Dominion Energy, Inc Common Stock (ticker: D)

2024-01-08

Dominion Energy, Inc., trading under the ticker symbol D on the New York Stock Exchange, is one of the United States' largest producers and transporters of energy. The company boasts a diversified portfolio that spans electricity generation, natural gas distribution, and storage solutions, serving both residential and commercial customers. With its headquarters in Richmond, Virginia, Dominion Energy's vast infrastructure includes a formidable footprint in the mid-Atlantic region where it operates nuclear, natural gas, and renewable energy facilities. As an S&P 500 index member, Dominion Energy captures investor interest for its consistent dividend payouts and its strategic investments in sustainable and renewable energy sources. As of the latest financial reports, the company exhibits a solid financial standing with a balance sheet that supports both growth and capital returns to shareholders. Market participants closely observe Dominion's regulatory environment, operational performance, and its commitment to transitioning to cleaner energy, which are factors that significantly influence the company's stock performance and prospects.

Dominion Energy, Inc., trading under the ticker symbol D on the New York Stock Exchange, is one of the United States' largest producers and transporters of energy. The company boasts a diversified portfolio that spans electricity generation, natural gas distribution, and storage solutions, serving both residential and commercial customers. With its headquarters in Richmond, Virginia, Dominion Energy's vast infrastructure includes a formidable footprint in the mid-Atlantic region where it operates nuclear, natural gas, and renewable energy facilities. As an S&P 500 index member, Dominion Energy captures investor interest for its consistent dividend payouts and its strategic investments in sustainable and renewable energy sources. As of the latest financial reports, the company exhibits a solid financial standing with a balance sheet that supports both growth and capital returns to shareholders. Market participants closely observe Dominion's regulatory environment, operational performance, and its commitment to transitioning to cleaner energy, which are factors that significantly influence the company's stock performance and prospects.

| Address | 120 Tredegar Street | City | Richmond | State | VA |

| Zip Code | 23219 | Country | United States | Phone | 804 819 2284 |

| Website | https://www.dominionenergy.com | Industry | Utilities - Regulated Electric | Sector | Utilities |

| Full Time Employees | 17,200 | Market Cap | $40,911,003,648 | Dividend Yield | 5.44% |

| Dividend Rate | $2.67 | Payout Ratio | 88.7% | Beta | 0.586 |

| Trailing PE | 16.24 | Forward PE | 15.62 | Volume | 2,756,918 |

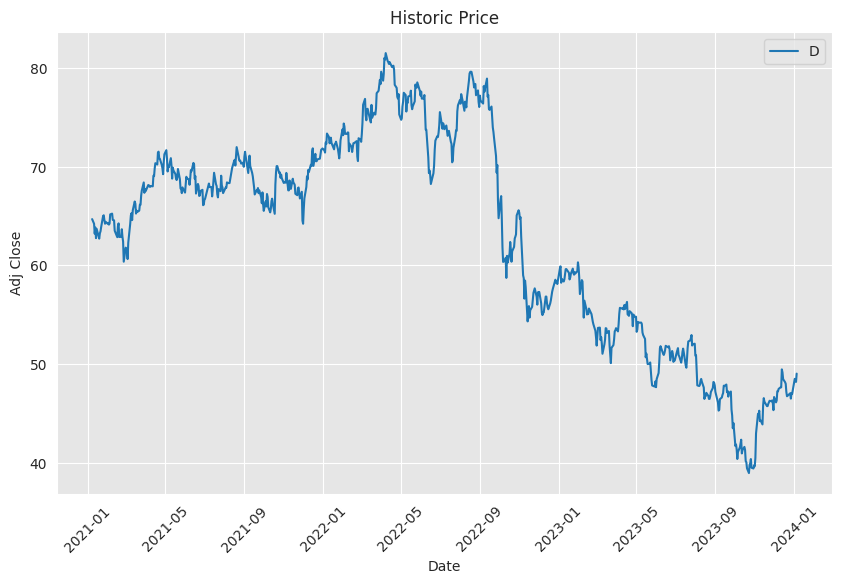

| Average Volume 10 days | 4,101,570 | Dividend Yield (5 Year Average) | 4.36% | Fifty Two Week Low | $39.18 |

