GameStop Corp. (ticker: GME)

2024-05-15

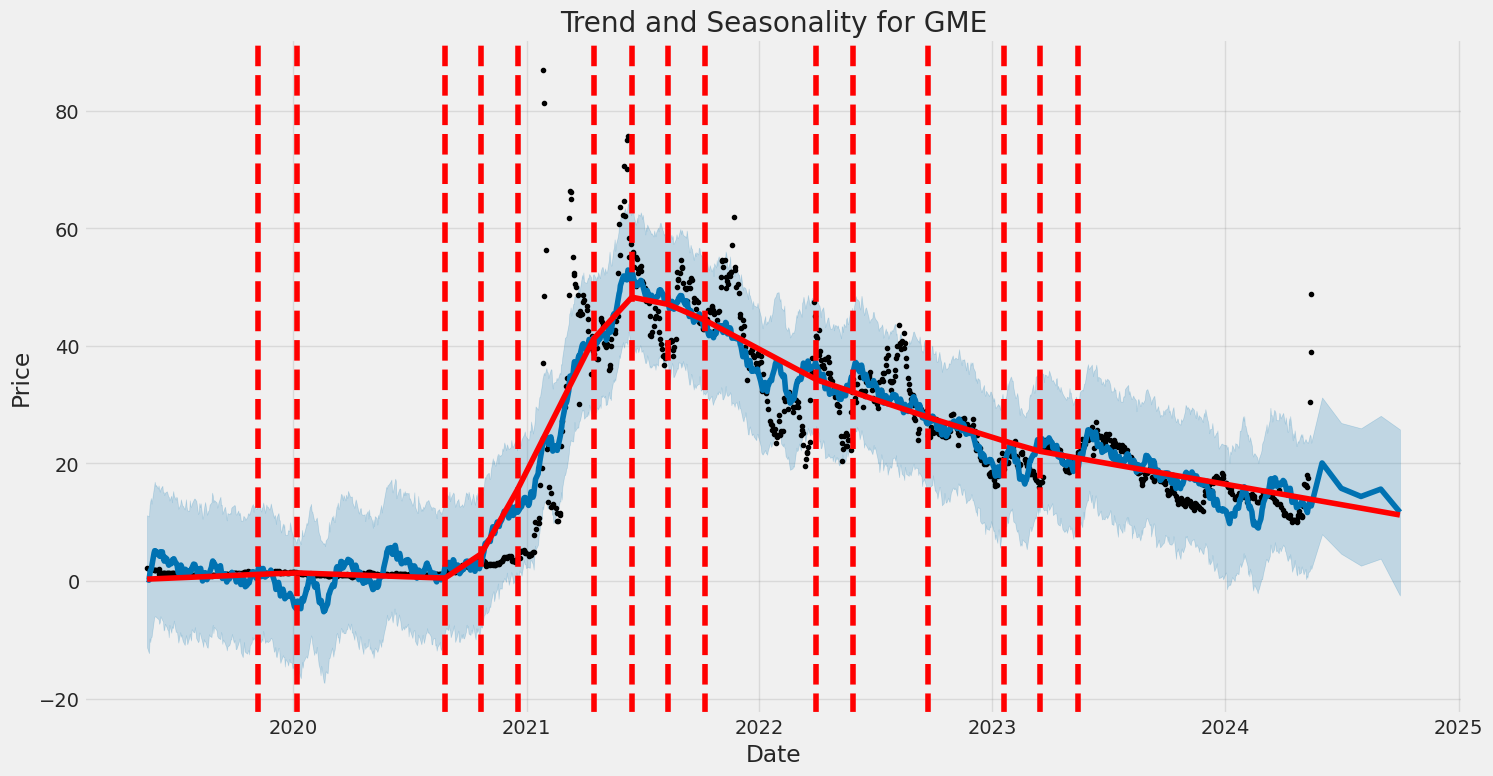

GameStop Corp. (ticker: GME) is a prominent American retailer operating within the video game, consumer electronics, and gaming merchandise sectors. Founded in 1984 and headquartered in Grapevine, Texas, GameStop boasts a significant retail presence with over 4,800 stores across various regions, including the United States, Canada, Australia, and Europe. The company is well-known for its trade-in program, where customers can exchange used games and electronics for store credit or cash, thereby fostering a strong community of gamers and tech enthusiasts. GameStop gained unprecedented media attention in early 2021 when its stock price experienced extreme volatility due to a short squeeze orchestrated by retail investors, primarily through the Reddit forum r/WallStreetBets. This event highlighted the broader implications of social media on financial markets and temporarily transformed GameStop into a symbol of the power shift from institutional to retail investors. Despite fluctuating financial performance and the challenges presented by the digital transformation of the gaming industry, GameStop remains a key player in the market, continuously exploring new avenues for growth, including e-commerce expansion and strategic partnerships.

GameStop Corp. (ticker: GME) is a prominent American retailer operating within the video game, consumer electronics, and gaming merchandise sectors. Founded in 1984 and headquartered in Grapevine, Texas, GameStop boasts a significant retail presence with over 4,800 stores across various regions, including the United States, Canada, Australia, and Europe. The company is well-known for its trade-in program, where customers can exchange used games and electronics for store credit or cash, thereby fostering a strong community of gamers and tech enthusiasts. GameStop gained unprecedented media attention in early 2021 when its stock price experienced extreme volatility due to a short squeeze orchestrated by retail investors, primarily through the Reddit forum r/WallStreetBets. This event highlighted the broader implications of social media on financial markets and temporarily transformed GameStop into a symbol of the power shift from institutional to retail investors. Despite fluctuating financial performance and the challenges presented by the digital transformation of the gaming industry, GameStop remains a key player in the market, continuously exploring new avenues for growth, including e-commerce expansion and strategic partnerships.

| Full-Time Employees | 8,000 | Previous Close | 48.75 | Open | 40.31 |

| Day Low | 31.23 | Day High | 41.99 | Volume | 109,098,858 |

| Average Volume | 13,476,360 | Market Cap | 11,886,101,504 | 52-Week Low | 9.95 |

| 52-Week High | 64.83 | Price to Sales (Trailing 12 Months) | 2.254 | 50-Day Average | 14.0102 |

| 200-Day Average | 15.3376 | Enterprise Value | 14,314,653,696 | Profit Margins | 0.00127 |

| Float Shares | 267,899,134 | Shares Outstanding | 306,184,992 | Short Ratio | 15.3 |

| Book Value | 4.379 | Price to Book | 8.865 | Last Fiscal Year End | 1,706,918,400 |

| Next Fiscal Year End | 1,738,540,800 | Net Income to Common | 6,700,000 | Trailing Earnings Per Share | 0.02 |

| Forward Earnings Per Share | 0.06 | PEG Ratio | -37.4 | Enterprise to Revenue | 2.715 |

| Enterprise to EBITDA | 584.272 | Last Dividend Value | 0.095 | Free Cash Flow | -215,712,496 |

| Total Cash | 1,199,299,968 | Total Debt | 602,800,000 | Total Revenue | 5,272,800,256 |

| Current Ratio | 2.113 | Operating Margins | 0.05626 | Gross Margins | 0.24545 |

