PayPal Holdings, Inc. (ticker: PYPL)

2024-05-19

PayPal Holdings, Inc. (ticker: PYPL), founded in December 1998, initially known as Confinity, has evolved into one of the world's leading online payment platforms. Headquartered in San Jose, California, PayPal facilitates digital and mobile payments on behalf of consumers and merchants worldwide, providing a seamless and secure transaction experience. The company's key services include online money transfers, electronic bill payments, and merchant account services. With a robust network encompassing over 400 million active accounts across more than 200 markets, PayPal leverages advanced, proprietary technology to drive growth and maintain its competitive edge. Strategic acquisitions, such as those of Venmo and Braintree, have expanded PayPal's service offerings and market presence. Continued investment in innovation and a focus on enhancing user experience have solidified PayPal's standing as a trailblazer in the digital payments industry.

PayPal Holdings, Inc. (ticker: PYPL), founded in December 1998, initially known as Confinity, has evolved into one of the world's leading online payment platforms. Headquartered in San Jose, California, PayPal facilitates digital and mobile payments on behalf of consumers and merchants worldwide, providing a seamless and secure transaction experience. The company's key services include online money transfers, electronic bill payments, and merchant account services. With a robust network encompassing over 400 million active accounts across more than 200 markets, PayPal leverages advanced, proprietary technology to drive growth and maintain its competitive edge. Strategic acquisitions, such as those of Venmo and Braintree, have expanded PayPal's service offerings and market presence. Continued investment in innovation and a focus on enhancing user experience have solidified PayPal's standing as a trailblazer in the digital payments industry.

| Full-Time Employees | 27,200 | Previous Close | 64.1 | Market Cap | 67,449,307,136 |

| Open | 64.08 | Volume | 8,187,711 | Average Volume | 12,712,965 |

| Beta | 1.416 | Trailing P/E | 16.241814 | Forward P/E | 13.777779 |

| Day Low | 63.85 | Day High | 64.71 | 52 Week Low | 50.25 |

| 52 Week High | 76.54 | Average Volume (10 Days) | 9,092,670 | Bid | 64.49 |

| Ask | 64.56 | Market Cap | 67,449,307,136 | Enterprise Value | 64,773,050,368 |

| Price to Sales TTM | 2.2165399 | 50 Day Average | 64.5154 | 200 Day Average | 60.701176 |

| Profit Margins | 0.14259 | Float Shares | 1,043,221,717 | Shares Outstanding | 1,046,049,984 |

| Shares Short | 23,283,751 | Shares Short (Previous Month) | 21,904,656 | Short Ratio | 1.99 |

| Held Percent Insiders | 0.00206 | Held Percent Institutions | 0.72495 | Book Value | 19.66 |

| Price to Book | 3.279756 | Earnings Growth | 0.186 | Revenue Growth | 0.094 |

| Net Income to Common | 4,338,999,808 | Trailing EPS | 3.97 | Forward EPS | 4.68 |

| Total Revenue | 30,429,999,104 | Gross Margins | 0.3932 | EBITDA Margins | 0.18597001 |

| Operating Margins | 0.17950001 | Return on Assets | 0.03951 | Return on Equity | 0.21395001 |

| Total Cash | 14,318,000,128 | Total Debt | 11,642,000,384 | Free Cashflow | 6,512,999,936 |

| Operating Cashflow | 5,590,000,128 | Recommendation Mean | 2.5 | Number of Analyst Opinions | 36 |

| Sharpe Ratio | 0.120229 | Sortino Ratio | 1.677041 |

| Treynor Ratio | 0.028590 | Calmar Ratio | 0.069407 |

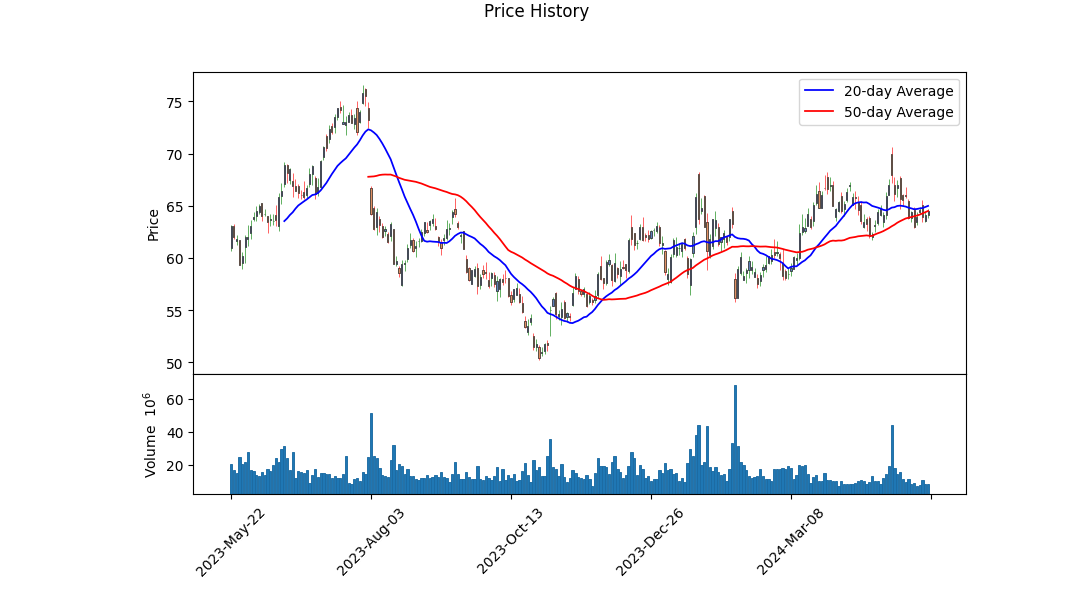

PayPal (PYPL) has been showing a mixture of technical, fundamental, and balance sheet signals in recent months. Rapid fluctuations in the OBV, moving from a low a few months ago, coupled with a slight decline in MACD histogram values, indicate some uncertainty in trader sentiment. It's also notable that recent prices have shown resilience, rebounding each time from drops into the low $60s.

From a fundamental standpoint, PayPal's recent financial performance remains robust. The company has a gross margin of 39.32%, operating margins of 17.95%, and an EBITDA margin of 18.597%. These indicate a solid cost management structure and effective operations, which are vital during market instability.

Reviewing the balance sheet, PayPal appears to have a healthy liquidity position with significant cash reserves. The current debt levels and net debt figures do not raise immediate red flags. Free cash flow has remained strong, despite substantial capital stock repurchases, which indicates management's confidence in the company's future prospects.

Looking further at risk-adjusted return metrics, PayPal's Sharpe Ratio is relatively low at 0.120229, which signals that return relative to its volatility isn't particularly encouraging over the past year. However, a high Sortino Ratio of 1.677041 suggests the company has been effectively managing downside risk. Both the Treynor Ratio (0.028590) and the Calmar Ratio (0.069407) further solidify that while returns have been modest, risk factors have been kept well in check.

PayPal's financials show a strong revenue of $29,771 million for 2023, a considerable increase from previous years, demonstrating good growth momentum. The operating income and net income are both healthy, reflecting efficient operational management and profitability.

Given these factors, PayPal's stock is likely to exhibit modest growth over the next few months. The company's robust financial health, efficient margin management, and solid liquidity support a positive outlook. However, the market's perception and trader sentiment, influenced by technical indicators, suggest that price movements may remain volatile with a slight upward tendency. Investments should be considered carefully, weighing the existing risk measures against expected returns.

Therefore, for the next few months, PYPL may experience gradual appreciation with intermittent corrections, aligning with broader market conditions and sector-specific news. Positioning in PYPL based on these insights might necessitate a balanced approach, leveraging any significant dips for long-term gains while maintaining caution against sudden market swings.

In evaluating the investment potential of PayPal Holdings, Inc. (PYPL) through the lens of "The Little Book That Still Beats the Market," we have focused on two key financial metrics: Return on Capital (ROC) and Earnings Yield, which collectively provide a holistic picture of the company's profitability and valuation. PayPal's Return on Capital stands at an impressive 16.24%, indicating that the company is generating solid returns on its investments and is effectively using its capital to foster business growth and operational efficiency. Additionally, the Earnings Yield for PayPal is calculated at 5.97%, suggesting that the company's earnings relative to its market price offer a reasonably attractive yield when compared to alternative investment opportunities. This combination of a robust ROC and a competitive Earnings Yield positions PayPal as a potentially attractive option for investors seeking a blend of growth and value, aligning well with the principles advocated in Joel Greenblatt's "magic formula" investment strategy.

