Intel Corporation (ticker: INTC)

2024-01-26

Intel Corporation (ticker: INTC) is a premier global technology company that has cemented its status as one of the leading manufacturers of semiconductor chips. Founded in 1968, the company has evolved to become a powerhouse in the development and production of microprocessors for personal computers, data centers, and a range of computing devices across various segments. Intel's product lineup extends beyond CPUs to include chipsets, motherboards, and integrated circuits for networked and embedded systems, alongside memory and storage solutions. As an S&P 500 component, Intel is publicly traded on the NASDAQ exchange, reflecting its prominent role in the tech industry's landscape. Emphasizing innovation, Intel dedicates substantial resources to research and development, enabling it to stay ahead in the competitive semiconductor market. The company also faces fierce competition from other chip manufacturers and must continuously adapt its strategies to maintain its market position amidst rapidly evolving technological trends and consumer demands.

Intel Corporation (ticker: INTC) is a premier global technology company that has cemented its status as one of the leading manufacturers of semiconductor chips. Founded in 1968, the company has evolved to become a powerhouse in the development and production of microprocessors for personal computers, data centers, and a range of computing devices across various segments. Intel's product lineup extends beyond CPUs to include chipsets, motherboards, and integrated circuits for networked and embedded systems, alongside memory and storage solutions. As an S&P 500 component, Intel is publicly traded on the NASDAQ exchange, reflecting its prominent role in the tech industry's landscape. Emphasizing innovation, Intel dedicates substantial resources to research and development, enabling it to stay ahead in the competitive semiconductor market. The company also faces fierce competition from other chip manufacturers and must continuously adapt its strategies to maintain its market position amidst rapidly evolving technological trends and consumer demands.

| Address | 2200 Mission College Boulevard, Santa Clara, CA, 95054-1549, United States | Phone | 408 765 8080 | Website | https://www.intel.com |

| Industry | Semiconductors | Sector | Technology | Previous Close | 49.55 |

| Day Low | 43.35 | Day High | 45.4 | Dividend Rate | 0.50 |

| Dividend Yield | 1.01% | Payout Ratio | 185% | 5 Year Avg Dividend Yield | 2.98% |

| Trailing PE | 109.13 | Forward PE | 16.79 | Volume | 127,090,033 |

| Market Cap | 184,552,210,432 | 52 Week Low | 24.73 | 52 Week High | 51.28 |

| Price to Sales (TTM) | 3.40 | Enterprise Value | 237,807,108,096 | Profit Margins | 3.12% |

| Shares Outstanding | 4,216,000,000 | Shares Short | 62,290,314 | Held Percent Insiders | 0.06% |

| Held Percent Institutions | 66.10% | Short Ratio | 1.56 | Book Value | 25.009 |

| Price to Book | 1.75 | Net Income | 1,688,999,936 | Trailing EPS | 0.40 |

| Forward EPS | 2.60 | PEG Ratio | 2.51 | Current Price | 43.65 |

| Target High Price | 68.00 | Target Low Price | 17.00 | Target Mean Price | 43.29 |

| Target Median Price | 45.00 | Recommendation Mean | 2.90 | Total Cash | 25,034,000,384 |

| Total Cash Per Share | 5.929 | EBITDA | 9,633,000,448 | Total Debt | 49,265,999,872 |

| Quick Ratio | 1.014 | Current Ratio | 1.542 | Total Revenue | 54,228,000,768 |

| Debt to Equity | 44.80 | Revenue Per Share | 12.942 | Return on Assets | 0.01% |

| Return on Equity | 1.57% | Free Cashflow | -14,132,625,408 | Operating Cashflow | 11,470,999,552 |

| Revenue Growth | 9.70% | Gross Margins | 40.04% | EBITDA Margins | 17.76% |

| Operating Margins | 9.37% | Currency | USD | 52 Week Change | 75.96% |

| Sharpe Ratio | -9.11932112563 | Sortino Ratio | -144.53627686058 |

| Treynor Ratio | 0.37176132476440 | Calmar Ratio | 3.48762322288702 |

Intel Corporation (INTC) is enduring a period marked by considerable volatility and challenges within the semiconductor industry, requiring a multifaceted analysis for accurate prediction. The analysis synthesizes technical indicators, fundamental analysis, and balance sheet strength to shape the investment narrative.

