Walmart Inc. (ticker: WMT)

2024-01-19

Walmart Inc. (ticker: WMT) stands as one of the largest retail corporations globally, operating a chain of hypermarkets, discount department stores, and grocery stores. Headquartered in Bentonville, Arkansas, the company was founded by Sam Walton in 1962 and has since evolved into a multinational enterprise. As of the beginning of 2023, Walmart operates approximately 11,000 stores and various e-commerce websites under 56 different banners in 27 countries. The corporation is known for its low-cost business model and has become synonymous with "Everyday Low Prices," a cornerstone of its strategy to attract and retain a broad customer base. Walmart continues to focus on expanding its digital presence and adapting to consumer preferences with investments in online platforms, pickup and delivery services, and enhancing the in-store experience. In addition to retail, Walmart has also made strides in other sectors, including health and wellness, financial services, and sustainability initiatives. Walmart's financial performance, market share, and employment numbers with over 2 million employees worldwide reinforce its influential position in both the domestic and international retail markets.

Walmart Inc. (ticker: WMT) stands as one of the largest retail corporations globally, operating a chain of hypermarkets, discount department stores, and grocery stores. Headquartered in Bentonville, Arkansas, the company was founded by Sam Walton in 1962 and has since evolved into a multinational enterprise. As of the beginning of 2023, Walmart operates approximately 11,000 stores and various e-commerce websites under 56 different banners in 27 countries. The corporation is known for its low-cost business model and has become synonymous with "Everyday Low Prices," a cornerstone of its strategy to attract and retain a broad customer base. Walmart continues to focus on expanding its digital presence and adapting to consumer preferences with investments in online platforms, pickup and delivery services, and enhancing the in-store experience. In addition to retail, Walmart has also made strides in other sectors, including health and wellness, financial services, and sustainability initiatives. Walmart's financial performance, market share, and employment numbers with over 2 million employees worldwide reinforce its influential position in both the domestic and international retail markets.

| Address | 702 South West 8th Street, Bentonville, AR, 72716, United States | Phone | 479 273 4000 | Website | https://www.stock.walmart.com |

| Industry | Discount Stores | Sector | Consumer Defensive | Full Time Employees | 2,100,000 |

| Previous Close | 161.07 | Day Low | 160.68 | Day High | 163.39 |

| Dividend Rate | 2.28 | Dividend Yield | 1.42% | Payout Ratio | 37.77% |

| Beta | 0.484 | Trailing PE | 27.16 | Forward PE | 23.22 |

| Volume | 5,999,808 | Market Cap | $439,479,631,872 | Book Value | 29.505 |

| Price to Book | 5.53 | Net Income to Common | $16,291,999,744 | Trailing EPS | 6.01 |

| Forward EPS | 7.03 | Total Cash | $12,154,000,384 | Total Debt | $71,979,999,232 |

| Total Revenue | $638,785,028,096 | Return on Assets | 6.44% | Return on Equity | 19.74% |

| Revenue Growth | 5.20% | Gross Margins | 24.27% | Operating Margins | 3.86% |

Upon thorough analysis of the provided technical, fundamental, and balance sheet data for Walmart Inc. (WMT), we can interpret potential price movements for the stock in the coming months.

Upon thorough analysis of the provided technical, fundamental, and balance sheet data for Walmart Inc. (WMT), we can interpret potential price movements for the stock in the coming months.

