Occidental Petroleum Corporation (ticker: OXY)

2024-02-08

Occidental Petroleum Corporation, trading under the ticker symbol OXY, is a prominent American company engaged in the exploration and production of oil and natural gas. With a strong operational focus in the United States, particularly in the Permian Basin, OXY has positioned itself as a leader in the hydrocarbon sector. The company's diversified portfolio extends beyond conventional exploration and production to encompass chemical manufacturing through its subsidiary, OxyChem. Additionally, Occidental has been proactive in addressing environmental concerns, embarking on various carbon capture and reduction initiatives to mitigate the climate impact of its operations. Financially, OXY has demonstrated resilience and strategic growth, leveraging acquisitions and partnerships to enhance its market position. Though affected by global oil price fluctuations, Occidental's forward-looking investments in technology and sustainability aim to secure its competitive edge in the energy industry's evolving landscape.

Occidental Petroleum Corporation, trading under the ticker symbol OXY, is a prominent American company engaged in the exploration and production of oil and natural gas. With a strong operational focus in the United States, particularly in the Permian Basin, OXY has positioned itself as a leader in the hydrocarbon sector. The company's diversified portfolio extends beyond conventional exploration and production to encompass chemical manufacturing through its subsidiary, OxyChem. Additionally, Occidental has been proactive in addressing environmental concerns, embarking on various carbon capture and reduction initiatives to mitigate the climate impact of its operations. Financially, OXY has demonstrated resilience and strategic growth, leveraging acquisitions and partnerships to enhance its market position. Though affected by global oil price fluctuations, Occidental's forward-looking investments in technology and sustainability aim to secure its competitive edge in the energy industry's evolving landscape.

| City | Houston | State | TX | Country | United States |

| Industry | Oil & Gas E&P | Sector | Energy | Full Time Employees | 11,973 |

| Dividend Rate | 0.72 | Dividend Yield | 0.0125 | Payout Ratio | 0.146 |

| Five Year Avg Dividend Yield | 4.68 | Beta | 1.654 | Trailing PE | 12.65 |

| Forward PE | 14.27 | Market Cap | 50,965,516,288 | Volume | 4,942,588 |

| Profit Margins | 0.18513 | Net Income To Common | 4,447,000,064 | Trailing EPS | 4.59 |

| Forward EPS | 4.07 | Total Cash | 611,000,000 | Total Debt | 20,710,000,640 |

| Total Revenue | 29,304,000,512 | EBITDA | 14,151,000,064 | Operating Cash Flow | 13,043,999,744 |

| Free Cash Flow | 4,830,125,056 | Return On Assets | 0.06086 | Return On Equity | 0.18697 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | -0.3089667216942268 | Sortino Ratio | -5.030355982343161 |

| Treynor Ratio | -0.12588753222808544 | Calmar Ratio | -0.4106761508720634 |

Analyzing Occidental Petroleum Corporation (OXY) using a blend of technical analysis, fundamental analysis, and an overview of balance sheet data reveals a comprehensive picture for its prospective stock price movement.