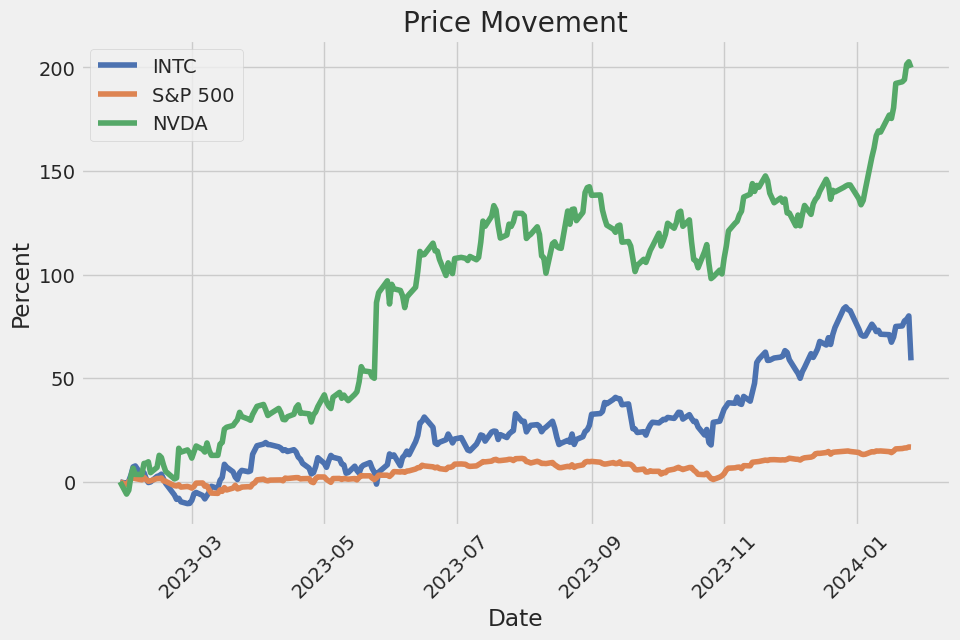

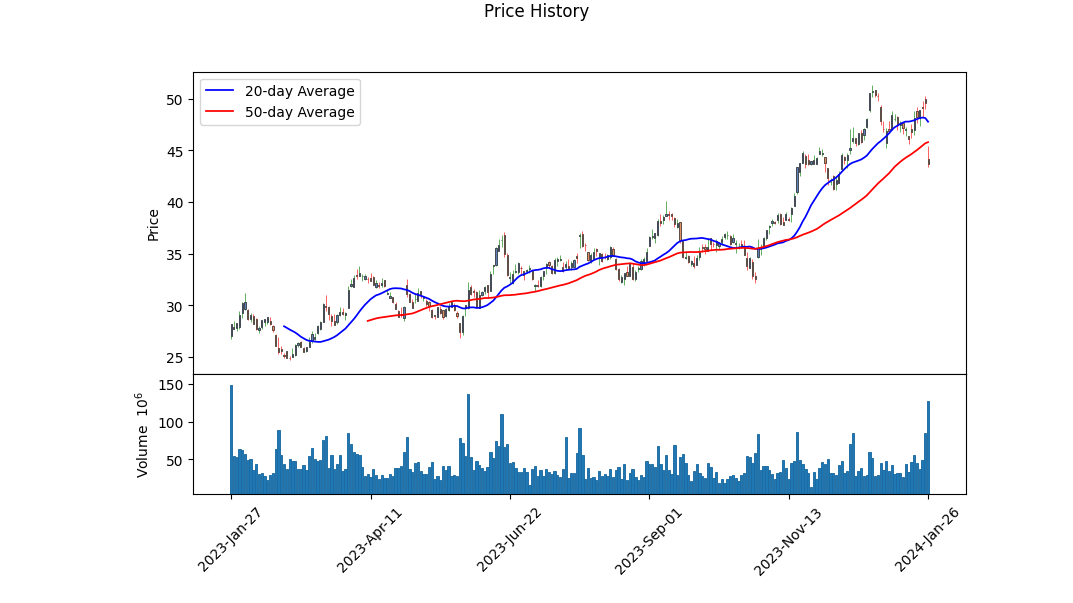

Technical Indicators: Over the most recent quarter, INTC presented a bullish signal with an escalation in its OBV (On-Balance Volume) from 0.267 million to 69.167 million, indicating increasing bullish volume. The OBV's prevailing uptrend hints at continued institutional and retail accumulation. However, a declining MACD Histogram signals a potential short-term reversal or a slowdown in momentum. Intels price trend, moving from $35.65 to $45.40 and closing at $44.18 on the last analyzed day, represents a significant appreciation, coherent with a broader uptrend.

