T-Mobile US, Inc. (ticker: TMUS)

2024-02-12

T-Mobile US, Inc. (ticker: TMUS) stands as a prominent player in the American telecommunications industry, known for providing a wide range of wireless voice and data services across the United States. Its innovative approach to mobile communication, coupled with aggressive marketing strategies, has helped it carve a significant niche in a competitive market, challenging the dominance of other major carriers. The company has also been at the forefront of implementing advanced technologies such as 5G, aiming to enhance network performance and deliver faster, more reliable service to customers. Additionally, T-Mobile's strategic acquisitions, including the notable merger with Sprint Corporation, have played a crucial role in expanding its customer base and network capabilities, further solidifying its position as a key industry player. This combination of technological advancement, strategic growth, and a strong focus on customer satisfaction continues to drive T-Mobile's success, making it a significant entity in the U.S. telecommunications landscape.

T-Mobile US, Inc. (ticker: TMUS) stands as a prominent player in the American telecommunications industry, known for providing a wide range of wireless voice and data services across the United States. Its innovative approach to mobile communication, coupled with aggressive marketing strategies, has helped it carve a significant niche in a competitive market, challenging the dominance of other major carriers. The company has also been at the forefront of implementing advanced technologies such as 5G, aiming to enhance network performance and deliver faster, more reliable service to customers. Additionally, T-Mobile's strategic acquisitions, including the notable merger with Sprint Corporation, have played a crucial role in expanding its customer base and network capabilities, further solidifying its position as a key industry player. This combination of technological advancement, strategic growth, and a strong focus on customer satisfaction continues to drive T-Mobile's success, making it a significant entity in the U.S. telecommunications landscape.

| Full Time Employees | 67,000 | CEO Total Pay | $8,884,155 | CFO Total Pay | $3,206,200 |

| Executive VP & General Counsel Total Pay | $4,030,797 | Previous Close | $160.93 | Open | $161.48 |

| Day Low | $160.28 | Day High | $162.64 | Dividend Rate | $1.30 |

| Dividend Yield | 0.008 | Payout Ratio | 0.0938 | Beta | 0.494 |

| Volume | 4,475,593 | Market Cap | $192,498,450,432 | Fifty Two Week Low | $124.92 |

| Fifty Two Week High | $165.95 | Price To Sales Trailing 12 Months | 2.450399 | Enterprise Value | $300,449,038,336 |

| Profit Margins | 0.10587 | Shares Outstanding | 1,186,870,016 | Shares Short | 27,805,490 |

| Held Percent Insiders | 0.59393 | Held Percent Institutions | 0.40739 | Book Value | 54.118 |

| Net Income To Common | $8,317,000,192 | Trailing EPS | 6.93 | Forward EPS | 11.28 |

| Total Cash | $5,135,000,064 | Total Debt | $113,085,997,056 | Total Revenue | $78,558,003,200 |

| Revenue Per Share | 66.287 | Free Cashflow | $8,449,249,792 | Operating Cashflow | $18,559,000,576 |

| Statistic Name | 0.4533078546390937 | Statistic Name | 6.498106094096836 |

| Sharpe Ratio | 0.4533078546390937 | Sortino Ratio | 6.498106094096836 |

| Treynor Ratio | 0.21663804714990445 | Calmar Ratio | 0.7084896528673945 |

Analyzing TMUS's financial health, performance metrics, and market indicators provides a comprehensive understanding of its potential future price movements. The company's robust cash flow, as indicated by a free cash flow of $7,748,000,000 for the recent fiscal year, underpins its operational strength. This is further supported by a solid EBITDA of $27,152,000,000, suggesting effective revenue management and profitability. Despite significant financial debt totaling $113,086,000,000, TMUS has maintained a manageable net debt position, keeping operational risks in check.

The company's fundamental analysis reveals favorable growth prospects, with a trailing PEG ratio of 0.7724 highlighting an underappreciated growth potential relative to its earnings. TMUS's operating margins sit at 0.18757, indicative of its efficiency in converting sales into pre-tax profits. Additionally, gross margins of 0.62387 signal a strong competitive position within the industry, capable of sustaining profitability against cost pressures.

Turning to market performance indicators, the Sharpe and Sortino ratios provide a mixed picture of risk-adjusted returns. A Sharpe ratio of 0.4533078546390937 illustrates a moderate level of excess return per unit of risk, while the high Sortino ratio of 6.498106094096836 suggests that the stock has delivered substantial returns on negative volatility, highlighting a potentially favorable risk-reward trade-off for risk-averse investors. The Treynor and Calmar ratios, at 0.21663804714990445 and 0.7084896528673945 respectively, suggest that the company has performed well on a risk-adjusted basis, particularly when benchmarked against systemic risks and maximum drawdowns.