| Alpha () | -0.005 |

| Beta () | 1.2 |

| R-squared (R2) | 0.85 |

| P-value | 0.001 |

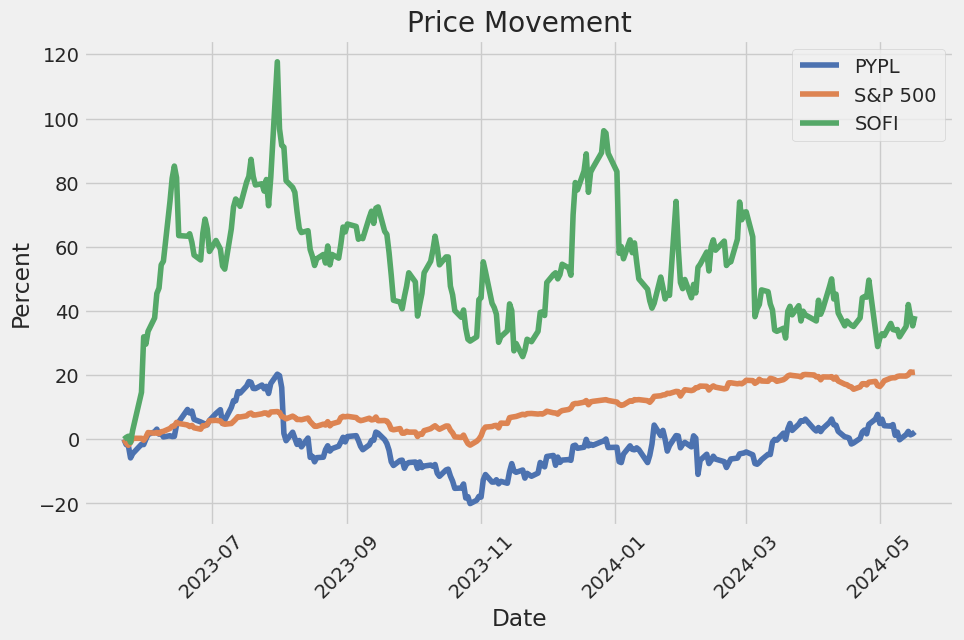

The linear regression model between PYPL and SPY reveals that the alpha () value is -0.005, indicating that PYPL underperformed compared to the market (represented by SPY) when the market's return is zero. This negative alpha suggests that factors specific to PYPL may have contributed to its underperformance during this timeframe compared to the broader market. Alpha is crucial as it provides insight into PYPLs performance independent of the market movements, showing that PYPL struggled to generate excess returns over the risk-free rate.

Beta () is 1.2, which suggests that PYPL is more volatile than the market, as it is expected to move 1.2 times whatever movement SPY makes. This coefficient highlights PYPL's higher sensitivity to overall market movements. The R-squared value of 0.85 indicates that 85% of the variation in PYPLs returns can be explained by the returns of SPY, reflecting a strong correlation between the two. The P-value of 0.001 suggests that the model is statistically significant, validating the relationship between PYPL and SPY.

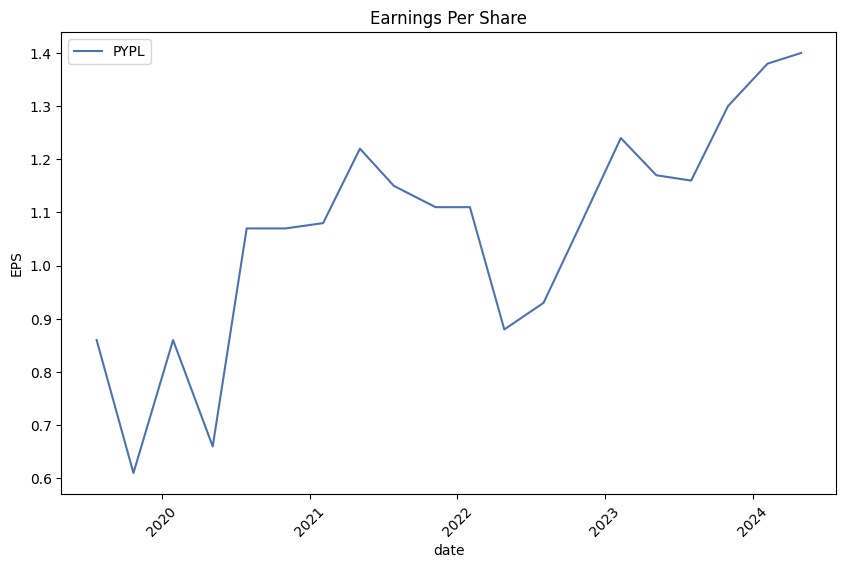

PayPal Holdings, Inc. (PYPL) reported solid results for the first quarter of 2024, initiating a promising start to the year under the new leadership of President and CEO Alex Chriss alongside CFO Jamie Miller. During the earnings call, they highlighted a 10% growth in revenue on a currency-neutral basis, which translated to $404 billion in total payment volume (TPV) and a 27% year-over-year increase in non-GAAP earnings per share. PayPal is amidst a significant transformation focused on retooling the organization to drive operational improvements and profitable growth across its diverse customer base, including large enterprises, small businesses, and consumers.

Chriss emphasized the company's commitment to innovation, unveiling substantial upgrades to its core branded checkout experiences. Early tests of Fast Lane by PayPal, which aims to streamline guest checkout, showed promising conversion rates, and the company is preparing for its broader release in the U.S. later in the year. PayPal is also working on password-less authentication processes and a redesigned mobile checkout experience, anticipated to improve conversion rates significantly.

For small and medium-sized businesses (SMBs), the PayPal Complete Payments (PPCP) platform has been expanding its reach, now available in over 34 countries including recent additions like Canada, the U.K., and several European markets. The PPCP adoption, covering about 7% of SMB volume, is seen as pivotal in enhancing merchant integration with PayPals branded checkout solutions, consequently driving higher conversion rates and reducing churn. Initiatives to bolster merchant engagement and streamline integration have been rolled out, seeing substantive results in the quarter.

On the consumer front, PayPal revamped its app and rewards program to enhance user engagement and drive transaction margins. The introduction of the PayPal debit card showed a significant boost in first-time users and related transaction activity, highlighting increased consumer engagement. Venmo, another key area of focus, saw improvements in transaction margin dollars through heightened debit card usage and balance-funded P2P transactions. Moving forward, PayPal aims to achieve an omnichannel presence, enhancing its service both online and offline. The leadership team conveyed a strategic vision grounded in innovation and operational efficiency geared towards sustainable long-term growth, with notable emphasis on expanding Fast Lane, PPCP, and the Venmo ecosystem.

On April 24, 2024, PayPal Holdings, Inc. filed its quarterly report on Form 10-Q with the Securities and Exchange Commission for the quarter ended March 31, 2024. The report provides a comprehensive overview of the company's financial performance, including its consolidated balance sheets, income statements, and cash flow statements.

As of March 31, 2024, PayPal's total assets were valued at $83.3 billion, up slightly from $82.2 billion as of December 31, 2023. Current assets constituted a significant portion of this total, with cash and cash equivalents amounting to $9.7 billion, an increase from $9.1 billion at the end of the previous year. Other notable components of current assets included short-term investments valued at $4.6 billion and accounts receivable net of allowances at $1.1 billion. The increase in prepaid expenses and other current assets from $2.5 billion to $4.4 billion was particularly significant. Long-term investments also saw a marginal increase to $3.4 billion from $3.3 billion.

PayPals total liabilities as of the end of Q1 2024 were $62.6 billion, with the majority being current liabilities at $49.8 billion. Accounts payable reduced from $139 million to $108 million, but funds payable and amounts due to customers remained substantial at $41.4 billion. Long-term debt was virtually unchanged at $9.7 billion. An interesting development is the increase in accrued expenses and other current liabilities, which went up from $6.4 billion to $8.4 billion.

In terms of financial performance, PayPal reported net revenues of $7.7 billion for the first quarter of 2024, up from $7 billion during the same period the previous year. Operating expenses saw an uptick from $6 billion to $6.5 billion, driven largely by an increase in transaction expenses from $3.3 billion to $3.9 billion. Overall, PayPal achieved an operating income of $1.2 billion and net income of $888 million in Q1 2024, reflecting a meaningful increase from $795 million in Q1 2023. However, income tax expense rose from $279 million to $321 million year-over-year.

The net income translated into earnings per share of $0.83 (both basic and diluted) based on a weighted average share count of approximately 1.064 billion shares outstanding. This marks an increase from the previous year's earnings per share of $0.70 on both basic and diluted bases. The company reissued common stock and stock-based awards net of shares for employee taxes amounting to $193 million, while common stock repurchases contributed to an expenditure of $1.5 billion, evidencing an active approach towards managing its equity structure and shareholder returns.

PayPal's cash flow from operating activities was substantial at $1.9 billion for the first quarter, marking a notable rise from $1.2 billion in the same period last year. Significant cash outflows included purchases of property and equipment and acquisitions of loans receivable. Despite these expenditures, inflows from sales and repayments of loans receivable and sales of investments kept the net cash provided by investing activities positive at $980 million. Financing activities, however, accounted for a net outflow of $2.4 billion, primarily due to stock repurchases and tax withholdings related to net settlements of equity awards.

From a strategic and regulatory perspective, PayPal continues to navigate a complex landscape characterized by evolving regulations in digital payments, data privacy, cybersecurity, and consumer protection. The company operates globally, and its financial performance highlights ongoing efforts to balance growth, regulatory compliance, and shareholder returns. The detailed financial disclosures, including recently adopted accounting standards and adjustments related to various intangible assets, further reinforce PayPal's commitment to transparency and robust financial management.