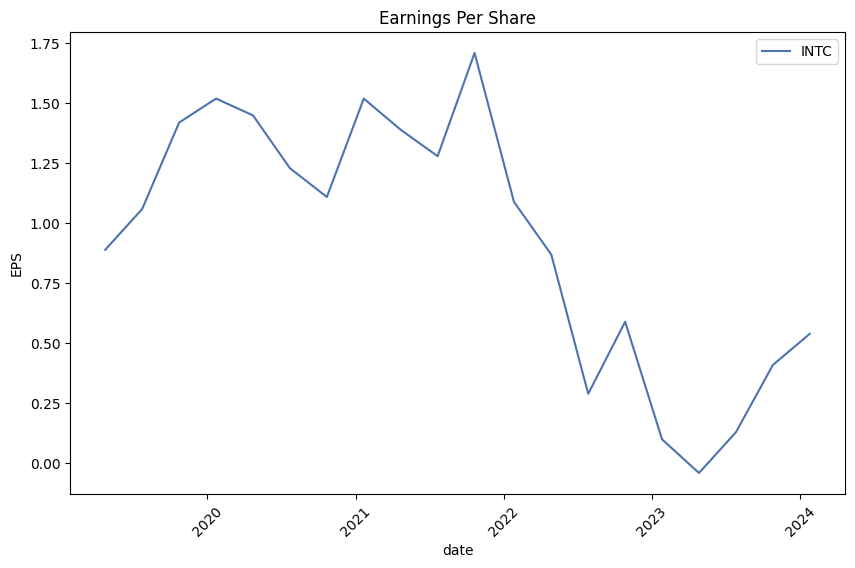

Fundamentals: INTC holds an impressive gross margin of 0.40037, although the modest operating margin of 0.09366 implies higher operational costs relative to revenue, which may weigh on future profitability. Notably, a Trailing PEG Ratio of 1.3271 conveys the stock is potentially overvalued in relation to its growth rate, suggesting a cautious approach should be taken.

Financial Health: Intel's balance sheet exposes a robust tangible book value growth over the analyzed period. While the companys net debt has increased, considerable cash reserves afford Intel the financial flexibility to pursue growth strategies or return value to shareholders.

Risk-Adjusted Performance: Substantial negative risk-adjusted performance ratios, represented by distressing Sharpe, Sortino, and Treynor ratios, alert investors to the high volatility and lower-than-expected returns relative to inherent risk. Conversely, a substantial Calmar Ratio suggests a historical resilience to drawdowns.

Analyst Expectations: Analyst projections outline a prospective bullish EPS growth, anticipating growth from $1.86 to $2.60 in the subsequent year. This optimism is increasingly substantiated by historical earnings surpassing estimates, a favorable sign for potential future performance.

Thus far, an evaluation of INTC from technical, fundamental, and analyst perspectives delivers a mixed outlook. Impressive growth prospects and solid book value are counterbalanced by significant volatility and potential overvaluation. The diminished recent momentum, in conjunction with negative risk-adjusted measures, signals that the forthcoming months may be fraught with containment or potential correction.

In short, while Intel Corporation's core metrics capture a company on solid footing capable of appreciable growth, investors must also account for the signs of market volatility and potential short-term valuation concerns. Any meaningful investment must not only factor in the promising analyst expectations and sound balance sheet but also hedge against the conspicuous risk indicators. Henceforth, continued vigilance and a tactical stance are recommended, supplementing quantitative analysis with continued monitoring of industry dynamics and broader market sentiment.

| Alpha | -0.0420 |

| Beta | 1.2284 |

| R-squared | 0.433 |

| Adj. R-squared | 0.432 |

| F-statistic | 958.9 |

| Prob (F-statistic) | 6.52e-157 |

| Log-Likelihood | -2558.9 |

| No. Observations | 1,258 |

| AIC | 5,122 |

| BIC | 5,132 |

| Standard Error | 0.040 |

| t (Beta) | 30.966 |

| P>|t| | 0.000 |

| [0.025 | 1.151 |

| 0.975] | 1.306 |

| Omnibus | 345.080 |

| Prob(Omnibus) | 0.000 |

| Skew | -0.718 |

| Kurtosis | 15.057 |

| Cond. No. | 1.32 |

The linear regression analysis of INTC securities compared to SPYan exchange-traded fund that mirrors the S&P 500 and serves as a benchmark for the overall marketsuggests a certain degree of correlation between INTC's performance and broader market movements, as evidenced by a beta coefficient of 1.2284. Beta, in this context, measures the sensitivity of INTC's returns to the market; herein, a beta greater than 1 indicates that INTC's price movements are more volatile in comparison to the market. However, the alpha () of -0.0420 conveys that the model predicts an average performance slightly below the expected market return after adjusting for systematic risk. Alpha is a common measure used to determine the excess return or underperformance of an investment relative to a benchmark index.