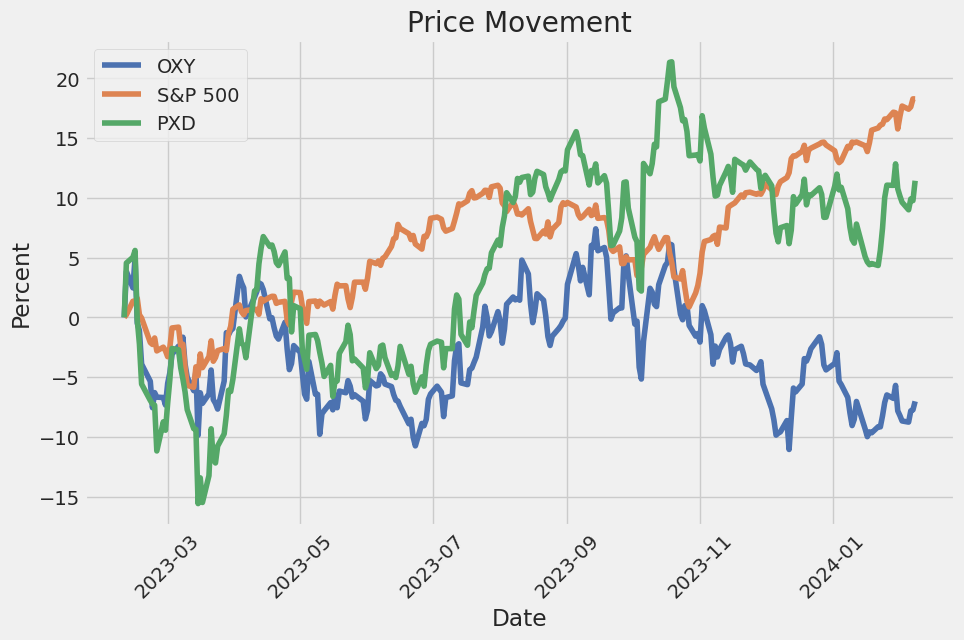

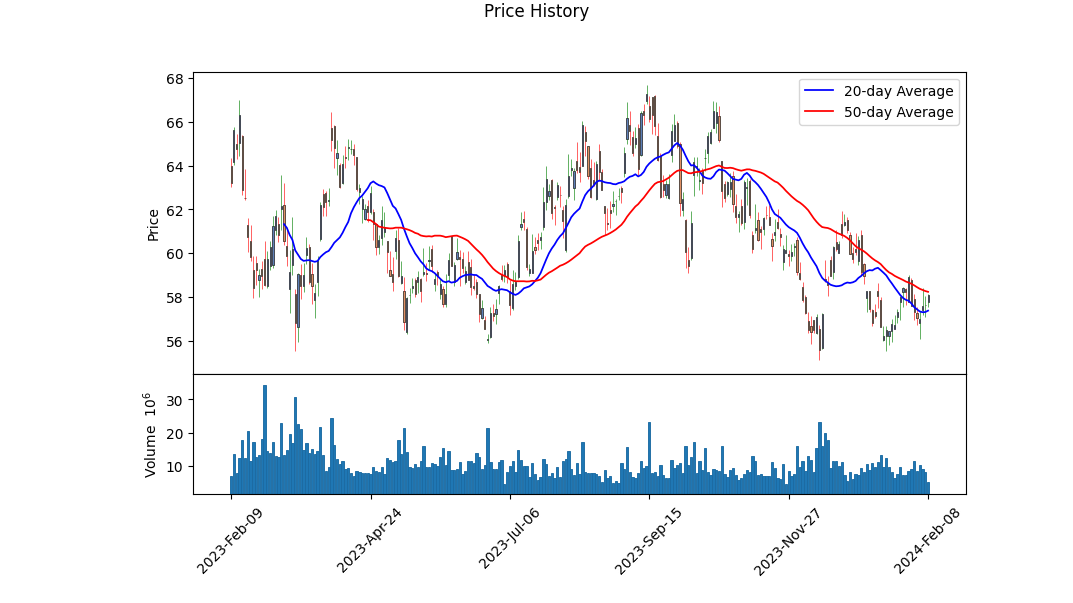

Technical indicators for OXY show a varied pattern leading up to February 8th, 2024, with prices showing a downtrend from highs of around 65.69 to lows of 58.13. The On-Balance Volume (OBV) indicator shows a decreasing trend from 3.35 million to -7.79 million, highlighting a strong selling pressure and volume outflow. The presence of the MACD histogram emerging towards the end lines indicates the possibility of a trend reversal or weakening of the current trend near the last observed date.

From a fundamental perspective, OXY demonstrates robust margins, with gross margins at 0.61841 and EBITDA margins at 0.4829, indicating efficient operations and profitability. However, the absence of a trailing Peg Ratio and the company's address in Houston, TX, though marginally impactful in isolation, contribute to the broader context within which the company operates.

The risk-adjusted return metrics, including Sharpe, Sortino, Treynor, and Calmar ratios, depict a less favorable view. The negative Sharpe Ratio of -0.3089667216942268 suggests a less desirable risk-adjusted return, and the extremely negative Sortino Ratio of -5.030355982343161 further amplifies concerns over negative returns in downward market movements. The negative Treynor and Calmar Ratios echo similar sentiments, indicating the stock has provided poor return per unit of risk and a disappointing return for the maximum drawdown experienced, respectively.

The financial and balance sheet analysis shows a mix of strengths and potential concerns. The reported increase in Free Cash Flow to 12.46 billion, as of December 31, 2022, demonstrates strong operational efficiency and cash generation. However, the significant levels of Net Debt, totaling 18.16 billion, highlight leverage and the need for careful debt management. Revenue and EBITDA growth underscore healthy business momentum, but the sector and broader economic context will dictate future profitability levels.

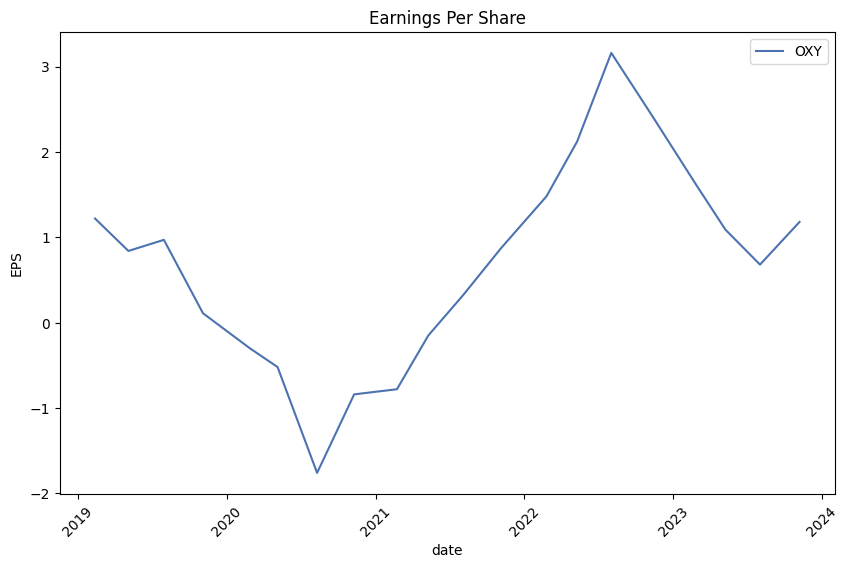

Analyst expectations, with an average EPS estimate of 4.07 for the next year, alongside a revenue estimate indicating a 7.4% sales growth, infer a cautiously optimistic outlook. Growth estimates present a mixed future, with a significant expected contraction in the current year's performance but an anticipated improvement next year.

