The Boeing Company (ticker: BA)

2024-02-04

The Boeing Company, represented on the stock market with the ticker symbol BA, is a multinational corporation that stands as one of the largest aerospace manufacturers in the world. Founded in 1916 by William Boeing, the company has its headquarters in Arlington, Virginia, and operates in multiple sectors, including commercial airplanes, defense, space, and security systems. Boeing has played a pivotal role in the aviation industry, developing a wide range of aircraft models that have significantly advanced commercial and military aviation. The corporation is also a leading producer of satellites, telecommunications equipment, and missile defense systems. Over the years, Boeing has been a crucial player in aerospace innovation, with a strong emphasis on sustainability and the next generation of space exploration. Despite facing challenges such as production issues with the 737 MAX and the global impact of the COVID-19 pandemic on air travel, Boeing continues to focus on safety, quality, and improving its operational efficiency to maintain its position as a key player in the global aerospace sector.

The Boeing Company, represented on the stock market with the ticker symbol BA, is a multinational corporation that stands as one of the largest aerospace manufacturers in the world. Founded in 1916 by William Boeing, the company has its headquarters in Arlington, Virginia, and operates in multiple sectors, including commercial airplanes, defense, space, and security systems. Boeing has played a pivotal role in the aviation industry, developing a wide range of aircraft models that have significantly advanced commercial and military aviation. The corporation is also a leading producer of satellites, telecommunications equipment, and missile defense systems. Over the years, Boeing has been a crucial player in aerospace innovation, with a strong emphasis on sustainability and the next generation of space exploration. Despite facing challenges such as production issues with the 737 MAX and the global impact of the COVID-19 pandemic on air travel, Boeing continues to focus on safety, quality, and improving its operational efficiency to maintain its position as a key player in the global aerospace sector.

| Address | 929 Long Bridge Drive | City | Arlington | State | VA |

| Zip Code | 22202 | Country | United States | Phone | 703 465 3500 |

| Website | https://www.boeing.com | Industry | Aerospace & Defense | Sector | Industrials |

| Full Time Employees | 171,000 | CEO Name | Mr. David L. Calhoun | CEO Pay | $5,480,396 |

| Market Cap | $127,750,062,080 | Volume | 6,265,330 | Average Volume | 9,201,021 |

| 52 Week Low | $176.25 | 52 Week High | $267.54 | Dividend Yield | 2.48% |

| Forward PE | 25.85 | Beta | 1.599 | Total Revenue | $77,794,000,896 |

| Net Income | -$2,222,000,128 | Total Cash | $15,964,999,680 | Total Debt | $54,121,000,960 |

| Current Price | $209.38 | Target High Price | $315.00 | Target Low Price | $190.00 |

| Target Mean Price | $260.26 | Target Median Price | $262.50 | Recommendation Mean | 2.0 (Buy) |

| Number of Analyst Opinions | 28 | Total Cash Per Share | $26.166 | EBITDA | $3,153,999,872 |

| Revenue Growth | 10.2% | Gross Margins | 11.892% | Operating Margins | 2.589% |

| Free Cashflow | $6,544,249,856 | Operating Cashflow | $5,960,000,000 | Last Dividend Value | $2.055 |