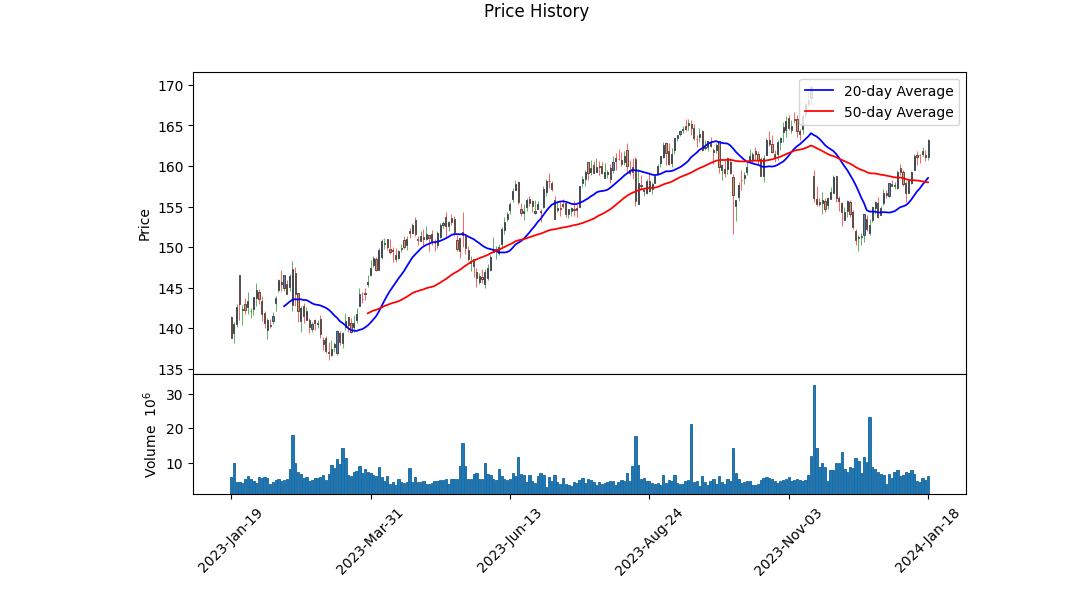

Technical Analysis: The technical indicators for WMT show the stock trading in a relatively narrow range with the price oscillating around the $161-$163 level recently. The On-Balance Volume (OBV) is on an uptrend, which indicates positive volume flow and could be seen as bullish for the stock. The Moving Average Convergence Divergence (MACD) histogram is also positive on the last trading day, suggesting that the momentum could be shifting to the upside.

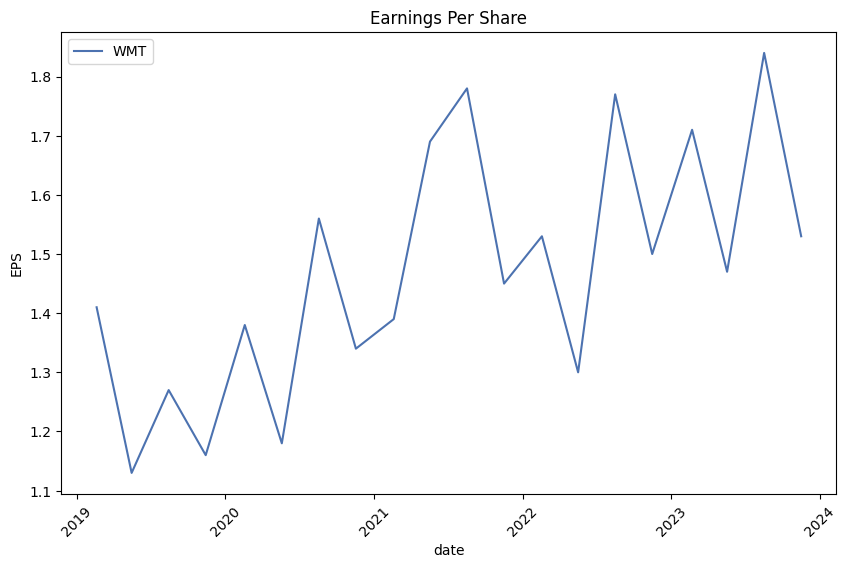

Fundamental Analysis: Walmart's fundamentals tell a story of a company with significant gross margins at 0.24272 and operating margins at 0.03857, indicating efficiency in its operations. The EBITDA margins stand at 0.05897. However, the trailing PEG ratio is somewhat high at 2.8298, suggesting that the stock might be overvalued compared to estimated future earnings growth. Analyst expectations, notably for earnings next year, indicate a consensus average estimate of $7.03 per share, a meaningful increase from the year-ago EPS of $6.46. Revenue estimates for the next year are also bullish, with an average estimate of $665.67B, representing 3.20% growth.

Balance Sheet and Cash Flows: Walmart's balance sheet portrays a company with considerable net debt of $30.587 billion, though they have managed to reduce this from $40.186 billion in 2020. The total debt has also been decreased, from $72.433 billion to $58.923 billion. The company has a solid tangible book value of $48.519 billion. The cash flow statement highlights that Walmart has a healthy free cash flow of $11.984 billion but a significant amount of this is used for capital expenditures and debt repayments, which may hinder their financial flexibility.

