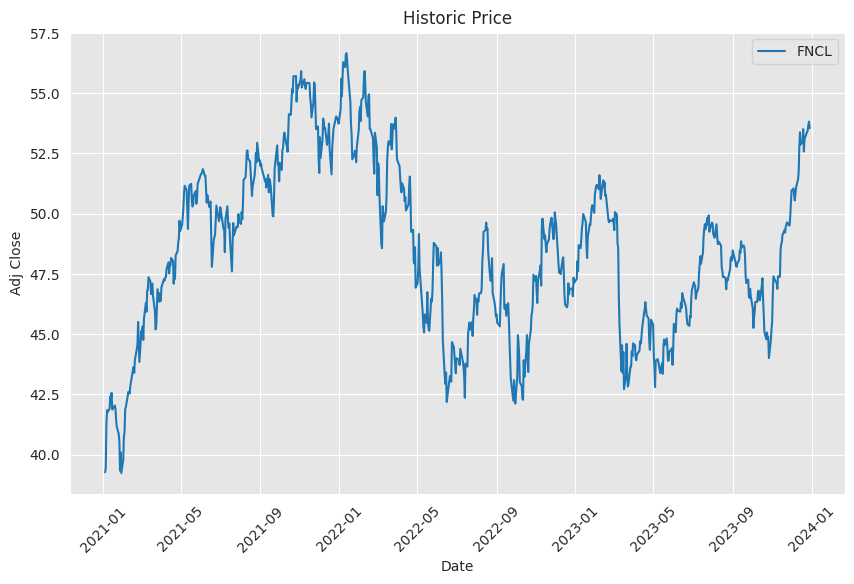

- The Adjusted Close price has been on an uptrend, rising from $48.03 on September 5 to $53.55 on December 29.

- Trading volume shows no consistent trend but an average between the range of roughly 70,000 to 230,000 shares traded daily.

- The Parabolic SAR (PSAR) has flipped from bearish to bullish as the dots have moved from being above to below the price bars, signifying a potential bullish trend.

- The On-Balance Volume (OBV) has shown an increase, indicating growing volume on up days, which can be a positive sign for continued upward momentum.

- MACD Histogram is showing a decrease in momentum as of the last trading day with a slightly negative value.

Fundamental Overview:

- The Price to Earnings (P/E) ratio is at a moderate 14.04, which may imply the stock is reasonably priced relative to earnings.

- FNCL has a yield of 2.11%, which could attract income-focused investors.

- The ETF's assets are substantial, emphasizing a strong market presence.

- FNCL is within a whisker of its 52-week high, indicating strong performance this past year.

- The ETF has experienced a year-to-date return of 14.7%, showcasing a positive performance for the year.

- FNCL's beta of 1.09 suggests that it is slightly more volatile than the market but is roughly aligned with market movements.

Considering the technical and fundamental data, the upward movement in the FNCL stock price appears to be supported by robust fundamentals, such as a reasonable trailing P/E ratio and solid YTD return, alongside strong technical signals like a bullish PSAR and increasing OBV. The ETF has also recently approached its 52-week high, which can act both as resistance or a breakout level if the price continues to ascend.

Given the rising trend line, the current fundamentals and the technical outlook, there appears to be potential for continued growth in FNCL's stock price over the upcoming months. The bullish sentiment is reinforced by the positive trailing returns and a sustained interest from the investment community in financial sector equities. However, the proximity to the 52-week high might trigger some profit-taking, leading to short-term pullbacks. Long-term investors, particularly those seeking exposure to the financial sector, may see such pullbacks as opportunities to increase their positions.

Market participants should monitor the volume trends and OBV for any signs of divergence, which could indicate a weakening trend, and keep an eye on the MACD histogram for further clues on momentum. Additionally, the ETF's performance relative to its moving averages, such as the fifty-day and two-hundred-day averages, will provide insights into the strength of any prevailing trend.