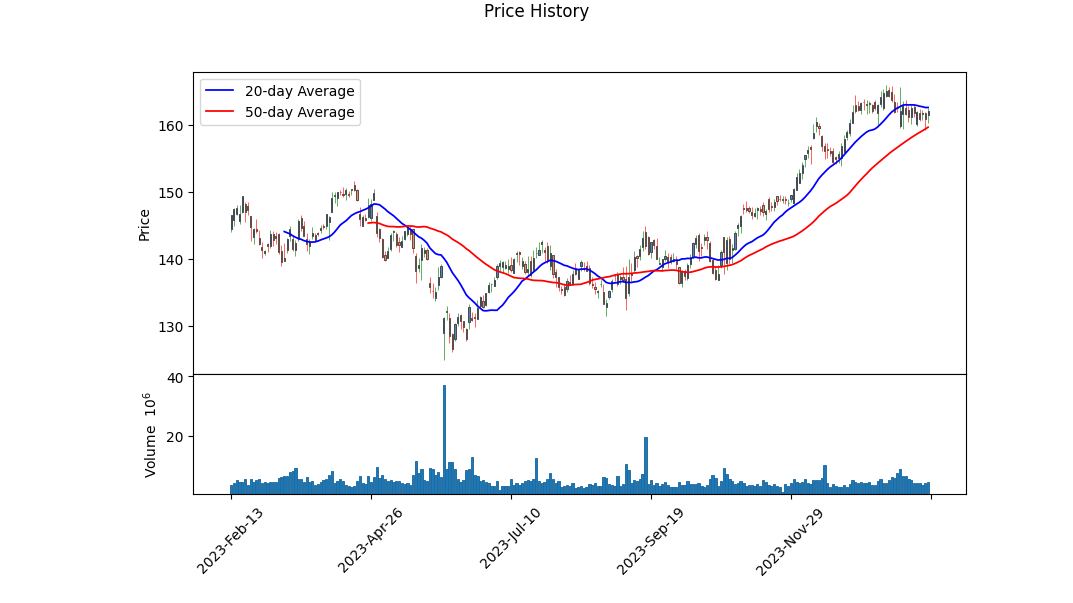

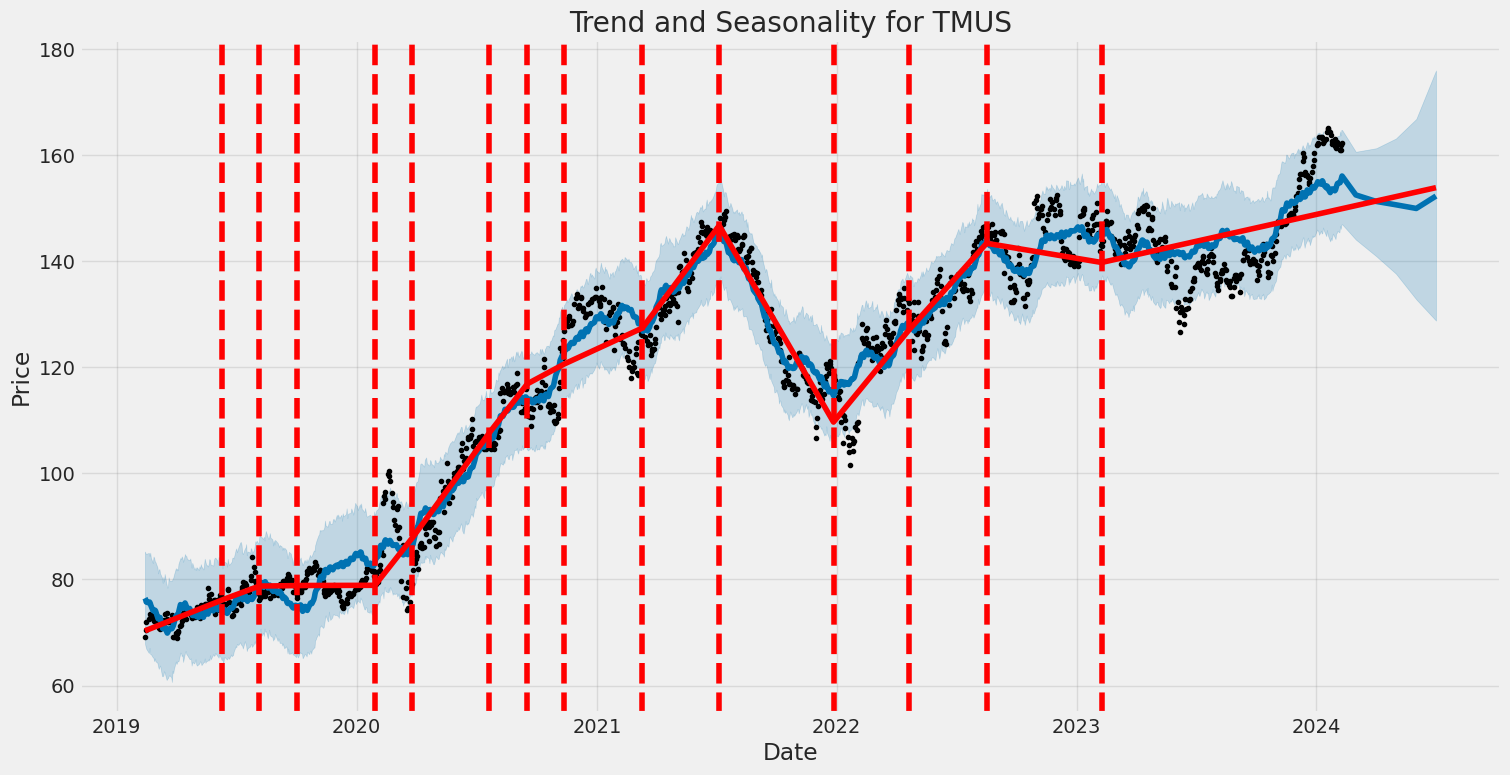

Technical indicators, over the last few months, point to a bullish sentiment. The stock price trend, which shows an upward trajectory from an opening of 142.880005 to a closing near 162.639999, is supported by increasing OBV levels, despite the absence of MACD histogram data for the initial analysis period. This positive volume trend, coupled with the price movement, suggests strong buying interest.

