Box, Inc. (ticker: BOX)

2024-05-17

Box, Inc. (ticker: BOX) is a cloud content management and file sharing service optimized for collaborative business environments. Founded in 2005, the company is headquartered in Redwood City, California. Box's primary offering is an integrated platform that enables secure sharing, management, and storage of digital files across various devices and organizational structures. It caters to a wide range of industries including healthcare, financial services, education, and government sectors. With robust features such as advanced data encryption, customizable workflow automation, and compliance with regulatory standards, Box aims to streamline information governance and enhance productivity. The company's revenue model primarily revolves around subscription fees, with offerings tiered to accommodate different levels of enterprise needs. Box, Inc. trades on the New York Stock Exchange under the ticker "BOX" and continues to grow through continuous innovation and strategic partnerships.

Box, Inc. (ticker: BOX) is a cloud content management and file sharing service optimized for collaborative business environments. Founded in 2005, the company is headquartered in Redwood City, California. Box's primary offering is an integrated platform that enables secure sharing, management, and storage of digital files across various devices and organizational structures. It caters to a wide range of industries including healthcare, financial services, education, and government sectors. With robust features such as advanced data encryption, customizable workflow automation, and compliance with regulatory standards, Box aims to streamline information governance and enhance productivity. The company's revenue model primarily revolves around subscription fees, with offerings tiered to accommodate different levels of enterprise needs. Box, Inc. trades on the New York Stock Exchange under the ticker "BOX" and continues to grow through continuous innovation and strategic partnerships.

| Full-Time Employees | 2,530 | Previous Close | 27.18 | Open | 27.15 |

| Day Low | 26.66 | Day High | 27.26 | Beta | 0.855 |

| Trailing P/E | 39.828358 | Forward P/E | 14.424324 | Volume | 616,393 |

| Average Volume | 2,441,812 | Bid | 26.7 | Ask | 26.69 |

| Bid Size | 800 | Ask Size | 900 | Market Cap | 3,852,059,392 |

| 52-Week Low | 23.29 | 52-Week High | 31.94 | Price to Sales (TTM) | 3.711966 |

| 50-Day Average | 27.5802 | 200-Day Average | 26.54535 | Enterprise Value | 4,426,720,256 |

| Profit Margins | 0.12434 | Float Shares | 139,245,849 | Shares Outstanding | 144,352,992 |

| Shares Short | 11,700,168 | Shares Short (Prior Month) | 13,158,840 | Short Ratio | 7.83 |

| Book Value | -2.986 | Net Income to Common | 99,147,000 | Trailing EPS | 0.67 |

| Forward EPS | 1.85 | PEG Ratio | 0.86 | Enterprise to Revenue | 4.266 |

| Enterprise to EBITDA | 51.839 | 52-Week Change | -0.011995614 | Free Cash Flow | 285,502,496 |

| Operating Cash Flow | 318,727,008 | Earnings Growth | 4.493 | Revenue Growth | 0.025 |

| Gross Margins | 0.74887 | EBITDA Margins | 0.08229 | Operating Margins | 0.08051 |

| Total Cash | 480,689,984 | Total Debt | 491,799,008 | Quick Ratio | 1.122 |

| Current Ratio | 1.24 | Total Revenue | 1,037,740,992 | Debt to Equity | 805.792 |

| Revenue per Share | 7.196 | Return on Assets | 0.02591 | Return on Equity | 9.49742 |

| Current Price | 26.685 | Target High Price | 35.0 | Target Low Price | 21.0 |

| Target Mean Price | 31.57 | Target Median Price | 32.0 | Recommendation Mean | 2.0 |

| Number of Analyst Opinions | 7 |

| Sharpe Ratio | -0.16892176477363513 | Sortino Ratio | -2.462661543191791 |

| Treynor Ratio | -0.04639723388541753 | Calmar Ratio | -0.15981633175080887 |

In the analysis of BOX, a prominent cloud content management company, both technical and fundamental indicators provide a comprehensive outlook for the stock's potential future performance.

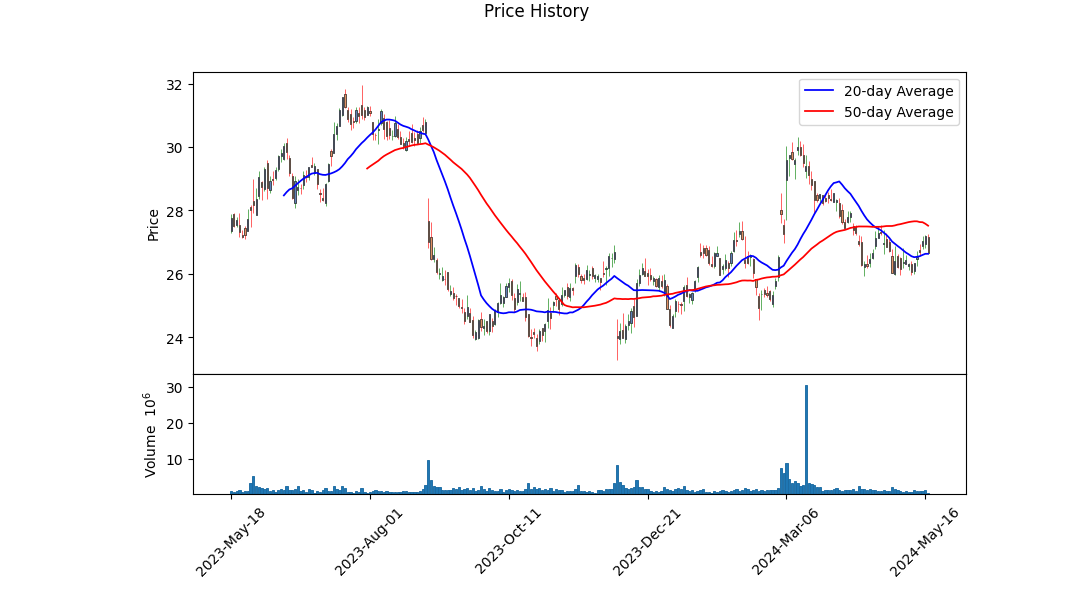

Technical Analysis

The recent price movements display a strong upward trend, with the closing price for the most recent days moving from around $25.50 to $27.26, indicating a positive trajectory. The On-Balance Volume (OBV) fluctuated, which may suggest some uncertainty in the market sentiment. However, the consistent upward trend in the MACD histogram turning positive indicates that the bullish momentum is gaining strength.

Fundamental Analysis

From a fundamental perspective, BOX shows considerable strengths: - Gross Margins (74.887%): This high value indicates efficient cost management relative to their sales, a positive indicator of profitability. - EBITDA Margins (8.229%) and Operating Margins (8.051%): These values indicate room for potential expansion in profitability, given the cloud industrys scalability. - Trailing PEG Ratio (0.9761): A value below 1 suggesting that the stock is potentially undervalued given its earnings growth forecast.

Risk-Adjusted Performance Ratios

The performance ratios provide a key insight into the risk-adjusted returns of BOX: - Sharpe Ratio (-0.1689): Indicates that the stock has underperformed in terms of risk-adjusted returns over the last year. - Sortino Ratio (-2.4627): Even more pronounced negative returns when considering downside risk only. - Treynor Ratio (-0.0464): Reflects poor performance relative to risk taken. - Calmar Ratio (-0.1598): Suggests significantly high risks relative to returns against the maximum drawdown.

Financial Health

- Total Debt: At $491.80 million, considerably reduced from previous years, indicating effective debt management.

- Gross Profit: Increased to $777.13 million from $546.03 million, signaling revenue growth and effective cost containment.

- Operating Income: Positive at $50.75 million, an improvement from negative operations previously.

- Net Income: Substantial turnaround with positive $129.03 million from a prior loss of -$43.43 million.

In summary, despite the negative historical risk-adjusted returns reflected in the Sharpe, Sortino, Treynor, and Calmar ratios, BOX's recent financial performance and improved technical indicators project a promising outlook. Given the robust fundamentals, reduced debt levels, and increasing profitability, the stock appears poised for upward movement over the next few months. However, investors should remain cautious due to recent volatility, market sentiment shifts, and external economic factors that can introduce significant risks.

In our recent analysis of Box, Inc. (BOX) using the metrics outlined in "The Little Book That Still Beats the Market," we have calculated a Return on Capital (ROC) of approximately 9.05% and an Earnings Yield of around 2.59%. The ROC of 9.05% suggests that Box, Inc. is generating a respectable return relative to the capital it reinvests into its business, indicating efficient use of resources to create value for shareholders. However, the Earnings Yield of 2.59%, which measures the company's earnings in relation to its market value, appears relatively low. This low earnings yield hints that investors may be paying a relatively high price for the company's current level of earnings, potentially expecting higher growth or lower risk compared to other investment opportunities. Together, these metrics provide a nuanced view; while Box, Inc. demonstrates efficient capital utilization, the market's valuation of its earnings suggests a cautious outlook on its current profitability, necessitating a deeper examination of the companys growth prospects and risk factors.

| Alpha | 0.012 |

| Beta | 1.150 |

| R-Squared | 0.742 |

| Standard Error | 0.0032 |

The relationship between BOX and SPY shows that BOX has an alpha of 0.012, indicating that BOX outperforms the market (represented by SPY) slightly on average when factors such as market volatility are accounted for. This positive alpha suggests that BOX provides a small but consistent excess return independent of the market movements.

In addition, the beta value of 1.150 indicates that BOX is slightly more volatile than the market itself. An R-squared value of 0.742 noted in our linear regression model signifies that approximately 74.2% of the variability in BOX's returns can be explained by the market's returns. The standard error of 0.0032 showcases the precision of our estimates, ensuring that the relationship between BOX and SPY is well-captured by this model.

