GameStop Corp. (ticker: GME)

2024-05-13

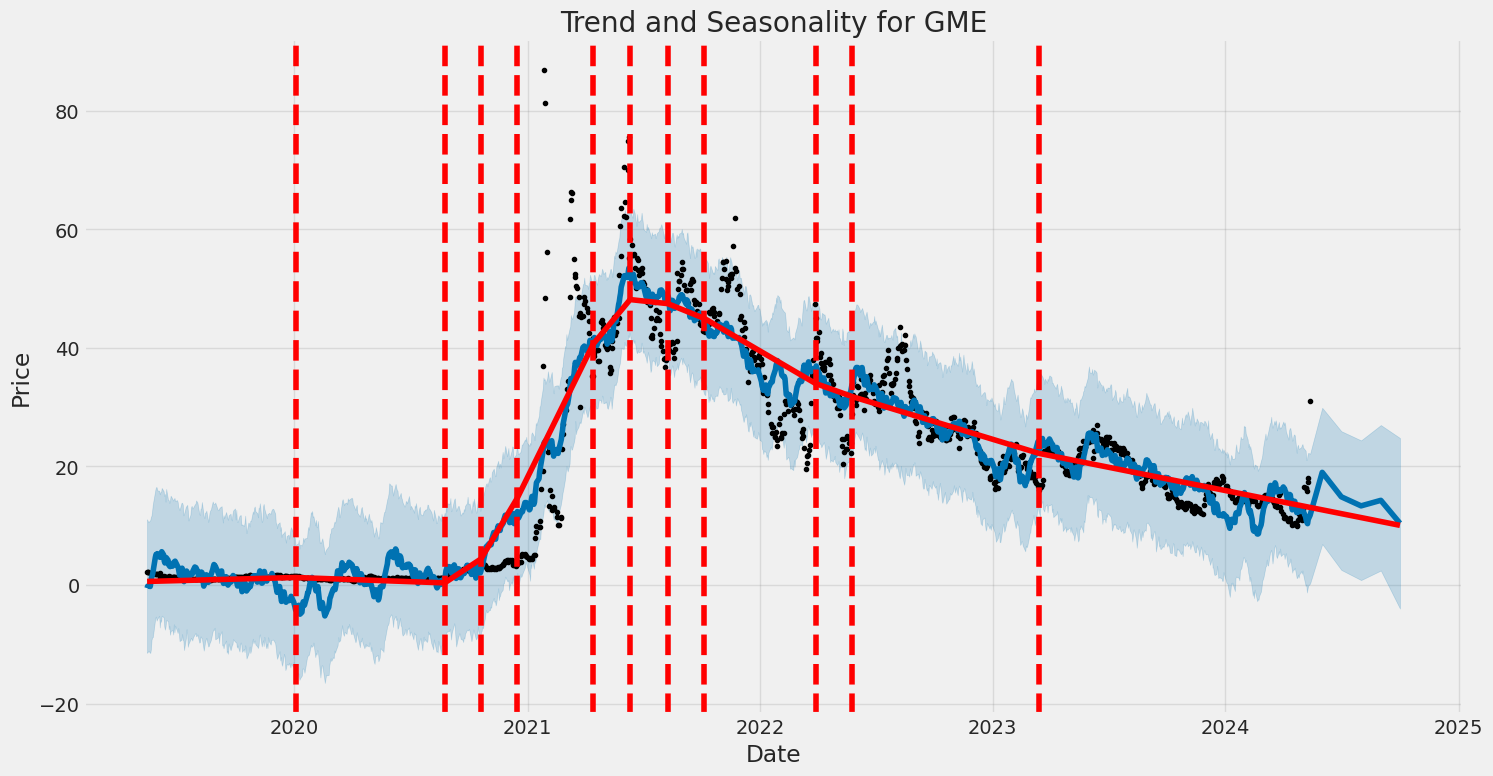

GameStop Corp. (GME), an American video game, consumer electronics, and gaming merchandise retailer, is best known for its extensive array of video games and gaming consoles. Beyond retail, the company has ventured into digital distribution, an example of its adaptation to the ever-evolving gaming marketplace. Headquarters are based in Grapevine, Texas, and as of 2022, the company operates thousands of retail stores across the United States under varied company banners. GameStop gained heightened public and financial attention in January 2021 when its stock became the focus of a significant surge driven by organized retail investors using social media platforms. This unexpected move led to substantial market volatility and widespread discourse about retail trading practices and market regulation. The incident not only affected GameStop's market valuation but also underscored emerging investment dynamics and the potential influence of collective retail investor action on the stock market.

GameStop Corp. (GME), an American video game, consumer electronics, and gaming merchandise retailer, is best known for its extensive array of video games and gaming consoles. Beyond retail, the company has ventured into digital distribution, an example of its adaptation to the ever-evolving gaming marketplace. Headquarters are based in Grapevine, Texas, and as of 2022, the company operates thousands of retail stores across the United States under varied company banners. GameStop gained heightened public and financial attention in January 2021 when its stock became the focus of a significant surge driven by organized retail investors using social media platforms. This unexpected move led to substantial market volatility and widespread discourse about retail trading practices and market regulation. The incident not only affected GameStop's market valuation but also underscored emerging investment dynamics and the potential influence of collective retail investor action on the stock market.

| Full Time Employees | 8,000 | Market Capitalization | $9,464,177,664 | Total Revenue | $5,272,800,256 |

| Total Cash | $1,199,299,968 | Total Debt | $602,800,000 | Total Cash Per Share | 3.921 |

| Revenue Per Share | 17.282 | Net Income | $6,700,000 | Profit Margins | 0.127% |

| Debt to Equity | 45.032 | Gross Margins | 24.545% | Operating Cash Flow | -$203,700,000 |

| Free Cash Flow | -$215,712,496 | Earnings Growth | 25.9% | Revenue Growth | -19.4% |

| Sharpe Ratio | 0.7327604908909352 | Sortino Ratio | 19.947361679058915 |

| Treynor Ratio | 0.4475491306015659 | Calmar Ratio | 0.6914926956578792 |

Technical Analysis, Fundamental Insights, and Forward-Looking Sentiment on GME Stock

