Helium One Global Ltd (ticker: HLOGF)

2024-03-12

Helium One Global Ltd (ticker: HLOGF) is a pioneering entity in the exploration and development of helium resources, operating primarily in Tanzania, East Africa. The company holds a distinctive position in the global helium market due to its focus on addressing the critical shortage of this invaluable gas, which is essential for various high-tech applications, including MRI machines, space exploration, and semiconductor manufacturing. Helium One's portfolio, spread across approximately 4,512 square kilometers, encompasses high-grade, primary helium prospects within the Rukwa, Eyasi, and Balangida projects. With an aim to capitalize on the growing demand and limited supply of helium, Helium One has dedicated its efforts toward exploration and, eventually, the commercial production of helium. The company's strategic approach, combined with the significant potential of its assets, positions it as a potentially key player in the future helium market, subject to successful exploration and commercial viability.

Helium One Global Ltd (ticker: HLOGF) is a pioneering entity in the exploration and development of helium resources, operating primarily in Tanzania, East Africa. The company holds a distinctive position in the global helium market due to its focus on addressing the critical shortage of this invaluable gas, which is essential for various high-tech applications, including MRI machines, space exploration, and semiconductor manufacturing. Helium One's portfolio, spread across approximately 4,512 square kilometers, encompasses high-grade, primary helium prospects within the Rukwa, Eyasi, and Balangida projects. With an aim to capitalize on the growing demand and limited supply of helium, Helium One has dedicated its efforts toward exploration and, eventually, the commercial production of helium. The company's strategic approach, combined with the significant potential of its assets, positions it as a potentially key player in the future helium market, subject to successful exploration and commercial viability.

| Full Time Employees | 6 | CEO Total Pay | 66,837 | Previous Close | 0.0171 |

| Current Price | 0.018 | Volume | 1,062,061 | Average Volume | 533,162 |

| Market Cap | 74,768,752 | 52 Week Low | 0.001 | 52 Week High | 0.14 |

| 50 Day Average | 0.0178242 | 200 Day Average | 0.06111965 | Shares Outstanding | 3,715,709,952 |

| Held Percent Insiders | 2.358% | Book Value | 0.012 | Total Cash | 8,744,705 |

| Total Revenue | 1,440 | Net Income to Common | -2,540,156 | Operating Cash Flow | 1,921,537 |