| Sharpe Ratio | 0.0607846674751211 | Sortino Ratio | 0.8926229980958108 |

| Treynor Ratio | 0.019712314141284947 | Calmar Ratio | 0.049138209762568275 |

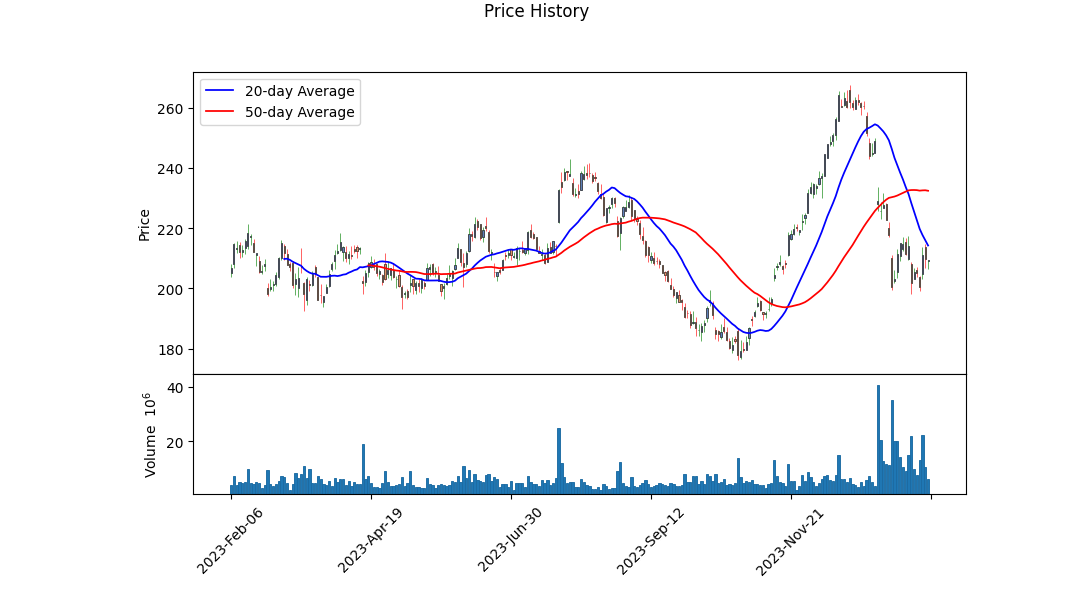

Analyzing the provided stock data, market sentiment, and financial ratios for a comprehensive review of its potential movements in the upcoming months. Given the reported financials, balance sheets, and cash flows, together with an in-depth look into technical indicators such as Open, High, Low, Close (OHLC) prices, moving averages, On-Balance Volume (OBV), and the Moving Average Convergence Divergence (MACD), we can infer nuanced market dynamics expected to influence the stock.

The technical indicators denote an evolving trend characterized by fluctuating trading volumes as evidenced by OBV and an eventual MACD histogram transition into positive territory towards the end of the observed period. This shift suggests a growing bullish sentiment, backed by increasing volumes that may continue to support an uptrend. However, the absence of data in the initial segment indicates the necessity for a cautious extrapolation, assuming potential historic volatility.

The fundamentals further cement our forecast, wherein the company has showcased a resilience through a combination of revenue adjustments and strategic responses to its debt levels, as delineated by its recent cash flow activities. Moreover, analyst expectations present a favorable viewpoint with anticipated growth in earnings and sales, underpinned by significant year-over-year improvements. The upwards revisions in EPS (Earnings Per Share) fortify the premise of a recovery in financial health and investor confidence.

Risk-adjusted return ratios such as Sharpe, Sortino, Treynor, and Calmar, although exhibit modest figures, indicate the stock's returns are achievable above the risk-free rate, signifying a relative attractiveness to investors seeking to balance reward with risk exposure. The Sharpe ratio shows this balance is not without its volatility challenges, while the Sortino ratio, by focusing on downside deviation, provides a comparatively optimistic view on the risk-adjusted return potential.

Given these analyses, coupled with the resilient fundamentals and optimistic analyst ratings, the stock is poised for a bullish trend in the ensuing months. The trajectory will likely be characterized by progressive growth, albeit moderated by market-wide contingencies and inherent volatility. Investors are advised to consider these dynamics, integrating both macroeconomic indicators and company-specific news flows, in strategizing their investment decisions.

Future market movements will be contingent upon the continuation of positive earnings reportings, adherence to strategic growth plans, and the broader market sentiment. Enhancements in operational efficiencies, growth in revenue, and further balance sheet improvements will serve as catalysts for the stock price appreciation. However, any deviations from expected financial performances or adverse macroeconomic developments could temper these forecasts.

As we navigate the months ahead, close monitoring of the aforementioned factors, alongside any emerging market trends, will be imperative in adapting our projections and strategies to the evolving market landscape.