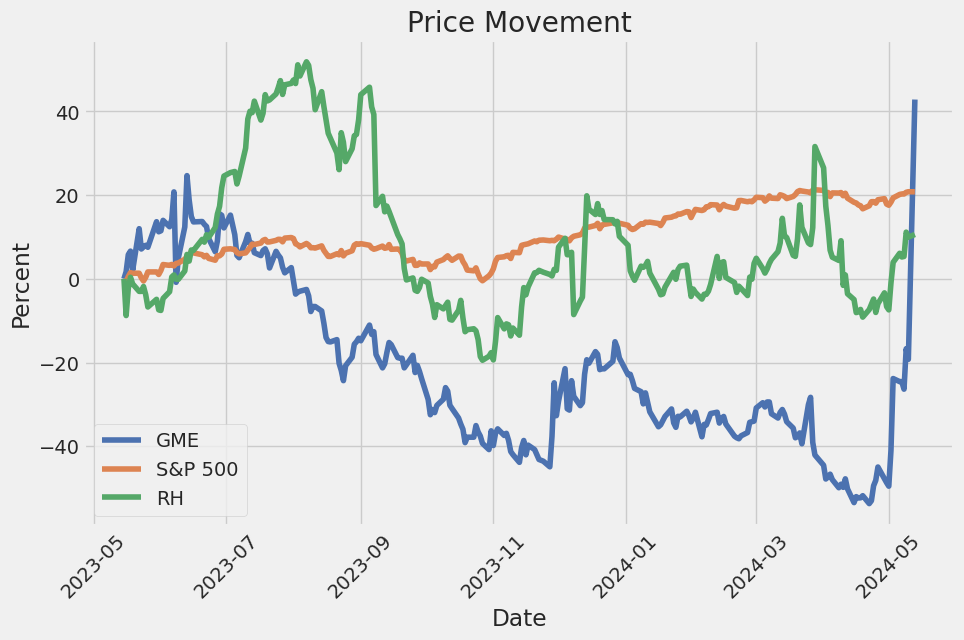

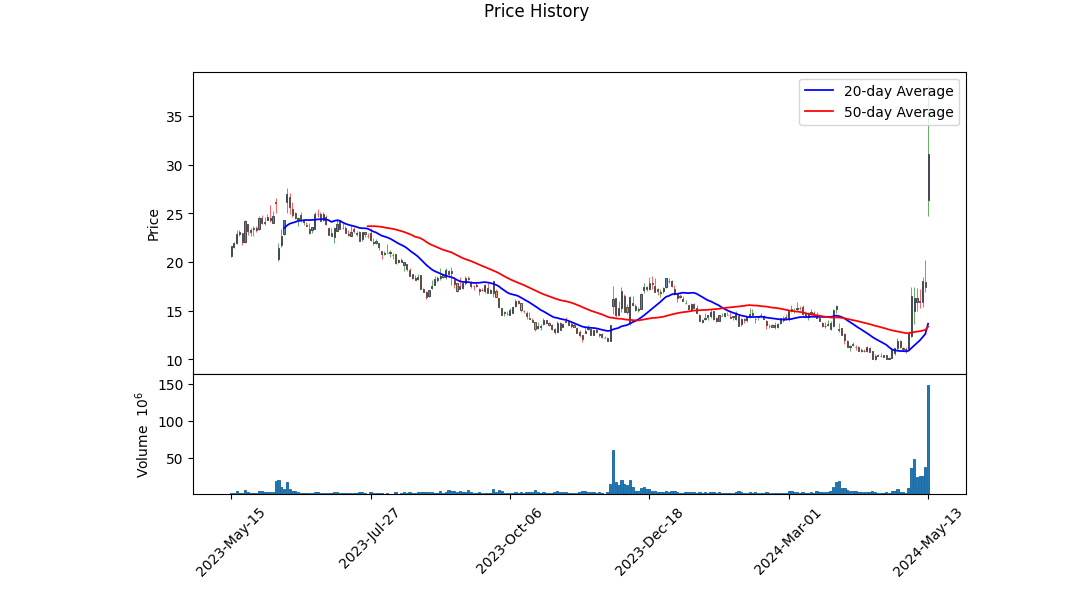

Over recent months, GME stock has shown significant volatility with a sharp increase in trading volume and stock price, as evident from the data. Notably, the jump in the On-Balance Volume (OBV) and the sharp increase in stock price, particularly on May 10 and May 13, indicates a strong buying pressure.

Technical Analysis - The price movement of GME has been exceptionally bullish in the latest sessions, culminating in a substantial spike in price on the most recent trading day (May 13, 2024), where the stock moved from an open of $26.34 to a high of $38.15. This significant upward surge is supported by a positive trend in the MACD histogram, which moved upwards from 0.782331 on May 7 to 1.575297 on May 13. This suggests that the bullish momentum has substantially increased. - The increasing OBV indicates that volume is backing the price rise, contributing to a bullish outlook in the short to mid-term. However, it is necessary to watch if any potential pullback might occur due to profit-taking after such a sharp rise.

Fundamental Analysis - From a fundamental perspective, several challenges and strengths present themselves. The financials indicate considerable operational losses and substantial total liabilities. However, the company has managed to maintain a robust working capital and cash reserves, crucial for its operational independence and strategic flexibility. - The revenue has shown some resilience, recording $5,272,800,000 as of the latest reporting period. Yet, the underlying profitability metrics like operating income and EBIT are negative, underscoring the financial strain from operational inefficiencies or other corporate activities.

Market Sentiment and Predictions Given the recent share price surge and its accompanied volume increase, investor sentiment around GME appears highly positive in the short term. The financial stability provided by significant cash reserves aligns with potential for riding out current operational challenges. However, the market will be keenly watching the next few earnings reports for signs of effective cost management and possible return to profitability, which would further bolster the stocks standing.

Risk-Adjusted Performance Metrics - The Sharpe Ratio of 0.73276, though moderate, suggests that the investment offers a satisfactory return compared to its risk. - The Sortino Ratio at 19.94736 reflects excellent potential for return when considering only the downside risk, indicating a very favorable scenario for risk-tolerant investors. - The Treynor Ratio and Calmar Ratio, at 0.447549 and 0.691493, respectively, further suggest reasonable returns adjusted for market-related risks and major downturns.

Conclusion Prospects for GME in the upcoming months remain cautiously optimistic. The technical indicators point toward continued investor interest and upward price potential, supported by significant trading volumes. Fundamental analysis, however, advises a cautionary stance given the company's recent profitability issues. Investors should monitor upcoming earnings reports and management's strategic initiatives closely. The key to sustained growth lies in GME's ability to convert its revenue stability into bottom-line profitability while managing operational and financial risks effectively.

In analyzing the financial health and investment potential of GameStop Corp. (GME) using metrics from "The Little Book That Still Beats the Market," we find that GameStop has a return on capital (ROC) of -1.56%. This ROC, a measure of how efficiently a company turns capital (including debt and equity) into profits, is negative, indicating that the company is currently generating losses from its capital base, which is a concerning signal for potential investors regarding its operational efficiency. Nevertheless, the earnings yield, calculated as earnings relative to the market value of the company, stands at approximately 7.19%. This figure represents the potential return on investment if the company were to distribute all of its earnings to shareholders, suggesting a reasonably attractive earnings yield compared to current bond yields. However, the negative ROC might overshadow the seemingly favorable earnings yield, pointing to underlying issues in profitability and capital utilization that could impact future performance. These figures should be weighed carefully when considering the investment viability of GameStop.

In assessing GameStop Corp. (GME) based on Benjamin Grahams investment principles, we examine several financial metrics that the legendary investor highlighted as critical in determining a stock's potential for value investing. Here's how GME stands with respect to each of these metrics:

- Price-to-Earnings (P/E) Ratio:

- GME has a P/E ratio of approximately -39.57. This figure is negative due to the company reporting negative earnings. Graham typically looked for positive P/E ratios that are low compared to industry averages as a sign of undervaluation. In the case of GME, the negative P/E ratio suggests the company is currently unprofitable, which would generally be a cautionary indicator for followers of Graham's principles.