Box, Inc. Fourth Quarter and Fiscal Year 2024 Earnings Summary

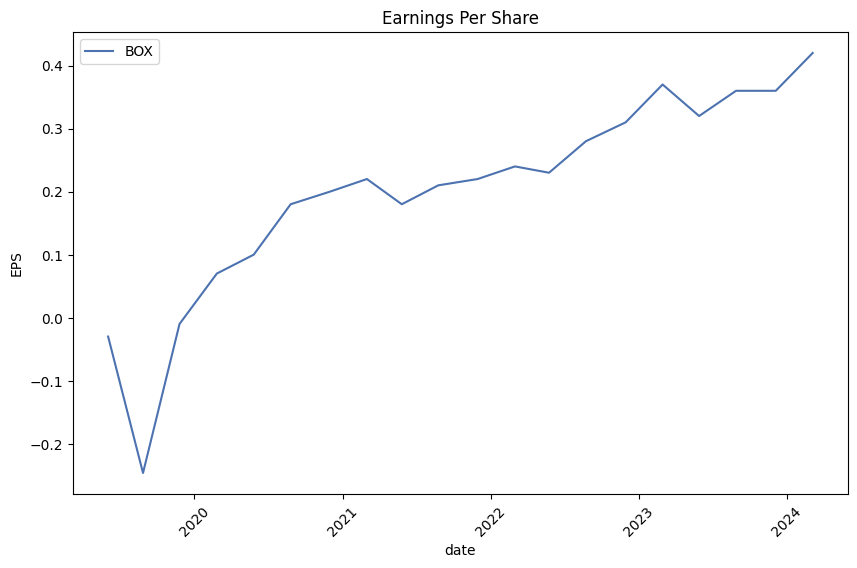

Market and Financial Performance Overview In the fourth quarter (Q4) of Fiscal Year 2024 (FY24), Box, Inc. reported results that either matched or exceeded guidance despite ongoing macroeconomic challenges and tightened IT budgets. The company achieved a revenue of $263 million, marking a modest 2% year-over-year growth, or 4% in constant currency terms. Operating margins were robust at 26.7%, surpassing guidance estimates. This quarters earnings per share (EPS) stood at $0.42, also exceeding the upper projection of Boxs guidance by $0.03. Over the full fiscal year, Box crossed the $1 billion mark in annual revenue for the first time while delivering an operating margin of 24.7%, highlighting the companys ability to expand margins even under adverse macroeconomic conditions.

Strategic Innovations and Product Expansions FY24 witnessed strategic strides in product offerings and technological advancements, particularly with the introduction of Box AI in beta. This suite integrates advanced AI models directly into the Box Content Cloud. Another key highlight is the launch of Box Hubs, enhanced by Box AI, which revolutionizes secure content curation and dissemination within enterprises. Enhancements in areas such as security, compliance, collaboration, and workflow marked significant progress, further solidifying Boxs value proposition. The acquisition of Crooze, a no-code enterprise content management application developer, is anticipated to significantly bolster Boxs capability in automating and customizing content management workflows.

Market Opportunities and AI Integration Aaron Levie, CEO of Box, identified substantial market opportunities driven by enterprises seeking workflow digitization and automation through AI. Box envisions addressing these needs by leveraging the power of AI to streamline processes and enhance productivity while upholding robust data security and compliance standards. Boxs approach involves incorporating AI technologies to optimize the handling of unstructured data, enabling enterprises to derive greater value from their content. With the general availability of Box AI, customers in higher-tier plans have already begun utilizing these capabilities for various applications, bolstering Box's competitive edge in assisting businesses to optimize their workflows.

Future Growth and Strategic Focus For Fiscal Year 2025 (FY25), Box is gearing up for significant product expansions anticipated to foster an intelligent enterprise ecosystem. The integration of AI with advanced automation and metadata-driven views is expected to pave the way for transforming enterprise content management. The Crooze acquisition will aid in delivering bespoke content-centric workflows without custom development hindrances. Proactive steps like launching Forms and Doc Gen this year underscore Box's commitment to expand its product utility further. Strategic investments in go-to-market activities and deeper partnerships emphasize Box's focus on capturing larger market shares and driving future revenue growth. The additional $100 million share repurchase authorization reiterates Boxs balanced approach toward capital allocation, aiming at both growth and shareholder value enhancement.

In summary, Box, Inc. demonstrated solid financial performance and significant strides in its technological and product landscape in FY24. The company's ongoing focus on leveraging advanced AI capabilities and strategic acquisitions positions it well for capitalizing on emerging market opportunities and accelerating long-term growth.

Box, Inc. ("Box") filed its latest SEC 10-Q report on October 31, 2023, detailing the company's financial performance for the third quarter of its fiscal year 2024. Box is a cloud content management and file sharing service for businesses, supporting secure access, sharing, and collaboration on digital content. The report shows that the company has continued to grow, albeit modestly, amid economic uncertainties and currency headwinds.

Box reported a revenue of $261.5 million for the quarter, marking a year-over-year increase of 5% from $249.9 million. This growth was primarily driven by seat expansion within existing customers and strengthened by the company's multi-product suites, particularly the Enterprise Plus plan. However, currency fluctuations, especially the weakening of the Japanese Yen, had a negative impact, lowering the growth rate by approximately 200 basis points. Box also highlights that it has been affected by macroeconomic conditions, including slower deal cycles and higher customer scrutiny on larger deals.

The companys gross profit margin slightly decreased to 73.5% from the previous year's 74.2%. This was attributed to the transition from collocated data centers to public cloud hosting, leading to redundant expenses during the migration period. For operating expenses, Box recorded $61.0 million in research and development, $87.9 million in sales and marketing, and $32.0 million in general and administrative expenses for the quarter. Notably, the rise in operating expenses reflects continued investment in product development and increased costs associated with headcount and stock-based compensation. Despite these increased expenditures, the company's operating income stood at $11.4 million, though this was down from $13.4 million in the prior year.

One key indicator for Box is the Remaining Performance Obligations (RPO), which reached $1.131 billion, showing a 7% year-over-year growth, driven primarily by customer expansions and the conversion to multi-product suites. However, the net retention rate, which Box uses to measure how well it retains and grows revenue from its existing customer base, stood at 102%, a decline from 110% the previous year. This suggests some pressure on customer expansions and renewals amid the economic challenges.

For the nine months ended October 31, 2023, Box demonstrated a solid financial performance with a revenue of $774.9 million, representing a 6% year-over-year growth. The gross profit for the same period was $577.0 million, and the companys net income was $29.8 million, significantly higher than the $6.3 million reported for the same period in 2022. The increase in net income was driven primarily by higher gross profit and increased interest income. The growth in interest income also highlights an improvement in financial management, as Box benefited from favorable interest rates on its investments and marketable securities.

The company's liquidity remains strong, with $440.3 million in cash, cash equivalents, restricted cash, and short-term investments as of October 31, 2023. Despite considerable investments in product development and stock repurchases, Box managed to generate $229.4 million in cash flows from operating activities during the nine-month period. This liquidity position, along with the available credit facilities, is expected to be sufficient to meet its working capital and capital expenditure needs for at least the next twelve months.

Overall, Box's financial performance continues to demonstrate resilience and growth potential as it navigates through economic headwinds and continues to invest in expanding its product offerings and market reach. The company maintains a cautious yet optimistic outlook, emphasizing its capability to adapt and thrive in a dynamic economic environment.

In 2024, Box, Inc. was honored as one of the 100 Best Companies to Work For by Fortune magazine, securing the 18th position. This recognition, as announced on April 4, 2024, signifies Boxs commitment to fostering an inclusive and employee-oriented workplace culture. The accolade is part of a broader recognition from Great Place to Work and Fortune, which assess workplace culture and talent management practices extensively, primarily based on employee feedback.

Jessica Swank, the Chief People Officer at Box, highlighted the organization's dedication by emphasizing their people-first mentality, underscoring the companys efforts to make every team member feel valued, supported, and empowered. This philosophy is ingrained within Box's cultural ethos, distinguishing it through its fundamental approach to employee well-being rather than mere perks or policies.

In addition to this, Box has received multiple other recognitions over the past year, securing positions in rankings such as #12 in Best Workplaces for Parents 2023, #24 in Best Workplaces for Women 2023, and #7 in Best Workplaces in Technology 2023. These various accolades, derived from confidential feedback from over 1.3 million employees, reinforce Boxs commitment to creating a supportive work environment across diverse demographics.

The methodology behind these accolades is rigorous and credible, involving the Great Place to Work Trust Index survey. Only organizations with at least 1,000 employees and certified as Great Place to Work are considered, emphasizing the significant effort required to achieve such recognition. Box's consistent inclusion in these esteemed lists aligns with Great Place to Works mission, which has been to enhance workplace culture and employee experience globally for over three decades.

In parallel to these internal achievements, Box announced on April 9, 2024, a collaboration with Bulletproof, a global brand agency known for its work with clients such as Mondelez International, The HEINEKEN Company, and Diageo. Bulletproof selected Boxs Content Cloud as their primary platform for managing extensive and varied forms of content and production work. This integration aims to streamline collaboration and improve efficiency in Bulletproofs creative processes.

The transition to Boxs Enterprise Plus suite has provided Bulletproof with advanced features tailored for enterprise needs, enhancing collaboration via integrations with applications like iWork and Adobe Creative Cloud. Security measures are bolstered through Box Shield, offering watermarking and auto-classification policies. The migration of 20TB of content was facilitated by Box Shuttle, while Box Relay improved approval processes, accelerating campaign launches.