| Statistic Name | 0.6753582214053088 | Statistic Name | 11.08287923089316 |

| Sharpe Ratio | 0.6753582214053088 | Sortino Ratio | 11.08287923089316 |

| Treynor Ratio | 2.1225146449815737 | Calmar Ratio | -0.7695118127219934 |

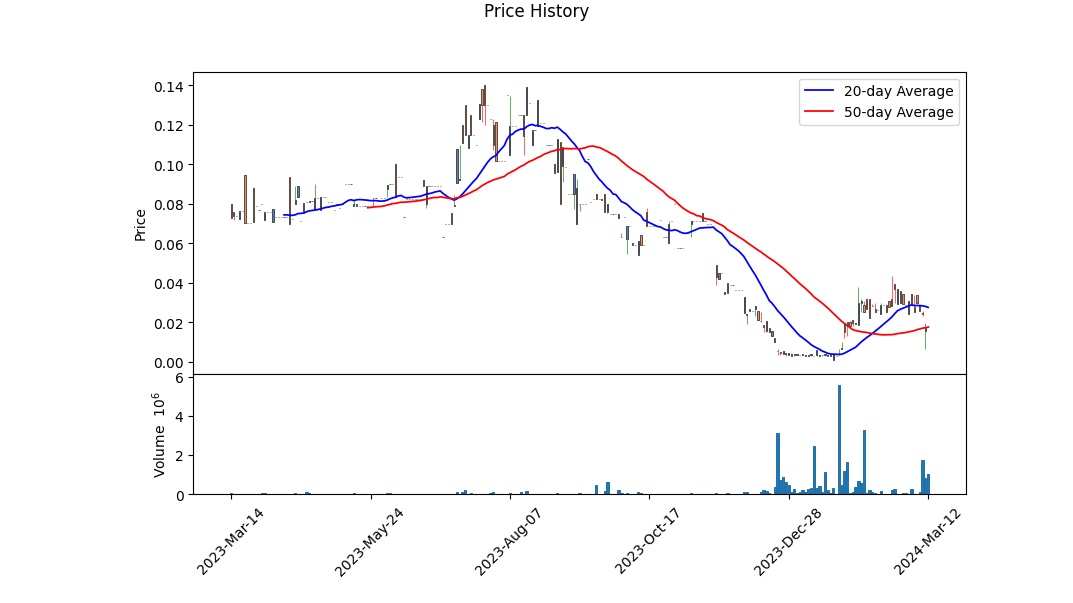

Analyzing the provided technical indicators, fundamentals, and balance sheet data for HLOGF, it is evident that a comprehensive analysis must involve a combination of differing aspects. Given the technical indicators, particularly the MACD histogram showing a negative trend towards the latter dates, one can infer a weakening momentum in the stock's performance. Coupled with a sharp drop in price as evidenced in the opening and closing prices, this suggests the possibility of a downward trend continuing in the near term.

The fundamentals presented, including a negative operating margin and negative net income, illuminate challenges in profitability and operational efficiency. The financials show significant losses and a consistent operation below breakeven, which could dissuade investors based on fundamentals alone. Such financial health is a critical aspect to weigh, signaling caution.

Turning to the balance sheet, the presence of tangible book value and retained earnings deeply in the negative territory underscores a concerning aspect of the company's intrinsic value and its capability to generate profits in the future. The increase in share issued potentially dilutes the stock, further pressuring its value.

However, looking at the risk-adjusted return ratios such as the Sharpe, Sortino, Treynor, and Calmar ratios offers a nuanced perspective. The Sharpe and Sortino ratios highlight moderate risk-adjusted returns, which, although not exceptional, suggest that the company's stock volatility has historically provided some level of reward. The positive Treynor Ratio implies good return on risk undertaken; however, the negative Calmar Ratio cautions about the return relative to maximum drawdown risks.