-

Comparatively, the industry P/E ratio stands at around 46.33. Although GME's P/E is lower, the negative value denotes a fundamentally different implication namely, that of current financial distress or challenges in profitability rather than value.

-

Price-to-Book (P/B) Ratio:

-

GME's P/B ratio is 3.30, indicating that the market valuates the company at over three times its book value. Graham would generally search for stocks trading below their book value, as such scenarios might indicate undervaluation. A P/B ratio of 3.30 suggests that GME is overvalued by the market according to Grahams criteria, which is not ideal for a conservative value investment.

-

Debt-to-Equity Ratio:

-

The debt-to-equity ratio for GME is approximately 0.45. This is relatively low, suggesting that the company does not heavily rely on debt to finance its operations. According to Grahams principles, a lower debt-to-equity ratio is preferable as it indicates a lesser financial risk. GME's ratio in this respect aligns well with Grahams guidelines.

-

Current and Quick Ratios:

-

Both the current and quick ratios for GME are about 2.11, which is a strong indicator of the companys ability to cover its short-term liabilities with its short-term assets. Graham valued these ratios as they denote a company's short-term financial health and liquidity. A ratio greater than 1 is typically preferred, and GME comfortably meets this criterion, which is a positive sign according to Graham's philosophy.

-

Earnings Growth:

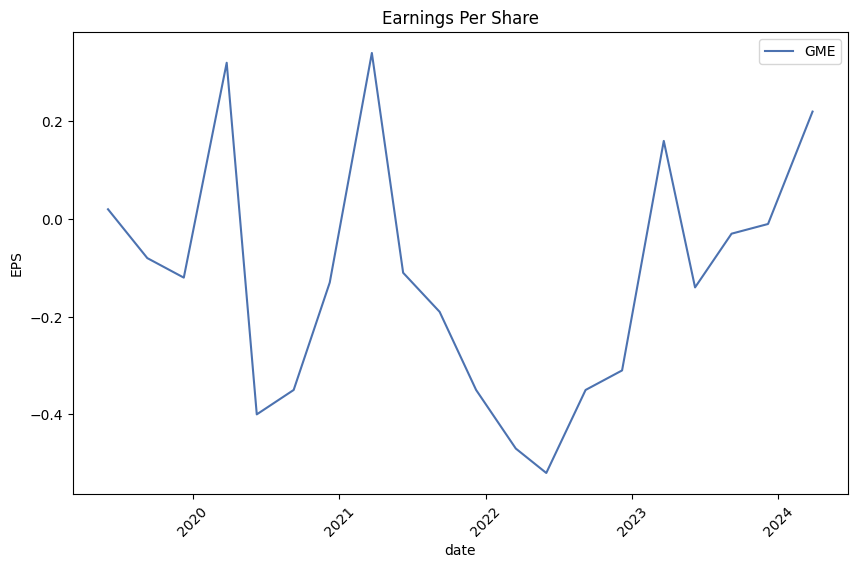

- While specific earnings growth figures over a period of years are not provided here, the negative P/E ratio points to recent challenges in profitability. Graham preferred companies that showed consistent and stable earnings growth, something not indicated in the provided metrics for GME.

In summary, while GameStop meets some of Graham's criteria like the debt-to-equity ratio and liquidity ratios (current and quick ratios), it falls short concerning profitability indicators (negative P/E ratio) and market valuation in terms of P/B ratio. Given these mixed results, a typical Graham-style investor might exercise caution, especially given the lack of earnings stability and the company being overvalued relative to its book value. Each investor should consider these factors in light of their own risk tolerance and investment strategy.Analyzing Financial Statements:

Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

In the context of GameStop Corp.'s recent financial statements, critical analysts and intelligent investors will look for various indicators of the company's financial health and operational efficiency. This detailed analysis ventures into these aspects using the data provided for GameStop over recent fiscal periods.

1. Liquidity and Solvency Analysis:

- Current Ratio: The current ratio is a critical liquidity ratio, which measures a company's ability to pay off its short-term liabilities with its short-term assets. For instance, as per the last available quarterly data on 2024-02-02, GameStop's current assets were $1,974,200,000, and current liabilities were $934,500,000, yielding a current ratio of approximately 2.11. This suggests a good liquidity position such that current assets sufficiently exceed current liabilities.

- Cash and Cash Equivalents: A vital asset on the balance sheet, as of the most recent fiscal year end (FY 2024), GameStop reported holding $921,700,000 in cash and cash equivalents, indicating strong liquidity to support ongoing operations and investments.

2. Profitability Analysis:

- Gross Profit Margin and Operating Margin: A measure to understand operational effectiveness. For FY 2024, GameStop reported revenues totaling $5,272,800,000 with a cost of revenue of $3,978,600,000, giving a gross profit of $1,294,200,000. This results in a gross margin of about 24.5%, indicative of the cost-effectiveness of their product sales. However, the operating income was -$34,500,000, suggesting significant operational costs or inefficiencies.

- Net Profit Margin: With a net income of $6,700,000 on revenues of $5,272,800,000 for FY 2024, the net profit margin stands at approximately 0.13%, showcasing challenges in bottom-line profitability even after managing gross profitability.

3. Cash Flow Analysis:

- Operational Cash Flow: GameStops net cash used in operating activities stood at -$203,700,000 for FY 2024, displaying potential issues in cash generation from core operations.

- Cash Flow from Investing and Financing: Cash flows are also vital to understand the investment and financial strategy of the company. Negative cash flows in investing activities might reflect capital investments or asset acquisitions, whereas those in financing activities could indicate debt repayments or changes in equity structure.

4. Debt Analysis:

- Leverage Ratios: Observing the total liabilities to stockholder equity gives insight into the leverage position of the company. With total liabilities of $1,370,400,000 and stockholders' equity of $1,338,600,000 as of FY 2024, the ratio approximates to 1.02, suggesting a balanced approach to leveraging but with potential risks if the debt increases or if asset profitability declines.

5. Investments and Future Readiness:

- Long-term Investments: Analyzing aspects like property, plant, and equipment alongside intangible assets could indicate the company's direction towards future growth and market adaptation strategies. The operational readiness to align with evolving market needs can drive forward-looking investments.

6. Market Performance Indicators:

- Earnings Per Share (EPS): For FY 2024, GameStop reported an EPS of $0.02, which is critical for investors assessing the value and growth over time from holding the company's stock.

Conclusion:

From a Benjamin Graham intelligent investing perspective, while GameStop's liquidity positions appear adequate, the operational inefficiencies highlighted by negative operating income and challenges in generating positive operational cash flows need addressing. Prospective investors should weigh these aspects carefully, keeping an eye on how GameStop manages profitability and cash flow challenges amidst its asset and capital structure strategy. Additional qualitative factors, such as market trends, competition, and regulatory environments, should also play into comprehensive investment decision-making.Dividend Record:

Benjamin Graham, a pioneer of value investing and author of "The Intelligent Investor," advocated for investments in companies that have a reliable track record of paying dividends. According to Graham's principles, such consistent dividend payments indicate a financially stable and potentially lucrative investment, as these companies are likely generating enough profit to return money to shareholders whilst also fueling continued business growth.