The Altman Z-Score of 1.8018015821375875, positioned within the 'grey' zone, suggests OXY is not without financial distress risk, while a Piotroski Score of 7 points towards strong financial health in operational terms.

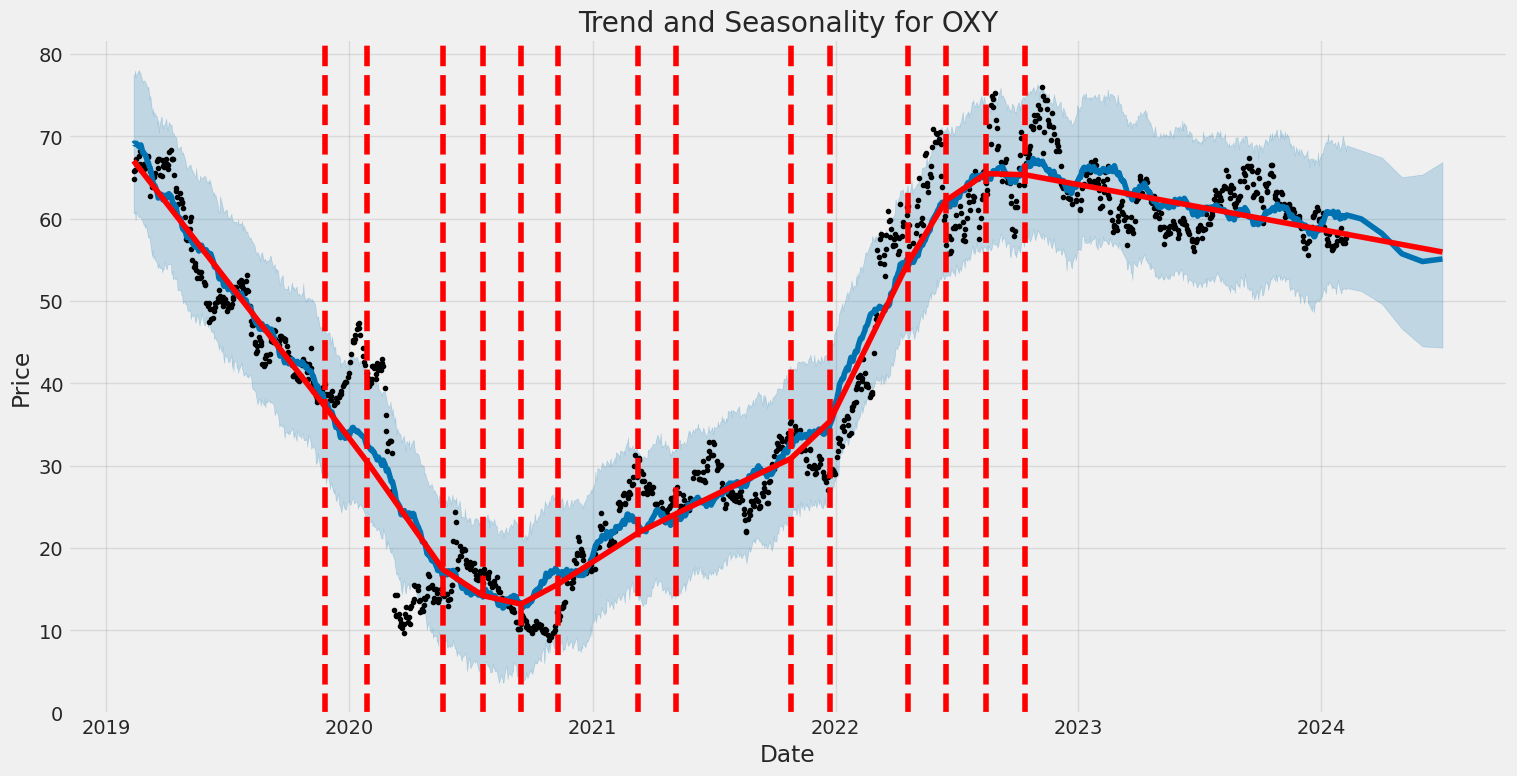

Considering these factors, OXY's stock price movement in the next few months is poised for volatility, marked by possible short-term recoveries but overshadowed by underlying pressures from market dynamics, high debt levels, and mixed growth prospects. Investors should exercise caution, keeping an eye on evolving market conditions, technical reversal patterns, and the company's adherence to strategic financial management. The critical period will be observing how the company maneuvers through its debt obligations and capitalizes on operational efficiencies to sustain growth and profitability in an uncertain market environment.

In our analysis of Occidental Petroleum Corporation (OXY) through the lens of the investment principles outlined in "The Little Book That Still Beats the Market," two key metrics stood out: the Return on Capital (ROC) and the Earnings Yield. The ROC for Occidental Petroleum came in at an impressive 22.53%. This figure is particularly indicative of the company's efficiency in utilizing its capital to generate profits, a testament to its operational excellence and strategic investment decisions. Such a high ROC suggests that OXY is not only generating returns well above average but is doing so in a way that is sustainable and indicative of a strong competitive position within its industry.