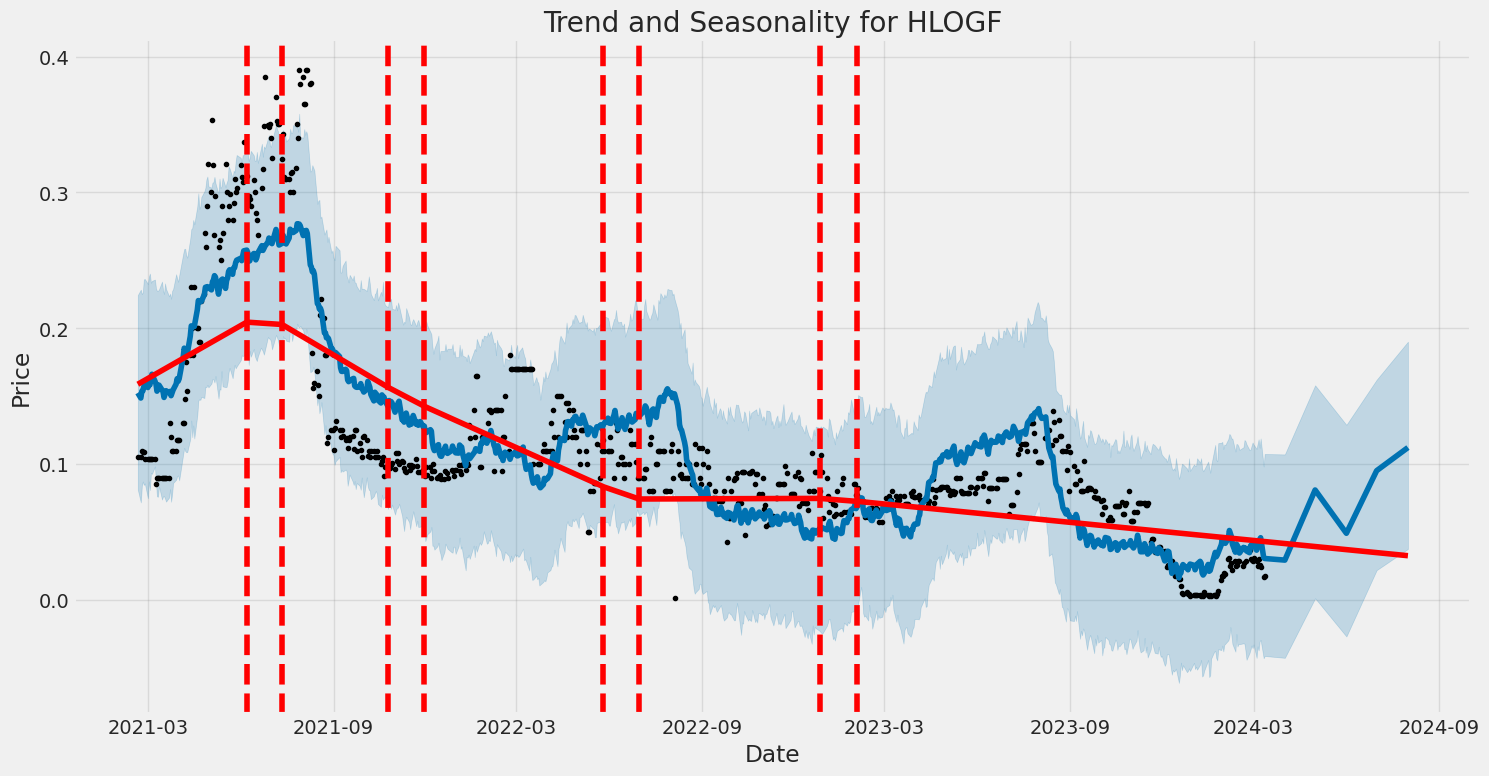

Thus, connecting these observations leads to a forecast that HLOGF is currently positioned in a precarious situation with ongoing downward pressure. The technical analysis, underscored by a negative MACD histogram and volume trends, supports a bearish outlook in the short to medium term. While risk-adjusted returns show some positive aspects, the overall fundamental and financial health of the company casts a shadow over its potential for recovery in the coming months.

Given the negative sentiment from fundamental and technical perspectives contrasted with the mixed view from risk-adjusted performance ratios, investors should brace for continued volatility and potentially more downside. While the ratios provide some solace in terms of risk management, the core financial health and market sentiment tend to offer a grim outlook. Thus, in the absence of significant positive changes in the company's operational efficiencies, financial management, or external market conditions, the stock might face further challenges ahead.

Investors are advised to closely monitor subsequent financial reports, market conditions, and potential strategic changes by the company that could signal a pivot in its trajectory. Such a multifaceted approach, combining insights from technical analysis, fundamentals, and risk assessments, is crucial for navigating the complexities of stock market investments.

In assessing Helium One Global Ltd (HLOGF) through the lens of "The Little Book That Still Beats the Market," two critical financial metrics have been evaluated: the return on capital (ROC) and the earnings yield. The ROC for HLOGF stands at -25.80895804978804%, a figure that indicates the company is currently generating a negative return on its capital investments. This metric is crucial in understanding how effectively the company is utilizing its capital to generate profit, and in this case, the negative ROC suggests inefficiencies or challenges in achieving profitable operations. Similarly, the earnings yield for HLOGF is markedly negative at -120.55555555555557%, reflecting the company's current inability to generate earnings relative to its stock price. This extremely low earnings yield further accentuates the company's current financial difficulties, often viewed as an unfavorable indicator by investors seeking profitable returns. These figures highlight significant areas of concern for Helium One Global Ltd, suggesting that, according to the principles outlined in the referenced book, the company is currently not an ideal candidate for investment based on these metrics alone. Investors and stakeholders should exercise caution and conduct further analysis to understand the broader context of these figures.