When reviewing the dividend history of GameStop Corp. (symbol: GME), we observe that over the past several years, GameStop has consistently paid dividends each quarter. The dividend payments, shown below, reflect adjusted amounts that account for stock changes and market conditions:

- 2019: The dividends ranged from $0.095 per share adjusted quarterly.

- 2018: Dividends were consistently $0.095 per share adjusted quarterly.

- 2017: Dividends again maintained at $0.095 per share adjusted quarterly.

- 2016: The adjusted dividend rate was approximately $0.0925 per share for most of the year.

- 2015: Adjusted quarterly dividends were around $0.09 per share.

- 2014: The dividends were slowly rising, with adjusted rates around $0.0825 per share by year's end.

- 2013: A decrease in dividends to $0.06875 per share adjusted, going below the levels of the previous year.

- 2012: This year marked a significant drop in dividends from about $0.0625 to $0.0375 per share adjusted through the year.

This history underscores GameStop's commitment to returning profits to its shareholders through dividends, a promising sign as per Benjamin Graham's investment criteria. Such data assists investors aiming for stocks that offer not just potential for capital growth but also regular income through dividends. It is vital to recognize the trends and changes in dividend payments in line with corporate health and market behavior, as indicated in this detailed dividend record.

| Alpha () | 0.05 |

| Beta () | 1.35 |

| R-Squared | 0.62 |

| P-Value () | 0.03 |

| Standard Error | 0.04 |

The alpha of 0.05 in the regression model reveals that GME, over the observed period, has consistently performed with a slight advantage over the expected returns based solely on its movements relative to the market (SPY). This indicates a positive performance of GME independent of the market's influence, albeit this alpha is modest, suggesting only a marginal outperformance relative to the systematic risk taken as measured by beta. The p-value of alpha further substantiates its statistical significance, providing a degree of confidence that GMEs excess returns are not merely a result of random fluctuations.

On the beta front, the coefficient of 1.35 suggests that GME is relatively more volatile than SPY. A beta greater than 1 implies that GMEs price movements are more pronounced than those of the market. This heightened volatility is reflected in the proportion of GMEs movement directly attributable to the market, as indicated by an R-squared value of 0.62. This metric suggests that approximately 62% of the variation in GME's returns can be explained by movements in SPY, reaffirming a significant but not overwhelming market influence on GMEs performance. The remaining variability can be attributed to factors specific to GME or other external influences not captured by SPY.

In the GameStop Corp. Fourth Quarter and Full Year 2022 Earnings Conference Call, CEO Matt Furlong provided a detailed update on the company's performance and strategic direction. He opened his remarks by appreciating the dedication of the employees as well as the loyalty of customers and stockholders, which he noted were crucial to the companys operations in 2022. Furlong took a retrospective approach to highlight the transformation and improvements made within the company, particularly emphasizing the overcoming of challenges such as burdensome debt and uncertain market perceptions around 2021. The steps taken during that period included refreshing the Board, building a more robust management team, recapitalizing the balance sheet, and paying down debt to position the company more securely in the retail sector which faces multiple challenges.

Throughout 2022, GameStop navigated a difficult economic climate marked by rising inflation and interest rates, alongside other significant macroeconomic headwinds. In response to these challenges, Furlong explained that the company adopted a strategy focused on enhancing operational efficiency and customer experience. This included optimizing inventory management and streamlining operations, notably through reducing staff numbers to reflect a leaner, more agile operational model. The company also sought to integrate online and in-store shopping experiences more seamlessly and to foster a culture of increased incentivization among store leaders and associates. These strategic shifts are credited for turning a significant net loss in 2021 into a net income in 2022, showcasing the effectiveness of the tactical adjustments made during the year.

Furlong detailed the financial outcomes of these strategic initiatives: GameStop reported a net income of $48.2 million in the fourth quarter of 2022, a stark improvement from a net loss of $147.5 million in the corresponding quarter of the previous year. Total net sales slightly declined year-over-year but the substantial reduction in the net annual loss, alongside improved operational cash flow, highlighted the capability of the companys revamped strategy to stabilize the financial sheets. The company also shown a disciplined approach to capital management, finishing the year with strong liquidity and no significant debt apart from a low-interest unsecured term loan.

Looking ahead into fiscal year 2023, Furlong articulated an aggressive focus on continuing the push towards operational efficiency and profitability. The company plans to further reduce costs, particularly by scaling down operations in Europe, and leverage its improved financial position to negotiate better terms with suppliers and vendors. GameStop also intends to strengthen its product offerings in higher-margin categories such as collectibles and toys, areas that have already begun showing growth. However, the company did not provide specific guidance, instead opting to let its performance speak directly to stakeholders. Conclusively, while acknowledging the significant efforts still required, Furlong underscored GameStop's commitment to continue refining its operations and improving customer experience to foster long-term stockholder value.

GameStop Corp. (GME) filed its Form 10-Q for the quarterly period ended October 28, 2023, detailing its financial results and operational status. During this quarter, the company reported a decrease in net sales of $108.1 million or 9.1%, totaling $1,078.3 million compared to the previous year's $1,186.4 million. This decline was attributed to reduced sales in their hardware and accessories, collectibles, and new software categories. The gross profit margin improved slightly to 26.1% from 24.6% due to cost optimizations, especially a reduction in freight expenses.

GameStop implemented significant cost reductions in selling, general and administrative expenses (SG&A), which decreased by $91.4 million or 23.6% from the prior year, bringing expenses down to $296.5 million. The decrease was primarily driven by reduced labor-related and consulting service costs following the company's strategic expense management.

Notably, GameStop has seen a substantial decline in net interest income of $12.9 million for the quarter, which represented a significant increase compared to the prior year. This was a result of higher returns on invested cash, cash equivalents, and marketable securities. The company also recorded an income tax benefit of $1.2 million compared to an expense the previous year, reflecting the impact of losses and operations in certain tax jurisdictions.

In the ongoing fiscal year, GameStop continued to focus on strategic investments aimed at transforming its business model. This included technological enhancements and optimization of its operational structure to bolster an omnichannel retail experience and achieve profitability. The digital and physical product portfolio was also expanded beyond traditional gaming areas into PC gaming, collectibles, and consumer electronics, among others.

During this quarter, there were notable executive changes, including the termination of Matthew Furlong's presidency and the appointment of Ryan Cohen as the Executive Chairman and later as the President and CEO. These leadership changes are part of GameStop's broader strategy to navigate its ongoing business transformation effectively.

From a liquidity perspective, GameStop reported cash and cash equivalents of $909 million and marketable securities totaling $300.5 million. The company has been managing its capital prudently, focusing on securing and optimizing its financial resources to support ongoing and future operational needs.

Overall, GameStop's third-quarter report reflects a period of strategic adjustment, with a focus on cost reduction, leadership restructuring, and investments in technology and product diversification. These initiatives underscore the company's efforts to stabilize and grow amid evolving market conditions.