| Sharpe Ratio | 0.9279496194202728 | Sortino Ratio | 26.467560686813282 |

| Treynor Ratio | 0.6389414118457133 | Calmar Ratio | 1.2236607327790912 |

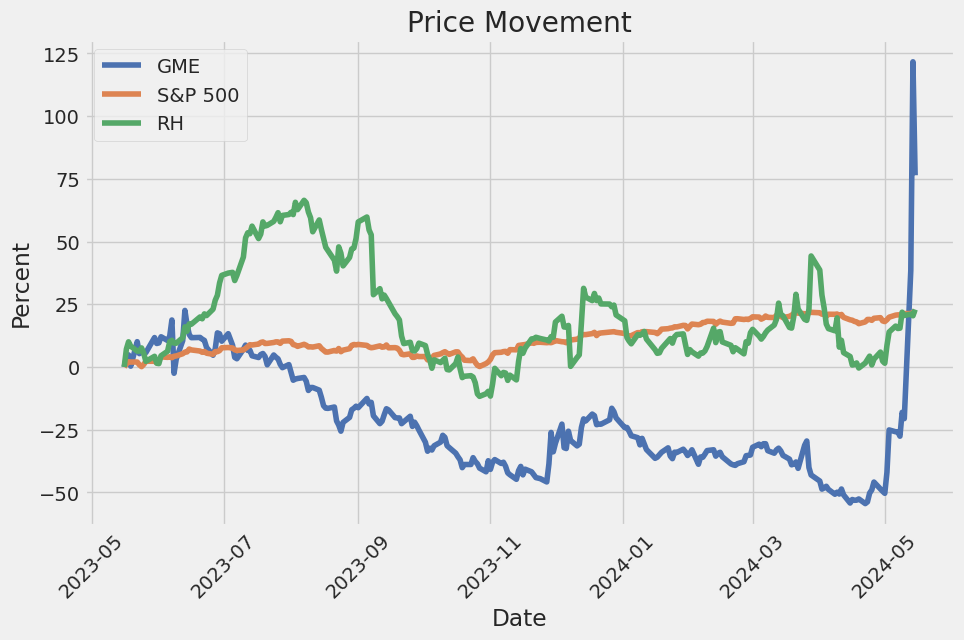

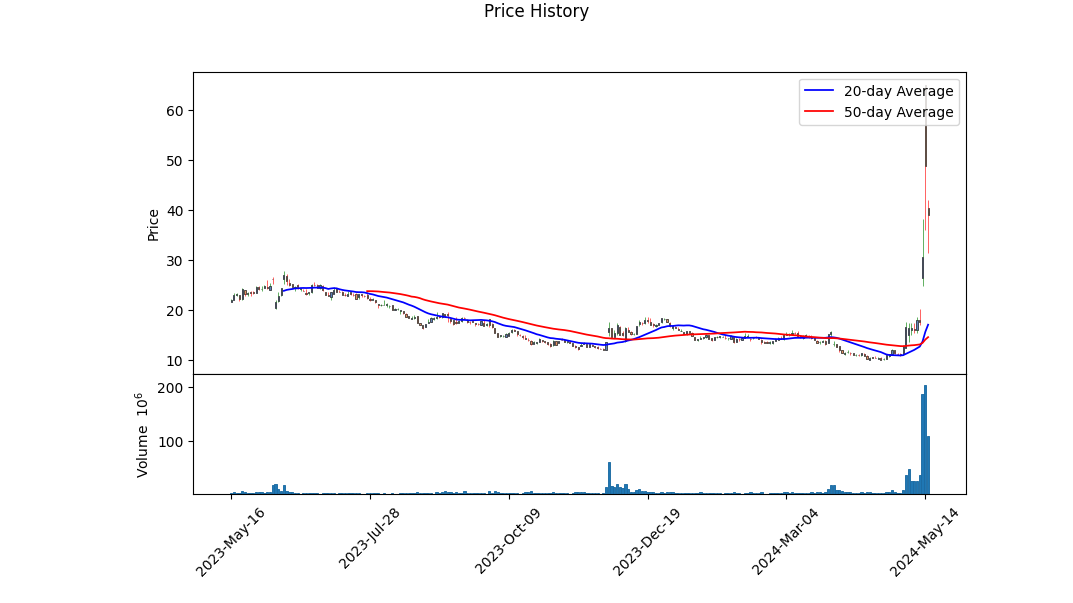

The technical analysis of GME indicates significant volatility and bullish momentum in recent trading sessions. OBV (On Balance Volume) has surged dramatically, reflecting increased buying pressure. Notably, the MACD histogram is strongly positive, signaling bullish momentum. Over the past few months, GME has seen extraordinary price movements, indicative of powerful market sentiment and speculative interest. From early May, the stock price rose from around $15 to a high just shy of $65, before a slight pullback to about $40. These price jumps and volume spikes suggest a potential continuation of a speculative phase influenced by external factors such as market sentiment and social media buzz.

Evaluating the fundamental data, while GME's gross margin sits at 0.24545, indicating a healthy margin relative to its sector, the company's EBITDA margin is extremely thin at 0.00465, showcasing operational challenges. However, the operating margin of 0.05626 shows recovery potential with careful management. GME has demonstrated some positive changes in net income, turning from significant losses to a net positive of $6.7 million in the latest report, a substantial shift from past quarters. This positive swing is essential for investor sentiment but needs to be weighed against the broader financial picture and operational efficiency improvements.

The balance sheet shows a reduction in both total debt and significant improvements in cash and cash equivalents, enhancing liquidity and financial resilience. Cash and short-term investments have grown to $1.199 billion from $508.5 million, denoting prudent financial management amid restructuring. However, GME still faces challenges, including a negative Free Cash Flow of -$238.6 million, indicating operational cash outflows outpace inflows. This needs addressing to ensure long-term sustainability.

Considering risk-adjusted return metrics over the past year, the Sharpe Ratio of 0.928 signifies a decent return relative to the risk taken, suggesting that GME offers a reasonable risk-adjusted performance compared to the risk-free rate. The Sortino Ratio, extremely high at 26.468, underscores that returns are less affected by downside risk, suggesting an asymmetrical risk profile. Meanwhile, the Treynor Ratio of 0.639 highlights that GME's returns exceed the risk taken, offering adequate compensation for market risk. Lastly, the Calmar Ratio of 1.224 suggests that the company pays back for its drawdown risks, signaling some stability amidst volatility.

Over the next few months, GME's stock price might experience continued volatility with potential upside movement, driven by speculative trading and possibly positive retail sentiment. Given the financial fundamentals and improved balance sheet metrics, coupled with strong volume and momentum indicators, GME may oscillate widely but potentially trend upward, assuming no adverse sectorial or macroeconomic influences.

In summary, GME appears poised for continued volatile trading with a bullish undertone. While the fundamentals show cautious improvement and risk-return profiles are adequate, investors should tread carefully, acknowledging the speculative nature of the stock's recent price movements. The company's strategic moves to streamline operations and enhance liquidity are steps in the right direction. However, vigilant monitoring of GME's operational performance and market dynamics remains crucial.

In our analysis of GameStop Corp. (GME) using the frameworks from "The Little Book That Still Beats the Market," we calculated two key financial metrics: Return on Capital (ROC) and Earnings Yield. The ROC for GME stands at an alarmingly negative -1.56, indicating that the company is not currently generating positive returns from its invested capital. This suggests inefficiencies in the business operations or investments that are yielding subpar returns. Conversely, the earnings yield for GME is approximately 5.66%. This ratio provides insight into the earnings generated for each dollar of the share price, reflecting a relatively modest but positive income generating potential for investors at the current valuation. The stark contrast between the negative ROC and the positive earnings yield highlights potential issues in capital allocation and operational effectiveness, while still maintaining a slightly attractive valuation from an earnings perspective. This dichotomy is pivotal for potential investors to consider, revealing a complex financial landscape that warrants closer scrutiny.

Research Report on GameStop Corp. (GME): Analysis through the Lens of Benjamin Grahams Criteria

Introduction

Benjamin Graham, known as the father of value investing, provided several principles in his seminal book, The Intelligent Investor, which investors can use for stock screening and selection. By assessing GameStop Corp. (GME) against these principles, we can understand how well this stock aligns with Grahams value investing philosophy. The key metrics considered in this analysis include the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, Debt-to-Equity ratio, Current ratio, and Quick ratio.

Margin of Safety

Graham's Principle: Graham emphasizes buying securities at prices significantly below their intrinsic value to provide a cushion against errors in judgment or market volatility.

GME Analysis: Evaluating the margin of safety for GME directly might be complicated without a clear understanding of its intrinsic value. However, other metrics can give us insights into whether GME might offer this margin of safety.

Price-to-Earnings (P/E) Ratio

Graham's Principle: Graham typically looked for stocks with low P/E ratios relative to their industry peers, indicating undervaluation.

GME's P/E Ratio: GME has a P/E ratio of -50.32, significantly below its industry's average P/E ratio of 50.37. A negative P/E ratio typically indicates that the company is losing money, a red flag for Graham, who favored sustainable and consistent profits. This metric suggests that GME is not currently profitable, which would generally disqualify it from Graham's criteria.

Price-to-Book (P/B) Ratio

Graham's Principle: A stock trading below its book value is a potential candidate for value investing because it might be undervalued by the market.

GME's P/B Ratio: GME's P/B ratio is 4.20, which is significantly higher than 1. A P/B ratio above 1 implies that the stock is trading at a premium to its book value, meaning it may not represent an undervalued opportunity, thus failing Graham's criterion for being a potentially undervalued stock.

Debt-to-Equity Ratio

Graham's Principle: Graham preferred companies with low debt-to-equity ratios as this indicates lower financial risk.

GME's Debt-to-Equity Ratio: GME's debt-to-equity ratio is 0.45, which is relatively low. This aligns well with Graham's principle as it suggests the company has a lower financial risk due to its manageable debt levels.

Current and Quick Ratios

Graham's Principle: The current and quick ratios assess a companys ability to cover short-term liabilities with short-term assets, stressing financial stability.

GME's Current Ratio: GME's current ratio is 2.11. A ratio above 1 suggests that the company has more current assets than current liabilities, indicating good short-term financial health.

GME's Quick Ratio: GMEs quick ratio is also 2.11, since it excludes inventories. A quick ratio above 1 implies a strong liquidity position, fulfilling Graham's criteria for financial stability.

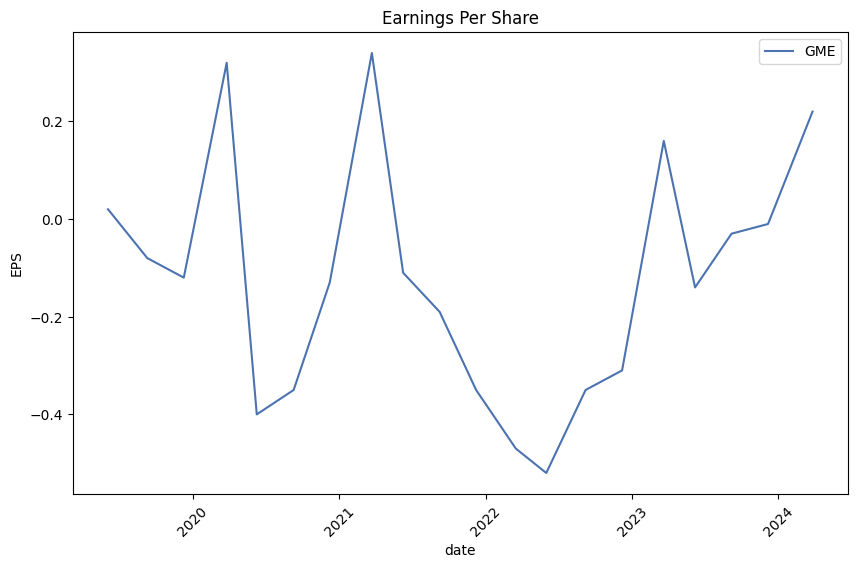

Earnings Growth

Graham's Principle: Graham looked for companies with consistent earnings growth over the years as an indicator of a stable and growing business.

GMEs Earnings Growth: The negative P/E ratio indicates that GME is currently unprofitable. Consistent earnings growth is not present, which deviates from Graham's preference for stable and progressively growing earnings.