The R-squared value of the model is 0.433, meaning roughly 43.3% of the variation in INTC's return can be explained by movements in SPY. This moderate R-squared value combined with a significant F-statistic (indicating the overall model fit) and a very low p-value of the F-statistic points to the model's reliability in capturing the dynamic between INTC and SPY, at least to some extent. It's important, nonetheless, to observe that the negative alpha signifies that during the period under analysis, INTC may not have provided sufficient returns to investors given the risk taken, relative to what could have been earned on a risk-free investment plus a premium derived from the market's return as suggested by the Capital Asset Pricing Model (CAPM).

Intel Corporation's Fourth Quarter 2023 Earnings Call indicated a strong close to the year with consistent execution and overachievement of financial targets. CEO Pat Gelsinger highlighted the company's progress in its IDM 2.0 transformation, emphasizing solid Q4 results that surpassed expectations for the fourth consecutive quarter. Revenue was at the upper end of their guidance, and the company benefited from strong earnings per share (EPS) upside due to focused efforts on operating leverage and expense management, including achieving their $3 billion cost savings goal for the year. Intel's outlook for Q1 suggests performance at the lower end of seasonal ranges, with specific challenges in discrete business areas like Mobileye, PSG, and business exits. However, the company remains optimistic about sequential and year-over-year growth for the rest of fiscal year 2024, with increasing momentum around new products and businesses.

Gelsinger detailed Intel's advancements in process technology, including being the first high-volume manufacturer of logic devices using Extreme Ultraviolet Lithography (EUV) in both the U.S. and Europe. Intel also reached manufacturing readiness for Intel 3 during Q4. The upcoming product launches of Sierra Forest and Granite Rapids were highlighted, with early customer feedback being positive. Furthermore, Intel's lead in incorporating gate-all-around transistors and backside power delivery at once has set them ahead of the competition, aligning with their aim to return to process leadership with the completion of Intel 20A and Intel 18A, bringing Intel back to the forefront of manufacturing technology.

The company has also made significant strides with Intel Foundry Services (IFS), making headway towards its goal of becoming the second-largest external foundry by 2030. This progress is underpinned by the rapid adoption of AI across industries, positioning IFS favorably in high-performance compute, a significant and growing segment. Noteworthy developments include strategic agreements, a major foundry contract with the U.S. government, a collaboration with United Microelectronics (UMC) on a 12-nanometer process platform, and advances in advanced packaging technology. Intel's 'IF Direct Connect' event on February 21 was announced as a showcase for their ecosystem and roadmap beyond Intel 18A.

Intel's AI business is a key part of its strategy, with AI workloads becoming a primary driver for future market growth. The company is poised to capitalize on AI's expansion not just in cloud computing but also in enterprises, edge computing, and the PC market. The AI-capable offerings in Intel's product portfolio are presented as comprehensive from cloud through network and enterprise to the edge. Gelsinger mentioned the strong sequential growth in the server business and cited the shipment of over 2.5 million units of 4th Gen Xeon processors. The AI accelerators like Gaudi 2 and the upcoming Gaudi 3 were noted to deliver competitive price-performance, and the pipeline for accelerator solutions is growing. Furthermore, Gelsinger welcomed new leadership to drive the data center acceleration business and improved PC business results were provided, showing strength in gaming and commercial segments with notable growth in AI-capable client processors.

CFO David Zinsner reflected on Q4, reporting that Intel exceeded revenue, gross margin, and EPS guidance, attributing this success to sound investment priorities, managed expenses, and a continued commitment to operational excellence. Zinsner outlined the fiscal achievements in context, emphasizing strong cash management, nearly $2 billion net inventory reduction, and substantial working capital initiatives. Looking ahead, the first-quarter guidance anticipates revenue between $12.2 billion to $13.2 billion and an expectation of improving results throughout the year. Zinsner also discussed Intel's "smart capital framework," including government incentives and capital offsets. He asserted that while significant investments in IDM 2.0 and five-nodes in four years process technology persist, they maintain the commitment to strong financial objectives. Intel's Smart Capital Framework was highlighted as instrumental in optimizing the company's manufacturing and process advantages, paving the way for long-term profitability and market leadership.

