Baker Hughes Company (ticker: BKR)

2024-03-01

Baker Hughes Company, trading under the ticker BKR, stands as a pivotal entity within the global energy sector, primarily focusing on providing solutions and services that enhance efficiency and productivity in the oil, gas, and renewable energy markets. With its headquarters in Houston, Texas, USA, Baker Hughes has carved a significant niche by offering a vast array of products and technologies aimed at enabling the safe and environmentally conscious extraction, transportation, and transformation of energy resources. The company operates through multiple segments, including Oilfield Services, Oilfield Equipment, Turbomachinery & Process Solutions, and Digital Solutions, each tailored to meet the evolving needs of energy production and management. The diversity in its service offering allows Baker Hughes to cater to a broad spectrum of customers, ranging from multinational oil corporations to independent energy producers, thereby playing a critical role in shaping the energy landscape to be more efficient and sustainable. As the energy sector continues to transition towards more renewable sources and seeks ways to reduce carbon footprints, Baker Hughes' commitment to innovation and technology positions it as a key player in driving the future of energy.

Baker Hughes Company, trading under the ticker BKR, stands as a pivotal entity within the global energy sector, primarily focusing on providing solutions and services that enhance efficiency and productivity in the oil, gas, and renewable energy markets. With its headquarters in Houston, Texas, USA, Baker Hughes has carved a significant niche by offering a vast array of products and technologies aimed at enabling the safe and environmentally conscious extraction, transportation, and transformation of energy resources. The company operates through multiple segments, including Oilfield Services, Oilfield Equipment, Turbomachinery & Process Solutions, and Digital Solutions, each tailored to meet the evolving needs of energy production and management. The diversity in its service offering allows Baker Hughes to cater to a broad spectrum of customers, ranging from multinational oil corporations to independent energy producers, thereby playing a critical role in shaping the energy landscape to be more efficient and sustainable. As the energy sector continues to transition towards more renewable sources and seeks ways to reduce carbon footprints, Baker Hughes' commitment to innovation and technology positions it as a key player in driving the future of energy.

| Full Time Employees | 58,000 | Previous Close | 29.48 | Open | 29.75 |

| Day Low | 29.37 | Day High | 29.86 | Dividend Rate | 0.84 |

| Dividend Yield | 0.0285 | Five Year Avg Dividend Yield | 3.15 | Beta | 1.42 |

| Trailing PE | 15.4921465 | Forward PE | 11.695652 | Volume | 12,815,718 |

| Average Volume | 9,030,179 | Market Cap | 29,823,168,512 | 52 Week Low | 26.12 |

| 52 Week High | 37.58 | Price to Sales Trailing 12 Months | 1.1692609 | Enterprise Value | 33,910,081,536 |

| Profit Margins | 0.07618 | Shares Outstanding | 1,000,880,000 | Book Value | 15.399 |

| Price to Book | 1.9215534 | Net Income To Common | 1,943,000,064 | Trailing Eps | 1.91 |

| Forward Eps | 2.53 | Earnings Quarterly Growth | 1.418 | Enterprise To Revenue | 1.329 |

| Enterprise To Ebitda | 9.084 | 52 Week Change | -0.08674103 | Last Dividend Value | 0.21 |

| Total Cash | 2,646,000,128 | Total Debt | 6,789,000,192 | Total Revenue | 25,506,000,896 |

| Debt To Equity | 43.746 | Revenue Per Share | 25.304 | Return On Assets | 0.0465 |

| Return On Equity | 0.13114001 | Free Cashflow | 2,389,250,048 | Operating Cashflow | 3,062,000,128 |

| Earnings Growth | 1.366 | Revenue Growth | 0.157 | Gross Margins | 0.20725 |

| Ebitda Margins | 0.14636 | Operating Margins | 0.11529 | Current Price | 29.59 |

| Target High Price | 49.0 | Target Low Price | 34.0 | Target Mean Price | 40.46 |

| Target Median Price | 40.0 | Recommendation Mean | 2.0 | Total Cash Per Share | 2.644 |