Furthermore, the Earnings Yield for Occidental Petroleum was calculated at 23.10%, a metric that provides significant insight into the valuation and potential attractiveness of the company's stock. An earnings yield at this level is remarkably high, suggesting that OXY's shares might be undervalued relative to the earnings the company is generating. This is a key indicator for investors, suggesting that the company could provide a favorable return on investment, especially when compared to alternative investments in the market or even to the risk-free rate. Together, these metrics underscore Occidental Petroleum's solid financial health and its potential as a lucrative investment opportunity, as evaluated through the strategic framework provided by "The Little Book That Still Beats the Market."

Based on the data calculated for Occidental Petroleum Corporation (OXY), let's analyze how the company stands against Benjamin Graham's criteria for stock selection and investment.

Margin of Safety: Unfortunately, we don't have a direct measure of the margin of safety from the metrics provided. However, this concept usually involves more nuanced calculation including the intrinsic value, which is not directly represented by the figures shown. Yet, the very high P/E ratio may indicate a low margin of safety according to Graham's philosophy, as the stock may be priced significantly higher compared to its earnings, leaving less room for error or market volatility.

Debt-to-Equity Ratio: The debt-to-equity ratio of 0.690 suggests that OXY has a moderate level of debt compared to its equity. According to Graham's principles, this would be acceptable, as it's below 1, indicating that the company doesn't rely excessively on debt to finance its operations. This implies a lower financial risk, which aligns with Graham's preference for companies with low debt-to-equity ratios.

Current and Quick Ratios: Both the current ratio and quick ratio for OXY are 1.145, showing that the company has slightly more short-term assets than its short-term liabilities. This indicates a reasonable level of financial stability, as the company appears able to cover its short-term obligations. According to Graham's criteria, this is a positive sign, even though more conservative investors might look for higher ratios to ensure greater liquidity.

Earnings Growth: Without specific data on earnings growth over the years, it's hard to assess OXY's performance against Graham's requirement for consistent earnings growth. Investors would need to examine OXYs historical earnings to make an informed judgment on this criterion.

Price-to-Earnings (P/E) Ratio: OXY's P/E ratio of 580.488 is extraordinarily high, especially in comparison to an industry P/E ratio of approximately 9.1. Graham typically sought stocks with low P/E ratios, indicating that OXY might be significantly overvalued according to Graham's philosophy. This high P/E ratio suggests that the market has high expectations for OXY's future growth, which could potentially lead to greater volatility or downside risk.

Price-to-Book (P/B) Ratio: With a P/B ratio of about 0.702, OXY is trading below its book value, which would typically be attractive to a value investor like Graham. Stocks trading below their book value can indicate that they are undervalued, offering a potentially attractive buying opportunity, assuming all other fundamentals are sound.

Conclusion:

While Occidental Petroleum Corporation appears to meet Graham's criteria in terms of its debt-to-equity ratio and its P/B ratio, indicating low financial risk and potentially being undervalued compared to its book value, the extremely high P/E ratio raises concerns. This high P/E ratio suggests that the stock might not have the margin of safety Graham deemed essential, positioning it as potentially overvalued and risky for conservative, value-focused investors. Additionally, without direct data on earnings growth and considering the liquidity measures are just adequate, investors following Grahams principles may exercise caution with OXY, precisely because of the valuation concerns highlighted by the P/E ratio. Further in-depth analysis, especially of earnings growth and intrinsic value calculations, would be necessary to make a more comprehensive assessment following Graham's approach.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

Key Financial Highlights of Occidental Petroleum Corporation (OXY) as per the Latest Reports

Balance Sheet Analysis:

- Cash and Cash Equivalents: Showed a notable increase from $2,764,000,000 at the end of FY 2021 to $4,569,000,000 by Q2 2021, indicating a strong liquidity position. However, there was a reduction to $2,059,000,000 by Q3 2021.

- Total Assets: Increased from $75,036,000,000 at the end of FY 2021 to $79,937,000,000 by Q2 2021, but slightly decreased to $75,758,000,000 by Q3 2021.

- Long-term Debt: The long-term debt is still significant, with a slight decrease from $29,431,000,000 (FY 2021) to $28,746,000,000 by Q2 2021, and then to $27,435,000,000 by Q3 2021.

- Total Equity: Increased gradually from $20,327,000,000 in FY 2021 to $18,244,000,000 by Q2 2021, demonstrating a decrease in shareholder's equity, before slightly recovering to $18,873,000,000 by Q3 2021.

Income Statement Analysis:

- Revenues: There has been significant volatility with revenues at $25,956,000,000 in FY 2021 before decreasing to $11,251,000,000 by Q2 2021, but then increasing to $18,043,000,000 by Q3 2021.

- Net Income/Loss: FY 2021 concluded with a profit of $2,322,000,000, but the trend shifted to a loss of $443,000,000 in Q2 2021 and further slightly improved to a profit of $785,000,000 by Q3 2021.

- Earnings Per Share (EPS): There was a notable swing from an EPS of 1.58 in FY 2021 to -0.47 in Q2 2021, then marginally improving to 0.19 by Q3 2021.

Cash Flow Analysis:

- Net Cash Provided by Operating Activities: Showed a gradual increase from $10,434,000,000 in FY 2021 to $4,224,000,000 by Q2 2021, before slightly reducing to $7,342,000,000 by Q3 2021.