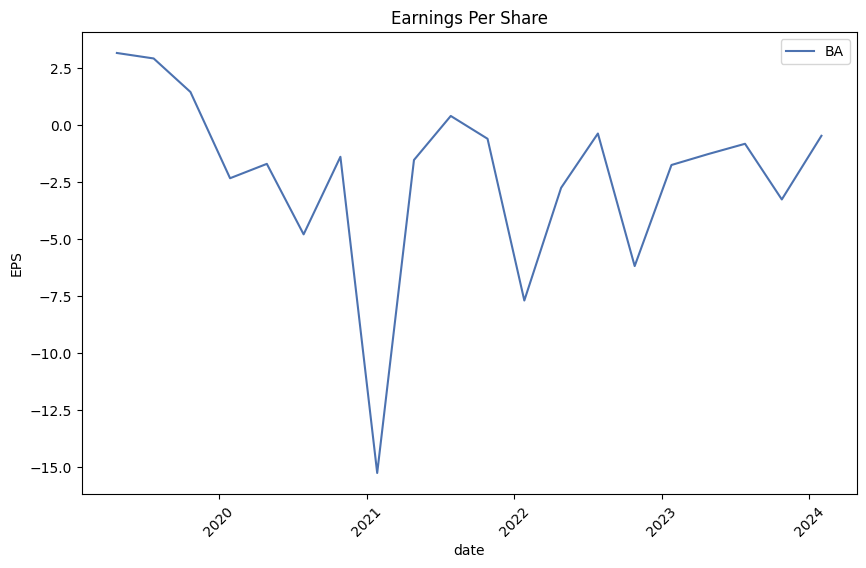

In the research analysis focused on The Boeing Company (BA), we have calculated two critical financial metrics that are integral to evaluating the company's financial health and investment potential: the return on capital (ROC) and the earnings yield. The ROC, which measures a company's efficiency in generating profits from its capital, is notably negative at -1.8768969284933834%. This figure indicates that Boeing is currently generating negative returns on the investments it has made in its business, which may signal concerns regarding its operational efficiency and profitability. Similarly, the earnings yield, which is essentially the inverse of the price-to-earnings ratio and serves as an indicator of the earnings generated per dollar invested in the company's stock, is also negative, standing at -1.7527939631292386%. This suggests that the company is experiencing a period of negative earnings, which, from an investment standpoint, could make Boeing less attractive to investors seeking immediate profitability. Collectively, these metrics should be considered attentively by investors, as they highlight current financial challenges faced by Boeing, although the broader context and future company prospects should also be taken into account when making investment decisions.

Based on the data provided for The Boeing Company (BA), it is evident that the company's financial performance and metrics have been under scrutiny through various quarters, reflecting the challenges and the operational adjustments the company has made over time. This analysis aims to provide a thorough understanding of Boeing's financial health, operational efficiencies, and strategic directions based on its stock screening, earnings reports, and key financial ratios.

Financial Performance Overview

Boeing's financial performance over the recent quarters shows a mix of challenges and recoveries. The revenues show fluctuations which are indicative of the aerospace sector's volatility, affected by economic policies, defense spending, and air travel demand. Notably, the company's efforts in streamlining operations, cost reduction, and focusing on high-demand segments like commercial airplanes and defense, space & security are evident through its operational adjustments.

Key Financial Ratios

-

Earnings Per Share (EPS): The EPS figures showed variability, reflecting the company's fluctuating net incomes over the periods. Negative values indicate losses, highlighting periods where the company faced significant headwinds, possibly including production issues, delivery delays, or decreased demand in aviation services due to global circumstances like the COVID-19 pandemic.

-

Debt to Equity Ratio: Boeing's debt levels, as reflected in its long-term debt figures and debt management strategies, suggest a leveraged position. The company's strategic decision to manage its debt and possibly resort to equity financing to navigate through its capital needs for production, R&D, and strategic acquisitions are critical.

-

Operating Income: The variability in operating income throughout the quarters points to Boeing's adjustment in operations, possibly due to fluctuating demand in commercial and military aircraft, changes in production rates, and the impacts of global economic conditions on contracts and deliveries.

-

Comprehensive Income: The comprehensive income variations reflect not just the operational performance but also the accounting adjustments, investments, and hedging strategies Boeing employs to manage its financial position.