| Ebitda | 3,732,999,936 | Quick Ratio | 0.748 | Current Ratio | 1.255 |

| Sharpe Ratio | -0.20084071711180645 | Sortino Ratio | -2.951043716556494 |

| Treynor Ratio | -0.06366722912481865 | Calmar Ratio | -0.18715953749570835 |

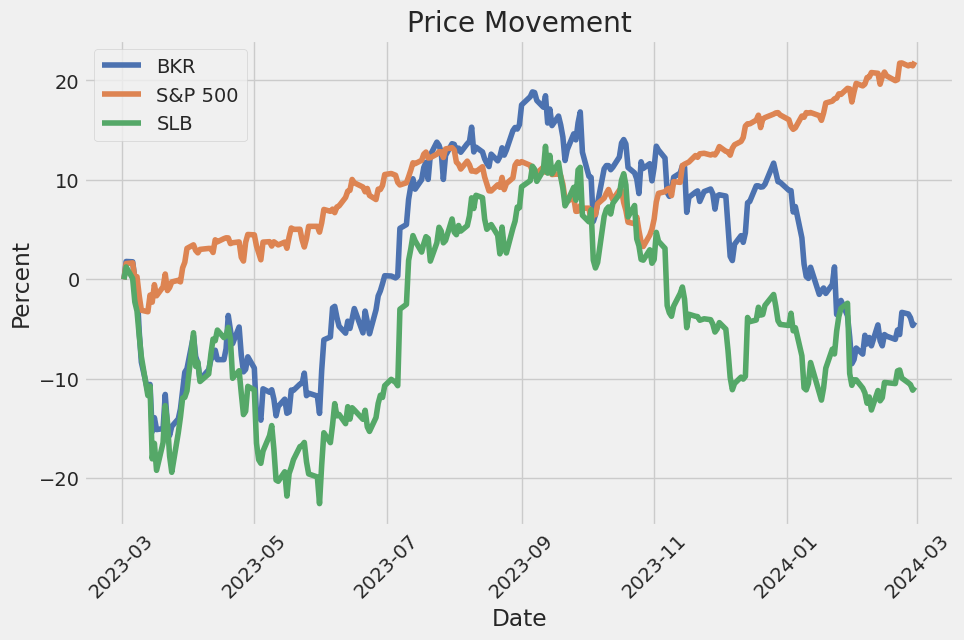

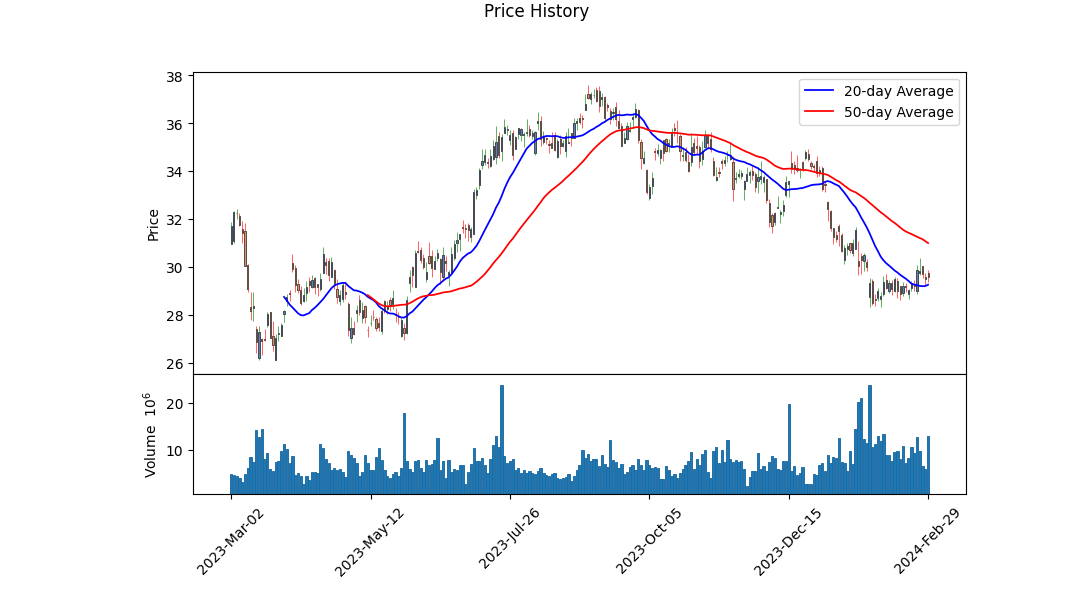

The analysis of BKR involves an integrated view that spans technical indicators, fundamentals, balance sheets, and market sentiment as derived from ratios and analyst expectations. On the technical front, recent price movements and volume changes signal a potentially bearish trend, with the stock experiencing a notable decrease in price from an opening of 35.00 to a closing of 29.75 over four months. This downward trend is corroborated by non-positive movements in On-Balance Volume, implying that selling pressure has dominated trading volumes. The absence of Moving Average Convergence Divergence (MACD) histogram values for a majority of the observed period limits the depth of trend analysis but the positive values observed in the latter part provide a slight bullish signal amongst bearish sentiments.

Fundamentally, BKR operates with strong gross, EBITDA, and operating margins, illustrating efficiency in profit generation from its revenues. However, the risk-adjusted return metrics such as the Sharpe, Sortino, Treynor, and Calmar ratios reflect investor skepticism, indicating that the stock's returns have not compensated adequately for the risk borne over the past year. Notably, a negative Sortino Ratio suggests that the negative performance deviations have been significant, discouraging for risk-averse investors.

The fundamental analysis, backed by recent financials, shows that BKR has managed to maintain operational profitability despite economic pressures. The retained earnings deficit highlights historical challenges in sustaining profits, yet recent trends in revenue and EBIT suggest an improving operational outlook. The balance sheet reveals a solid foundation with substantial cash and cash equivalents, providing financial flexibility.

Analyst expectations paint a picture of cautious optimism, predicting growth in earnings and revenue over the next year with estimates indicating an upward trajectory. This consensus suggests a belief in the company's potential to navigate its industry's challenges and capitalize on available opportunities.

Considering the compiled data and analysis, the forecast for BKRs stock in the upcoming months is cautiously optimistic. Technical indicators highlight potential volatility and near-term challenges; however, fundamental and market sentiment analysis underscores a solid operational foundation with prospects for growth driven by industry position and financial strategy. The disparity between fundamental strength and current market sentiment may offer speculative opportunities for long-term investors. As the market assimilates BKR's operational potential and strategic directions, a gradual appreciation in stock price could be anticipated, contingent on broader market stability and economic conditions.