- Investment Activities: FY 2021 saw a net cash used in investing activities of $1,253,000,000, which increased to $1,036,000,000 by Q2 2021, and slightly improved to spending only $1,202,000,000 by Q3 2021.

- Financing Activities: FY 2021 had a significant net cash used in financing activities of $8,572,000,000, reducing to $616,000,000 by Q2 2021, and then expanding to $6,040,000,000 by Q3 2021.

Commentary:

Occidental Petroleum Corporation demonstrated liquidity strength early in 2021 with an increase in cash and cash equivalents, but observed a notable decline as the year progressed into Q3. While operating cash flows remain strong, financing activities indicate ongoing debt management and restructuring efforts. The fluctuating net income figures suggest a volatile market environment, impacting earnings. Despite the prevalent challenges, recovery signs in Q3 revenue and EPS point towards resilience. It is essential to closely monitor long-term debt levels and equity changes for a comprehensive understanding of financial health.

Recommendations:

- Debt Management: Continue to focus on reducing long-term debt to enhance financial stability.

- Operational Efficiency: Enhance operational efficiency to improve profit margins, particularly focusing on cost management.

- Strategic Investments: Focus on strategic investments to stimulate growth in revenue, especially in more sustainable energy sectors to future-proof the business.

Note: The financial figures are represented in USD.Based on the provided historical data for the symbol 'OXY', it illustrates a comprehensive dividend record, showcasing the company's dividend payout history. From this data, several key observations about the dividend payments can be made which align with principles favored by Benjamin Graham:

-

Consistency: The data reflects a clear pattern of regular dividend payments, showing a commitment to returning value to shareholders. Regular dividend payouts, for Benjamin Graham, signify a company's stable and reliable earnings, which is a positive attribute for long-term investments.

-

Adjustments over Time: There are variations in the amount of dividends paid over time. This could indicate adjustments based on the company's profitability and cash flow, which is a common practice to maintain financial health and sustainability. Benjamin Graham appreciated companies that managed their financial resources wisely, ensuring their capability to pay dividends consistently.

-

Recent Increase in Dividend Payments: A notable observation is the increase in dividend payments from $0.01 in 2020 to $0.18 by 2023. This demonstrates the company's improving financial performance and/or confidence in its future earnings capacity. For Graham, such an upward trend could be an indicator of a company's growing business and operational efficiency, provided it's not compromising its financial stability for the sake of higher dividends.

-

Adaptability during Hard Times: The record indicates a substantial decrease in dividends at certain periods, notably in the transition from 2019 to 2020, where dividends dropped from $0.79 to $0.01. These adjustments reflect the company's adaptability in response to possibly challenging economic conditions or internal financial constraints. Benjamin Graham would consider the ability to sustain dividends, even at a reduced rate, as an indication of a resilient and strategically managed company.

-

Periodic Evaluations: Each dividend payment comes after a declaration date, showing that the company periodically evaluates its capacity to distribute profits back to shareholders. This prudent approach is in line with Graham's principles, where financial decisions should be made based on thorough analysis and ensuring the company's long-term sustainability.

In summary, the dividend record for 'OXY' showcases a pattern of consistent dividend payments with adjustments reflecting the companys operational and financial status over time. Such a record would likely appeal to investors who, following Benjamin Graham's investing philosophy, value company stability, consistent return on investment, and prudent financial management.

| Statistic Name | Statistic Value |

| R-squared | 0.217 |

| Adj. R-squared | 0.217 |

| F-statistic | 348.4 |

| Prob (F-statistic) | 8.18e-69 |

| Log-Likelihood | -3367.2 |

| No. Observations | 1257 |

| AIC | 6738 |

| BIC | 6749 |

| coef (const) | -0.0038 |

| coef (0) | 1.4102 |

| std err (const) | 0.100 |

| std err (0) | 0.076 |

| t (const) | -0.038 |

| t (0) | 18.666 |

| P>|t| (const) | 0.969 |

| P>|t| (0) | 0.000 |

| [0.025 | 1.262 |

| 0.975] | 1.558 |

| Omnibus | 333.130 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 23791.254 |

| Skew | -0.084 |

| Kurtosis | 24.312 |

| Cond. No. | 1.32 |

In the linear regression model analyzing the relationship between OXY and SPYwhere SPY represents the broader marketthe coefficient of determination, or R-squared value, stands at 0.217. This suggests that approximately 21.7% of the variations in OXY can be explained by its relationship with SPY. The adjusted R-squared confirms this interpretation, implying that the fit of the model is relatively stable across different datasets. The model's F-statistic at 348.4 with a corresponding p-value near zero strongly suggests that the model is statistically significant. However, the intercept, denoted by alpha (-0.0038), suggests a very slight negative bias when SPY does not move, though this alpha value is not statistically significant given its p-value of 0.969, indicating that OXY's performance is largely in line with market movements rather than demonstrating a strong independent trajectory.