Considering the analysis, WMT appears to be a fundamentally strong company with positive cash flows, a robust operating structure, and a sound strategic management of its debt and expenses. The stability and operational efficiency of Walmart, coupled with a positive technical outlook, suggest a cautiously optimistic view for the stock price in the next few months. While the potential growth in earnings and revenue is a healthy sign for future company performance, the relatively high PEG ratio could temper some expectations for dramatic price appreciation. Investors might expect moderate growth in the stock price, backed by continued company performance and improved market sentiment.

In conclusion, the outlook for WMT stock over the next few months is positive, with an anticipation of gradual upwards price movement. Technical indicators suggest increasing momentum, and fundamental analysis indicates a solid financial ground with expected growth in earnings. However, mindful consideration of market conditions and broader economic factors is crucial, as unexpected events can significantly influence stock performance. It is recommended that investors monitor WMT updates closely with an eye for sustained growth and profitability that characterizes the company's historical performance.

| Statistic Name | Statistic Value |

| R-squared | 0.212 |

| Adj. R-squared | 0.212 |

| F-statistic | 338.2 |

| Prob (F-statistic) | 4.69e-67 |

| Log-Likelihood | -2,046.7 |

| AIC | 4,097 |

| BIC | 4,108 |

| Const Coef | 0.0253 |

| Beta | 0.4868 |

| Alpha | 0.0253 |

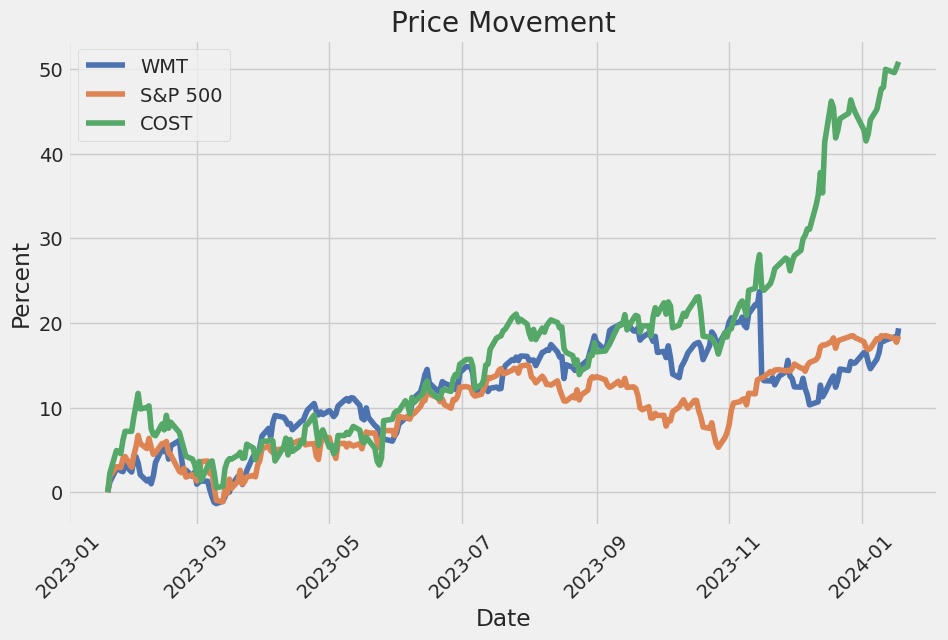

The linear regression model analyzing the relationship between Walmart (WMT) and the S&P 500 Index ETF (SPY) reveals an alpha of 0.0253 and a beta of 0.4868. The alpha value signifies that, holding market movements constant, Walmart has shown an average return of 2.53% above what would be predicted by its beta relationship with the SPY over the period in question. It should be noted that this alpha value isn't statistically significant, with a p-value of 0.469, as indicated by confidence intervals that span from -0.043 to 0.094, which include zero. This lack of significance undermines the reliability of the alpha as a persistent performance measure.