This assessment synthesizes technical analysis and fundamental valuation, highlighting the importance of multi-faceted insight in predicting stock movements. BKR's journey ahead appears poised between immediate technical pressures and a fundamentally anchored pathway towards value realization. Investors are advised to monitor forthcoming earnings announcements, sector-related developments, and macroeconomic indicators closely as they refine their investment thesis on BKR.

In analyzing Baker Hughes Company (BKR) from an investment perspective, two critical financial metrics were examined: Return on Capital (ROC) and Earnings Yield. Based on our calculations, Baker Hughes boasts a Return on Capital (ROC) of 13.33%, which is quite telling of the company's efficiency in deploying its capital to generate profits. This suggests that for every dollar invested in capital, the company successfully generates approximately 13.33 cents of profit, indicating a potent ability to utilize its capital effectively in its operations and investments. Furthermore, the Earnings Yield of Baker Hughes stands at 6.52%, offering insight into the company's valuation from an earnings perspective relative to its share price. This earnings yield indicates that investors can expect to earn a return of 6.52% from the company's earnings if the current share price remains constant, making it an attractive proposition for investors seeking companies with profitable earnings relative to their share price. These metrics collectively suggest that Baker Hughes is proficient in capital utilization and presents a potentially valuable investment opportunity from a profitability standpoint.

Analyzing Baker Hughes Company (BKR) through the lens of Benjamin Grahams value investing principles provides an interesting perspective on its investment potential. By evaluating BKRs performance across several key metrics, we can discern how well it aligns with Grahams criteria for stock selection. Below, each metric is assessed based on the data provided:

1. Price-to-Earnings (P/E) Ratio: BKR's P/E ratio stands at 94.44, which appears quite high, especially when compared to Graham's preference for stocks with low P/E ratios relative to their industry peers. Without the industry average P/E ratio provided for comparison, it's challenging to make a definitive judgment against the industry standard. However, traditionally, a P/E ratio significantly higher than the market average would suggest the stock is overvalued, likely falling outside Grahams criteria for investment.

2. Price-to-Book (P/B) Ratio: The P/B ratio of BKR is 0.80, indicating that the stock is trading at a value slightly below its book value. This measure would catch Graham's attention, as he often looked for stocks trading below their book value, assuming it signals a potential undervaluation and thus a closer alignment with his investment philosophy.

3. Debt-to-Equity Ratio: BKR shows a debt-to-equity ratio of 0.39. By Grahams standards, which prefer companies with a low debt-to-equity ratio, BKR would be considered to have a relatively healthy balance sheet. Lower debt levels imply lower financial risk, which fits well within the margin of safety principle advocated by Graham.

4. Current and Quick Ratios: Both the current and quick ratios for BKR are identical at 1.25. These ratios, which assess a companys ability to cover its short-term liabilities with its short-term assets, indicate moderate financial stability. Graham's approach looks for strong liquidity positions as a sign of financial health, and while BKR's figures here do not scream robustness, they do not indicate immediate liquidity concerns either.

5. Earnings Growth: Unfortunately, specific data regarding BKRs earnings growth over a period of years is not provided here. As this is a crucial aspect of Grahams analysis seeking companies showing consistent earnings growth a thorough examination would require this historical earnings data.

Conclusion: Based on the available metrics, BKR presents a mixed alignment with Benjamin Grahams investment principles. The companys P/B ratio aligns well with Grahams criteria, suggesting potential undervaluation. The moderate debt levels and adequate liquidity ratios also suggest a financial structure that may be appealing from a value investing perspective. However, the significantly high P/E ratio poses a concern, potentially indicating overvaluation, which contrasts starkly with Graham's methodology. Without a comparison to the industry average P/E ratio or data on earnings growth, a complete assessment remains inconclusive. Investors following Grahams principles might see selective positives in BKR but should proceed with caution and seek further analysis, especially regarding earnings growth and relative P/E valuation, before considering an investment.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

In examining the array of financial data presented for Baker Hughes Company over various fiscal periods from the fiscal year ending December 31, 2021, through to the third quarter of 2023 several key insights emerge on the company's financial health and operational performance.

Assets and Liabilities: Baker Hughes consistently reports a strong asset base, indicating significant investments in property, plant, and equipment, alongside valuable intangible assets including goodwill and intellectual property. For FY 2021, total assets stood at $35.49 billion, with a slight fluctuation to $35.41 billion by the end of 2022, and a consistent upward trajectory through the subsequent quarters of 2023. Liabilities have also seen varied changes, suggesting active financial management strategies concerning debt and operational liabilities.

Revenue Streams: Revenue detail underscores the company's ability to generate sales from its core operations, with a notable increase from $20.5 billion in FY 2021 to over $23 billion by the end of 2022. This upward trend in revenue generation speaks volumes about Baker Hughes' market position and the effectiveness of its sales strategies, even in the face of global market volatility.

Operating Income and Net Losses: Throughout the observed periods, Baker Hughes has faced challenges impacting its profitability, marked by operating losses and net losses in certain quarters. This could be attributed to the highly competitive nature of the industry, fluctuating oil prices, and the global economic environment impacting operational costs and margins. For instance, Q3 2021 highlights a notable operating loss alongside comprehensive income losses, hinting at periods of financial distress or strategic investments that have yet to yield returns.