The beta coefficient of 1.4102 indicates a relatively high elasticity relative to SPY; for every unit increase in SPY, OXY is expected to increase by 1.4102 units, adjusting for the model. This figure points to OXY's volatility in relation to the market: OXY tends to react more strongly to market movements than the average asset. Such traits make OXY a higher beta asset within the context of this analysis, suggesting that investors might expect higher returns to compensate for this increased risk. The statistical significance of this beta value is underscored by its p-value, indicating a very strong relationship between OXY's movements and the broader market as represented by SPY. Despite the apparent market correlation, the near-zero alpha hints at minimal excess return over the market that could be attributed to OXY independently of its market sensitivity.

Occidental Petroleum Corporation (OXY) reported its third quarter 2023 earnings, showcasing record performance supported by strong operational execution across its diverse asset portfolio, which has positively impacted earnings and cash flow. President and CEO, Vicki Hollub, led the discussion, emphasizing not only the quarter's success but also the advancements in 1PointFive and Direct Air Capture technology, which are expected to significantly contribute to the company's portfolio moving forward. Despite the absence of Senior VP and CFO, Sunil Mathew, due to a family emergency, the company provided financial results and guidance, indicating confidence in their strategies and financial health.

The quarter saw exceptional results in oil and gas production, surpassing the midpoint of guidance by 34,000 barrels of oil equivalent per day (BOE/d), prompting an increase in the full year production guidance. This performance boost was largely attributed to improved well performance in key basins and higher uptime driven by favorable conditions in the Gulf of Mexico. Moreover, Delaware operations set a record for continuous pumping time, and innovative technology deployments, such as a new natural gas hybrid frac pump, are expected to reduce completion costs and emissions over time.

On the financial front, OxyChem outperformed earnings expectations, driven by heightened PVC and caustic soda demand. The quarter also saw significant shareholder returns, with $600 million in common share repurchases and further redemptions of preferred equity, marking a notable step in advancing the shareholder return framework. Moreover, the collaboration with BlackRock in funding the STRATOS Direct Air Capture facility underscored the market's growing interest in carbon capture technologies and reinforced Oxy's commitment to becoming a leader in the low-carbon sector.

Looking into the future, Occidental Petroleum is poised for growth through various strategies, including the enhancement of oil recovery processes, expansion into Direct Air Capture with strategic partner investments, and a focus on reducing operational costs. The anticipated growth in the carbon dioxide removal credit market coupled with policy support underscores the potential for Direct Air Capture technology. The company's vision for large-scale carbon removal is supported by partnerships that will expedite development and drive down costs, enhancing Oxy's leadership in the emerging CDR market. With a robust plan for deploying capital and advancing lower-carbon solutions, Occidental is setting a sustainable path toward carbon neutrality while ensuring value creation for its shareholders.

hich would further alter Occidentals financial results. Additionally, Occidental's financial outcomes are influenced by geopolitical developments, global economic conditions, and industry-specific factors such as production levels, operational performance, and the execution of strategic initiatives.

For the three months ended September 30, 2023, Occidental reported net income of $1.375 billion, a decrease from the $2.746 billion reported for the same period in 2022. This decline in earnings was attributable to various factors, including lower received prices for oil and gas due to fluctuations in the global markets, partially offset by decreased costs in specific operational areas. Income before income taxes for the same period in 2023 was $1.809 billion compared to $3.648 billion in 2022, underscoring the challenges posed by the volatile pricing environment and market conditions. Notably, Occidental's effective tax rate for the three-month period ended September 30, 2023, was 24%, compared to 25% for the corresponding period in 2022, reflecting the company's tax management strategies amidst the changing business landscape.

For the nine months ended September 30, 2023, net income was reported as $3.498 billion, a significant decrease from the $11.377 billion reported for the nine months ended September 30, 2022. This reduction was influenced by a range of factors, including the aforementioned market dynamics affecting commodity prices and operational performance. Occidental's strategic focus on optimizing its asset portfolio and enhancing operational efficiencies was evident in its approach to managing these market challenges. The worldwide effective tax rate for the first nine months of 2023 was 28%, illustrating the impact of jurisdictional income mix and associated tax implications. This compares to a significantly lower tax rate for the same period in 2022, which was affected by a tax benefit related to Occidentals legal entity reorganization.

The oil and gas segment of Occidental's business experienced considerable activity, with a notable transaction being the sale of certain non-core proved and unproved properties in the Permian Basin, resulting in a significant gain. These strategic asset management decisions are part of Occidentals broader effort to streamline its operations and focus on its most productive and profitable assets.

For its midstream and marketing segment, Occidental reported derivative mark-to-market losses, which were a reflection of the inherent risk and volatility in commodity markets. Nevertheless, Occidental continues to leverage its midstream assets and marketing capabilities to optimize the value chain from production to market.

The chemical segment of Occidental, through its subsidiary OxyChem, continues to be a stable contributor to the companys performance, reflecting the diversity and resilience of Occidentals integrated business model.

In summary, Occidental's results for the three and nine months ended September 30, 2023, were shaped by a complex interplay of market conditions, operational performance, and strategic initiatives aimed at maximizing value and ensuring long-term sustainability. The company remains focused on managing costs, optimizing assets, and navigating the challenges and opportunities presented by the global energy and chemicals markets.