| Fifty Two Week High | $63.68 | Price to Sales (TTM) | 2.29 | Enterprise Value | $85,341,511,680 |

| Profit Margins | 9.59% | Book Value | $31.36 | Price to Book | 1.56 |

| Net Income to Common | $2,507,000,064 | Trailing EPS | $3.01 | Forward EPS | $3.13 |

| Total Revenue | $17,898,000,384 | Total Cash | $137,000,000 | Total Debt | $42,659,000,320 |

| Earnings Growth | -81.6% | Revenue Growth | -3.9% | Gross Margins | 47.57% |

| EBITDA Margins | 47.13% | Operating Margins | 30.63% | Return on Assets | 3.16% |

| Return on Equity | 9.15% | Shares Outstanding | 836,796,992 | Held Percent Institutions | 74.48% |

Technical Analysis Summary:

Technical Analysis Summary:

- In recent months, the stock prices have displayed a gradual upward momentum with higher lows and higher highs, which is a positive signal in the context of trend analysis.

- On the last trading day, the stock closed higher than it opened, forming a bullish candle, which could indicate potential continuation of the uptrend.

- Volume has been fluctuating, but there's an overall increase in the On-Balance Volume (OBV), suggesting that buying pressure may be accumulating.

- The Moving Average Convergence Divergence (MACD) histogram shows a crossover from negative to positive on the last day, which could be a sign of a bullish trend reversal or strengthening.

- The Parabolic SAR indicator shows a switch on the last trading day from a bearish to bullish trend, which could signal a potential trend reversal to the upside.

Fundamental Analysis Summary:

- The financial data implies a company with a stable gross margin and high operating margin, which could be indicative of efficient management and strong profitability.

- EBITDA remains robust, although it has seen a decline in the previous year, which will be a point of concern to monitor.

- The net income has fluctuated over the years, with a significant drop from 2021 to 2022. It is crucial to understand the reasons behind this drop and whether it's a one-off event or a signal of an underlying issue.

- The company has been actively managing its debt, with both repayments of existing debt and issuance of new debt, which indicates thoughtful financial management but also raises questions about long-term financial leverage and cost of capital.

- Cash flows, specifically free cash flow, are negative, which is a red flag and needs closer scrutiny to understand the sustainability of the company's financials.

Balance Sheet Analysis Summary:

- The balance sheet shows a sizable amount of debt, indicating the company is heavily leveraged, which is a risk factor.

- A consistent increase in net debt over the last three years suggests the company is taking on more debt; monitoring debt covenants and interest coverage ratios will be important.

- Tangible book value has been increasing, which could be seen as a sign of asset base growth, yet in the presence of high liabilities, the net asset value and financial health would need further evaluation.

Cash Flow Analysis Summary:

- Negative free cash flow is concerning because it points to the possibility that the company might not be generating enough capital to sustain operations without external financing.

- Large amounts of repurchased capital stock in 2022 against a backdrop of negative free cash flow could be seen as a strategy to return value to shareholders despite cash flow challenges.

- Heavy debt issuance may have been used to cover operational expenses or investment activities, which cannot always be considered sustainable.

Based on the combination of TA and fundamental analysis, it seems that there may be a short-term positive momentum that could lead to a rise in stock prices. However, several red flags in the fundamental data, specifically in cash flow and leverage, could undermine long-term value. A conservative next few months could likely feature volatile movements with an upward bias in stock prices, but persistent vigilance is warranted, with readiness to reconsider should fundamentals deteriorate.

Investors might want to capitalize on short-term bullish signals indicated by technical analysis while closely monitoring the fundamental financial health aspects. Potential growth is tempered by concerns of financial sustainability, and thus, positions should be gauged with care, considering these specifics. Further in-depth analysis of the financials, market conditions, and sector performance is warranted before making informed decisions on long-term investments.