Intel's 2023 results were lauded as a testament to the company's focus and discipline amidst a cautious macroeconomic backdrop. The dedication was said to have driven robust product ramp-ups, market share management, and diligent execution of product and process roadmaps. Additionally, they are implementing strategic exits from particular markets, identifying profitable niches where they can leverage established IP. A newly-adopted internal foundry model was accredited with better cost and value insights, driving toward a more profitable financial model with 60% gross and 40% operating margins as long-term targets.

Intel Corporation reported its third-quarter financial results for the period ending September 30, 2023. Total revenue was $14.2 billion, which marked a decrease of $1.2 billion or 8% compared to the third quarter of the previous year. This decline was largely attributed to a fall in revenue across various segments, particularly in Data Center and AI (DCAI) and Network & Edge (NEX). The Client Computing Group (CCG) saw a 3% drop, largely due to a decrease in desktop volume, attributed to reduced demand across business market segments, and lower notebook average selling prices (ASPs) resulting from a higher mix of small core and older generation products. However, this was partly offset by increased notebook volume as customer inventory levels began to show signs of normalization and a rise in desktop ASPs driven by increased sales in the commercial and gaming market segments.

DCAI's 10% revenue reduction was due to a 35% decline in server volume, reflecting a softer CPU data center market, despite a 38% increase in ASPs primarily because of a lower mix of hyperscale customer-related revenue and a higher mix of high core count products. NEX's revenue plummeted by 32% as customers adjusted to lower inventories and a reduced demand environment across product lines. Conversely, the Mobileye segment saw revenue growth of $80 million in Q3 2023, reaching a total revenue of $530 million, driven by higher demand for EyeQ products. Operating income for Mobileye increased to $170 million in Q3 due to this higher demand.

Intel Foundry Services (IFS) reported a revenue of $311 million, which was up by $233 million from the previous year's third quarter, fueled by higher packaging revenue and multi-beam mask writer tool sales. However, IFS encountered an operating loss of $86 million in Q3 2023, a slight reduction from the $90 million loss in Q3 2022, primarily due to increased spending aimed at driving strategic growth.

For the quarter, the gross margin was 42.5%, down by 0.1 percentage points from the same quarter in the previous year. The decline in gross margin was attributed to lower revenue, increased unit costs, and higher period charges. Intel's diluted earnings per share (EPS) attributable to Intel was $0.07 for Q3 2023, a significant decrease from $0.25 in Q3 2022. Operating cash flow experienced a decline of $0.9 billion or 12% from the third quarter in the previous year.

In terms of the outlook and ongoing operations, Intel's Ireland fabrication facility has started high-volume production of Intel 4 technology, the first instance of EUV technology being utilized in high-volume manufacturing in Europe. Intel also announced the forthcoming Intel CoreTM Ultra processors, expected to launch in Q4 2023, featuring integrated neural processing units for AI acceleration. The planned acquisition of Tower Semiconductor Ltd. was terminated due to delays in obtaining regulatory approval, although Intel initiated a commercial agreement with Tower for foundry services and manufacturing capacity. Additionally, Intel received a $600 million grant from the State of Ohio to support the construction of two chip factories in the state.

The company faced multiple legal proceedings, including those related to the European Commission's competition matter, where a fine was imposed on Intel based on findings of unfair business practices, which Intel plans to appeal. Intel was also involved in litigation with VLSI Technology LLC over alleged patent infringements, with a jury awarding substantial damages to VLSI in two separate trials. Intel still disputes the claims and intends to defend against them vigorously. Other legal contests include those related to alleged security vulnerabilities in Intel products and patent and IP claims from other entities. The outcome of these legal proceedings could have a material impact on Intel's financial position and operations, but the company believes the results will not have a detrimental effect in the long term. Intel may also consider settlement of these matters in the interests of stakeholders.

Several contributing factors have supported the Dow Jones Industrial Average's robust performance in the past three months, pushing it to reach its highest levels since the prior year, as noted on December 13, 2023, by Zacks.com. The SPDR Dow Jones Industrial Average ETF (DIA), which traces the Dow Jones Index, has experienced a 5.8% surge in the same timeframe, aligning with the Dow's ascent. Within the DIA's portfolio, individual contributors stand out, including Intel Corporation (INTC), which has shown an upswing of 13.3% over the trailing three-month period.