Occidental Petroleum Corporation, often referred to as Oxy, signifies a standout investment avenue within the energy sector, particularly appealing for those interested in dividend yields. The energy market, known for its volatility, presents Oxy with a unique position to leverage, given its substantial operations in oil and gas. Its resilience, underscored by efficient cost management and strategic operations, holds the promise of maintaining profitability and, by extension, sustainable dividend payouts. This characteristic is especially vital in an industry where fluctuations in oil prices, geopolitical tensions, and shifts toward renewable energy sources are commonplace.

The recommendation of Oxy as a prudent investment choice is further solidified by high-profile endorsements, notably Warren Buffett's Berkshire Hathaway. Such significant confidence from an esteemed investor augments Oxy's appeal, shedding light on its inherent strengths and potential for growth and sustained dividend payments. These aspects, coupled with the company's pivot towards innovation and sustainability, place it at a strategic vantage point amid the industry's transition to greener energy solutions.

Additionally, Oxy's commitment to shareholder returns is exemplified through its dividend offerings, emphasizing its financial health and optimistic future cash flow prospects. This appeal is not only rooted in its operational strength and strategic market positioning but also in its adaptability, which positions it well for navigating future market challenges and opportunities.

Berkshire Hathaway's growing stake in Oxy, particularly its increment to a 34% ownership through additional share acquisitions, highlights a strategic investment move. This indicates a broader confidence in Oxy, alongside Buffett's openness to evolving his investment stance, signifying a blend of traditional value investments and selective exploration of high-growth sectors. Oxy, with its substantial investments in efficiency, sustainability, and strategic acquisitions, mirrors Buffett's adaptive investment philosophy, balancing traditional energy operations with forward-looking growth imperatives.

Occidental Petroleum's role in the industrys consolidation trend, as demonstrated by significant acquisitions like that of CrownRock, showcases its efforts to bolster its position in the competitive landscape, particularly in the Permian Basin. This move, akin to strategies employed by counterparts like ExxonMobil, underscores an industry-wide approach toward achieving economies of scale and amplifying shareholder value through enhanced financial metrics and operational synergies.

The company's undervaluation, as identified in recent analyses, juxtaposed with its performance metrics and strategic initiatives, presents it as a "screaming bargain." Its aggressive debt reduction, strategic acquisitions, and focus on sustainability and carbon capture technologies underpin a robust growth outlook. With a forward-looking trajectory encapsulated by ventures into LNG projects and carbon capture, alongside solid financial leverage for future acquisitions, Oxy's narrative is that of promising growth and lucrative investment potential.

Moreover, the recent classification of Oxy's stock into the "buy zone" following a rating upgrade is indicative of an optimistic market outlook on its performance and strategic endeavors. The company's adept navigation through economic downturns, strategic acquisitions, and endorsements by significant investors like Berkshire Hathaway, culminate in a favorable investment thesis.

In conclusion, through strategic acquisitions mirroring industry leaders, robust financial health underscored by significant debt reduction and shareholder-friendly practices, and strategic foresight towards sustainability and market trends, Occidental Petroleum Corporation heralds a compelling investment narrative. Despite the cyclical nature of the oil and gas industry, Oxy's strategic positioning, buoyed by industry endorsements and strategic investments, renders it a notable contender for those eyeing dividend yields and long-term growth within the energy sector. As the landscape evolves, Oxy's adaptability and strategic initiatives position it well to leverage future opportunities, making it an attractive proposition for informed investors.

Occidental Petroleum Corporation (OXY) has experienced significant volatility from February 2019 through February 2024, as indicated by a specialized analysis model known as the ARCH (Autoregressive Conditional Heteroskedasticity) model. The model's parameters, including a coefficient (omega) of 10.2473 and an alpha[1] value of 0.3394, suggest fluctuations in the company's asset returns. Essentially, these figures point to a notable degree of unpredictability in OXY's stock performance, with omega indicating the base level of volatility and alpha[1] reflecting the impact of past returns on current volatility.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -3402.37 |

| AIC | 6808.75 |

| BIC | 6819.02 |

| No. Observations | 1257 |

| Df Residuals | 1257 |

| Omega | 10.2473 |

| Alpha[1] | 0.3394 |

Analyzing the financial risk associated with a $10,000 investment in Occidental Petroleum Corporation (OXY) involves a detailed examination of stock volatility and predictive analyses of future returns. This analysis integrates advanced statistical methods and artificial intelligence approaches to provide a comprehensive view of the potential risks and rewards.

Volatility Modeling Approach

The volatility modeling approach is essential for understanding the fluctuations in the Occidental Petroleum Corporation's stock prices. This statistical method models the variance in the company's stock price over time, assuming that volatility is not constant but changes in response to new information. By examining past price movements and volatility patterns, this approach estimates the level of risk associated with the stock. It quantifies how much the stock price can deviate from its average value, which is crucial for risk assessment.

Machine Learning Predictions

On the other side, the machine learning predictions approach, specifically through the implementation of a decision trees ensemble method, provides a forward-looking perspective on the stock's potential future performance. By analyzing historical data, including stock prices and financial indicators, this model identifies patterns that may influence future stock returns. The predictive power of this approach lies in its ability to process vast amounts of data and recognize complex relationships that traditional analytical methods might overlook.

Value at Risk (VaR) Analysis

Combining the insights from volatility modeling and machine learning predictions enables an accurate calculation of the Value at Risk (VaR) for a $10,000 investment in Occidental Petroleum Corporation over a one-year period. The VaR, calculated at a 95% confidence interval, stands at $276.59. This figure represents the maximum expected loss over a one-year period, given normal market conditions and a confidence level of 95%. Essentially, it suggests that there is a 5% chance that the investment could lose more than $276.59 over the next year.