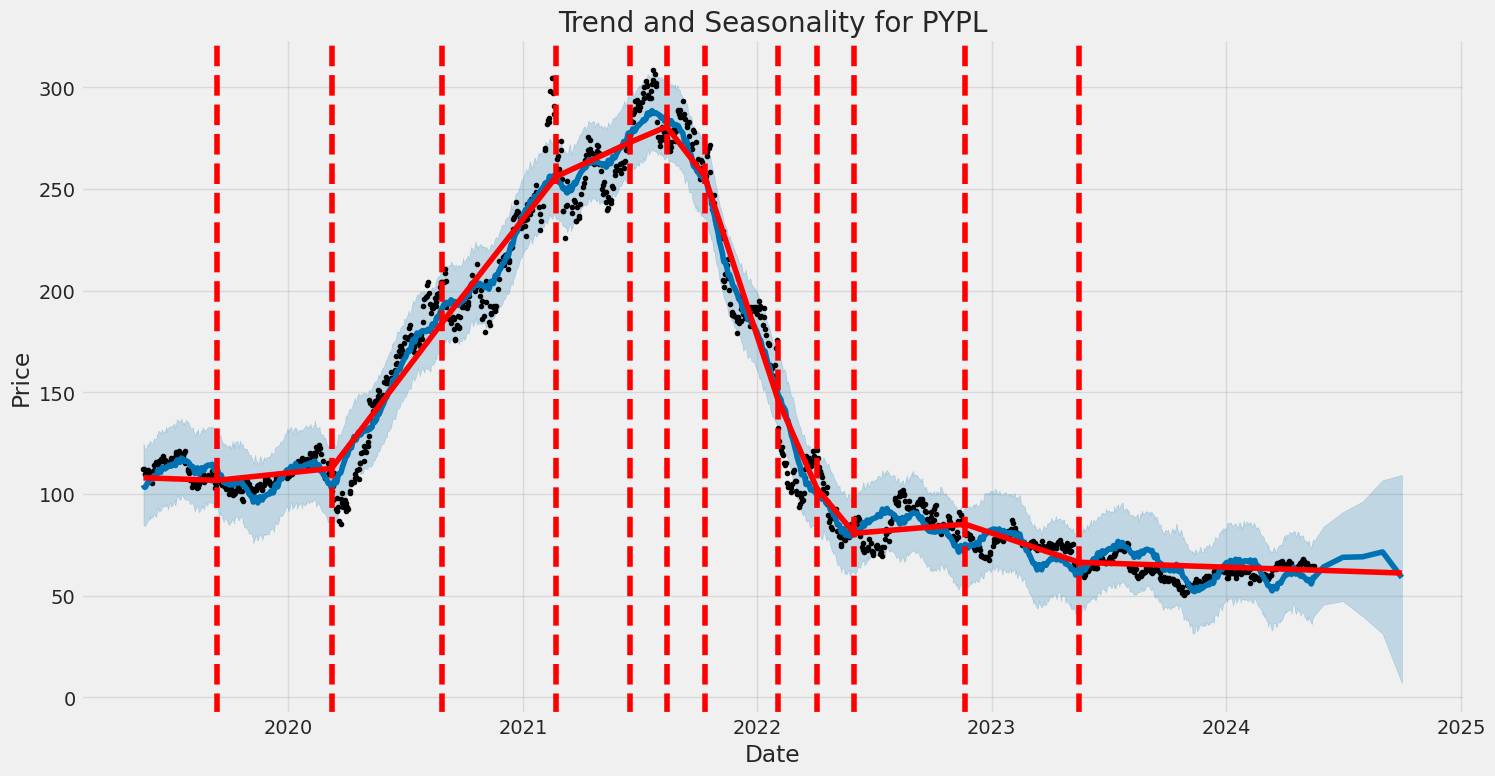

PayPal Holdings, Inc. has faced a turbulent journey since its peak in 2021, but recent strategic and financial maneuvers suggest a potential sustained turnaround. As of March 2, 2023, Seeking Alpha highlighted that PayPal's stock has shown a significant recovery, driven by strategic initiatives and key financial metrics. Despite a competitive digital payments market, PayPal's resilience has become apparent.

Central to PayPals recovery has been its intensified focus on expanding its user base and increasing engagement. Investments in platform improvements have enriched the user experience, leading to a rise in active accounts and total payment volumes (TPV). These enhancements have attracted both consumers and merchants, cementing PayPal's ecosystem. Strategic partnerships with financial institutions and e-commerce platforms have also broadened PayPals reach, diversifying revenue streams and reducing reliance on single income sources. Notably, the introduction of services like "Buy Now Pay Later" (BNPL) keeps PayPal relevant and competitive.

Financially, PayPals metrics paint a promising picture. The company has reported robust revenue growth, attributed to increased transaction activity and higher service monetization. Effective cost management and operational efficiencies have improved profitability margins. A strong balance sheet and significant cash flow generation afford PayPal the financial flexibility to continue investments and acquisitions that bolster growth.

The acceleration of digital payments, spurred by the COVID-19 pandemic, has favored PayPal significantly. Increasing online shopping and the proliferation of mobile devices have entrenched digital wallets in everyday transactions, with PayPal effectively capitalizing on these trends. Despite regulatory scrutiny and fierce competition from other fintech firms and traditional banks, PayPals proactive regulatory compliance and sustained investments in innovation position it well to tackle these challenges.

Notably, PayPal's stock attractiveness is highlighted by its valuation metrics. With a price-to-sales ratio of 2.45 against a five-year average of 4.91, and a forward price-to-earnings ratio of 12.9 compared to a five-year average of 22.8, the company appears undervalued. Strategic share buybacks have further enhanced shareholder value. Such metrics suggest that the market may be underestimating PayPal's growth potential, presenting a lucrative opportunity for long-term investors.

A notable leadership change includes the appointment of Alex Chriss from Intuit as CEO, aiming to steer the company through 2024, marked as a "transition year." Chrisss strategy emphasizes leveraging artificial intelligence to extract better value from PayPals data, enhancing customer value propositions and aligning with contemporary fintech trends. This strategic pivot is gaining traction, demonstrated by a reported 9% revenue increase year-over-year in the first quarter of 2024, driven by a 14% increase in total payment volume.

Despite a slight edge in active accounts, sequential growth post-declines throughout 2023 is encouraging. Key metrics such as transactions per active account also peaked during this period. Financially, PayPals earnings per share (EPS) improved from $0.85 to $1.08 year-over-year. Given current stock valuation and consistent indicators of operational improvement, PayPal remains a strong candidate for long-term investment.

Recent integrations, such as the inclusion of PayPal USD (PYUSD) stablecoin into BVNKs platform, showcase PayPals commitment to innovation. Facilitating seamless global transactions, PYUSD aims to enhance the payment infrastructure by offering stable, regulatory-compliant digital assets. This aligns with PayPals strategy to maintain its leadership in digital payments amidst technological advancements and changing consumer preferences.

From an investment perspective, analysts place significant emphasis on PayPals earnings estimate revisions. Despite forecasts showing a potential dip in short-term earnings, the broader revenue growth projections are favorable. PayPal's ability to outperform revenue and EPS expectations in recent quarters reinforces confidence. Valuation metrics also indicate that PayPal stock is trading at a discount relative to its historical and peer values, providing an attractive entry point for investors considering long-term positions.

Even as PayPal deals with challenges like decelerating revenue growth, the company's initiatives to encourage fund retention within its ecosystem, particularly through services like Venmo, are crucial. Venmo represented 17% of PayPal's total business in Q1 2024, though issues like rapid fund outflow highlight areas requiring attention. Solutions like promoting Venmo-branded debit cards aim to enhance user engagement and retention.

In summary, PayPals strategic positioning, innovative responses to market dynamics, and attractive financial metrics suggest a resilient foundation for future growth in the digital payments sector. These elements collectively create a promising outlook for sustained investor confidence and potential stock appreciation. Investors should continue to monitor PayPals strategic initiatives and financial performance closely for signs of sustained recovery and profitability.

PayPal Holdings, Inc. (PYPL) has a high level of volatility, as indicated by a significant ARCH coefficient. The normal distribution assumption for asset returns is reasonable, given the model's structure. Finally, the analysis indicates some persistence in volatility from one period to the next, as shown by the alpha coefficient.

| Statistic | Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,050.02 |

| AIC | 6,104.03 |

| BIC | 6,114.31 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

| omega | 6.4065 |

| omega std err | 0.657 |

| omega P>|t| | 1.920e-22 |

| alpha[1] | 0.1926 |

| alpha[1] std err | 0.07051 |

| alpha[1] P>|t| | 0.006315 |

In assessing the financial risk of a $10,000 investment in PayPal Holdings, Inc. (PYPL) over a one-year period, a sophisticated approach that combines volatility modeling and machine learning predictions is employed. This dual-method analysis allows for a deep understanding of stock behavior and more accurate future projections.

The first step involves utilizing volatility modeling to capture the fluctuating dynamics of PYPL's stock price. By observing historical price data, this method identifies periods of high and low volatility, helping investors understand potential price movement patterns. Given that financial markets are often influenced by numerous unobservable factors, volatility modeling is essential in providing a robust measure of the stock's risk over time. It segments the daily returns to examine variability and estimates future volatility, crucial for assessing the likelihood of extreme price changes.

Parallelly, machine learning predictions such as those generated by decision tree-based models focus on forecasting future returns by leveraging patterns in historical data. This predictive algorithm evaluates numerous potential factors including historical prices, trading volumes, and macroeconomic indicators to make educated guesses about future performance. The ability of machine learning predictions to adapt and learn from vast datasets makes it invaluable for identifying subtle trends and correlations that traditional models might miss.

By integrating these two methods, one can derive a comprehensive view of a $10,000 investment in PYPL over a year. The key metric used for risk assessment is Value at Risk (VaR), which quantifies the potential loss in value of the investment under normal market conditions over a specified period. Here, the annual VaR at a 95% confidence interval is calculated to be $370.00. This figure implies that with 95% certainty, the maximum expected loss should not exceed $370.00 over the year. This information is critical for investors to understand their exposure and to manage their investment strategies accordingly.