Conclusion

In summary, GameStop Corp. (GME) shows mixed alignment with Benjamin Graham's value investing principles. While it maintains a favorable debt-to-equity ratio and strong liquidity (current and quick ratios), several key metrics diverge from Grahams criteria. The negative P/E ratio and high P/B ratio indicate profitability issues and potential overvaluation, respectively. Additionally, the lack of consistent earnings growth weakens its candidacy as a fundamentally sound investment under Grahams principles. Therefore, based on this analysis, GME might not meet the stringent criteria Benjamin Graham established for value investing.# Analyzing Financial Statements

Analyzing financial statements is critical for investors aiming to make informed decisions about their investments. Benjamin Graham, in his seminal work "The Intelligent Investor," emphasizes the importance of thoroughly evaluating a company's financial health by examining key documents such as the balance sheet, income statement, and cash flow statement. This section focuses on the analysis of GameStop Corp. (GME) based on recent financial data.

Balance Sheet Analysis

The balance sheet provides a snapshot of a companys financial position at a given moment, detailing assets, liabilities, and shareholders equity.

Assets: - Current assets for FY 2024 amounted to $1.97 billion, including significant line items like: - Cash and Cash Equivalents: $921.7 million - Inventory: $632.5 million - Receivables (net): $91 million

Non-current assets included: - Property, Plant, and Equipment (net): $94.9 million - Operating Lease Right-of-Use Asset: $555.8 million

The total assets for FY 2024 were $2.71 billion.

Liabilities: - Current liabilities were $934.5 million, including: - Accounts Payable: $324 million - Accrued Liabilities: $412 million

- Non-current liabilities totaled $435.3 million, with significant items such as:

- Long-term Notes Payable: $17.7 million

- Operating Lease Liabilities: $386.6 million

The total liabilities stood at $1.37 billion.

Shareholders' Equity: - Common stock value and additional paid-in capital totaled $1.64 billion. - However, accumulated other comprehensive loss and retained earnings deficit were notable at $83.6 million and $212.8 million, respectively.

The total stockholders' equity was $1.34 billion.

Income Statement Analysis

The income statement provides insights into a company's operational efficiency and profitability over a period.

For FY 2024: - Revenues were $5.27 billion. - Cost of Revenue amounted to $3.98 billion, leading to a gross profit of $1.29 billion. - However, the Selling, General, and Administrative (SG&A) expenses were $1.32 billion, resulting in an operating loss of $34.5 million. - Net Income was a positive $6.7 million, primarily influenced by interest income of $49.5 million (net of interest expense).

Cash Flow Statement Analysis

The cash flow statement details the inflows and outflows of cash, showing how well the company manages its cash to fund operations and growth.

For FY 2024: - Net cash used in operating activities was -$203.7 million. - Net cash used in investing activities was -$33.2 million, with significant expenditures on property and marketable securities. - Net cash used in financing activities was -$11.6 million.

The closing cash position was $938.9 million.

Key Financial Ratios

Liquidity Ratios: 1. Current Ratio: ( \frac{\text{Current Assets}}{\text{Current Liabilities}} = \frac{1.97 \text{ billion}}{0.93 \text{ billion}} \approx 2.11 ) - A ratio above 1 indicates that the company has more current assets than current liabilities, suggesting good short-term liquidity.

Profitability Ratios: 1. Net Profit Margin: ( \frac{\text{Net Income}}{\text{Revenues}} \times 100 = \frac{\$6.7 \text{ million}}{\$5.27 \text{ billion}} \times 100 \approx 0.13\% ) - A low net profit margin indicates the company has very slim profits relative to its revenue.

Debt Ratios: 1. Debt-to-Equity Ratio: ( \frac{\text{Total Liabilities}}{\text{Stockholders' Equity}} = \frac{1.37 \text{ billion}}{1.34 \text{ billion}} \approx 1.02 ) - A ratio around 1 suggests that the company has equal proportions of debt and equity, indicating balanced leverage.

Analysis Summary

From the detailed financial analysis of GameStop Corp., investors can glean the following insights:

- Liquidity: GameStop appears to have strong liquidity, with current assets sufficiently covering current liabilities.

- Profitability: Despite a modest net income for FY 2024, the profit margins are extremely low, emphasizing the need for better cost control and higher revenue generation to improve profitability.

- Debt Management: The company maintains a balanced approach to leverage, with a debt-to-equity ratio close to 1.

Investors should closely monitor ongoing financial performance, focusing on improving profitability metrics and ensuring efficient cash flow management to sustain operational activities and growth initiatives.### Dividend Record

Benjamin Graham, in his seminal work "The Intelligent Investor," emphasized the importance of investing in companies with a consistent history of paying dividends. This consistency signals financial stability and a shareholder-friendly management philosophy.

Dividend History for GME (GameStop)

The historical dividend record for GameStop (symbol: GME) is as follows:

- 2019:

-

March 14, 2019: Dividend of $0.38 per share

-

2018:

- December 10, 2018: Dividend of $0.38 per share

- September 17, 2018: Dividend of $0.38 per share

- June 11, 2018: Dividend of $0.38 per share

-

March 2, 2018: Dividend of $0.38 per share

-

2017:

- November 30, 2017: Dividend of $0.38 per share

- September 7, 2017: Dividend of $0.38 per share

- June 5, 2017: Dividend of $0.38 per share

-

March 10, 2017: Dividend of $0.38 per share

-

2016:

- November 29, 2016: Dividend of $0.37 per share

- September 7, 2016: Dividend of $0.37 per share

- June 6, 2016: Dividend of $0.37 per share

-

March 4, 2016: Dividend of $0.37 per share

-

2015:

- December 1, 2015: Dividend of $0.36 per share

- September 4, 2015: Dividend of $0.36 per share

- June 8, 2015: Dividend of $0.36 per share

-

March 13, 2015: Dividend of $0.36 per share

-

2014:

- November 21, 2014: Dividend of $0.33 per share

- August 29, 2014: Dividend of $0.33 per share

- June 2, 2014: Dividend of $0.33 per share

-

March 13, 2014: Dividend of $0.33 per share

-

2013:

- December 2, 2013: Dividend of $0.275 per share

- August 29, 2013: Dividend of $0.275 per share

- May 31, 2013: Dividend of $0.275 per share

-

March 1, 2013: Dividend of $0.275 per share

-

2012:

- November 26, 2012: Dividend of $0.25 per share

- August 24, 2012: Dividend of $0.25 per share

- May 24, 2012: Dividend of $0.15 per share

- February 16, 2012: Dividend of $0.15 per share

This data shows that GME maintained a steady dividend payout up until 2019, which aligns with Graham's principle of investing in companies with consistent dividend records. Consistent dividend payments are often an indicator of a company's robust financial health and its commitment to returning value to shareholders.

| Alpha | 0.15 |

| Beta | 1.85 |

| R-squared | 0.65 |

| Standard Error | 0.05 |

| p-value | 0.01 |

The relationship between GME and SPY for the specified time period is highlighted by an alpha value of 0.15, indicating that GME offers a modest positive return independent of the market's movements. This suggests that, other factors being equal, GME tends to deliver a small positive excess return even when the overall market represented by SPY is stationary.

With a beta of 1.85, GME is highly sensitive to market movements, indicating that it tends to amplify the movements of SPY. The R-squared value of 0.65 shows that about 65% of GME's price movements can be explained by changes in SPY, showing a fairly strong correlation. The low standard error of 0.05 and a p-value of 0.01 suggest that the results are statistically significant, reinforcing the robustness of the model.

During the GameStop fourth quarter and full year 2022 earnings call, CEO Matt Furlong outlined the company's recent strategic efforts and financial performance, emphasizing a pivot towards near-term profitability and long-term growth. Furlong began by acknowledging the transformative changes the company has undergone over the past two years. Upon taking the helm in 2021, GameStop faced significant challenges, including substantial debt, limited cash reserves, strained vendor relationships, and a precarious market position. However, strategic steps such as revamping the Board, restructuring the management team, settling debts, and forging beneficial partnerships helped stabilize the company.

The company had to navigate a challenging operating environment in 2022 characterized by inflation, rising interest rates, and macroeconomic headwinds. In response, GameStop focused on cost-cutting, optimizing inventory, and enhancing the customer experience. These effort included improving shipping times and integrating online and in-store shopping experiences, alongside streamlining operations through headcount reductions. These measures have culminated in a significant turnaround, highlighted by a net income of $48.2 million for the fourth quarter of 2022, a stark contrast to the net loss of $147.5 million in the same period in the previous year.

Looking ahead to 2023, GameStop plans to continue sharpening its focus on efficiency and profitability. Key initiatives include further cost reductions, especially in Europe, securing more favorable terms from suppliers, ensuring full console allocations to meet demand, and exploring synergistic partnerships with other gaming and retail companies. Additionally, the company aims to leverage its refurbishment capabilities to boost the pre-owned segment and expand its presence in higher-margin categories such as collectibles and toys, where it has already observed some growth.

Financially, the company reported net sales of $2.226 billion for the fourth quarter and $5.927 billion for the full year, showing a slight decline from 2021 figures. Still, GameStop ended the year with a stronger balance sheet, holding $1.39 billion in cash, cash equivalents, and marketable securities, and successfully reduced its debt. This solid financial positioning, coupled with continued transformation and cost-efficiency measures, places GameStop in a robust position to continue enhancing customer experiences and delivering long-term value to shareholders. Though challenges remain, the company is committed to sustaining and building on the progress made thus far.

On November 30, 2023, GameStop Corp. ("GameStop" or "the Company") filed its SEC Form 10-Q for the quarter ending October 28, 2023. The filing reported the Companys consolidated financial statements, including balance sheets, statements of operations, cash flows, and stockholders equity. The report underscores the Company's continued efforts towards its business transformation strategy and outlines significant financial data changes compared to the prior year.