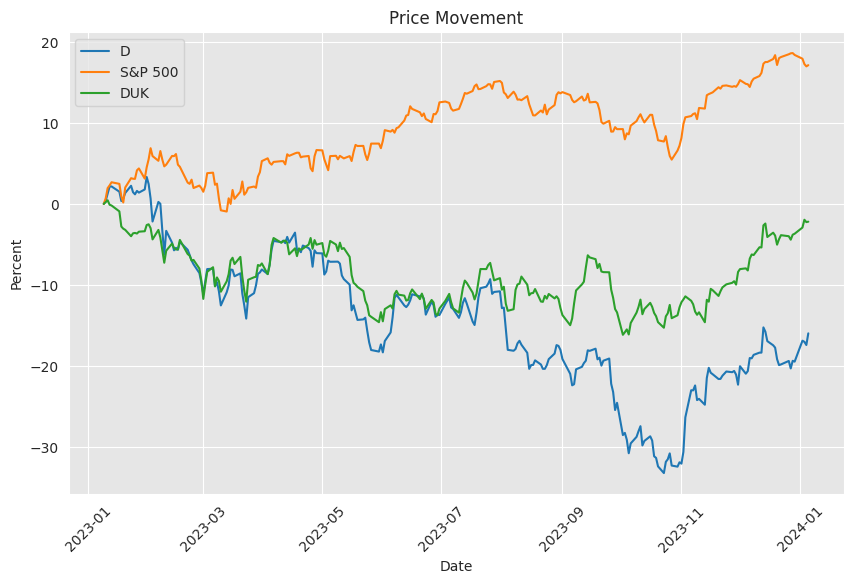

In the linear regression model between the performance of stock D and the SPY, which is a proxy for the overall market performance, the value of alpha () is -0.0436, implying a slight negative average excess return of stock D independent of the market's movements. However, this alpha has a p-value of 0.289, which means it is not statistically significant at common significance levels, hence it may not be a reliable indicator of the stock's performance relative to the market. The beta () of the model at 0.6938 suggests that stock D has less volatility compared to the market: it tends to move less than 1 for every move in the SPY, indicating that it is less risky than the market as a whole.

The analysis reflects data spanning 1256 observations and the regression's R-squared of 0.284 indicates that approximately 28.4% of the variability in stock D's returns can be explained by the market's returns as represented by SPY. The adjusted R-squared of 0.283 corrects this figure for the number of predictors in the model and shows similar explanatory power. The F-statistic of 496.7 with a very small p-value (< 0.0001) signals that the model is statistically significant, ensuring that SPY is a meaningful predictor of D's performance, at least under this specific model and time period context.

Below is a table with key values from the linear regression calculation:

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.0436 | 0.041 | -1.062 | 0.289 | -0.124 | 0.037 |

| SPY | 0.6938 | 0.031 | 22.287 | 0.000 | 0.633 | 0.755 |

In the 10-Q filing for Dominion Energy, Inc. (Dominion or the Company), a prominent energy company that serves utility and retail energy customers, the report provides critical financial data and operational insights into the company's performance for the reporting period ending September 30. As a producer and transporter of energy, Dominion operates an expansive network of natural gas storage systems and serves millions of customers across multiple states with electricity and gas.

Financially, the company detailed its earnings, revenue streams, and capital expenditures, indicating the status of its liquidity and cash flows. These metrics are integral to assessing the company's ongoing financial health and its ability to meet short-term obligations, fund operations, and invest in future projects. The revenue and profit margins must be analyzed, including any segmented revenue from different business units, such as regulated electric, gas, and nonregulated energy services.

Regulatory changes and environmental compliance are also crucial highlights in the report, as Dominion operates within a heavily regulated industry. Any shifts in regulatory frameworks at the federal or state level can have a formidable impact on the company's operations, cost structure, and strategic planning. Likewise, Dominion must adhere to stringent environmental standards, with emphasis on managing its assets and transitioning towards cleaner energy sources to meet policy requirements and public expectations.