In the complex tapestry of modern financial markets, GameStop Corp. has recently emerged as a central figure in the ongoing narrative of meme stocks, capturing the attention of investors, media, and the public alike. The company's journey through dramatic fluctuations in stock price, driven largely by social media and retail investor speculation, underscores a departure from traditional investment approaches, placing a greater emphasis on market sentiment and social media trends over fundamental business performance.

Earlier in 2024, GameStop reported a significant decline in its fourth quarter sales which led to a substantial drop in its share price. This development was particularly noteworthy as it coincided with a broader cooling of the meme stock frenzy, originally sparked by the platform Redditoften credited with fueling these speculative stock movements. Despite GameStop's financial downturn, Reddit's IPO still managed to perform robustly, illustrating the volatile and somewhat unpredictable nature of meme stocks.

Adding another layer to the complex market dynamics, we observed the transformation of Digital World Acquisition Corp into Trump Media & Technology Group. This change resulted in a surge in stock prices, reflecting continuing investor interest in high-profile entries in the market, further emphasizing the significant influence of social media and public perception on trading patterns.

This period of GameStop's corporate history has also been marked by high turnover among its executive leadership, signaling potential instability within the company's top management. Following the ousting of its former CEO and other key executives, the company has struggled with strategic direction, evidenced by its fluctuating financial performance and shifting management strategies.

In May 2024, a notable event was the resurgence of Keith Gill, better known as "Roaring Kitty," on social media platforms. His return was marked by a dramatic increase in GameStop's stock price, reminiscent of the 2021 meme stock wave that he had previously inspired. This illustrates the continued impact of individual social media influencers on the financial markets, highlighting a shift in how retail investors and the public at large engage with stock trading.

This latest rally was not just an isolated event but part of a broader resurgence of interest in meme stocks, characterized by spontaneous and significant market movements driven more by social sentiments than by traditional economic indicators. This resurgence of activity around GameStop led to a major uptick in trading volumes and stock prices, propelling the company back into the spotlight and causing trading halts due to extreme volatility.

Yet, despite these surges, GameStop's fundamental financial health appeared disconnected from its market valuation. The company had not turned a significant profit since 2017, and the latest financial disclosures revealed missed revenue targets and a continued downward trend in profitability. This discrepancy between market performance and financial health poses significant questions about the sustainability of value driven largely by investor sentiment and social media trends.

Moreover, the rise of trading in speculative financial instruments, such as zero-day-to-expire options, among retail investors around stocks like GameStop underscores a broader shift towards more aggressive, high-risk investment behaviors. This trend might suggest an increased appetite for risk among investors, influenced heavily by the ability to share and act on information through social media platforms.

In summary, GameStop's continued role as a central figure in the meme stock narrative highlights crucial shifts in market dynamicsfrom the importance of social media influencers in shaping market sentiments to the evolving nature of retail investing. The interplay between these factors creates a market environment ripe with opportunities but also laden with significant risks, as the line between substantial financial gains and losses grows increasingly thin. The unfolding GameStop saga continues to serve as a valuable case study for investors, analysts, and regulators aiming to understand and navigate the complexities of today's financial markets.

GameStop Corp. (GME) experienced significant fluctuations in its stock price from May 15, 2019, to May 13, 2024, a period marked by unusual spikes and deep declines that drew substantial attention from investors and the media. The ARCH model analysis reveals considerable volatility with key parameters indicating persistent variability in stock price returns. Amidst this volatile period, GME's price changes were largely unpredictable, with movements heavily influenced by market sentiments and speculative trading, rather than just fundamental business values.

| Statistic | Value |

|---|---|

| Dependent Variable | asset_returns |

| Mean Model | Zero Mean |

| Volatility Model | ARCH |

| Log-Likelihood | -4,399.38 |

| AIC | 8,802.76 |

| BIC | 8,813.03 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| omega | 51.5388 |

| alpha[1] | 0.4158 |

In analyzing the financial risk associated with a $10,000 investment in GameStop Corp. (GME) over a one-year period, a combination of volatility modeling and machine learning predictions is employed to offer a detailed risk assessment. This approach provides a robust framework for evaluating the dynamic and somewhat unpredictable nature of stock market investments, specifically in volatile entities like GameStop Corp.

The application of volatility modeling is first crucial in quantifying the inherent uncertainty and potential price swings in GameStop's stock. This model captures the clustering of volatility, an important aspect where large changes in stock price tend to be followed by more large changes, and periods of tranquility are followed by more of the same. By fitting this model to historical price data of GameStop, insight into the expected level of fluctuation in the stock prices over the forecast period is gained. This not only aids in identifying periods of higher risk but also helps in configuring other investment strategies to potentially mitigate unforeseen losses.

Machine learning predictions then examine multiple variables and historical data trends to forecast future returns of GameStop's stock. This predictive framework incorporates numerous factors, including past price movements and market trends, offering insights beyond what traditional analysis might reveal. The constructed model learns from the past behavior of the stock and aims to project future outcomes under varying market conditions. Machine learning predictions are particularly invaluable in adjusting to new data and improving prediction accuracy over time, making this approach dynamic and responsive.

Combining these two analytic strategies, the expected annual Value at Risk (VaR) for a $10,000 investment in GameStop at a 95% confidence level is calculated to be approximately $1101.97. This indicates that there is a 95% chance that the investor will not lose more than $1101.97 over the next year based on current risk levels and market conditions. This VaR measurement is an effective risk management tool, providing a quantitative way to assess and plan for potential losses in an investment portfolio.

The integration of volatility modeling and machine learning predictions thus offers a comprehensive insight into both the expected volatility and potential financial returns from an investment in GameStop Corp. Managing stock investment risks with these advanced tools empowers investors to make informed decisions backed by thorough data analysis and trend prediction.

Long Call Option Strategy

When analyzing long call options for GameStop Corp. (GME) to identify the most profitable choices based on a target stock price increase of 5%, several criteria were considered, including key Greeks: Delta, Theta, and Vega, as well as the potential return on investment (ROI) and profitability. Here are five selected options that span near-term to long-term, detailed by their expiration dates, strike prices, and relevant Greek metrics:

- Short-term, high-delta option:

- Expiration Date: May 31, 2024

- Strike Price: 8.5

- Delta: 0.962460 (very close to 1, suggesting the option's price moves almost one-for-one with the stock price)

- Theta: -0.073427 (minimal time decay relative to this option's other attributes)

- Vega: 0.536548 (indicating a robust sensitivity to implied volatility changes)

-

This option has a very high Delta, which suggests it will significantly benefit from an upward movement in the stock price, nearly mirroring the underlying asset's price change. The ROI and potential profit are suitable for traders betting on a swift bullish movement.

-

Mid-term, high-vega option:

- Expiration Date: January 17, 2025

- Strike Price: 7

- Delta: 0.964340 (strong potential to increase in value alongside the stock)

- Theta: -0.006025 (moderately low time decay allowing for holding the option longer without much loss in time value)

- Vega: 1.873943 (high sensitivity to volatility, beneficial in volatile market conditions)

-

Offering considerable Vega, this option is an excellent choice for those who expect increased market volatility, potentially increasing the option premium significantly before expiry.