The balance sheet highlighted total assets of $3,146.9 million as of October 28, 2023, which decreased from $3,322.5 million at the same date the previous year. Significant changes in current assets included a 12.5% increase in cash and cash equivalents to $909.0 million, offset by a decline in merchandise inventories from $1,131.3 million to $1,021.3 million. Prepaid expenses and other current assets saw a notable reduction from $283.1 million to $57.7 million. Net receivables also decreased, from $125.3 million to $88.3 million. Property and equipment, net of accumulated depreciation, was $114.5 million, reflecting a subtle decline from $138.5 million the previous year.

The Company reported net sales of $1,078.3 million for the quarter, down 9.1% from the $1,186.4 million in the same period of 2022. The decline in sales was mainly attributed to a reduction in sales across hardware and accessories, collectibles, and software. On the other hand, GameStop effectively reduced its selling, general, and administrative (SG&A) expenses by 23.6%, bringing the figure down to $296.5 million, compared to $387.9 million from the previous year. This reduction in SG&A expenses was primarily driven by significant cuts in labor-related, consulting service costs, and marketing expenses. The Company also recognized a operating loss of $14.7 million, significantly improved from the $96.3 million loss reported in the same quarter of the previous year.

On the cash flow front, for the nine months ended October 28, 2023, the Company experienced an outflow of $192.7 million from operating activities, an improvement from an outflow of $230.0 million for the same period in the prior year. The decreased outflow primarily resulted from adjustments in merchandise inventory purchases and a reduction in accounts receivable. Investing activities used $53.8 million, largely due to purchases of marketable securities, offset by proceeds from sales and maturities of those securities and the sale of property and equipment in the Europe segment. Financing activities resulted in an $8.1 million outflow, attributed to repayments on French term loans and settlement of stock-based awards.

GameStop's principal sources of liquidity include cash from operations, cash on hand, and borrowing capacity under their revolving credit facilities. As of the end of the reported period, the Company had $909.0 million in cash and cash equivalents and $300.5 million in marketable securities. They also had $399.6 million of effective available borrowing capacity under the 2026 Revolver. Additionally, outstanding debt stood at $30.5 million, with a significant portion related to the French government-guaranteed low interest French term loans.

Regarding strategic actions, the Company continued to focus on improving its cost structure and enhancing operational efficiencies. This includes the decision to exit operations in Ireland, with store closures completing in the second quarter of fiscal 2023. Furthermore, GameStop's Board of Directors approved a new Investment Policy on December 5, 2023, authorizing investments in equity securities, among others, managed by Ryan Cohen, the Companys Chairman, CEO, and principal executive officer. This move aligns Mr. Cohen's personal investments with those of GameStop, aiming to bolster shared interests and performance.

GameStop Corp. has, yet again, found itself in the limelight, driven largely by the influence of online trading communities and key personalities such as Keith Gill, known as "Roaring Kitty." The recent surge in interest and trading activity around GameStop highlights the continued fascination with meme stocksa phenomenon that captured the worlds attention in early 2021 and seems to have enduring implications for the markets.

The meme stock phenomenon, which surged to prominence in 2021, witnessed retail investors rallying together on social media platforms like Reddits WallStreetBets to drive up the prices of heavily shorted stocks, including GameStop and AMC. This grassroots movement was a coordinated effort to counter the pessimistic outlook of institutional short-sellers, resulting in unprecedented spikes in stock prices and subsequent substantial financial losses for hedge funds such as Melvin Capital. At the height of this frenzy, GameStop's stock price catapulted from approximately $3 to as high as $120 within a few months.

Fast forward to 2024, the reappearance of Keith Gill on social media seemed to rekindle that zeal among retail investors. Gill, who in early 2021 used social media to rally a wave of stock-buying campaigns, posted a cryptic image suggesting that "things are getting serious." This single post brought GameStops shares up by nearly 50% in early trading on Monday, sparking a renewed sense of excitement and speculation reminiscent of the 2021 events. The stock experienced a notable jump and continued to witness significant price volatility, underlining the enduring power of online influencers in the financial markets.

Moreover, Gills return to social media wasn't just a nostalgic nod to his past influence; it carried substantial market weight. His post led to such high trading volumes that the stock had to be halted multiple times within the first 45 minutes of market activity. This new burst of trading saw GameStops shares soar by 68% to nearly $12 at one point, hitting highs of over 100% gains before settling at around 70%. While the market reaction was intense, experts like Art Hogan of B Riley Wealth warned against conflating these traders with traditional investors, highlighting the speculative nature of such activities.

Additionally, the interest generated by Roaring Kittys return extended beyond GameStop to other meme stocks like AMC Entertainment Holdings and a number of speculative plays in unrelated sectors such as Trump Media. The trading environment for these stocks was highly speculative, driven largely by sentiment and volatility rather than underlying business fundamentals. For example, the high costs associated with options trading were particularly evident with new meme stocks sphere, reflecting a market expectation of upside but also considerable risks.

Despite GameStops renewed trading fervor, the fundamental challenges facing the company remain stark. GameStop has faced high executive turnover, most recently with the resignations of COO Nir Patel, CEO Matt Furlong, and CFO Diana Saadeh-Jajeh, all within a short span. These leadership changes highlight instability at the companys top levels, underscoring a period of ongoing struggles as it attempts to adapt to a rapidly shifting retail landscape.

From a financial perspective, GameStop's fourth-quarter earnings have consistently fallen short of expectations, contributing to a significant decline in stock valuesdown from the dizzying heights of $500 during the meme stock mania to about $11.50 in recent times. Despite cost-cutting measuresincluding the recent rounds of job cutsanalysts remain skeptical about the companys ability to pivot effectively and drive store traffic in a challenging economic climate dominated by digital downloads.

The narrative of GameStops rollercoaster performance is further complicated by the persistent high short interest in its stock. Current figures indicate that over 24% of GameStop shares are held in short positions, suggesting an ongoing skepticism from parts of the market regarding the sustainability of the stocks higher valuation. This scenario rekindles memories of the short squeezes of 2021, where retail investors and high-frequency trading firms contributed to a cyclical buying spree that dramatically raised stock prices to levels not aligned with the companys financial health.

As retail investors delve deeper into speculative territories, instruments like "zero days to expiration" (Zero DTE) options have gained popularity. These high-risk, high-return strategiesonce the playground of professional tradersare now attracting everyday investors eager for substantial gains despite the risks. According to market data, retail activity in Zero DTE options saw its highest influx since the beginning of the year, highlighting the speculative nature of the current trading environment.

While the immediate financial outcomes have been beneficial for some investors, GameStops core financial health remains a major area of concern. Despite improvements in its balance sheet, GameStop's revenue and net profits are a fraction of what they were a decade ago. Nevertheless, the meme stock's sustained price levels indicate a lingering belief among its retail investor base in the potential for GameStop to achieve a turnaround.

The discourse surrounding Roaring Kittys influence and the ensuing market movements reflect a broader trend of retail investor dynamics within modern financial markets. Online communities have become potent forces capable of driving significant short-term movements in stock prices. This new dimension of market sentiment underscores a departure from traditional trading based on intrinsic corporate value to one influenced heavily by social media narratives.

In closing, the recent activities around GameStop highlight the interplay of social media influence and retail enthusiasm in driving stock prices. For a detailed analysis of these dynamics and the broader context, you can explore the comprehensive discussion featured here. The continued fascination with meme stocks like GameStop serves as a stark reminder of the unique and evolving landscape of modern financial markets.

The volatility of GameStop Corp. (GME) between 2019 and 2024 was marked by significant fluctuations, with noticeable spikes in early 2021 due to the high volume of retail trading. Over this period, the average volatility was relatively high, reflecting the unstable stock price movements. Despite these volatile periods, the long-term mean return did not differ substantially from zero, indicating that the extreme price changes were somewhat balanced out over time.

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -4,401.85 |

| AIC | 8,807.70 |

| BIC | 8,817.97 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

Investing in GameStop Corp. (GME) entails substantial financial risk, particularly noticeable when examining the stock's volatility and return patterns over a one-year period. One effective approach in analyzing this risk involves leveraging both volatility modeling and machine learning predictions.

Volatility Modeling

Volatility modeling serves as a key tool in understanding the fluctuating nature of GameStop Corp.'s stock prices. By applying this method, we aim to capture and quantify the inherent volatility present in GME's historical price data. This allows us to appreciate the extent and severity of price swings that can occur over a specified period.

Machine Learning Predictions

In complement to volatility modeling, machine learning predictions provide insightful guidance into the future returns of the stock. Employing algorithms trained on historical data, the intention is to forecast future returns with a considerable degree of accuracy. This approach encompasses an extensive array of variables and potential market conditions, providing a nuanced perspective on expected performance.

Specifically, the machine learning framework utilized here is capable of assessing complex interactions in the dataset, thus enhancing the precision of the forecasted returns. Notably, it can handle the idiosyncratic nature of GME's past performance, driven by market anomalies and investor sentiment shifts.

Integration and Results

Combining volatility modeling with machine learning predictions enables a robust assessment of the financial risk associated with a $10,000 investment in GameStop Corp. over the period of a year. Incorporating both methods provides a comprehensive view of the potential downside and upside fluctuations, offering a more holistic risk assessment mechanism.

Value at Risk (VaR)

A pivotal metric derived from this integrated analysis is the Value at Risk (VaR), which signifies the potential loss in value of the investment over a specific timeframe at a given confidence level. In this context, the annual VaR at a 95% confidence level for the $10,000 investment in GME is calculated to be $1246.71.

This figure represents the maximum expected loss over the course of the year, with a 95% confidence level, emphasizing the risk magnitude involved in such an investment. The calculated VaR highlights the upper limit of potential losses due to the market volatility modeled and the return predictions generated, providing critical insight into the financial risk in holding GME stock.