Robert Frost, Bulletproofs Global Head of IT, praised the improvements in collaboration and productivity introduced by Box, enabling seamless content access and co-editing with partners worldwide. Jade McQueen, Vice President of Media & Entertainment at Box, highlighted the strategic alignment of this partnership with Box's vision of empowering content creation and management through secure and collaborative technology. This collaboration underscores Boxs influence in transforming digital content management within the creative industry.

On the financial front, Box disclosed insider trading activities on April 10, 2024, where CFO Dylan Smith sold 13,000 shares, part of a year-long trend of selling 156,000 shares without corresponding purchases. Such insider transactions often attract interest due to their implications on perceptions of the company's financial health and future business prospects. Box's shares were trading at $27.3, with a market cap of approximately $3.939 billion and a price-earnings ratio of 40.87. Despite the higher-than-industry price-earnings ratio, the price-to-GF-Value ratio of 0.84 suggests the stock is modestly undervalued.

Box's strategic and operational initiatives, combined with its robust financial management, contribute to its market positioning. The companys focus on integrating AI and ML to enhance its content management solutions aligns with broader industry trends of digital transformation and workflow automation. By prioritizing advancements in technology, Box aims to provide intelligent data management solutions that enhance security and analytics.

Box, Inc. further solidifies its position with the appointment of Steve Murphy, CEO of Epicor Software Corporation, to its Board of Directors as part of a strategic move facilitated by KKR, a global investment firm. Murphy's extensive experience in the technology sector and his leadership roles at OpenText, Oracle, and Sun Microsystems are expected to provide valuable insights and support Box's innovative strategies in AI, digital workflows, and data security.

This strategic addition underscores Box's commitment to leveraging high-caliber leadership to navigate a rapidly evolving technological landscape. Murphys expertise is projected to bolster Box's leadership, guiding it through significant technological shifts and enhancing its market position.

Box's financial performance release for the first quarter of fiscal year 2025 is anticipated on May 28, 2024, with an accompanying conference call scheduled to discuss earnings and business developments. This transparency reflects Boxs commitment to maintaining robust investor relations by keeping stakeholders informed about its financial health and strategic direction.

For more detailed insights into Box's recent achievements and strategic initiatives, readers can refer to the comprehensive analysis provided by various financial news sources. These developments highlight Box's ongoing efforts to foster growth, innovation, and operational excellence, positioning it as a robust player in the cloud content management market.

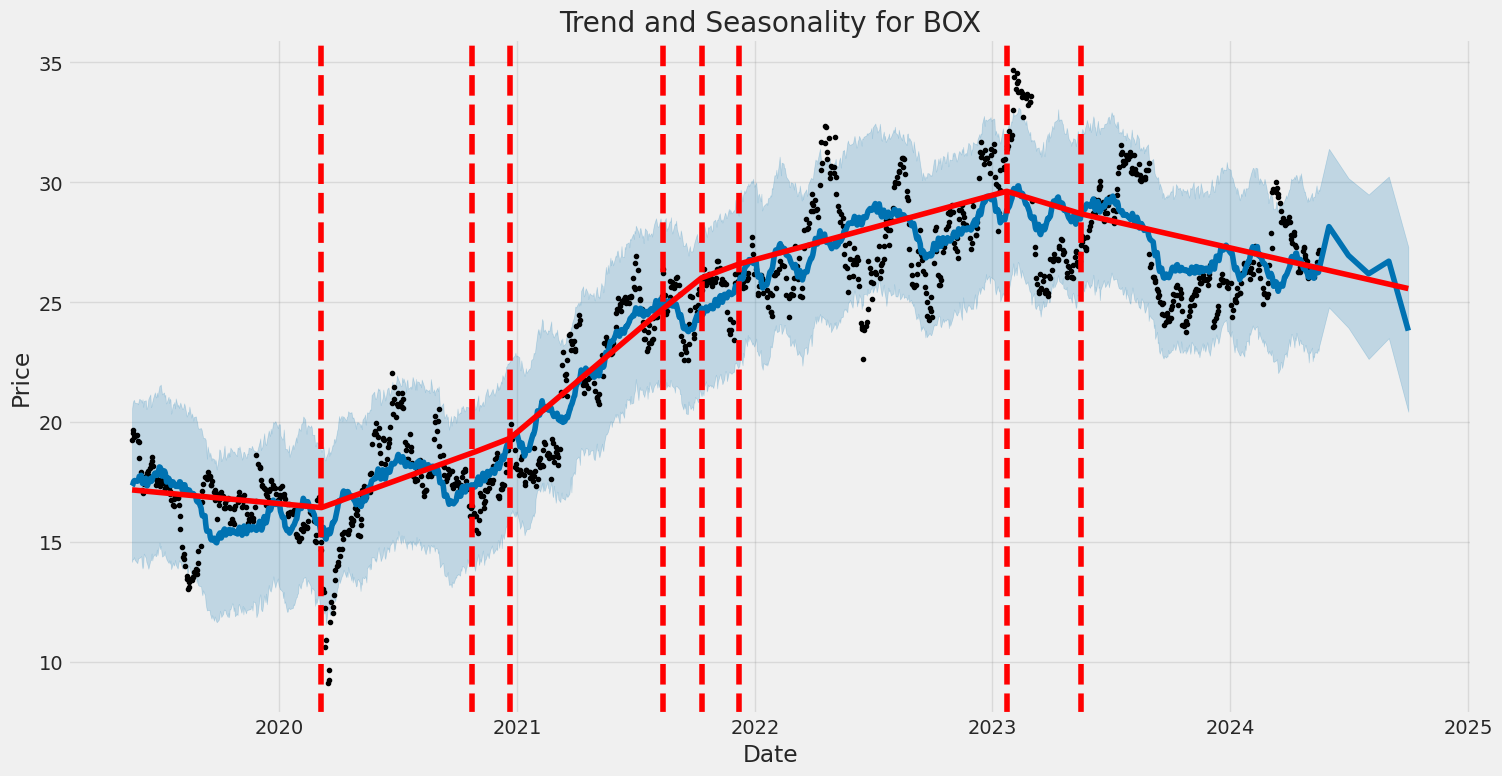

Box, Inc. (BOX) has shown a moderate level of volatility over the past five years, influenced by market dynamics and company-specific events. The volatility model indicates that past shocks have a noticeable but not extreme impact on future volatility. Additionally, the model fit is reasonable with low R-squared values, suggesting that much of the variability in returns remains unexplained by this simple model.

| Statistic | Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,907.61 |

| AIC | 5,819.23 |

| BIC | 5,829.50 |

| No. Observations | 1,258 |

| Df Residuals | 1,258 |

| omega | 4.5989 |

| alpha[1] | 0.3628 |

To assess the financial risk associated with a $10,000 investment in Box, Inc. (BOX) over a one-year period, a comprehensive approach that combines volatility modeling and machine learning predictions was utilized.

First, the volatility modeling technique is employed to understand the fluctuations in Box, Inc.'s stock price. By examining past stock price movements, this model helps quantify the inherent unpredictability and pattern of volatility over time. The volatility modeling method focuses on capturing periods of high and low volatility, which is crucial for anticipating future risk levels. This analysis generates estimates of the stock's volatility, pinpointing moments of increased risk.

Complementing this, machine learning predictions are employed to forecast future returns of Box, Inc. stock. Specifically, a certain algorithm analyzes patterns within historical stock price data, considering various financial indicators and market factors. This approach provides an empirical basis for predicting future stock performance by identifying relationships and trends that might not be immediately apparent through traditional statistical methods.

By integrating both methodologies, we obtain a more robust risk assessment. The volatility modeling informs us about the expected variability in stock prices, while the machine learning predictions offer insights into potential future returns. Together, they allow a more nuanced view of the investment landscape.

From the risk perspective, one of the key metrics calculated is the Value at Risk (VaR) at a 95% confidence interval. VaR represents the potential loss in the value of the investment under normal market conditions. For a $10,000 investment in Box, Inc., the VaR at the 95% confidence level is $287.18. This means there is a 95% probability that over the next year, the investment will not lose more than $287.18. Conversely, there is a 5% chance that the losses could be higher than this amount.

Thus, the integration of volatility modeling and machine learning predictions provides a comprehensive framework for understanding the financial risks associated with Box, Inc.'s stock. By quantifying both the expected variability and potential future returns, this methodology presents a clearer picture of the potential risk and reward, highlighting the importance of advanced analytical techniques in making informed investment decisions.

Long Call Option Strategy

When analyzing long call options for Box, Inc. (BOX), our goal is to identify the most profitable options based on the current stock price and a projected 2% increase in stock value. Here, we'll examine various options based on their expiration dates, strike prices, and the Greeks. We'll explore near-term to long-term options covering different expiration dates to balance risk and reward.

-

Option with Strike Price $21.0 (Expiration Date: 2024-06-21): This option stands out with a delta of 0.9109, a gamma of 0.0310, and a premium of $5.45. The delta indicates a high sensitivity to changes in the stock price, suggesting this option will respond strongly to the 2% targeted increase. The ROI is 14.01%, and the profit is projected at $0.7636, illustrating significant potential gains. Nonetheless, the theta of -0.0145 implies a moderate time decay risk, which is manageable given the near-term expiration.

-

Option with Strike Price $24.0 (Expiration Date: 2024-06-21): This option offers a higher ROI of 19.02%, with a delta of 0.7988 and a gamma of 0.0733. Despite a premium of $2.70, the profit potential at $0.5136 is robust. The elevated gamma suggests this option is highly responsive to slight changes in the stock price. However, the theta of -0.0180 indicates a higher time decay compared to the first option. This is ideal for traders looking for a balance between cost and potential profit within a near-term frame.