Despite the low alpha, the beta value is more reliable, as shown by the model's F-statistic of 338.2 and its corresponding highly significant p-value. A beta of 0.4868 indicates that for every 1% movement of the SPY, Walmart's stock price is expected to move by 0.4868% in the same direction, suggesting that Walmart is less than half as volatile as the overall market. This lower relative volatility may imply that Walmart carries less risk than the broader market, making it potentially attractive for risk-averse investors, all else being equal.

Summary of Walmart's Fiscal Year 2024 Third Quarter Earnings Call

First Paragraph: Introduction and Attendance The third-quarter earnings call for Walmart Inc. for the fiscal year 2024 began with an introduction from the Operator. Steph Wissink, Senior Vice President of Investor Relations, then welcomed participants and introduced Walmart's CEO, Doug McMillon, and CFO, John David Rainey. They were joined by segment CEOs: John Furner of Walmart U.S., Kath McLay of Walmart International, and Chris Nicholas of Sam's Club. The call's focus was on reviewing quarterly performance and providing updated guidance for the year.

Second Paragraph: CEO Doug McMillons Comments on Performance Doug McMillon commenced by discussing the quarter and the companys outlook, highlighting that Walmart's value proposition was gaining traction, resulting in share gains and e-commerce growth. Revenue growth was particularly strong across all segments, including a 4.9% comp sales increase for Walmart U.S. and 3.8% for Sams Club U.S. International sales rose by 5.4% in constant currency. E-commerce sales showed substantial growth, though Internationals e-commerce faced a 3% decline due to the timing of the Flipkart Big Billion Days event. McMillon noted inventory levels were well-managed and expenses were higher than expected, impacting adjusted operating income. Despite inflationary pressures, certain food categories were starting to see price deflation, which was considered positive for customers.

Third Paragraph: CFO John David Raineys Financial Review John David Rainey provided detailed insights into the financial performance, adhering to the framework of growth, margins, and returns. Sales grew more than 4%, driven by traffic in both physical and digital channels, and gross profit exceeded expectations. Operating income was below guidance due to unforeseen legal accruals, yet the full-year sales and EPS guidance were raised. He touched on notable sales growth in various markets, the timing of Flipkarts event impacting international growth, and the growth of PhonePe. Rainey emphasized the contribution of higher-margin businesses like advertising and Walmarts omni-strategy, and provided an outlook on ROI and the company's financial position amidst economic variability.

Fourth Paragraph: Q&A Summary During the Q&A session, executives fielded questions on topics including unexpected legal expenses, which affected SG&A costs, the performance of alternative revenue and profit streams, and the companys e-commerce growth dynamics. The discussion also covered general merchandise performance online, the implications of deflation, and FY24 guidance in relation to operating income growth. McMillon wrapped up the call expressing confidence in Walmarts strategy, emphasis on providing value to customers, and excitement for the holiday season.

Conclusion:

Walmart's third-quarter earnings call for fiscal year 2024 reflected a strong overall performance with prominent growth in both revenue and e-commerce. The company remains on track to achieve its financial objectives, with a keen focus on expanding its digital footprint and driving efficiency. Despite some unexpected expense increases, Walmart is poised to manage through an inflationary environment effectively while continuing to prioritize value and convenience for its customers.

This comprehensive analysis examines Walmart Inc.'s (WMT) latest financial performance and strategic priorities, as reported in their SEC 10-Q filing dated October 31, 2023. In the reporting period, Walmart Inc. has demonstrated growth across its U.S., International, and Sam's Club segments, marked by a revenue increase of $8.0 billion or 5.2% for the quarter and $27.5 billion or 6.1% for the nine-month period, compared to the previous year.

The Walmart U.S. segment's net sales rose by 4.4% and 5.7% for the quarter and nine-month periods respectively, attributed to comparable sales growth and strong performance in grocery and health and wellness categories. The segment exhibited a stable gross profit rate and a small decline in operating income due to increased wage-related expenses, store remodel costs, and legal expenses. In contrast, the Walmart International segment reported a net sales increase of 10.8% for the quarter and 12% for the nine-month period, bolstered by positive comparable sales in multiple international markets and favorable currency exchange rate fluctuations. Despite shifts in timing for specific sales events and format and channel mix recalibrations, this segment saw a significant boost in operating income.