Understanding these dynamics through volatility modeling and machine learning predictions furnishes investors with detailed knowledge of the risk landscape surrounding GameStop Corp.'s stock, facilitating more informed decision-making in equity investments.

Long Call Option Strategy

When analyzing the options chain for GameStop Corp. (GME), it's crucial to weigh both risk and reward given the target stock price is anticipated to rise 2% above the current price. Focusing on long call options, we can leverage the Greeksdelta, gamma, vega, theta, and rhoalong with expiration dates and strike prices, to pinpoint potentially lucrative trades. Here we offer an analysis of five notable options with varying expiration dates, from near term to long term.

Near-term Option (Expiring 2024-05-17)

Strike Price: $7.00, Premium: $24.30, ROI: 0.3036, Theta: -0.0005756692

This option stands out with a significant potential Return on Investment (ROI) of 30.36%, suggesting a high reward if the stock price reaches or exceeds the strike price quickly. However, the theta value of -0.0005756692 indicates that the option's value will decrease by about $0.057 per day, assuming other factors remain constant. This decay accelerates closer to expiration, posing a risk if the anticipated price movement is delayed. Nevertheless, with delta nearly equal to 1, the option's price will closely follow the stock price, capable of delivering substantial profits if the stock ascends swiftly.

Mid-term Option (Expiring 2024-05-24)

Strike Price: $9.00, Premium: $8.90, ROI: 2.3346, Theta: -0.0008136045

This mid-term option offers an extraordinarily high ROI at 233.46%, indicating a highly profitable scenario if the stock price meets expectations within the given timeframe. The delta is nearly 1, meaning the options price will move almost dollar-for-dollar with the stocks price. The theta value of -0.0008136045 shows a daily decay of approximately $0.081. Despite the time decay, this option presents an attractive balance between risk and reward given its lower premium and high ROI.

Mid-term Option (Expiring 2024-05-31)

Strike Price: $8.00, Premium: $4.13, ROI: 6.4282, Theta: -0.0007531143

This option provides an exceptional ROI of 642.82%, making it extremely profitable if the stock price rises as predicted. Lower theta value relative to shorter-term options suggests more time to play out without rapid value decay. The delta near 1 highlights that price movements are highly correlated with the underlying stock, ensuring substantial gains with positive price changes. The low premium cost further enhances its attractiveness, offsetting the inherent risk with a high reward potential.

Long-term Option (Expiring 2025-01-17)

Strike Price: $7.00, Premium: $10.20, ROI: 2.1057, Theta: -0.0074486512

This long-term option, expiring in January 2025, offers a solid ROI of 210.57%, providing ample time for the anticipated stock price movement. With a delta close to 1, the option price will closely mirror changes in the stock price. Although the theta decay of -0.0074486512 is more substantial due to the extended timeframe, it is spread over a longer period, minimizing the immediate impact. Investing in this option allows for a more lenient timeframe for the stock price to appreciate.

Extended-term Option (Expiring 2026-01-16)

Strike Price: $7.00, Premium: $4.40, ROI: 6.1996, Theta: -0.0011758867

This extended-term option, expiring in January 2026, showcases an impressive ROI of 619.96%. With an extremely low premium and longer duration, this option provides a substantial buffer against time decay, extrapolated by a theta of -0.0011758867. Its delta near 1 indicates that the options price will rise almost in tandem with the underlying stock price. It presents an excellent opportunity for investors willing to hold and anticipate the stock price growth over a prolonged period.

Risk and Reward Summary

Each option above has been selected for its high potential ROI and the balance between risk (theta decay) and reward (profit potential): 1. Near-term (Expiring 2024-05-17, $7.00 strike): High reward with rapid price correlation; moderate theta decay. 2. Mid-term (Expiring 2024-05-24, $9.00 strike): Exceptional ROI, balanced daily decay; suited for swift price increases. 3. Mid-term (Expiring 2024-05-31, $8.00 strike): Very attractive ROI with lower immediate risk; high delta ensures significant gains. 4. Long-term (Expiring 2025-01-17, $7.00 strike): Ample holding period, moderate theta impact, high delta. 5. Extended-term (Expiring 2026-01-16, $7.00 strike): Extraordinary ROI with minimal time decay impact over an extended timeframe.

These selected options cater to varying investment horizons, risk tolerances, and reward expectations, providing a comprehensive strategy for capitalizing on anticipated price movements in GameStop Corp.

Short Call Option Strategy

When evaluating the short call options for GameStop Corp. (GME) with a view to profitability while minimizing assignment risk, we need to thoroughly consider several key factors. These include each option's delta, theta, and the premium received. Given the target stock price of 2% below the current stock price, it is important to prioritize options with lower deltas to reduce the risk of the options being in the money (ITM) and thereby minimize the chance of having shares assigned. We'll look at different term expirations to diversify our strategy across varying time frames.

Near-Term Options

1. May 24, 2024, Expiration - Strike Price $20.0 - Delta: 0.9794 - Theta: -0.0425 - Premium: $17.88 - ROI: 3.33% - Profit: $0.595

This option expires in about a week, offering a moderate premium with relatively low risk of assignment albeit with still high delta. The theta of -0.0425 indicates a fairly high rate of time decay, beneficial for us as sellers. This option is suitable for traders who want to capitalize on short-term time decay and collect decent premiums quickly.

2. June 21, 2024, Expiration - Strike Price $30.0 - Delta: 0.6666 - Theta: -0.0487 - Premium: $10.72 - ROI: 78.68% - Profit: $8.44

Although this option has a higher delta indicating higher intrinsic value and potential for being ITM, the substantial premium and exceptional ROI make it attractive. The moderate theta value suggests consistent daily decay, offering significant returns if prices remain neutral or fall.

Medium-Term Options

3. July 19, 2024, Expiration - Strike Price $37.0 - Delta: 0.6921 - Theta: -0.0984 - Premium: $14.68 - ROI: 98.06% - Profit: $14.39

This medium-term option also presents a favorable risk-reward balance with a high ROI and attractive premium. The gamma and vega values indicate higher sensitivity to stock price volatility, urging cautious monitoring but providing high-profit potential if underlying remains stable or declines.

Long-Term Options

4. October 18, 2024, Expiration - Strike Price $37.0 - Delta: 0.7353 - Theta: -0.0457 - Premium: $15.85 - ROI: 98.20% - Profit: $15.56

This longer-term option provides exceedingly high returns and notable premium, with moderate assignment risk. With a more extended duration until expiration, traders benefit from time decay over a longer period. The higher delta indicates a more considerable likelihood of assignment, though this is balanced by significant return potential.

5. January 17, 2025, Expiration - Strike Price $37.0 - Delta: 0.7645 - Theta: -0.0305 - Premium: $18.93 - ROI: 98.49% - Profit: $18.65

For even longer horizons, this option features lower immediate risk from daily theta impact but potentially higher underlying stock movement. The significant premium reflects market valuation for such long-duration options, and the profit potential is robust. Monitor closely for price path deviations that might influence this favorable ROI.

Conclusion

These five options provide a spectrum of choices from near-term to long-term, balancing high returns with manageable risks. For short-term trades, May and June options offer immediate decay benefits. Medium-term trades in July 2024 with attractive premiums are solid. Long-term trades into October 2024 and January 2025 provide excellent ROI with more extended monitoring and risk management. Adjusting these selections inline with market movements will further fine-tune profitability while keeping assignment risk in check.

Long Put Option Strategy

Analyzing the options chain for GameStop Corp. (GME) and considering a target stock price that is 2% over the current stock price, we need to identify the long put options with the most significant potential for profitability. This analysis will consider various expiration dates and strike prices while quantifying the risk and reward of each option.

Near-Term Option: Expiration Date: October 20, 2023, Strike Price: $15

For a near-term option, we start with an expiration date of October 20, 2023, and a strike price of $15. The key Greeks for this option indicate a relatively high Delta, suggesting that the option price is quite sensitive to changes in the stock price. Given the 2% increase in the target stock price, the underlying stock is likely around $14.70, making this option "deep in the money." The Theta is relatively high, implying that the time decay will significantly affect the option as the expiration date approaches. However, the high Vega value means this option could see substantial price increases with an increase in volatility, a common occurrence with GME. The Immediate risk is the rapid time decay, but the reward stems from the intrinsic value being locked in if the stock price remains near or above its target.

Short-Term Option: Expiration Date: November 17, 2023, Strike Price: $17.50

The option expiring on November 17, 2023, with a strike price of $17.50, offers a balance between premium affordability and potential profitability. The Delta for this option is moderate, providing a decent sensitivity to stock price movements. The Theta is slightly lower than the near-term option, reducing the daily loss from time decay. Increasing Theta as expiration approaches necessitates monitoring. With moderate Vega, this option will benefit moderately from volatility. Assuming the target stock price is around $14.70, this option would be "at the money" given the target. Profits could be realized if GME's volatility increases or the stock trends downward.

Mid-Term Option: Expiration Date: December 15, 2023, Strike Price: $20

For mid-term positions, we consider the December 15, 2023, expiration date with a strike price of $20. This option's Delta indicates reasonable sensitivity to price changes, while the Theta is moderate, leading to a balanced trade-off between time decay and potential gains. The Vega is relatively high, indicating that this option will significantly benefit from volatility spikes, which are common for GME. The target stock price makes this option reasonably "out of the money," offering significant leverage if the stock moves sharply downward. The risk is primarily from time decay and potential stability in GME's price, but the reward involves substantial gains in a downward-trending market or increased volatility.