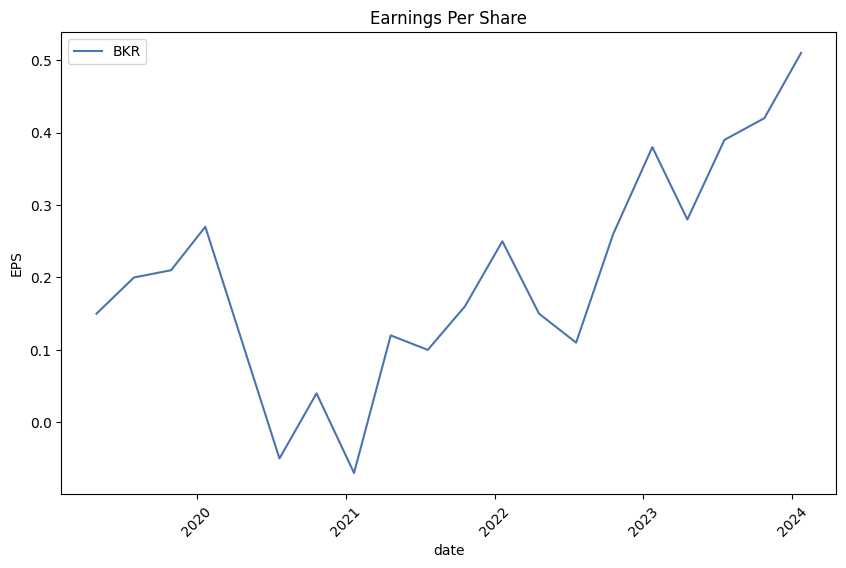

Comprehensive Income and Earnings Per Share: Comprehensive income figures reveal periodic recoveries and the realization of losses, signaling the company's resilience and capacity to navigate financial and operational hurdles. Earnings per share (EPS) data fluctuate across the examined periods, reflecting the company's erratic profitability amidst strategic readjustments and market dynamics. For investors, these metrics are crucial in understanding the risk and return profile of investing in Baker Hughes.

Cash Flow Considerations: The cash flow statements across these periods provide insights into the companys operational efficiency, investment activities, and financing strategies. Notably, Baker Hughes demonstrates robust operational cash flow, underscoring its core operational strength. Investment activities reveal significant outlays for productive assets and acquisitions, indicative of strategic growth initiatives. Financing activities, meanwhile, reflect the company's approaches to managing debt, equity, and dividends essential factors for investor assessments on financial health and future growth prospects.

Conclusion: Analyzing Baker Hughes Companys financial statements reveals a complex picture of a company navigating the intricacies of the oil and gas industry, with strategic investments aimed at long-term growth, balanced against the challenges of market volatility and operational costs. For the intelligent investor, understanding these dynamics through the lens of Benjamin Graham's principles emphasizing a deep dive into financial statements is crucial in assessing the company's potential for sustainable growth, profitability, and risk management.Given the extensive listing of dividend records shown above, it's clear that the company in question has demonstrated a strong and consistent history of paying dividends. This aligns well with Benjamin Graham's investment philosophy as described in "The Intelligent Investor." Graham, known as the father of value investing, emphasized the importance of dividends in assessing a company's overall health and investment quality. He believed that a solid dividend record is one indicator of a company's financial stability and commitment to returning value to shareholders.

Analyzing the data, we see a consistent pattern of dividend payments over decades, which provides evidence of the company's ability to generate and distribute profits to its shareholders over a long period. This kind of financial discipline and reliability is exactly what Graham advised investors to look for in a company, signaling not only its ability to navigate different economic cycles but also its focus on shareholder value.

Such a company would likely be appealing to investors following Graham's principles, as it exhibits one of the key characteristics he believed was important in a good investment: a reliable dividend-paying record. This suggests not only a certain level of stability and profitability but also implies a management philosophy that prioritizes shareholder returns, both of which are cornerstones of the investment approach Graham advocated.

| Statistic Name | Statistic Value |

| R-squared | 0.298 |

| Adj. R-squared | 0.298 |

| F-statistic | 533.2 |

| Prob (F-statistic) | 1.33e-98 |

| Log-Likelihood | -2872.0 |

| No. Observations | 1257 |

| AIC | 5748. |

| BIC | 5758. |

| coef (const) | -0.0136 |

| std err (const) | 0.067 |

| t (const) | -0.203 |

| P>|t| (const) | 0.839 |

| [0.025 | -0.145 |

| 0.975] (const) | 0.118 |

| coef (0) | 1.1752 |

| std err (0) | 0.051 |

| t (0) | 23.091 |

| P>|t| (0) | 0.000 |

| [0.025 (0) | 1.075 |

| 0.975] (0) | 1.275 |

| Omnibus | 88.534 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 417.612 |

| Skew | 0.031 |

| Prob(JB) | 2.07e-91 |

| Kurtosis | 5.823 |

| Cond. No. | 1.32 |

The linear regression model reveals a statistically significant relationship between the performance of BKR and that of the broader market, represented here by SPY. The model outputs a beta (slope) of 1.1752, indicating that, on average, for every 1% movement in SPY, BKR is expected to move by approximately 1.1752%. However, the R-squared value is 0.298, suggesting that only about 30% of the variability in BKR's movements can be explained by the movements in SPY. This indicates that while there is a positive correlation, there are also other factors influencing BKR that are not captured by SPY's movements.