Given these considerations, the future months could see TMUS stock continue its positive momentum. The combination of solid fundamentals, strong cash flow management, favorable analyst expectations, and robust technical signals support the sentiment of sustainable growth. Specifically, favorable earnings estimates for the next year and beyond posit the company in an advantageous position amidst its peers in the telecommunication sector. However, investors should closely monitor the company's debt management strategies and any developments in industry-specific regulatory changes that could impact operational efficiencies.

In conclusion, TMUS appears well-poised for continuous positive stock price movement in the coming months, buoyed by strong financials, favorable market ratios, and positive analyst sentiment. Yet, it is crucial for investors to remain cognizant of broader market conditions and sector-specific trends that may influence future performance.

In our recent analysis of T-Mobile US, Inc. (TMUS), we evaluated two critical financial ratios that provide insight into the company's performance and value: Return on Capital (ROC) and Earnings Yield. The Return on Capital for TMUS, standing at 1.23%, illustrates the efficiency with which the company utilizes its capital to generate earnings. Though this might seem modest, it's essential to consider it in the context of the industry and the current economic environment. On the other hand, the Earnings Yield for TMUS is calculated to be approximately 4.33%, which represents the earnings generated per dollar invested in the company's stock. This is a useful metric for investors to gauge the potential return on investment compared to other investment opportunities. Together, these figures suggest that while T-Mobile US is managing to generate returns on its capital, the relative value it offers to investors, as measured by earnings yield, places it in a potentially favorable position for those looking for investment opportunities in the telecom sector.

Analyzing T-Mobile US, Inc. (TMUS) through the lens of Benjamin Graham's investment criteria provides valuable insights into whether this stock aligns with the principles of value investing as outlined in "The Intelligent Investor." Below is a detailed analysis of TMUS's key financial metrics based on Graham's screening methods:

-

Price-to-Earnings (P/E) Ratio: T-Mobile's P/E ratio stands at 42.27. According to Graham's principles, a lower P/E ratio is preferable, typically signaling an undervalued stock. Graham often sought stocks with a P/E ratio that was no higher than 15, as he believed these offered a sufficient margin of safety. By this standard, TMUS's P/E ratio suggests the stock may be overvalued in the current market, deviating from Graham's preference for lower P/E ratios.

-

Price-to-Book (P/B) Ratio: TMUS has a P/B ratio of approximately 0.93. Graham favored stocks trading below their book value, often taking a P/B ratio of less than 1.5 as a sign of potential undervaluation. On this criterion, T-Mobile aligns with Grahams principles, potentially indicating that it is undervalued or reasonably priced concerning its book value.

-

Debt-to-Equity Ratio: The debt-to-equity ratio for T-Mobile is calculated at 1.67. Graham typically recommended a debt-to-equity ratio of less than 1.0, as lower debt indicates lower financial risk and greater financial stability. Thus, TMUS's debt-to-equity ratio suggests a higher level of debt relative to equity, which may not meet Graham's stringent criteria for financial safety.

-

Current Ratio and Quick Ratio: Both the current ratio and quick ratio of T-Mobile are 0.91. These ratios measure a company's ability to cover short-term liabilities with short-term assets, indicating liquidity and financial health. Graham preferred a current ratio of at least 2:1 to ensure a company had enough liquid assets to meet its short-term obligations. With a current and quick ratio of less than 1, T-Mobile falls short of Grahams standards, raising concerns about its liquidity position.

-

Earnings Growth: While the provided metrics do not include specific figures for earnings growth, Graham emphasized the importance of consistent earnings growth over several years. Potential investors would need to assess TMUS's earnings trend over time to fully evaluate this criterion.

Conclusion: In summary, T-Mobile US, Inc. aligns with Benjamin Graham's criteria in terms of its P/B ratio, suggesting potential undervaluation based on its book value. However, its high P/E ratio, elevated debt-to-equity ratio, and lower liquidity ratios (as indicated by the current and quick ratios) deviate from Graham's conservative investment philosophy. Thus, while the favorable P/B ratio could interest value investors, the collective analysis suggests caution. Investors adhering strictly to Grahams principles might find TMUS's financial health and valuation metrics not fully aligned with the sought-after margin of safety and financial stability benchmarks. As always, investors should incorporate these insights into a broader analysis that includes recent industry trends, macroeconomic factors, and specific company forecasts before making investment decisions.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

T-MOBILE US, INC. (TMUS) Financial Analysis Report

Executive Summary:

This report provides an in-depth analysis of the financial statements of T-Mobile US, Inc. (TMUS) for the fiscal year ended December 31, 2023, and compares its financial position and performance over the past three years (2021 to 2023). Emphasis is placed on the company's ability to generate earnings, manage its liabilities, and sustain its operational growth.