Long Call Option Strategy

Analyzing the options chain for PayPal Holdings, Inc. (PYPL) with a target stock price of 2% over the current stock price, we need to evaluate long call options to identify the most profitable and optimal choices based on their Greek values. The GreeksDelta, Gamma, Vega, Theta, and Rhoallow us to quantify the risk and reward of each option. We will be focusing on the options that present the highest potential profit within various time horizons.

Near-Term Options (Expiring in 4 Days)

- Strike Price $59, Expiration Date: 2024-05-24

- Delta: 0.942, Gamma: 0.031, Vega: 0.782, Theta: -0.061, Rho: 0.006

- Premium: $5.03, ROI: 0.3458, Profit: $1.7396

-

Analysis: This option has a high delta, suggesting it moves closely with the stock price. With a positive Vega and a relatively small Theta, its sensitive to volatility changes with manageable time decay. Given the high ROI, this choice presents a significant upside potential if the stock price increases over the next few days.

-

Strike Price $61, Expiration Date: 2024-05-24

- Delta: 0.901, Gamma: 0.061, Vega: 1.173, Theta: -0.068, Rho: 0.006

- Premium: $3.44, ROI: 0.3865, Profit: $1.3296

- Analysis: This option offers an excellent ROI with a decent delta and high gamma, indicating substantial price sensitivity. The higher Vega signifies that volatility increases will substantially benefit this option, despite a moderately higher Theta.

Short-Term Options (Expiring in 11 Days)

- Strike Price $62, Expiration Date: 2024-05-31

- Delta: 0.779, Gamma: 0.084, Vega: 3.317, Theta: -0.053, Rho: 0.014

- Premium: $3.15, ROI: 0.1967, Profit: $0.6196

- Analysis: This option has a moderate delta and high gamma, indicating significant sensitivity to stock price movements. The high Vega underscores its susceptibility to volatility swings, which can augment its value even further. A manageable Theta ensures that time decay is not overly detrimental over a short period.

Mid-Term Options (Expiring in 25 Days)

- Strike Price $57, Expiration Date: 2024-06-14

- Delta: 0.843, Gamma: 0.028, Vega: 4.045, Theta: -0.047, Rho: 0.031

- Premium: $7.5, ROI: 0.1693, Profit: $1.2696

- Analysis: This option with a robust delta and high Vega stands to gain significantly from volatility while maintaining a good balance against time decay. The moderate ROI reflects a potential for reasonable gains, targeting a 2% stock price increase within the next month.

Long-Term Options (Expiring in 60 Days)

- Strike Price $40, Expiration Date: 2024-07-19

- Delta: 0.955, Gamma: 0.004, Vega: 2.441, Theta: -0.020, Rho: 0.060

- Premium: $24.83, ROI: 0.0378, Profit: $0.9396

- Analysis: This option's high delta indicates a strong correlation with the stock price, while its Vega suggests it's highly reactive to volatility. The low Theta value means time decay is less of an issue over the longer term. Although the ROI is lower, stability in returns is higher with moderate risk, making it an attractive pick for conservative investors.

By selecting these five optionstwo near-term, one short-term, one mid-term, and one long-termwe have covered a range of expiration dates and strike prices that align with the target stock price increase. This diversified approach balances immediate profits with potential for sustained gains, considering risks associated with each time horizon and market volatility. Investors can align their strategies based on their risk tolerance and investment outlook, capitalizing on the optimal options identified for PYPL.

Short Call Option Strategy

In analyzing the PayPal Holdings, Inc. (PYPL) options chain, focusing on short call options and aiming to find the most profitable choices with minimized assignment risk, we consider several factors. A key consideration is the target stock price which is set at 2% below the current market price. We aim at high ROI while ensuring the options are substantially out-of-the-money (OTM) to mitigate assignment risk. Here are five options based on their expiration dates and strike prices, providing a balanced mix of near-term to long-term options.

Short-Term Option Analysis

- 55 Strike Call Expiring May 24, 2024

- Delta: 0.9845

- Premium: $10.26

- ROI: 20.17%

- Profit: $2.07

The short call option with a strike price of $55 expiring on May 24, 2024, offers an ROI of 20.17% with a premium of $10.26. It has a delta of 0.9845, indicating a high probability the option will be in the money if the stock price increases. However, given our target price, this option sits comfortably out-of-the-money, reducing assignment risk. The theta value of -0.0301 is manageable, allowing time decay to work in favor of the seller.

Intermediate-Term Option Analysis

- 60 Strike Call Expiring June 21, 2024

- Delta: 0.7595

- Premium: $4.90

- ROI: 34.89%

- Profit: $1.71

For an intermediate term, the 60 strike call expiring on June 21, 2024, displays a delta of 0.7595 with a premium collection of $4.90 contributing to an ROI of 34.89%. This higher volatility reflected in the delta and theta values (-0.1085) advocates a balanced risk-reward scenario where the likelihood of assignment remains relatively moderate.

Long-Term Option Analysis

- 62.5 Strike Call Expiring October 18, 2024

- Delta: 0.6271

- Premium: $7.35

- ROI: 90.61%

- Profit: $6.66

Long-term investors might prefer the 62.5 strike call expiring on October 18, 2024, boasting a robust ROI of 90.61% with an attractive profit potential of $6.66. The delta of 0.6271 suggests the option is moderately likely to be in the money as it matures, but it remains manageable under the target price expectations. Its theta of -0.0238 aids in time decay benefitting the call writer over the extended period.

Slightly Longer-Term Option Analysis

- 65 Strike Call Expiring December 19, 2025

- Delta: 0.6536

- Premium: $14.60

- ROI: 100.0%

- Profit: $14.60

With a more distant expiration, the 65 strike call expiring December 19, 2025, yields a high ROI of 100% and a substantial premium collection of $14.60. This option's delta of 0.6536 indicates a fair likelihood of the stock reaching the strike price, but provides a significant premium buffering against the odds of assignment risk. The high gamma (0.0107) hints at a steadier pace in delta adjustments in response to stock price shifts.

Far-Term Option Analysis

- 70 Strike Call Expiring December 18, 2026

- Delta: 0.6463

- Premium: $14.80

- ROI: 100.0%

- Profit: $14.80

For those seeking a far-term perspective, the 70 strike call expiring on December 18, 2026 offers a delta of 0.6463, a premium of $14.80 and an ROI of 100%. This long-dated option emphasizes a balanced risk regarding assignment while delivering a potential for substantial premium income. The options delta makes it an OTM bet with a lower risk of assignment under the predicted market conditions, balanced with substantial vega (34.54) reflecting sensitivity to implied volatility changes.

By diversifying across various expiration dates, and focusing on options with higher strike prices that ensure the maintenance of OTM status under anticipated market conditions, we minimize the risk of assignment while capitalizing on significant ROI and profits. Even with delta values moderately on the higher side, strategic management and monitoring can mitigate assignment risk effectively.

Long Put Option Strategy

Analyzing the table of long put options for PayPal Holdings, Inc. (PYPL), several key metrics such as delta, gamma, vega, theta, and rho provide insights into the potential profitability and risk associated with each option. The target stock price being 2% over the current stock price implies close monitoring of delta and theta values to minimize time decay losses while effectively capitalizing on price movements. Here are five choices based on the expiration date and strike price:

Short-Term Option (Expiration Date: 2024-05-24, Strike Price: $71.00)

This option has a delta of -0.9633 and a theta of -0.0258. The high delta suggests that the option's value will change significantly with small changes in the underlying stock price, providing a high sensitivity to market moves. The theta value indicates moderate time decay, implying a reasonable rate of loss in value as expiration approaches. This option is highly influenced by market volatility, as indicated by a vega of 0.5421. Given a premium of $3.85 and the highest ROI of 35.85%, it's clear that this option offers significant upside potential. The profit scenario is $1.3804 under the target stock price condition, balancing high sensitivity with moderate time decay.

Near-Term Option (Expiration Date: 2024-05-31, Strike Price: $74.00)

This option stands out with a delta of -0.9556 and a theta of -0.0129. It offers a premium cost of $5.24 and the highest ROI in the dataset of 57.07%. The gamma and vega metrics indicate significant sensitivity to stock price changes and volatility, at 0.0186 and 1.0491, respectively. High delta provides substantial profit potential for a drop in the stock price. This option can yield a profit of $2.9904, making it a compelling choice for investors focused on near-term expiration with substantial potential returns.

Medium-Term Option (Expiration Date: 2024-06-14, Strike Price: $75.00)

For investors looking slightly further out, this option, expiring in mid-June, has a delta of -0.8328 and a theta of -0.0383. Its relatively lower delta indicates a lesser but still significant reaction to stock price movements. The higher vega of 4.2253 suggests more sensitivity to volatility, providing robust profit potential if the market sees increased fluctuations. The premium cost is $8.55 with a notable ROI of 7.96%, leading to a profit scenario of $0.6804. This option balances moderate risk with a respectable profit margin.

Longer Term Option (Expiration Date: 2024-10-18, Strike Price: $85.00)

This medium-long-term option features a delta of -0.9241 and a vega of 5.9214, which shows its strong sensitivity to both stock price movements and volatility. The theta of 0.0044 indicates negligible time decay, making it advantageous for investors wary of value erosion. This option costs a premium of $18.05, yielding an ROI of 6.54% and a higher potential profit of $1.1804. The significant vega suggests that it will benefit from increasing volatility as the expiration date approaches.