The alpha (intercept) of the model is -0.0136, suggesting an average expected return differential between BKR and the market that is slightly negative when the market return is zero. However, the statistical significance of alpha, as indicated by its p-value, is very low (P>|t| = 0.839), which means that there is a high likelihood that the alpha observed could have occurred by chance and it may not provide reliable evidence of BKR's performance over or below the market independently of its correlation with SPY. In practical terms, while BKR generally moves with the market, its excess return over the market, as indicated by the models alpha, is not statistically significant.

In the Baker Hughes Company fourth quarter 2023 earnings call, leadership team discussed the company's performance and strategic direction. Chairman and CEO, Lorenzo Simonelli, highlighted a transformative year for Baker Hughes with significant achievements in operational efficiency and financial performance. The company successfully executed on cost reduction strategies, realigned its IET business, and launched initiatives to streamline its OFSE business. Notably, Baker Hughes achieved record results in primary financial metrics including orders, revenue, EBITDA, EPS, and free cash flow. The adjusted EBITDA saw a 26% year-over-year increase, marking a third consecutive year of double-digit growth, and adjusted diluted earnings per share improved by 76% from the previous year.

Turning to specifics, Simonelli shared that the total company orders increased by 14% year-over-year, with New Energy orders seeing a significant 45% increase. The strong market tailwinds across both segments and operational improvements since 2022 were key contributors to these record results. In terms of the broader market dynamics, oil prices experienced a downturn due to weaker-than-anticipated demand and strong production growth, leading to an unexpected inventory build towards year-end. Despite this, prices remained at levels favorable for growth across Baker Hughes' core markets. Looking ahead, the company sees potential challenges in the global economic climate and geopolitical risks, but remains optimistic about the long-term development plans across the industry.

The presentation also covered Baker Hughes' ventures into the LNG and New Energy sectors. Despite recent weakness in LNG prices, the long-term outlook for the global LNG market remains robust, supported by strong levels of demand and strategic projects like the Ruwais LNG project in the United Arab Emirates. The company also emphasized its commitment to the energy transition, acknowledging the complexity and duration the transition may entail. Baker Hughes is adopting an all-encompassing strategy to decarbonize the planet, leveraging its technology and expertise across various energy sources.

Chief Financial Officer, Nancy Buese, provided an overview of the company's consolidated results and outlined the financial outlook for the first quarter and full year of 2024. Baker Hughes anticipates sustained revenue growth led by its international segments, with both OFSE and IET segments expected to exhibit margin improvements and robust revenue growth. Buese also detailed the company's capital allocation strategy, which aims to return significant value to shareholders through dividends and share buybacks. Overall, Baker Hughes demonstrated strong performance in 2023 and outlined a strategic path forward that emphasizes efficiency, growth in New Energy and LNG sectors, and shareholder value maximization.

ctivity in OFSE and IET. OFSE increased $1,755 million and IET increased $1,665 million. Total segment operating income increased $608 million, driven by growth in OFSE and IET, reflecting higher activity levels, improved pricing, cost productivity, and cost-out initiatives, tempered by inflationary pressures and costs associated with investments in new energy solutions.

Oilfield Services & Equipment OFSE revenue of $11,405 million for the first nine months of 2023 increased $1,755 million, or 18%, from the same period in 2022, predominantly due to increased international activity and impact from price improvements. In North America, revenue increased marginally by $364 million, despite a slightly lower rig count, highlighting operational efficiencies and improved pricing. Notably, the international market, excluding the effects of discontinuing Russian operations, saw a more substantial revenue increase of $1,392 million, benefiting from higher activity levels in the Middle East/Asia and Latin America regions. The segment's operating income for the first nine months reflected a significant increase, benefiting from volume growth, pricing improvements, and cost reduction efforts despite inflationary pressures and reduced activity related to Russia.

Industrial & Energy Technology IET revenue of $7,267 million for the first nine months of 2023 increased $1,665 million, or 30%, from the first nine months of 2022, primarily due to a substantial increase in orders in the Gas Technology Equipment product line, along with growth in Industrial Technology and Gas Technology Services. This growth reflects heightened demand for energy technology and services, including LNG projects driving Gas Technology Equipment orders. The IET segment demonstrated an operating income increase, benefiting from volume and price improvements across its product lines, and cost optimization. Despite facing inflationary challenges and increased research and development expenditure for new energy investments, the segment improved its profitability through strategic pricing and cost management initiatives.

Corporate and Other Items Corporate expenditures decreased slightly, demonstrating the effect of ongoing corporate optimization processes aimed at reducing overhead costs. The significant reduction in restructuring, impairment, and other charges year-over-year reflects the 2022 restructuring plans and asset impairments primarily related to the discontinuation of Russian operations, with more stabilized charges in 2023 as these initiatives normalize.

Interest expense, net decreased due to higher interest income, reflecting improved interest rates on cash balances and reduced debt levels. Other non-operating income (loss), net, saw a significant positive swing, primarily due to gains from the change in fair value of certain equity investments in 2023, contrasting with losses recorded in 2022.

Outlook and Conclusion As we move forward, we maintain a positive outlook for the oil and gas industry, supported by ongoing drilling and production activities alongside a growth trajectory in new energy solutions. Our results for the first nine months of 2023 underpin our strategic direction towards operational efficiency, cost management, and investment in future energy solutions, setting a robust foundation for sustainable growth. Continued focus on cost-out initiatives, digital transformation, and strategic investments in the energy transition will be critical in navigating the evolving energy landscape and leveraging opportunities for expansion in both traditional and new energy markets.