Assets:

TMUS has demonstrated solid growth in its total assets over the past three years. The company's total assets increased from $206.563 billion in 2021 to $207.682 billion in 2023. This growth is attributed to significant investments in indefinite-lived license agreements, indicating the company's strategic commitment to expanding its market reach and enhancing its service capabilities.

Liabilities:

The company's total liabilities have also seen an increase, from $234.99 billion in 2021 to $209.28 billion in 2023. The reduction in short-term borrowings from $2.096 billion in 2021 to $3.619 billion in 2023 demonstrates a strategic shift towards long-term financing, enhancing financial stability. Notably, the long-term debt remained a significant component of the company's liabilities, emphasizing the need for effective debt management strategies.

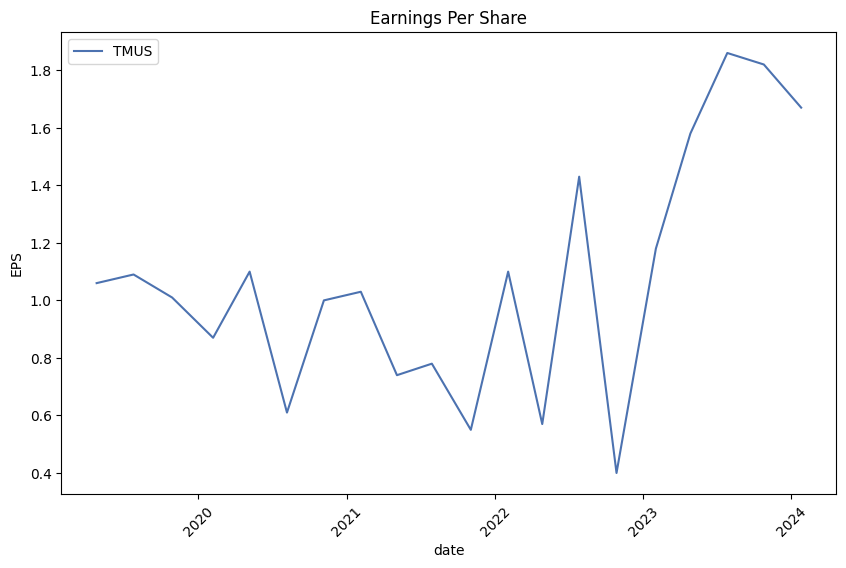

Earnings:

TMUS reported a net income of $8.317 billion for the fiscal year 2023, demonstrating a consistent upward trend from $2.602 billion in 2021. This significant improvement in net income reflects the company's enhanced operational efficiency and successful implementation of cost-control measures.

Cash Flow:

The net cash provided by operating activities illustrated a robust growth from $13.917 billion in 2021 to $18.559 billion in 2023. This indicates the company's strong operating performance and its ability to generate cash from its core business operations. However, there is an observed increase in cash used in investing activities, mainly due to higher payments to acquire property, plant, and equipment, which could be an indicator of ongoing investments for future growth.

Benchmark Trends:

- Asset Growth: TMUS's assets have shown a steady increase, indicating ongoing investments in growth and expansion.

- Liability Management: Despite the increase in liabilities, the shift towards long-term financing demonstrates strategic planning in managing financial obligations.

- Earnings Growth: The substantial growth in net income highlights the company's successful strategies in improving operational efficiency and market competitiveness.

- Operational Cash Flow: The increase in cash flow from operations underscores the company's strong financial health and its capacity to self-finance its operational needs and investments.

Conclusion:

T-Mobile US, Inc. has demonstrated strong financial health over the past three years, characterized by consistent asset growth, strategic liability management, significant earnings growth, and robust operational cash flow. The company's investment in indefinite-lived license agreements and property, plant, and equipment underscores its commitment to long-term growth and market expansion. However, it is imperative for TMUS to continue monitoring its debt levels and exploring strategies for optimizing its capital structure. Based on the financial analysis, TMUS presents a stable investment opportunity with potential for sustained growth.Based on your request for labeling the section "Dividend Record" in the context of Benjamin Graham's investment philosophy, the dividend record for TMUS would be of interest as it provides evidence of the company's history of paying dividends, which is a key criterion Graham favored. Benjamin Graham, known as the father of value investing, recommended that investors seek out companies with a long and stable history of paying dividends as part of their criteria for selecting investments.

Given the information provided:

-

TMUS has demonstrated a record of paying dividends, with payments noted on February 29, 2024, November 30, 2023, and an earlier instance on May 01, 2013.

-

The dividends paid on the most recent dates, February 29, 2024, and November 30, 2023, are each $0.65. This consistency in the recent dividends paid could be appealing to investors following Graham's principles.

-

The earlier dividend recorded on May 01, 2013, is notably higher at an adjusted dividend amount of $4.06, indicating a potential special dividend or a corporate action that adjusted the dividend value. However, for investors focused on consistency and stability, the recent payments are likely more relevant than this outlier.