The integration of these methods allows for a robust analysis by considering both historical volatility and predictive insights. While the volatility modeling approach provides a measure of the stock's inherent risk based on its past behavior, the machine learning predictions incorporate potential future events and trends that could impact stock performance. This dual analysis offers a comprehensive perspective on the potential financial risk associated with investing in Occidental Petroleum Corporation, thereby allowing investors to make more informed decisions based on a calculated estimation of maximum potential loss.

Analyzing the provided options chain for Occidental Petroleum Corporation (OXY) call options reveals insights into the most profitable options based on the Greeks, premium, return on investment (ROI), and profit, aiming for a target stock price increase of 5% over the current price. Here, we'll focus on some standout options from the dataset that might offer attractive opportunities under the specified conditions, without referring to specific rows but focusing on expiration dates, strike prices, and relevant Greek values.

For a short-term investment horizon, options expiring on February 16, 2024, particularly those with strike prices of $42.5 and $47.5, exhibit high ROI values of 0.3338 and 0.4888, respectively, suggesting significant profit potential relative to the premium paid. These options are characterized by high delta values (0.9954 for $42.5 strike and 0.9928 for $47.5 strike), indicating a strong sensitivity to changes in the stock price, which is favorable for achieving our target.

Moving towards a medium-term horizon, the options expiring on March 1, 2024, with strike prices extending from $40.0 to $55.0, consistently show promising prospects. For instance, options with a $54.0 strike exhibit a relatively high delta of 0.8449, indicating they move closely with the stock's price, combined with a notable ROI of 0.5849, making them attractive for investors expecting a moderate stock price increase.

For investors with a long-term perspective, examining-options expiring on January 17, 2025, across a range of strike prices from $30.0 to $45.0, reveals consistently appealing characteristics. Such as the option with a $40.0 strike, showcasing a high delta of 0.8549. This option, alongside its counterparts, balances a reasonable sensitivity to stock price changes (as seen in delta values) with substantial vega values, indicating potential profitability from increased volatility.

It's crucial to note the importance of the Greeks in informing these decisions. Specifically:

- Delta informs us how much the price of an option is expected to move based on a $1 change in the underlying stock price. Options with higher delta values are generally more responsive to the stock price movement, which is desirable in scenarios expecting a precise move in the underlying asset.

- Vega measures sensitivity to volatility. Options with higher vega values can benefit more from an increase in implied volatility, which is often the case leading up to news events or earnings announcements.

- ROI and profit directly correlate with the potential return from each option, guiding investors towards decisions that align with their risk-reward preferences.

Given these illustrations, selecting the most profitable options depends significantly on the investor's risk tolerance, investment horizon, and market outlook. Short-term focused traders might prioritize high-delta, high-ROI options for quicker gains, whereas long-term investors might lean towards options offering a balanced approach with moderate delta and significant vega values to capitalize on longer-term trends and volatility adjustments.

Similar Companies in Oil & Gas E&P:

Pioneer Natural Resources Company (PXD), Coterra Energy Inc. (CTRA), Report: Diamondback Energy, Inc. (FANG), Diamondback Energy, Inc. (FANG), ConocoPhillips (COP), Report: EOG Resources, Inc. (EOG), EOG Resources, Inc. (EOG), Report: Devon Energy Corporation (DVN), Devon Energy Corporation (DVN), Report: Marathon Oil Corporation (MRO), Marathon Oil Corporation (MRO), Report: APA Corporation (APA), APA Corporation (APA), Permian Resources Corporation (PR), Report: Chevron Corporation (CVX), Chevron Corporation (CVX), Exxon Mobil Corporation (XOM), Hess Corporation (HES)

https://seekingalpha.com/article/4659788-buffett-4-dividend-buys-for-december

https://www.youtube.com/watch?v=X62L5FArR3I

https://www.fool.com/investing/2024/01/05/this-oil-stock-is-following-leaders-exxonmobil-and/

https://www.fool.com/investing/2024/01/10/this-ultra-high-yield-dividend-stock-enters-2024-a/

https://www.fool.com/investing/2024/01/14/3-super-warren-buffett-stocks-to-buy-in-january/

https://www.fool.com/investing/2024/01/15/want-to-invest-like-buffett-buy-this-stock-in-2024/

https://www.fool.com/investing/2024/01/15/why-occidental-petroleum-significantly-underperfor/

https://www.fool.com/investing/2024/01/19/stock-warren-buffett-purchased-every-month-5-years/

https://www.fool.com/investing/2024/01/20/warren-buffett-owns-occidental-but-you-should-cons/

https://www.fool.com/investing/2024/01/21/occidental-petroleum-good-exxonmobil-chevron/

https://seekingalpha.com/article/4665625-4-buyable-buffett-dividend-dogs-in-january

https://www.youtube.com/watch?v=_WAgD3IqCcg

https://www.sec.gov/Archives/edgar/data/797468/000079746823000092/oxy-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 7gdfDz

Cost: $1.14779

https://reports.tinycomputers.io/OXY/OXY-2024-02-08.html Home