In the constantly evolving and competitive landscape of the Fortune 500 industry leaders, Baker Hughes has carved a niche for itself, especially in the realm of dividend growth and investment potential. The company thrives in the oilfield services sector, navigating through the challenges of fluctuating oil prices, geopolitical tensions, and the shift towards renewable energy sources. Despite these hurdles, Baker Hughes has demonstrated resilience, underscored by its commitment to dividends and growth prospects, making it an attractive option for investors looking for stable returns and growth opportunities in the transitioning energy sector.

Baker Hughes' adaptability is further emphasized through its investments in technologies aimed at reducing carbon footprints and enhancing oil recovery rates. This approach aligns with the global movement towards sustainability, opening doors to new growth avenues and partnerships. The significances of Baker Hughes' strategies are highlighted in a comprehensive analysis from Seeking Alpha, dated October 3, 2023, which regards the company among the top four January dividend-paying Fortune 500 companies, hinting at a rewarding investment landscape.

The company's strategic clarity and optimism for growth amidst global uncertainties reflect a balanced approach to navigating complex market dynamics. Baker Hughes anticipates robust demand for oil and gas, particularly from developing regions. The company's international operations are set to witness high single-digit growth, despite the turbulent industry conditions brought forth by variables such as OPEC cuts and industry consolidation, especially in North America.

Baker Hughes is not just focused on tackling the present but is also geared towards future growth, particularly in the liquefied natural gas (LNG) sector. The company's backlog in LNG projects and engagement in international LNG endeavors illustrates a commitment to a significant part of the future energy supply chain, banking on global LNG capacity expansions by 2030.

The beginning of 2024 has seen Baker Hughes facing challenges, including a decline in its stock value, as detailed by The Motley Fool on February 5, 2024. Factors such as weaker-than-expected oil demand and adjustments in North American drilling and construction spending expectations from "flattish" to a decline have influenced this downturn. However, Baker Hughes remains optimistic, eyeing growth and expansion in its new energy business, which includes carbon capture, utilization, and hydrogen storage solutions.

Baker Hughes has also demonstrated a strong commitment to health and safety, initiating a comprehensive CPR and defibrillator training for its employees. This move not only aims at enhancing survival rates from cardiac arrests within workplace environments but also empowers employees to act as lifesavers in their communities. This initiative, launched across several of its Industrial & Energy Technology facilities in Italy and the U.K., underscores Baker Hughes' dedication to building resilient and responsible societies.

Looking ahead, the political landscape could significantly impact Baker Hughes' trajectory, especially if a 'America First' policy under a potential Donald Trump administration were to materialize. Trump's advocacy for reduced regulations on domestic oil and gas producers and expedited global LNG export projects could play to Baker Hughes' strengths, potentially altering the company's growth path for the better.

In February 2024, Baker Hughes secured a monumental multi-year contract with Petrobras for integrated well construction services for the Buzios field, offshore Brazil. This contract not only solidifies Baker Hughes' position as a crucial provider of integrated solutions in Brazil but also showcases the company's broad capabilities in well construction.

Amidst financial mixed outcomes and a notable decline in stock value since its last earnings report, Baker Hughes continues to show promising signs of financial resilience and strategic growth planning. With expectations for notable earnings and revenue growth in the forthcoming fiscal year, based on Zacks Equity Research February 28, 2024, Baker Hughes presents itself as a potentially viable investment in the rapidly shifting energy sector.

Baker Hughes' operations in the energy landscape, especially through its insights provided by weekly rotary rig count data, reflect broader trends in the U.S. oil and gas sector. The gradual increase in the total U.S. rig count and the nuanced landscape of the U.S. drilling activity suggest shifts in exploration and production strategies, spotlighted by the activity in the Permian Basin. This data offers indispensable insights for stakeholders, guiding investment and operational decisions within the industry.

Notably, Baker Hughes stands as a beacon in growth investing arenas, distinguished by Zacks Equity Research for its role in the oilfield services sector and its forward-leaning stance on clean energy. With an impressive Growth Style Score of A, the company is projected to experience significant earnings and sales growth, backed by a buoyant outlook on clean energy solutions. Baker Hughes integrates historical success in cash flow growth with anticipated expansions, mirroring the company's readiness to lead in the transitioning energy market.

In essence, Baker Hughes navigates an intricate path in the oilfield services sector, balancing its foundational strengths with strategic growth foresight. The company's pursuit of sustainability, strategic investments in clean energy solutions, and readiness to adapt to shifting political and market dynamics underscore its robust position in an evolving energy landscape. Amidst financial uncertainties and operational challenges, Baker Hughes' trajectory reflects a blend of resilience, strategic ingenuity, and a forward-looking approach to securing a sustainable and profitable future in the energy sector.