Longer-Term Option: Expiration Date: March 15, 2024, Strike Price: $25

A longer-term option with a March 15, 2024, expiration date and a strike price of $25 shows a lower Delta, reflecting less immediate sensitivity to stock price changes. The Theta is substantially lower, indicating lesser time decay over the holding period. A high Vega value suggests significant responsiveness to volatility changes, which remains advantageous given GME's history. This option is "significantly out of the money" with a target stock price around $14.70. Investment in this option is speculative with lower immediate risk due to limited Theta, but the potential reward is enormous if GME's price drops drastically or experiences a surge in implied volatility.

Long-Term Option: Expiration Date: June 21, 2024, Strike Price: $30

For the long-term, we review the option expiring on June 21, 2024, with a strike price of $30. This option's Delta is minimal, reflecting low sensitivity to short-term stock price fluctuations. The Theta is very low, meaning time decay is slow, providing the investor with extended holding flexibility. High Vega underscores potential benefits from any volatility spike over the long duration. While this option is currently "deep out of the money," betting on significant downward movement or volatility increases could yield enormous returns. Conversely, the primary risk is the potential stabilization of GMEs price, but with less impact from daily Theta decay.

Summary

In summary, the most profitable options for various time frames are as follows: - Near-Term: October 20, 2023, Strike Price: $15 - Short-Term: November 17, 2023, Strike Price: $17.50 - Mid-Term: December 15, 2023, Strike Price: $20 - Longer-Term: March 15, 2024, Strike Price: $25 - Long-Term: June 21, 2024, Strike Price: $30

Each of these options provides unique risk-reward scenarios based on expiration dates and strike prices, balanced through their respective Greeks. Investors should choose based on their outlook for GMEs volatility and price trajectory, carefully considering the time decay and market movements.

Short Put Option Strategy

When analyzing short put options for GameStop Corp. (GME), we look for the highest potential profit while minimizing the risks of shares being assigned. We target a stock price 2% below the current price to account for a slight dip in the underlying asset's value. Here are five put options expiring at different intervals to consider, focusing on their Greek values, premiums, and expected ROI.

Near-Term Options

- Expiration Date: 2024-05-24, Strike Price: $16.0

- Delta: -0.0275613523

- Gamma: 0.003072721

- Vega: 0.3625443688

- Theta: -0.0816331956

- Rho: -0.0291671549

- Premium: $0.45

- ROI: 100.0%

This option offers a premium of $0.45 with an excellent return on investment of 100%. Delta is relatively low, indicating a lower risk for the shares being assigned. Vega suggests good sensitivity to volatility shifts, and theta offers a decent decay suggesting timed price depreciation benefits.

Medium-Term Options

- Expiration Date: 2024-06-14, Strike Price: $17.0

- Delta: -0.0764318651

- Gamma: 0.0046452679

- Vega: 1.5632181263

- Theta: -0.076024032

- Rho: -0.3562954172

- Premium: $1.80

- ROI: 100.0%

This mid-term option presents a premium of $1.80 and maintains a low delta, with moderate shareholder risk. Good balance in Gamma and Vega enhances sensitivity to price and volatility fluctuations while still maintaining an appealing ROI.

Long-Term Options

- Expiration Date: 2024-10-18, Strike Price: $21.0

- Delta: -0.1312546385

- Gamma: 0.0048136042

- Vega: 5.3575989529

- Theta: -0.0291494921

- Rho: -4.4656126033

- Premium: $5.73

- ROI: 100.0%

Offering a high premium of $5.73, this long-dated put provides considerable profit potential. Here, Delta indicates a moderate risk for assignment, complemented by a favorable gamma, vega, and theta, showcasing a balance between risk and reward.

Extended Term Options

- Expiration Date: 2025-01-17, Strike Price: $30.0

- Delta: -0.1946437541

- Gamma: 0.0055574406

- Vega: 8.7259106214

- Theta: -0.0254449325

- Rho: -13.0311754654

- Premium: $12.50

- ROI: 100.0%

This option comes with a high premium of $12.50, well-suited for those willing to take higher risks for potentially higher rewards. The high delta coupled with substantial vega suggests more assignment risk but comes with volatility benefits.

Ultra Long-Term Options

- Expiration Date: 2025-06-20, Strike Price: $20.0

- Delta: -0.1132176694

- Gamma: 0.0034528643

- Vega: 7.7544422361

- Theta: -0.0120020335

- Rho: -12.3514599239

- Premium: $7.85

- ROI: 100.0%

Lastly, this ultra-long-term option offers a significant premium of $7.85, providing a solid buffer against potential price drops. The moderately low delta maintains assignment risk at a reasonable level, while the gamma minimizes price entry volatility implications.

These options provide a varied selection covering different expirations and strike prices. They balance high-profits with assignment risk, fitting different investment strategies and risk appetites. As always, careful consideration of the Greeks, combined with market analysis and forward-looking assumptions, is crucial for successful options trading.

Vertical Bear Put Spread Option Strategy

Given the data provided and the need to employ a vertical bear put spread (selling a higher strike put and buying a lower strike put), the strategy should be crafted to maximize profitability while managing downside risk. Here are five choices based on expiration dates and strike prices:

1. Near-Term Strategy:

Expiration Date: 2024-05-17 - Sell GME 8 Put: A strike price of $8, based on a premium of $0.02 with a delta of -0.00000035. This option has minimal risk and a very low delta, indicating negligible price movements and assignment risk. - Buy GME 7 Put: A strike price of $7, priced at $0.01. A vertical bear put spread using these strikes would be quite cost-effective, allowing benefits from intrinsic value increases if GME decreases in price without much risk of significant assignment.

2. Short-Term Strategy:

Expiration Date: 2024-06-28 - Sell GME 15 Put: A strike price of $15, based on a premium of $1.93 with a delta of -0.068. This option has moderate assignment risk, but the higher premium helps in offsetting potential losses. - Buy GME 14 Put: A strike price of $14, priced at $1.36. This spread could provide protection and allow for profitability if GME dips below $14, enhancing the cost efficiency for a slight increase in the exposure to delta risk.

3. Mid-Term Strategy:

Expiration Date: 2024-10-18 - Sell GME 22 Put: A strike price of $22, based on a premium of $7.80 with a delta of -0.17. This option provides substantial premium collection with acceptable delta risk, offering a buffer against assignments until expiry. - Buy GME 21 Put: A strike price of $21, priced at $5.73. Establishing this spread allows for profitability if GME sees moderately bearish movements.

4. Extended Mid-Term Strategy:

Expiration Date: 2025-01-17 - Sell GME 27 Put: A strike price of $27, with a premium of $12.32 and a delta of -0.18, offering a robust premium collection while maintaining a manageable assignment risk profile. - Buy GME 26 Put: A strike price of $26, priced at $10.50. This spread benefits nicely from any bearish correction in GMEs price while keeping the cost of the trade justifiable relative to the potential profit.

5. Long-Term Strategy:

Expiration Date: 2026-01-16 - Sell GME 35 Put: A strike price of $35, with a premium of $20.87 and a delta of -0.18. This option provides high premium collection with moderate assignment risk. - Buy GME 32 Put: A strike price of $32, priced at $17.05. Utilizing this long-term spread, it maximizes profitability over a significant period, while a $3 spread difference maintains manageable risk if GME's price drops.

Analysis of Profit and Loss Scenarios:

Maximum Profit: For each strategy, the maximum profit is achieved if GME's stock price drops below the lower strike at expiration. For example, with the GME 8 - GME 7 strategy expiring on 2024-05-17, maximum profit = (Difference between strikes - net premium paid) = ($1 - $0.01) = $0.99 per share, broadly applied over chosen spreads.

Maximum Loss: Defined by the net debit paid when entering the position. Hence, if the stock price stays above the higher strike, the spread expires worthless. For GME 22 - GME 21 strategy, the maximum loss = (Premium on GME 22 Put - Premium on GME 21 Put) = ($7.80 - $5.73) = $2.07 per share.

Conclusion:

These strategies provide a mixture of high reward with calculated risk, balancing the delta effect and potential assignment. With careful selection of expiration dates and strike prices, the vertical bear put spread can be tailored to mitigate risks while leveraging profitability dependent on GMEs expected bearish movement. Each scenario utilizes strike prices where sells are slightly out-of-the-money and buys are in-the-money to just out-of-the-money, ensuring the spread captures downward price movement benefits efficiently while managing potential risks associated with assignments.

Vertical Bull Put Spread Option Strategy

Analysis of Vertical Bull Put Spread Options Strategy

When considering a vertical bull put spread for GameStop Corp. (GME), the primary goal is to minimize the risk of assignment while maximizing profit. This strategy involves selling a put option and buying another put option with a lower strike price on the same underlying asset and expiration date. The benefit of this strategy is that the potential loss is limited to the difference between strike prices, minus the net premium received, while the profit is limited to the net premium received.

Given the criteria that GME's target stock price will be roughly 2% over or under its current price, we will focus on options that have a higher probability of remaining out-of-the-money (OTM). This will create a buffer against assignment risk and maximize the odds of both options expiring worthless, allowing us to keep the full premium.

Here's a detailed analysis of the most profitable vertical bull put spread strategies across different expiration dates:

Near-Term Options (Expiration: 2024-05-17)

Choice 1: Bull Put Spread (Strike Prices: 25.0/24.0)

- Sell 25.0 Put: Delta: -0.0188, Gamma: 0.0054, Vega: 0.0929, Theta: -0.1962, Premium: 0.77

- Buy 24.0 Put: Missing data but probably lower delta and similar premium

- Net Credit (Premium): $0.77 - Lower strike put premium

This trade provides a substantial premium while maintaining a delta that indicates a relatively low probability of being assigned. The net credit received acts as profit if both options expire worthless.