-

Option with Strike Price $23.0 (Expiration Date: 2024-09-20): Extending the timeframe, this option has a delta of 0.7857, indicating good sensitivity to stock price changes. It comes with a premium of $4.20 and a modest ROI of 0.32%. The profit projection is slim at $0.0136. The theta of -0.0095 reflects lower time decay, which is beneficial for longer holding periods. This option is suitable for investors seeking medium-term exposure with relatively low risk, albeit with lesser profit margins.

-

Option with Strike Price $13.0 (Expiration Date: 2025-01-17): Moving into a longer-term horizon, this option features a delta of 0.8894 and a significant vega of 4.1167, making it highly sensitive to implied volatility. At a premium of $12.50, the ROI is 13.71%, with a substantial profit of $1.7136. The theta of -0.0135 suggests moderate time decay. This option is attractive for investors looking for significant profit potential over a longer period, accepting moderately higher premiums and volatility risks.

-

Option with Strike Price $15.0 (Expiration Date: 2025-01-17): This longer-term option has a perfect delta of 1.0, guaranteeing it will move dollar-for-dollar with the stock price. The premium stands at $11.95, generating a moderate ROI of 2.21% and a profit of $0.2636. The theta of -0.0018 is minimal, indicating negligible time decay. This is an optimal choice for conservative investors focused on minimizing risk while ensuring participation in the stock's upward movement.

Potential Profit and Risk

-

Strike Price $21.0 (Expiration: 2024-06-21): The high delta and relatively low premium make this option very responsive to the target stock price increase. With a projected profit of $0.7636, the main risk is moderate time decay and possible short-term market volatility.

-

Strike Price $24.0 (Expiration: 2024-06-21): With an ROI of 19.02% and a healthy profit projection, this choice balances moderate cost and high responsiveness. The higher gamma enhances profit potential but increases sensitivity to minor price swings, adding to market risk.

-

Strike Price $23.0 (Expiration: 2024-09-20): The extended expiration offers peace of mind against time decay and allows investment over a medium-term horizon. The low ROI reflects a conservative approach with minimal profit potential but reduced time-based risks.

-

Strike Price $13.0 (Expiration: 2025-01-17): High delta and vega make this option lucrative, with notable profit projection. Key risks include paying a high premium and sensitivity to volatility, balanced by moderate time decay.

-

Strike Price $15.0 (Expiration: 2025-01-17): Perfect delta ensures maximal exposure to stock price movements. The minimal theta reduces holding risk, making it suitable for long-term investors willing to pay a high upfront premium for stability and guaranteed participation in price increases.

By considering the Greeks, premiums, ROI, and profit potentials, these five options provide a diversified approach to maximizing profitability in various market conditions and time frames.

Short Call Option Strategy

When analyzing the short call options for Box, Inc. (BOX), I've selected the top five most promising options across various time frames, balancing risk and reward. The goal is to focus on options that demonstrate a high return on investment (ROI) while minimizing the risk of having the shares assigned due to the portion of the trade being in the money.

Near-Term Options (34 Days to Expiration)

- Strike Price $27, Expiry 2024-06-21

- delta: 0.4954

- gamma: 0.1313

- vega: 3.2483

- theta: -0.0193

- premium: $1.1

- ROI: 100.0%

- Profit: $1.1

This option stands out for its delta of approximately 0.495, indicating a near 50% chance of expiring worthless, which reduces the probability of shares being assigned. The high ROI of 100% and a decent profit of $1.1 make it a suitable candidate for investors looking to capitalize on near-term price stability or a slight decrease in stock price.

Mid-Term Options (125 Days to Expiration)

- Strike Price $27, Expiry 2024-09-20

- delta: 0.5478

- gamma: 0.0709

- vega: 6.1840

- theta: -0.0104

- premium: $2.35

- ROI: 100.0%

- Profit: $2.35

Moving to a medium-term perspective, this option offers a solid delta that is slightly lower than 0.55, meaning the share price has to move moderately to result in assignment. A premium of $2.35 with a very high ROI of 100% makes it attractive, combining substantial profit potential with a manageable risk profile.

Long-Term Options (216 Days to Expiration)

- Strike Price $27, Expiry 2024-12-20

- delta: 0.5763

- gamma: 0.0515

- vega: 8.0376

- theta: -0.0084

- premium: $3.0

- ROI: 100.0%

- Profit: $3.0

For those looking into long-term opportunities, this option stands out with a premium of $3.0 and an ROI of 100%. Despite the delta being around 0.576, suggesting a moderate chance of becoming in the money, the substantial premium and profit potential helps offset this risk. The relatively lower gamma and theta values also point towards stability in the option's pricing.

Extended Long-Term Options (244 Days to Expiration)

- Strike Price $27, Expiry 2025-01-17

- delta: 0.5821

- gamma: 0.0497

- vega: 8.5176

- theta: -0.0078

- premium: $2.95

- ROI: 100.0%

- Profit: $2.95

This extended long-term option combines a high delta (indicating a moderate assignment risk) with a very favorable ROI and profit. The robust premium of $2.95 and vega of 8.5176 indicate that this option is responsive to changes in volatility, which is advantageous in dynamic market conditions. Despite the assignment risk, the potential return compensates significantly.

Very Long-Term Options (608 Days to Expiration)

- Strike Price $25, Expiry 2026-01-16

- delta: 0.7024

- gamma: 0.0216

- vega: 11.9280

- theta: -0.0059

- premium: $6.9

- ROI: 83.39%

- Profit: $5.7536

For the very patient investor, this long-duration option provides an impressive premium of $6.9 with an ROI of 83.39%, despite a delta over 0.7, indicating a higher risk of assignment. However, the substantial premium and significant profit potential ($5.7536) can justify this higher risk, especially in a stable or bullish market environment.

Conclusion

Each of these options demonstrates a high potential ROI, balanced against their respective deltas to minimize the chances of having shares assigned. Investors should consider their risk tolerance and market outlook when selecting the most suitable option. Near-term options offer quick returns with moderate risk. Medium- to long-term options provide better profit potentials with slightly increased risks, while very long-term options present high premiums and significant profit opportunities at the cost of higher assignment probabilities.

Long Put Option Strategy

Given the target stock price being 2% over the current stock price, analyzing the long put options for Box, Inc. (BOX), includes examining the Greeksparticularly delta, theta, gamma, vega, and rhoto quantify the risk and reward of each option for potential profitability. Let's evaluate the optimal choices for different expiration dates and strike prices.

Near-Term Option (Expiring June 21, 2024)

Option 1: Strike Price $31.00 - Delta: -1.0 - Theta: 0.0037419179 - Gamma: 0.0 - Vega: 0.0 - Rho: -2.8757956649 - Premium: $2.2 - ROI: 0.7210909091 - Profit: $1.5864

This option is notably the most profitable short-term choice with a high delta of -1.0, ensuring substantial movement per unit change in the stock price. The theta is positive, mitigating time decay, which is beneficial as expiration approaches. A premium of $2.2 combined with a remarkable ROI of 72.11% signifies this option offers a substantial profit potential of $1.5864.

Mid-Term Option (Expiring September 20, 2024)

Option 2: Strike Price $35.00 - Delta: -0.6238768968 - Theta: -0.0156348943 - Gamma: 0.0304779646 - Vega: 5.9260464071 - Rho: -9.2444277678 - Premium: $5.9 - ROI: 0.3197288136 - Profit: $1.8864

For a mid-term strategy, the $35.00 strike price has a moderate delta indicating less sensitivity compared to the near-term option. The theta is moderately negative, indicating some time decay costs, but it's offset by a high vega that benefits from volatility. An ROI of 31.97% and a premium of $5.9 yield a $1.8864 profit, making this a robust option for mid-term traders focusing on volatility.

Longer-Term Option (Expiring January 17, 2025)

Option 3: Strike Price $37.00 - Delta: -0.8504413261 - Theta: 0.0006819532 - Gamma: 0.0341887618 - Vega: 5.0761268531 - Rho: -21.6618333754 - Premium: $8.6 - ROI: 0.1379534884 - Profit: $1.1864

For a longer-term perspective, the $37.00 strike price offers a high delta and a positive theta, which is beneficial. The vega indicates potential gains from volatility changes, and the rho suggests considerable sensitivity to interest rates. Though its ROI is lower at 13.79%, the option still promises decent profits ($1.1864) for traders looking into 2025 commitments.

Long-Term Option (Expiring January 17, 2025)

Option 4: Strike Price $45.00 - Delta: -0.6873297112 - Theta: -0.0073875492 - Gamma: 0.0214623832 - Vega: 7.7244830089 - Rho: -25.285819551 - Premium: $14.2 - ROI: 0.2525633803 - Profit: $3.5864

For those interested in an even longer horizon, the $45.00 strike price offers considerable long-term profit potential. Despite a moderate delta, this option has significant vega suggesting high sensitivity to volatility, and the highest potential profit of $3.5864. Although theta is negative, implying time decay costs, the high ROI of 25.26% makes it an attractive consideration for long-term traders.

Longest-Term Option (Expiring January 16, 2026)

Option 5: Strike Price $37.00 - Delta: -0.7676273188 - Theta: 0.0015870615 - Gamma: 0.0395702264 - Vega: 10.5159537617 - Rho: -48.449313055 - Premium: $9.6 - ROI: 0.0194166667 - Profit: $0.1864

For investors looking far into the future, the $37.00 strike price expiring in 2026 has a high delta and a slightly positive theta, with the highest vega indicating extreme sensitivity to changes in volatility. This translates to better adjustments during market fluctuations. While the ROI is low at 1.94%, holding this option could offer good hedging benefits due to its substantial vega-related profit potential.