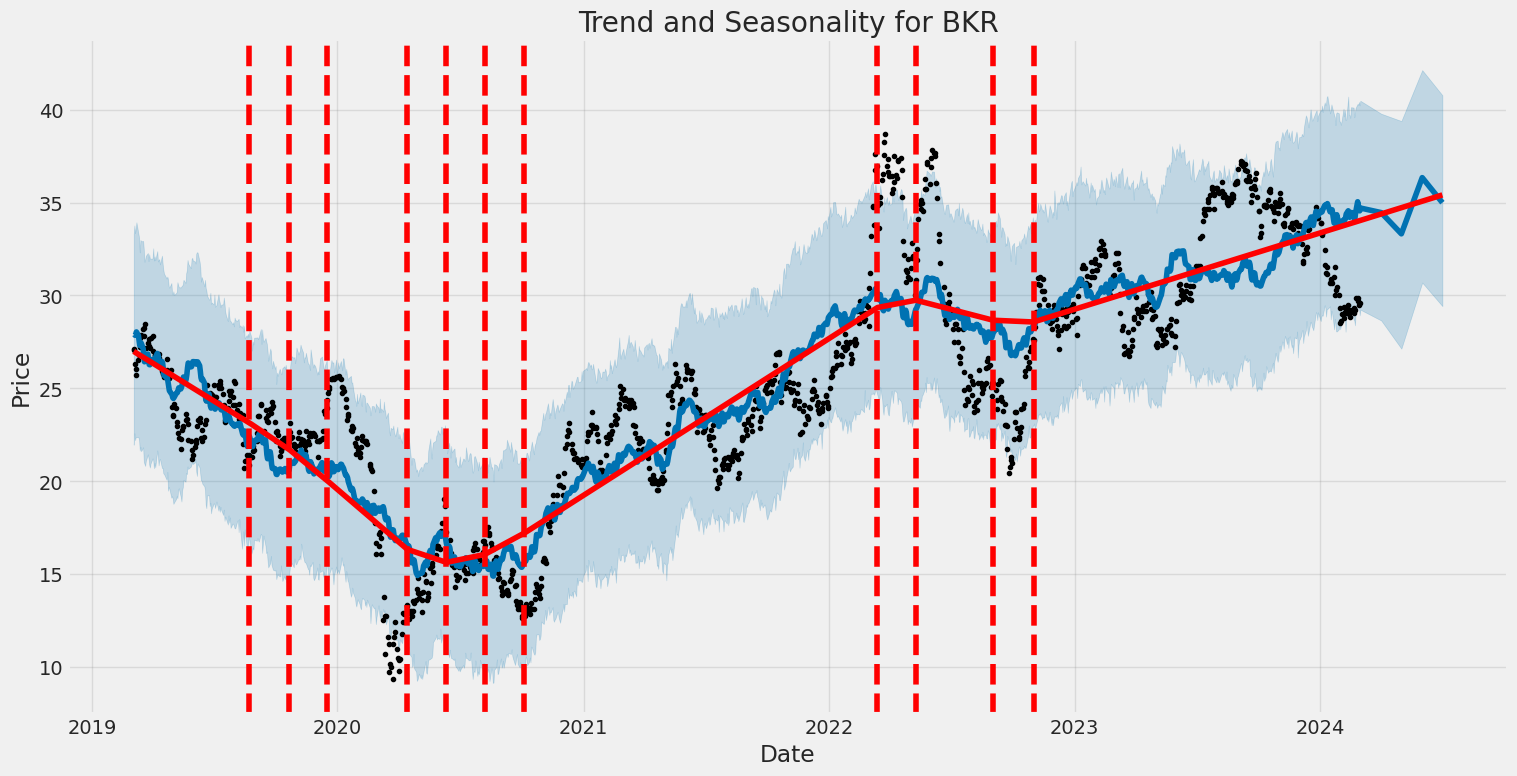

The Baker Hughes Company (BKR) experienced notable volatility from 2019 to 2024, as indicated by the ARCH model analysis. The model, focusing solely on the volatility of asset returns without accounting for the mean, demonstrates significant fluctuations in BKR's stock value. Key features of this volatility include a high coefficient value (omega) indicating the baseline level of variance in returns, and an alpha[1] value suggesting a substantial impact of previous time period's squared returns on current volatility.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Log-Likelihood | -3012.10 |

| AIC | 6028.20 |

| BIC | 6038.47 |

| No. Observations | 1257 |

| omega | 5.3555 |

| alpha[1] | 0.3303 |

Analyzing the financial risk of investing $10,000 in Baker Hughes Company (BKR) over a one-year period requires a sophisticated approach that integrates both volatility modeling and machine learning predictions. This analysis aims to provide an in-depth view of the potential risks associated with equity investment, specifically focusing on the stock of Baker Hughes Company.

Volatility modeling plays a crucial role in understanding the fluctuations in Baker Hughes Company's stock price. This method is particularly adept at capturing the dynamic nature of the market, allowing for the estimation of conditional variance over time. By fitting the historical daily returns of BKR's stock to this model, it becomes possible to forecast future volatility. This forecasting is critical, as it helps in gauging the expected range of variation in the stock's price, which is a direct indicator of the investment's risk level.

On the other hand, the role of machine learning predictions in this context is to harness historical data for forecasting future returns of BKR's stock. By employing a method that learns from the patterns in the data, it is possible to make out-of-sample predictions on the stock's future performance. The predictive model, after being trained on historical data, considers various factors and indicators that might influence the stock's future price, allowing for a refined forecast that complements the insights gained from volatility modeling.

When combined, these two approaches provide a comprehensive view of the potential risks involved in investing in Baker Hughes Company. The integration allows for a nuanced understanding of both the expected fluctuations in the stock's price (volatility) and the directional movement (returns).

The results of this integrative analysis are encapsulated in the calculation of the Value at Risk (VaR) for a $10,000 investment in BKR at a 95% confidence interval, which stands at $274.14. This figure essentially means that there is a 95% confidence level that the investor will not lose more than $274.14 over one year, based on the model's predictions. This risk metric is pivotal for investors as it provides a quantifiable measure of the potential loss associated with the investment, factoring in both the volatility and expected returns of Baker Hughes Company's stock as forecasted by the combined methodologies.