-

Inventory Management: The inventory levels, including work-in-progress and commercial aircraft programs, give insight into Boeing's production efficiency, demand forecasting, and supply chain management. High inventory levels may suggest production optimisation or anticipation of increased demand, whereas sharp increases or decreases warrant analysis against market demand and production capability adjustments.

Stock Performance and Market Sentiments

Analyzing Boeings stock performance requires understanding its P/E ratios, dividends, and market capitalization trends over time. There's a clear indication that market sentiments have fluctuated based on Boeing's operational adjustments, delivery schedules, and strategic decisions in response to both market demand and challenges.

Market and Future Outlook

Boeing operates in a highly volatile market, influenced by geopolitical factors, economic policies, and global demand for air travel and defense. Its strategic focus on R&D, sustainability, and tapping into emerging markets like unmanned aerial vehicles, space exploration, and military contracts will be crucial for long-term growth. Additionally, Boeing's ability to manage its supply chain, address production challenges, and navigate through regulatory compliances will significantly impact its market position and financial health.

Conclusion

In conclusion, Boeing's strategic adjustments reflect its resilience and adaptability in a complex and challenging market. Its focus on improving operational efficiencies, strategic investments in emerging technologies, and prudent financial management positions it for recovery and growth. However, close monitoring of its debt management, production efficiencies, and market demand alignment are essential for sustainable performance. The aerospace giants future will significantly depend on its ability to innovate, manage its financial health prudently, and cater to the evolving market demands in both commercial and defense sectors.

| Statistic Name | Statistic Value |

| Alpha | -0.09074148731706384 |

| Beta | 1.473795526862442 |

| R-squared | 0.370 |

| Adjusted R-squared | 0.370 |

| F-statistic | 737.5 |

| Prob (F-statistic) | 3.97e-128 |

| Log-Likelihood | -2951.5 |

| AIC | 5907 |

| BIC | 5917 |

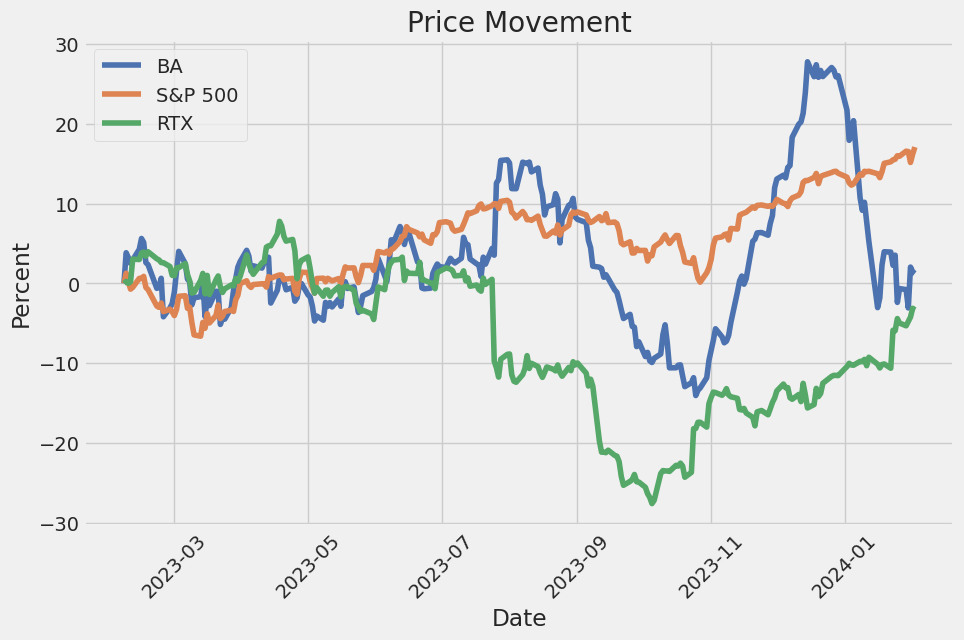

In the relationship modeled between Boeing (BA) and the S&P 500 index (SPY), representing the broader market, the linear regression summary highlights key statistical metrics that elucidate how BA's performance correlates with the overall market movements indexed by SPY. The alpha value of approximately -0.0907 suggests that BA, on an average, underperformed the market's expected return on a risk-adjusted basis. This negative alpha implies that the stock had a slight deviation below the expected market return, considering it was risk-adjusted.