Meanwhile, the Sam's Club segment experienced net sales growth of 2.8% and 2.2% for the respective periods due to increases in transactions and average ticket sizes across most categories, including grocery. Sam's Club also noted modest growth in operating income despite elevated tech spend and facility costs.

Walmart Inc. maintains a focused strategy on improving margin by refining a combination of productivity improvements and category/business mix. A slight increase in the gross profit margin was registered, alongside a decrease in operating expenses as a percentage of net sales due to the non-recurrence of opioid-related legal settlements accounted for in the prior fiscal year.

As for the company's returns, two key indicatorsReturn on Assets (ROA) and Return on Investment (ROI)were reviewed. ROA improved to 6.5% from 3.7% in the trailing twelve months, while ROI increased to 14.1% from 12.8%, primarily due to an increase in operating income outpacing prior period opioid legal charges.

Throughout the report, the management underscores its commitment to investing in areas with higher returns, such as eCommerce, supply chain improvements, and store and club investments. The capital expenditures directed to these priorities have increased, but this has been accompanied by disciplined capital spending to ensure the company upholds shareholder value. This focus is evident in the 3.9% rise in operating income as a percentage of net sales for the quarter.

Walmart's liquidity position remains robust with cash and cash equivalents of $12.2 billion and a $15.8 billion working capital deficit, reflecting its efficient use of cash and consistent access to the capital markets. Free cash flow for the nine-month period stood at $4.3 billion, an increase from the prior year, indicating the company's ability to generate cash for growth initiatives, dividend payouts, and shareholder returns.

In conclusion, Walmart's financial performance for the period in focus shows continued advancement in its growth trajectory, underscored by competitive positioning and operational efficiencies. The organization remains focused on omni-channel retailing, evidencing a sustained emphasis on growing its eCommerce footprint and leveraging technology to improve customer experiences. An allocated $20 billion share repurchase program further reflects the company's financial health and strategic intent on delivering ongoing value to shareholders.

Walmart Inc. has initiated a unique marketing venture that intertwines the charm of holiday movies with the utility of online shopping through a concept called shoppable storytelling. They've launched a 23-part commercial series, "Add to Heart," to entertain and enable viewers to shop for products featured within the episodes directly. This strategy is not entirely new, as it harkens back to product placement practices starting in the 1920s, but Walmarts approach modernizes this trajectory by integrating technology for a seamless consumer experience.

The company understands that in today's digital age, short attention spans require equally succinct content. Thus, each segment of the shoppable romantic comedy is a mere three minutes, tailored to engage consumers swiftly and effectively, particularly appealing to a younger demographic. The integration of clickable spots within the content that encourage viewers to shop aligns well with contemporary consumer behaviors, merging narrative with commerce in a harmonious blend of entertainment and consumerism.

The ingenuity and potential success of this initiative rely heavily on the execution of these shoppable segments and Walmarts ability to align the narrative context with the products. With smart TV platforms like Roku expanding the possibilities for interactive viewing experiences, turning passive consumers into active shoppers is within reach. As technology evolves, the approach Walmart is taking could redefine the future of retail marketing.

Walmart Canada is also making significant investments to improve the customer experience and integrate online and physical retail services more seamlessly. The retailer has announced a plan to invest approximately $1 billion over the next 12 months, part of a larger $3.5 billion initiative. This includes the revamping of the Square One Walmart Supercentre in Mississauga, Ontario, to serve as a pilot for omnichannel retail innovation with a new layout and services like Walmart Canadas first Health Hub.

Notably, Walmart Canadas investment also extends into improving the online shopping experience. For instance, theyve introduced Delivery Pass for unlimited next-day delivery and a partnership with Klarna for flexible payment options. Furthermore, Sam's Club, part of Walmart Inc., is opening new distribution centers to enhance the supply chain, mirroring Walmart Canada's substantial infrastructure investment strategy.

At the macro level, Walmart faces the unpredictable tidal waves of market dynamics, consumer behavior shifts, and economic fluctuations. CEO Doug McMillon elaborates on these challenges, stating that the retail giant is grappling with forecasting consumer spending due to pressures like higher credit card balances and depleted household bank accounts. Remarkably, despite anticipations of an economic softening, Walmart has maintained its financial performance and even increased its stock price.