Investments in infrastructure, such as electric transmission, renewable energy projects, and natural gas pipelines, signify the company's commitment to maintaining a robust and modern energy grid that can meet the demands of residential, commercial, and industrial customers. These investments also reflect its strategic initiatives to adapt to a changing energy landscape marked by a shift towards sustainability and the reduction of carbon footprints.

Moreover, the company's risk management strategies are articulated through its use of derivative instruments and hedging activities aimed at mitigating market volatility and price fluctuation risks associated with commodity trading. The effectiveness of these financial instruments in shielding the company from adverse market conditions is an important concern for investors and stakeholders.

Finally, the 10-Q report discusses any significant events or changes since the last reporting period, such as asset disposals, acquisitions, legal proceedings, or other material events that could affect the company's future operations and financial results. These subsequent events inform readers about pertinent developments that may not be reflected in the financial statements but could play a significant role in shaping the company's trajectory.

This summary of Dominion Energy's 10-Q filing provides a snapshot of the company's economic health, operational achievements, and challenges for the period ending on September 30, with a forward-looking perspective on how current strategies and market conditions may affect future performance.

In the fast-evolving landscape of technology and artificial intelligence (AI), Nvidia has staked a significant claim with its unveiling of the GeForce RTX 40 Super series at CES 2024. The RTX 4080 Super, RTX 4070 Ti Super, and RTX 4070 Super graphics cards represent a stride forward in gaming and AI application performance. With the RTX 4080 Super outpacing the RTX 3080 Ti by 1.4 times in raw speed and delivering doubled performance with the assistance of Nvidia's AI-driven Deep Learning Super Sampling technology, the company continues to assert its dominance in the GPU market.

The latest offerings from Nvidia are not merely about advancing video game aesthetics; they reflect a strategic pivot towards AI PCs, designed to process AI tasks directly on the machine, potentially enhancing user privacy and data security. Nvidia's foresight in creating AI-optimized PCs places it in alignment with industry giants such as AMD, Intel, and Qualcomm, all of whom are driving AI capabilities into consumer and enterprise devices.

Microsoft's partnership and the integration of the Copilot AI assistant key on Windows keyboards demonstrate the software titan's investment in making AI functionalities an integral part of personal computing. The success of these initiatives is apparent in Nvidia's stock performance, where it experienced a staggering 244% growth over the past year, primarily propelled by its data center operations but significantly supported by its gaming division. The substantial revenues from these sectors attest to Nvidia's strategic positioning within the digital ecosystem.

The energy landscape is another area undergoing significant transformation, with Dominion Energy at the forefront of strategic asset reallocation. The sale of key natural gas utilities to Enbridge is a strong indicator of Dominion's commitment to refocusing on its core business areas while maintaining an emphasis on operational efficiency and shareholder returns. This deal allows Dominion to potentially reinvest in more focused operations and signals increased financial flexibility, which could be critical in maintaining consistent dividends for its shareholders.

Enbridge, known for its stable yield and consecutive annual dividend increases, provides an example of attractiveness to income-focused investors. The company's robust dividend yield of 7.4% is indicative of the steady cash flow expected from its regulated operations, which includes the newly acquired assets from Dominion. With its slight growth projections, Enbridge remains an appealing low-volatility investment choice, mainly catering to those seeking predictable income streams.

ExxonMobil's diversification across the energy sector, from extraction to refining and distribution, has been crucial to its capacity to navigate the cyclical nature of commodity prices and maintain a 41-year streak of dividend increases. This diversified portfolio provides a sense of security to investors looking for an energy company capable of maintaining payouts amid market variability.

Devon Energys dividend policy, tied to the company's performance, offers an interesting risk-reward equation for investors. The variable nature of its dividends, which rise and fall with energy costs, presents a more dynamic investment approach, contrasting the static income models provided by traditional utility dividend stocks. This policy appeals to a category of investors comfortable with heightened fluctuations in pursuit of higher yields.