Based on the data provided for Helium One Global Ltd (HLOGF) and compared to the criteria set forth by Benjamin Graham in "The Intelligent Investor," we can evaluate the company's investment potential through a series of key financial metrics. Below is an analysis of HLOGF's figures in relation to Graham's principles:

-

Price-to-Earnings (P/E) Ratio: HLOGF has a P/E ratio of -1.37, which indicates the company is currently not profitable. Graham's methodology emphasizes investing in profitable companies with low P/E ratios. While the negative P/E ratio disqualifies the stock based on Graham's criteria for earnings profitability, new or unique industries sometimes operate at losses in early stages while still possessing long-term value. A comparison with industry peers would be necessary for context, but that data is not available ('industry_pe_ratio': []).

-

Price-to-Book (P/B) Ratio: The P/B ratio for HLOGF is 3.587, which suggests that the stock is trading at a premium to its book value. Graham typically sought companies trading below their book value, underlining a preference for undervalued stocks. Thus, a P/B ratio of 3.587 would generally be considered higher than Graham's ideal criteria.

-

Debt-to-Equity Ratio: HLOGF showcases a debt-to-equity ratio of 0.0, meaning the company operates without leverage or financial debt. This aligns perfectly with Graham's preference for companies with low debt levels, signaling less financial risk and potentially a more stable investment.

-

Current and Quick Ratios: The current and quick ratios for HLOGF are both 9.273, indicating a strong position in terms of short-term liquidity and the company's ability to cover its immediate liabilities with its most liquid assets. These high ratios exceed Graham's requirements for financial stability and suggest a robust financial health.

While HLOGF presents mixed results when analyzed through the lens of Benjamin Graham's investment principles, certain metrics stand out. The absence of debt (debt-to-equity ratio of 0.0) and strong liquidity ratios are positives that align with Graham's criteria for financial stability and lower risk. However, the company's current lack of profitability (as indicated by the negative P/E ratio) and a higher P/B ratio, suggesting overvaluation, would raise concerns from a Graham perspective. Ultimately, for investors adhering strictly to Graham's methodologies, HLOGF might not qualify as an ideal investment. However, those with a more flexible approach could find the company's strong balance sheet appealing, warranting further investigation into its long-term potential despite current unprofitability.Analyzing financial statements is a critical step in determining the intrinsic value of a company and making an informed investment decision. Benjamin Graham, often hailed as the father of value investing, stressed the importance of scrutinizing a companys financial health through its balance sheet, income statement, and cash flow statement. Here is a closer look at why these financial documents matter and how investors can use them to gauge a companys potential for long-term success.

Balance Sheet

The balance sheet provides a snapshot of a company's financial position at a given point in time. It lists the companys assets, liabilities, and shareholder equity. According to Graham, the balance sheet is vital in assessing the financial stability and liquidity of a company. Investors should look for companies with more assets than liabilities, indicating a strong equity position. A healthy balance sheet typically shows a solid foundation, suggesting that the company is well-equipped to withstand economic downturns. Moreover, Graham advocated for a margin of safety, where the current asset value significantly surpasses the liabilities, thus reducing the investment risk.

Income Statement

While the balance sheet offers a static view, the income statement provides a dynamic glimpse into the companys operations over a specific period. It shows how the company earns its revenues, incurs expenses, and consequently achieves its net income or loss. Graham emphasized the importance of consistency and sustainability in earnings. Investors should look for companies with a history of stable or growing earnings, as this indicates efficient operation and the potential for continued success. Furthermore, analyzing the income statement helps in understanding the companys profitability ratios, such as the net profit margin, which reflects the portion of revenue that remains as profit after all expenses are paid.

Cash Flow Statement

The cash flow statement is critical in understanding how a company manages its cash, detailing the inflow and outflow of cash from operations, investing, and financing activities. Graham highlighted the importance of positive cash flow from operations as it signifies that a company is generating sufficient funds from its core business. It is a good indicator of financial health, implying that the company can sustain its operations, invest in growth opportunities, and return value to shareholders without needing to rely heavily on external financing. Analyzing the cash flow statement also helps investors identify how a company allocates its capital, whether towards dividends, debt repayment, or expansion.