By integrating insights from volatility modeling with machine learning predictions, investors can gain a much clearer understanding of the inherent risks of an equity investment in Baker Hughes Company, as demonstrated by the calculated annual Value at Risk at a 95% confidence interval. This comprehensive approach allows for a sophisticated risk assessment, tailoring the analysis specifically to the dynamics of Baker Hughes Company's stock.

Based on the given options chain for Baker Hughes Company (BKR) call options, we can analyze the provided Greeks to identify the most profitable options. The "Greeks" we will review include Delta, Gamma, Vega, Theta, and Rho, which respectively measure an option's sensitivity to the stock's price change, the delta's sensitivity, volatility, time decay, and interest rates. Additionally, the Return on Investment (ROI) and profit potential are crucial for evaluating the options' profitability.

For the sake of clarity, we'll take a precise approach, focusing on options that show balanced potential based on their Greeks, considering the target stock price is foreseen to be 5% over the current stock price. This analysis assumes a good understanding of the options market and underlying strategies that might benefit from specific Greek values.

Options with higher delta values are more attractive for investors expecting a significant move in the underlying stock price, as these options mimic the stock's price movement more closely. For instance, options with a delta near 0.9, such as the call option expiring on June 21, 2024, with a strike price of 13.0, present a high probability of ending in the money. It has a delta of 0.909, indicating a strong sensitivity to the stock's price change.

Meanwhile, options with a high gamma, like the call option with a strike of 29.0 expiring on March 15, 2024, might be appealing for their potential for rapid increases in delta, making them potentially highly profitable if the stock moves favorably. However, its short time to expiration and inherent risks associated with high gamma need to be carefully considered.

Considering vega, options with a higher vega are more sensitive to changes in the underlying's volatility. For example, the call option expiring on July 19, 2024, with a strike price of 27.0, has a high vega, suggesting it could gain value if the stock's volatility increases, which is a crucial factor to consider given the potential for fluctuating oil and energy markets impacting Baker Hughes.

Theta tells us how much an option's price decreases as the expiration date approaches. Options with a lower absolute theta value, such as the call option expiring on January 17, 2025, with a strike price of 20.0, loses value at a slower rate, making it an interesting choice for a longer-term bullish strategy on BKR.

Lastly, for those concerned with interest rate sensitivity, options with higher rho, like the call option expiring on January 17, 2025, with a strike of 20.0, may be more desirable, especially in an environment of rising rates, as they stand to gain more as rates rise.

Considering ROI and profit potential, the call option expiring on March 15, 2024, with a strike of 30.0, offers a high ROI of 1.2755 but comes with high risk given its short time to expiration and high gamma. On the other end, the option expiring on January 17, 2025, with a strike of 13.0, presents a significant profit potential and is more conservative with a longer duration and a high delta, making it worth considering for investors bullish on BKR over the longer term.

In summary, when choosing the most profitable call options for Baker Hughes Company, an investor's strategy should consider their market outlook, risk tolerance, and the specific Greeks that align with their investment thesis. The above examples highlight options with characteristics that could be appealing under different scenarios and objectives, emphasizing the importance of a balanced, well-thought approach to options trading.

Similar Companies in Oil & Gas Equipment & Services:

Report: Schlumberger Limited (SLB), Schlumberger Limited (SLB), Report: NOV Inc. (NOV), NOV Inc. (NOV), Weatherford International plc (WFRD), Tenaris S.A. (TS), Halliburton Company (HAL), TechnipFMC plc (FTI), NOW Inc. (DNOW), ChampionX Corporation (CHX), Report: Oceaneering International, Inc. (OII), Oceaneering International, Inc. (OII), Bristow Group Inc. (VTOL), RPC, Inc. (RES), Report: Cactus, Inc. (WHD), Cactus, Inc. (WHD), Tidewater Inc. (TDW), Valaris Limited (VAL), Expro Group Holdings N.V. (XPRO)

https://www.youtube.com/watch?v=wo1NFC5EJ7k

https://www.youtube.com/watch?v=OD2P-7wval0

https://www.fool.com/investing/2024/02/05/heres-why-shares-of-baker-hughes-slumped-in-januar/

https://finance.yahoo.com/news/baker-hughes-provides-lifesaving-cpr-131500103.html

https://finance.yahoo.com/news/trump-triumph-7-stocks-buy-190149757.html

https://finance.yahoo.com/news/baker-hughes-secures-major-multi-130000315.html

https://finance.yahoo.com/news/why-baker-hughes-bkr-down-163019784.html

https://finance.yahoo.com/news/baker-hughes-bkr-stock-sinks-231505573.html

https://finance.yahoo.com/news/permian-oil-drilling-rig-count-133600766.html

https://finance.yahoo.com/news/growth-investor-1-stock-could-144513910.html

https://seekingalpha.com/article/4673802-4-fortune-500-industry-leaders-for-february-dividends

https://finance.yahoo.com/news/baker-hughes-bkr-sees-more-231507206.html

https://www.sec.gov/Archives/edgar/data/1701605/000170160523000078/bkr-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: H3VotJ

Cost: $0.93930

https://reports.tinycomputers.io/BKR/BKR-2024-03-01.html Home