The composition of the energy sector's dividend stock offerings illustrates a diverse palette for investors with varied income goals. While Enbridge and ExxonMobil offer steadiness and resilience, Devon Energy introduces an element of fluidity in dividend returns. Dominion Energy's choice to divest specific assets, such as the transaction with Enbridge, showcases their strategic intent to realign focus and continue to provide shareholder value amidst a transforming energy landscape.

On the trail of Nvidia's success is AMD, which has announced a new line of AI-enhanced desktop processors at CES 2024. As AI becomes central to computing advancements, AMD aims to capture a share of a burgeoning market niche that necessitates powerful chips capable of handling AI algorithms with ease. This move engenders competition within the semiconductor industry, which could alter the landscape of high-performance computing.

Dominion Energy, although operating in a distinct sector from AMD and Nvidia, could observe such evolutions in technology with interest for their broader implications. With technological advancements potentially influencing energy demand and optimizations within the sector, Dominion may see shifts in how energy services are utilized and delivered. The developments in AI and graphics processing capabilities underscore Nvidia's intent to dominate the tech sector, while AMD's entrance into the AI PC chip market challenges the status quo, setting the stage for an intensified competitive landscape.

In contrast to the high-tech trajectory of Nvidia and AMD, companies like Enbridge and TC Energy have carved out a special niche in the energy sector, attracting investors with their long history of dividend growth and robust balance sheets. Enbridge's diversified business model across multiple energy infrastructure segments, coupled with its financial health, ensures the sustainability of its dividend, making it a particularly attractive stock for income-focused investors. With a consistent dividend payment record and a robust 7.7% yield, Enbridge proves to be a stable investment choice.

The natural gas sector within which Dominion Energy has recently expanded exhibits several attractive dividend stocks, notably Enbridge and TC Energy, which entice retirees with their durable business models and considerable yield. Both companies display financial strength and reliable dividend histories, presenting themselves as viable options for investors seeking steady returns through dividends. Their strategic emphasis on midstream assets, substantial cash flow generation, and commitment to dividend growth underscore their attractiveness in a sector characterized by essential service delivery.

Similar Companies in Electric Utilities:

Report: Duke Energy Corporation (DUK), Duke Energy Corporation (DUK), Report: Southern Company (SO), Southern Company (SO), Exelon Corporation (EXC), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Report: American Electric Power Company, Inc. (AEP), American Electric Power Company, Inc. (AEP), FirstEnergy Corp. (FE), PPL Corporation (PPL), PG&E Corporation (PCG), Edison International (EIX), Xcel Energy Inc. (XEL)

News Links:

https://www.fool.com/investing/2023/12/28/near-a-52-week-low-this-dividend-stock-buy-now/

https://finance.yahoo.com/news/nvidia-rolls-chips-claims-leadership-161946249.html

https://www.fool.com/investing/2024/01/04/3-dividend-stocks-to-buy-hand-over-fist-in-january/

https://www.fool.com/investing/2023/12/16/heres-why-enbridge-is-a-no-brainer-dividend-stock/

https://seekingalpha.com/article/4659880-better-high-yield-swan-stock-enbridge-or-tc-energy

https://finance.yahoo.com/m/85d4ab67-2e9a-374e-8345-1173f533326b/amd-rounds-out-ai-pc-chip.html

https://www.fool.com/investing/2023/12/28/could-these-3-ultra-high-yield-stocks-help-you-ret/

https://finance.yahoo.com/m/c79a3e42-3ec3-39d4-8829-82910ea6cc1c/dow-jones-up-as-nvidia-clears.html

https://finance.yahoo.com/m/d8a248a0-c2c8-3a0b-98b4-4aab80b73f9d/seven-big-2023-winners.html

https://www.sec.gov/Archives/edgar/data/0000715957/000095017023061178/d-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: qR3p1Q