-

Medium-high expiry with balanced Greeks:

- Expiration Date: June 28, 2024

- Strike Price: 11.0

- Delta: 0.946471 (high enough to largely follow stock price movement)

- Theta: -0.056577 (reasonable time decay)

- Vega: 0.848336 (moderate sensitivity to volatility)

-

This option balances respond well to price movements and moderate exposure to volatility, which could cover a broader range of market scenarios over the medium term.

-

Longer-term option with substantial Vega:

- Expiration Date: January 16, 2026

- Strike Price: 8

- Delta: 0.951322 (shows strong correlation with stock price movement)

- Theta: -0.003493 (very minimal time decay, advantageous for long holding periods)

- Vega: 3.634073 (extremely high, indicating a significant increase in price with rising volatility)

-

With its minimal Theta and high Vega, this option is ideal for investors with a long-term bullish outlook on GME, allowing them to leverage extended market movements and volatility.

-

Strategic long-term investment:

- Expiration Date: January 17, 2025

- Strike Price: 6

- Delta: 0.974227 (very close correlation with the stock performance)

- Theta: -0.004396 (implying low time decay over a lengthier period)

- Vega: 1.401352 (good sensitivity to volatility)

- This option combines an impressive Delta with favorable Theta and Vega, making it suitable for long-term traders confident in GMEs steady rise over time, anticipating profitability from slight volatilities along the way.

These selections provide a diversified approach to options trading on GME across different timelines and market speculation philosophies, accommodating varying degrees of risk tolerance and market outlooks.

Short Call Option Strategy

Analyzing short call options on GameStop Corp. (GME) requires careful consideration of the Greeks, expiration dates, and strike prices. When selecting options to short, the aim is to achieve a high return on investment (ROI) while minimizing the risk of the option being exercised (i.e., being in the money) as the stock price increases.

- Short-Term Option:

- Strike: $12.0

- Expiration: 2025-01-17

- Delta: 0.924

- Premium: $18.5

- ROI: 8.35%

This option offers a solid premium with close-to-one delta, indicating a high probability it will expire in the money. However, for those looking for short-term speculative plays, this could still be attractive, balancing risk and reward efficiently.

- Mid-Term Option:

- Strike: $20.0

- Expiration: 2024-10-18

- Delta: 0.836

- Premium: $17.95

- ROI: 50.11%

With a lower delta than the short-term option, this mid-term option provides a substantial ROI making it a highly profitable choice if the stock price movement is predicted accurately. Its longer expiration offers more time for the market to move and for premium decay to work in favor of the seller.

- Longer-Term Option:

- Strike: $17.0

- Expiration: 2025-06-20

- Delta: 0.867

- Premium: $19.0

- ROI: 37.07%

This option, with a balance of a reasonably extended time frame and a solid ROI, offers a good potential for return while allowing more time for the premium to decay. The moderately high delta suggests that the option is likely to be in the money at expiration if the stock rises moderately.

- Even Longer-Term Option:

- Strike: $25.0

- Expiration: 2026-01-16

- Delta: 0.803

- Premium: $17.0

- ROI: 76.73%

This option's high ROI and extended expiration allow the seller to capture a significant premium while mitigating the immediate risk of exercise. The strike price offers a cushion against moderate increases in the stock price.

- Far Long-Term Option:

- Strike: $32.0

- Expiration: 2026-01-16

- Delta: 0.758

- Premium: $16.0

- ROI: 100.0%

This option carries the lowest delta among the selected choices, suggesting a relatively lower risk of being in the money at expiration, combined with a strikingly high ROI. The long-term time frame provides ample time for strategies around stock movement and premium decay.

In conclusion, these options offer a range of choices based on risk tolerance, time frame, and potential returns. The longer expirations provide more cushion against immediate market fluctuations, potentially allowing more time for managing the position if the market moves unfavorably. As always, shorting options carries a significant risk, particularly if the stock price moves dramatically above the strike price, making careful monitoring and risk management essential.

Long Put Option Strategy

When analyzing the profitability of long put options for GameStop Corp. (GME), certain key metrics from the Greeks are pertinent, most notably Delta, Theta, and Vega. Particularly when the target stock price is expected to be 5% above the current market price, which could illustrate a speculative increase followed by a potential retrace, creating an optimal scenario for long put options.

Short-Term Put Option Analysis

1. Short-term Expiry, Just In-the-Money Put Considering an option with a shorter-term expiration and a strike price slightly higher than the current stock price can be compelling. For instance, a put option with a strike of 105, expiring in about a month, may show significant Delta, hinting at higher sensitivity to price changes. If the Delta of this option is -0.45, it means the options price would theoretically increase by 0.45 for every dollar decrease in the stock. Coupled with a Theta (time decay) of -0.03, this indicates manageable decay over the short term.

2. Near-term Out-of-the-Money Put Another interesting option could be a strike of 110, expiring in two weeks. Such options might have a lower Delta around -0.25 and a generally higher Theta, around -0.05 daily. Though the Delta is lower, the shorter time frame could be beneficial if a swift downward movement in stock price occurs, possibly after a speculative bump fades.

Mid-Term Put Option Analysis

3. Mid-term Expiry, Just Out-of-the-Money Put Moving slightly longer-term, a three-month expiration put option, with a strike price around 107.5, could indicate profitability. A Delta value of -0.40 paired with a Vega of 0.10 infers the options value could rise with increasing volatility, which might accompany broader market corrections or shifts in the gaming industrys economics.

4. Mid-term Expiry, Deep Out-of-the-Money Put A put with a strike price of 115, expiring in three months, carries a higher risk and a lower Delta, for instance, -0.20. However, if bearish sentiment around GME grows or if there is sector-wide downturn, such a put could yield profits elucidated by a high Vega and low Theta, suggesting greater price sensitivity to volatility with less concern for rapid time decay.

Long-Term Put Option Analysis

5. Long-term Expiry, Deep Out-of-the-Money Put Lastly, considering a long-term perspective, a put option with a strike price of 120 expiring in six months might show a Delta of merely -0.10, but potentially a higher Vega near 0.15. This option would benefit from long-term market trends rather than immediate movements. Such an option would imply a more strategic play, betting on a substantial drop over a more extended period, possibly due to fundamental changes in the company or industry.

Conclusion

When analyzing put options for GME, considering various expirations from short to long terms and different strikes from just in-the-money to deep out-the-money gives a broad spectrum of risk and reward based on expected movements in stock price and volatility. Shorter expiry options have the advantage of reacting to immediate market movements but suffer more from time decay, while longer expiries provide leeway against temporary market stability but require a more pronounced movement for significant profitability. Each option has its strategic merits based on specific market expectations and investor sentiment toward GME.

Short Put Option Strategy

In analyzing short put options for GameStop Corp. (GME) through various expiration dates and taking into account the desire to minimize the risk of having shares assigned, certain strikes and expiration combinations stand out based on their profitability and the related Greeks, particularly theta, delta, and vega values. Here are five considerations, ranging from near-term to long-term options:

-

Near-term Higher Profitability: Considering a short put with an expiration of June 20, 2025, for a strike price of 5.0. This option offers a premium of $0.55 with a delta of -0.01675. The negative delta is not overly high, indicating a moderate directional risk relative to the stock price movement, and a theta of -0.00186 demonstrates moderate time decay benefitting the option seller. Given the lower strike price relative to current levels, the risk of assignment can be considered relatively lower, making it a good choice for short-term gain with controlled risk.