Furthermore, the beta coefficient determining BA's volatility relative to SPY is 1.4738. This indicates that Boeing's stock is more volatile in comparison to the market; a beta greater than 1 suggests that the stock's price movements are more pronounced relative to the overall market volatility. The R-squared value of 0.370 implies that approximately 37% of BA's price movements can be explained by the movements in the SPY index. This relatively moderate R-squared value alongside the significant beta highlights a considerable but not overwhelming correlation between BA's stock movements and the broader market trends encapsulated by SPY.

The Boeing Company's fourth-quarter earnings call for 2023 started with introductions by Matt Welch, the Vice President of Investor Relations. He then handed it over to Dave Calhoun, Boeing's President and CEO, and Brian West, the Chief Financial Officer. Calhouns opening remarks focused on addressing the Alaska Airlines Flight 1282 incident involving a 737 MAX 9, emphasizing Boeing's commitment to quality, regulatory compliance, and transparency. He highlighted the steps Boeing is taking to ensure such an event does not recur, including immediate actions to strengthen quality control, cooperation with the FAA, and engaging an independent review of Boeing's commercial airplane quality management system. Calhoun also mentioned a significant focus on regaining customer and public trust through demonstrated action rather than mere assurances.

Brian West provided a detailed overview of Boeing's financial performance for the fourth quarter, noting a 10% year-over-year increase in revenue to $22 billion, attributed to higher commercial volume and favorable mix, with a core loss per share of $0.47. He highlighted the free cash flow of $3 billion for the quarter, consistent with the prior year and up sequentially from the third quarter, primarily due to improved commercial deliveries and strong order activity. West's presentation covered specifics regarding the Boeing Commercial Airplanes (BCA), including order bookings and delivery numbers, and progress on various airplane models, notably the 737, 787, and the paused 777X production.

Regarding defense and space, Boeing Defense, Space & Security (BDS) booked $8 billion in orders during the quarter, with revenue up 9% to $6.7 billion. The division faced challenges, as indicated by a negative operating margin, but plans were laid out to improve margins to high single digits by the 2025-2026 timeframe. Goals include stabilizing operational performance on fighter and satellite programs and maturing fixed-price development programs. Boeing Global Services (BGS) showed strength, with orders worth $6 billion, a backlog now at $20 billion, and operating margins at a robust 17.4%.

The call concluded with Calhoun reiterating Boeing's commitment to overcoming current challenges and improving the company's operations and quality management. He expressed confidence in Boeing's employees and the steps being taken to enhance safety and quality standards. Throughout the earnings call, the focus was on addressing the recent 737 MAX incident, underlining ongoing recovery efforts, and detailing financial performance across Boeing's business units. While specific financial outlooks for 2024 were not provided due to current priorities, there was an emphasis on quality, safety, and transparent engagement with regulatory bodies to guide Boeing's path forward.

The Boeing Company, a leading aerospace firm, reported its quarterly financial performance for the period ending September 30, 2023. During this period, the company experienced a substantial increase in revenues, climbing to $55.8 billion for the nine months ending September 30, 2023, up from $46.6 billion in the corresponding period in 2022. This improvement was attributed to heightened activity across Boeing's three main operational segments: Commercial Airplanes, Defense, Space & Security, and Global Services. Specifically, the Commercial Airplanes segment saw a notable rise in revenues to $23.4 billion, driven by an uptick in 787 and 737 aircraft deliveries. Similarly, the Defense, Space & Security segment's revenues surged to $18.2 billion, buoyed by lower charges on development programs and increased activity in space and proprietary programs. Additionally, revenues in the Global Services segment rose to $14.3 billion, primarily due to a rebound in commercial services revenue across its commercial portfolio.

Despite these revenue gains, Boeing reported a GAAP loss from operations of $1.1 billion for the nine months ending September 30, 2023, and a diluted loss per share of $3.64, indicating ongoing operational challenges. The effective tax rate for the nine-month period was negative 10.8%, reflecting additional financial complexities within the period.