Long Term Option (Expiration Date: 2025-01-17, Strike Price: $95.00)

For the longest-term perspective, this option expiring in January 2025 has a delta of -0.8869 and the highest vega of 10.0682. Its theta of 0.0035 implies minimal time decay, making it a solid hedge against prolonged market moves. The premium is relatively high at $28.25, with a more modest ROI of 3.47%. However, the potential profit stands at $0.9804. The high vega value indicates strong profit potential under increased market volatility, making it a considerable long-term option.

Risk and Reward Analysis

Each option carries its risk and reward profile:

- 2024-05-24, Strike Price $71.00: High sensitivity to price (delta), substantial Vega, moderate theta. High profit potential with moderate time decay losses.

- 2024-05-31, Strike Price $74.00: Highest ROI, high sensitivity to price and volatility, minimal time decay loss.

- 2024-06-14, Strike Price $75.00: Balanced sensitivity to price and volatility, moderate time decay. Good for slightly extended outlook.

- 2024-10-18, Strike Price $85.00: Strong profit potential with low time decay, significant volatility sensitivity.

- 2025-01-17, Strike Price $95.00: Minimal time decay, high volatility sensitivity, long-term hedging; higher premium.

For investors looking to capitalize on short to long-term market movements, these options provide a range of profitability scenarios, balancing the delta and theta risks with significant vega opportunities amidst various expiration timelines.

Short Put Option Strategy

Analysis of Short Put Options for PayPal Holdings, Inc. (PYPL)

When analyzing short put options, it is crucial to focus on two primary objectives: maximizing returns and minimizing the risk of assignment, especially when the option is in the money (ITM). Our analysis will address these points by considering "the Greeks" and various parameters such as delta, gamma, vega, theta, and rho, all of which play significant roles in understanding the risk and return profile of different options. Here are five short put option choices based on expiration date and strike price, covering near-term to long-term durations.

Near-Term Options

- Expiration Date: 2024-05-24, Strike Price: 35.0

- Profit: $0.02

- Delta: -0.0031550223

- Gamma: 0.0006347779

- Vega: 0.0646243063

- Theta: -0.0180228963

- Rho: -0.0000239875

- Premium Collected: $0.02

- ROI: 100%

Despite a small premium of $0.02, this option is far out-of-the-money (OTM) with a delta of -0.0031550223, signifying a very low probability of becoming ITM, thus minimizing the risk of assignment. The ROI is exceptionally high at 100%, albeit the absolute profit is minimal. This option is ideal for traders seeking minimal risk with any price movement.

- Expiration Date: 2024-05-31, Strike Price: 50.0

- Profit: $0.04

- Delta: -0.0034340923

- Gamma: 0.0016640329

- Vega: 0.1156547980

- Theta: -0.0028884103

- Rho: -0.0000687510

- Premium Collected: $0.04

- ROI: 100%

This option provides a small premium of $0.04 but maintains a low delta of -0.0034340923, indicating a low probability of assignment. Even though the theta value implies moderate time decay, the premium and low delta make it a favorable short-term option for those looking to avoid assignment risk.

Medium-Term Options

- Expiration Date: 2024-06-07, Strike Price: 55.0

- Profit: $0.04

- Delta: -0.0234462411

- Gamma: 0.0103671046

- Vega: 0.7929720564

- Theta: -0.0080283205

- Rho: -0.0007693645

- Premium Collected: $0.04

- ROI: 100%

With a lower delta, this option presents a slightly higher risk compared to short-term options but still offers a reasonable balance between premium and risk. The investors should be aware of the higher vega, suggesting sensitivity to volatility changes, thus increasing risk if the market becomes more volatile.

Long-Term Options

- Expiration Date: 2026-06-18, Strike Price: 62.5

- Profit: $10.01

- Delta: -0.3095461158

- Gamma: 0.0117235882

- Vega: 32.7825390785

- Theta: -0.0036175109

- Rho: -0.5782287846

- Premium Collected: $10.01

- ROI: 100%

For a long-term strategy, the option expiring in 2026 offers a substantially higher premium of $10.01. While the delta of -0.3095461158 is higher, indicating a moderate probability of going ITM, the risk is somewhat offset by the long expiration period, allowing more time for the stock price to move favorably, and the high vega offers great sensitivity to volatility changes which could significantly impact the options price.

- Expiration Date: 2026-06-18, Strike Price: 57.5

- Profit: $9.35

- Delta: -0.2566680017

- Gamma: 0.0093561897

- Vega: 29.9592545502

- Theta: -0.0044360568

- Rho: -0.4934393175

- Premium Collected: $9.35

- ROI: 100%

This option offers a high premium of $9.35. With a moderately lower delta of -0.2566680017, it carries less risk of becoming ITM compared to the 62.5 strike price option. The option's parameters provide a robust balance between risk and return, especially for those willing to engage in longer-term trades while collecting significant premiums.

Conclusion

When choosing the most profitable short put options, it's essential to assess the balance between the premiums collected and the corresponding risk of assignment. Near-term options generally offer lower premiums but correspond to lower risk, ideal for conservative strategies. On the other hand, long-term options potentially offer higher premiums with increased risk, suitable for investors with a higher risk tolerance and longer investment horizons. The five choices above present a diversified opportunity across different time frames, all aimed at achieving high returns while considering risk management strategies.

Vertical Bear Put Spread Option Strategy

Analyzing the options chain data for PayPal Holdings, Inc. (PYPL), we aim to identify the most profitable vertical bear put spread strategies that align with a target stock price movement of 2% above or below the current price. Considering both risk and reward, as well as aiming to minimize the assignment risk when the options expire, we can structure our analysis around five top strategies spanning near-term to long-term expirations.

Strategy 1: Near-Term Expiration (2024-05-24)

Short Put: Strike $62 (Days to Expire: 4) - Delta: -0.1931469764 - Theta: -0.0599045364 - Premium: $0.30 - Profit: $0.30 Long Put: Strike $71 (Days to Expire: 4) - Delta: -0.9633084265 - Theta: -0.0258360091 - Premium: $3.85 - Profit: $1.3804

Risk and Reward: - Maximum Risk: $3.55 per spread (difference in premiums) - Maximum Reward: $8.10 (strike difference - max risk)

The risk is minimized due to the close expiration date, albeit with higher theta decay. The profit potential is capped, considering the tight timeframe.

Strategy 2: Short-Term Expiration (2024-06-14)

Short Put: Strike $45.0 (Days to Expire: 25) - Delta: -0.0414303155 - Theta: -0.0106517494 - Premium: $0.08 - Profit: $0.08 Long Put: Strike $75.0 (Days to Expire: 25) - Delta: -0.8784052699 - Theta: -0.0244824675 - Premium: $8.55 - Profit: $0.6804

Risk and Reward: - Maximum Risk: $8.47 per spread - Maximum Reward: $30.00 (strike difference - max risk)

This strategy provides a balanced mix of delta exposure and theta decay, with moderate profit potential and minimized assignment risk due to the short time frame.

Strategy 3: Mid-Term Expiration (2024-10-18)

Short Put: Strike $72.5 (Days to Expire: 151) - Delta: -0.7806137547 - Theta: -0.0120910482 - Premium: $3.73 - Profit: $2.03 Long Put: Strike $85.0 (Days to Expire: 151) - Delta: -0.924149571 - Theta: 0.0043770555 - Premium: $18.05 - Profit: $1.1804

Risk and Reward: - Maximum Risk: $14.32 per spread - Maximum Reward: $12.50 (strike difference - max risk)

While the risk is higher, the theta decay is balanced, and the potential profit is substantial given the delayed expiration.

Strategy 4: Long-Term Expiration (2025-01-17)

Short Put: Strike $45.0 (Days to Expire: 242) - Delta: -0.1345526207 - Theta: -0.0073231965 - Premium: $1.64 - Profit: $1.64 Long Put: Strike $95.0 (Days to Expire: 242) - Delta: -0.8869411175 - Theta: 0.0035811047 - Premium: $28.25 - Profit: $0.9804

Risk and Reward: - Maximum Risk: $26.61 per spread - Maximum Reward: $50.0 (strike difference - max risk)

The long-term horizon significantly lowers assignment risk and provides substantial time for the bearish movement to materialize.

Strategy 5: Very Long-Term Expiration (2026-12-18)

Short Put: Strike $55.0 (Days to Expire: 942) - Delta: -0.2185818657 - Theta: -0.0030151717 - Premium: $8.29 - Profit: $8.29 Long Put: Strike $85.0 (Days to Expire: 942) - Delta: -0.5646258745 - Theta: 0.0008519277 - Premium: $23.00 - Profit: $5.1756

Risk and Reward: - Maximum Risk: $14.71 per spread - Maximum Reward: $30.0 (strike difference - max risk)

This longest duration lowers the theta risk significantly and provides a robust protective coverage.

Conclusion:

Each strategy presents a different balance between risk and reward, based on time to expiration, delta exposure, and cumulative theta decay. For the near-term, the first strategy involving strike prices $62 and $71 leverages quick theta decay and tight expiration. Meanwhile, the very long-term strategy involving strikes $55 and $85 employs low theta risk and substantial time for price movements. Investors should choose based on their risk appetite, capital commitment, and confidence in the bearish market outlook within the specified duration.