Intel has been adapting its business strategy, shifting focus from a primarily PC-oriented enterprise to one that emphasizes data-centric opportunities such as artificial intelligence (AI) and autonomous driving. Looking forward, Intel's earnings are expected to grow by 98.5% in 2024, exhibiting promising potential and a forward-looking trajectory. The stock's performance is significant due to its role in the Dow's overall upturn, substantiated by a Zacks Rank #1 standing, despite holding a smaller 0.8% portion of the DIA's holdings. Investors' underlying confidence in the capabilities and prospects of semiconductor companies broadly is reflected in Intel's stock appreciation.

The rationale behind the broader market's outperformance appears to hinge on several macroeconomic factors. Consumer sentiment reflects renewed confidence in the economy, potentially prompted by expectations of an end to the Federal Reserve's interest rate hikes. The perceived deceleration of inflation, evidenced by consecutive monthly declines, also contributes to the bullish market sentiment.

The Dow, known for its cyclicality, thrives with economic improvements. Within the DIA's portfolio, the financial sector's allocation stands at 20.3%, followed by healthcare, IT, industrials, and consumer discretionary sectors. The ETF charges 16 basis points in annual fees and is classified with a 'Medium' risk outlook according to Zacks ETF Rank.

Intel's status as a leading semiconductor company was further cemented with its notable performance in 2023. The company's significant stock upturn aligned with the market's evolving demands, with impressive strides in diversifying its portfolio. This has placed Intel among the blue-chip companies making notable leaps in stock performance, alongside Salesforce, Microsoft, Apple, and Boeing.

Intel's resurgence is accompanied by a market leaning towards expansion, with a positive shift toward cyclical stocks and small-cap stocks. These trends lead to a conducive environment for equities, presenting opportunities to capitalize on strategic investments and ongoing innovation.

Amidst this economic and market rejuvenation, Intel has geared up to compete more assertively in the server CPU market. Despite challenges from AMD, the launch of Intel's Emerald Rapids server CPUs is aimed at delivering noteworthy performance enhancements. Intel's innovations reach beyond current offerings, anticipating major performance and efficiency gains with the forthcoming Granite Rapids and Sierra Forest server CPU families set to debut in 2024. Meanwhile, Intel plans advances in its manufacturing process to maintain a competitive edge into 2025 and beyond, intending to reclaim leadership in the server CPU market.

During the stock market's near two-month-long rally that culminated in the week of December 14, 2023, Intel's performance stood out as significant. The Dow surged 15%, with Intel's stock price seeing an impressive increase. This historic run-up has not only been marked by Intel's success but also by gains from other corporations like Boeing and Salesforce, along with substantial gains by Carnival and other major corporations within the chipmaker industry. The market's momentum was fueled by expectations of rate cuts in 2024, a surge in bond markets, and forecasts hoping for the S&P 500 to set fresh records.

Investor interest peaked with Intel's announcement at the AI Everywhere launch event. Intel unveiled a series of new chips, such as the Intel Core Ultra mobile processor family and Intel Xeon processors with built-in AI hardware. The new offerings align with increasing demand for AI and machine learning technologies, signaling Intel's commitment to maintaining and advancing its market position. Additionally, the announcement highlighted partnerships with over 100 software vendors to foster new AI applications for PCs.

Intel's strategy to compete in the AI chip market builds on its acquisition of Habana Labs, underscoring ongoing efforts to align product lines with the demands of AI models. The Gaudi3 chip, intended to make Intel competitive with Nvidia and AMD, exemplifies Intel's ambition in the AI domain, with expectations of significant market growth.

Intel recently bolstered its product line with the release of the Intel Core Ultra processor, integrated with a neural processing unit for more efficient AI task handling. The company also announced plans to extend this processor to 230 designs from PC makers globally, indicating a leap into AI computing. Executives voiced confidence in the company's AI chips, expressing Intel's intent to compete in the AI market, and the company's stock reflected the positive market response to the announcements.

Further, Intel has made ambitious moves to innovate and expand operations. The introduction of Meteor Lake, produced using the Intel 4 process, demonstrates the company's technological advances, while investments such as the semiconductor facility in Germany and an assembly and test facility in Poland indicate global expansion efforts.