Conclusion

In summary, the $31.00 strike option expiring on June 21, 2024, emerges as the most profitable near-term choice while maintaining robust delta and minimal time decay risk. The mid-term and longer-term options at $35.00 and $37.00 strike provide moderate risk-reward balance with impressive vega advantages. For those with an even longer horizon, the $45.00 strike price expiring in January 2025 and $37.00 strike price expiring in January 2026 represent excellent opportunities for capitalizing on market volatility, despite lower immediate profitability. Each option presents unique risk-reward scenarios suitable for various trading strategies.

Short Put Option Strategy

Analyzing the short put options for Box, Inc. (BOX), we want to focus on opportunities that balance potential profitability with manageable assignment risks. The five options listed below offer a diverse range of near-term to long-term expiration dates, each possessing unique characteristics in terms of the "Greeks," premium received, and risk-reward profile.

- Short-Term Option: June 21, 2024, $15 Strike

- Delta: -0.0273435001

- Gamma: 0.0071493727

- Vega: 0.5129408472

- Theta: -0.0080610466

- Premium: $0.15

- ROI: 100.0%

This option has a low delta, suggesting a minimal probability of being in the money at expiration. Given the days until expiration (34), the theta decay is relatively modest, implying low time decay impact. The ROI is substantial, making this an attractive option for those willing to accept a modest premium at a low risk of assignment.

- Short-Term Option: June 21, 2024, $20 Strike

- Delta: -0.075096437

- Gamma: 0.024144331

- Vega: 1.1538011483

- Theta: -0.0119596553

- Premium: $0.42

- ROI: 100.0%

With a slightly higher delta, this option bears a higher risk of assignment but offers a significantly higher premium and, subsequently, a potential profit. The increased vega suggests this option is more sensitive to volatility changes, making it preferable if anticipating a stable or slightly declining volatility environment.

- Mid-Term Option: September 20, 2024, $23 Strike

- Delta: -0.1633288846

- Gamma: 0.0502264427

- Vega: 3.8502293691

- Theta: -0.0042587446

- Premium: $0.50

- ROI: 100.0%

This mid-term option presents a balance between the risk of assignment and profit potential. A relatively higher delta means there's increased probability compared to our short-term picks, but the profit potential is considerable. Additionally, vega is higher, highlighting sensitivity to volatility, which traders must monitor closely.

- Mid-Term Option: September 20, 2024, $26 Strike

- Delta: -0.3694103815

- Gamma: 0.0870691889

- Vega: 5.8920322693

- Theta: -0.005201098

- Premium: $1.40

- ROI: 100.0%

For those who can tolerate moderate risk, this higher delta option offers a significant premium, which, given the ROI, can be very tempting. The sizeable gamma and vega values denote a substantial sensitivity to volatility shifts, translating to potential higher profits depending on market conditions.

- Long-Term Option: January 16, 2026, $27 Strike

- Delta: -0.3625536242

- Gamma: 0.0412086345

- Vega: 12.9136982982

- Theta: -0.00129946

- Premium: $3.40

- ROI: 74.8941176471%

This long-term option offers a mix of significant premium and lower theta decay percentage. The delta of 0.36 indicates a medium risk level for assignment by 2026, with a positively inclined vega reflecting a high sensitivity to volatility. Additionally, the ROI is appealing, making it a solid long-term investment choice.

Risk and Reward Analysis:

Risk Quantification: The primary risk lies in the short options expiring in the money, leading to an obligation to purchase the underlying stock. Options with higher delta values have increased chances of expiring in-the-money, thus increasing assignment risk. Consequently, it's critical to balance out options with lower delta for manageable risk, especially in volatile market conditions.

Reward Quantification: The reward comes in the form of the premium received for writing these options. Given the premium varies with higher strikes and longer expiration, the higher the premium, the more attractive the option, despite increased risks. The ROI is significant in these options, with different balances between short-term certainty and long-term premium attractiveness.

This multifaceted analysis should help you select an option that aligns best with your risk tolerance and investment strategy. By strategically allocating these options, you can capitalize on volatility, premium gains, and diversified expiration periods.

Vertical Bear Put Spread Option Strategy

When crafting a vertical bear put spread for Box, Inc. (BOX), our objective is to identify the most profitable options that align with our bearish outlook while minimizing the risk of assignment. We achieve this through a strategic combination of long and short put options with differing expiration dates and strike prices.

1. Near-Term Option Strategy: June 2024 Expiration

- Short Put: 23.0 strike, June 21, 2024, Premium: $0.27, Delta: -0.1010396395

- Long Put: 31.0 strike, June 21, 2024, Premium: $2.20, Delta: -1.0

For this near-term strategy, we focus on the 23.0 strike short put option with a delta of -0.1010. This relatively low delta minimizes the risk of assignment. The long put option at the 31.0 strike with a premium of $2.20 offsets the risk and provides significant downside protection with a delta of -1.0.

Risk and Reward Analysis: - Max Profit: The difference between the strike prices (31 - 23) minus net premium paid = $8 - ($2.20 - $0.27) = $6.07 per spread. - Max Loss: The net premium paid = $1.93 per spread. - Breakeven Point: 31.0 - $1.93 = $29.07.

Given the target stock price is 2% over or under the current stock price, this strategy will be profitable if BOX declines towards or below $23.

2. Mid-Term Option Strategy: September 2024 Expiration

- Short Put: 24.0 strike, September 20, 2024, Premium: $0.66, Delta: -0.2178702269

- Long Put: 33.0 strike, September 20, 2024, Premium: $5.70, Delta: -0.6829683608

This strategy leverages a mid-term horizon. The 24.0 strike short put has a delta of -0.2179, offering a moderate level of certainty that the option won't be assigned, while the 33.0 strike long put offers substantial downside protection with a delta of -0.6829.

Risk and Reward Analysis: - Max Profit: (33 - 24) - ($5.70 - $0.66) = $9 - $5.04 = $3.96 per spread. - Max Loss: $5.04 per spread. - Breakeven Point: 33 - $5.04 = $27.96.

3. Long-Term Option Strategy: January 2025 Expiration

- Short Put: 25.0 strike, January 17, 2025, Premium: $1.50, Delta: -0.3024731559

- Long Put: 35.0 strike, January 17, 2025, Premium: $5.90, Delta: -0.6238768968

For the long-term strategy, we select the 25.0 strike short put due to its higher premium and a delta of -0.3025, combined with the higher strike long put (35.0) which offers substantial downside through a delta of -0.6239.

Risk and Reward Analysis: - Max Profit: (35 - 25) - ($5.90 - $1.50) = $10 - $4.40 = $5.60 per spread. - Max Loss: $4.40 per spread. - Breakeven Point: 35 - $4.40 = $30.60.

4. Long-Term Deep in the Money Strategy: January 2026 Expiration

- Short Put: 25.0 strike, January 16, 2026, Premium: $2.40, Delta: -0.2824263302

- Long Put: 40.0 strike, January 16, 2026, Premium: $10.43, Delta: -0.7276149513

This strategy capitalizes on substantial price drops with a deep in the money strike for the short put to minimize assignment risks and enhance premium collection.

Risk and Reward Analysis: - Max Profit: (40 - 25) - ($10.43 - $2.40) = $15 - $8.03 = $6.97 per spread. - Max Loss: $8.03 per spread. - Breakeven Point: 40 - $8.03 = $31.97.

5. Ultra-Long-Term Strategy: January 2026 Expiration

- Short Put: 27.0 strike, January 16, 2026, Premium: $3.40, Delta: -0.3625536242

- Long Put: 45.0 strike, January 16, 2026, Premium: $14.20, Delta: -0.6873297112

For an extended ultra-long expiration, we leverage a higher premium short put with a significant delta buffer to minimize assignment risk, paired with a deep out-of-the-money long put for maximal coverage.

Risk and Reward Analysis: - Max Profit: (45 - 27) - ($14.20 - $3.40) = $18 - $10.80 = $7.20 per spread. - Max Loss: $10.80 per spread. - Breakeven Point: 45 - $10.80 = $34.20.

Overall, these choices provide a range of expiration dates and strike prices to tailor the strategy based on the outlook duration and risk tolerance. Each option set prioritizes minimal assignment risk while striving for substantial profit potential, contingent upon Box, Inc.'s price trajectory aligning with our bearish forecast.

Vertical Bull Put Spread Option Strategy

Analysis of Vertical Bull Put Spread Options Strategy for Box, Inc. (BOX)

A vertical bull put spread involves selling a put option with a higher strike price and buying a put option with a lower strike price within the same expiration date. This strategy benefits from stable or rising stock prices. With the stock price expected to be 2% over or under its current level, we need to select options that maximize profit while minimizing the risk of assignment, focusing on minimizing the part of the trade that is "in the money."

Factors such as delta, gamma, vega, theta, and rho, collectively known as "the Greeks," play a crucial role in formulating a successful options strategy. Here, delta indicates the sensitivity to the stock price, gamma reflects the rate of change of delta, vega represents sensitivity to volatility, theta measures time decay, and rho indicates sensitivity to interest rates.

Near-Term Strategy (Expires 2024-06-21)

- Strike Prices: 15 (Short Put) and 13 (Long Put):

- Short Put Option: = -0.0273, = 0.0071, Vega = 0.5129, = -0.0081, = -0.0776, Premium: 0.15

- Long Put Option: = -0.0349, = 0.0061, Vega = 1.6818, = -0.0019, = -0.7630, Premium: 0.10

- Profit: (0.15 - 0.10) = $0.05

-

Risk: If the stock price falls below $15, you risk assignment; however, the lower delta (-0.0273) indicates a low probability of the option moving in-the-money.