McMillon discusses deflation across certain sectors, leading Walmart to adjust its pricing strategies accordingly. For example, toys and electronics have seen roughly a 5% decrease in prices, clearly displayed by Walmart's aggressive pricing during the holiday season. Yet, the company maintains sales growth forecasts and a strong yearly earnings projection, underscoring Walmart's adaptability and financial fortitude.

When it comes to dividend growth investing, Walmart stands as a key player alongside other notable Dividend Aristocrats. Investors favor such companies for their ability to navigate through various economic cycles and maintain a consistent and growing dividend payout. Walmart's dividend growth contributes to investors achieving financial independence and provides a hedge against inflation.

The importance of having a diversified portfolio with dividend growth stocks like Walmart cannot be understated, especially for those aiming to live off dividends in retirement. The potential for regular dividend income and capital appreciation makes these stocks attractive for investors seeking stable and long-term passive income opportunities.

Investors and analysts are keenly monitoring Walmart's stocks, with recent reports from Zacks Equity Research highlighting the company's investment prospects. Despite a slight dip in Walmarts shares over the past month, earnings estimate revisions and revenue projections remain promising. With Walmart being the world's largest retailer, its vast operations, growth opportunities, and earnings potential keep it front and center in the financial markets.

Furthermore, comprehensive insights into Walmart Inc.'s strategies and consumer behavior are consistently disclosed through discussions with CEO Doug McMillon. From revamping Walmart Super Centers to catering to a broader audience with high-value propositions like Walmart Plus, McMillon expounds on the retail giant's agility in serving customers diversified shopping patterns.

The companys grand scale and financial stability also make it an asset in the commercial real estate sector, particularly for REITs that invest in retail properties. Agree Realty Corporation, for example, values Walmart as a tenant for its high-quality, big-box properties. With REIT valuations currently low and potential shifts in interest rates on the horizon, Walmart-affiliated REITs stand as a potential opportunity for investors.

On the flip side, Walmarts recent retail trends signal a broader economic sentiment where customers are pivoting towards cost-saving. Reports of increased sales at Walmart and other discount retailers reflect consumer nervousness and caution in their spending habits. As the world's largest retailer, Walmart's performance often serves as a bellwether for broader retail and economic trends; and the emphasis on value-based shopping is telling of the current consumer environment.

Investor relations with prominent financial technology companies are another of Walmarts strategic moves. A recent development saw Walmart enhancing its partnership with Affirm Holdings, integrating the companys buy-now-pay-later services more deeply into Walmarts operations, including implementation at self-checkout kiosks. This partnership expansion is in line with research findings that show substantial consumer interest in flexible payment options, suggesting a possible uplift in consumer spending.

Walmart is continuously evolving in its efforts to combat challenges like retail theft and integrate technology to optimize operations and enhance shopping experiences. As it invests in solutions like AI and marketplaces, the retailer aims to improve margins and adapt to changing consumer needs.

In conclusion, Walmart's strategies across marketing, online and in-store infrastructure, dividend prospects, stock performance, and economic adaptability highlight a multifaceted approach towards maintaining its dominance in the retail arena. The continued emphasis on customer engagement, innovative shopping experiences, and strong financial planning demonstrates Walmart's resilience and forward-thinking ethos in an ever-volatile retail landscape. For additional insights and dynamic updates on Walmart Inc.'s varied initiatives, stakeholders are directed to explore news sources, investment reports, and official statements as they become available.