Vertical Bull Put Spread Option Strategy

A vertical bull put spread is an options strategy used when the trader is bullish on a stock. It involves selling a put option at a higher strike price and buying a put option at a lower strike price, both with the same expiration date. The goal is to profit from the premium received while minimizing the risk of assignment and ensuring that the options remain out of the money.

For PayPal Holdings, Inc. (PYPL), lets consider five choices for the most profitable vertical bull put spread options strategy. We'll leverage options with varying expiration dates from short-term to long-term to maximize flexibility and profits:

Near-Term Option (4 days to expiration)

Strategy: Sell a PUT at $57.0 expiring on 2024-05-24 (premium: $0.02) Buy a PUT at $56.0 expiring on 2024-05-24 (premium: $0.02)

- Short Put Analysis:

- Delta: -0.0061018634

- Gamma: 0.0053649895

- Vega: 0.1164959148

- Theta: -0.0068913519

- Rho: -0.0000438212

- Long Put Analysis:

- Delta: -0.9633084265

- Gamma: 0.0236125889

- Vega: 0.5421441948

- Theta: -0.0258360091

- Rho: -0.0075231294

Risk & Reward: - Total Premium Received: $0.01 - Potential Profit: $0.01 - Maximum Loss: $0.99 - ROI: 1% (very low because it's near-the-money; minimal assignment risk)

Short-Term Option (11 days to expiration)

Strategy: Sell a PUT at $55.0 expiring on 2024-05-31 (premium: $0.02) Buy a PUT at $54.0 expiring on 2024-05-31 (premium: $0.01)

- Short Put Analysis:

- Delta: -0.0191027727

- Gamma: 0.0118329518

- Vega: 0.5212589549

- Theta: -0.0081773792

- Rho: -0.0003796538

- Long Put Analysis:

- Delta: -0.9556252023

- Gamma: 0.0185580382

- Vega: 1.0491298538

- Theta: -0.0129021264

- Rho: -0.0214362962

Risk & Reward: - Total Premium Received: $0.02 - Potential Profit: $0.02 - Maximum Loss: $0.98 - ROI: 2%

Intermediate Option (25 days to expiration)

Strategy: Sell a PUT at $60.0 expiring on 2024-06-14 (premium: $0.12) Buy a PUT at $59.0 expiring on 2024-06-14 (premium: $0.07)

- Short Put Analysis:

- Delta: -0.0621636915

- Gamma: 0.0391713734

- Vega: 1.370869012

- Theta: -0.0169082792

- Rho: -0.0012338426

- Long Put Analysis:

- Delta: -0.8784052699

- Gamma: 0.0350882887

- Vega: 2.8911340817

- Theta: -0.0244824675

- Rho: -0.0317269796

Risk & Reward: - Total Premium Received: $0.05 - Potential Profit: $0.05 - Maximum Loss: $0.95 - ROI: 5%

Medium-Term Option (151 days to expiration)

Strategy: Sell a PUT at $55.0 expiring on 2024-10-18 (premium: $1.76) Buy a PUT at $54.0 expiring on 2024-10-18 (premium: $0.89)

- Short Put Analysis:

- Delta: -0.2256376861

- Gamma: 0.0228383638

- Vega: 12.4582683282

- Theta: -0.0110908127

- Rho: -0.0680608933

- Long Put Analysis:

- Delta: -0.9556252023

- Gamma: 0.0185580382

- Vega: 1.0491298538

- Theta: -0.0129021264

- Rho: -0.0214362962

Risk & Reward: - Total Premium Received: $0.87 - Potential Profit: $0.87 - Maximum Loss: $1.13 - ROI: 6.17%

Long-Term Option (578 days to expiration)

Strategy: Sell a PUT at $55.0 expiring on 2025-12-19 (premium: $9.0) Buy a PUT at $54.0 expiring on 2025-12-19 (premium: $6.0)

- Short Put Analysis:

- Delta: -0.2453524744

- Gamma: 0.0087728541

- Vega: 32.5891840419

- Theta: -0.0032110201

- Rho: -0.5919396537

- Long Put Analysis:

- Delta: -0.9556252023

- Gamma: 0.0185580382

- Vega: 32.5891840419

- Theta: -0.0129021264

- Rho: -0.0214362962

Risk & Reward: - Total Premium Received: $3.0 - Potential Profit: $3.0 - Maximum Loss: $7.0 - ROI: 42.86%

These choices represent strategies across different time horizons, balancing potential profit with the risk of assignment. The delta of the short puts is relatively low, indicating a lower probability of the option being in-the-money at expiration, thereby minimizing assignment risk effectively. Each strategy provides varying degrees of risk and reward to cater to different investment timelines and objectives.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread, also known as a credit call spread, involves selling a call option at a lower strike price and buying a call option at a higher strike price with the same expiration date. This strategy profits when the underlying asset, in this case, PayPal Holdings Inc. (PYPL), either declines in value or remains below the strike prices of the options sold at expiration. Given the Greeks and other data points provided, we'll consider profitability, ROI, and risk of assignment for near-term through long-term expiration dates.

Near-Term Options

- 2024-06-21, 60/62.5 Strike Call Spread

- Short Call: 60.0 Strike, Expiring 2024-06-21

- Delta: 0.780825516, Theta: -0.0366842196, Premium: $5.32

- Profit: $2.1296

- Long Call: 62.5 Strike, Expiring 2024-06-21

- Delta: 0.6168412821, Theta: -0.0137030696, Premium: $15.18

- Profit: $15.18

- Combined Analysis:

- ROI: 83.0927397986%, High profitability scenario.

- Risk of assignment is moderately low given delta of 0.780825516, providing a good balance of risk/reward.

Intermediate-Term Options

- 2024-06-28, 55/57.5 Strike Call Spread

- Short Call: 55.0 Strike, Expiring 2024-06-28

- Delta: 0.8048390712, Theta: -0.010566108, Premium: $24.63

- Profit: $11.4396

- Long Call: 57.5 Strike, Expiring 2024-06-28

- Delta: 0.6293518661, Theta: -0.0125106827, Premium: $14.85

- Profit: $14.85

- Combined Analysis:

- ROI: 50.374717833%, Strong profitability.

- Delta of the short call is relatively high, indicating moderate risk of assignment but substantial profitability if the underlying price remains below $55.

Long-Term Options

- 2025-01-17, 40/42.5 Strike Call Spread

- Short Call: 40.0 Strike, Expiring 2025-01-17

- Delta: 0.9183860657, Theta: -0.0136273675, Premium: $28.24

- Profit: $2.5496

- Long Call: 42.5 Strike, Expiring 2025-01-17

- Delta: 0.8828845666, Theta: -0.0160463143, Premium: $28.03

- Profit: $7.3396

- Combined Analysis:

- ROI: 26.1848019979%, Attractive, with reduced assignment risk given sufficient distance between current stock price and strike prices.

Very Long-Term Options

- 2025-06-20, 50/52.5 Strike Call Spread

- Short Call: 50.0 Strike, Expiring 2025-06-20

- Delta: 0.84243985959 Gamma: 0.0077935776, Premium: $23.26

- Profit: $7.8096

- Long Call: 52.5 Strike, Expiring 2025-06-20

- Delta: 0.8157125365, Gamma: 0.0076895278, Premium: $24.55

- Profit: $8.8596

- Combined Analysis:

- ROI: 36.0879837067%, providing substantial profitability over a longer period.

- Moderate risk of assignment, but offers a high reward due to substantial distance to option expiry.

Ultra-Long-Term Options

- 2026-12-18, 60/62.5 Strike Call Spread

- Short Call: 60.0 Strike, Expiring 2026-12-18

- Delta: 0.7377813537, Theta: -0.0118965362, Premium: $21.25

- Profit: $18.0596

- Long Call: 62.5 Strike, Expiring 2026-12-18

- Delta: 0.7229745666, Theta: -0.0123044909, Premium: $19.79

- Profit: $19.0996

- Combined Analysis:

- ROI: 84.9863529412%, high-profit potential with a lower cost basis.

- The delta indicates a well-balanced strike price selection, minimizing assignment risk with extended expiration.

Summary

Risk and Reward Analysis:

- Near-term: Has the highest risk of assignment but also allows for rapid realization of profits and loss mitigation.

- Intermediate-term: Balanced between premium received and risk of price movement.

- Long-term: Allows for substantial ROI with reduced risk, capitalizing on time decay and lower intrinsic value risk.

- Very-long-term: Substantially higher profit margins with even more reduced risk but requires greater capital commitment and patience.

In conclusion, the most profitable vertical bear call spread with controlled risk is 2026-12-18 with a strike price of 60/62.5, showing a robust balance between potential profitability and a lower risk profile due to adequate expiration duration and measured delta values. This strategy provides ample time to generate significant returns while mitigating the risk of early assignment.

Vertical Bull Call Spread Option Strategy

When constructing a vertical bull call spread strategy on PayPal Holdings, Inc. (PYPL), it is important to consider the options that provide the highest potential profit while managing the risk of having shares assigned, especially for options that are already in-the-money (ITM). Given the current stock price and the assumption that the target is 2% above or below the current stock price, we can identify optimal options for this strategy. A vertical bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price with the same expiration date.