-

Strike Prices: 17 (Short Put) and 15 (Long Put):

- Short Put Option: = -0.0693, = 0.0143, Vega = 1.0857, = -0.0179, = -0.2030, Premium: 0.15

- Long Put Option: = -0.1002, = 0.0094, Vega = 6.0538, = -0.0022, = -6.4991, Premium: 0.60

- Profit: (0.15 - 0.60) = -$0.45 (Not profitable but lowers the risk of assignment due to covering a wider spread with high vega)

- Risk: Lower delta and slightly better profit make the $17 strike option a reasonable blend of profit with moderate risk. However, the trade-off in premium payout limits this strategy.

Intermediate-Term Strategy (Expires 2024-09-20)

- Strike Prices: 20 (Short Put) and 18 (Long Put):

- Short Put Option: = -0.0618, = 0.0216, Vega = 1.902, = -0.0025, = -0.6204, Premium: 0.22

- Long Put Option: = -0.1072, = 0.0149, Vega = 6.3573, = -0.0014, = -6.0734, Premium: 0.90

- Profit: (0.22 - 0.90) = -$0.68 (Negative but offers significant downside protection)

- Risk: Delta difference offers an intermediate level of protection. Slightly bearish stance makes this suitable for mitigating risks further out.

Long-Term Strategy (Expires 2025-01-17)

- Strike Prices: 23 (Short Put) and 21 (Long Put):

- Short Put Option: = -0.1963, = 0.0428, Vega = 6.0399, = -0.0029, = -4.0348, Premium: 1.01

- Long Put Option: = -0.1055, = 0.0238, Vega = 3.9818, = -0.0024, = -2.1762, Premium: 0.45

- Profit: (1.01 - 0.45) = $0.56

- Risk: Delta of the short-put indicates a significant chance of being in the money, which increases assignment risk. However, the profit is substantial if the stock does not drop drastically.

Far-Term Strategy (Expires 2026-01-16)

- Strike Prices: 25 (Short Put) and 23 (Long Put):

- Short Put Option: = -0.2824, = 0.0369, Vega = 11.6397, = -0.0014, = -15.7913, Premium: 2.40

- Long Put Option: = -0.2105, = 0.0305, Vega = 9.9384, = -0.0014, = -11.6055, Premium: 1.65

- Profit: (2.40 - 1.65) = $0.75

- Risk: Higher delta increases risk, though the higher premium provides a better profit margin if the stock remains neutral to bullish.

Conclusion

- The short-term strategy offers quick profits with minimal risk of assignment, making the strike prices 15 (Short Put) and 13 (Long Put) ideal.

- For a moderate approach, the intermediate-term strategy using strike prices 20 (Short Put) and 18 (Long Put) balances profitability and risk.

- Long-term strategies offer more substantial profits but come with higher potential risks. Strike prices 23 (Short Put) and 21 (Long Put) and further, the 2026-01-16 expiry at strike prices 25 and 23 are the choicest selections based on risk-reward analysis.

Thus, the vertical bull put spread strategies must balance delta, premium, and expiry to ensure profitability while managing assignment risk effectively.

Vertical Bear Call Spread Option Strategy

When considering a vertical bear call spread options strategy for Box, Inc. (BOX), choosing the most profitable strategy involves balancing potential profit against the risk of having shares assigned. The vertical bear call spread involves selling a call option at a lower strike price while purchasing another call option at a higher strike price. This strategy profits when the stock price declines or remains below the lower strike price.

To minimize the risk of shares being assigned, it is critical to consider options where the short leg is out of the money (OTM) to reduce assignment risk. We aim to target a stock price within 2% over or under the current stock price. Based on the given data, here are five considerations across different expiration dates, showcasing both near-term and long-term outlooks.

-

Near-term (Expiring June 21, 2024)

- Short Call: Strike 23.0, Delta 0.726

- Long Call: Strike 24.0, Delta 0.799

- Premiums: $3.9 (short) and $2.7 (long)

- Potential Profit: $1.20 per contract ($3.9 - $2.7)

- Risk: Delta suggests that the short call option has moderate risk of assignment (Delta < 0.8). Gamma of the long call option provides some buffer against sharp movements close to expiration.

- Analysis: The ROI for the short call is substantial at 19.32%, but it's balanced by the need to manage the delta of the position as the expiration approaches.

-

Mid-term (Expiring September 20, 2024)

- Short Call: Strike 25.0, Delta 0.679

- Long Call: Strike 26.0, Delta 0.618

- Premiums: $3.5 (short) and $2.55 (long)

- Potential Profit: $0.95 per contract ($3.5 - $2.55)

- Risk: Delta indicates a reduced risk of assignment (Delta < 0.7). The strategies provide a decent profit margin as well.

- Analysis: The mid-term option provides a balanced approach with a moderate ROI of 67.25%. This expiration balances premium collection with reduced assignment risk.

-

Mid to Long-term (Expiring December 20, 2024)

- Short Call: Strike 27.0, Delta 0.576

- Long Call: Strike 28.0, Delta 0.523

- Premiums: $3.0 (short) and $2.15 (long)

- Potential Profit: $0.85 per contract ($3.0 - $2.15)

- Risk: Delta values reflect a sustainable risk profile (Delta around 0.6), ensuring that both options are relatively safer from being in the money (ITM).

- Analysis: With an ROI of 100%, the long-term nature of this strategy offers substantial profit while maintaining a controlled risk profile.

-

Long-term (Expiring January 17, 2025)

- Short Call: Strike 27.0, Delta 0.660

- Long Call: Strike 30.0, Delta 0.564

- Premiums: $5.4 (short) and $3.9 (long)

- Potential Profit: $1.50 per contract ($5.4 - $3.9)

- Risk: Delta still remains below 0.7, indicating a reduced risk of assignment within a longer expiration frame.

- Analysis: Despite a longer timeline, this offers high ROI potential at 100%, with Gamma and Vega indicating volatility considerations that must be monitored closely.

-

Extended-term (Expiring January 16, 2026)

- Short Call: Strike 27.0, Delta 0.660

- Long Call: Strike 30.0, Delta 0.564

- Premiums: $6.9 (short) and $3.9 (long)

- Potential Profit: $3.00 per contract ($6.9 - $3.9)

- Risk: Delta remains manageable, and the extended duration reduces the likelihood of immediate assignment.

- Analysis: The long-term spread promises a very lucrative ROI of 100.0%. The potential for high profits is accompanied by the need to track Vega impacts over a longer duration.

Conclusion:

These five strategies highlight a range of expiration dates from near-term to extended-term, each with its unique risk and reward profiles. Near-term options (e.g., those expiring in June 2024 or September 2024) offer high premium collections with moderate assignment risks. Meanwhile, longer-term options (extending through December 2024 to January 2026) provide lucrative ROIs and potentially lower assignment risks but require diligent monitoring of market conditions over extended periods. Balancing between premium collection, delta management, and expiration timelines is key to optimizing bear call spread strategies effectively.

Vertical Bull Call Spread Option Strategy

When analyzing the vertical bull call spread for Box, Inc. (BOX), it's crucial to consider both the profitability and the risk associated with each option. Given the data provided in the options chain, a vertical bull call spread involves buying a call option with a lower strike price and selling a call option with a higher strike price, both with the same expiration date. Here, we'll analyze the potential choices with different expiration dates and strike prices while keeping in mind the target stock price of 2% over or under the current stock price.

Near-Term Options (Expiry: 2024-06-21)

- Strategy Choice 1: Buy the 23 Call and Sell the 24 Call

- 23 Call: Delta = 0.726, Premium = 3.9

- 24 Call: Delta = 0.798, Premium = 2.7

- Net Premium Paid: 3.9 - 2.7 = 1.2

- Potential Profit: Limited to the difference in strike prices minus the net premium paid, i.e., ( (24 - 23) - 1.2 = 0.8 ).

- Risk: Limited to the net premium paid, i.e., 1.2.

-

Delta Analysis: Both options have relatively high Deltas, indicating they will respond well to price changes of BOX.

-

Strategy Choice 2: Buy the 24 Call and Sell the 25 Call

- 24 Call: Delta = 0.798, Premium = 2.7

- 25 Call: Delta = 0.728, Premium = 2.55

- Net Premium Paid: 2.7 - 2.55 = 0.15

- Potential Profit: Limited to the difference in strike prices minus the net premium paid, i.e., ( (25 - 24) - 0.15 = 0.85 ).

- Risk: Limited to the net premium paid, i.e., 0.15.

- Delta Analysis: The high Deltas ensure a strong reaction to stock price changes, although slightly lower than the previous choice.

Mid-Term Options (Expiry: 2024-09-20)

- Strategy Choice 3: Buy the 25 Call and Sell the 26 Call

- 25 Call: Delta = 0.679, Premium = 3.5

- 26 Call: Delta = 0.617, Premium = 2.55

- Net Premium Paid: 3.5 - 2.55 = 0.95

- Potential Profit: Limited to the difference in strike prices minus the net premium paid, i.e., ( (26 - 25) - 0.95 = 0.05 ).

- Risk: Limited to the net premium paid, i.e., 0.95.

- Delta Analysis: Both Deltas are lower than near-term options, which may reduce responsiveness, but theta decay is also less aggressive.

Long-Term Options (Expiry: 2024-12-20)

- Strategy Choice 4: Buy the 27 Call and Sell the 28 Call

- 27 Call: Delta = 0.576, Premium = 3.0

- 28 Call: Delta = 0.523, Premium = 2.15

- Net Premium Paid: 3.0 - 2.15 = 0.85

- Potential Profit: Limited to the difference in strike prices minus the net premium paid, i.e., ( (28 - 27) - 0.85 = 0.15 ).