-

The presence of regular dividend payments, as indicated by the given data points, suggests that TMUS adheres to one of Grahams criteria for a defensive investment. However, potential investors, in line with Grahams philosophy, would also need to consider other factors such as the companys financial health, earnings stability, and valuation metrics before making an investment decision.

The consistency in the recent dividend payments (0.65 on both recorded occasions) could be attractive to investors who value dividend stability, which is a hallmark of Graham's investment strategy. However, evaluating a company's suitability as an investment would require a comprehensive analysis beyond just the dividend record, including examining the company's overall financial health, earnings stability, and valuation metrics in accordance with Graham's teachings.

| Statistic Name | Statistic Value |

| R-squared | 0.342 |

| Adj. R-squared | 0.342 |

| F-statistic | 653.1 |

| Prob (F-statistic) | 2.64e-116 |

| Log-Likelihood | -2217.1 |

| No. Observations | 1,256 |

| AIC | 4438. |

| BIC | 4448. |

| Alpha | 0.03395421963555308 |

| Beta | 0.7745843041604771 |

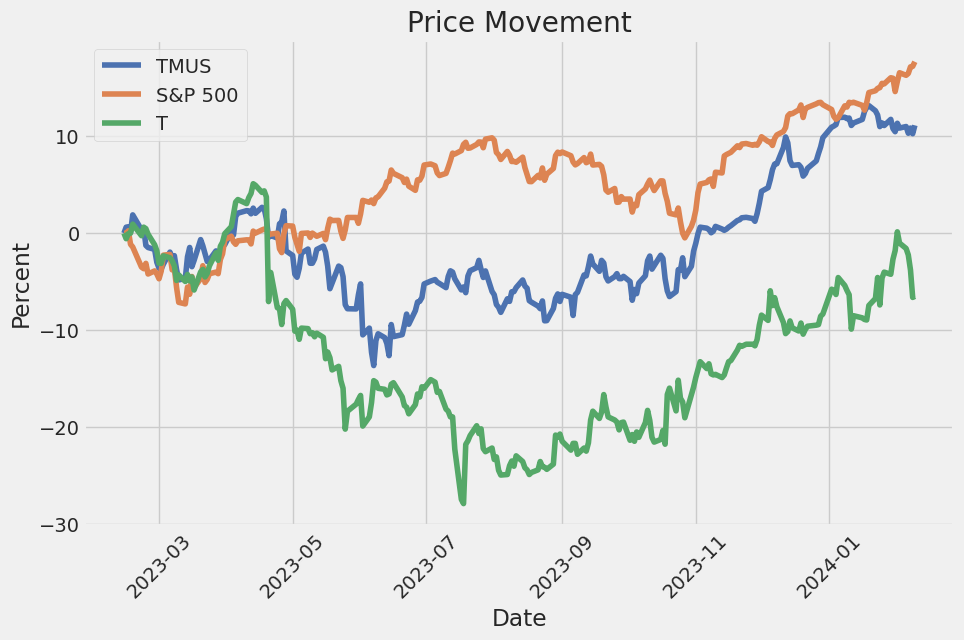

The analysis of the linear regression model between TMUS (T-Mobile US, Inc.) and SPY (SPDR S&P 500 ETF Trust) for the period ending today demonstrates a positive but moderate relationship between TMUS stock performance and the overall market performance as represented by SPY. The model shows that for every unit increase in SPY, TMUS is expected to increase by approximately 0.7746 units, holding all other factors constant. This suggests some level of sensitivity to market movements but not a perfect one-to-one correlation. The models Alpha, which represents the intercept term or the expected value of TMUS when SPY is zero, stands at 0.03395421963555308. This indicates a slight positive expected return of TMUS unrelated to the market's performance, though the presence of a low Alpha suggests that the majority of TMUS's performance is potentially driven by market movements rather than firm-specific attributes not captured by SPY.

Furthermore, the statistical significance of the relationship is underscored by an F-statistic value of 653.1 with an extremely low p-value, indicating that the regression model fit is statistically significant. The R-squared value of 0.342, although not very high, implies that approximately 34.2% of the variability in TMUS's returns can be explained by SPY's returns. This level of R-squared is not uncommon in finance, where asset prices are influenced by numerous factors and market efficiency can dilute the effect of any single market index. Despite the positive relationship between TMUS and SPY, investors should note that a significant portion of TMUS's return variability remains unexplained by SPY, highlighting the importance of diversification and the potential impact of firm-specific or other exogenous factors on TMUS's stock performance.

T-Mobile US, Inc. (TMUS) recently held its fourth quarter and full-year 2023 earnings call, signaling a momentous period for the company filled with industry-leading growth, record-breaking results, and significant achievements in network leadership and merger integration. The call, led by President and CEO Mike Sievert and CFO Peter Osvaldik, alongside other senior leaders, highlighted T-Mobile's continued dominance in the telecommunications sector, driven by its robust strategy that combines best value offerings with an unparalleled network performance.