On a quarterly basis, for the three months ending September 30, 2023, Boeing's revenues increased to $18.1 billion from $16 billion in the same quarter of 2022. However, this period also experienced a significant operational loss of $808 million and an elevated effective negative income tax rate of 48.9%, contributing to a diluted loss per share of $2.70. This financial performance underscores the volatile nature of Boeing's markets and operational challenges, despite the rebound in services demand and aircraft deliveries.

Boeing's outlook remains underpinned by its backlog of orders valued at $469.2 billion, promising future revenue potential. Yet, the conversion of this backlog into actual revenue is uncertain due to factors including the timing of 737 and 787 deliveries from inventory and the entry into service of new aircraft models like the 777X and 737 Max variants.

In summary, Boeing's financial results for the nine and three months ending September 30, 2023, depict a company experiencing revenue growth across its core segments but still facing operational losses. The company's performance reflects both the ongoing recovery in its commercial services market and the persisting challenges in converting its significant backlog of orders into profitable operations.

The Boeing Company, a juggernaut in the aviation industry, has recently encountered a series of significant events that underscore both the challenges and opportunities it faces. The narrative surrounding Boeing is multifaceted, ranging from regulatory clearances and delivery milestones in China to pressing quality control issues that compel a critical examination of its flagship 737 Max aircraft. These developments are not only pivotal for Boeing's strategic operations but also have substantial implications for its standing in the global aerospace market.

The resumption of 737 Max deliveries in China marks a watershed moment for Boeing, breaking a suspension that persisted for over four years due to safety concerns after two tragic crashes in 2019. The clearance from China's aviation regulator to resume these deliveries heralds a potential renaissance for Boeing in the world's largest aviation market. This comeback is further bolstered by China's aviation authorities encouraging Boeing to deepen its market presence, as evidenced by the symbolic movement of a 737 Max designated for China Southern Airlines. This maneuver underscores the thawing relations between Boeing and Chinese aviation sectors and hints at a brighter future for Boeing's operations in the region.

The significant demand for aircraft in China, where Boeing projects the country will account for 20% of the world's aircraft demand through 2042, presents a substantial opportunity for growth. The resumption of deliveries, including the pivotal handover of a 787 Dreamliner to Juneyao Airlines, indicates not only a strategic recovery effort but also a broader plan to capitalize on China's burgeoning aviation market.

Moreover, the aerospace industry's competitive landscape is witnessing a shake-up, particularly in the satellite launch market. Boeing, through its partnership in the United Launch Alliance (ULA), finds itself in a beneficial position as Arianespace faces challenges with its Ariane 6 rocket, potentially redirecting commercial interest towards Boeing and Lockheed's aerospace offerings. This scenario is emblematic of the intersecting challenges and strategic maneuvers that define the aerospace sector's competitive dynamics.

However, Boeing's journey is not devoid of turbulence. The company has issued advisories concerning quality control, specifically a potential loose bolt in the 737 Max's rudder control system. This issue, which prompted immediate responses from airlines including Alaska Airlines and United Airlines, illustrates the ongoing scrutiny Boeing faces regarding the safety and reliability of its aircraft. These quality concerns necessitate rigorous attention to detail and a commitment to safety standards, reflecting the broader industry imperative for mechanical integrity and operational efficiency.

The grounding of Alaska Airlines' entire fleet of Boeing 737 Max 9 aircraft following a midair incident further exacerbates the challenges Boeing must navigate. This event, marked by an "explosive decompression at the window exit," has thrust Boeing back into the contentious spotlight of aviation safety. The decision by airlines to ground these aircraft for inspections, coupled with the FAA's and NTSB's involvement in investigating the incident, underlines the critical importance of safety in aviation operations. It also poses questions about the impact on Boeing's reputation and operational stability, given the historical context of the 737 Max's global grounding in 2019.

Amidst these developments, Boeing remains a fulcrum around which the aerospace sector pivots. With strategic advancements in China, potential benefits from the competitive dynamics in the aerospace industry, and the hurdles presented by quality control challenges, Boeing's trajectory is emblematic of a company at the nexus of opportunity and scrutiny. As Boeing steers through these developments, the company's ability to adapt, innovate, and uphold the highest safety standards will be paramount in determining its future course in the ever-evolving aerospace landscape.