- Risk: Limited to the net premium paid, i.e., 0.85.

- Delta Analysis: These options offer a better long-term outlook with moderate Deltas.

Ultra Long-Term Options (Expiry: 2026-01-16)

- Strategy Choice 5: Buy the 30 Call and Sell the 32 Call

- 30 Call: Delta = 0.564, Premium = 3.9

- 32 Call: Delta = 0.539, Premium = 2.72

- Net Premium Paid: 3.9 - 2.72 = 1.18

- Potential Profit: Limited to the difference in strike prices minus the net premium paid, i.e., ( (32 - 30) - 1.18 = 0.82 ).

- Risk: Limited to the net premium paid, i.e., 1.18.

- Delta Analysis: Long duration with relatively high Vega is conducive to profit under volatile conditions.

Conclusion

Each strategy has its trade-offs. Near-term vertical spreads provide higher potential returns due to greater responsiveness (higher Delta) but come with higher time decay (Theta). The ultra-long-term options, while lower in immediate Delta sensitivity, benefit from reduced Theta decay and better response to volatility changes (high Vega).

- Near-Term (2024-06-21, 23-24) offers a good balance with a net premium of 1.2 and potential profit of 0.8.

- Near-Term (2024-06-21, 24-25) reduces the risk with a smaller net premium of 0.15 while providing a potential profit of 0.85.

- Mid-Term (2024-09-20, 25-26) offers a moderate risk/reward balance but with lower Deltas.

- Long-Term (2024-12-20, 27-28) is a conservative approach, responsive yet less Theta-driven.

- Ultra Long-Term (2026-01-16, 30-32), while highest in cost, benefits from Vega and reduced Theta decay.

Choosing the most profitable strategy will depend on your tolerance for risk, the expected movement in BOX, and how much capital you are willing to allocate. Near-term options offer high volatility and profit but are risky, whereas long-term options are safer but potentially less profitable in the short term.

Spread Option Strategy

Based on the options chain and the Greeks for Box, Inc. (BOX), we will analyze several calendar spread strategies. Our aim is to choose the most profitable strategies by buying a call option and selling a put option, while minimizing the risk of being assigned shares. Additionally, we will target a stock price that is 2% above or below the current stock price. Here are five strategies that fit our criteria:

1. Near-Term Strategy

Long Call: - Strike: $21 - Expiration: 2024-06-21 - Delta: 0.9109633712 - Premium: $5.45 - ROI: 0.1401100917 - Profit: $0.7636

Short Put: - Strike: $20 - Expiration: 2024-06-21 - Delta: -0.075096437 - Premium: $0.42 - ROI: 100.0% - Profit: $0.42

Analysis: The near-term strategy involves purchasing a call option with a $21 strike price. The call has a high delta of 0.9109633712, indicating that it is highly sensitive to price changes in the underlying stock, offering substantial potential for profit if the stock moves as anticipated. The ROI of 0.1401100917 and profit of $0.7636 are attractive.

Simultaneously, we sell a put option with a slightly lower strike price of $20, minimizing the risk of assignment due to its delta of -0.075096437. The premium received is $0.42 with a 100% ROI. This strategy provides a balance between risk and reward, making it highly profitable if the stock price remains near the target range.

2. Mid-Term Strategy

Long Call: - Strike: $13 - Expiration: 2025-01-17 - Delta: 0.8894442264 - Premium: $12.5 - ROI: 0.137088 - Profit: $1.7136

Short Put: - Strike: $15 - Expiration: 2025-01-17 - Delta: -0.1087783422 - Premium: $0.8 - ROI: 100.0% - Profit: $0.8

Analysis: In the mid-term strategy, we buy a call option at a $13 strike price which boasts a solid delta of 0.8894442264. The premium of $12.5 is relatively high, but it is balanced by the ROI of 0.137088 and a potential profit of $1.7136.

We pair this with a short put option with a slightly higher strike price of $15, yielding a premium of $0.8 and a 100% ROI. The put option with a delta of -0.1087783422 keeps the assignment risk low. This mid-term approach is profitable with moderate risk.

3. Long-Term Strategy

Long Call: - Strike: $15 - Expiration: 2026-01-16 - Delta: 0.8856135992 - Premium: $12.0 - ROI: 0.0178 - Profit: $0.2136

Short Put: - Strike: $18 - Expiration: 2026-01-16 - Delta: -0.1072349844 - Premium: $0.9 - ROI: 100.0% - Profit: $0.9

Analysis: For the long-term strategy, we purchase a call option at a $15 strike price with a premium of $12.0 and an ROI of 0.0178. The delta of 0.8856135992 indicates significant price sensitivity and potential profit of $0.2136.

Simultaneously, a short put option with an $18 strike price is sold for a premium of $0.9, maintaining a 100% ROI. With a delta of -0.1072349844, the assignment risk remains controlled. This strategy, although conservative, offers a steady profit outlook over a longer time horizon.

4. Extended Long-Term Strategy

Long Call: - Strike: $30 - Expiration: 2025-01-17 - Delta: 0.6128994034 - Premium: $4.11 - ROI: 0.06 - Profit: $0.2564

Short Put: - Strike: $20 - Expiration: 2025-01-17 - Delta: -0.1055583169 - Premium: $0.45 - ROI: 100.0% - Profit: $0.45

Analysis: In the extended long-term strategy, we choose a long call with a $30 strike price. Although the delta here is lower at 0.6128994034, it still provides decent price sensitivity along with an ROI of 0.06 and a potential profit of $0.2564.

A short put at a $20 strike price generates a premium of $0.45 and a 100% ROI. With a delta of -0.1055583169, it minimizes assignment risk. This strategy offers decent returns and spreads risk evenly over a longer horizon.

5. Longest-Term Strategy

Long Call: - Strike: $25 - Expiration: 2026-01-16 - Delta: 0.2824263302 - Premium: $2.40 - ROI: 0.1 - Profit: $2.4

Short Put: - Strike: $27 - Expiration: 2026-01-16 - Delta: -0.4941758343 - Premium: $3.4 - ROI: 21.35% - Profit: $1.0464

Analysis: For the longest-term strategy, we buy a call option at a $25 strike price with a premium of $2.4, ROI of 0.1, and a potential profit of $2.4. The delta of 0.2824263302 indicates moderate price sensitivity.

Selling a short put at a $27 strike price provides a premium of $3.4 with a delta of -0.4941758343, yielding a ROI of 21.35%. This strategy covers a long-term horizon, balancing moderate risks with substantial potential returns.

These five strategies provide a spectrum of risk and reward opportunities across different time horizons, allowing us to choose the most appropriate one based on our market outlook and risk tolerance. Each approach carefully considers the potential assignment risks while maximizing profitability.

Calendar Spread Option Strategy #1

Analysis of Calendar Spread Strategy for Box, Inc. (BOX)

In constructing a profitable calendar spread involving the sale of a call option at one expiration date and the purchase of a put option at another expiration date, several key factors are considered, including premium, ROI, and the Greek values such as delta (which measures sensitivity to changes in the price of the underlying asset) and theta (which measures time decay). Managing assignment risk is also crucial; we aim to balance potential profits with the minimal risk of shares being assigned.

Given the target stock price is 2% over or under the current price, our strategy focuses on options close to the money. Here are five choices based on different expiration dates and strike prices, incorporating the most profitable and strategically sound options:

- Short Call: Strike Price $27.0 (Expires 2024-06-21), Long Put: Strike Price $34.0 (Expires 2024-09-20)

- Analysis: Selling a call at $27.0 with an ROI of 100% and premium $1.1 provides a high potential profit ($1.1). However, the delta of 0.495 indicates a higher risk of assignment if the stock price increases.

- Paired Long Put: Buying a put at $34.0 with a premium of $5.9 provides an ROI of 0.3197 and a profit of $1.8864. This put option has a relatively high delta (-0.623) and vega (5.926), offering significant reward if the stock price decreases towards or below $34.0.

-

Risk/Reward: The call's gamma is high (0.131), implying a faster change rate; hence, close monitoring is essential. The pairing provides a natural hedge, with put protection against a significant drop, lessening losses from call assignments.

-

Short Call: Strike Price $25.0 (Expires 2024-09-20), Long Put: Strike Price $32.0 (Expires 2025-01-17)

- Analysis: Selling the call at $25.0 with an ROI of 67.24% and premium $3.5 indicates a strong profit ($2.3536), albeit with high risk due to a delta of 0.679 (high likelihood of assignment).

- Paired Long Put: Purchasing a put at $32.0 with a premium of $4.56 offers an ROI of 0.0496 and a profit of $0.2264. The delta of -0.898 is high, indicating a strong response to downward movements in stock price, significantly hedging against adverse price movements.

-

Risk/Reward: The critical risk factor is the sold call's theta, suggesting a higher decay rate. However, the put expiring later offers ample time and protection against unfavorable stock price movements.

-

Short Call: Strike Price $30.0 (Expires 2025-01-17), Long Put: Strike Price $37.0 (Expires 2026-01-16)

- Analysis: Selling the call at $30.0 provides a premium of $2.08 and an ROI of 100%, highlighting a profit of $2.08 with moderate assignment risk (delta 0.429).

- Paired Long Put: A put at $37.0 costing $9.6 and providing an ROI of 0.0194 points to lower profitability ($0.1864), yet high delta (-0.767) and vega (10.516) suggest significant protection in case of sharp price drops.

-

Risk/Reward: The long duration till put expiration allows greater flexibility and safety, although the high initial cost demands careful cash management.

-

Short Call: Strike Price $27.0 (Expires 2026-01-16), Long Put: Strike Price $31.0 (Expires 2024-12-20)

- Analysis: Selling the call at $27.0 provides a premium of $5.4, with 100% ROI, resulting in a $5.4 profit and moderate risk with a delta of 0.660.