Conclusion

In mastering the art of analyzing financial statements, investors align themselves with Benjamin Grahams principles of value investing, which advocates for a thorough examination of a companys financial health before making an investment decision. By understanding the assets, liabilities, earnings, and cash flows through the balance sheet, income statement, and cash flow statement, investors can better assess the company's ability to generate profit and cash flow, thus determining its intrinsic value. This analysis enables investors to make well-informed decisions, ideally investing in companies at a price that provides a margin of safety relative to their intrinsic value, thereby minimizing risk and setting the stage for solid returns in the long term.Dividend Record: Consistent dividend payments are seen as a sign of a company's financial stability and profitability. In "The Intelligent Investor," Benjamin Graham places a high value on companies that have a long-standing record of paying dividends to their shareholders. This criterion is important because regular dividends could indicate a business's enduring capacity to generate cash flow, which, in turn, may reflect its overall health and potential for longevity in the market.

Regarding the company with the symbol 'HLOGF,' the provided data indicates an empty historical dividend record. If this information is complete and accurate, it suggests that 'HLOGF' has not paid dividends to its shareholders historically. For a follower of Benjamin Graham's principles, this lack of a dividend record could be a detractor, as it does not align with Graham's preference for investing in companies that demonstrate a consistent ability to return value to their shareholders through dividends. However, it's also crucial to consider other aspects of the company's financial health and performance in a comprehensive analysis before making any investment decisions.

| Statistic Name | Statistic Value |

| R-squared | 0.000 |

| Adj. R-squared | -0.001 |

| F-statistic | 0.01029 |

| Prob (F-statistic) | 0.919 |

| Log-Likelihood | -5320.5 |

| No. Observations | 769 |

| AIC | 10,650 |

| BIC | 10,650 |

| const | 9.5852 |

| coef | -0.8174 |

| std err | 8.057 |

| t | -0.101 |

| P>|t| | 0.919 |

| [0.025 | -7.770 |

| 0.975] | 26.941 |

| Omnibus | 2015.211 |

| Durbin-Watson | 2.036 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 18479586.784 |