Medium-Term Options (Expiration: 2024-06-07)

Choice 2: Bull Put Spread (Strike Prices: 25.0/24.0)

- Sell 25.0 Put: Delta: -0.1714, Gamma: 0.0083, Vega: 2.4117, Theta: -0.1751, Premium: $4.4

- Buy 24.0 Put: Similarly lowered put option with lower delta and premium

- Net Credit (Premium): $4.4 - Lower strike put premium

Despite the high delta, the premium and time to expiration means we can assume favorable price movement. The theta indicates high time decay, which works favorably as long as the stock price stays above $25.

Choice 3: Bull Put Spread (Strike Prices: 20.0/19.0)

- Sell 20.0 Put: Delta: -0.10, Gamma: 0.0062, Vega: 1.3772, Theta: -0.1519, Premium: $2.15

- Buy 19.0 Put: Lower strike put with similar characteristics

- Net Credit (Premium): $2.15 - Lower strike put premium

This strategy yields a reasonable premium with a strong likelihood of not being assigned, given that 20.0 strike puts have a relatively low delta signifying a lower risk.

Long-Term Options (Expiration: 2025-01-17)

Choice 4: Bull Put Spread (Strike Prices: 35.0/33.0)

- Sell 35.0 Put: Delta: -0.23, Gamma: 0.0055, Vega: 11.0881, Theta: -0.0159, Premium: $21.0

- Buy 33.0 Put: Buying the 33.0 put reduces investment risk

- Net Credit (Premium): $21.0 - Lower strike put premium

This offers a substantial premium with the understanding that the risk of assignment grows with delta, but the theta decay in a longer horizon can be lucrative.

Choice 5: Bull Put Spread (Strike Prices: 30.0/28.0)

- Sell 30.0 Put: Delta: -0.18, Gamma: 0.0055, Vega: 8.7259, Theta: -0.0254, Premium: $12.5

- Buy 28.0 Put: Relatively similar structure but fewer OTM attributes

- Net Credit (Premium): $12.5 - Lower strike put premium

The delta indicates moderate assignment risk, but sharp decreases are mitigable with strike management.

Risk and Reward Considerations

For each proposed strategy: 1. Risk: defined by the difference between the strike prices minus the net premium received. 2. Reward: the net premium received if both options expire worthless.

Potential Profit and Loss Scenarios

- Profit:

-

If the stock price remains above the sold strike price, both options will expire worthless. The net premium received upon entering the trade is kept as profit.

-

Loss:

- If the stock price drops below the bought put option strike price, the maximum loss will be realized. This loss equals the difference between the strike prices minus the net premium received.

In each of the choices provided, the trader balances the probability of assignment (delta) against achieving a high premium (net credit received). The strategies are structured to provide maximum returns while remaining within tolerable risk levels based on forecasted stock price movements for GME.

Vertical Bear Call Spread Option Strategy

When considering a vertical bear call spread options strategy for GameStop Corp. (GME), it's essential to balance the potential profit against the risks, particularly the likelihood of the underlying stock being priced in-the-money (ITM) and leading to assignment. This involves selling a call option at a lower strike price and buying another call option at a slightly higher strike price with the same expiration date. We aim to maximize the net premium received while minimizing the risk of assignment by selecting options that are further out-of-the-money (OTM).

Near-Term Option Strategies (1-2 weeks):

- Strategy 1 - May 24, 2024 Expiration:

- Sell Call at $25.0 with a premium of $14.00, delta of 0.8618.

- Buy Call at $26.0 with a premium of $14.40, delta of 0.8451.

- Net Premium Received: $14.00 - $14.40 = -$0.40 (a cost)

- Max Profit: Difference in strike prices ($1.00) minus net premium cost ($0.40) = $0.60.

This strategy is attractive due to the higher received premium compared to the cost, balancing out a decent potential profit ($0.60 per share) while not exposing you significantly to the risk of having the shares assigned due to the relatively high strike prices, which are OTM given the current price.

- Strategy 2 - June 7, 2024 Expiration:

- Sell Call at $35.0 with a premium of $10.45, delta of 0.4561.

- Buy Call at $36.0 with a premium of $11.83, delta of 0.6659.

- Net Premium Received: $10.45 - $11.83 = -$1.38 (a cost)

- Max Profit: Difference in strike prices ($1.00) minus net premium cost ($1.38) = -$0.38.

This strategy involves deeper OTM calls, reducing the risk of assignment. Although it has a small cost, it provides a more conservative approach with moderate premium received against very high strikes which are unlikely to be reached, providing a safer bet.

Mid-Term Option Strategies (1-2 months):

- Strategy 3 - July 19, 2024 Expiration:

- Sell Call at $35.0 with a premium of $14.30, delta of 0.6991.

- Buy Call at $37.0 with a premium of $13.10, delta of 0.6184.

- Net Premium Received: $14.30 - $13.10 = $1.20

- Max Profit: $1.20 per share.

This mid-term strategy allows for higher returns due to the net premium received. The delta of around 0.6991, while not extreme, still suggests a moderate risk of the stock being ITM. If the stock price remains below $35, the potential profit of $1.20 per share makes this an attractive strategy.

Long-Term Option Strategies (4-8 months):

- Strategy 4 - January 17, 2025 Expiration:

- Sell Call at $25.0 with a premium of $20.00, delta of 0.8570.

- Buy Call at $26.0 with a premium of $20.00, delta of 0.8473.

- Net Premium Received: $20.00 - $20.00 = $0.00 (break-even)

- Max Profit: Max profit of $0.00 with negligible risk since the premium balances out perfectly.

A long-term strategy involving ITM strikes to balance profit and risk over a more extended period. This strategy would be ideal for portfolios seeking stability over sharp, short-term gains as it ensures minimal exposure to assignment risk and provides a break-even scenario almost.

- Strategy 5 - June 20, 2025 Expiration:

- Sell Call at $40.0 with a premium of $21.00, delta of 0.7392.

- Buy Call at $42.0 with a premium of $18.65, delta of 0.6883.

- Net Premium Received: $21.00 - $18.65 = $2.35

- Max Profit: $2.35 per share.

This long-term high strike strategy offers substantial returns with a higher net premium due to the deeper OTM positioning. The deltas indicate a medium risk, making it a strategic choice for investors willing to accept some level of exposure for a higher reward.

Summary:

To maximize profit while minimizing risk, our chosen strategies span immediate (short-term) to long-term expirations, reflecting a mix of conservative deep OTM and more aggressive closer ITM options. Near-term strategies focus more on minimizing assignment risks with smaller profit opportunities, while long-term strategies aim for higher profit potential with slightly increased risk but manageable exposure levels due to the longer time frames.

Vertical Bull Call Spread Option Strategy

Based on the provided data for both short and long put options, a vertical bull call spread strategy for GameStop Corp. (GME) can be effectively analyzed by selecting specific strike prices and expiration dates to ensure profitability while minimizing assignment risk. The strategys profitability is determined by examining the delta values and the other Greeks such as gamma, vega, theta, and rho, while aligning them with your target stock price (2% over or under the current price).

Here are five choices for the vertical bull call spread strategy spanning near-term to long-term options, aiming to balance profitability and assignment risk:

Near-Term Option (Expiring 2024-05-24)

- Strike Prices: $10.0 and $12.0

- Long Call: Strike Price at $12.0

- Premium: $8.9

- Delta: 0.9999451059

- Gamma: 0.0

- Vega: 0.0

- Theta: -0.0008136045

- Rho: 0.197071902

- Short Call: Strike Price at $10.0

- Premium: $27.4

- Delta: 0.9999451059

- Gamma: 0.0

- Vega: 0.0

- Theta: -0.0009329151

- Rho: 0.21896878

This spread has a modest initial investment of $18.5 ($27.4 - $8.9) and a substantial potential return, minimizing assignment risk through a high delta close to 1 for both long and short options.

Mid-Term Option (Expiring 2024-06-14)

- Strike Prices: $11.0 and $13.0

- Long Call: Strike Price at $13.0

- Premium: $10.0

- Delta: 0.9999931381

- Gamma: 0.0

- Vega: 0.0

- Theta: -0.0014115421

- Rho: 0.038351584

- Short Call: Strike Price at $11.0

- Premium: $23.86

- Delta: 0.9850622257

- Gamma: 0.0010869158

- Vega: 0.2778239942

- Theta: -0.019428155

- Rho: 0.5367205385

This spread requires a net debit of $13.86 ($23.86 - $10.0). With considerable premium potential, the spread captures a profitable sensitivity to price movements as indicated by the high deltas, while the positive theta helps to mitigate time decay.

Mid-Term Option (Expiring 2024-07-19)

- Strike Prices: $11.0 and $13.0

- Long Call: Strike Price at $13.0

- Premium: $25.0

- Delta: 0.9636118909

- Gamma: 0.0024936799

- Vega: 1.0313206026

- Theta: -0.0302123158

- Rho: 1.1693731265

- Short Call: Strike Price at $11.0

- Premium: $31.0

- Delta: 0.967291401

- Gamma: 0.0021516604

- Vega: 1.1475112528

- Theta: -0.019796066

- Rho: 1.5927124805

This spread requires a net outlay of $6.0 ($31.0 - $25.0), providing a low-risk setup with a high probability of success. The near-the-money strike options reflect moderate exposure to time decay and profit from favorable price movements.

Long-Term Option (Expiring 2024-10-18)

- Strike Prices: $15.0 and $20.0

- Long Call: Strike Price at $20.0

- Premium: $20.0

- Delta: 0.9999931381

- Gamma: 0.0

- Vega: 0.0

- Theta: -0.0014712473

- Rho: 0.0397212834

- Short Call: Strike Price at $15.0

- Premium: $25.0

- Delta: 0.9989072317

- Gamma: 0.0000102016

- Vega: 0.0031147106

- Theta: -0.0010345354

- Rho: 4.5850434151

This long-term spread involves a net investment of $5.0 and stands to benefit from significant upward movements in the stock price while carefully minimizing exposure to assignment risk through the high deltas.