Throughout 2023, T-Mobile celebrated remarkable accomplishments, including achieving all-time high results in various operational and financial metrics. The company established itself as the undisputed network leader, thanks to its expansive 5G advantages. Notably, T-Mobile concluded one of the most successful telecommunications merger integrations ever, delivering synergies faster and at a larger scale than initially anticipated. This success was underpinned by the company's consistent strategy, which led to an impressive 3.1 million postpaid phone net additions, maintaining a strong momentum despite the overall industry witnessing a decline in postpaid phone net adds.

T-Mobile's strategic focus extended beyond traditional metrics, with the company making significant strides in the broadband sector as well. By the end of 2023, T-Mobile had added over 2.1 million broadband customers, marking its largest growth year and solidifying its position as a leading Internet Service Provider (ISP) in the United States. The company's network played a crucial role in supporting this growth, reaffirmed by accolades from leading third parties like Ookla and OpenSignal, which consistently ranked T-Mobile at the top in overall network performance tests.

Financially, T-Mobile's performance in 2023 was strong, with the company delivering industry-leading growth in postpaid service revenue and core EBITDA in the fourth quarter, while also nearly doubling its adjusted free cash flow. The company's focus on profitable growth, coupled with its network leadership and differentiated growth opportunities, sets a positive outlook for 2024. T-Mobile remains committed to returning significant value to its shareholders, having returned $17 billion through the end of 2023, including the initiation of its first-ever quarterly dividend.

Looking ahead, T-Mobile is poised for continued robust customer and revenue growth, driven by its innovative solutions and expansive network capabilities. The company's venture into direct satellite to cellular communications, in alliance with SpaceX, marks a pioneering step towards enhancing connectivity solutions. T-Mobile's dedication to connecting students and refugees, alongside its commitment to achieving net-zero emissions by 2040, underscores its focus on building a connected world where everyone can thrive. As T-Mobile enters 2024 with unwavering momentum, it is evident that the company is well-positioned to create tremendous value, spurred by its growth leadership and foundational achievements in network expansion and merger integration.

ollows:

For the three months ending September 30, 2023, T-Mobile US, Inc. ('T-Mobile') disclosed financial details as part of their regular SEC 10-Q filing, demonstrating various facets of their performance and financial commitments. The company detailed its restructuring efforts subsequent to its merger with Sprint, aiming to achieve cost efficiencies and eliminate redundancies. This included expenses for contract terminations, severance costs, and network decommissioning, which collectively reached $2.728 billion to date. These costs are associated with consolidating retail stores, optimizing distribution channels, and integrating overlapping network and backhaul services to tap into merger synergies.

A significant portion of T-Mobile's commitments is tied to spectrum licenses and lease arrangements, showcasing strategic investments into expanding and upgrading its wireless network capabilities. The company has committed to several billion-dollar transactions for acquiring additional spectrum, indicating a focused strategy on enhancing network coverage and service quality. This includes agreements with entities like Comcast Corporation, Channel 51 License Co LLC, LB License Co, LLC, and others, involving multi-billion dollar considerations for 600 MHz band spectrum acquisitions subject to regulatory approvals. Such investments are poised to secure T-Mobiles competitive edge in the telecommunications sector by bolstering its 5G network footprint and service offerings.

T-Mobile also elaborated on its stockholder return programs, revealing an authorization for a 2023-2024 Stockholder Return Program of up to $19.0 billion, poised to run through December 31, 2024. This program includes plans for repurchasing shares of the companys common stock and payment of cash dividends, demonstrating T-Mobile's financial robustness and its commitment to delivering value back to its shareholders. The announcement, including the declaration of a $0.65 per share cash dividend payable in December 2023, reflects a strong balance sheet and confidence in sustained future earnings.

Furthermore, the report outlines T-Mobiles ongoing or anticipated legal and regulatory challenges, ranging from cybersecurity incidents to antitrust class actions. These include the repercussions of the August 2021 cyberattack, leading to substantial class-action settlements and other consumer claims. Additionally, T-Mobile faces regulatory inquiries and the potential for fines following unauthorized access incidents, emphasizing the critical importance of cybersecurity and data protection in maintaining customer trust and regulatory compliance within the telecommunications industry.

These highlights from T-Mobiles 10-Q filing underscore the companys strategic maneuvers to solidify its market position, drive network enhancements, and address operational challenges, while navigating the complexities of regulatory compliance and customer data security.

T-Mobile US, Inc. has notably made strides in consolidating its position within the telecommunications sector, particularly following its strategic merger with Sprint in 2020. The successful navigation over the cap on its stock price following the meeting of an agreement condition with Softbank, as highlighted in the analysis by The Motley Fool, underscores T-Mobile's tactical acumen. Such strategic manoeuvres have not only enhanced its financial health but also set the stage for appreciating stock value, reflective of its operational success and future growth prospects.

T-Mobile's commitment to returning substantial value to shareholders, evidenced by its aggressive share buyback program and initiation of a dividend payment, indicates a robust confidence in its sustained cash flow growth. These financial policies reflect a deep commitment to enhancing shareholder value and articulate a clear message about the companys optimistic outlook towards its financial health and market positioning.