Lastly, Intel's engagement with the Federal Reserve's policy changes showcases the company's positioning to thrive as declining interest rates favor growth stocks. Positive revisions to Intel's earnings estimates and a strong market and sector outlook amplify Intel's potential for growth.

For further details and analysis of Intel Corporation's market performance and initiatives, a variety of resources from Zacks Investment Research and other financial analyses published in December 2023 are available, providing a comprehensive overview of the company amidst the wider economic context.

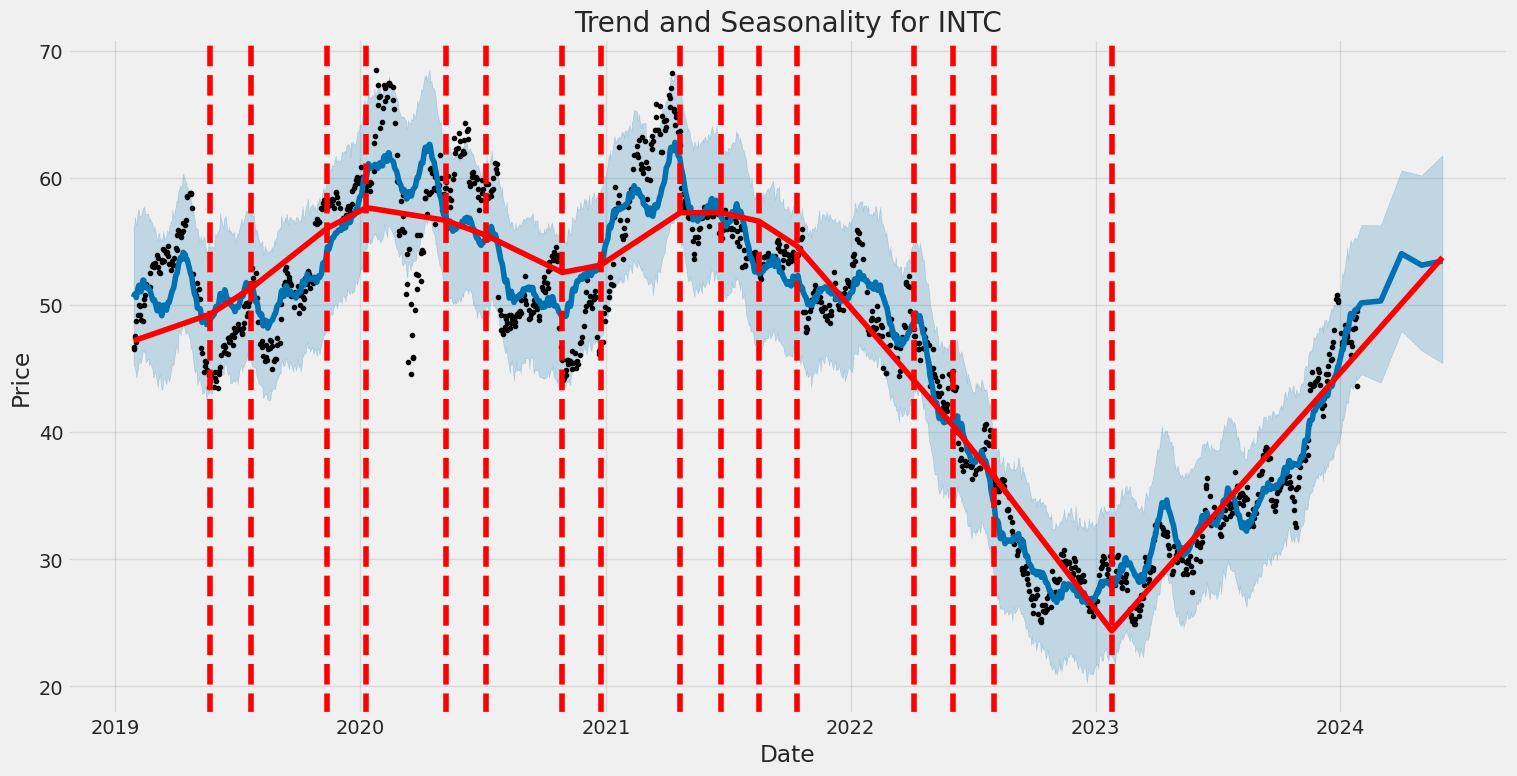

Over the period from January 2019 to January 2024, the volatility of Intel Corporation (INTC) showed no clear pattern in daily returns since the R-squared value is essentially zero, indicating that past returns were not predictive of future returns. The ARCH model indicates that there is a significant amount of volatility inherent in Intel's stock movements, as evidenced by the omega coefficient being significant at 4.5611. Moreover, the alpha coefficient which measures the impact of previous day returns on the current volatility is also significant at 0.2029, indicating that past returns do have some effect on current volatility.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Log-Likelihood | -2,843.72 |