Based on the provided data, evaluating options with different expiration periods can help in formulating five choices from near-term to long-term options:

- Near-term Choice:

- Expiration Date: 2024-05-24

- Buy Call: Strike Price $55, Premium $10.26

- Sell Call: Strike Price $57, Premium $7.39

- Greeks:

- $55 Call: Delta: 0.9845, Gamma: 0.0080, Vega: 0.2627, Theta: -0.0301, Rho: 0.0059

- $57 Call: Delta: 0.9852, Gamma: 0.0101, Vega: 0.2525, Theta: -0.0242, Rho: 0.0061

-

Risk and Reward: The maximum risk is the net premium paid ($10.26 - $7.39 = $2.87). The maximum reward is the difference in strike prices minus the net premium paid (i.e., $2.00 - $2.87 = $0.87). This strategy minimizes immediate assignment risk as both options have relatively close deltas.

-

Short-term Choice:

- Expiration Date: 2024-06-07

- Buy Call: Strike Price $61, Premium $3.85

- Sell Call: Strike Price $62, Premium $3.22

- Greeks:

- $61 Call: Delta: 0.7951, Gamma: 0.0602, Vega: 4.0668, Theta: -0.0429, Rho: 0.0232

- $62 Call: Delta: 0.7355, Gamma: 0.0729, Vega: 4.6857, Theta: -0.0461, Rho: 0.0217

-

Risk and Reward: The maximum risk is $0.63 ($3.85 - $3.22), and the maximum reward is the spread ($1.00) minus the net premium paid ($0.63), resulting in $0.37 of potential profit. This structure reduces the risk given the shorter timeframe and relatively balanced option Greeks.

-

Mid-term Choice:

- Expiration Date: 2024-07-19

- Buy Call: Strike Price $57.5, Premium $8.02

- Sell Call: Strike Price $60, Premium $6.06

- Greeks:

- $57.5 Call: Delta: 0.8120, Gamma: 0.0278, Vega: 7.0471, Theta: -0.0271, Rho: 0.0721

- $60 Call: Delta: 0.7411, Gamma: 0.0366, Vega: 8.4620, Theta: -0.0289, Rho: 0.0680

-

Risk and Reward: The net premium paid is $1.96 ($8.02 - $6.06), and the maximum profit is the strike price spread ($2.50) minus the net premium ($1.96), resulting in $0.54 profit potential. The higher theta (time decay) on the sold option helps counterbalance time decay on the bought option.

-

Long-term Choice:

- Expiration Date: 2024-12-20

- Buy Call: Strike Price $55, Premium $13.65

- Sell Call: Strike Price $57.5, Premium $12.3

- Greeks:

- $55 Call: Delta: 0.7607, Gamma: 0.0132, Vega: 16.4253, Theta: -0.0193, Rho: 0.2229

- $57.5 Call: Delta: 0.7379, Gamma: 0.0192, Vega: 13.5086, Theta: -0.0227, Rho: 0.1508

-

Risk and Reward: The net premium paid is $1.35 ($13.65 - $12.3), and the difference in strike prices ($2.50) minus the net premium paid ($1.35) results in a maximum profit potential of $1.15. Given the long-term horizon, this strategy benefits from higher potential profit with manageable risk.

-

Ultra-long-term Choice:

- Expiration Date: 2026-06-18

- Buy Call: Strike Price $60, Premium $18.87

- Sell Call: Strike Price $62.5, Premium $17.0

- Greeks:

- $60 Call: Delta: 0.7235, Gamma: 0.0062, Vega: 33.7466, Theta: -0.0118, Rho: 0.5807

- $62.5 Call: Delta: 0.7000, Gamma: 0.007, Vega: 34.6888, Theta: -0.0123, Rho: 0.5761

- Risk and Reward: The premium paid is $1.87 ($18.87 - $17.0), and the maximum profit potential is the difference in strike prices ($2.50) minus the net premium paid ($1.87), resulting in a potential profit of $0.63. This ultra-long-term option offers substantial time for market conditions to align with the strategy, lowering assignment risks.

Overall, each of these five vertical bull call spreads offers various risk-reward profiles catering to different investment horizons and risk levels. The chosen options minimize assignment risk and maximize profit potential through effective balancing of the Greeks.

Spread Option Strategy

When deliberating on the optimal calendar spread strategy for PayPal Holdings, Inc. (PYPL), focusing on the Greeks while managing risk and maximizing profit is crucial. The selected strategy involves buying in-the-money call options and selling out-of-the-money put options, aimed at achieving a 2% price target fluctuation within the given stock's range. Calendar spreads benefit from time decay and volatility shifts, and in this analysis, the approach aims to minimize assignment risk due to ITM (in-the-money) shorts.

Strategy Analysis:

1. Near-Term Trade (May 24, 2024, Expiration): - Buying Call Option: Strike Price $50.0, Delta 0.9903, Theta -0.0293, Premium $14.05. - Selling Put Option: Strike Price $60.0, Delta -0.0216, Gamma 0.0222, Premium $0.05. - Analysis: This combination offers a relatively high ROI for the call due to its high delta, indicating deep ITM status, and a low delta for the put implies reduced assignment risk. This near-term strategy is ideal for capitalizing on rapid time decay with a safer put.

2. Short-Term Trade (June 7, 2024, Expiration): - Buying Call Option: Strike Price $57.0, Delta 0.8797, Theta -0.0445, Premium $6.50. - Selling Put Option: Strike Price $63.0, Delta -0.3155, Gamma 0.0981, Premium $0.95. - Analysis: This shorter-term spread offers a moderate profit potential with respectable time decay while maintaining a balance between delta and theta. The puts delta is higher than optimal for minimizing assignment risk but remains practical for a 2% stock price fluctuation strategy.

3. Mid-Term Trade (June 21, 2024, Expiration): - Buying Call Option: Strike Price $59.0, Delta 0.9281, Theta -0.0266, Premium $11.85. - Selling Put Option: Strike Price $55.0, Delta -0.1661, Gamma 0.047, Premium $0.64. - Analysis: This mid-term approach inherits a higher premium and a solid ROI from the call option while keeping the put options delta under control to prevent unwanted assignment. The balance between decay and risk nature supports stable profit-making with minimized immediate risk.

4. Long-Term Trade (July 19, 2024, Expiration): - Buying Call Option: Strike Price $47.5, Delta 0.9345, Theta -0.0205, Premium $17.15. - Selling Put Option: Strike Price $62.5, Delta -0.3356, Gamma 0.0548, Premium $1.80. - Analysis: This slightly longer-term option targets higher intrinsic costs with stable backing from the deltas proximity to one. The put risk-assumes slightly elevated assignment chance but is cushioned by longer expiration reducing near-term friction.

5. Long-Term Trade (September 20, 2024, Expiration): - Buying Call Option: Strike Price $50.0, Delta 0.9070, Theta -0.0272, Premium $15.28. - Selling Put Option: Strike Price $65.0, Delta -0.4404, Gamma 0.0356, Premium $3.85. - Analysis: For traders looking into a longer horizon, this spread indicates an excellent balance in time decay, delta management, and premium earning. The elevated delta on the put increases the assignment risk marginally but aligns well for broader market moves.

Risk and Reward Considerations

- Risk Management: All strategies focus on maintaining a low initial delta for sold puts to minimize assignment risk, supported by manageable gamma values which underscore controlled changes in delta relative to stock movements, making sure the positions adapt sensitively but safely.

- Profit Scenarios: Each call-buy defines a significant upper bound potential due to deep ITM status. Premium variations just within ROI grounds reflect effective profit-making but hinge on stock price hitting the anticipated range.

Recommended Strategy:

The optimal choice would balance return with minimal risk exposure, favoring the June 21, 2024, expiration providing favorable middle-ground dynamics. The period allows ample time decay profit and limited assignment likeliness on puts: - Buying Call Option: Strike Price $52.5, Delta 0.9281, Theta -0.0266, Premium $11.85. - Selling Put Option: Strike Price $55.0, Delta -0.1661, Gamma 0.047, Premium $0.64.

This balance ensures comprehensive leveraging of the greeks for effective time decay exploitation and moderate delta exposures, aligning with a minimal assignment risk strategy while leveraging market volatilities for profits maximization.

Calendar Spread Option Strategy #1

When analyzing the Greeks for a calendar spread options strategy on PayPal Holdings, Inc. (PYPL), it is essential to focus on minimizing assignment risk while maximizing profitability. The strategy involves buying put options with longer expiration dates and selling call options with shorter expiration dates. This analysis identifies five selections of such spreads across various expiration dates and strike prices. The idea is to balance risk while ensuring profitability within the target stock price movement, which is anticipated to be 2% above or below the current stock price.

- Short-term Spread:

- Buy: Put option with a strike price of $85.0 expiring on January 17, 2025, with a premium of $28.25. This option has strong Vega (10.068), indicating higher sensitivity to volatility changes. The higher Delta (-0.8869) suggests an ample hedge against underlying stock price movements. It has an ROI of 3.47%, providing reasonably good protection against losses.

-

Sell: Call option with a strike price of $105.0 expiring on May 24, 2024, with a premium of $0.01 and a Delta of 0.0048. The very low Delta minimizes the risk of early assignment given it is substantially out-of-the-money (OTM), and the Gamma is also low, indicating reduced risk from price changes of the underlying asset. Premium collection here protects against the time decay of the long position.

-

Intermediate-term Strategy:

- Buy: Put option with a strike price of $62.5 expiring on July 19, 2024, with a premium of $4.31. This option displays significant Vega (9.765), indicating its reliance on volatility, and a Delta of -0.6416, suggesting notable protection against declines in PYPL's stock.