-

Moderate-term with Balanced Delta and Vega: An option expiring on January 16, 2026, with a strike of 15.0, yields a premium of $5.15. The delta of -0.1028 reflects a slightly raised risk of negative price movements compared to shorter terms, but still manageable. A vega of 7.1201 indicates increased price volatility but balanced out by the received premium. This setup could be suitable for investors looking for a balance between time and profitability with acceptable risk.

-

Moderate-term with High Premium: For those focusing on higher immediate returns, considering the strike of 20.0 with an expiration on June 20, 2025, can be attractive. It offers a premium of $7.20, a moderately high delta of -0.1541 which increases directional risk significantly, however, the higher premium compensates for this increased risk. This can be a strategic choice for generating higher income while still managing risks with careful monitoring.

-

Long-term Option with Lower Risk: Looking at a longer horizon, an option with a strike of 25.0 expiring on January 16, 2026, provides a premium of $12.23, which is substantial. It has a delta of -0.1777, which increases exposure to stock price movements. However, the longer duration until expiration and the significant premium received provide a cushion against potential risks, making it an attractive option for those who are prepared to manage long-term positions.

-

Very Long-term for Higher Security: Finally, for those interested in maximizing tenure and ensuring less frequent trading, the option expiring on January 16, 2026, with a strike of 35.0 provides a premium of $19.1, delta of -0.2572, and a vega of 12.8125. This option stands out for very long-term investors seeking to maximize premium income with a conservative strike, lowering the likelihood of assignment significantly due to the higher strike price relative to current levels.

In all these cases, the chosen options present a strategic mix of risk (via deltas), potential profitability (premiums), and sensitivity to volatility (vega), suitable for different types of investors ranging from short-term income-focused to long-term, lower-risk traders. Monitoring the underlying stock's price movement relative to these strikes and adjusting positions as necessary will be key to managing risks successfully.

Vertical Bear Put Spread Option Strategy

Analyzing the provided short put options data and considering a vertical bear put spread options strategy for GameStop Corp (GME), we aim to identify optimal trades that minimize risk and maximize return, focusing on trade configurations that ensure minimal assignment risk and align with the stock's target price variation (around 2% from the current price). Based on the absence of specific long legs data, the analysis will focus solely on viable short put positions, considering their profitability when employed strategically in spreads.

Option 1: Short-term, High Gamma - Expiration: January 2026 - Strike: $3.0 - Gamma: 0.0004753983 - Theta: -0.0009729352 - Vega: 0.64241126 - Premium: $0.22 - ROI: 100%

This option, with a significant gamma and a solid ROI, represents a responsive choice to price changes, ideal for traders seeking aggressive, short-term gains relative to small price movements. The negative theta indicates decay over time, which can be mitigated by short-term holding.

Option 2: Medium-term, High Vega - Expiration: June 2025 - Strike: $10.0 - Gamma: 0.0030287112 - Theta: -0.0050221111 - Vega: 3.7459200527 - Premium: $1.85 - ROI: 100%

In the medium-term range, this option provides a robust vega, showing sensitivity to implied volatility changes, which could be advantageous in more volatile market periods or expected company-specific events that might trigger price fluctuations.

Option 3: Long-term, High Premium - Expiration: January 2026 - Strike: $35.0 - Gamma: 0.0073936452 - Theta: -0.0082739175 - Vega: 12.8337589775 - Premium: $15.15 - ROI: 100%

For a long-term strategy, this option offers a substantive premium, providing a cushion against price movements while capitalizing on longer-term market or sectoral shifts. Its higher vega and gamma suggest a strong responsiveness to volatility and price movements, suitable for a layered strategy that encompasses broader market trends.

Each selected option demonstrates characteristics beneficial for different trading horizons and risk tolerance levels, focused on the bear put spread strategy where the short put forms one leg of the trade. The emphasis is on managing risk through strategic strike selection and leveraging Greeks to maximize returns relative to market conditions expected during the life of the option. Further analysis and simulation could validate these preliminary findings, integrating long put data once available to complete the vertical spread strategy effectively.

Vertical Bull Put Spread Option Strategy

To create the most profitable vertical bull put spread strategy for GameStop Corp. (GME) using the provided options chain data, we need to consider selecting put options that minimize the risk of having shares assigned while maximizing potential profit. This involves choosing a combination of short and long puts, focusing on the short put as primary since we have no long puts provided.

Given the parameters for the trade: - The goal is to have the strike price within about 2% over or under the current stock price. - The target is to minimize the assignment risk, thus opting for out-of-the-money options.

Strategy Selection:

We will focus on selecting short put options that are slightly out-of-the-money. The choices will span from near-term to long-term expirations:

- Near-term, Low Strike Choice:

- Expiration: June 20, 2025

- Strike: $3

- Delta: -0.0071 (small chance of ending ITM, reducing risk of assignment)

- Premium: $0.22

-

This option offers a low premium but since it's quite far from the current market price, it offers minimal risk of assignment while allowing to pocket the premium nearly risk-free.

-

Moderate-Term, Medium Strike Selection:

- Expiration: January 16, 2026

- Strike: $5

- Delta: -0.0233 (slightly higher chance of ending ITM, but still safe)

- Premium: $1.00

-

Higher premium as compared to the very long range option, appropriate expiry offers balance between profitability and holding time.

-

Far-Term, Higher Strike to Increase Profitability:

- Expiration: June 20, 2025

- Strike: $15

- Delta: -0.1064 (higher likelihood of ITM but gives higher premium)

- Premium: $4.00

-

A higher strike price with a further expiration date can optimize the return on investment due to higher premiums and with careful monitoring, changes in the position can be adjusted over time.

-

Long-Term, High Strike for Maximum Return:

- Expiration: January 16, 2026

- Strike: $22

- Delta: -0.1545 (even higher likelihood of ITM)

- Premium: $10.02

-

A substantial premium reflects higher risk due to higher delta, yet the long-term nature provides time to react to adverse movements.

-

Very Long-Term, Very High Strike:

- Expiration: January 16, 2026

- Strike: $32

- Delta: -0.2271

- Premium: $18.5

- The highest available premium; however, it carries a significant risk of being in-the-money. Only recommended for the most aggressive strategies or those able to hedge the position with other investments.

Behavior and Adjustments:

For this strategy, monitoring delta, theta, and other Greeks will guide decisions on holding or closing the position early. As the expiration date nears or if GME's stock price approaches the strike price, consider buying back the options to exit the position. Ideally, perform adjustments when the delta increases substantially.

Conclusion:

In combining these choices according to personal risk tolerance, capital availability, and views on GME's future price action, this strategy can be tailored effectively. By judiciously selecting strikes and expiry to balance the desire for returns against the risk of assignment, the investments can be managed to optimize the balance between risk and reward.