A final caveat: while the ETF's beta suggests a level of market-mirroring volatility, any broader market instability arising from macroeconomic factors could affect FNCLs price movements significantly. Tracking broader market trends and sector-specific news is recommended to stay aligned with potential shifts in the market's dynamics.

In recent years, the investment landscape has been significantly shaped by the dynamics surrounding index funds and Exchange-Traded Funds (ETFs), among which the Fidelity MSCI Financials Index ETF (FNCL) has been a major player. This fund provides widespread exposure to a range of financial institutions such as banks, insurance companies, and financial services providers by tracking the MSCI USA IMI Financials Index. Amidst the fluctuating interest rates and macroeconomic trends observed in today's markets, the performance and attraction of such ETFs can experience notable sways.

Particularly, the behaviour of sectors like technology and real estate investment trusts (REITs) in relation to interest rate movements has been critical. As highlighted by Terence Reilly in a Seeking Alpha article, periods of rising interest rates often see these sectors underperform, while energy and financials could possibly benefit. This bifurcation between sector winners and losers is a crucial consideration for market participants and investors who are navigating this volatile environment.

Under such circumstances, the broader market, and specifically the performance of the S&P 500 index, is heavily influenced by the valuation of large-cap tech stocks. Understandably, companies like Apple, Amazon, and Microsoft significantly sway the index performance due to their considerable market capitalizations. These tech giants can face difficulties during times of increasing interest rates, leading to potential losses in the market-cap weighted indexes which would be hard to offset by gains in smaller sectors like energy.

In the realm of personal investing, especially within 401(k) plans, these market conditions and the recent inflation increases suggest a pivotal moment for strategic reassessment. Moving away from traditionally underperforming vehicles such as value funds, precious metals, and commodities towards individual retirement accounts (IRAs) offers a breadth of investment options better suited to hedge against these changes. This practical approach may better align with the anticipated commodity super-cycle and the desire for diversified portfolios that can withstand inflationary pressures as illustrated by a simple anecdote of postal service fee increases.

| company | symbol | percent |

|---|---|---|

| Berkshire Hathaway Inc Class B | BRK-B | 8.05 |

| JPMorgan Chase & Co | JPM | 7.80 |

| Visa Inc Class A | V | 7.13 |

| Mastercard Inc Class A | MA | 6.01 |

| Bank of America Corp | BAC | 3.76 |

| Wells Fargo & Co | WFC | 2.78 |

| S&P Global Inc | SPGI | 2.35 |

| The Goldman Sachs Group Inc | GS | 1.96 |

| BlackRock Inc | BLK | 1.93 |

| American Express Co | AXP | 1.83 |

Internationally, the banking sector has been under the lens due to a series of events that slid into focus following the collapse of Silicon Valley Bank (SVB). Talks from industry experts like Stephen H. Dover of Franklin Templeton highlight how localized bank failures can prompt a broad systemic impact. The banking sector has historically been laced with implicit depositor guarantees, but recent developments have made this guarantee appear more explicit, leading to discussions about the level of trust investors and depositors place in the regulatory frameworks that govern these financial institutions.

Growing anxiety in global markets, spurred by volatility and critical scrutiny of central bank policies, such as the potential reevaluation of rate hikes by the US Federal Reserve, exemplify the nervy financial climate. The implications are vast, influencing policy decisions that could either spur growth or necessitate tighter regulations, potentially elevating costs and impacting banking operations in the pursuit of greater stability.

As we witness these macroeconomic shifts, we must also examine the recent changes announced by MSCI regarding its sector and subsector hierarchies. These adjustments implicate a reshuffling of company categorizations, which is set to affect the contents of numerous sector ETFs, including those in the information technology and financials sectors. Payment processors and companies that traditionally fell under the Information Technology Data Processing and Outsourced Services Sector are being transitioned, which results in a significant update to the composition of ETFs such as FNCL.