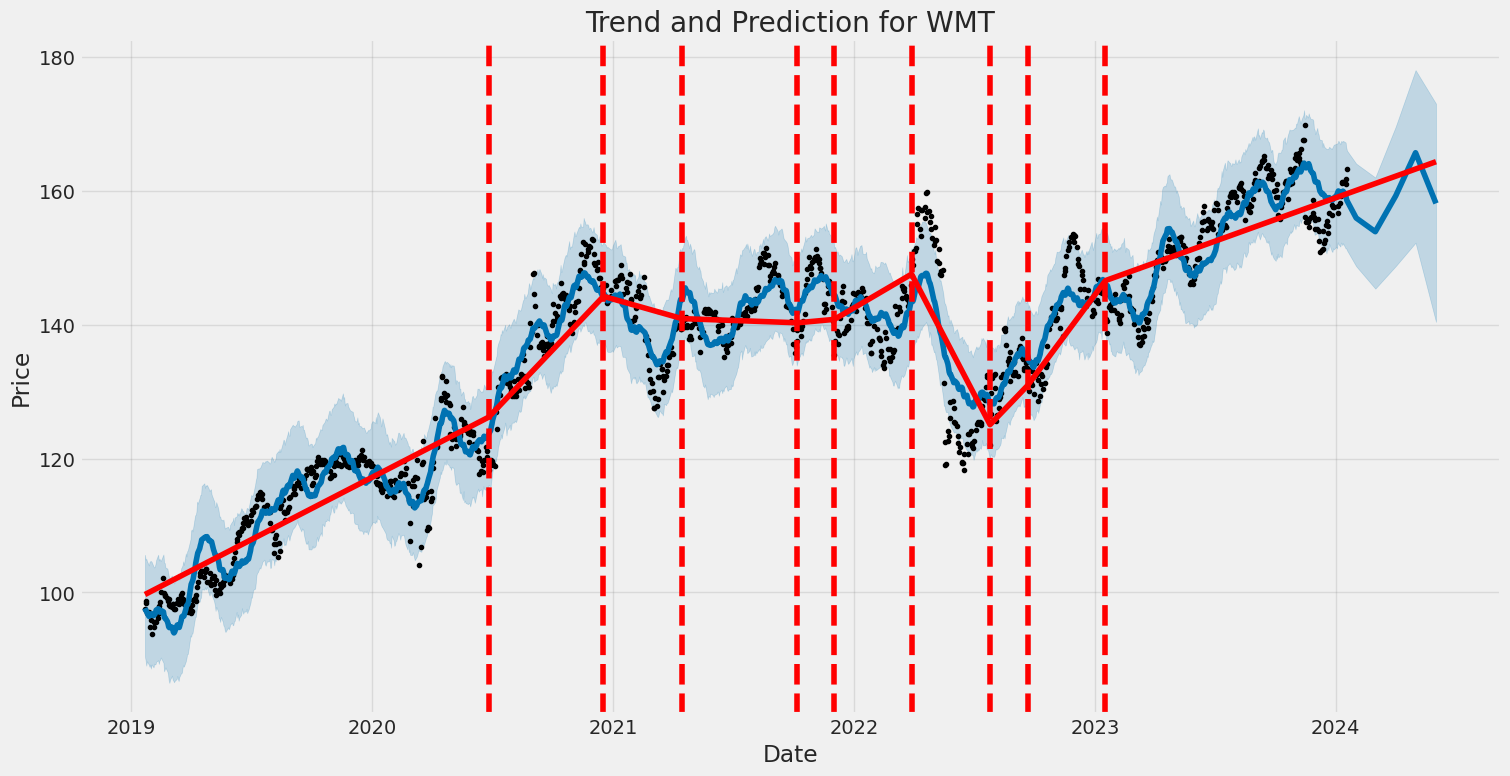

Walmart Inc.'s (WMT) stock volatility from January 22, 2019, to January 18, 2024, can be summarized in three key points. The stock exhibits variability indicated by a zero-mean volatility model, which suggests the mean return over the period is not significantly different from zero, inferring that the stock's fluctuations might be interpreted as random or without a clear upward or downward trend. Secondly, the ARCH model coefficient (omega) is positive and significantly different from zero, which means there are periods of higher and lower volatility in the price movements of Walmarts stock. Lastly, the positive alpha coefficient (alpha[1]) indicates that past volatility does affect future volatility, meaning if the stock prices experienced large swings in value at one point, it's likely that such volatility could continue or be reflected in subsequent time periods.

Here is the HTML table:

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Log-Likelihood | -2,096.49 |

| AIC | 4,196.98 |

| BIC | 4,207.25 |

| No. Observations | 1,256 |

| omega | 1.3627 |

| alpha[1] | 0.2512 |

To analyze the financial risk associated with a $10,000 investment in Walmart Inc. (WMT) over a one-year period, a combination of volatility modeling and machine learning predictions has been employed.