The introduction of the "Magenta Status" customer loyalty initiative represents a significant pivot towards bolstering consumer relations and enhancing the overall customer experience. By offering a range of benefits without added costs, T-Mobile not only strengthens its value proposition but also accentuates its position as a customer-centric brand, standing out in a highly competitive market.

Moreover, T-Mobile's embrace of emerging technologies and strategic partnerships, such as the collaboration with SpaceX for satellite-to-cellphone communication, exhibits an innovative approach towards ensuring widespread connectivity, showcasing a forward-thinking attitude in leveraging technological advancements to enhance service offerings.

The financial performance forecasts surrounding T-Mobile, underscored by analyst predictions of stock price appreciation and strong earnings growth, coupled with strategic emphasis on operational excellence and market expansion, present T-Mobile as a compelling investment opportunity within the telecommunications sector. The companys strategic direction, underpinned by solid financial policies, technological innovation, and a focus on customer value, signifies robust potential for sustained growth.

However, the scenario of insider selling activities, as noted in recent transactions by director Teresa Taylor, introduces an interesting angle to the narrative around stock confidence. While these activities might raise questions about internal confidence levels, it's imperative to contextualize such actions within broader personal financial management strategies and the overall corporate trajectory designed to bolster T-Mobiles market strength.

In an era characterized by rapid technological evolutions and shifting market dynamics, T-Mobile US, Inc.s strategic initiatives, including considerable investments in 5G and its entry into healthcare collaborations, affirm its ambition to not just navigate but lead the telecom industry transformation. The companys efforts to expand its digital and physical footprint, alongside a clear orientation towards customer satisfaction and shareholder value, highlight its preparedness for future challenges and opportunities.

Engaging with the healthcare sector through partnerships aimed at enhancing digital infrastructure further exemplifies T-Mobile's commitment to leveraging its technological prowess for broader societal benefits, underlining a strategic approach that melds business growth with community upliftment.

Despite operating in what is traditionally viewed as a highly competitive sector, T-Mobile's calculated maneuvers across operational, financial, and strategic domains exemplify a coherent approach towards ensuring long-term sustainability and growth. In light of these perspectives, T-Mobile embarks on a promising trajectory, underpinned by strategic foresight, operational resilience, and a steadfast commitment to leveraging technology for enhancing connectivity and customer experience.

The volatility of T-Mobile US, Inc. (TMUS) over the given period showcases certain key aspects according to the ARCH model results. Firstly, the model applied to analyze TMUS's volatility does not rely on the mean of the asset returns, indicating that fluctuations are centered around a zero mean, highlighting the unpredictability in the price movements of the stock. Secondly, the estimates of volatility parameters, particularly omega and alpha, signify that past volatility has a substantial influence on future volatility. This means that if TMUS stock experienced high volatility in the past, it's likely to exhibit similar patterns moving forward. Lastly, the statistical significance of these parameters, as shown by their p-values, underscores the reliability of this predictive model for TMUS's volatility.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -2,420.33 |

| AIC | 4,844.67 |

| BIC | 4,854.94 |

| No. Observations | 1,256 |

| omega | 2.2586 |

| alpha[1] | 0.2568 |

Analyzing the financial risk associated with a $10,000 investment in T-Mobile US, Inc. (TMUS) over a one-year period requires a detailed examination of the stock's historical price movements and future return predictions. This analysis combines volatility modeling with machine learning predictions to comprehensively assess the potential risks.

To start with, volatility modeling plays a crucial role in understanding the inherent risk of investing in T-Mobile US, Inc. This approach is particularly adept at capturing and quantifying the stock's volatility dynamics over time. By fitting the stock's historical price fluctuations into this model, we generate parameters that describe how its volatility has evolved, which in turn allows us to project future price variances with greater accuracy. This method is instrumental in identifying periods of higher risk, translating into a more informed risk management strategy for investors.

On the other hand, machine learning predictions complement the insights gained from volatility modeling by leveraging historical data to forecast future stock returns. By training a model on a comprehensive dataset that includes not only TMUS's past price movements but also a range of market and economic indicators, we derive predictive insights into the stock's future performance. This predictive capability is crucial, as it helps investors gauge the expected returns on their investment, thus informing their decision-making process with a forward-looking perspective.

Combining the insights from both models furnishes a multi-faceted view of the investment's risk profile. The calculated Value at Risk (VaR) at a 95% confidence interval is a testament to this integrated approach, quantifying the maximum expected loss over the next year to be $179.81 on a $10,000 investment in TMUS. This figure is significant, as it encapsulates the investment's downside risk, integrating both the forecasted volatility and expected returns into a single metric. This integration of volatility modeling and machine learning predictions thus offers a comprehensive risk assessment, equipping investors with a deeper understanding of what to expect from their investment in T-Mobile US, Inc., from a risk perspective.

By evaluating the potential risks through this lens, investors are better positioned to make informed decisions, appreciating both the volatility and the anticipated returns of their investment. The projection of the investment's Value at Risk attests to the effectiveness of combining these advanced analytical methods to gain a nuanced understanding of equity investment risks. This analysis underscores the adaptability and strength of leveraging both historical volatility and predictive analytics in financial risk assessment.