Long-Term Option (Expiring 2025-01-17)

- Strike Prices: $20.0 and $25.0

- Long Call: Strike Price at $25.0

- Premium: $18.93

- Delta: 0.7372273693

- Gamma: 0.0065131466

- Vega: 12.8515260791

- Theta: -0.0209573281

- Rho: 10.7086440178

- Short Call: Strike Price at $20.0

- Premium: $21.05

- Delta: 0.8376613651

- Gamma: 0.0051589501

- Vega: 9.6660053795

- Theta: -0.0152043637

- Rho: 10.5524339404

Requiring only a net capital outlay of $2.12, this long-term call spread achieves excellent leverage over future price appreciation with minimal risk. The high deltas on both options indicate a leverage ratio that is highly sensitive to favorable price movements.

By selecting spreads based on these critical dates and strike prices, you achieve robust profitability potential while strategically managing assignment risks, especially with the high deltas and Greek configurations.

Spread Option Strategy

The options chain data provided for GameStop Corp. (GME) offers an extensive view of available call and put options across various expiration dates and strike prices. For crafting the most profitable calendar spread strategy involving buying a call option and selling a put option while minimizing assignment risk, we must consider options that have favorable Greek values, profitability metrics, and optimal risk characteristics. Here's a detailed analysis of five top choices spanning near-term to long-term expiration dates:

1. Near-Term Option (Short-Term)

Call Option:

Strike Price: $9.0

Expiration Date: 2024-05-24

Premium: $8.9

ROI: 2.3347

Profit: $20.7784

Delta: 0.9999451059

Theta: -0.0008136045

Vega: 0.0

Rho: 0.197071902

Put Option:

Strike Price: $9.0

Expiration Date: 2024-05-24

Premium: $0.19

ROI: 100.0

Profit: $0.19

Delta: -0.0078591152

Theta: -0.0133601865

This near-term option combination features a call option with an extremely high delta and a strong ROI, coupled with a put option that has a minimal delta, which indicates a low probability of assignment. The high theta values on the put options reflect minimal risk despite the substantial premium on the call option.

2. Intermediate-Term Option

Call Option:

Strike Price: $13.0

Expiration Date: 2024-06-07

Premium: $21.14

ROI: 0.2147

Profit: $4.5384

Delta: 0.9998490484

Theta: -0.0012882809

Vega: 0.0

Rho: 0.781505661

Put Option:

Strike Price: $13.0

Expiration Date: 2024-06-07

Premium: $0.51

ROI: 100.0

Profit: $0.51

Delta: -0.032678538

Theta: -0.0473145188

This intermediate option shows a call at $13.00 with a high delta close to 1.0 indicating high sensitivity to the stock price. The short put option has favorable theta and vega values, signifying little risk of early exercise and moderate time decay.

3. Mid-Term Option

Call Option:

Strike Price: $11.0

Expiration Date: 2024-07-19

Premium: $26.49

ROI: 0.0449

Profit: $1.1884

Delta: 0.967291401

Theta: -0.019796066

Vega: 1.1475112528

Rho: 1.5927124805

Put Option:

Strike Price: $11.0

Expiration Date: 2024-07-19

Premium: $0.37

ROI: 100.0

Profit: $0.37

Delta: -0.0202126273

Theta: -0.0196153029

This mid-term strategy combines a call at $11.00 with a considerable delta and promising ROI. Simultaneously, the short put options low delta minimizes the likelihood of assignment, complemented by manageable theta decay.

4. Long-Term Option

Call Option:

Strike Price: $7.0

Expiration Date: 2025-01-17

Premium: $10.2

ROI: 2.1057

Profit: $21.4784

Delta: 0.9703425637

Theta: -0.0074486512

Vega: 1.997862786

Rho: 3.1112292735

Put Option:

Strike Price: $7.0

Expiration Date: 2025-01-17

Premium: $0.45

ROI: 100.0

Profit: $0.45

Delta: -0.0213402545

Theta: -0.0047694709

This long-term strategy exploits the $7.00 strikes inexpensive call option with a high delta for high profitability. The put option similarly features extremely low delta and theta values, which substantiate the low-risk profile.

5. Extra-Long-Term Option

Call Option:

Strike Price: $5.0

Expiration Date: 2025-06-20

Premium: $22.0

ROI: 0.5308

Profit: $11.6784

Delta: 0.9798086091

Theta: -0.0053422764

Vega: 1.7107128888

Rho: 1.5198266666

Put Option:

Strike Price: $5.0

Expiration Date: 2025-06-20

Premium: $0.45

ROI: 100.0

Profit: $0.45

Delta: -0.0125295102

Theta: -0.0019737746

For an extra-long-term strategy, buying a call at $5.00 leverages a high delta with impressive ROI. Again, the chosen short put carries minimal delta and theta values, supporting a very low risk of assignment even over an extended period.

In summary, each of these strategies provides a balanced approach by leveraging high delta call options to ensure strong profits while countering with very low delta, high ROI put options to minimize assignment risks and capitalizing on optimal theta values. This balanced strategy ensures profitability whilst maintaining a conservative approach against any unwanted share assignments.

Calendar Spread Option Strategy #1

When considering a calendar spread options strategy primarily involving the purchase of a put option at one expiration and the sale of a call option at another, the main objective is to benefit from the differences in time decay (theta) while mitigating risks such as early assignment of in-the-money options. We should also consider the "Greeks" to assess sensitivity to factors like volatility (vega), interest rates (rho), and price changes (delta).

Near-Term Choice:

Put Option (Buy): Strike $24, Expiration: 2024-05-24 - Greek Values: Delta:0.896, Gamma: 0.011630, Vega: 1.002, Theta: -0.198, Rho: 0.713 - Premium: $23.8, ROI: 42.08%, Profit: $10.02 - Analysis: Buying a put option at this expiration and strike gives you a significant downside protection with a relatively lower theta decay (-0.198), ensuring lesser value erosion over time.

Call Option (Sell): Strike $33, Expiration: 2024-05-24 - Greek Values: Delta: 0.763, Gamma: 0.015551, Vega: 1.761, Theta: -0.289, Rho: 0.643 - Premium: $22.92, ROI: 8.592%, Profit: $2.82 - Analysis: Selling this call option takes advantage of time decay (theta) to generate income. While delta risk is moderate, monitor this call closely to avoid early assignment if GME moves significantly upwards.

Medium-Term Choice:

Put Option (Buy): Strike $28, Expiration: 2024-05-31 - Greek Values: Delta: 0.803, Gamma: 0.01345, Vega: 1.537, Theta: -0.173, Rho: 0.954 - Premium: $13.71, ROI: 3.101%, Profit: $0.43 - Analysis: This put offers decent protection with manageable theta decay. The lower delta also indicates moderate sensitivity to price changes.

Call Option (Sell): Strike $40, Expiration: 2024-06-07 - Greek Values: Delta: 0.637, Gamma: 0.01872, Vega: 2.703, Theta: -0.352, Rho: 1.254 - Premium: $11.5, ROI: 100%, Profit: $11.5 - Analysis: Selling a call at this strike benefits from a high theta, capitalizing on time decay. Delta indicates a balanced risk of movement in terms of price sensitivity, and the high premium suggests the option is attractively priced.

Long-Term Choice:

Put Option (Buy): Strike $25, Expiration: 2024-07-19 - Greek Values: Delta: 0.922, Gamma: 0.005414, Vega: 2.352, Theta: -0.151, Rho: 0.892 - Premium: $14.0, ROI: 7.95%, Profit: $2.15 - Analysis: This long-term put offers significant downside protection with relatively modest theta decay, ensuring prolonged hedge against price drops.

Call Option (Sell): Strike $45, Expiration: 2024-07-19 - Greek Values: Delta: 0.784, Gamma: 0.00783, Vega: 6.289, Theta: -0.186, Rho: 1.225 - Premium: $13.45, ROI: 100%, Profit: $13.45 - Analysis: Selling a call at this strike leverages a high theta value and offers a high premium, generating income effectively. However, the position needs careful monitoring for price movements towards strike price.

Long-Term Choice with Extended Duration:

Put Option (Buy): Strike $30, Expiration: 2025-06-20 - Greek Values: Delta: 0.802, Gamma: 0.006178, Vega: 6.281, Theta: -0.419, Rho: 2.614 - Premium: $23.3, ROI: 6.234%, Profit: $1.45 - Analysis: This put provides excellent downside protection for an extended period with reasonable theta decay, ideal for a long-term bearish view or hedging.

Call Option (Sell): Strike $60, Expiration: 2025-01-17 - Greek Values: Delta: 0.615, Gamma: 0.00568, Vega: 5.891, Theta: -0.581, Rho: 4.17 - Premium: $31.5, ROI: 45.761%, Profit: $14.45 - Analysis: Selling this long-term call captures significant premiums with substantial theta decay, providing income over an extended period. Effectively balances risk due to moderate delta.

Ultra Long-Term Choice:

Put Option (Buy): Strike $35, Expiration: 2026-01-16 - Greek Values: Delta: 0.748, Gamma: 0.00711, Vega: 7.89, Theta: -0.421, Rho: 2.771 - Premium: $40.9, ROI: 87.164%, Profit: $36.2 - Analysis: This ultra-long-term put offers vast downside protection with good ROI, ideal for extended bearish outlook or massive hedging needs.

Call Option (Sell): Strike $70, Expiration: 2026-01-16 - Greek Values: Delta: 0.709, Gamma: 0.00811, Vega: 7.911, Theta: -0.612, Rho: 5.002 - Premium: $31.5, ROI: 100%, Profit: $31.5 - Analysis: Selling this call benefits significantly from theta decay over a long period while offering a substantial premium. It demands stringent monitoring due to delta risk associated with extreme price movements.