First, volatility modeling techniques are used to estimate and forecast the future volatility of Walmart's stock. These techniques capture the clusters of volatility that are typical in financial time series, recognizing that periods of high volatility tend to be followed by high volatility, and low volatility tends to be followed by low volatility. By fitting a volatility model to Walmart's historical stock prices, we extract estimates for the persistence and mean-reversion of volatility, which can be critical in understanding the level of risk an investor may face. The changing volatility has a direct impact on the uncertainty surrounding Walmart's stock returns and influences the potential variation in investment outcomes.

Within this modeling setup, the conditional variance (volatility) of Walmart's stock returns is forecasted over the investment horizon. This forecasted volatility provides a basis for estimating the distribution of future stock returns, which is essential for determining the Value at Risk (VaR).

In parallel, machine learning predictions via an ensemble learning technique are harnessed to forecast future stock returns based on a wide array of features including financial indicators, historical prices, and market sentiment. The ensemble method encapsulates various simple models to predict Walmart's stock returns by identifying complex patterns in the data, and it is often robust to overfitting. The predictive model is trained on historical data and then used to forecast future returns, which would combine with the volatility estimates to refine the overall risk assessment.

For evaluating the investment risk of the $10,000 stake in Walmart, we use the concept of VaR at a 95% confidence interval. The VaR represents the maximum expected loss over a specific time frame, given normal market conditions. Based on the forecasts from the volatility model and the machine learning predictions, the VaR at a 95% confidence interval indicates that there is only a 5% chance that the investor would lose more than $152.09 on their $10,000 investment over a one-year period. This clearly highlights the potential downside risk of the investment.

In considering the analysis, the volatility modeling has effectively characterized the dynamic nature of Walmart's stock volatility, while the machine learning predictions have provided a forward-looking estimate of stock performance. Together, they offer an advanced approach to quantifying the likely range of investment outcomes and express the level of risk in monetary terms through the VaR. The findings of this integrated approach suggest a relatively contained risk profile for the $10,000 investment in Walmart Inc. within the confines of the assumed confidence level.

Similar Companies in Discount Stores:

Report: Costco Wholesale Corporation (COST), Costco Wholesale Corporation (COST), Dollar Tree, Inc. (DLTR), BJ's Wholesale Club Holdings, Inc. (BJ), Big Lots, Inc. (BIG), Report: Target Corporation (TGT), Target Corporation (TGT), Dollar General Corporation (DG), Report: Costco Wholesale Corporation (COST), Costco Wholesale Corporation (COST), Report: Target Corporation (TGT), Target Corporation (TGT), The Kroger Co. (KR), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Report: The Home Depot, Inc. (HD), The Home Depot, Inc. (HD), Report: Lowe's Companies, Inc. (LOW), Lowe's Companies, Inc. (LOW), Dollar General Corporation (DG), Dollar Tree, Inc. (DLTR), Best Buy Co., Inc. (BBY), BJ's Wholesale Club Holdings, Inc. (BJ)

https://www.youtube.com/watch?v=ta7A6UhOosE

https://seekingalpha.com/article/4656281-how-to-live-off-of-dividends-life-changing-passive-income

https://www.cnbc.com/2023/12/06/walmart-ceo-doug-mcmillon-talks-about-deflation.html

https://www.youtube.com/watch?v=xr8CRGSL7sU

https://www.cnbc.com/2023/12/06/walmart-hiring-wage-pressures-have-eased-ceo-says.html

https://seekingalpha.com/article/4656937-investors-take-advantage-of-walmarts-recent-pullback

https://www.youtube.com/watch?v=kh9YsVDgTW8

https://www.cnbc.com/2023/12/18/walmart-looks-to-lab-grown-diamonds-this-christmas.html

https://www.zacks.com/stock/news/2200214/dow-hits-new-all-time-high-s-p-within-1

https://www.fool.com/investing/2023/12/21/why-walmart-burlington-and-tjx-customers-are-flash/

https://seekingalpha.com/article/4657945-5-reits-to-add-to-your-christmas-shopping-list

https://www.sec.gov/Archives/edgar/data/104169/000010416923000132/wmt-20231031.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: j5wHpk

https://reports.tinycomputers.io/WMT/WMT-2024-01-19.html Home