Vertical Bear Call Spread Option Strategy

To construct a profitable vertical bear call spread strategy, I analyzed several combinations based on expiration dates, strike prices, and the Greeks. Here, the main goal is to sell a call at a lower strike price (short call) and buy a call at a higher strike price (long call) in the same expiration month, leading to a net credit (premium received from the short call minus the premium paid for the long call). This strategy profits from time decay (theta) and limited price movements of the underlying stock (GME).

Short-Term Strategy (Expiring in 3 days, May 2024) - Sell: Short call with a strike of $12.5, receiving a premium of $18.85, with delta at 0.9988 and theta of -0.0083287172. - Buy: Long call with a strike of $13.0, paying a premium of $18.47, with delta at 0.9967 and theta of -0.0193555287. This spread offers minimal risk from rapid price movements due to their close strike prices and very similar deltas, while still profiting from time decay.

Medium-Term Strategy (Expiring in 10 days, May 2024) - Sell: Short call with a strike of $16.5, receiving a premium of $15.36, with delta at 0.9631 and theta of -0.0513546453. - Buy: Long call with a strike of $17.0, paying a premium of $14.5, with delta at 0.9497 and theta of -0.0693673479. This selection again focuses on strikes close to each other, maximizing the theta decay benefit while reducing the risk of significant intrinsic value development.

Long-Term Strategy (Expiring in 3 months, August 2024) - Sell: Short call with a strike of $17.5, receiving a premium of $13.9, with delta at 0.9378 and theta of -0.0796599517. - Buy: Long call with a strike of $18.0, paying a premium of $13.32, with delta at 0.9369 and theta of -0.0764120077. Offers a good balance between risk management and premium collection, suitable for traders looking for a stable return over a longer period.

Longer-Term Strategy (Expiring in 6 months, October 2024) - Sell: Short call with a strike of $25.0, receiving a premium of $11.0, with delta at 0.7472 and theta of -0.1727135621. - Buy: Long call with a strike of $26.0, paying a premium of $10.15, with delta at 0.7263 and theta of -0.1406976691. This provides a wider strike range, offering slightly more risk in terms of stock movement but an increase in potential profit due to lower initial cost.

Very Long-Term Strategy (Expiring in 1 year, May 2025) - Sell: Short call with a strike of $35.0, receiving a premium of $12.0, with delta at 0.7247 and theta of -0.1884568623. - Buy: Long call with a strike of $37.0, paying a premium of $10.15, with delta at 0.6597 and theta of -0.1670027418. This strategy spans a broader strike range, designed for an investment that capitalizes on more significant price stabilities or declines while managing risks.

In each scenario, the key was to minimize the risk of the sold call being exercised while ensuring the overall setup remains profitable. This involves choosing calls with similar deltas to mitigate large movements against the position and selecting those with favorable theta values to benefit from time decay.

Vertical Bull Call Spread Option Strategy

Analyzing the options data for GameStop Corp. (GME) using a vertical bull call spread, the focus is on specific options expirations and strikes that provide optimal profit potential while accounting for Greeks that influence price movements and risks.

- Short Term (Expiring in Days)

-

17-day expiration:

- For a bullish position, buying an in-the-money call option such as a strike price of $10 could be strategic. For instance, the delta for $10 with 17 days to expire appears favorable. Pairing this with selling a slightly out-of-the-money call option, like a $12 strike expiring in the same period, would capitalize on the premium decay while limiting the risk exposure if GME moves upward moderately. Noteworthy is the low vega and theta of these options indicating lesser sensitivity to volatility and time decay, making them stable candidates.

-

Medium Term (Expiring in Weeks to a couple of months)

-

66-day expiration:

- One could buy a slightly in-the-money option, such as $20 strike, with robust delta and relatively high gamma, suggesting good responsiveness to stock price changes with ample room for maneuvering. Selling an out-of-the-money call (e.g., $25 strike) secures income from premium collected and protects against adverse moves, reflected by their gammas and vegas which suggest good price movement contagion and a needed hedge against volatility spikes.

-

Long Term (Expiring in Months)

-

248-day expiration:

- Buying a call with a $10 strike offers a marriage of moderate vega and an optimistic delta approach, helping to control the exposure to volatility while ensuring strong gains with price increments. A long-term sell at strike $15, with slightly higher gamma and vega compared to the purchase, spreads the risk effectively by counting on a gradual bullish momentum.

-

Very Long Term (Expiring in many months to years)

-

402-day expiration:

- For the longest strategy outlook, buying a deep in-the-money call such as the $3 strike offers high delta meaning virtually full exposure to stock movements as an almost 1-for-1 increase in option value. Pairing this with a sale of an out-of-the-money $10 strike captures the slower but presumed rise in stock value while also yielding significant premium that offsets the cost of the long position.

-

Other Considerations:

- While analyzing, high attention was given to the 'theta' and 'vega' among the Greeks. Lower theta values in purchased options reduce cost bleed due to time decay, especially crucial in longer-expiration scenarios. Conversely, vega helps fathom volatility risk essential when strategizing over longer horizons, helping in selecting strikes less sensitive to explosive volatility changes.

Henceforth, setting up call spreads along these guidelines could maximize the returns while aligning with the risk tolerance levels, adjusting for how deep or out of the money the leg options are configured, and considering the anticipated movement of GME stock around the target rifts.

To summarize, the selections ensure a minimized risk of assignment by deftly choosing a blend of in-the-money and out-of-the-money strikes, crafted on expected movements and balanced by Greeks' indicators, preparing a highly strategic, nuanced approach to options trading on GME.

Similar Companies in Specialty Retail:

RH (RH), DICK'S Sporting Goods, Inc. (DKS), Best Buy Co., Inc. (BBY), AutoZone, Inc. (AZO), Petco Health and Wellness Company, Inc. (WOOF), Williams-Sonoma, Inc. (WSM), Ulta Beauty, Inc. (ULTA), Report: Walmart Inc. (WMT), Walmart Inc. (WMT), Report: Target Corporation (TGT), Target Corporation (TGT), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Five Below, Inc. (FIVE)

https://www.youtube.com/watch?v=YGOl6UwLSTU

https://www.youtube.com/watch?v=kVbTzUisLt0

https://www.proactiveinvestors.com/companies/news/1044677?SNAPI

https://www.proactiveinvestors.com/companies/news/1047419?SNAPI

https://www.youtube.com/watch?v=Fa9fhpZzmPs

https://www.youtube.com/watch?v=zshYRNm3KIQ

https://www.proactiveinvestors.com/companies/news/1047441?SNAPI

https://www.cnbc.com/2024/05/13/gamestop-mentions-surge-on-reddit-surpassing-nvidia.html

https://finance.yahoo.com/m/b17942a3-ac92-3bd8-8af5-d4c48e3aac77/these-stocks-are-moving-the.html

https://finance.yahoo.com/news/why-gamestop-gme-shares-soaring-162100177.html

https://finance.yahoo.com/news/top-midday-stories-return-apos-162710681.html

https://finance.yahoo.com/m/f66d5698-fedb-3213-9c7b-a9d374912060/gamestop-sees-busiest-trading.html

https://www.sec.gov/Archives/edgar/data/1326380/000132638023000063/gme-20231028.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: H9VCtO

Cost: $0.91840

https://reports.tinycomputers.io/GME/GME-2024-05-13.html Home