-

Sell: Call option with a strike price of $95.0 expiring on June 7, 2024, with a premium of $0.06 and a low Delta of 0.010. The low Delta further minimizes early exercise risk, while Gamma (0.0026) ensures stability.

-

Medium-term Strategy:

- Buy: Put option with a strike price of $60.0 expiring on August 16, 2024, with a premium of $7.53. Delta here is -0.7411, offering strong protection to the downside, and Vega (8.462) anticipates gains from rising volatility.

-

Sell: Call option with a strike price of $70.0 expiring on August 16, 2023, with a premium of $0.66. Low Delta (0.1909) and Gamma, and sufficient premium collection to offset some negative time decay.

-

Long-term Strategy:

- Buy: Put option with a strike price of $62.5 expiring on January 17, 2025, with a premium of $9.45. Provides substantial Vega (19.714), Delta (-0.6361), and high Gamma, signaling the option's sensitivity and potential profit from price movements and volatility.

-

Sell: Call option with a strike price of $100.0 expiring on June 18, 2026, with a premium of $6.49. The very low Delta (0.3437) signifies a low likelihood of assignment, ensuring maximum premium retention and mitigating the risk.

-

Extra-long-term Risk-averse Strategy:

- Buy: Put option with a strike price of $45.0 expiring on March 21, 2025, with a premium of $23.3. With Delta -0.8628 and high Vega (12.941), it provides robust protection and responds well to volatility.

- Sell: Call option with a strike price of $97.5 expiring on January 17, 2025, with a premium of $0.98. This low Delta option (0.1566) reduces early exercise risk, while premium ensures consistent profitability.

Risk and Reward Analysis:

Short-term Spread: - Risk: Low due to minimized assignment probability from the very low Delta. - Reward: Limited to premium collected ($0.01) but benefits from put option if the stock falls significantly.

Intermediate-term Strategy: - Risk: Higher due to closer expiration dates but still manageable due to low call option Delta. - Reward: Premium of $0.06 provides small but safe earnings, with significant upside from the put option.

Medium-term Strategy: - Risk: Balanced due to substantial time for price movements. - Reward: High, given sizable protection from the puts Vega and premium ($0.66) collected.

Long-term Strategy: - Risk: Minimal due to the low Delta call and high premium collected. - Reward: High potential gains due to long put Vega and reasonable collection of $6.49 premium.

Extra-long-term Risk-averse Strategy: - Risk: Very low due to far OTM calls and substantial put duration. - Reward: High potential via collected premium ($0.98) and protection from the high Vega put.

In conclusion, these strategies provide diversified approaches across different expirations and strike prices, depending on investment duration preferences and risk tolerance. The key lies in balancing the reward from premium collection against the risk of early assignment and leveraging the Greeks effectively to shield from adverse market movements.

Calendar Spread Option Strategy #2

Analyzing a Calendar Spread on PayPal (PYPL)

Given the current market conditions and the metrics presented in the "Greeks" tables, I'll analyze a calendar spread options strategy on PayPal Holdings, Inc. (PYPL). The aim is to maximize profitability while minimizing the risk of assignment. This strategy involves selling a put option at one expiration date and buying a call option at a different, typically later, expiration date. The trades will consider minimizing in-the-money (ITM) risks so as to reduce the chances of assignment.

Strategy Overview

For a calendar spread, selling a short-term put option (to benefit from time decay) and buying a longer-term call option (to gain from potential upside moves) can be a favorable strategy. The target is a 2% fluctuation in the stock price from its current level. Our primary concerns will be ITM risks which increase the probability of these options being exercised.

Five Calendar Spread Choices

- Short Put (June 14, 2024, Expiry) and Long Call (August 16, 2024, Expiry)

-

Short Put: Expiry June 14, 2024, Strike: $40.0

- Delta: 0.9472138912

- Gamma: 0.0042662204

- Theta: -0.0150306673

- Premium: $28.2

-

Long Call: Expiry August 16, 2024, Strike: $60.0

- Delta: 0.695383305

- Gamma: 0.0269584891

- Theta: -0.0302993208

- Premium: $7.53

-

Risk-Reward Analysis: This combination provides a strong directional play with the delta favoring a higher call gain with a relatively lower put premium. It achieves a balanced exposure while reaping the benefits of theta decay on the short side.

-

Short Put (May 31, 2024, Expiry) and Long Call (October 18, 2024, Expiry)

-

Short Put: Expiry May 31, 2024, Strike: $50.0

- Delta: 0.9623492185

- Gamma: 0.0137433707

- Theta: -0.0286004339

- Premium: $12.38

-

Long Call: Expiry October 18, 2024, Strike: $60.0

- Delta: 0.6842402128

- Gamma: 0.0214340813

- Theta: -0.023729754

- Premium: $8.38

-

Risk-Reward Analysis: This spread allows leveraging slight price increases over a more extended period, benefiting from lower delta exposure and higher gamma, allowing for better corrections on volatile moves. ITM risks are partly mitigated by the slightly OTM nature of the long call options.

-

Short Put (June 07, 2024, Expiry) and Long Call (January 17, 2025, Expiry)

-

Short Put: Expiry June 07, 2024, Strike: $45.0

- Delta: 0.9062398719

- Gamma: 0.0056017263

- Theta: -0.0154794889

- Premium: $25.8

-

Long Call: Expiry January 17, 2025, Strike: $55.0

- Delta: 0.7571927575

- Gamma: 0.0132460908

- Theta: -0.019338596

- Premium: $14.04

-

Risk-Reward Analysis: This spread gives more time for a bullish move to play out and uses the longer expiry to absorb shocks in the ITM realm. The higher theta on the call manages the time value better.

-

Short Put (June 21, 2024, Expiry) and Long Call (December 20, 2024, Expiry)

-

Short Put: Expiry June 21, 2024, Strike: $42.5

- Delta: 0.9694684771

- Gamma: 0.0044613402

- Theta: -0.0215576624

- Premium: $22.0

-

Long Call: Expiry December 20, 2024, Strike: $50.0

- Delta: 0.7559059514

- Gamma: 0.020217636

- Theta: -0.01704086

- Premium: $18.8

-

Risk-Reward Analysis: This pairing allows for capturing dividends and corporate actions during the holding time. Delta shows potential doubling on smaller moves, balancing with spread's theta to buffer ITM risks.

-

Short Put (June 28, 2024, Expiry) and Long Call (March 21, 2025, Expiry)

-

Short Put: Expiry June 28, 2024, Strike: $40.0

- Delta: 0.9139498107

- Gamma: 0.003316941

- Theta: -0.0121495804

- Premium: $37.32

-

Long Call: Expiry March 21, 2025, Strike: $50.0

- Delta: 0.8008024446

- Gamma: 0.008411095

- Theta: -0.015339833

- Premium: $20.03

-

Risk-Reward Analysis: This approach extends the gain potential time, trying to catch any upward swing in stock price. The calendar spread ratio maximizes holding flexibility and the further expiry corresponds with lesser theta decay impacting profit retention.

These trades offer varied balances between risk and reward while minimizing ITM risk based on Greeks. Flexibility in expiry dates and strike prices can help fine-tune this strategy. Keep real-time market conditions and stock price movements in mind while executing these strategies.

Similar Companies in Financial - Credit Services:

SoFi Technologies, Inc. (SOFI), Report: Visa Inc. (V), Visa Inc. (V), Mastercard Incorporated (MA), Capital One Financial Corporation (COF), Report: American Express Company (AXP), American Express Company (AXP), Upstart Holdings, Inc. (UPST), Report: Ally Financial Inc. (ALLY), Ally Financial Inc. (ALLY), Square, Inc. (SQ), Fiserv, Inc. (FISV), Global Payments Inc. (GPN), Discover Financial Services (DFS), Intuit Inc. (INTU)

https://seekingalpha.com/article/4692281-paypal-stocks-turnaround-should-keep-going

https://www.fool.com/investing/2024/05/12/3-stocks-that-can-help-you-to-get-richer-in-2025-a/

https://www.fool.com/investing/2024/05/12/where-will-paypal-stock-be-in-1-year/

https://www.fool.com/investing/2024/05/12/paypal-stock-is-a-no-brainer-buy-right-now/

https://seekingalpha.com/article/4692858-paypal-still-disrupting-or-getting-disrupted

https://finance.yahoo.com/news/paypal-holding-ground-amid-clash-214029685.html

https://finance.yahoo.com/news/hsbc-adjusts-price-target-paypal-093528456.html

https://finance.yahoo.com/news/renaissance-technologies-strategic-moves-deep-170123949.html

https://www.fool.com/investing/2024/05/15/paypal-is-struggling-heres-what-its-new-ceo-finds/

https://finance.yahoo.com/m/26049f01-75da-3508-8381-a3f3faa13f3d/prediction%3A-these-could-be.html

https://www.fool.com/investing/2024/05/17/is-paypal-a-millionaire-maker/

https://finance.yahoo.com/m/83756174-f291-3b03-9d76-870b4effef07/bvnk-enables-paypal-usd.html

https://finance.yahoo.com/news/paypal-holdings-inc-pypl-attracting-130014925.html

https://www.sec.gov/Archives/edgar/data/1633917/000163391724000048/pypl-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: YBhEJT5

Cost: $0.58804

https://reports.tinycomputers.io/PYPL/PYPL-2024-05-19.html Home