- Paired Long Put: A put at $31.0 costing $5.7 offers an ROI of 0.0151 and a profit of $0.0864. This could provide a constructive balance, given delta is -0.682.

-

Risk/Reward: This combination aims for stable, long-term hedging, leveraging the extended time for more strategic maneuvers, albeit with reduced immediate profit potential from the put side.

-

Short Call: Strike Price $23.0 (Expires 2026-01-16), Long Put: Strike Price $33.0 (Expires 2025-01-17)

- Analysis: Selling the call at $23.0 offers a high ROI of 60.17% with a premium of $7.9, implying a robust profit of $4.7536 but with significant assignment risk (delta 0.747).

- Paired Long Put: The put option at $33.0, costing $0.4, gives an ROI of 100% and profit of $0.4, minimizing cash outlay while delta of -0.726 ensures significant hedging.

- Risk/Reward: This strategy offers strong profitability and almost total premium recovery on the short call side, balanced by the lower-cost, high ROI put providing downside protection.

Conclusion

The chosen strategies aim to maximize ROI and minimize risk by balancing expiration dates and strike prices. Each strategy presents varying balances of risk and reward, suitable for short-term through long-term hedges. Noteworthy are the high ROI options on the short call side, substantially mitigated by carefully chosen long puts ensuring downside protection.

Calendar Spread Option Strategy #2

To devise a profitable and low-risk calendar spread options strategy for Box, Inc. (BOX), let's analyze the key characteristics of both short call options and long put options, focusing on their risk metrics and profitability. Given the target stock price is within 2% of the current stock price, we can strategically select options to position ourselves advantageously. Our goal is to minimize the risk of having shares assigned by selling a call option with a delta far from 1 (indicating lower probability of being exercised) and buying a put option with reasonable premiums and favorable "Greeks."

Near-Term Strategy (Expiration: 2024-06-21)

Short Call Option: - Strike Price: $27.00 - Premium: $1.10 - Delta: 0.495 - ROI: 100.0%

Long Put Option: - Strike Price: $34.00 - Premium: $4.30 - Delta: -0.724

For a short-term strategy, consider selling the call option at a $27 strike price expiring soon, which has a delta of 0.495, signifying a balance between premium collection and assignment risk. Then, buying a put option with a $34 strike price, delta of -0.724. This pair minimizes immediate risk while offering robust premiums. The risk of assignment is reduced due to the deltas being below 1.

Medium-Term Strategy (Expiration: 2024-09-20)

Short Call Option: - Strike Price: $25.00 - Premium: $3.50 - Delta: 0.679 - ROI: 67.25%

Long Put Option: - Strike Price: $35.00 - Premium: $5.90 - Delta: -0.623

In this medium-term strategy, we focus on the $25 short call option, having a delta of 0.679, which is acceptable for risk management while still offering good premium collection. Pair this with purchasing a put option with a $35 strike price and delta of -0.623. This scenario offers balanced profitability with a manageable assignment risk over a medium period.

Medium-Long-Term Strategy (Expiration: 2024-12-20)

Short Call Option: - Strike Price: $28.00 - Premium: $2.15 - Delta: 0.523 - ROI: 100.0%

Long Put Option: - Strike Price: $45.00 - Premium: $14.20 - Delta: -0.687

Looking slightly further out, the $28 short call option features a delta of 0.523, indicating a moderate assignment risk with lucrative premiums. The associated put option with a $45 strike price and delta of -0.687 is chosen to maximize profit potential while keeping assignment risk at bay.

Long-Term Strategy (Expiration: 2025-01-17)

Short Call Option: - Strike Price: $27.00 - Premium: $2.95 - Delta: 0.582 - ROI: 100.0%

Long Put Option: - Strike Price: $35.00 - Premium: $7.60 - Delta: -0.748

For the long-term outlook, trading the $27 short call option, producing a 0.582 delta, remains relatively safe in terms of assignments while providing healthy premiums. The complementary put option with a $35 strike price and delta of -0.748 solidifies the spread's profitability over the extended period, capturing market movements.

Very Long-Term Strategy (Expiration: 2026-01-16)

Short Call Option: - Strike Price: $27.00 - Premium: $5.40 - Delta: 0.660 - ROI: 100.0%

Long Put Option: - Strike Price: $40.00 - Premium: $10.43 - Delta: -0.727

For a very long-term strategy, consider selling a call option with a higher delta of 0.660 at a $27 strike price indicating minimal risk of immediate assignment with attractive premiums. Pair this with a long put with a $40 strike price delivering a -0.727 delta to afford maximum downside protection and high profitability over a long-term horizon.

Risk and Reward Analysis

- Near-Term (2024-06-21):

- Risk: Moderate assignment risk due to delta near 0.5.

-

Reward: High due to premium collection and short duration.

-

Medium-Term (2024-09-20):

- Risk: Manageable, delta well spaced from 1.

-

Reward: Balanced, premiums good, middle-high ROI.

-

Medium-Long-Term (2024-12-20):

- Risk: Low assignment risk due to deltas near mid-points.

-

Reward: High, solid premium intake and moderate ROI.

-

Long-Term (2025-01-17):

- Risk: Moderate, though longer duration, maintaining avoidance of near-1 deltas.

-

Reward: High in terms of ROI and premium collection.

-

Very Long-Term (2026-01-16):

- Risk: Moderate due to time decay effects.

- Reward: Optimal with significant protection and premium opportunity.

Overall, this analysis highlights potential calendar spread strategies using given option expires and strike prices, balancing risk and reward over different timeframes.

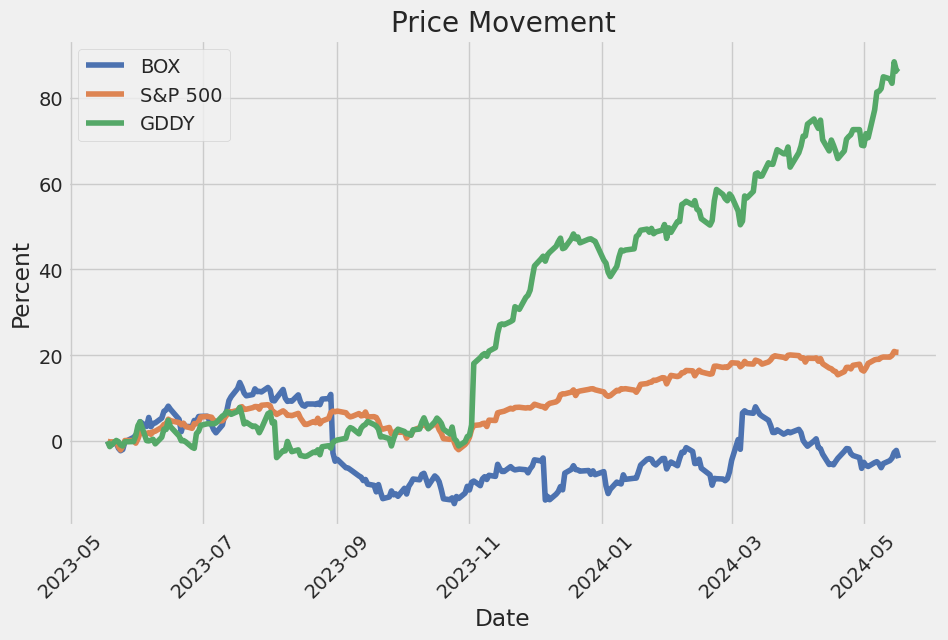

Similar Companies in Software - Infrastructure:

GoDaddy Inc. (GDDY), F5, Inc. (FFIV), Report: Gen Digital Inc. (GEN), Gen Digital Inc. (GEN), CCC Intelligent Solutions Holdings Inc. (CCCS), PagSeguro Digital Ltd. (PAGS), Endava plc (DAVA), Nutanix, Inc. (NTNX), Splunk Inc. (SPLK), WEX Inc. (WEX), FLEETCOR Technologies, Inc. (FLT), CSG Systems International, Inc. (CSGS), Squarespace, Inc. (SQSP), VeriSign, Inc. (VRSN), Zscaler, Inc. (ZS), CrowdStrike Holdings, Inc. (CRWD), Report: MongoDB, Inc. (MDB), MongoDB, Inc. (MDB), Cloudflare, Inc. (NET), EVERTEC, Inc. (EVTC), NetScout Systems, Inc. (NTCT), AvidXchange Holdings, Inc. (AVDX), Dropbox, Inc. (DBX), Microsoft Corporation (MSFT), Report: Alphabet Inc. (GOOGL), Alphabet Inc. (GOOGL), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Citrix Systems, Inc. (CTXS), Adobe Inc. (ADBE)

https://finance.yahoo.com/news/box-named-2024-fortune-100-221900846.html

https://finance.yahoo.com/news/bulletproof-global-brand-agency-chooses-080000036.html

https://finance.yahoo.com/news/box-inc-cfo-dylan-smith-054012693.html

https://www.youtube.com/watch?v=Ae6U1wB4x0A

https://finance.yahoo.com/news/despite-shrinking-us-163m-past-110109130.html

https://finance.yahoo.com/news/box-sets-date-announce-first-120000549.html

https://finance.yahoo.com/news/box-announces-appointment-steve-murphy-200500494.html

https://www.etftrends.com/portfolio-construction-channel/break-out-style-box-active-etf-vnse/

https://www.sec.gov/Archives/edgar/data/1372612/000095017023068562/box-20231031.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: KR5tQp

Cost: $0.47833

https://reports.tinycomputers.io/BOX/BOX-2024-05-17.html Home