| AIC | 5,691.44 |

| BIC | 5,701.72 |

| No. Observations | 1,258 |

| omega | 4.5611 |

| alpha[1] | 0.2029 |

To analyze the financial risk of a $10,000 investment in Intel Corporation (INTC) over a one-year period, we employ a mix of volatility modeling and machine learning predictions. The process involves two main steps: modeling the stock's volatility and forecasting future stock returns.

The volatility modeling technique is crucial for grasping the dynamic nature of the volatility inherent to Intel Corporations stock. This model assumes that future volatility is not constant but varies over time with patterns that can be partly predicted using past market data. By using historical price data, the model captures the persistence and mean reversion characteristics of the stock's volatility, which aids in estimating potential price swings over the investment horizon.

Moving on to the predictive element of the analysis, machine learning predictions come into play. A specific machine learning algorithm, which operates through the use of decision trees and an ensemble learning method, is tasked with capturing the complex relations between various market factors and the stock's future returns. This approach involves training the algorithm on historical data to discern the subtleties of the market, thus enabling the prediction of future returns based on the learnt patterns.

The incorporation of volatility modeling in the analysis allows the determination of the stock's volatility over the investment period, which is an essential aspect when calculating the Value at Risk (VaR). VaR is a commonly used risk measure that shows the potential loss in value of an investment over a set time period at a given confidence level. For the $10,000 investment in Intel Corporation, the calculated VaR at a 95% confidence interval is $394.09. This figure implies that there is a 5% chance that the investment will lose more than $394.09 over the course of a year. This insight is valuable for investors as it quantifies the expected downside risk and provides a monetary figure reflecting the potential losses that might be incurred.

In summary, by integrating the volatility modeling with machine learning predictions, we are able to extract a nuanced understanding of the potential risks associated with an equity investment in Intel Corporation. The calculated VaR offers a precise risk metric that encapsulates the interplay between the modelled volatility and predicted returns, highlighting the financial risk of the investment.

Similar Companies in Semiconductors:

Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Report: Taiwan Semiconductor Manufacturing Company Limited (TSM), Taiwan Semiconductor Manufacturing Company Limited (TSM), Marvell Technology, Inc. (MRVL), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Advanced Micro Devices, Inc. (AMD), Broadcom Inc. (AVGO), Qualcomm Incorporated (QCOM), Texas Instruments Incorporated (TXN), Applied Materials, Inc. (AMAT), Analog Devices, Inc. (ADI), Lam Research Corporation (LRCX)

https://www.fool.com/investing/2023/12/13/intels-emerald-rapids-server-chips-could-deliver-s/

https://www.zacks.com/stock/news/2197442/5-stocks-powering-dow-etf-s-3-month-outperformance

https://www.zacks.com/stock/news/2197812/3-of-the-best-blue-chip-stocks-to-ride-the-dow-rally

https://www.zacks.com/stock/news/2197904/5-winning-stocks-of-2023-as-dow-jones-hits-new-record

https://www.cnbc.com/2023/12/14/intel-unveils-gaudi3-ai-chip-to-compete-with-nvidia-and-amd.html

https://www.proactiveinvestors.com/companies/news/1036251?SNAPI

https://www.fool.com/investing/2023/12/14/why-intel-stock-was-moving-up-today/

https://www.youtube.com/watch?v=-GIQQHXg874

https://www.fool.com/investing/2023/12/14/intel-announced-new-ai-chips-should-amd-stock-inve/

https://www.youtube.com/watch?v=s1mHRvLmAIE

https://www.youtube.com/watch?v=tztumWL7zAc

https://www.zacks.com/stock/news/2198516/fed-ensures-a-tech-rally-yet-again-in-2024-5-top-picks

https://www.zacks.com/stock/news/2198796/intel-intc-launches-ai-chips-to-drive-growth-momentum

https://www.fool.com/investing/2023/12/15/why-intel-stock-popped-today/

https://www.sec.gov/Archives/edgar/data/50863/000005086323000103/intc-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: HZVktF

Cost: $1.05755

https://reports.tinycomputers.io/INTC/INTC-2024-01-26.html Home