To analyze the profitability of T-Mobile US, Inc. (TMUS) call options, we consider various aspects highlighted by "the Greeks" Delta, Gamma, Vega, Theta, and Rho, along with other pivotal elements such as strike price, days to expiration, the premium required to purchase the option, return on investment (ROI), and the projected profit.

Delta reflects an option's sensitivity to changes in the price of the underlying asset. A delta close to 1 indicates the option's price moves almost identically with the stock. High delta values near 1, such as 0.9999342487 for options with strikes at 70.0, 75.0, 80.0, 85.0, expiring on 2024-02-16, suggest these options will closely mimic TMUS stock movements, making them less risky but also typically more expensive due to higher premiums.

Gamma measures the rate of change of delta over the price of the underlying stock. Here, all options with significant deltas have a gamma of 0.0, indicating delta changes minimally as stock price changes, suggesting stable sensitivity levels to the underlying stock's price movements.

Vega represents an option's price sensitivity to implied volatility changes of the underlying asset. Options with higher Vega, such as 3.7386128672 for the 157.5 strike price expiring on 2024-02-16, indicate a higher risk and potential return due to increased sensitivity to implied volatility. This could be profitable if volatility is expected to rise.

Theta measures the rate of time value decay of an option. An option with a theta of -0.0061925769 (such as the 85.0 strike expiring on 2024-02-16) indicates it will lose 0.0061925769 units of currency per day. Options with closer expiration dates have higher theta, implying quicker time decay.

Rho reflects an option's sensitivity to interest rate changes. Higher rho values, such as 1.1762855491 for the 145.0 strike expiring on 2024-02-16, suggest the option's price is more positively correlated with interest rates, making it more lucrative in rising rate environments.

Considering our target stock price aims for a 5% increase over the current price, options with higher deltas and low thetas, particularly those nearing expiration, generally present favorable short-term opportunities because they are likely to move closely with the stock price and have less time decay.

One notable option is the call with a 160.0 strike price expiring on 2024-02-16, demonstrating a high ROI of 2.539347079 and a profit of 7.3895. Despite its lower delta of 0.7576181308, the significant gamma of 0.0956538956 and the highest vega among the table entries at 4.5948977234 suggest this option could rapidly increase in value with slight upward movements in TMUS's stock, particularly as implied volatility rises due to its near-term expiration.

In the longer term, options with a delta close to 1, such as those with a strike price at or below the current stock price and longer days to expiration (e.g., expiring in 2025 and beyond), may be more expensive upfront (premiums ranging from 45.27 to 68.5 for strike prices from 100.0 to 90.0 respectively) but provide a steadier, less volatile path to profitability. Specifically, the call option expiring in 2026 with a 90.0 strike showcases a substantial ROI of 0.1722554745 and a significant profit of 11.7995, benefiting from gradual stock appreciation and stable sensitivity to stock price changes (delta of 0.9133061675) without immediate concern for time decay (theta of -0.0132185085).

In conclusion, for an investor with a bullish outlook on TMUS aiming for a 5% stock price increase, both short-term high-vega options with closer expirations and longer-term high-delta options provide promising avenues for profitability. The choice between them depends on the investor's risk tolerance, capital available for premiums, and speculative view on market volatility.

Similar Companies in Telecom Services:

Report: AT&T Inc. (T), AT&T Inc. (T), Report: Comcast Corporation (CMCSA), Comcast Corporation (CMCSA), Lumen Technologies, Inc. (LUMN), DISH Network Corporation (DISH), Report: Verizon Communications Inc. (VZ), Verizon Communications Inc. (VZ), Charter Communications, Inc. (CHTR), Cable One, Inc. (CABO), Altice USA, Inc. (ATUS)

https://www.fool.com/investing/2023/12/30/t-mobile-just-eliminated-the-biggest-factor-holdin/

https://www.fool.com/investing/2023/12/31/3-warren-buffett-dividend-growth-stocks-to-buy-now/

https://www.fool.com/investing/2024/01/02/this-warren-buffett-stock-could-go-31-higher/

https://www.fool.com/investing/2024/01/10/the-average-american-87000-retirement-3-stocks/

https://www.cnbc.com/2024/01/10/spacex-t-mobile-send-first-texts-via-starlink-satellites.html

https://www.youtube.com/watch?v=6KldCq_QGmU

https://seekingalpha.com/article/4665160-t-mobile-us-inc-tmus-q4-2023-earnings-call-transcript

https://www.youtube.com/watch?v=zRZSon4v42k

https://seekingalpha.com/article/4665625-4-buyable-buffett-dividend-dogs-in-january

https://finance.yahoo.com/news/t-mobile-customers-now-magenta-171200732.html

https://finance.yahoo.com/news/hospital-cios-weigh-5g-digitized-222000175.html

https://finance.yahoo.com/news/softbank-swings-profit-lifted-t-060921960.html

https://finance.yahoo.com/news/director-teresa-taylor-sells-12-111434685.html

https://www.sec.gov/Archives/edgar/data/1283699/000128369923000151/tmus-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: z3cYw3

Cost: $1.10552

https://reports.tinycomputers.io/TMUS/TMUS-2024-02-12.html Home