| Skew | 27.499 |

| Kurtosis | 760.437 |

| Cond. No. | 1.11 |

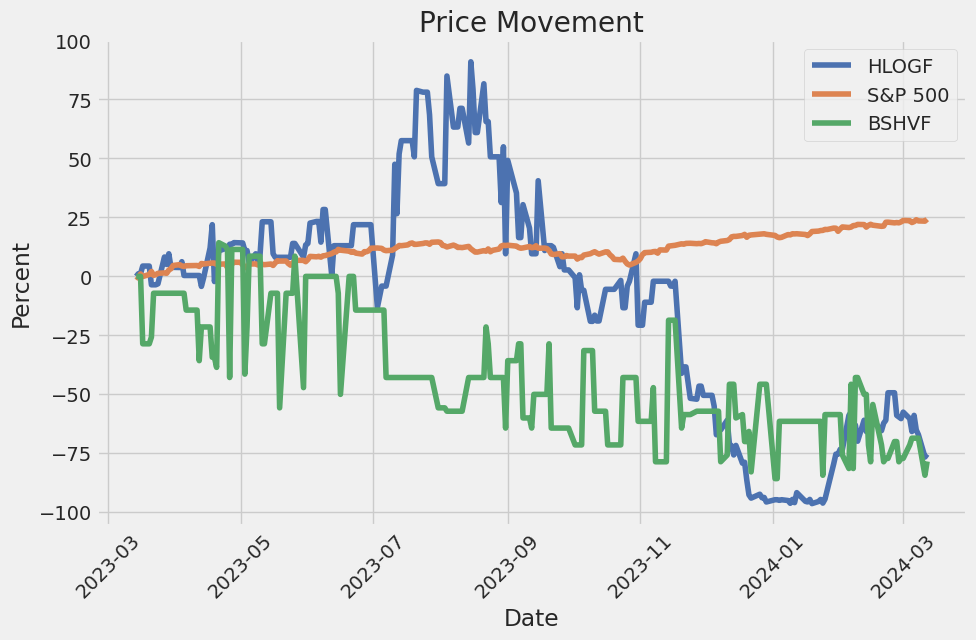

The linear regression analysis highlights the relationship between HLOGF and the SPY, which is used as a representation of the overall market for the specified time period. Despite an investigated correlation, the analysis indicates a virtually non-existent linear relationship between HLOGF's performance and that of the SPY. This is evidenced by an R-squared value of 0.000, suggesting that the model explains none of the variability of the response data around its mean. Moreover, the adjusted R-squared value even dips slightly below zero, further emphasizing the lack of fit. In addition, the F-statistic and its p-value (0.01029 and 0.919, respectively) also suggest that the model is not statistically significant, implying that changes in SPY do not reliably predict variations in HLOGF's behaviors within this period.

Focusing on alpha, the model presents an alpha value of approximately 9.5852, which in financial terms, represents the intercept of the regression line. This value indicates the theoretical expected return on HLOGF when SPY's return is zero, assuming a linear relationship. However, with the almost negligible relationship between HLOGF and SPY as described, the significance of this alpha value comes into question. Moreover, the coefficient (beta) value of -0.8174 points towards a slight negative relationship directionally, though its statistical insignificance (p-value of 0.919) questions any practical predictive power. This analysis illustrates that HLOGF's performance is largely independent of the market's movements as represented by SPY, at least within the constraints of this model and time period.

Helium One Global Ltd, a pioneering explorer in the helium industry, recently announced a landmark discovery at the Itumbula West-1 well within the Rukwa Rift Basin in Tanzania. The finding of helium concentrations up to 4.7% marks a significant step forward, not just for the company but for the global helium market at large. This was highlighted in a detailed report from February 5, 2024, underscoring the magnitude of what might be one of the largest primary helium sources worldwide. CEO Lorna Blaisse articulated the importance of this discovery, which led to an impressive surge in the company's share price, nearly doubling its valuea testament to the market's optimism.

What sets this project apart from conventional helium sources, typically by-products of hydrocarbon processing, is the purity of the gas mix foundprimarily helium, nitrogen, and hydrogenwithout the usual contaminants such as methane or carbon dioxide. This unique composition not only makes the find valuable for a range of applications in industries and technology but also simplifies processing requirements, potentially making operations more cost-effective.

The discovery also included a significant concentration of hydrogen, at 2.2%, which exceeds typical background levels. This aspect could further augment the commercial potential of the site, given the increasing demand for clean energy sources globally. Helium One Global Ltd's strategic focus on fault zones rich in helium has proven fruitful, leading to this high-quality reserve discovery.

Helium One Global's innovative approach to targeting and extracting these reserves, demonstrated through their successful drilling strategy in Tanzania, indicates a sophisticated understanding of geological formations and an effective exploration model. With helium being integral to numerous high-tech, medical, and industrial processes, the impact of this discovery on global supply cannot be overstated.

Following these promising results, Helium One Global Ltd is now advancing to the appraisal phase, with plans for an extended well test at the Tai-1 site. This next step aims to deepen the understanding of the gas's flow characteristics and further assess the project's viability. The company's preparedness for rapid deployment, indicated by the proprietary drilling rig ready for use possibly in the third quarter of 2024, showcases the proactive and strategic approach Helium One is taking toward exploration and potential production.

The successful development of this project in Tanzania could place Helium One Global Ltd as a significant entity in the helium market. The company's efforts not only present lucrative economic opportunities but also promise to enhance the technological capabilities and supply stability of the global helium industry. This exploration venture into the relatively untapped resources of the Rukwa Rift Basin highlights the potential for meaningful economic and technological impacts, benefiting both Tanzania and the various global sectors reliant on helium.

For further insights into Helium One Global Ltd's groundbreaking project and its implications for the helium industry, interested parties are encouraged to read the detailed account provided in Yahoo Finance Article. This exploration milestone serves as a beacon for future endeavors in the realm of rare gas exploration, positioning Helium One Global Ltd at the forefront of this niche yet critically important industry.