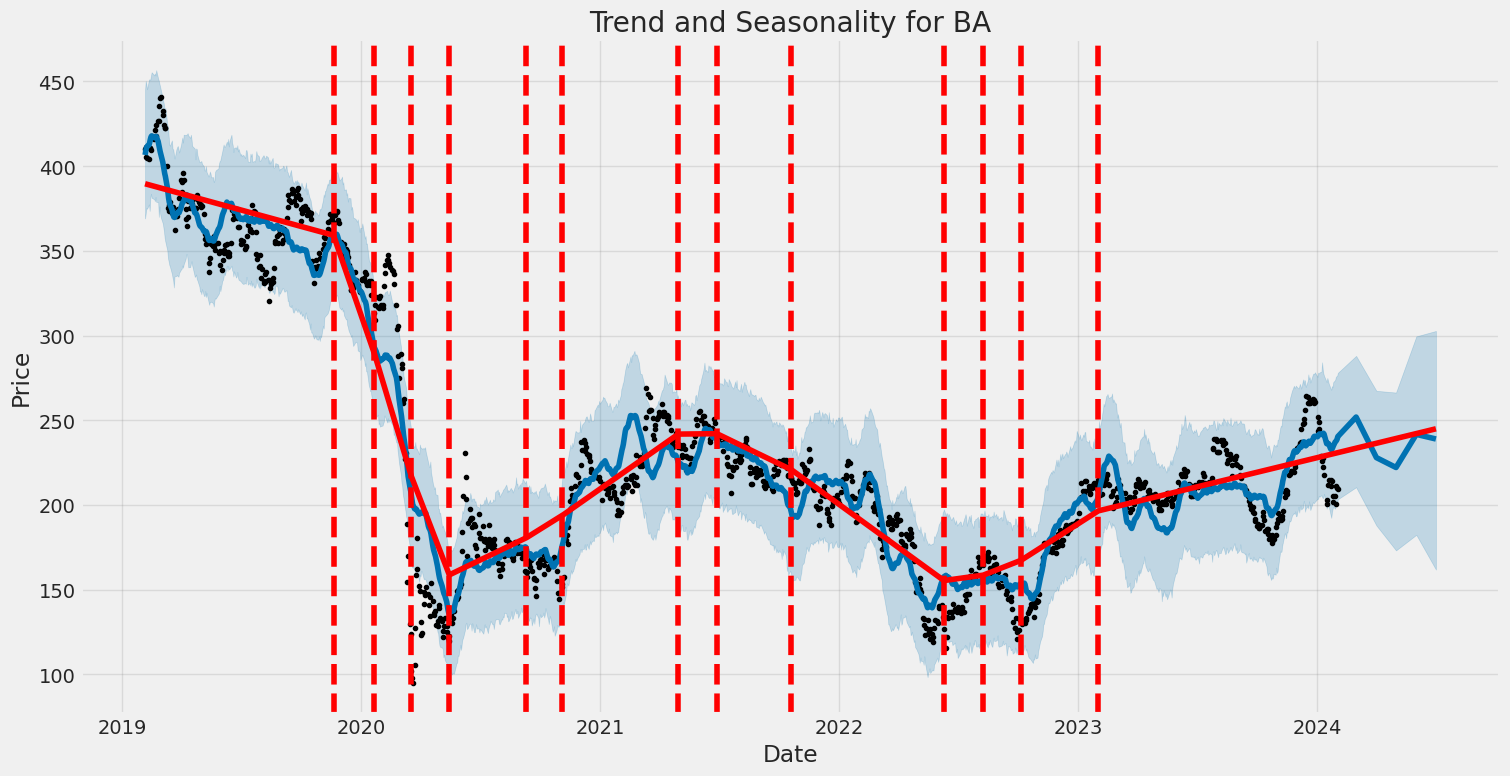

The volatility of The Boeing Company (BA) between February 2019 and February 2024 demonstrates significant fluctuations, as observed through the application of a Zero Mean - ARCH model to its asset returns. The model identified a coefficient omega of 5.874, suggesting a baseline level of variance in return, and an alpha[1] of 0.4088, indicating that past squared returns are a significant predictor of future volatility. These results imply that The Boeing Company's stock experienced notable unpredictability during this period, with both external factors and its own past performance driving its volatility.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3090.16 |