In reaction to MSCI's changes, some investors might opt for a phased realignment of their ETF holdings, particularly within tax-advantaged accounts to circumvent taxable events. With this in mind, one must consider the revised investment outlook post-pandemic which has revealed a sequenced global recovery rather than a synchronized one, as posited by Chris Dillon of T. Rowe Price.

Adequate vaccine distribution has allowed certain economies to fare better than others, with the US and China at the forefront. Consequently, while the US is visualizing the reopening phase, other emerging markets like India and Brazil are still in the throes of grappling with the pandemic. This uneven recovery trajectory calls for a nuanced investment approach that weighs the global economic disparities.

Adding to this complex investment dialogue is the expectation of China's continued development into a significant investment frontier despite geopolitical tensions with the US. China's markets, particularly in the technology, healthcare, and financial sectors, promise rewarding opportunities, yet remain underrepresented in global market indices. The preference towards cyclical market components stands out, with T. Rowe Price's 2021 Mid-Year Market Outlook anticipating sectors such as energy, financials, and industrials to benefit most from the economic rebound.

The emphasis on a sequenced recovery is then married with the layered concerns surrounding inflation, as detailed by Joseph Calhoun of Seeking Alpha. The evidences of investor anxiety through the increasing popularity of Treasury Inflation-Protected Securities (TIPS) underscore their collective effort to hedge against the surging inflation. Yet, the market's perception of the inflationary spike as transitory offers a silver lining, suggesting a temporal phase rather than a long-term fixture.

Focusing on short-term economic signals and long-term growth expectations, the markets wrestle with factors like supply chain disruptions and workforce impacts caused by the pandemic, which have played into the trepid counterpart of speculative investment strategies. Furthermore, the chatter of stability in industrial production despite setbacks portrays a resilient, albeit cautious, economic posture.

These various aspects converge in the realm of the Fidelity MSCI Financials Index ETF and its broader ecosystem. The performance of prominent financial companies, the vicissitudes of macroeconomic trends, and unexpected events that rattle the banking sector offer a perpetually changing tapestry for ETF investors. The comprehensive analysis of corporate dynamics, economic indicators, and sector-specific news will remain central to interpreting and projecting the movements within financial-centric ETFs like FNCL. To navigate this financial climate effectively, stakeholders must persist in the meticulous dissection of multifaceted market conditions as exemplified by their repeated assessments of top holdings within the sector.

In the end, the Fidelity MSCI Financials Index ETF and other such sector-centric ETFs are indicative of the larger narrative of the investment realm; they encapsulate the gravity of economic developments as well as policy decisions, simultaneously highlighting investor sentiment and strategy. Forestalling a definitive conclusion to the sprawling dialogues of economics and finance, these funds stand as a testament to the fluidity and persistence required in successful long-term investment decision-making.

Similar Companies in Exchange Traded Fund:

Vanguard Financials ETF (VFH), Report: iShares U.S. Financials ETF (IYF), iShares U.S. Financials ETF (IYF), SPDR S&P Bank ETF (KBE), Report: Financial Select Sector SPDR Fund (XLF), Financial Select Sector SPDR Fund (XLF), Report: Invesco KBW Bank ETF (KBWB), Invesco KBW Bank ETF (KBWB), Report: iShares U.S. Regional Banks ETF (IAT), iShares U.S. Regional Banks ETF (IAT), Invesco KBW Financial Sector ETF (KBWD)

News Links:

https://www.fool.com/investing/2022/10/29/company-report-roundup-tesla-tractor-supply-americ/

https://seekingalpha.com/article/4461716-weekly-market-pulse-inflation-scare

https://seekingalpha.com/article/4459299-winners-and-losers

https://seekingalpha.com/article/4436518-chris-dillon-expect-a-sequenced-not-synchronized-recovery

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: lGiYAGQ

https://reports.tinycomputers.io/FNCL/FNCL-2024-01-01.html Home