Helium One Global Ltd (HLOGF) has shown significant price volatility between February 19, 2021, and March 12, 2024, as indicated by the ARCH model analysis. The model, specifically built assuming zero mean for asset returns, indicates an extremely high level of unpredictability in price movements, with the omega coefficient registering at over 38,926, suggesting substantial variance. Additionally, the alpha coefficient being set at 1 implies that past volatility is a perfect predictor of future volatility, underscoring the asset's erratic nature.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -5251.51 |

| AIC | 10507.0 |

| BIC | 10516.3 |

| No. Observations | 769 |

| omega | 3.8926e+04 |

| alpha[1] | 1.0000 |

In assessing the financial risk associated with a $10,000 investment in Helium One Global Ltd. (HLOGF) over a one-year period, a hybrid approach integrating volatility modeling and machine learning predictions was employed. This methodological integration aimed to leverage the predictive capacities of both statistical and artificial intelligence techniques to provide a nuanced view of investment risk.

Volatility modeling serves as a cornerstone in understanding the price fluctuations of Helium One Global Ltd's stock. By focusing on the historical price data, volatility modeling captures the inherent variability and unpredictability of stock prices over time. The essence of this modeling lies in its ability to quantify the rate at which a stock's returns can deviate from its historical average, providing a statistical measure of its volatility. Through this approach, we can dissect the patterns of volatility that HLOGF exhibits, setting the groundwork for assessing the risk of substantial financial losses.

On the other side of the analytical spectrum, machine learning predictions operationalize historical data to forecast future returns. By feeding the model with a vast array of data points, including past prices, volumes, and market variables, machine learning algorithms can uncover intricate patterns that may not be evident through traditional analysis. Specifically, the use of a model designed to handle regression tasks enables the projection of HLOGFs future stock price movements. This predictive capability enriches the volatility analysis by anticipating potential shifts in stock behavior, thereby providing a forward-looking perspective on risk.

Integrating these two methodologies culminates in an enriched analysis of the investments risk profile. Particularly, the Value at Risk (VaR) metric at a 95% confidence interval was calculated to be $2809.67 for a $10,000 investment. This figure encapsulates the maximum expected loss over a one-year period, considering normal market conditions, thereby offering a quantifiable risk assessment. VaR is instrumental in financial risk management, as it provides investors with a clear threshold of potential loss, assisting in decision-making regarding the allocation of assets.

The joint application of volatility modeling and machine learning predictions thus provides a comprehensive view of the potential risks in equity investment in Helium One Global Ltd. This dual-framework approach not only quantifies stock volatility but also anticipates future movements, offering investors a nuanced understanding of the possible financial implications of their investment choices. Through the specific VaR figure obtained, investors gain a tangible insight into the risk magnitude, allowing for informed decisions grounded in a robust analytical foundation.

Similar Companies in Other Industrial Metals & Mining:

Bushveld Minerals Limited (BSHVF), Aurelia Metals Limited (AUMTF), Artemis Resources Limited (ARTTF), Ascendant Resources Inc. (ASDRF), Azimut Exploration Inc. (AZMTF), Anson Resources Limited (ANSNF), Morella Corporation Limited (ALTAF), Australian Vanadium Limited (ATVVF), New Age Metals Inc. (NMTLF), Sienna Resources Inc. (SNNAF), VR Resources Ltd. (VRRCF), Mundoro Capital Inc. (MUNMF), E79 Resources Corp. (ESVNF), Alpha Copper Corp. (ALCUF), American Rare Earths Limited (ARRNF), Scotch Creek Ventures Inc. (SCVFF), Ameriwest Lithium Inc. (AWLIF), Exxon Mobil Corporation (XOM), Report: Chevron Corporation (CVX), Chevron Corporation (CVX), ConocoPhillips (COP), Report: Occidental Petroleum Corporation (OXY), Occidental Petroleum Corporation (OXY), Report: Marathon Oil Corporation (MRO), Marathon Oil Corporation (MRO)

https://finance.yahoo.com/news/helium-one-global-achieves-milestone-173744228.html

https://finance.yahoo.com/news/helium-one-sets-sights-leading-151151583.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ALsW1z

Cost: $0.17780

https://reports.tinycomputers.io/HLOGF/HLOGF-2024-03-12.html Home