| AIC | 6184.33 |

| BIC | 6194.60 |

| No. Observations | 1257 |

| omega | 5.8740 |

| alpha[1] | 0.4088 |

Analyzing the financial risk involved in investing $10,000 in The Boeing Company (BA) over a span of one year involves integrating sophisticated methods to forecast potential outcomes and measure risk. This evaluation incorporates volatility modeling and machine learning predictions to offer a nuanced understanding of the stock's financial behavior.

Volatility modeling, traditionally used to gauge the unpredictability in the price movements of assets, plays a crucial role in understanding The Boeing Company's stock volatility. This approach is instrumental in estimating the extent of price fluctuations that the stock might experience over time. By analyzing past price variations, volatility modeling facilitates the construction of a predictive framework that can forecast the stock's future volatility. This is essential in risk management, as it helps in determining the likelihood and magnitude of price movements that the stock could undergo.

In tandem with volatility modeling, machine learning predictions further enhance the analysis by leveraging historical data to forecast future returns. Specifically, a model such as the one based on decision trees that is trained on historical data can identify patterns and relationships that might not be immediately apparent. By analyzing vast amounts of data and learning from it, this model can predict the stock's future price movements with a certain degree of accuracy. The synergy between understanding volatility and forecasting returns offers a comprehensive view of the potential financial risks involved.

The integration of these two methods culminates in calculating the Value at Risk (VaR) for a $10,000 investment in The Boeing Company over one year, with a 95% confidence level. The VaR, amounting to $317.32, represents the maximum expected loss over this period under normal market conditions. This figure is crucial for investors as it quantifies the potential risk of loss in monetary terms, offering a clear perspective on what can be at stake.

Through the combination of volatility modeling and machine learning predictions, investors are equipped with a dual framework that not only forecasts future stock returns but also quantifies the potential variability and risk associated with those returns. Being able to estimate the maximum probable loss with a high level of confidence empowers investors. They can make more informed decisions regarding their investment in The Boeing Company, balancing their expectations of returns against the quantified risks. This comprehensive approach to analyzing financial risk underscores the importance of leveraging both historical volatility and predictive analytics in investment decision-making.

Similar Companies in Aerospace & Defense:

Report: Raytheon Technologies Corporation (RTX), Raytheon Technologies Corporation (RTX), Report: Northrop Grumman Corporation (NOC), Northrop Grumman Corporation (NOC), Report: General Dynamics Corporation (GD), General Dynamics Corporation (GD), Report: L3Harris Technologies, Inc. (LHX), L3Harris Technologies, Inc. (LHX), Lockheed Martin Corporation (LMT), Huntington Ingalls Industries, Inc. (HII), Rocket Lab USA, Inc. (RKLB), Astra Space, Inc. (ASTR), Airbus SE (EADSY), Textron Inc. (TXT)

https://www.proactiveinvestors.com/companies/news/1036920?SNAPI

https://www.cnbc.com/2023/12/21/boeing-hands-over-first-787-dreamliner-to-china-since-2019.html

https://www.fool.com/investing/2023/12/23/arianes-new-price-tag-is-bad-news-for-airbus/

https://www.youtube.com/watch?v=Yxp1Tp3ccYg

https://www.proactiveinvestors.com/companies/news/1037167?SNAPI

https://www.youtube.com/watch?v=ePRzwDl6Jrs

https://www.fool.com/investing/2023/12/30/jaw-dropping-news-boeing-and-lockheed-just-matched/

https://www.fool.com/investing/2024/01/03/why-boeing-stock-took-flight-in-december/

https://seekingalpha.com/article/4661160-january-dogs-of-the-dow-2-buyable-6-watchable

https://www.proactiveinvestors.com/companies/news/1037658?SNAPI

https://www.sec.gov/Archives/edgar/data/12927/000001292723000062/ba-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: F9GCXO

Cost: $1.05527